Market Overview

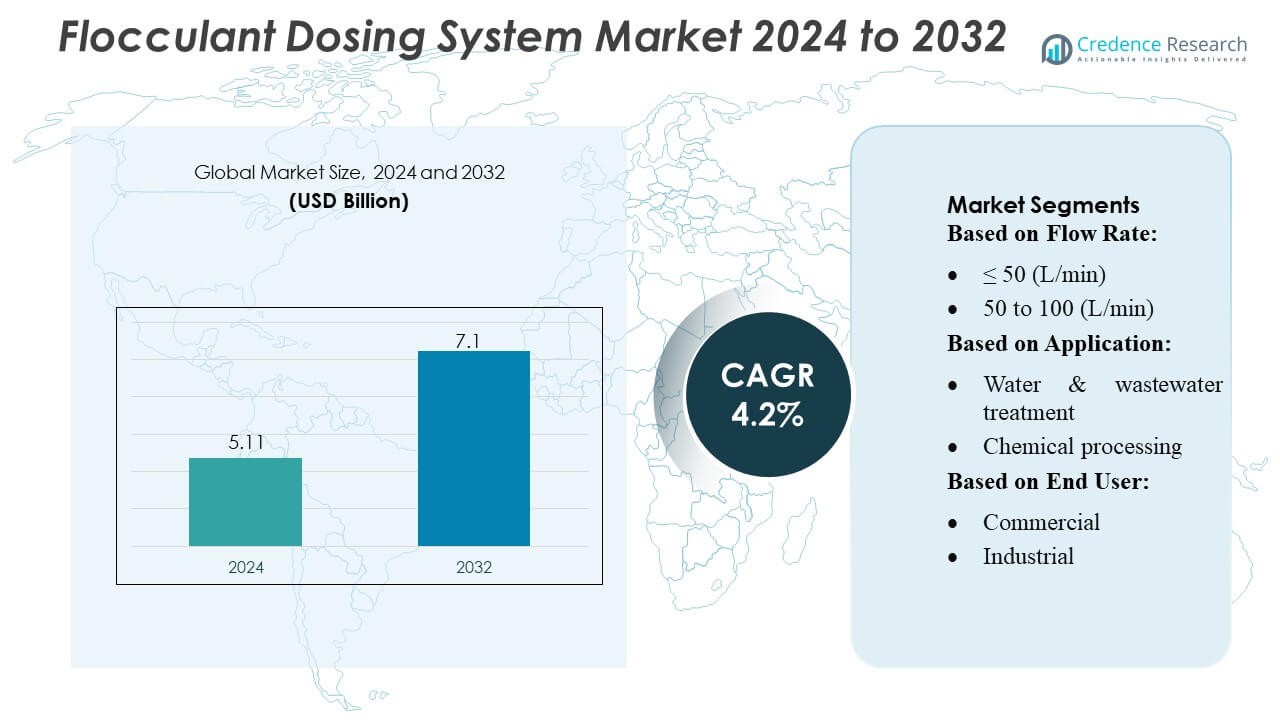

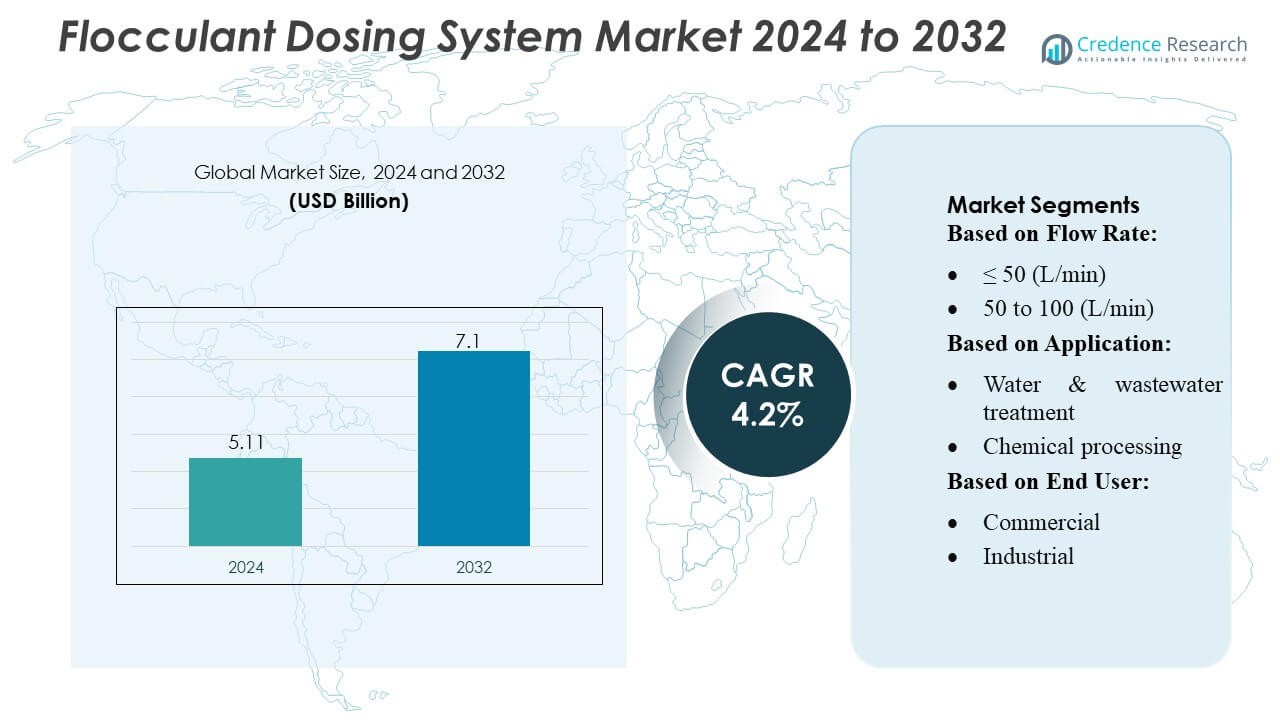

Flocculant Dosing System Market size was valued USD 5.11 billion in 2024 and is anticipated to reach USD 7.1 billion by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flocculant Dosing System Market Size 2024 |

USD 5.11 Billion |

| Flocculant Dosing System Market, CAGR |

4.2% |

| Flocculant Dosing System Market Size 2032 |

USD 7.1 Billion |

The Flocculant Dosing System Market is shaped by a competitive group of global manufacturers that focus on precision dosing technologies, automated polymer activation, and digital monitoring capabilities to support municipal and industrial treatment needs. These companies strengthen their market positions through continuous product innovation, integration of smart control systems, and expansion into high-growth regions. Asia Pacific emerges as the leading regional market with an approximate 34–36% share, driven by rapid industrialization, expanding wastewater treatment infrastructure, and tightening regulatory requirements across major economies. Growing investments in modernization and sustainable water management further reinforce the region’s dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Flocculant Dosing System Market reached USD 5.11 billion in 2024 and is projected to hit USD 7.1 billion by 2032, reflecting a 4.2% CAGR driven by rising demand for efficient chemical dosing and sludge management optimization.

- Increasing regulatory pressure on wastewater treatment and industrial effluent quality acts as a major driver, boosting adoption of automated and precision-controlled dosing systems across municipal and industrial facilities.

- Smart dosing technologies, IoT-enabled monitoring, and modular system designs represent key market trends, supporting higher accuracy, reduced chemical consumption, and improved operational efficiency.

- Competitive intensity remains high as manufacturers prioritize innovation in digital controls, energy-efficient pumps, and advanced polymer activation, while cost constraints and operational complexities act as notable restraints.

- Asia Pacific leads the market with 34–36% share, supported by rapid urbanization and expanding treatment infrastructure, while the ≤50 L/min flow-rate segment holds the dominant share due to its suitability for small and mid-scale applications.

Market Segmentation Analysis:

By Flow Rate

The ≤50 L/min segment holds the dominant share, accounting for around 42–45% of the Flocculant Dosing System Market, driven by its strong adoption in small and mid-scale treatment units that require precise polymer dosing and energy-efficient operation. This flow range supports compact plant layouts, reduces operational costs, and ensures easy integration with automated control systems. Its popularity in decentralized wastewater systems and industrial pretreatment facilities reinforces demand, while upgrades in dosing accuracy, modular design, and low-maintenance components continue to expand adoption across diverse end-use environments.

- For instance, Watson-Marlow’s pump portfolio includes the “530 process pumps,” which deliver flow rates up to 3.5 L/min and operate at pressures up to 7 bar, making them well suited for compact or smaller-scale chemical dosing applications.

By Application

Water and wastewater treatment remains the leading application, representing over 48–50% of the market, supported by expanding municipal utilities, stricter discharge regulations, and the growing need for sludge management optimization. The segment benefits from widespread deployment of flocculants for solid–liquid separation, clarification, and effluent polishing across municipal and industrial treatment plants. Rising global investments in wastewater recycling, membrane pretreatment, and advanced treatment infrastructure further strengthen the segment’s dominance. Increasing adoption of automated dosing platforms and polymer optimization programs continues to drive system upgrades and new installations.

- For instance, SPX FLOW supplies high-efficiency mixing and fluid-handling equipment — such as its “Lightnin Series 700/800 High Torque Mixers” — widely used for flocculation and sludge mixing in treatment plants, ensuring stable mixing of polymers and chemicals in tanks ranging from 5 m³ to over 1,000 m³.

By End User

The municipal segment dominates the market with approximately 40–42% share, driven by large-scale investments in urban wastewater treatment, aging infrastructure modernization, and regulatory mandates emphasizing water quality improvement. Municipal utilities rely heavily on flocculant dosing systems for sludge dewatering, primary clarification, and tertiary treatment, boosting demand for accurate, continuous-flow dosing technologies. The segment also benefits from long-term operational contracts and public spending on centralized treatment facilities. Rising focus on water reuse, smart plant automation, and sustainable chemical consumption further accelerates municipal adoption and system replacement cycles.

Key Growth Drivers

- Rising Demand for Advanced Water & Wastewater Treatment

Growing global pressure to improve water quality, reduce pollutant loads, and expand wastewater recycling drives strong adoption of flocculant dosing systems. Municipal utilities and industries invest in automated dosing technologies to enhance solid–liquid separation efficiency, optimize sludge handling, and meet stringent environmental regulations. Increasing industrial effluent generation in sectors such as chemicals, food processing, and pharmaceuticals further accelerates system installations. The push for sustainable water management and expanding urban infrastructure continues to reinforce demand for high-precision flocculant dosing solutions.

- For instance, Blue-White’s “PRO Series” peristaltic dosing pumps can deliver flow rates from 0.1 mL/min to 20 L/min with operating pressures up to 7 bar, making them suitable for small to medium-scale municipal and industrial water treatment systems.

- Expansion of Industrial Automation and Digital Dosing Controls

The market benefits from the rapid integration of automation, digital monitoring, and smart dosing algorithms that significantly improve treatment accuracy and operational efficiency. Industries increasingly adopt PLC-controlled and IoT-enabled dosing platforms to reduce manual intervention, enhance chemical utilization, and lower operational costs. Real-time viscosity measurement, polymer activation optimization, and remote diagnostics strengthen reliability in continuous treatment processes. As industries prioritize predictive maintenance and data-driven process optimization, digitally enabled dosing systems see rising preference across small, mid-scale, and large installations.

- For instance, ProMinent’s gamma/ X digital metering pumps incorporate PLC interfaces and IoT connectivity, enabling remote monitoring and precise dosing control across small to mid-scale treatment units. The pump is designed for high-precision micro-metering of chemicals with flow rates typically up to around 45 L/h, depending on the specific pump configuration and pressure rating.

- Growth in Sludge Management and Dewatering Operations

Rising sludge volumes from municipal and industrial wastewater plants fuel demand for optimized flocculant dosing systems that improve dewatering efficiency and reduce downstream handling costs. As plants modernize their sludge treatment lines, they increasingly adopt automated polymer preparation units and high-accuracy dosing pumps. The emphasis on reducing sludge disposal costs, improving cake dryness, and minimizing energy consumption strengthens market growth. Regulatory pressure on landfill usage and biosolids management further accelerates adoption of flocculant-based treatment processes supported by optimized dosing infrastructure.

Key Trends & Opportunities

- Increasing Shift Toward Smart, Sensor-Integrated Dosing Systems

The market experiences a strong trend toward intelligent dosing solutions equipped with sensors for turbidity, flow rate, and polymer viscosity monitoring. These systems enable adaptive, closed-loop control that significantly enhances treatment stability and minimizes overdosing. The shift toward Industry 4.0 technologies creates opportunities for manufacturers to integrate cloud analytics, digital twins, and automated calibration features. Growing end-user preference for remote monitoring and performance dashboards supports the transition to highly automated, data-centric flocculant dosing platforms.

- For instance, Nikkiso’s Smart Dosing Pump Systems integrate with external flow sensors and control systems capable of handling process flows across a wide range, often up to 50 L/min for specific models.

- Growing Opportunity in Decentralized and Modular Treatment Plants

Rising urbanization, resource constraints, and the need for localized treatment systems create new opportunities for compact and modular flocculant dosing units. Small and decentralized wastewater plants in industrial estates, residential communities, and remote regions increasingly adopt portable dosing systems due to their low footprint and simplified operation. Manufacturers capitalize on this trend by offering plug-and-play units with flexible flow-rate configurations. The expanding use of containerized treatment systems in developing regions continues to boost demand for modular, energy-efficient dosing technologies.

- For instance, Grundfos’ ME/ME X compact dosing pumps support flow rates from 0.2 L/h to 100 L/h with operating pressures up to 16 bar, allowing deployment in small-scale, decentralized wastewater plants.

- Expansion of Eco-Friendly and Low-Chemical Treatment Solutions

End users show growing interest in reducing chemical consumption and improving environmental sustainability, creating opportunities for flocculant dosing systems that support bio-based polymers and high-efficiency formulations. Advanced dosing platforms that optimize polymer activation and minimize wastage gain traction across municipal and industrial applications. The wider shift toward green treatment technologies, including natural coagulants and biodegradable polymers, encourages investment in systems capable of precise low-dosage control. This trend positions environmentally aligned dosing solutions for accelerated market penetration.

Key Challenges

- High Capital Costs and Budget Constraints in Municipal Projects

High initial investment requirements for automated and sensor-integrated flocculant dosing systems remain a major barrier, especially for small municipalities and budget-constrained utilities. Upfront expenditures for preparation tanks, control systems, dosing pumps, and calibration units limit adoption despite long-term savings. Delays in public funding cycles and competition with other water infrastructure priorities further slow procurement. The challenge becomes more prominent in developing regions where treatment facilities operate with limited modernization budgets.

- Operational Complexity and Skilled Workforce Limitations

Despite technological advancements, many flocculant dosing systems require skilled operators to manage polymer activation, adjust dosing rates, and maintain system calibration. Plants lacking trained personnel face risks of overdosing, underdosing, or inconsistent treatment performance. Limited knowledge of polymer behavior, viscosity changes, and equipment troubleshooting increases operational challenges. Workforce shortages in water utilities and industrial facilities intensify the issue, compelling vendors to offer extensive training and simplified system designs, yet skill gaps remain a significant adoption barrier.

Regional Analysis

North America

North America holds around 30–32% of the Flocculant Dosing System Market, supported by mature wastewater treatment infrastructure, strong regulatory frameworks, and continuous investments in plant modernization. Municipal utilities adopt automated dosing technologies to improve sludge handling, optimize chemical usage, and comply with stringent effluent discharge norms. Industrial sectors such as oil & gas, chemicals, and food processing further reinforce demand through expanding process-water treatment operations. The region also benefits from early adoption of digital monitoring systems, remote diagnostics, and energy-efficient dosing platforms, strengthening long-term market growth.

Europe

Europe accounts for approximately 26–28% share, driven by strict environmental regulations, widespread focus on wastewater recycling, and ongoing upgrades to aging treatment plants. The region’s strong chemical, pharmaceutical, and food-processing industries contribute significantly to industrial demand for high-precision dosing solutions. Countries such as Germany, the UK, and France prioritize chemical optimization, automated polymer activation, and advanced sludge management technologies. Growing adoption of Industry 4.0 and digital water management platforms accelerates integration of smart dosing systems. Sustainability pressures and circular-economy initiatives also stimulate investment in energy-efficient, low-chemical dosing infrastructures.

Asia Pacific

Asia Pacific leads the global market with approximately 34–36% share, fueled by rapid industrialization, expanding municipal wastewater treatment capacity, and rising environmental compliance requirements. China, India, and Southeast Asian countries invest heavily in new treatment infrastructure, driving large-scale demand for flocculant dosing systems across municipal, industrial, and decentralized plants. Industrial sectors—including chemicals, textiles, mining, and electronics—strengthen installations due to high effluent loads and growing water reuse initiatives. The region’s shift toward smart automation, coupled with government-backed water sustainability programs, continues to boost adoption of advanced dosing technologies.

Latin America

Latin America holds roughly 8–9% of the market, supported by growing investments in urban wastewater treatment, industrial expansion, and environmental compliance initiatives. Countries such as Brazil, Mexico, and Chile increasingly adopt flocculant dosing systems to improve water quality and reduce sludge handling costs across municipal utilities and mining operations. Industrial wastewater from food processing, chemicals, and pulp & paper sectors also contributes to demand. Budget limitations and uneven infrastructure development remain challenges, yet rising interest in modular, cost-efficient dosing units strengthens market penetration in both urban and semi-urban regions.

Middle East & Africa

The Middle East & Africa region represents around 6–7% share, driven by growing demand for water treatment solutions in water-scarce economies and expanding industrial projects. Countries such as Saudi Arabia, the UAE, and South Africa adopt flocculant dosing systems to support desalination pretreatment, industrial effluent management, and municipal wastewater operations. The mining and oil & gas sectors significantly influence adoption due to high flocculant consumption for clarification and sludge control. Despite infrastructure gaps and funding constraints, ongoing investments in wastewater recycling and industrial expansion sustain steady market growth.

Market Segmentations:

By Flow Rate:

- ≤ 50 (L/min)

- 50 to 100 (L/min)

By Application:

- Water & wastewater treatment

- Chemical processing

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Flocculant Dosing System Market features a competitive landscape shaped by leading global manufacturers such as Watson-Marlow Fluid Technology Solutions, SPX Flow, Blue White Pumps, ProMinent Group, Nikkiso Co. Ltd., Grundfos Holding A/S, SEKO S.P.A., IDEX Corporation, Netzsch Pumps, and Verder Liquid B.V. the Flocculant Dosing System Market is defined by continuous innovation in automated dosing technologies, digital monitoring capabilities, and high-precision pump systems tailored for both municipal and industrial treatment facilities. Manufacturers focus on developing intelligent dosing platforms that enhance polymer activation efficiency, minimize chemical wastage, and improve process stability across varying flow conditions. The market also sees strong competition in offering modular, energy-efficient, and low-maintenance systems suited for decentralized and large-scale plants. Companies increasingly prioritize integration with IoT, real-time analytics, and predictive maintenance tools to strengthen operational reliability. Strategic partnerships, expansion into emerging markets, and investments in R&D reinforce competitive positioning, while sustainability-driven solutions and advanced control systems continue to shape differentiation across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Watson-Marlow Fluid Technology Solutions

- SPX Flow

- Blue White Pumps

- ProMinent Group

- Nikkiso Co. Ltd.

- Grundfos Holding A/S

- SEKO S.P.A.

- IDEX Corporation

- Netzsch Pumps

- Verder Liquid B.V.

Recent Developments

- In June 2025, Ingersoll Rand acquired Lead Fluid Intelligent Equipment manufacturing, reinforcing its in-region, for region growth strategy. Lead Fluid specializes in design and manufacturing of precision fluid handling solutions, including peristaltic pumps, syringe pumps, gear pumps, and pump heads.

- In March 2025, Grundfos launched the new DDA Smart Digital Dosing Pump for industrial, commercial, and utility applications, which enhances safety, user-friendliness, and dosing precision. This new pump uses a variable-speed stepper motor and a turn-down ratio.

- In November 2024, NETZSCH launched the PERIPRO tube pump, designed for continuous operation in demanding applications like wastewater treatment. The pump has a hermetically sealed design with a built-in leakage sensor to prevent contamination.

- In May 2024, The Verder Group acquired a majority stake in ITC, a Spanish manufacturer of dosing pumps for agricultural and water treatment applications. This acquisition strengthens Verder Liquid, the group’s pump division, by expanding its presence in the global dosing pump sector.

Report Coverage

The research report offers an in-depth analysis based on Flow Rate, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance through wider adoption of automated and smart dosing systems that enhance treatment accuracy and operational efficiency.

- Digital monitoring, IoT connectivity, and predictive maintenance will become standard features across new installations.

- Municipal wastewater treatment expansion will continue to drive strong demand for high-precision dosing technologies.

- Industrial sectors will increase investments in optimized polymer dosing to improve effluent quality and meet stricter environmental regulations.

- Modular and compact dosing units will gain traction in decentralized and small-scale treatment facilities.

- Sustainability priorities will accelerate the use of low-chemical and energy-efficient dosing solutions.

- Integration of AI-driven dosing algorithms will improve performance consistency under varying operating conditions.

- Vendors will expand service-based models offering remote support, real-time diagnostics, and performance optimization.

- Developing regions will emerge as high-potential markets due to rising infrastructure investments and regulatory enforcement.

- Continuous R&D in advanced polymers and activation technologies will enhance treatment outcomes and boost system upgrades.