Market Overview:

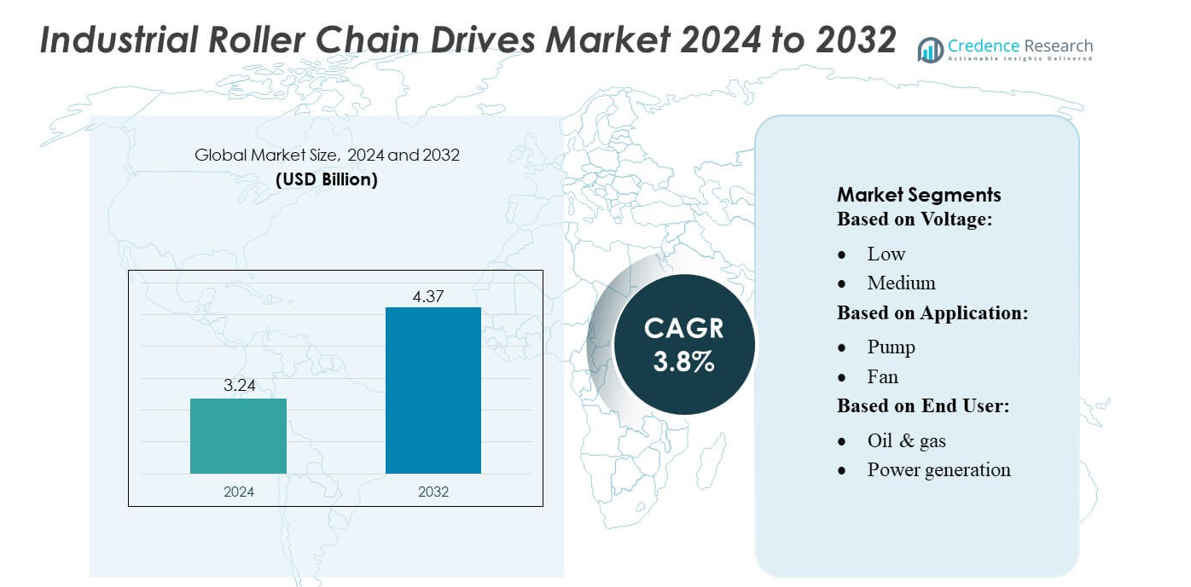

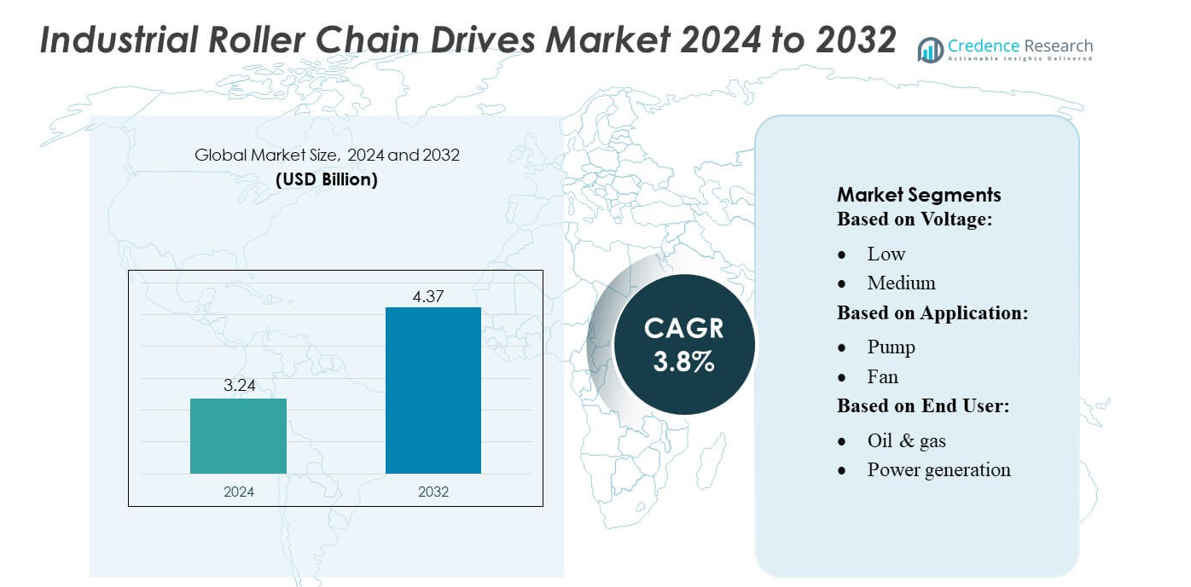

Industrial Roller Chain Drives Market size was valued USD 3.24 billion in 2024 and is anticipated to reach USD 4.37 billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Roller Chain Drives Market Size 2024 |

USD 3.24 billion |

| Industrial Roller Chain Drives Market, CAGR |

3.8% |

| Industrial Roller Chain Drives Market Size 2032 |

USD 4.37 billion |

The Industrial Roller Chain Drives Market, including Rockwell Automation, Hitachi, WEG, Schneider Electric, Yaskawa, Danfoss, GE, Eaton, SIEMENS and ABB, consistently drive innovation in chain durability, precision manufacturing, and maintenance-free designs. Among all regions, Asia-Pacific leads with approximately 39 % market share, fueled by booming industrialization, widespread automation adoption, and expansion of heavy-machinery manufacturing. Producers leverage strong regional supply chains and cost-efficient production to deliver high-performance chain drives tailored for automotive, mining, and material-handling industries. This dominant region remains the focal point for global growth, while leading companies compete on quality, customization, and technological improvements to meet escalating demand worldwide.

Market Insights

- The Industrial Roller Chain Drives Market was valued at USD 3.24 billion in 2024 and is projected to reach USD 4.37 billion by 2032, registering a CAGR of 3.8% during the forecast period.

- Market drivers include rising demand for high-durability, low-maintenance chain systems and increased automation adoption across automotive, mining, and manufacturing sectors, enhancing operational efficiency.

- Key market trends highlight innovations in wear-resistant materials, precision-engineered chain designs, and smart monitoring features introduced by companies such as Rockwell Automation, Hitachi, WEG, Schneider Electric, Yaskawa, Danfoss, GE, Eaton, SIEMENS, and ABB.

- Market restraints involve fluctuating raw-material costs, operational challenges in extreme environments, and availability of alternative power-transmission technologies limiting rapid market expansion.

- Asia-Pacific leads regional performance with 39% market share, while heavy-duty and high-load chain segments dominate product adoption due to extensive use in processing, material handling, and heavy machinery applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

In the voltage-based segmentation of the industrial roller chain drives market, the low-voltage sub-segment emerges as dominant, capturing roughly 60–65% of the demand. This predominance is driven by the prevalence of small to mid-sized motors and drive systems in standard manufacturing, material handling, and conveyor applications, where low-voltage systems offer safer, cost-effective and easier-to-maintain solutions. Additionally, the broad availability of compatible low-voltage chain-drive systems and minimal infrastructure requirements underpins continued preference for this sub-segment.

- For instance, Rockwell Automation’s Allen-Bradley PowerFlex 525 low-voltage AC drives operate within a 0.4–22 kW power range and support embedded EtherNet/IP connectivity, enabling precise speed control in chain-driven conveyor systems while reducing installation time by up to 70 minutes per drive through their patented slot-based modular design.

By Application

Within the application categories, Conveyor (and general material handling) applications constitute the largest share, estimated around 35–40% of total usage. Roller chain drives are favored in conveyor systems because they deliver consistent, reliable power transmission under continuous duty — an essential requirement for production lines, logistics, and packaging operations. Demand is boosted by increasing automation in manufacturing and warehousing, rising throughput needs, and the need for efficient material flow. Secondary but significant contributions also arise from pump, fan, compressor, extruder and miscellaneous power-transmission uses, though none approach the conveyor sub-segment in scale.

- For instance, Hitachi’s SJ-P1 series industrial inverters, used widely in chain-driven conveyor systems, deliver precise torque control with a 200% overload capacity for 3 seconds and support motor outputs ranging from 0.75 kW up to 160 kW.

By End-User

On the end-user front, the Manufacturing sector (general industrial manufacturing facilities) commands the largest share, roughly in the range of 40–45% of total consumption. This dominance reflects the widespread deployment of roller chain drives across assembly lines, processing equipment, and material handling installations in factories. The growth is primarily driven by rising industrial automation, expansion of production capacities in emerging economies, and continuous modernization and replacement of legacy mechanical systems. Other end-users such as mining & metals, oil & gas, pulp & paper, marine, and miscellaneous industries contribute smaller but steady demand, often for specialized heavy-duty roller chains.

Key Growth Drivers

Rising Automation Across Manufacturing Facilities

The growing adoption of automated production lines across automotive, electronics, packaging, food processing, and general manufacturing sectors significantly accelerates the demand for roller chain drives. Automation initiatives require reliable, high-efficiency power-transmission components capable of operating under continuous duty, variable loads, and harsh conditions. Roller chain drives benefit from their durability, low maintenance frequency, and compatibility with automated conveyor and material-handling systems. As factories upgrade equipment to enhance throughput and reduce downtime, the need for robust mechanical drive systems continues to increase, reinforcing this segment’s expansion.

- For instance, WEG recently launched its W23 Sync+ Ultra IE6 motor, which supports motor outputs from 0.75 to 1250 kW, operates across a speed range of 750 to 6000 rpm, and maintains high efficiency even when load and speed are reduced by 25%, with efficiency losses of less than 2% under such conditions.

Expansion of Material Handling and Logistics Infrastructure

Rapid growth in warehousing, distribution centers, and intralogistics infrastructure is driving considerable consumption of roller chain drives, particularly for conveyor systems, packaging lines, pallet movement, and sorting equipment. The surge in e-commerce and just-in-time delivery models has intensified the requirement for reliable, high-cycle-life chain drives that ensure uninterrupted operations. The focus on increasing automation density within warehouses further boosts the installation of chain-driven conveyors. Continuous investments in fulfillment centers and industrial parks across developing regions strengthen the long-term demand outlook.

- For instance, Schneider Electric’s Altivar 610 series Variable Frequency Drive (VFD) supports motor outputs up to 110 kW (150 HP) and provides a continuous output current of 211 A at 2.5 kHz, with a peak transient current of 260 A for high torque conveyor startup.

Increased Demand from Heavy Industries and Process Sectors

Heavy industries such as mining, cement, steel manufacturing, and petrochemicals increasingly rely on roller chain drives for high-load, high-torque applications including crushers, grinders, conveyors, and process equipment. The drives’ mechanical strength, resistance to abrasion, and ability to operate in dusty, high-temperature, or corrosive environments make them essential components in such sectors. Expansion projects in metals & minerals processing, power generation, and oil & gas infrastructure add to the installation base. Moreover, modernization and replacement cycles for aging mechanical systems enhance recurring demand for premium roller chain solutions.

Key Trends & Opportunities

Adoption of Advanced Materials and Surface Treatments

A key trend shaping market evolution is the increasing use of advanced alloys, corrosion-resistant steels, and specialized surface treatments such as nickel plating, black oxide coating, and hardened bushings. These innovations extend service life, reduce wear, and enhance performance in demanding conditions. Manufacturers also offer lubrication-free and low-noise roller chains that address maintenance-reduction goals in automated plants. The shift toward sustainable and energy-efficient machinery presents opportunities for high-precision, long-life roller chains tailored for modern Industry 4.0-compliant facilities.

- For instance, Danfoss A/S’s VLT® AutomationDrive FC 302 features integrated overload capacity of 150% for 60 seconds, supports motor outputs ranging from 0.25 kW to 1.2 MW, and offers adjustable frequency control from 0.01 Hz to 650 Hz, enabling precise torque management in roller chain-driven conveyor systems.

Growing Integration of Predictive Maintenance and Smart Monitoring

The market is witnessing a rapid rise in predictive-maintenance-enabled chain drive systems, supported by sensors, condition-monitoring devices, and IoT-based analytics platforms. These technologies track vibration, chain elongation, temperature, and lubrication levels to prevent unexpected failures and costly downtime. Companies offering chain drives compatible with digital monitoring gain a competitive advantage, as end-users increasingly seek reliability, serviceability, and lifecycle insights. This trend creates opportunities for OEMs to design smart, retrofittable solutions that align with evolving industrial digitization strategies.

- For instance, Eaton’s PowerXL DG1 drive supports motor outputs from 0.75 kW up to 630 kW, operates across a mains‑voltage range (230 V, 400–500 V, 525–600 V), and remains fully functional in ambient temperatures up to 50 °C without derating.

Strong Opportunities in Emerging Industrial Economies

Expanding manufacturing capacities in Asia-Pacific, the Middle East, Latin America, and parts of Africa present sizable opportunities for roller chain drive suppliers. Rapid industrialization, growth of assembly plants, investment in material-handling systems, and the development of new industrial corridors drive equipment installations. These regions actively upgrade from traditional belt-drive systems to more durable and efficient chain drives. Localized production, cost-effective distribution networks, and aftermarket service support strengthen the opportunity landscape for global and regional manufacturers.

Key Challenges

Competition from Alternative Drive Technologies

Roller chain drives face increasing competition from belt drives, gear drives, and direct-drive systems. Belt drives offer lower noise and reduced lubrication needs, while gear and direct-drive technologies provide high efficiency and minimal maintenance in certain applications. As industries prioritize energy efficiency, noise reduction, and clean operational environments, adoption of alternative drive technologies may limit growth in specific segments. Manufacturers must innovate in low-lubrication designs and precision chains to maintain competitiveness amid the shift toward modern drive solutions.

Maintenance Requirements and Operational Downtime

Regular lubrication, tension adjustment, and periodic replacement are necessary to ensure optimal chain drive performance, which can increase maintenance workloads and operational costs. In high-cycle or high-speed environments, improper upkeep may lead to chain elongation, noise issues, and component failures. Unplanned downtime remains a significant concern, particularly in fully automated production lines where disruptions can be costly. These maintenance-intensive characteristics pose challenges for users moving toward maintenance-free or low-maintenance systems, influencing procurement decisions in advanced manufacturing setups.

Regional Analysis

North America

North America commands a significant position in the Industrial Roller Chain Drives Market, holding an estimated 28–30% market share, driven by strong adoption across automotive manufacturing, packaging machinery, and agricultural equipment. The region benefits from mature industrial automation capabilities and early integration of high-efficiency chain drive systems to enhance equipment reliability. Growth is further supported by continuous investments in maintenance-free and corrosion-resistant chain solutions tailored for harsh operating conditions. The United States leads demand due to extensive production facilities and a sustained shift toward energy-optimized mechanical power transmission components across multiple industrial environments.

Europe

Europe accounts for approximately 24–26% market share, sustained by its advanced manufacturing ecosystem and strict quality standards for industrial components. Countries such as Germany, Italy, and France drive demand through ongoing modernization of heavy machinery, material-handling systems, and food-processing lines. The region emphasizes precision-engineered roller chain drives designed for reduced noise, higher load capacity, and extended service life. Growing investments in Industry 4.0, coupled with the adoption of predictive maintenance and automated lubrication systems, continue to strengthen Europe’s position. Sustainability regulations also encourage the use of environmentally compliant materials and recyclable chain components.

Asia-Pacific

Asia-Pacific leads the Industrial Roller Chain Drives Market with a dominant 38–40% market share, underpinned by rapid industrialization, expansion of manufacturing hubs, and large-scale production of heavy machinery. China, Japan, South Korea, and India collectively drive substantial demand due to high machinery output, rising automation levels, and significant investments in automotive, construction, and industrial processing sectors. The region’s strong supply chain ecosystem supports cost-efficient production and widespread adoption of high-durability chain drives. Continuous capacity expansion in mining, agriculture, and logistics equipment further accelerates growth, establishing Asia-Pacific as the most dynamic and competitive regional market.

Latin America

Latin America captures roughly 6–7% market share, supported by steady demand from agriculture, mining, and general manufacturing industries. Countries such as Brazil, Mexico, and Argentina are increasing their use of robust roller chain drives to enhance productivity in processing plants and material-handling operations. The region benefits from incremental adoption of energy-efficient mechanical transmission systems and growing interest in low-maintenance chain designs suited for dusty or corrosive environments. Although industrial modernization progresses at a gradual pace, rising regional investments in infrastructure, food processing, and automotive assembly continue to stimulate market expansion across Latin America.

Middle East & Africa

The Middle East & Africa region holds an estimated 4–5% market share, driven by expanding industrial bases in sectors such as oil & gas, mining, construction, and heavy equipment manufacturing. Demand centers around high-strength, wear-resistant roller chain drives capable of sustaining extreme temperatures and abrasive operating conditions common across the region. Countries including Saudi Arabia, the UAE, and South Africa are prioritizing upgrades to material-handling systems, processing lines, and industrial machinery. Increasing diversification efforts in non-oil industries and rising automation adoption support moderate yet consistent market growth across this developing region.

Market Segmentations:

By Voltage:

By Application:

By End User:

- Oil & gas

- Power generation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial Roller Chain Drives Market features a highly competitive landscape shaped by leading global automation and power-transmission manufacturers, including Rockwell Automation, Inc., Hitachi, Ltd., WEG S.A., Schneider Electric, Yaskawa Electric Corporation, Danfoss A/S, General Electric Company, Eaton Corporation, SIEMENS AG, and ABB. The Industrial Roller Chain Drives Market reflects a competitive environment characterized by continuous technological enhancement, strong product differentiation, and strategic global expansion. Manufacturers prioritize developing high-strength, wear-resistant chain systems designed for improved load capacity, reduced maintenance needs, and enhanced operational reliability across heavy-duty industrial applications. Innovation focuses on precision engineering, advanced heat-treatment processes, and optimized lubrication mechanisms to boost efficiency and extend service life. Companies increasingly invest in automated production facilities and digital quality-control systems to ensure consistent performance standards. Market participants also strengthen competitiveness through regional distribution networks, aftermarket service initiatives, and product customization tailored to specific industrial equipment requirements, reinforcing long-term customer value and market stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Yaskawa’s GA800 variable speed drive is a versatile solution for controlling a wide range of motor technologies, applicable from simple fans and pumps to complex test dynamometers.

- In August 2024, Sprint Electric launched its new Generis AC drive technology which uses a patented switching method to eliminate the need for a DC link. This design enables four-quadrant control as standard, allowing for energy recovery and reducing harmonics. Key benefits include improved efficiency, less heat generation, higher motor precision, a unity power factor, minimal current distortion, and simplified control by removing the need for braking resistors.

- In January 2023, ABB announced the opening of its Mexico technology center for the North American region. The organization initially invested in its New Mexico Technology and Engineering Center (MXTEC) situated in Merida, Yucatan.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance through wider adoption of high-efficiency roller chains designed to reduce friction and extend operational lifespan.

- Manufacturers will integrate smart monitoring features that enable predictive maintenance and minimize unplanned machine downtime.

- Material innovations such as advanced alloys and surface treatments will enhance durability and performance in harsh industrial environments.

- Automation growth across manufacturing, logistics, and processing sectors will continue to elevate demand for precision-engineered chain drives.

- Energy-optimized mechanical transmission systems will gain importance as industries prioritize lower power consumption.

- Emerging markets will drive future expansion through rapid industrialization and investments in heavy machinery.

- Customization of chain configurations for specialized equipment will increasingly influence purchasing decisions.

- Sustainability requirements will promote recyclable materials and eco-efficient production processes in chain manufacturing.

- Digital platforms for lifecycle management and remote condition assessment will strengthen aftermarket services.

- Strategic mergers, partnerships, and capacity expansions will shape competitive positioning and accelerate technological innovation.