Market Overview

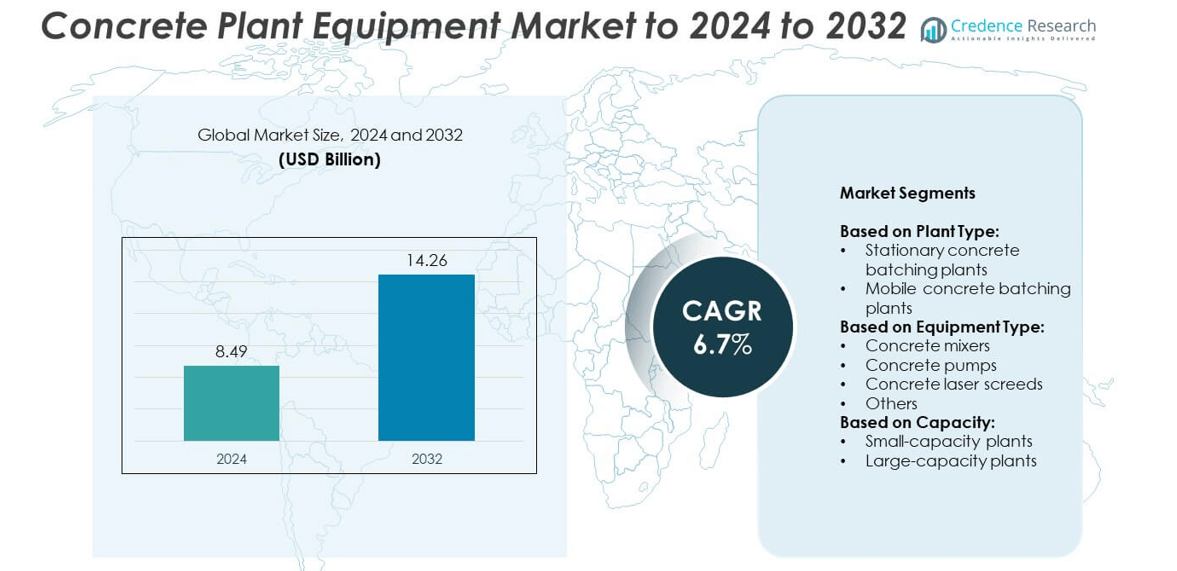

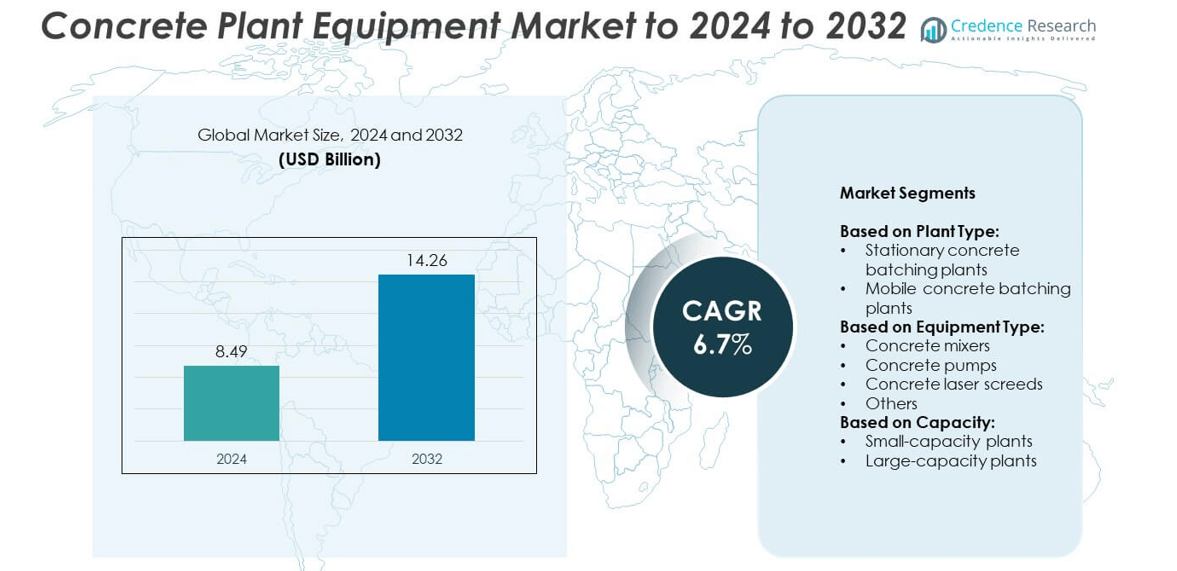

Concrete Plant Equipment Market size was valued USD 8.49 billion in 2024 and is anticipated to reach USD 14.26 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Plant Equipment Market Size 2024 |

USD 8.49 billion |

| Concrete Plant Equipment Market, CAGR |

6.7% |

| Concrete Plant Equipment Market Size 2032 |

USD 14.26 billion |

The concrete plant equipment market is led by major players such as Liebherr, Elkon, Zoomlion, McCrory Engineering, Sany, Ammann, Putzmeister, Lintec, and Schwing Stetter. These companies focus on developing advanced batching technologies, energy-efficient systems, and digital automation to enhance productivity and precision. Strategic collaborations and regional expansions strengthen their global presence, particularly in fast-growing construction markets. Asia-Pacific remains the dominant region, accounting for 33% of the global market in 2024, driven by large-scale infrastructure projects in China, India, and Japan. North America and Europe follow, supported by modernization and sustainability-focused construction activities.

Market Insights

- The concrete plant equipment market was valued at USD 8.49 billion in 2024 and is projected to reach USD 14.26 billion by 2032, growing at a CAGR of 6.7%.

- Rising infrastructure investments and expanding construction projects across industrial, commercial, and residential sectors are driving equipment demand.

- Technological advancements such as automation, IoT integration, and energy-efficient batching systems are shaping market trends.

- The market is moderately consolidated, with key players focusing on innovation, modular plant design, and strategic partnerships to strengthen competitiveness.

- Asia-Pacific leads with a 33% market share, followed by North America at 29% and Europe at 25%; the stationary concrete batching plants segment dominates overall market share due to its high output and precision.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Plant Type

The stationary concrete batching plants segment dominates the market with over 62% share in 2024. These plants are preferred for large-scale infrastructure and industrial projects that demand high output and consistent concrete quality. Their ability to produce up to 240 m³/hour and integrate advanced automation for precise batching supports their dominance. For instance, Ammann Group’s CBT 130 TB Elba plant delivers 131 m³/hour with energy-efficient operation, enhancing project efficiency in bridge and highway construction. Growing investments in urban infrastructure further drive stationary plant installations worldwide.

- For instance, MEKA’s K200 stationary plant delivers 200 m³/hour output with twin-shaft mixing.

By Equipment Type

Concrete mixers lead the market, accounting for around 45% share in 2024, owing to their extensive use across ready-mix and precast applications. The growing need for uniform mix quality and high productivity supports their widespread adoption. Advanced mixer models now feature real-time load monitoring and automated cleaning systems. For instance, Liebherr’s twin-shaft mixer DW 3.0 produces 120 m³/hour while reducing mixing time by 25 seconds per batch. Increasing demand for high-strength concrete in commercial and industrial structures further fuels this segment’s growth.

- For instance, Liebherr’s plant equipped with the DW 3.0 mixer has a theoretical compacted output of 171 m³/hour (30 s mixing) per technical data.

By Capacity

Large-capacity plants hold a dominant 58% market share in 2024, driven by their suitability for mega construction and infrastructure projects. These plants can produce more than 150 m³/hour, catering to highways, airports, and urban transit developments. The ability to maintain output consistency and reduce cycle time ensures strong adoption by contractors. For instance, MEKA’s MB-200W large-capacity plant delivers 200 m³/hour with advanced twin-shaft technology for continuous operation. Expanding government infrastructure programs and rapid urbanization continue to strengthen demand for large-capacity concrete plants globally.

Key Growth Drivers

Rising Infrastructure Development Worldwide

Large-scale infrastructure projects, including highways, metro networks, and industrial facilities, are driving the demand for concrete plant equipment. Governments across Asia-Pacific and the Middle East are investing heavily in urban development and transportation projects. The steady growth in public infrastructure construction supports the deployment of high-capacity stationary and mobile batching plants, which deliver consistent concrete quality and high output. This growing infrastructure focus makes large-scale development the primary driver of market expansion.

- For instance, Ammann’s CBS TB Elba model can produce 177 to 190 m³/hour (standard concrete) using 4.0–4.5 m³ mixers.

Increasing Demand for Ready-Mix Concrete (RMC)

The shift toward ready-mix concrete is significantly boosting equipment adoption across the commercial and residential sectors. Ready-mix plants offer advantages such as precise batching, consistent mix quality, and reduced labor dependency. Urbanization and industrialization have increased the need for reliable and efficient concrete production systems. This demand is particularly strong in developing economies, where RMC plants support faster construction cycles and better quality control, positioning them as a central growth factor in the market.

- For instance, Liebherr’s new generation batching plant commissioned recently expects to deliver 130 m³/hour output.

Technological Advancements in Batching Automation

Automation and digital control technologies are enhancing plant efficiency, accuracy, and reliability. Advanced batching systems equipped with real-time monitoring and automated weighing functions minimize material waste and reduce errors. The integration of cloud-based production control and predictive maintenance further improves uptime and operational performance. As construction companies seek higher precision and lower operational costs, automation technology remains one of the most influential growth drivers in the concrete plant equipment market.

Key Trends & Opportunities

Adoption of Energy-Efficient and Sustainable Equipment

Sustainability is reshaping equipment design, with manufacturers focusing on low-emission and energy-saving solutions. Electrically operated mixers and water recycling systems are gaining traction as industries align with green building standards. Construction companies are increasingly choosing equipment that minimizes fuel use and carbon output. The rise of sustainable construction practices presents new opportunities for equipment manufacturers to deliver eco-friendly, energy-efficient batching solutions across both developed and emerging markets.

- For instance, Ammann’s CBT TB Elba basic unit can be transported via two 40-ft containers + one flat-rack for modular deployment.

Integration of IoT and Remote Monitoring

IoT-enabled systems are transforming how concrete plants operate and are maintained. Real-time data collection, performance tracking, and predictive maintenance allow operators to enhance efficiency and reduce downtime. Remote access to operational dashboards enables better decision-making and quality control. The integration of smart technologies in batching systems creates strong growth opportunities for digital service offerings and improves reliability in large-scale construction operations.

- For instance, Connected Inventions’ IoT dashboards cut concrete drying from 12–16 weeks to 8–10 weeks, trimming projects by ~2 months.

Expansion in Modular and Mobile Plant Design

The increasing preference for modular and portable plants supports quick installation and mobility in temporary or remote construction sites. Compact mobile batching systems help reduce setup costs and time, offering greater flexibility for contractors. Their adaptability to various project scales and site conditions enhances operational efficiency. This trend toward modular and mobile designs creates new opportunities for equipment manufacturers targeting infrastructure, road, and mining applications.

Key Challenges

High Initial Investment and Maintenance Costs

Concrete plant equipment requires significant upfront investment and continuous maintenance. The inclusion of automation, advanced mixers, and monitoring systems increases the total cost, making it difficult for small and mid-scale contractors to afford. Additionally, spare parts and technical servicing contribute to ongoing operational expenses. These financial burdens limit equipment adoption in price-sensitive markets and can slow the overall pace of modernization in construction practices.

Skilled Workforce Shortage in Equipment Operation

Operating advanced batching and pumping systems requires trained personnel with technical expertise in automation and digital control systems. Many developing markets face a shortage of skilled workers capable of managing modern concrete equipment efficiently. This skill gap often results in lower productivity, increased downtime, and higher maintenance errors. The lack of adequate training programs remains a key challenge that limits optimal equipment utilization across global construction sectors.

Regional Analysis

North America

North America holds a 29% share of the concrete plant equipment market in 2024. The region benefits from strong demand in infrastructure renewal, commercial construction, and residential development. The U.S. Infrastructure Investment and Jobs Act has accelerated the adoption of advanced batching and mixing systems. High preference for automation and energy-efficient equipment drives regional growth. Manufacturers in the U.S. and Canada continue to expand their production facilities to meet rising concrete requirements for road, bridge, and industrial projects, ensuring steady market expansion through the forecast period.

Europe

Europe accounts for 25% of the global market, driven by sustainable construction policies and advanced equipment technologies. The region’s emphasis on reducing emissions and improving efficiency supports the demand for eco-friendly batching plants. Western Europe leads with robust infrastructure renovation projects and the adoption of smart concrete production systems. Germany, France, and the U.K. are key markets with strong government backing for green building practices. Integration of digital control systems and modular designs enhances productivity, helping European manufacturers maintain competitiveness in both domestic and export markets.

Asia-Pacific

Asia-Pacific dominates the market with a 33% share in 2024, driven by rapid urbanization and large-scale infrastructure investments. China, India, and Japan lead construction activities, supporting the strong demand for both stationary and mobile batching plants. Expanding industrial zones, transportation corridors, and housing projects sustain continuous equipment adoption. Increasing government spending on public infrastructure projects and smart city development fuels regional demand. Domestic manufacturers in China and India are also strengthening production capabilities, providing cost-effective solutions that make Asia-Pacific the fastest-growing market for concrete plant equipment.

Latin America

Latin America represents 8% of the concrete plant equipment market, supported by infrastructure modernization and urban development projects. Brazil and Mexico are the primary contributors, focusing on road, housing, and commercial construction. The region’s construction sector is witnessing gradual recovery, leading to higher investments in concrete batching and mixing technologies. Growing public-private partnerships and regional development programs encourage equipment adoption. However, financial constraints and uneven economic growth still pose challenges. Increasing use of modular and mobile plants offers flexibility and supports the long-term growth outlook across the region.

Middle East & Africa

The Middle East & Africa hold a 5% share of the global market in 2024. Ongoing infrastructure expansion in the Gulf Cooperation Council (GCC) countries and Africa’s emerging urban projects drive steady growth. Mega projects such as NEOM and Lusail City increase demand for large-capacity concrete plants. African nations like South Africa and Kenya are investing in road and housing development, fueling moderate regional adoption. The market benefits from government-backed industrial diversification and smart city initiatives, encouraging further adoption of modern, high-output concrete batching and mixing systems.

Market Segmentations:

By Plant Type:

- Stationary concrete batching plants

- Mobile concrete batching plants

By Equipment Type:

- Concrete mixers

- Concrete pumps

- Concrete laser screeds

- Others

By Capacity:

- Small-capacity plants

- Large-capacity plants

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete plant equipment market features key players such as Liebherr, Elkon, Zoomlion, McCrory Engineering, Sany, Ammann, Putzmeister, Lintec, Schwing Stetter, Fangyuan, Meka, RexCon, Janeoo, CON-E-CO, and XCMG. The market remains moderately consolidated, with global and regional manufacturers focusing on product innovation and automation integration. Companies are developing advanced batching systems with improved precision, real-time monitoring, and energy efficiency to strengthen their market position. Strategic partnerships, acquisitions, and regional expansions are common approaches to increase global reach and customer base. Manufacturers are also investing in eco-friendly and modular plant designs to meet environmental standards and improve installation flexibility. Rising adoption of digital technologies such as IoT-based control systems and AI-driven predictive maintenance tools is redefining operational efficiency. Continuous R&D investment and emphasis on high-performance, low-maintenance solutions remain key strategies for gaining a competitive edge in this growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liebherr

- Elkon

- Zoomlion

- McCrory Engineering

- Sany

- Ammann

- Putzmeister

- Lintec

- Schwing Stetter

- Fangyuan

- Meka

- RexCon

- Janeoo

- CON-E-CO

- XCMG

Recent Developments

- In 2024, Sany Showcased revolutionary equipment under the theme “Chariots of Development” at Bauma Conexpo 2024 in India.

- In 2023, MEKA Successfully commissioned a stationary concrete batching plant (K 140) in Uzbekistan, featuring fully galvanized components for increased corrosion resistance.

- In 2023, Liebherr Introduced a new generation of concrete batching plants, including a mobile version called Mobilmix, designed for large volumes of concrete on vast construction sites.

Report Coverage

The research report offers an in-depth analysis based on Plant Type, Equipment Type, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady expansion driven by ongoing global infrastructure projects.

- Automation and digital control technologies will become standard in batching systems.

- Demand for energy-efficient and low-emission equipment will rise under sustainability goals.

- Mobile and modular concrete plants will gain traction for remote and short-term projects.

- Integration of IoT and AI for predictive maintenance will enhance operational efficiency.

- Emerging economies in Asia-Pacific will continue to lead market growth.

- Manufacturers will focus on product standardization and improved automation compatibility.

- Smart sensors and cloud-based monitoring will improve production accuracy and quality control.

- Equipment rental and leasing models will expand, supporting small-scale contractors.

- Global collaborations and technology partnerships will shape future innovation in concrete plant equipment.