Market Overview:

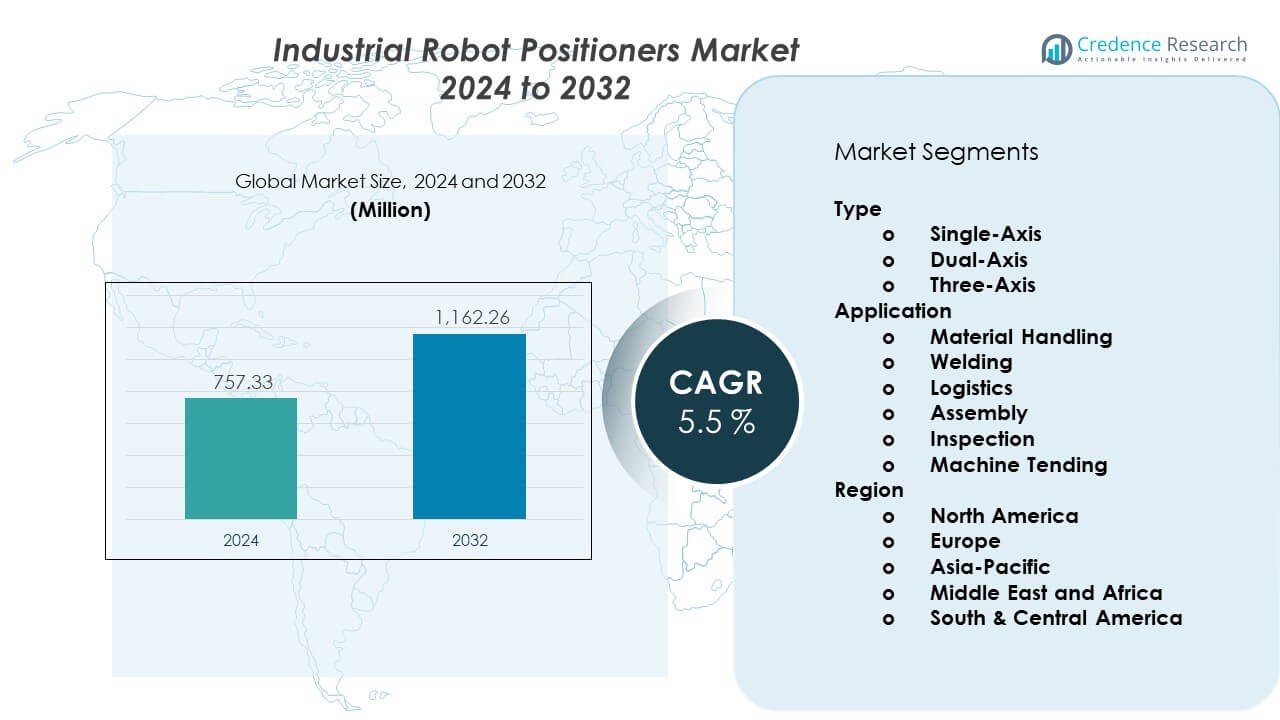

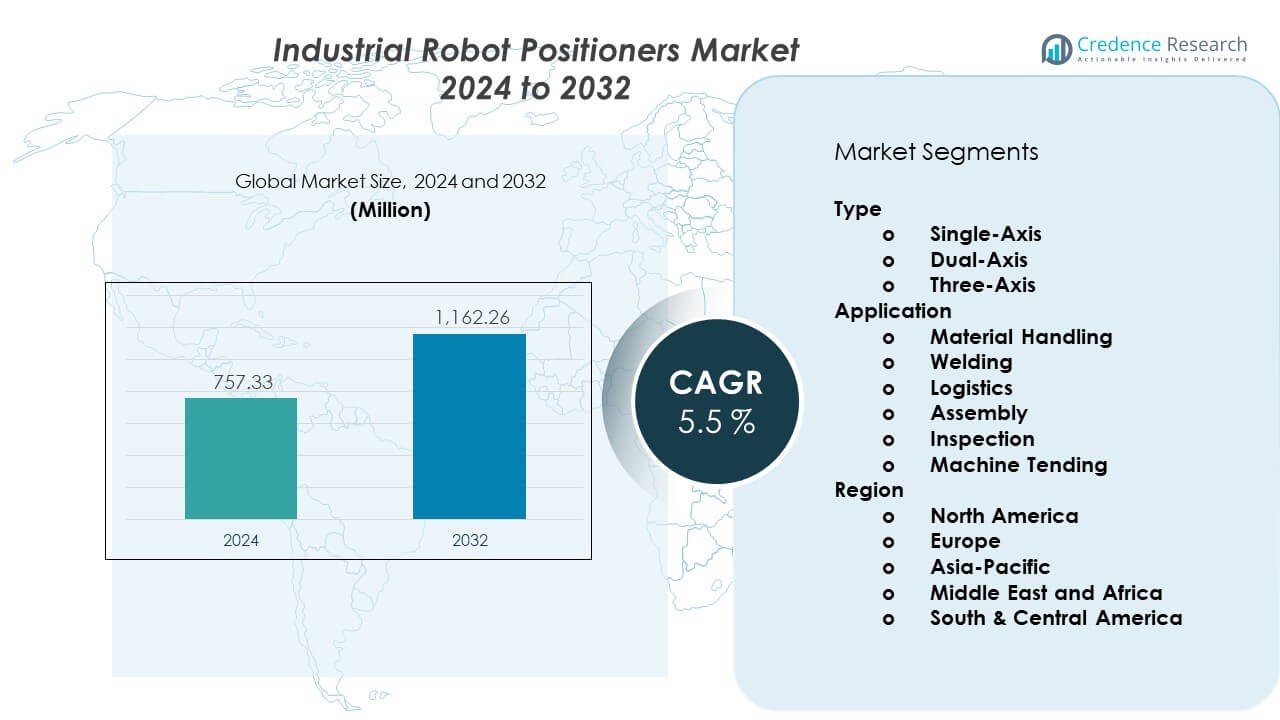

The Industrial Robot Positioners Market is projected to grow from USD 757.33 million in 2024 to an estimated USD 1,162.26 million by 2032, with a CAGR of 5.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Robot Positioners Market Size 2024 |

USD 757.33 Million |

| Industrial Robot Positioners Market, CAGR |

5.5% |

| Industrial Robot Positioners Market Size 2032 |

USD 1,162.26 Million |

Strong market drivers come from the shift toward flexible production systems. Automotive plants deploy advanced positioners to manage large body parts and improve weld accuracy. Metal fabrication units adopt multi-axis models to support high-mix production with lower downtime. Industrial users prefer systems that raise process repeatability and lift throughput during peak load. Robotics suppliers enhance payload capacity and control features to meet new layout needs. The rise of digital manufacturing fuels steady integration across automated floors.

North America and Europe lead due to strong adoption of industrial robots across automotive and machinery plants. These regions benefit from early automation, skilled integrators, and wider use of high-precision welding lines. Asia Pacific emerges as a fast-growing market because China, Japan, and South Korea expand robot density across factories. Growing metal and electronics production also lifts system uptake across the region. Emerging countries in Southeast Asia strengthen their role as new manufacturing hubs, driving wider interest in mid-range and high-payload positioners.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Industrial Robot Positioners Market is valued at USD 757.33 million in 2024, projected to reach USD 1,162.26 million by 2032, reflecting a steady 5% CAGR driven by wider automation and multi-axis adoption across factories.

- North America holds about 32% of the market due to strong automation maturity; Europe accounts for nearly 28% supported by advanced robotics infrastructure; Asia-Pacific secures around 25%, driven by high robot density and industrial expansion.

- Asia-Pacific is the fastest-growing region, increasing its share rapidly due to major investments in automotive, electronics, and metal processing, supported by rising automation across China, Japan, South Korea, and Southeast Asia.

- The application segment is led by welding with around 30% share, driven by high demand for precision rotation and cycle stability in automotive and metal fabrication plants.

- The type segment is dominated by dual-axis positioners with roughly 35% share, as manufacturers prefer greater motion flexibility for multi-angle operations and high-mix production environments.

Market Drivers:

Rising Need For High-Precision Positioning Systems In Automated Production

High-precision units support welding, assembly, and part handling in many plants. Many factories adopt these systems to lift accuracy in tight-cycle processes. The Industrial Robot Positioners Market gains steady traction due to higher reliance on automated layouts. Manufacturers deploy multi-axis units to manage complex angles during fabrication work. Robotics teams use advanced controllers to raise repeatability across long shifts. Automotive lines depend on stable positioning to improve seam quality. Heavy engineering units apply these tools to handle large workpieces with safe movement. It helps many users maintain tighter tolerances within modern production floors.

- For instance, the ABB IRBP K positioner series supports a payload of up to 1,000 kg(1 tonne) with a repetitive accuracy of ±0.05 degrees. This enables precision welding in automotive body shops and helps many users maintain tighter tolerances within modern production floors.

Growing Adoption Of Flexible Manufacturing Systems Across High-Mix Lines

Flexible layouts drive wider integration of robot positioners across varied workloads. Plants shift from fixed setups to adaptable platforms that support quick changeovers. Many users replace manual fixtures with programmable units to lift throughput. Robot integrators configure solutions that match high-mix assembly needs. Manufacturers value the drop in downtime during batch transitions. Automotive suppliers deploy these tools to manage multi-model production windows. Fabrication lines use them to reduce layout complexity during frequent shifts. The Industrial Robot Positioners Market benefits from rising demand for fast and flexible production support.

- For instance, certain robots within Yaskawa’s GP series, such as the GP8 or GP25 models, support 360° rotation and feature a superior cycle-to-cycle repeatability of ±0.01 mm to ±0.02 mm, enabling rapid reconfiguration in high-mix factories.

Expanding Use Of Automated Welding Lines In Automotive And Metal Fabrication

Automated welding units rely on stable part rotation and accurate orientation. Many plants integrate positioners to control joint alignment during complex weld runs. Automotive OEMs use high-load platforms to manage full-body frames. Metal fabrication units require precise tilt and rotation for clean seams. Robotics specialists pair sensors with positioners to refine weld-path consistency. Many users report stronger output quality due to improved part stability. Medium industries adopt compact models for repetitive welding tasks. It strengthens adoption across regions with growing vehicle and metalwork output.

Increased Focus On Productivity Gains And Reduced Human Risk In Heavy Tasks

Positioners help factories cut manual strain in heavy part handling. Many users shift toward mechanized fixtures to raise safety performance. Large components move with controlled rotation that supports consistent workflow. Manufacturers gain improved floor efficiency due to reduced manual errors. Robotics teams deploy synchronized positioners to shorten cycle gaps. Many plants reduce rework rates with stable part alignment. High-payload systems support long production schedules without fatigue. The Industrial Robot Positioners Market gains traction through its role in safer and faster job execution.

Market Trends:

Rapid Integration Of Multi-Axis Platforms To Support Complex Part Orientation

Factories integrate multi-axis tools to handle diverse angles and shapes. Many users upgrade from single-axis units to improve motion freedom. Multi-axis rotation supports advanced welding and machining paths. Robotics suppliers develop compact models with higher torque. The Industrial Robot Positioners Market absorbs strong interest in modular motion systems. Many fabrication shops use programmable setups for curved or asymmetric parts. Automotive suppliers deploy synchronized stages for complex frame work. Compact multi-axis models support tight production cells. It drives steady momentum toward refined orientation control.

- For instance, KUKA’s KP3-V2H three-axis positioners are available with a payload capacity of up to 1,500 kg per side (3,300 lbs), supporting heavy automotive frame assemblies with complex rotation demands.

Growing Use Of Smart Sensors And Real-Time Control Features In Positioning Units

Smart sensors help monitor load, angle, and torque during operation. Many factories adopt systems with real-time feedback to improve motion accuracy. Programmable controllers adjust rotation to match path requirements. Robotics vendors supply platforms with digital monitoring tools. Many users track performance to reduce alignment errors. The Industrial Robot Positioners Market shows strong progress in sensor-aided refinement. Plants use real-time data to maintain workflow stability across shifts. Smart tools help extend unit lifespan through predictive checks. It strengthens the shift toward connected positioning systems.

- For instance, FANUC integrates its iRVision and Force Sensor technology in robotic setups, enabling sub-millimeter adjustment accuracy and torque monitoring across multi-axis positioning units.

Rising Preference For Modular And Scalable Positioner Architectures Across Industries

Modular designs help users extend robot stations with less downtime. Plants adopt scalable platforms to match varied part dimensions. Many suppliers offer bolt-on modules for future expansion. Fabrication lines gain value from quick adjustments during layout changes. The Industrial Robot Positioners Market benefits from interest in expandable architectures. Automotive lines use scalable systems for multi-model schedules. Modular setups fit evolving production plans without heavy redesign. Many manufacturers reduce capital load due to staged upgrades. It encourages broader uptake across cost-sensitive sectors.

Increased Deployment Of Collaborative Positioners To Support Human-Robot Workflows

Collaborative units support shared work areas with controlled motion. Many plants integrate safe rotation tools for joint tasks. Sensors help detect proximity and lower movement speed when required. Robotics vendors design compact units for human-assist applications. The Industrial Robot Positioners Market gains steady interest due to workplace safety needs. Many SMEs deploy collaborative tools to balance automation and manual tasks. Operators gain help with heavy or repetitive positioning activity. Collaborative designs support flexible cell layouts in smaller spaces. It supports smoother integration of human-robot workflows.

Market Challenges Analysis:

High Upfront Costs And Integration Complexity Across Multi-Axis Systems

High investment costs limit adoption across smaller factories. Many SMEs face budget pressure during automation upgrades. Integration requires skilled teams to align motion paths and robot controls. Plants spend time synchronizing positioners with welders or manipulators. The Industrial Robot Positioners Market faces hurdles due to long installation cycles. Users encounter delays when calibrating multi-axis movement. Many suppliers must provide extensive training to improve user readiness. Complex load requirements demand stronger engineering checks. It slows deployment in cost-sensitive markets.

Limited Standardization, Maintenance Burden, And Compatibility Issues In Diverse Production Cells

Many industries face challenges due to varied fixtures and part geometries. Positioners must match multiple robot brands, which raises compatibility issues. Users deal with longer maintenance schedules for heavy-duty units. High wear on rotation joints demands frequent inspection. Plants struggle with downtime when part alignment drifts. The Industrial Robot Positioners Market works through gaps in standard interfacing and accessory fit. Many teams need custom integration to manage mixed equipment. It increases service load during long production cycles.

Market Opportunities:

Rising Demand For Automated Welding And Fabrication Units Across Emerging Industrial Regions

Emerging regions expand industrial output across metalwork and automotive plants. Many factories adopt automated welding stations to lift throughput. Positioners gain traction due to increased need for precise part rotation. Robotics suppliers enter new markets with localized service centers. The Industrial Robot Positioners Market benefits from growing capital investment in modern assembly floors. Many users shift to programmable fixtures to reduce error rates. Upgrading manual shops offers a large untapped base. It creates strong room for growth across developing zones.

Growing Interest In Digital Twins And Simulation-Driven Layout Planning For Robot Positioning

Simulation tools help users plan layouts before installation. Many factories test rotation paths virtually to confirm cycle flow. Digital twins reduce integration mistakes and shorten commissioning time. Robotics teams use simulation to match payloads with layout space. The Industrial Robot Positioners Market gains new scope from software-driven planning. Many users value shorter testing cycles during early design work. Digital planning supports better alignment before physical setup. It improves ROI for large-scale automation projects.

Market Segmentation Analysis:

Type

Single-axis units hold steady traction due to simple layouts and lower setup needs. Many factories use them for basic rotation tasks that support welding and light fabrication. Dual-axis positioners gain wider preference where plants handle more complex angles. Three-axis units lead advanced jobs in automotive and heavy engineering due to higher motion range and better load control. The Industrial Robot Positioners Market benefits from demand for multi-axis models that lift precision across automated lines. Many users choose higher-axis types to reduce manual adjustments. It supports stronger workflow stability in high-volume environments.

- For instance, Comau offers various robust positioner modules (such as the MP-2500 or the TR-4500) and NJ-series robots that, when integrated into a welding cell, can collectively manage payloads exceeding 1,500 kg, enabling complex rotational paths for heavy fabrication.

Application

Material handling remains a major use case due to rising focus on safe rotation of heavy parts. Welding lines adopt positioners to maintain joint accuracy and stable part alignment. Logistics units deploy compact models for controlled movement in assembly sequences. Assembly operations use programmable platforms to manage varied component sizes with faster cycle flow. Inspection stations prefer units that offer precise tilt control to support quality checks. Machine tending benefits from accurate part orientation during loading and unloading tasks. Many factories use these systems to improve repeatability across diverse operations. It strengthens adoption across mixed industrial workflows.

- For instance, FANUC’s M-2000series integrated positioning solutions handle up to 2,300 kg payloads, enabling stable transfer and machine tending tasks in large automotive plants.

Segmentation:

Type

- Single-Axis

- Dual-Axis

- Three-Axis

Application

- Material Handling

- Welding

- Logistics

- Assembly

- Inspection

- Machine Tending

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a leading share of the global market due to strong automation adoption across automotive and metal fabrication units. Many factories upgrade welding and assembly cells to match higher productivity goals. The Industrial Robot Positioners Market gains steady traction in this region due to early integration of multi-axis systems. Users invest in advanced platforms that support heavy-load applications and improve cycle accuracy. The United States drives most installations with strong demand from automotive and machinery OEMs. Canada supports growth through investments in flexible manufacturing systems. It maintains a high share due to robust technological maturity and skilled integrators.

Europe

Europe captures a significant share supported by strong industrial automation policies and advanced robotic infrastructure. Germany leads demand with heavy reliance on precision welding and engineering operations. Many manufacturers deploy positioners to manage complex part geometry across multi-model production lines. The Industrial Robot Positioners Market benefits from the region’s high robot density and stringent quality standards. France, Italy, and Spain expand usage across automotive and metal processing hubs. Users focus on multi-axis platforms to improve workflow consistency. It maintains a strong share through active modernization of fabrication plants.

Asia-Pacific

Asia-Pacific records the fastest growth and continues to increase its share due to rapid industrial expansion. China leads adoption with large-scale automation across automotive, electronics, and machinery sectors. Japan and South Korea contribute strong demand supported by mature robotics ecosystems. The Industrial Robot Positioners Market grows quickly in this region due to rising investments in flexible production systems. Southeast Asia emerges as a new hub with wider use in welding and assembly lines. Users adopt cost-efficient models to support large manufacturing clusters. It secures a rising share driven by aggressive automation across diverse industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- FANUC Corporation

- KUKA

- Yaskawa Electric Corporation

- Comau

Competitive Analysis:

The Industrial Robot Positioners Market shows strong competition driven by global robotics leaders and specialized automation firms. Major companies like ABB, FANUC, KUKA, Yaskawa, and Comau focus on precision, high-load capability, and advanced multi-axis control. Many vendors improve controller software to support flexible setups and shorter cycle times. Automotive, metal fabrication, and machinery plants push demand for stable rotation systems, which encourages suppliers to expand product ranges. It grows stronger with service-based models that help factories upgrade older platforms. Many companies strengthen integration support to improve deployment speed across mixed production cells. Partnerships with robot integrators help reach new industries. Vendors compete on reliability, safety functions, and customization options.

Recent Developments:

- In October 2025, ABB entered into a definitive agreement with SoftBank Group to sell its robotics division for USD 5.375 billion. This landmark acquisition represents a major transformation for ABB’s robotics business, which generated approximately USD 2.3 billion in revenue in 2024. The deal is part of SoftBank’s broader strategy to advance artificial intelligence-powered robotics and autonomous systems under its “physical AI” vision. The transaction, expected to close between mid- and late-2026, is subject to regulatory approvals in the European Union, the US, and China. Following the acquisition, ABB Robotics will continue to benefit from SoftBank’s cutting-edge AI investments while maintaining its market-leading position in industrial automation and positioner solutions worldwide.

- At the Schweissen & Schneiden 2025 welding and cutting exhibition, FANUC presented new H-frame positioners and advanced welding robot solutions. The highlight of FANUC’s exhibition stand was the newly developed TCP (Tool Centre Point) measurement device, which detects and measures any deviation in the welding torch’s position from its programmed path and automatically compensates the robot’s movements to ensure consistent, accurate welds. The H-frame positioner, featuring simple and rigid design, demonstrates an effective and economical solution for automotive suppliers and metal fabricators. This technological advancement underscores FANUC’s continued innovation in robotic positioner technology for welding applications.

- KUKA Digital, the newly established business segment of KUKA, entered into a strategic partnership with software provider Noux Node, headquartered in Finland. This collaboration aims to deliver comprehensive digitalization solutions for production landscapes by combining KUKA’s deep expertise in manufacturing automation with Noux Node’s advanced software capabilities. The partnership enables joint customers to collect data and distribute software packages, including critical security updates, in real production environments while leveraging best IT and DevOps practices. The collaboration supports both companies in achieving their ambitious global growth targets. KUKA and Noux Node made their first joint appearance on the international stage at Manufacturing Performance Days in June 2025 in Tampere, Finland, showcasing their integrated solutions for AI-driven industrial digitalization.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for multi-axis platforms will shape new automation investments.

- High-load and precision-focused systems will gain traction in heavy industries.

- Software-driven motion control will improve accuracy across complex production lines.

- Integration of sensors and diagnostics will reduce downtime across factories.

- Collaborative positioners will expand where human-robot workflows are essential.

- Modular architectures will support scalable upgrades in fast-changing plants.

- Adoption in EV, aerospace, and metal fabrication will show strong acceleration.

- Compact models will grow in SMEs seeking cost-efficient automation.

- Digital twins will influence layout planning and system optimization.

- Global vendors will expand services to strengthen long-term customer retention.