Market Overview

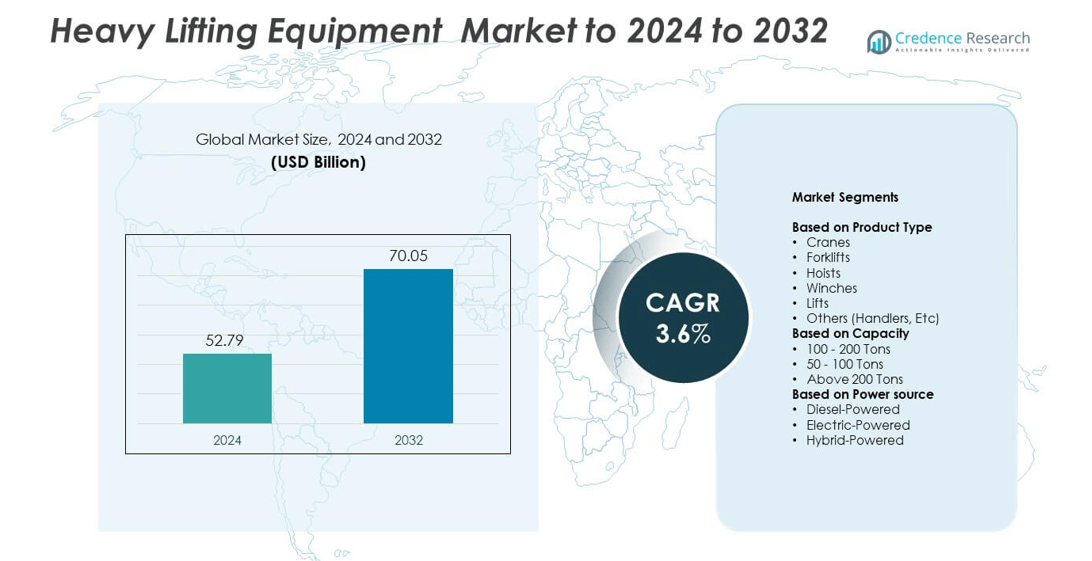

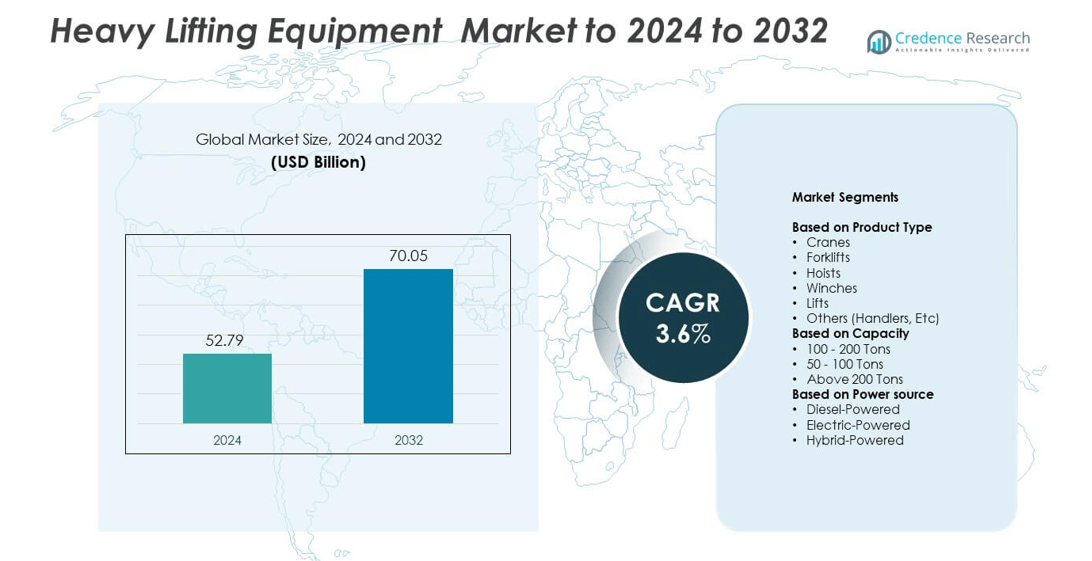

The Heavy Lifting Equipment Market size was valued at USD 52.79 billion in 2024 and is anticipated to reach USD 70.05 billion by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Lifting Equipment Market Size 2024 |

USD 52.79 billion |

| Heavy Lifting Equipment Market, CAGR |

3.6% |

| Heavy Lifting Equipment Market Size 2032 |

USD 70.05 billion |

The heavy lifting equipment market is dominated by leading players such as Liebherr, Komatsu, Tadano, Palfinger, Konecranes, Demag Cranes & Components, Manitowoc Company, SANY, and Cargotec, among others. These companies compete through innovation, extensive distribution networks, and expansion into emerging economies. They focus on developing energy-efficient, automated, and hybrid-powered equipment to meet global sustainability standards. Strategic mergers and partnerships enhance their product portfolios and strengthen aftersales support. North America leads the global market with a 34% share, followed by Europe at 28% and Asia-Pacific at 26%, reflecting strong industrial demand and infrastructure investment across key regions.

Market Insights

- The Heavy Lifting Equipment Market was valued at USD 52.79 billion in 2024 and is projected to reach USD 70.05 billion by 2032, growing at a CAGR of 3.6%.

- Rising infrastructure and industrial development, along with the adoption of automation, are driving strong demand for advanced lifting machinery across sectors.

- Key trends include the growing use of electric and hybrid-powered cranes, integration of IoT-based monitoring systems, and emphasis on sustainability in equipment design.

- The market is highly competitive, with major players focusing on innovation, mergers, and digital solutions to strengthen their global footprint.

- North America led the market with a 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 26%, while cranes remained the dominant product segment, holding 42% of the overall share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Cranes dominated the heavy lifting equipment market with a 42% share in 2024. Their versatility in construction, mining, and offshore applications drives widespread adoption. Mobile cranes, in particular, support large infrastructure projects requiring flexible load-handling capabilities. Forklifts and hoists also show steady growth due to increased use in logistics and manufacturing. Advancements in automation, telematics, and load monitoring systems are enhancing efficiency and safety standards, further strengthening crane demand across both developed and emerging economies.

- For instance, Liebherr’s LR 11000 crane lists 1,000 t capacity, 220 m hoist height, and 184 m radius.

By Capacity

The 100–200 tons segment held the largest share of 46% in 2024. This range offers the ideal balance of lifting strength and operational flexibility, making it suitable for construction, shipbuilding, and heavy manufacturing. Equipment in this range is widely preferred for infrastructure development and industrial plant expansion. The growing number of renewable energy projects, such as wind farms and power stations, continues to fuel demand for mid-range lifting equipment with improved reach and stability.

- For instance, Tadano’s AC 5.160-1 all-terrain crane provides 160 t capacity and a 68 m main boom, with 14.51 m overall length.

By Power Source

Diesel-powered equipment led the market with a 61% share in 2024. Diesel models remain dominant due to their high torque output and suitability for outdoor and heavy-duty operations. They are essential in large construction sites, ports, and mining projects where continuous operation is required. However, electric and hybrid-powered variants are gaining traction driven by emission regulations and sustainability goals. Technological upgrades in battery performance and charging systems are further encouraging the shift toward cleaner lifting solutions worldwide.

Key Growth Drivers

Rising Infrastructure and Industrial Development

Global investments in infrastructure and industrial expansion are fueling heavy lifting equipment demand. Large-scale projects in transportation, energy, and construction sectors require advanced lifting solutions for efficiency and safety. The growing emphasis on urban infrastructure, ports, and renewable installations supports consistent demand for cranes, forklifts, and hoists. Emerging economies, particularly in Asia-Pacific, are witnessing significant construction activities, increasing equipment procurement across public and private sectors. This surge in development projects directly drives the steady expansion of the heavy lifting equipment market worldwide.

- For instance, Mammoet notes modern wind-turbine components reaching 136 t, increasing heavy-lift demand at energy sites.

Technological Advancements and Automation

Automation and digital integration are transforming heavy lifting operations. Modern equipment now features telematics, remote monitoring, and predictive maintenance systems, improving uptime and operational precision. Manufacturers are integrating sensors, AI-based load control, and IoT connectivity to enhance safety and efficiency. These innovations minimize manual errors and support compliance with safety regulations. The transition toward automated lifting systems is especially beneficial in logistics and offshore sectors, where precision and safety are critical. This technological evolution continues to boost equipment adoption globally.

- For instance, Linde Material Handling capped charging at 180 kW for 17 K-trucks using connect:charger, supporting continuous, telematics-driven operations.

Growing Emphasis on Safety and Efficiency

Stringent safety regulations and the need to optimize material handling efficiency are major market drivers. Companies are investing in equipment with advanced control systems, overload protection, and operator assistance features. The focus on reducing workplace accidents and improving operational performance is encouraging the replacement of outdated machines with new, compliant models. Industries such as construction, mining, and shipping prioritize high-performance lifting solutions that enhance safety while reducing operational costs, thereby driving steady market expansion across multiple sectors.

Key Trends & Opportunities

Adoption of Electric and Hybrid Equipment

The transition toward electric and hybrid-powered lifting equipment is gaining strong momentum. Rising fuel costs and environmental regulations are encouraging businesses to adopt energy-efficient alternatives. Electric-powered cranes and forklifts offer lower maintenance costs and reduced emissions, aligning with global sustainability goals. Battery technology advancements are extending operating hours and reducing downtime, improving productivity across industries. This shift presents a strong opportunity for manufacturers focusing on eco-friendly and high-performance lifting equipment solutions in both developed and emerging markets.

- For instance, Plug Power reports over 72,000 fuel-cell systems deployed and 275 hydrogen fueling stations, underpinning electric fleet adoption.

Integration of Smart and Connected Technologies

Smart lifting systems equipped with IoT sensors, GPS, and analytics platforms are reshaping the industry. These systems enable real-time tracking, performance diagnostics, and predictive maintenance, ensuring greater reliability and safety. Data-driven insights help operators optimize load capacity and prevent equipment failures. The use of cloud-based monitoring tools and AI-driven automation is transforming operations in construction, logistics, and manufacturing. As industries prioritize digital transformation, connected lifting solutions are emerging as a key opportunity for sustained market growth.

- For instance, Manitowoc’s parts network manages more than 70,000 unique part numbers through global distribution centers, reflecting high upkeep complexity.

Key Challenges

High Initial Costs and Maintenance Expenses

Heavy lifting equipment involves significant capital investment and maintenance costs. Small and medium-sized enterprises often face financial constraints in acquiring modern, automated machinery. Frequent component servicing, compliance upgrades, and spare part replacements further increase operational expenses. High entry costs restrict adoption in developing economies, where leasing and rental alternatives are preferred. Despite long-term efficiency benefits, these cost challenges continue to slow the widespread transition to advanced heavy lifting solutions among cost-sensitive end users.

Skilled Labor Shortage and Safety Compliance

The shortage of skilled operators remains a pressing issue in the heavy lifting equipment market. Operating complex machinery requires technical expertise and training to ensure safe and efficient handling. Inadequate skill levels increase the risk of accidents and equipment misuse, leading to downtime and productivity loss. Moreover, strict safety compliance standards across industries demand continuous workforce training. Companies are investing in simulation-based operator training and certification programs to address this challenge and enhance operational reliability.

Regional Analysis

North America

North America held the largest share of 34% in the heavy lifting equipment market in 2024. The region’s growth is driven by extensive construction, oil and gas, and port infrastructure projects across the United States and Canada. High adoption of advanced cranes, forklifts, and hoists supports industrial efficiency and safety compliance. Manufacturers focus on automation and hybrid-powered equipment to meet stringent emission standards. Expanding logistics and manufacturing sectors also contribute to equipment modernization. Continuous investments in renewable energy and industrial facilities further strengthen North America’s leading market position.

Europe

Europe accounted for a 28% share in the heavy lifting equipment market in 2024. The region benefits from robust demand in automotive, construction, and offshore wind energy sectors. Countries such as Germany, the Netherlands, and the United Kingdom are leading adopters of smart lifting technologies. Increasing focus on workplace safety and energy efficiency drives the replacement of older machinery with modern, digitalized systems. Strong presence of key manufacturers and government-backed infrastructure programs also support market growth. Rising investments in green construction and electric equipment adoption further sustain Europe’s steady expansion.

Asia-Pacific

Asia-Pacific captured a 26% market share in 2024, supported by rapid urbanization, industrialization, and infrastructure development. China, India, Japan, and South Korea are major contributors, driven by growing construction and manufacturing activities. Government initiatives in smart cities and transportation modernization are fueling equipment demand. Local manufacturers are expanding production capacities to meet domestic needs while exporting to other regions. The growing preference for cost-effective and energy-efficient models is shaping market competition. Asia-Pacific’s strong economic growth and large-scale industrial projects position it as a key emerging market for heavy lifting solutions.

Latin America

Latin America held an 8% share of the global heavy lifting equipment market in 2024. The region’s demand is rising due to ongoing infrastructure projects in Brazil, Mexico, and Chile. Expansion in mining, oil exploration, and logistics sectors is driving adoption of cranes and hoists. Economic reforms and foreign investments are encouraging modernization of heavy machinery fleets. However, high equipment costs and limited local manufacturing capacity restrain faster growth. Increasing government efforts to improve port and transportation infrastructure are expected to create new opportunities for market expansion in the region.

Middle East & Africa

The Middle East & Africa accounted for a 7% market share in 2024, primarily driven by construction, oil and gas, and industrial projects. Countries such as Saudi Arabia, the UAE, and South Africa are investing heavily in infrastructure modernization and energy diversification. Demand for high-capacity cranes and heavy-duty lifting systems is increasing in large-scale industrial and petrochemical complexes. Despite challenges related to import dependency, regional governments are supporting domestic manufacturing initiatives. Continued urban development and diversification of non-oil industries will further strengthen the market outlook across the region.

Market Segmentations:

By Product Type

- Cranes

- Forklifts

- Hoists

- Winches

- Lifts

- Others (Handlers, Etc)

By Capacity

- 100 – 200 Tons

- 50 – 100 Tons

- Above 200 Tons

By Power source

- Diesel-Powered

- Electric-Powered

- Hybrid-Powered

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The heavy lifting equipment market is highly competitive, with major players such as Liebherr, Komatsu, Tadano, Palfinger, Konecranes, Demag Cranes & Components, Manitowoc Company, SANY, Sarens, Cargotec, Shanghai Zhenhua Heavy Industries (ZPMC), Mammoet, Sennebogen, JASO Industrial Cranes, Terex, Agilent Technologies, Waters Corporation, Bruker, and Becton Dickinson shaping the industry landscape. Companies are focusing on product innovation, automation, and energy-efficient lifting systems to strengthen market presence. Strategic collaborations, mergers, and investments in digital technologies are enhancing operational performance and safety standards. Manufacturers are expanding production capacities and service networks to meet global infrastructure and industrial demand. Emphasis on sustainable designs, electric and hybrid-powered machinery, and remote monitoring solutions is driving long-term competitiveness. Continuous research and development in telematics and smart load management systems are enabling companies to cater to evolving construction, logistics, and manufacturing requirements while maintaining reliability and efficiency across diverse applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liebherr

- Komatsu

- Tadano

- Palfinger

- Konecranes

- Demag Cranes & Components

- Manitowoc Company

- SANY

- Sarens

- Cargotec

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Mammoet

- Sennebogen

- JASO Industrial Cranes

- Terex

- Agilent Technologies

- Waters Corporation

- Bruker

- Becton Dickinson

Recent Developments

- In 2025, Liebherr introduced the LR 1300.2 SX unplugged, an all-electric 300-tonne crawler crane designed for emission-free and quiet operation

- In 2024, Konecranes launched the flagship X-series industrial crane, which features advanced capabilities like wireless software upgrades, remote monitoring, and several “Smart Features,” including automatic load sensing functions.

- In 2023, Komatsu Ltd. Launched a 20-ton PC210LCE electric excavator with a large battery capacity for extended operating time.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing automation and digital control systems will enhance equipment precision and safety.

- Demand for electric and hybrid-powered lifting equipment will grow due to emission regulations.

- Integration of IoT and AI technologies will enable predictive maintenance and real-time monitoring.

- Expansion of renewable energy projects will drive the need for high-capacity lifting systems.

- Urbanization and infrastructure modernization will continue to support market growth globally.

- Equipment rental and leasing services will expand as cost-effective alternatives for small firms.

- Manufacturers will focus on lightweight materials to improve fuel efficiency and load capacity.

- Safety compliance standards will push the adoption of smart load management systems.

- Developing regions will witness rapid adoption through government-led industrialization programs.

- Ongoing R&D investments will lead to advanced, sustainable, and connected heavy lifting solutions.