Market Overview:

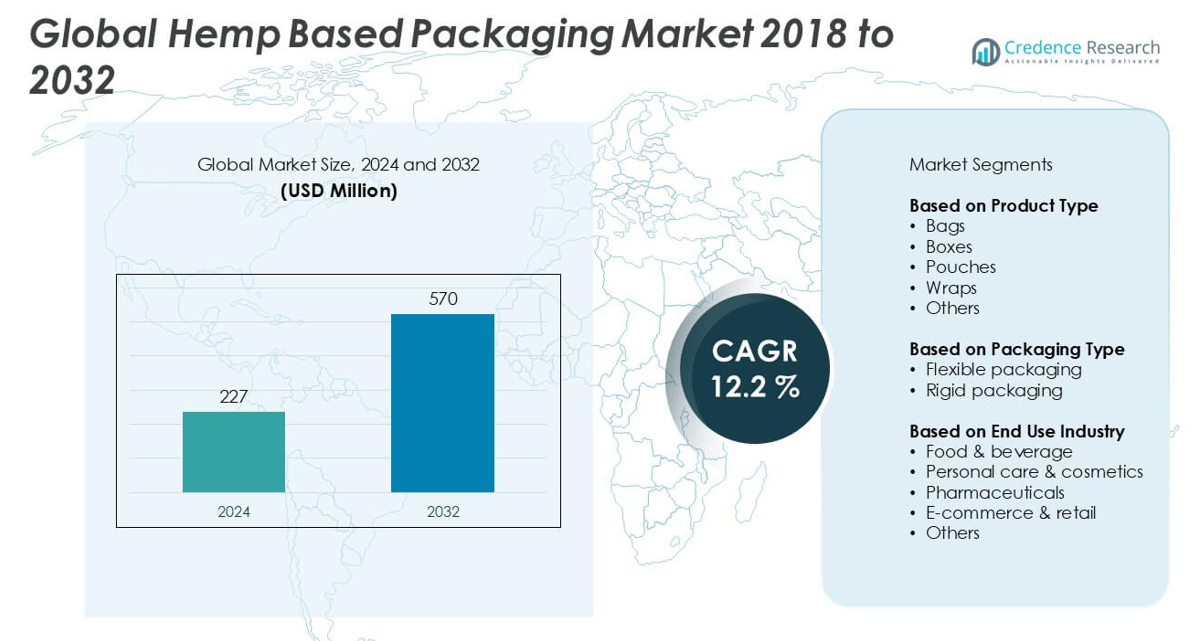

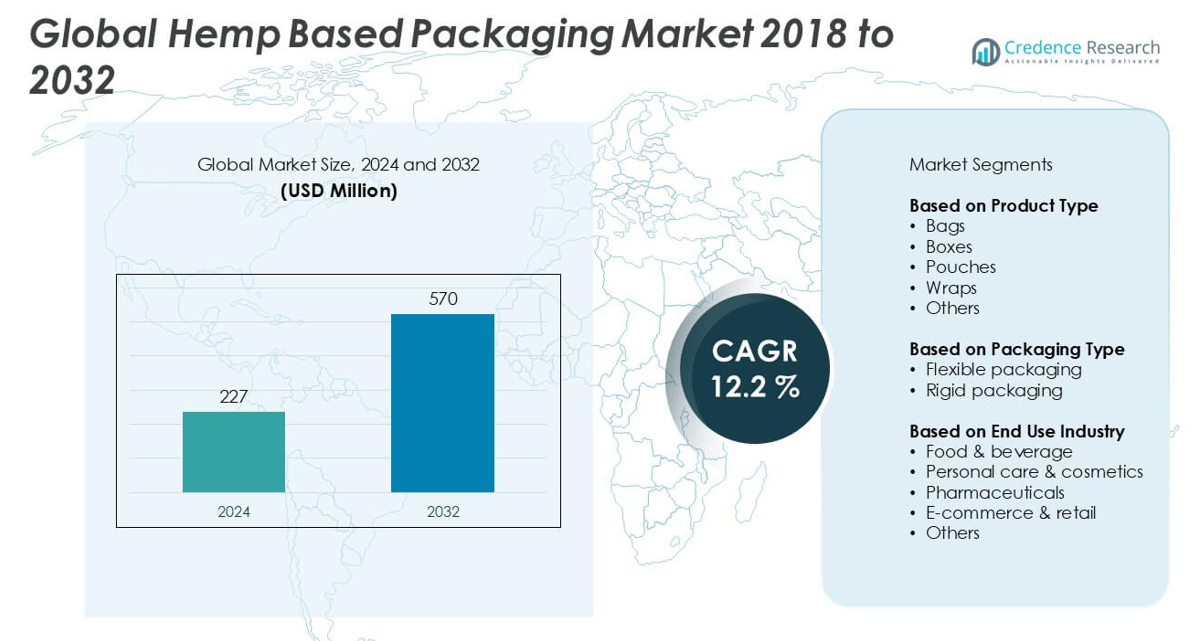

The Hemp-Based Packaging market size was valued at USD 227 million in 2024 and is anticipated to reach USD 570 million by 2032, at a CAGR of 12.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemp Based Packaging Market Size 2024 |

USD 227 million |

| Hemp Based Packaging Market, CAGR |

12.2% |

| Hemp Based Packaging Market Size 2032 |

USD 570 million |

Leading players in the hemp-based packaging market include Canopy Growth Corporation, Tilray Inc., Aurora Cannabis Inc., Charlotte’s Web Holdings, Inc., and Elixinol Global Limited. These companies are leveraging their expertise in hemp cultivation and product innovation to develop sustainable packaging solutions for diverse industries such as food, cosmetics, and retail. North America emerged as the dominant region in 2024, accounting for 38% of the global market share, driven by early legalization of industrial hemp, strong consumer awareness, and robust investment in eco-friendly packaging technologies. Europe followed with 30% market share, supported by stringent environmental regulations and a strong focus on circular economy practices. Competitive strategies among key players include vertical integration, R&D investment in biodegradable materials, and strategic collaborations with eco-conscious brands. As demand continues to grow, top companies are focusing on expanding their geographic footprint and improving cost-efficiency to strengthen their market positions.

Market Insights

- The hemp-based packaging market was valued at USD 227 million in 2024 and is projected to reach USD 570 million by 2032, growing at a CAGR of 12.2% during the forecast period.

- Rising environmental concerns, regulatory bans on single-use plastics, and growing demand for biodegradable alternatives are key factors driving market growth.

- Increasing adoption in the food & beverage industry, along with innovations in hemp-blended flexible packaging, is shaping positive market trends and expanding application scope.

- The competitive landscape includes key players such as Canopy Growth Corporation, Tilray Inc., and Charlotte’s Web Holdings, Inc., focusing on product innovation, strategic partnerships, and sustainability branding.

- North America led the market with a 38% share in 2024, followed by Europe at 30%, while the bags segment dominated the product category with over 35% share; however, high production costs and limited processing infrastructure remain key restraints to wider adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In 2024, the bags segment held the largest market share in the hemp-based packaging market, accounting for over 35% of the global revenue. Bags have gained dominance due to their widespread use in food packaging, retail carry solutions, and e-commerce deliveries. Their lightweight structure, biodegradability, and ease of customization make them a preferred eco-friendly alternative to plastic bags. The rising demand for sustainable consumer packaging and increasing regulatory pressure to reduce plastic waste have significantly driven the adoption of hemp-based bags across multiple industries, contributing to this segment’s market leadership.

- For instance, Elixinol Global Limited introduced biodegradable hemp bags with a fiber tensile strength exceeding 70 MPa, enabling increased load capacity and enhanced durability for retail packaging applications.

By Packaging Type

The flexible packaging segment emerged as the dominant category, capturing more than 60% of the total market share in 2024. Its leadership is attributed to its adaptability, lightweight nature, and lower material consumption compared to rigid packaging. Hemp-based flexible packaging is particularly favored in the food and personal care industries, where resealable pouches and wraps offer convenience and extended shelf life. Growing consumer preference for portable and sustainable packaging options, combined with advancements in compostable film technology, continues to fuel the expansion of this segment globally.

- For instance, Charlotte’s Web Holdings, Inc. launched a hemp-based flexible pouch line that extended shelf stability of CBD-infused gummies by 35 days under ASTM D6400-certified biodegradable storage conditions.

By End Use Industry

The food & beverage sector was the leading end-use industry in 2024, holding nearly 40% of the market share in hemp-based packaging. The dominance of this segment stems from increasing consumer demand for natural and biodegradable packaging for organic and health-oriented food products. Hemp packaging offers a safe and sustainable alternative, aligning with the clean-label movement and reducing the environmental footprint. Regulatory shifts promoting green packaging in food supply chains and a growing inclination toward sustainable branding have further propelled the use of hemp-based solutions in this industry.

Market Overview

Rising Demand for Sustainable Packaging Solutions

Increasing environmental concerns and tightening global regulations on single-use plastics are driving demand for sustainable alternatives like hemp-based packaging. Consumers are more inclined toward biodegradable and compostable packaging options that reduce ecological harm. Governments and corporations alike are pushing for plastic-free packaging commitments, significantly boosting the adoption of hemp materials. Hemp’s natural biodegradability, fast growth cycle, and low ecological footprint make it a prime candidate for sustainable packaging, supporting its expanding role in the circular economy and contributing to long-term market growth.

- For instance, Canopy Growth Corporation replaced over 1.2 million plastic containers with industrial hemp-based biodegradable alternatives across its product lines in 2023, as part of its sustainability transformation roadmap.

Growing Adoption in Food & Beverage Industry

The food and beverage sector has become a major consumer of hemp-based packaging due to rising health consciousness and demand for eco-friendly product presentations. Brands are increasingly adopting plant-based materials that align with clean-label strategies and environmentally responsible practices. Hemp packaging offers excellent breathability, durability, and food safety, making it suitable for snacks, dry foods, and beverages. As food manufacturers prioritize green packaging solutions to meet consumer expectations and regulatory standards, the hemp packaging segment continues to gain substantial traction.

- For instance, Tilray Inc. partnered with a specialty packaging supplier to deploy hemp-based wraps for its Manitoba Harvest granola bar line, producing 250,000 units per quarter under FDA-compliant packaging protocols.

Supportive Regulatory and Government Initiatives

Favorable regulations and policy frameworks supporting industrial hemp cultivation and use in packaging are catalyzing market expansion. Governments in regions like North America and Europe are incentivizing the production and commercialization of hemp-based products through subsidies and regulatory ease. These initiatives encourage investment in hemp farming and processing infrastructure, enabling cost reduction and scaling of packaging applications. As global regulatory momentum shifts toward sustainable materials, hemp packaging is benefiting from an increasingly supportive legal environment that fosters innovation and market entry.

Key Trends & Opportunities

Technological Advancements in Biodegradable Packaging

Ongoing R&D in material science is enhancing the functionality and scalability of hemp-based packaging solutions. Innovations such as hemp-blended bioplastics, multilayer compostable films, and printable hemp fiber sheets are expanding the application scope. These advancements improve shelf life, water resistance, and strength, making hemp packaging more competitive with traditional plastics. Companies are also investing in automation and advanced molding technologies to lower production costs and increase efficiency. Such innovations offer significant opportunities for product differentiation and large-scale commercialization.

- For instance, HempFusion Wellness Inc. developed a thermoformable hemp-polymer composite with a water absorption rate of less than 2.5% over 48 hours, allowing use in refrigerated and semi-moist food packaging.

Brand Positioning Through Eco-Friendly Packaging

Sustainable packaging is becoming a key element of brand identity, particularly among health-conscious and environmentally aware consumers. Companies are leveraging hemp-based packaging to appeal to a growing demographic that values transparency, sustainability, and ethical sourcing. Hemp packaging allows businesses to communicate their environmental commitments effectively, creating a strong brand connection. As competition intensifies across sectors like personal care, organic food, and wellness, using hemp-based packaging as a value-added branding tool offers significant marketing and revenue-generating potential.

- For instance, Nuleaf Naturals incorporated hemp-based secondary packaging with a 92% post-consumer fiber content in its full-spectrum CBD line, which contributed to a 17% increase in brand favorability ratings in post-purchase surveys conducted in 2023.

Key Challenges

High Production Costs and Limited Processing Infrastructure

Despite growing interest, the high cost of producing hemp-based packaging remains a significant barrier. Hemp fibers require specialized processing equipment, and limited availability of industrial-scale manufacturing facilities adds to cost burdens. Compared to plastic and other conventional materials, hemp packaging still faces challenges in achieving cost parity. This restricts its adoption, especially among small and medium-sized enterprises operating under tight margins. Investment in processing infrastructure and supply chain optimization is essential to address this constraint.

Inconsistent Supply of Raw Materials

The hemp packaging market is highly dependent on the availability of quality raw materials, which varies regionally due to differences in hemp cultivation regulations and climate conditions. Fluctuations in supply can impact production timelines and pricing, posing a challenge for large-scale and consistent packaging output. Additionally, hemp is still a relatively niche crop in many parts of the world, limiting its accessibility. Ensuring a reliable and sustainable raw material supply is critical to maintaining growth momentum in this sector.

Regional Analysis

North America

North America dominated the hemp-based packaging market in 2024, holding a market share of approximately 38%. The region’s leadership is attributed to early legalization of industrial hemp, strong consumer preference for sustainable packaging, and aggressive corporate sustainability goals. The United States, in particular, benefits from a well-established hemp cultivation infrastructure and high demand in food and personal care industries. In Canada, supportive regulatory frameworks and innovation in biodegradable materials further boost growth. Key market players in this region are heavily investing in R&D to enhance product performance, recyclability, and cost-efficiency, supporting long-term market penetration.

Europe

Europe accounted for around 30% of the global hemp-based packaging market in 2024, driven by stringent environmental regulations and robust consumer awareness. Countries such as Germany, France, and the Netherlands are leading adopters due to strong emphasis on circular economy practices and plastic reduction mandates under the European Green Deal. The region also benefits from advanced bio-based material technology and supportive policy frameworks promoting industrial hemp. Growth in the food & beverage and cosmetics sectors, coupled with brand demand for eco-friendly image building, continues to propel the market forward across Western and Northern Europe.

Asia Pacific

The Asia Pacific region held approximately 20% of the market share in 2024 and is expected to grow at the fastest CAGR over the forecast period. China and India are emerging as major hemp producers due to favorable climates and expanding agricultural policies. The region’s rising e-commerce sector, along with increasing demand for affordable, sustainable packaging solutions, is driving market expansion. Japan and South Korea are witnessing growing consumer awareness regarding eco-friendly materials, fueling demand in personal care and food packaging. Government support and industrial investment in bio-material innovation are likely to further accelerate growth.

Latin America

Latin America captured about 7% of the global hemp-based packaging market in 2024. Countries like Brazil, Chile, and Colombia are progressively liberalizing hemp cultivation and promoting bio-economy initiatives. Growing concerns over plastic waste, particularly in food packaging and retail, are driving demand for alternative materials. While still in early development stages, the market benefits from increasing investment in sustainable agriculture and the gradual establishment of hemp-processing infrastructure. Local start-ups and eco-conscious brands are adopting hemp packaging to align with green branding efforts, contributing to moderate but steady regional growth.

Middle East & Africa

The Middle East & Africa region accounted for nearly 5% of the global market in 2024, with growth primarily driven by the UAE, South Africa, and Israel. Market development is in a nascent phase due to limited hemp cultivation and regulatory constraints, but interest is rising as sustainability gains momentum. The hospitality and cosmetics sectors are adopting biodegradable packaging to enhance their environmental image, especially in premium offerings. Government-led sustainability programs and increased imports of eco-friendly materials are supporting early-stage growth. However, the market still faces challenges related to raw material sourcing and consumer adoption.

Market Segmentations:

By Product Type

- Bags

- Boxes

- Pouches

- Wraps

- Others

By Packaging Type

- Flexible packaging

- Rigid packaging

By End Use Industry

- Food & beverage

- Personal care & cosmetics

- Pharmaceuticals

- E-commerce & retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hemp-based packaging market is characterized by a moderately fragmented competitive landscape, with both established players and emerging companies actively developing sustainable packaging solutions. Key industry participants such as Canopy Growth Corporation, Tilray Inc., and Aurora Cannabis Inc. leverage their vertical integration and access to raw hemp to expand their packaging offerings. Meanwhile, companies like Charlotte’s Web Holdings, Inc., Elixinol Global Limited, and Nuleaf Naturals focus on product innovation and eco-friendly branding to differentiate themselves in niche segments such as food, cosmetics, and wellness packaging. Start-ups and specialized firms like Hempfoods Ltd. and Navitas LLC are gaining traction by catering to local markets and forming strategic partnerships with eco-conscious brands. R&D investments are centered on improving material durability, biodegradability, and scalability. Competitive dynamics are further influenced by regulatory compliance, supply chain efficiency, and sustainable sourcing. As demand for green packaging rises globally, companies are expected to focus on cost-effective innovation and regional expansion to maintain market relevance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nuleaf Naturals

- Navitas LLC

- Elixinol Global Limited

- Charlotte’s Web Holdings, Inc.

- Hempfoods Ltd.

- Tilray Inc.

- HempFusion Wellness Inc.

- Aurora Cannabis Inc.

- HempAmericana, Inc.

- Canopy Growth Corporation

Recent Developments

- In October 2024, One World Products secured its first order for 1,400 hemp-based reusable containers from Flex-N-Gate, a tier 1 automotive supplier, marking a pioneering move into renewable materials for the automotive industry.

- In September 2024, RENW launched an industrial hemp-based packaging solution to reduce reliance on plastic and tree-based materials. Utilizing proprietary sulfur-free technology and over 75 patents, its biodegradable, compostable, and recyclable products help companies meet sustainability goals without compromising cost or performance. RENW plans to build 10 U.S. manufacturing facilities, supporting rural economies.

- In October 2023, Good Supply rolled out new sustainable hemp packaging for pre-rolls, vapes, and flower, introducing biodegradable hemp tubes and vape mouthpieces.

- In March 2023, Planet Based Foods Global Inc. announced that its wholly-owned subsidiary Planet Based Foods announced its expansion into the non-dairy frozen dessert category with the unveiling of new hemp-based and organic vegan ice cream at Natural Products EXPO West.

- In February 2023, Hemp Foods Australia announced a new nationwide distribution deal with Australia’s largest supermarket chain, Woolworths. Under the deal, the company’s certified organic hemp gold seed oil will increase, ranging from 100 Woolworths stores to 948 stores nationwide.

Market Concentration & Characteristics

The Hemp Based Packaging Market demonstrates moderate market concentration, featuring a mix of established players and emerging entrants operating across regional and niche segments. It reflects characteristics of a growing but maturing sector where innovation, sustainable sourcing, and regulatory compliance strongly influence competitive positioning. Key players such as Canopy Growth Corporation, Tilray Inc., and Charlotte’s Web Holdings, Inc. hold notable presence due to integrated hemp supply chains and investments in biodegradable packaging technologies. It shows strong alignment with global sustainability goals, appealing to industries focused on reducing environmental impact. Consumer preference for natural and compostable materials has led to wider adoption in food, cosmetics, and e-commerce sectors. Product differentiation is driven by factors such as packaging durability, flexibility, and visual appeal. The market relies on strategic partnerships and regional expansion to address supply chain gaps and rising demand. It benefits from increasing government support for industrial hemp and remains sensitive to changes in raw material availability and price volatility.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging Type, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The hemp-based packaging market is expected to witness steady growth due to rising demand for eco-friendly alternatives to plastic.

- Increasing government regulations on single-use plastics will further accelerate the adoption of hemp packaging solutions.

- Continued investment in R&D will enhance the durability, flexibility, and shelf life of hemp-based packaging materials.

- North America and Europe will maintain dominance, while Asia Pacific is projected to grow rapidly due to expanding industrial hemp cultivation.

- Growth in e-commerce and retail sectors will boost demand for biodegradable and compostable packaging formats.

- The food and beverage industry will remain the largest end-user, driven by sustainability goals and consumer demand for green packaging.

- Flexible packaging formats like pouches and wraps will gain traction over rigid formats due to cost efficiency and convenience.

- Strategic collaborations between packaging firms and hemp producers will strengthen supply chain integration.

- Consumer preference for plant-based, toxin-free materials will drive brand shifts toward hemp-based solutions.

- Advancements in automated processing and scalable production will lower manufacturing costs and support mass-market adoption.