Market Overview

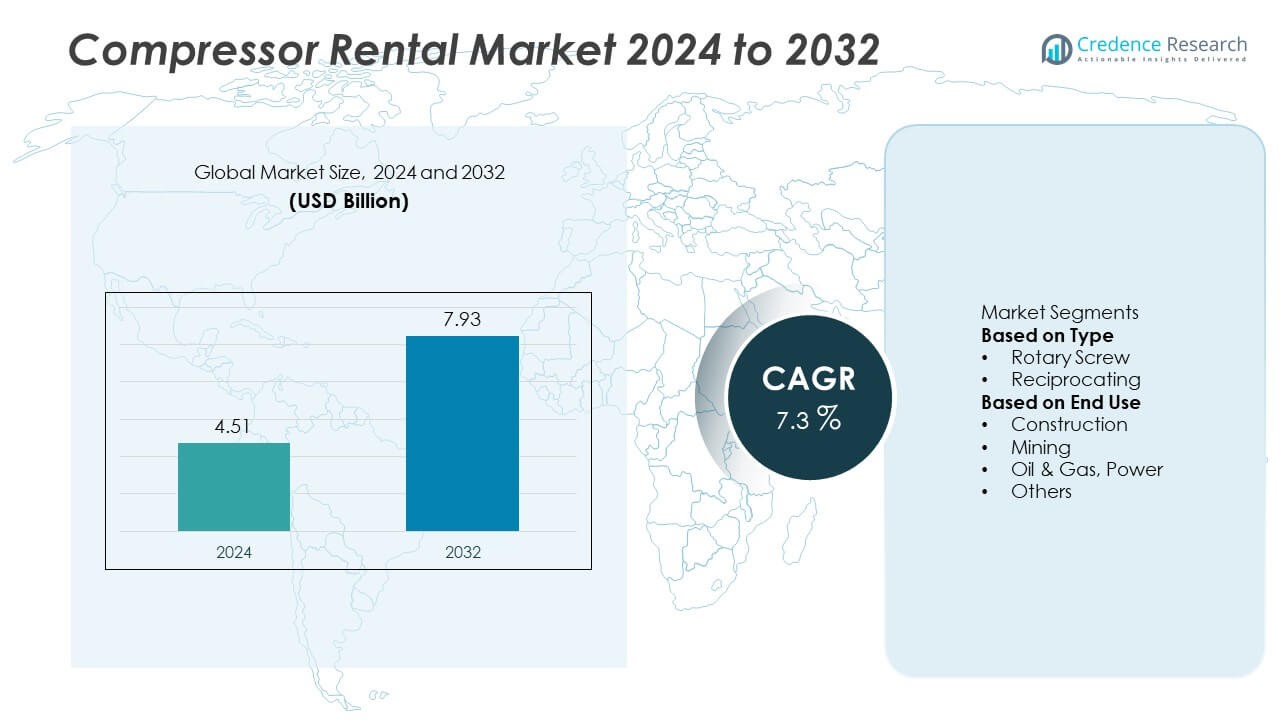

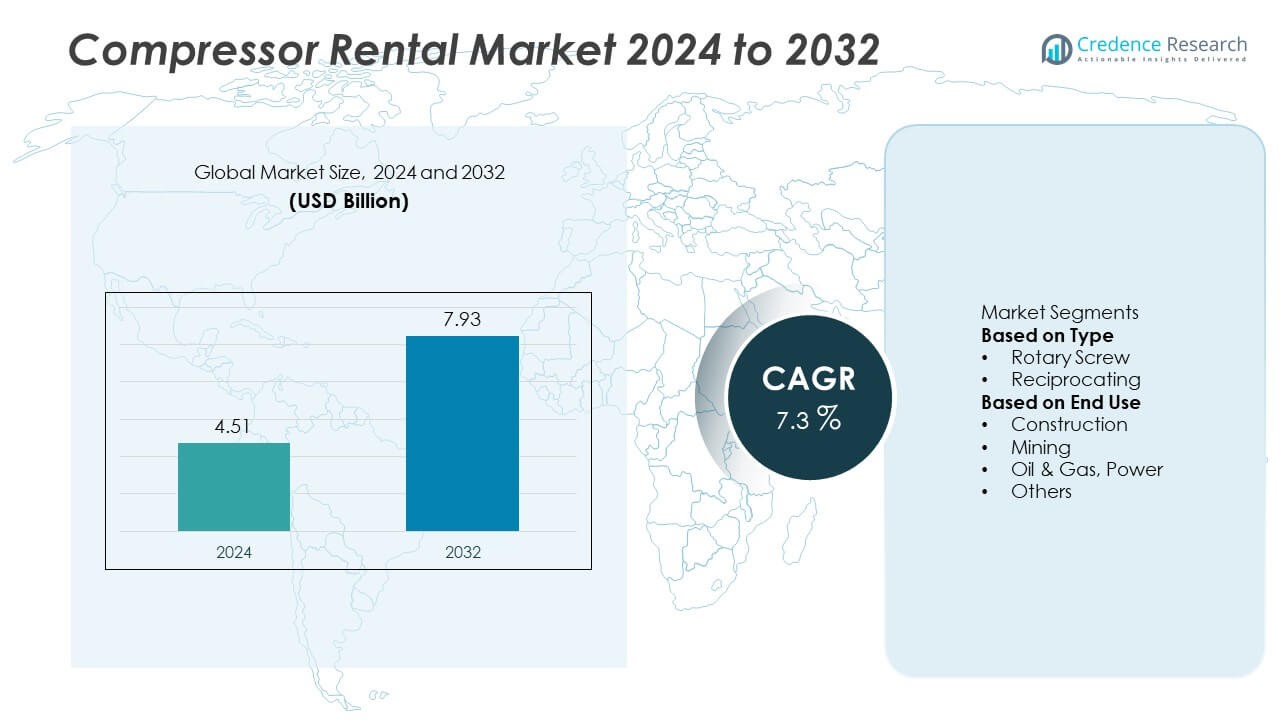

The Compressor Rental Market was valued at USD 4.51 billion in 2024 and is projected to reach USD 7.93 billion by 2032, expanding at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compressor Rental Market Size 2024 |

USD 4.51 Billion |

| Compressor Rental Market, CAGR |

7.3% |

| Compressor Rental Market Size 2032 |

USD 7.93 Billion |

The compressor rental market is led by key players such as Atlas Copco, Aggreko, Caterpillar, Ingersoll Rand, Coates Hire, Sunbelt, Cramo, Blueline, ACME Fab-Con, and Herc Rentals. These companies dominate through large rental fleets, advanced energy-efficient systems, and broad industry coverage across construction, oil and gas, and manufacturing sectors. North America led the market with a 34% share in 2024, driven by industrial modernization and strong construction activity. Europe followed with 28%, supported by growing adoption of eco-friendly compressors and flexible rental models. Asia-Pacific held a 29% share, fueled by rapid industrialization and infrastructure expansion in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The compressor rental market was valued at USD 4.51 billion in 2024 and is projected to reach USD 7.93 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Market growth is driven by rising demand from construction, mining, and oil and gas sectors requiring temporary and flexible compressed air solutions.

- Key trends include the growing shift toward energy-efficient, low-emission compressors and increased adoption of digital monitoring for rental fleet optimization.

- The market is competitive, with leading players such as Atlas Copco, Aggreko, and Ingersoll Rand focusing on rental service expansion, reliability, and technological upgrades.

- North America led with a 34% market share in 2024, followed by Europe with 28% and Asia-Pacific with 29%, while the rotary screw segment dominated with 63% share due to higher efficiency and continuous operation capability.

Market Segmentation Analysis:

By Type

The rotary screw segment dominated the compressor rental market in 2024, accounting for a 63% share. This segment’s leadership is driven by its efficiency, continuous operation, and low maintenance requirements. Rotary screw compressors are widely used in construction, mining, and oil and gas industries due to their ability to deliver a consistent air supply under high-demand conditions. Their compact design and energy-efficient performance make them ideal for long-duration operations. The increasing preference for oil-free and variable-speed models is further boosting adoption across large-scale industrial applications.

- For instance, Ingersoll Rand introduced its Next Generation R-Series rotary screw compressors, which included a variable-speed drive option known for reducing energy consumption. The 200kW model with this VSD technology, designated as RS200n, delivers a variable airflow, with one specification showing a maximum capacity of 41.2 cubic meters per minute (approx. 1455 CFM) between 7 and 10 bar (101.5 and 145 PSI).

By End Use

The construction segment held the largest market share of 34% in 2024, supported by strong infrastructure growth and increasing demand for portable air compressors on construction sites. These systems are vital for powering pneumatic tools, sandblasting, and material handling operations. The ongoing expansion of road, rail, and residential projects across emerging economies continues to fuel demand. Additionally, rental services offer flexibility and cost efficiency for short-term projects, encouraging construction firms to rely on compressor rentals rather than capital purchases.

- For instance, Caterpillar’s XHP1170 portable air compressor delivers 1,170 CFM at 350 PSI, supporting high-pressure applications in highway and tunnel construction.

Key Growth Drivers

Rising Infrastructure and Construction Activities

Rapid global urbanization and large-scale infrastructure projects are major drivers of the compressor rental market. Construction companies prefer rental compressors for their flexibility, cost-efficiency, and minimal maintenance burden. The surge in road development, metro rail expansion, and commercial building construction across Asia-Pacific and the Middle East is creating sustained demand. Portable and energy-efficient rotary screw compressors are particularly favored for their reliability in remote and high-demand construction environments, boosting rental adoption across both public and private projects.

- For instance, Coates supplied portable compressors to the WestConnex M4-M5 Link project in New South Wales, including 400 cubic feet per minute (CFM) units, to provide continuous air supply for equipment associated with the large-scale tunnelling infrastructure.

Expansion of Oil, Gas, and Mining Operations

Increasing exploration and production activities in oil, gas, and mining sectors significantly drive market growth. Compressors are essential for drilling, pneumatic tools, and conveying materials in these industries. Rental solutions provide operators with flexibility during project-based or seasonal operations, reducing upfront investment. As companies focus on optimizing operational costs and reducing downtime, the preference for high-performance rental compressors continues to grow, particularly in regions with strong resource extraction industries such as the Middle East, North America, and Africa.

- For instance, Aggreko provided a customized solution involving oil-free compressors to reduce fuel costs and emissions during a critical turnaround on a North Sea offshore platform. The partnership with engineering consultancy Katoni helped ensure uninterrupted operations during the project, which involved decommissioning and plug and abandonment.

Growing Industrialization and Manufacturing Output

Expanding industrial and manufacturing sectors across developing economies are fueling demand for air compressors used in assembly lines, material handling, and maintenance. Manufacturers increasingly rent compressors to manage fluctuating production needs and avoid high capital expenditures. The trend toward automation and continuous operations requires reliable air supply, favoring rental models that ensure operational continuity without asset ownership costs. This growth is particularly strong in Asia-Pacific, where rapid industrialization is accompanied by the rising adoption of advanced compressor technologies.

Key Trends & Opportunities

Shift Toward Energy-Efficient and Oil-Free Compressors

A strong trend in the compressor rental market is the adoption of energy-efficient and oil-free compressors to meet sustainability goals. Manufacturers are introducing variable-speed and oil-free rotary screw compressors that minimize energy consumption and reduce environmental impact. End users in sectors such as food processing, pharmaceuticals, and electronics increasingly demand clean compressed air, driving this shift. Rental providers are capitalizing on this opportunity by expanding eco-friendly fleets to attract clients focused on energy conservation and regulatory compliance.

- For instance, Atlas Copco launched its ZR 90-160 VSD+ series of oil-free compressors, which is used in industries like pharmaceuticals and is ISO 8573-1 Class 0 certified for contaminant-free air. The exact performance specifications vary by model within the series.

Digital Monitoring and Predictive Maintenance Adoption

Integration of IoT and digital technologies in compressor rental fleets is transforming market dynamics. Smart compressors equipped with sensors allow remote monitoring, predictive maintenance, and real-time performance tracking, reducing downtime and operational costs. Rental companies are leveraging these advancements to offer value-added services and data-driven maintenance plans. The use of connected technologies enhances fleet efficiency and client satisfaction while supporting sustainable and efficient operations across diverse industrial applications.

- For instance, Herc Rentals implemented IoT and telematics to improve efficiency and customer experience in its industrial rental operations. The company has publicly reported significant growth in the use of digital service calls and telematics alerts, among other benefits.

Key Challenges

High Maintenance and Operational Costs

Despite offering flexibility, compressor rental operations involve significant maintenance and servicing costs. Frequent usage in harsh environments leads to wear and tear, requiring regular inspection and component replacement. Maintaining large rental fleets with diverse compressor models also adds logistical complexity. These factors increase operational expenses for rental providers, especially smaller players. Ensuring performance reliability while managing maintenance costs remains a key challenge impacting profitability in competitive regional markets.

Stringent Emission and Noise Regulations

Government regulations regarding air and noise pollution present challenges for compressor rental providers. Diesel-powered compressors, commonly used in construction and mining, face restrictions due to carbon emissions and noise output. Compliance with environmental standards requires investment in cleaner and quieter technologies, increasing rental costs. Transitioning to electric and hybrid models offers long-term sustainability benefits but demands high upfront investment. Balancing regulatory compliance with cost-efficiency continues to challenge industry participants, particularly in highly regulated markets like Europe and North America.

Regional Analysis

North America

North America held a 30% share of the compressor rental market in 2024, driven by strong demand across construction, oil and gas, and industrial sectors. The United States leads regional growth due to its extensive infrastructure projects, shale gas exploration, and well-established rental ecosystem. Increasing focus on energy efficiency and emission compliance promotes the adoption of advanced, low-emission compressors. Rental companies are expanding service networks to support short-term and emergency industrial applications. Continuous investments in renewable energy and infrastructure modernization sustain steady market demand across the region.

Europe

Europe accounted for a 26% share of the compressor rental market in 2024, supported by stringent environmental regulations and growing industrial automation. Countries such as Germany, the U.K., and France are key markets with rising demand for energy-efficient and oil-free compressors. The shift toward sustainable construction and manufacturing practices fuels rental adoption. Strong emphasis on equipment maintenance, reliability, and flexible financing options enhances market penetration. Additionally, the presence of established rental providers offering technologically advanced compressors continues to strengthen the region’s competitive position and long-term growth prospects.

Asia-Pacific

Asia-Pacific dominated the compressor rental market with a 34% share in 2024, fueled by rapid industrialization, infrastructure development, and expanding energy sectors. China, India, and Japan are leading markets due to growing construction, mining, and manufacturing activities. Increasing investment in oil and gas exploration and renewable power projects further boosts compressor rental demand. The region’s cost-sensitive industries prefer rentals for operational flexibility and reduced capital expenditure. Expanding presence of international rental companies and rising adoption of efficient rotary screw compressors reinforce Asia-Pacific’s position as the fastest-growing regional market.

Middle East & Africa

The Middle East & Africa captured a 6% share of the compressor rental market in 2024, driven by ongoing oil and gas exploration, infrastructure expansion, and large-scale industrial projects. Countries such as Saudi Arabia, the UAE, and South Africa are leading demand for portable and high-pressure compressors. Extreme climatic conditions and project-based operations favor rental solutions over ownership. Government-led investments in energy diversification and construction under initiatives like Vision 2030 are further fueling growth. The region’s increasing focus on reducing operational costs strengthens reliance on rental services across industrial applications.

South America

South America held a 4% share of the compressor rental market in 2024, supported by rising industrial development and mining activities in Brazil, Argentina, and Chile. Expanding oil and gas projects and the resurgence of construction sectors are key growth factors. Economic recovery and improved infrastructure investment attract international rental service providers. The demand for portable and cost-effective compressors is increasing among small and medium enterprises. However, regulatory uncertainty and limited service infrastructure remain challenges. Despite these constraints, ongoing industrial expansion continues to create steady opportunities for compressor rental growth.

Market Segmentations:

By Type

- Rotary Screw

- Reciprocating

By End Use

- Construction

- Mining

- Oil & Gas, Power

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the compressor rental market includes major players such as Aggreko, Ingersoll Rand, Coates Hire, Caterpillar, Blueline, Atlas Copco, ACME Fab-Con, Herc Rentals, Cramo, and Sunbelt. These companies compete through service flexibility, fleet diversity, and technological innovation. Market leaders focus on expanding rental fleets with energy-efficient and low-emission compressors to meet environmental standards. Strategic partnerships and mergers are strengthening service coverage across industrial, mining, and construction sectors. Companies are investing in remote monitoring, predictive maintenance, and digital platforms to optimize uptime and customer service. Regional expansion and customized rental packages for specific industries, such as oil and gas or power generation, remain central to growth strategies. Continuous investment in sustainable and hybrid compressor solutions enhances competitive differentiation in a market increasingly driven by efficiency and reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Atlas Copco completed its acquisition of specialty rental firm National Tank & Equipment (NTE), adding 25 locations across eight U.S. states to its rental network.

- In 2025, Aggreko expanded its “Greener Upgrades” range with new oil-free air compressors, enhancing rental availability across North America and Europe to support lower-emission industrial operations.

- In 2025, Herc Rentals increased its specialty fleet with the addition of high-pressure portable compressors designed for 24-hour continuous operation, targeting construction and oilfield applications.

Report Coverage

The research report offers an in-depth analysis based on Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising infrastructure and industrial project activity worldwide.

- Demand for energy-efficient and low-emission compressors will continue to strengthen.

- Rotary screw compressors will maintain dominance due to their reliability and operational efficiency.

- Construction and oil & gas sectors will remain the largest end-use industries for rentals.

- Digital monitoring and IoT-enabled compressor systems will enhance operational transparency and uptime.

- Asia-Pacific will experience the fastest growth driven by expanding manufacturing and construction bases.

- Rental service providers will focus on fleet modernization and predictive maintenance technologies.

- Environmental regulations will accelerate the shift toward electric and hybrid compressor models.

- Partnerships between OEMs and rental firms will expand access to advanced compressor technologies.

- Long-term market expansion will rely on sustainability initiatives and flexible short-term rental models.