Market Overview

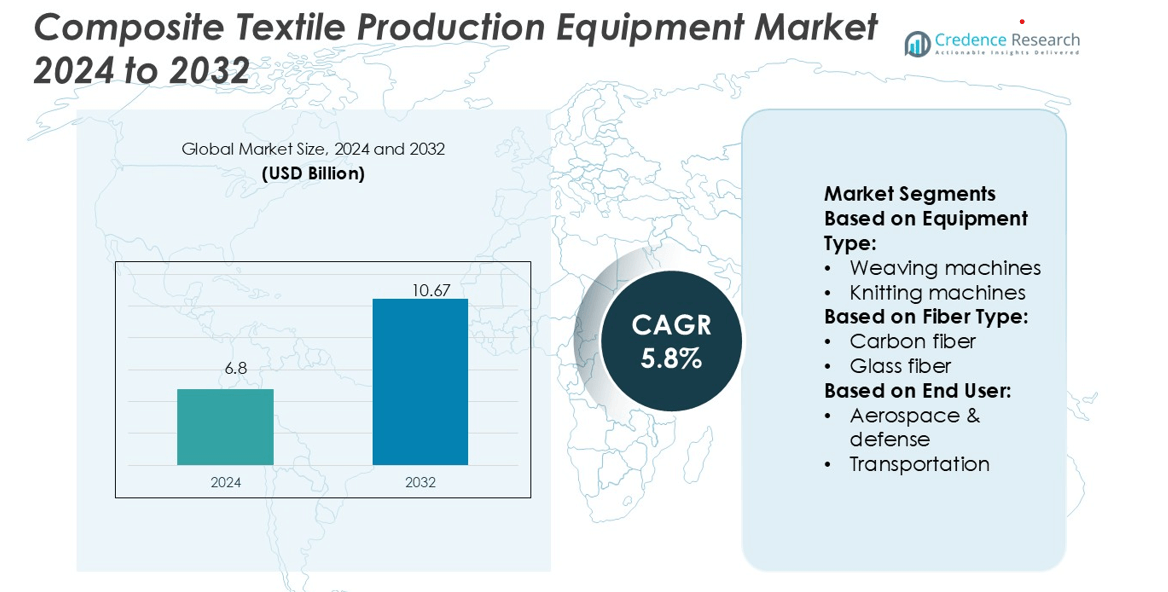

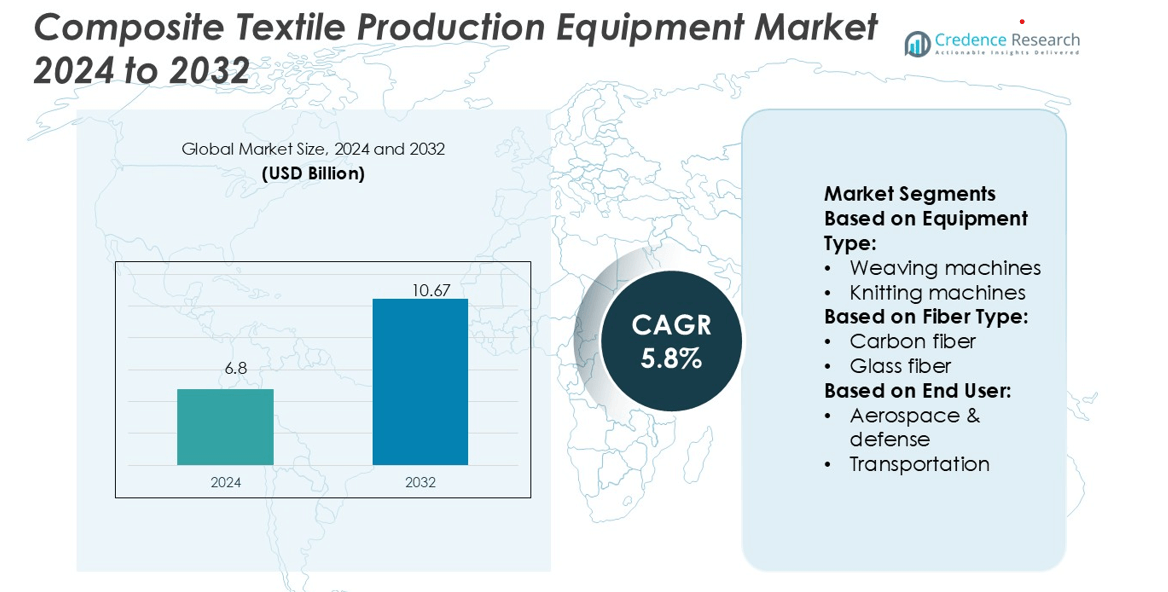

Composite Textile Production Equipment Market size was valued USD 6.8 billion in 2024 and is anticipated to reach USD 10.67 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Composite Textile Production Equipment Market Size 2024 |

USD 6.8 billion |

| Composite Textile Production Equipment Market, CAGR |

5.8% |

| Composite Textile Production Equipment Market Size 2032 |

USD 10.67 billion |

The Composite Textile Production Equipment Market is highly competitive, with leading players such as Lindauer DORNIER GmbH, KARL MAYER Holding SE & Co. KG, Itema Group, Cygnet Texkimp, Lamiflex S.p.A., IMESA S.r.l., Hangzhou Dengte Textile Machinery Co., Ltd, Dashmesh Jacquard and Powerloom Pvt. Ltd., Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd., and Griffith Textile Machines. These companies focus on precision engineering, automation, and smart control technologies to enhance fabric quality and production efficiency. Asia-Pacific dominates the market with a 34% share, supported by large-scale manufacturing, rising investments in composites, and rapid adoption of automated equipment in China, Japan, and South Korea.

Market Insights

- The Composite Textile Production Equipment Market was valued at USD 6.8 billion in 2024 and is expected to reach USD 10.67 billion by 2032, registering a CAGR of 5.8% during the forecast period.

- Rising demand for lightweight and high-strength materials in aerospace, automotive, and renewable energy sectors is driving equipment innovation and adoption.

- The market is witnessing a trend toward automation, IoT-enabled control systems, and AI-based quality monitoring to enhance production efficiency and consistency.

- Competition is intense, with key players focusing on digital manufacturing, sustainability, and customized machinery to strengthen their global presence.

- Asia-Pacific holds a 34% share, leading global demand, while weaving machines dominate by equipment type due to their extensive use in carbon and glass fiber textile production for industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment Type

Weaving machines dominate the Composite Textile Production Equipment Market with the largest share. These machines are widely used for producing high-strength fabrics in aerospace and automotive applications. Their precision control systems and integration with automated looms enhance fiber alignment and consistency. The growing adoption of computer-controlled weaving systems supports complex multi-layer structures used in carbon and glass fiber composites. Companies invest in advanced looms capable of producing lightweight yet durable fabrics, driving market expansion through higher efficiency and reduced material wastage.

- For instance, Lindauer DORNIER’s P2 rapier weaving machine supports a machine width up to 540 cm and operates at 600 picks per minute, enabling high-throughput composite fabric production with precise control of yarn alignment.

By Fiber Type

Carbon fiber holds the dominant share in the market due to its superior strength-to-weight ratio and fatigue resistance. It is highly preferred in aerospace, defense, and performance automotive manufacturing. The increased use of high-modulus carbon fiber in aircraft fuselage and body panels has accelerated demand. Manufacturers focus on enhancing production speed through optimized prepreg and braiding technologies. The rising emphasis on lightweight construction for fuel efficiency further supports carbon fiber equipment growth compared to glass or natural fibers.

- For instance, their lab-scale Direct Melt Impregnation thermoplastic line is 5 m long and 1 m wide, scalable to process up to 600 mm width prepregs as thin as 0.1 mm.

By End User

The aerospace and defense segment leads the market, accounting for the largest share. Composite textiles are used in aircraft fuselages, rotor blades, and structural reinforcements to achieve weight reduction and high durability. The growing adoption of automated weaving and prepreg machines enhances productivity in aircraft manufacturing. Major aerospace firms invest heavily in modernizing production lines for composite materials to meet increasing aircraft orders. The push for lightweight and fuel-efficient aircraft designs continues to drive strong equipment demand from this end-user segment.

Key Growth Drivers

Rising Demand for Lightweight and High-Performance Materials

The growing need for lightweight materials in aerospace, automotive, and wind energy sectors drives market growth. Composite textiles offer high strength-to-weight ratios, improving efficiency and reducing fuel consumption. Manufacturers increasingly adopt automated weaving, knitting, and prepreg systems to produce advanced fabrics for aircraft and electric vehicles. For instance, aerospace firms utilize carbon fiber composites to achieve up to 20% fuel savings. This demand for lightweight performance materials continues to expand production capacity and boost equipment modernization investments.

- For instance, IMESA manufactures the highly customizable KK1 DS LC Pre-cut laminator line, which typically offers processing speeds up to 25 m/min under programmable control.

Advancements in Automation and Digital Manufacturing

Automation plays a key role in improving production speed and accuracy in composite textile equipment. The integration of robotics, AI-driven quality control, and IoT-based monitoring reduces manual errors and downtime. Automated prepreg and braiding machines enhance fiber placement precision, ensuring consistent fabric quality. For instance, leading manufacturers use digital twin technology for predictive maintenance and performance optimization. These advancements in automation support cost efficiency, scalability, and customization, strengthening the global competitiveness of composite textile production facilities.

- For instance, Lamiflex (in its broader group) deploys an electronic Kanban system that cut stock levels by 30% and reduced internal material-handling time by 30 minutes per week — outcomes from its lean automation drive.

Expansion of Renewable Energy and Infrastructure Projects

Increasing investments in wind energy and infrastructure development stimulate composite textile equipment demand. Wind turbine blades and structural reinforcements rely heavily on glass and carbon fiber fabrics. Governments worldwide are investing in renewable energy projects, creating strong demand for durable, corrosion-resistant materials. For example, large-scale wind farm installations in Europe and Asia require high-capacity weaving and prepreg machines. The need for long-lasting and lightweight composite components drives continued adoption across renewable and civil engineering sectors.

Key Trends & Opportunities

Integration of Smart Manufacturing and Data Analytics

Smart manufacturing adoption transforms composite textile production through real-time analytics and AI-driven insights. Equipment with embedded sensors enables predictive maintenance and continuous quality monitoring. Data-driven optimization minimizes material waste and enhances throughput. Companies integrating advanced MES and cloud systems gain a competitive advantage by ensuring operational efficiency. This trend creates opportunities for equipment manufacturers offering intelligent control systems designed for precision-driven composite production lines.

- For instance, HKS 3-M ON PLUS machine handles gauges E 14 to E 28 and supports working widths of 130”, 180”, 210”, plus unlimited pattern repeat lengths via its ON pattern drive.

Growing Use of Sustainable and Bio-Based Fibers

Sustainability initiatives are driving a shift toward natural and bio-based composite fibers. Equipment manufacturers are adapting to handle plant-based fibers like flax and hemp while maintaining structural performance. Green composites reduce carbon footprints and align with circular economy goals. For instance, the construction and automotive sectors increasingly favor biodegradable fiber reinforcements. This transition toward eco-friendly materials creates new opportunities for equipment innovation focused on renewable and recyclable input compatibility.

- For instance, Itema has extended its iSAVER® technology (initially for denim looms) to new fabrics, enabling up to 6 colours weft insertion with no waste selvedge.

Increased Investment in Aerospace and Defense Manufacturing

Rising aerospace investments, particularly in developing regions, create strong growth potential. Advanced composite textiles are vital for aircraft, drones, and defense vehicle production. Equipment suppliers providing high-speed, precision-controlled weaving and prepreg systems benefit from defense modernization programs. Expansion in commercial aviation fleets further accelerates demand for efficient, high-output machinery capable of processing next-generation carbon and aramid fibers.

Key Challenges

High Capital Investment and Maintenance Costs

Composite textile production equipment requires substantial initial investment and ongoing maintenance expenses. Small and medium enterprises face financial constraints when upgrading to automated or digital systems. High costs of robotics, software integration, and specialized tooling limit adoption. Additionally, frequent maintenance and skilled labor needs increase operational expenses. These financial barriers slow market penetration among emerging manufacturers, especially in cost-sensitive regions.

Technical Complexity and Skilled Workforce Shortage

Operating advanced composite textile equipment demands specialized technical knowledge. A shortage of trained operators and engineers capable of managing automation and quality control systems poses challenges. Misalignment or improper handling during fiber placement can lead to significant production losses. Training programs and partnerships with academic institutions are essential to address this gap. The limited availability of skilled talent hampers production efficiency and restricts large-scale technology deployment.

Regional Analysis

North America

North America holds a 31% market share in the Composite Textile Production Equipment Market, driven by advanced aerospace, defense, and automotive sectors. The U.S. leads regional adoption due to strong investments in automation and high-performance materials. Major manufacturers focus on integrating digital production technologies, such as robotic weaving and AI-based monitoring, to enhance precision. Growing demand for lightweight composites in electric vehicles and aircraft further fuels market growth. The presence of key players and continuous R&D investments strengthen North America’s dominance in high-end composite textile machinery.

Europe

Europe accounts for 28% of the global market share, supported by its mature automotive and wind energy industries. Countries such as Germany, France, and the U.K. lead equipment innovation, emphasizing sustainability and automation. European firms increasingly adopt carbon and glass fiber processing machinery to meet regulatory emission standards. Collaborative R&D initiatives between textile equipment manufacturers and aerospace companies boost production capacity. The region’s focus on Industry 4.0 technologies, combined with stringent environmental policies, accelerates adoption of eco-efficient composite production systems.

Asia-Pacific

Asia-Pacific dominates with a 34% market share, making it the fastest-growing region in composite textile production equipment. China, Japan, and South Korea lead manufacturing advancements through large-scale automation and investment in aerospace and construction sectors. Expanding EV production and renewable energy projects drive equipment demand across the region. Governments promote domestic composite manufacturing capabilities to reduce import reliance. Additionally, the rise of low-cost production facilities and skilled labor availability enhances regional competitiveness, positioning Asia-Pacific as the global hub for composite textile machinery.

Latin America

Latin America holds a 4% market share, showing steady growth supported by increasing industrialization and automotive production in Brazil and Mexico. Regional manufacturers are gradually adopting composite textile equipment for lightweight components in transportation and construction. The growing demand for renewable energy infrastructure, especially wind turbine components, supports equipment investments. However, limited access to advanced machinery and skilled operators slows widespread adoption. Strategic partnerships with international manufacturers are expected to accelerate technological adoption and improve production capabilities in the region.

Middle East & Africa

The Middle East & Africa capture a 3% market share, driven by emerging infrastructure projects and aerospace investments. The UAE and Saudi Arabia focus on diversifying industries through composites used in defense and construction applications. African countries like South Africa are adopting glass fiber equipment for local manufacturing. However, limited industrial infrastructure and high import costs challenge growth. Regional initiatives promoting industrial modernization and foreign investments are expected to strengthen production capacity, creating future opportunities for composite textile equipment suppliers.

Market Segmentations:

By Equipment Type:

- Weaving machines

- Knitting machines

By Fiber Type:

By End User:

- Aerospace & defense

- Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Composite Textile Production Equipment Market features prominent players such as Lindauer DORNIER GmbH, Dashmesh Jacquard And Powerloom Pvt. Ltd., Cygnet Texkimp, IMESA S.r.l., Lamiflex S.p.A., Hangzhou Dengte Textile Machinery Co., Ltd, KARL MAYER Holding SE & Co. KG, Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd., Itema Group, and Griffith Textile Machines. The Composite Textile Production Equipment Market is characterized by strong technological innovation, automation, and process optimization. Companies are investing heavily in advanced weaving, knitting, and prepreg systems integrated with IoT and AI-driven controls to enhance precision and efficiency. The focus is shifting toward high-speed, energy-efficient machinery capable of handling complex fiber structures such as carbon and glass composites. Manufacturers are also emphasizing sustainability by developing eco-friendly production systems and recyclable materials. Strategic collaborations, digital transformation, and capacity expansion across Asia-Pacific and Europe define the ongoing competition within this rapidly advancing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lindauer DORNIER GmbH

- Dashmesh Jacquard And Powerloom Pvt. Ltd.

- Cygnet Texkimp

- IMESA S.r.l.

- Lamiflex S.p.A.

- Hangzhou Dengte Textile Machinery Co., Ltd

- KARL MAYER Holding SE & Co. KG

- Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd.

- Itema Group

- Griffith Textile Machines

Recent Developments

- In March 2025, DORNIER presents new developments of its machines and systems for composite series production at JEC World 2025. On the P2 Roving, the global benchmark for production systems for high-quality fabrics made of carbon, glass and aramid fibers, it is possible to produce technical reinforcing fabrics for high-end applications extremely economically thanks to its high insertion capacity and its patented and maintenance-free DORNIER SyncroDrive.

- In November 2024, Teknor Apex, a trusted provider of custom plastic compounds for the healthcare industry, declared the expansion of its medical-grade thermoplastic elastomer (TPE) portfolio with new grades specifically designed for biopharmaceutical tubing applications.

- In June 2024, KARL MAYER Technische Textilien launched the new MAX GLASS ECO, a composite machine with a focus on standard non-crimp fabrics made of glass fibers. The MAX GLASS ECO incorporates proven solutions from the KARL MAYER GROUP’s range of multiaxial machines, including features from its predecessor, the MAXTRONIC®, and combines these with sophisticated new technical developments.

- In May 2024, BASF is committed to a sustainable future. It has set the ambitious aim of reducing its Scope 3.1 emissions by 15% across its portfolio by 2030 and getting net zero by 2050.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Fiber Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and digitalized composite textile machinery will continue to rise globally.

- Integration of AI and IoT technologies will improve production accuracy and reduce downtime.

- Carbon and glass fiber equipment will dominate due to expanding aerospace and EV applications.

- Manufacturers will invest more in sustainable and energy-efficient textile machinery designs.

- Asia-Pacific will strengthen its position as the leading production and export hub.

- Europe will focus on advanced R&D and eco-friendly composite manufacturing technologies.

- Partnerships between equipment makers and material suppliers will increase innovation speed.

- Smart manufacturing adoption will enhance predictive maintenance and production efficiency.

- Demand for bio-based and recyclable composite materials will open new equipment opportunities.

- Global competition will intensify as new entrants adopt automation and cost-effective solutions.