Market Overview

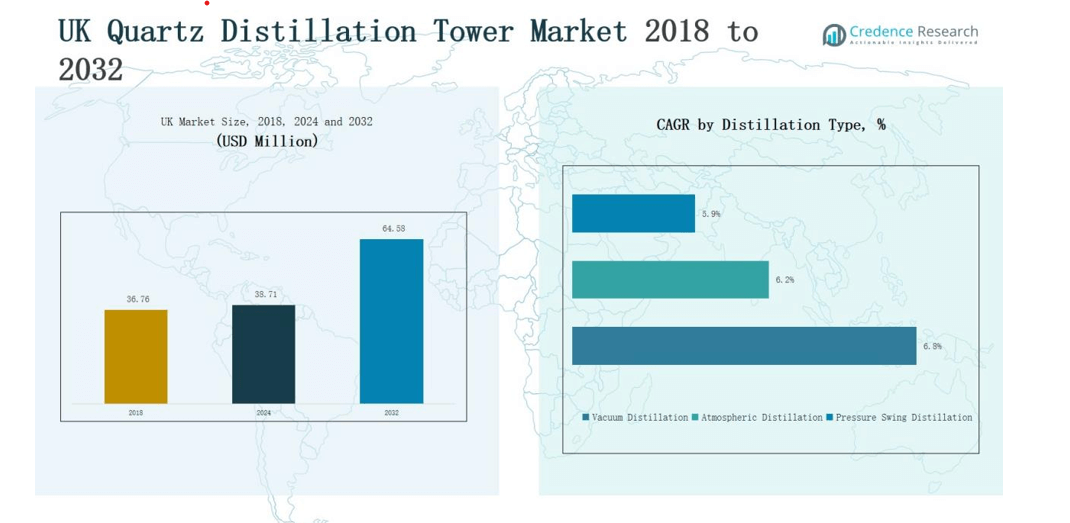

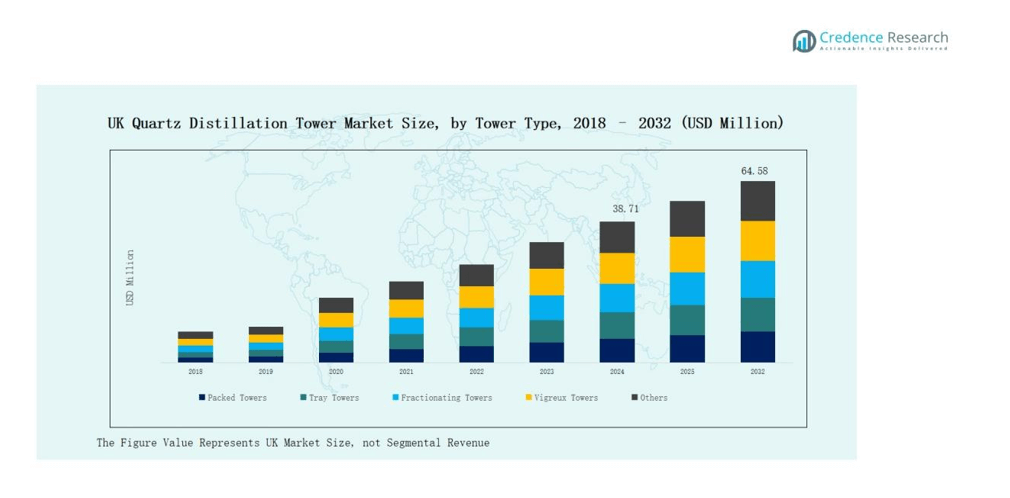

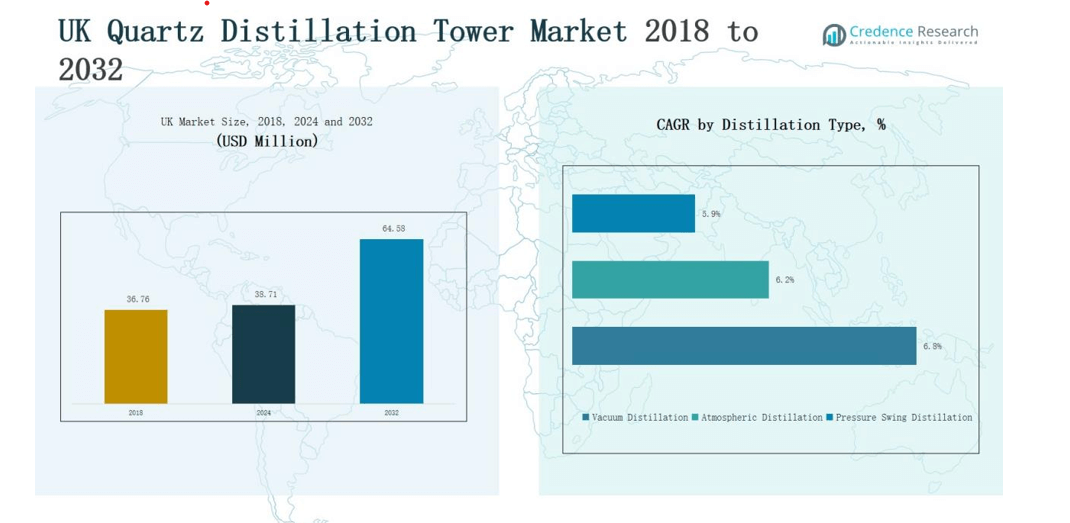

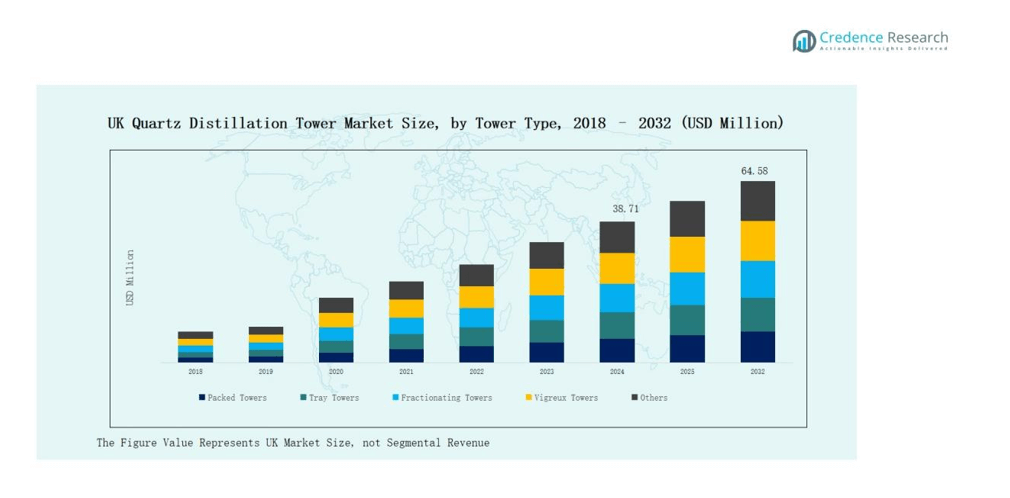

The UK Quartz Distillation Tower Market size was valued at USD 36.76 million in 2018, increased to USD 38.71 million in 2024, and is anticipated to reach USD 64.58 million by 2032, growing at a CAGR of 6.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Distillation Tower Market Size 2024 |

USD 38.71 million |

| UK Quartz Distillation Tower Market, CAGR |

6.61% |

| UK Quartz Distillation Tower Market Size 2032 |

USD 64.58 million |

The UK Quartz Distillation Tower Market is shaped by prominent players such as Saint-Gobain, Pall Corporation, Fenix Process Technologies, HAT International Ltd., Montz GmbH, Nikon Corporation, Heraeus, Koch-Glitsch, and Sulzer Ltd. These companies focus on precision manufacturing, high-purity quartz engineering, and advanced automation to enhance process reliability and energy efficiency. Strategic collaborations with semiconductor and pharmaceutical manufacturers strengthen their market presence. Continuous investment in R&D and material innovation supports product performance and durability. England emerged as the leading region, commanding 58% of the total market share in 2024, driven by its strong semiconductor base, advanced research ecosystem, and concentration of high-tech manufacturing facilities.

Market Insights

- The UK Quartz Distillation Tower Market was valued at USD 36.76 million in 2018, increased to USD 38.71 million in 2024, and is projected to reach USD 64.58 million by 2032, growing at a CAGR of 6.61%.

- England dominated the market with a 58% share in 2024, supported by strong semiconductor, chemical, and pharmaceutical manufacturing clusters across London, Cambridge, and Manchester.

- The Packed Towers segment led by 41% share due to high efficiency, low pressure drop, and suitability for corrosive and high-purity applications in semiconductor and pharmaceutical industries.

- The Vacuum Distillation segment accounted for 46% share, driven by its superior energy efficiency and precision in temperature-sensitive material separation across advanced industrial operations.

- Stainless Steel material dominated with 52% share, offering superior corrosion resistance, structural durability, and long operational lifecycles for high-performance quartz distillation applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

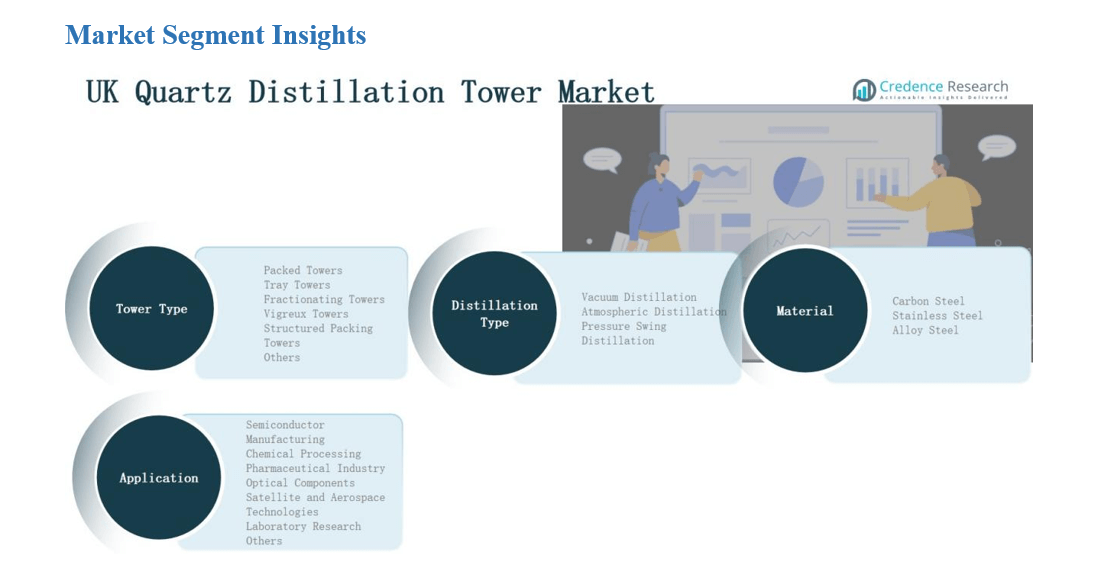

Market Segment Insights

By Tower Type

The Packed Towers segment dominated the UK Quartz Distillation Tower Market, accounting for 41% of the total share in 2024. Their high efficiency in mass transfer, low pressure drop, and suitability for corrosive environments drive strong adoption in semiconductor and pharmaceutical applications. The increasing focus on high-purity quartz structures enhances demand. Energy-efficient design improvements and material optimization further strengthen their preference over tray or fractionating systems in precision industrial processes.

- For instance, Heraeus Quartztech introduced a high-purity fused quartz packed tower system tailored for pharmaceutical solvent recovery, reducing operational pressure drops by 18% compared to conventional designs.

By Distillation Type

The Vacuum Distillation segment led the UK Quartz Distillation Tower Market, holding 46% of the share in 2024. It is widely used for temperature-sensitive materials requiring low thermal degradation during separation. The technology’s ability to operate at reduced pressures enhances product purity and energy savings. Growing semiconductor and specialty chemical production drives adoption, supported by rising R&D in low-contamination quartz towers designed for high-precision distillation and controlled manufacturing environments.

- For instance, QSIL advanced its R&D on high-purity quartz products for the semiconductor industry, integrating automated production technologies to enhance material consistency in controlled manufacturing environments

By Material

The Stainless Steel segment dominated the UK Quartz Distillation Tower Market, capturing 52% of the total share in 2024. Stainless steel’s superior corrosion resistance, structural durability, and compatibility with high-purity quartz assemblies make it ideal for long operational lifecycles. Industries prefer stainless steel towers for semiconductor, pharmaceutical, and fine chemical applications. Rising use of hybrid quartz-steel configurations improves thermal stability and mechanical strength, reinforcing the segment’s leadership across advanced industrial facilities.

Key Growth Drivers

Rising Semiconductor Manufacturing Demand

The growing semiconductor industry in the UK drives strong demand for high-purity quartz distillation towers. These systems enable contamination-free processing and precise temperature control essential for chip fabrication. The expansion of cleanroom facilities and local semiconductor R&D centers supports market growth. Manufacturers focus on developing energy-efficient and corrosion-resistant tower designs to meet process precision requirements, reinforcing the use of quartz-based systems across advanced manufacturing and electronic production environments.

- For example, UK-based startup Quantum Motion has created a full-stack quantum computer using standard silicon chips that are compatible with mass-manufacturing technologies, demonstrating a path toward scalable quantum technology

Technological Advancements in Quartz Engineering

Continuous innovation in quartz processing technologies enhances material strength, purity, and thermal resistance. UK-based manufacturers and European suppliers are investing in precision fabrication and automated assembly systems to improve tower efficiency and lifespan. Integration of digital control systems further enables performance optimization during distillation operations. These advancements reduce maintenance costs, increase output quality, and promote adoption across pharmaceutical, chemical, and microelectronics applications, strengthening the overall growth trajectory of the market.

- For instance, Momentive Technologies, a global leader in fused quartz, manufactures high-purity quartz tubes and other products for the semiconductor industry at its facilities, including a specialty quartz plant in Geesthacht, Germany.

Expanding Use in Chemical and Pharmaceutical Applications

The UK’s chemical and pharmaceutical sectors increasingly adopt quartz distillation towers for high-purity separation and solvent recovery processes. Their ability to maintain chemical stability under extreme thermal conditions ensures consistent output quality. Rising investments in drug formulation and specialty chemical manufacturing drive installation of customized quartz towers. The growing emphasis on sustainable production and material recyclability also boosts demand for corrosion-resistant and low-maintenance quartz equipment across these industrial domains.

Key Trends & Opportunities

Adoption of Automation and Smart Monitoring Systems

Automation and IoT-based monitoring are becoming key trends in UK quartz distillation tower operations. Smart sensors enable real-time pressure, temperature, and flow control, improving process reliability. Data-driven optimization enhances energy efficiency and predictive maintenance, reducing downtime. Manufacturers are integrating AI-enabled systems for performance analytics and fault detection. This trend supports the shift toward Industry 4.0 compliance, improving scalability and efficiency in high-precision manufacturing facilities across the country.

- For instance, Heraeus Comvance implemented an AI-driven automated quality control system that processes up to 15,000 images in 15 minutes to detect bubbles and cracks in quartz glass cylinders, enhancing defect detection accuracy and production consistency.

Sustainability and Energy Efficiency Focus

The UK market is witnessing rising interest in sustainable quartz tower designs with reduced energy footprints. Manufacturers emphasize lightweight structures and optimized heat transfer systems that minimize power consumption. The push for net-zero industrial operations encourages adoption of recyclable materials and eco-friendly production processes. Government sustainability initiatives and green manufacturing incentives further expand opportunities for energy-efficient quartz distillation towers tailored to environmentally responsible industrial standards.

- For instance, Heraeus Conamic captures waste heat from its quartz processes and repurposes it to heat adjacent facilities, cutting net energy demand.

Key Challenges

High Production and Material Costs

Manufacturing quartz distillation towers involves complex fabrication processes and costly raw materials. High-purity quartz and precision machining significantly elevate production expenses. Small and medium manufacturers face profitability pressures due to limited economies of scale. Moreover, volatile energy and material prices in Europe add cost uncertainty. These factors challenge widespread adoption, particularly among cost-sensitive sectors that rely on steel-based alternatives or refurbished tower systems to minimize capital expenditure.

Limited Domestic Quartz Supply Chain

The UK depends heavily on imported high-grade quartz materials from Europe and Asia, increasing vulnerability to supply chain disruptions. Transportation delays, geopolitical instability, and rising import costs affect consistent availability of raw materials. This dependence hinders timely production and customization capabilities for local manufacturers. Building domestic quartz purification and processing facilities remains essential to reduce external dependency and stabilize pricing structures in the long term.

Complex Installation and Maintenance Requirements

Quartz distillation towers demand specialized handling during installation and maintenance due to their fragile nature and high precision requirements. Skilled labor shortages in the UK engineering workforce amplify the challenge. Frequent calibration, cleaning, and inspection are required to maintain system integrity. Improper maintenance can lead to contamination or structural stress, reducing tower lifespan. These complexities increase operational costs and deter small-scale industries from adopting quartz-based systems.

Regional Analysis

England

England led the UK Quartz Distillation Tower Market, holding 58% of the total share in 2024. Strong semiconductor and chemical manufacturing clusters across London, Cambridge, and Manchester drive high demand for precision distillation systems. The region’s advanced research facilities and presence of global players such as Saint-Gobain and Pall Corporation support continuous innovation. It benefits from robust infrastructure and skilled engineering resources. The growing focus on sustainable production and automation technology enhances adoption across industries seeking efficiency and purity in operations.

Scotland

Scotland accounted for 19% of the UK Quartz Distillation Tower Market in 2024. The region’s growing pharmaceutical and specialty chemical industries rely on quartz towers for high-purity separation processes. Investments in biotech facilities across Glasgow and Edinburgh strengthen market prospects. Research partnerships between universities and industrial manufacturers promote technological adaptation in precision distillation. Government support for clean manufacturing practices encourages wider use of energy-efficient and corrosion-resistant quartz tower systems across industrial facilities.

Wales

Wales captured 13% of the total market share in 2024. The regional growth is supported by expanding electronics and materials engineering sectors that require advanced distillation systems. Local investments in process optimization and sustainable manufacturing enhance market penetration. The availability of industrial parks and skilled labor improves production capability. It continues to attract small and medium manufacturers focusing on cost-effective quartz-based solutions for laboratory and pilot-scale operations in the region.

Northern Ireland

Northern Ireland held 10% of the market share in 2024. The industrial base is expanding through increased activity in pharmaceutical research and microelectronic assembly. Manufacturers adopt quartz distillation towers to ensure chemical stability and high product purity. The region’s trade connectivity with the Republic of Ireland supports cross-border equipment supply and technological collaboration. It benefits from government incentives promoting industrial modernization and advanced material adoption, strengthening its position in high-purity process equipment manufacturing.

Market Segmentations:

By Tower Type

- Packed Towers

- Tray Towers

- Fractionating Towers

- Vigreux Towers

- Structured Packing Towers

- Others

By Distillation Type

- Vacuum Distillation

- Atmospheric Distillation

- Pressure Swing Distillation

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Application

- Semiconductor Manufacturing

- Chemical Processing

- Pharmaceutical Industry

- Optical Components

- Satellite and Aerospace Technologies

- Laboratory Research

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Quartz Distillation Tower Market features a moderately consolidated structure with several global and regional manufacturers competing through product quality, material innovation, and customization. Key players such as Saint-Gobain, Pall Corporation, Fenix Process Technologies, HAT International Ltd., and Montz GmbH emphasize precision engineering and automation to improve purity, corrosion resistance, and energy efficiency. Companies invest heavily in R&D to develop high-purity quartz assemblies suitable for semiconductor, pharmaceutical, and chemical industries. Local firms collaborate with research institutions to enhance process innovation and sustainability. Strategic partnerships, mergers, and expansion of production facilities strengthen market presence. The growing adoption of digital monitoring systems and modular tower designs intensifies competition in the high-performance equipment segment. Continuous technological advancement and emphasis on clean manufacturing standards support long-term competitiveness, while international suppliers expand distribution networks to meet increasing demand across the UK’s advanced manufacturing and research-driven industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Raschig GmbH

- Montz GmbH

- Saint-Gobain

- Fenix Process Technologies

- HAT International Ltd.

- Nikon Corporation

- Pall Corporation

- Heraeus

- Koch-Glitsch

- Sulzer Ltd.

- Shin-Etsu Quartz Products Co., Ltd.

- Wacom Quartz Corporation

- Helios Italquartz S.r.l.

- Terme Quartz Internazionale

- Hubei Feilihua Quartz Glass Co., Ltd.

Recent Developments

- In May 2024, KCC Corporation completed the acquisition of Momentive Performance Materials, expanding its capabilities in high-purity quartz and ceramic solutions used in distillation tower manufacturing.

- In January 2025, SCHOTT AG finalized the acquisition of QSIL GmbH Quarzschmelze Ilmenau, enhancing its capabilities in high-purity quartz glass production across.

- In April 2025, Glacier Energy successfully delivered a 50-meter distillation column manufactured in its UK facility.

Report Coverage

The research report offers an in-depth analysis based on Tower Type, Distillation Type, Material, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz distillation systems will rise with semiconductor expansion in the UK.

- Manufacturers will focus on automation and smart monitoring to improve process accuracy.

- Local production of quartz components will increase to reduce import dependency.

- Adoption of corrosion-resistant and energy-efficient tower designs will strengthen sustainability goals.

- Pharmaceutical and specialty chemical industries will continue driving precision distillation requirements.

- Partnerships between manufacturers and research institutions will promote technology advancement.

- Integration of digital twins and predictive maintenance tools will enhance operational reliability.

- Growing investment in clean manufacturing infrastructure will boost equipment modernization.

- New entrants will explore niche applications in optics and aerospace processing sectors.

- Government incentives for innovation and energy efficiency will support market competitiveness.