Market Overview:

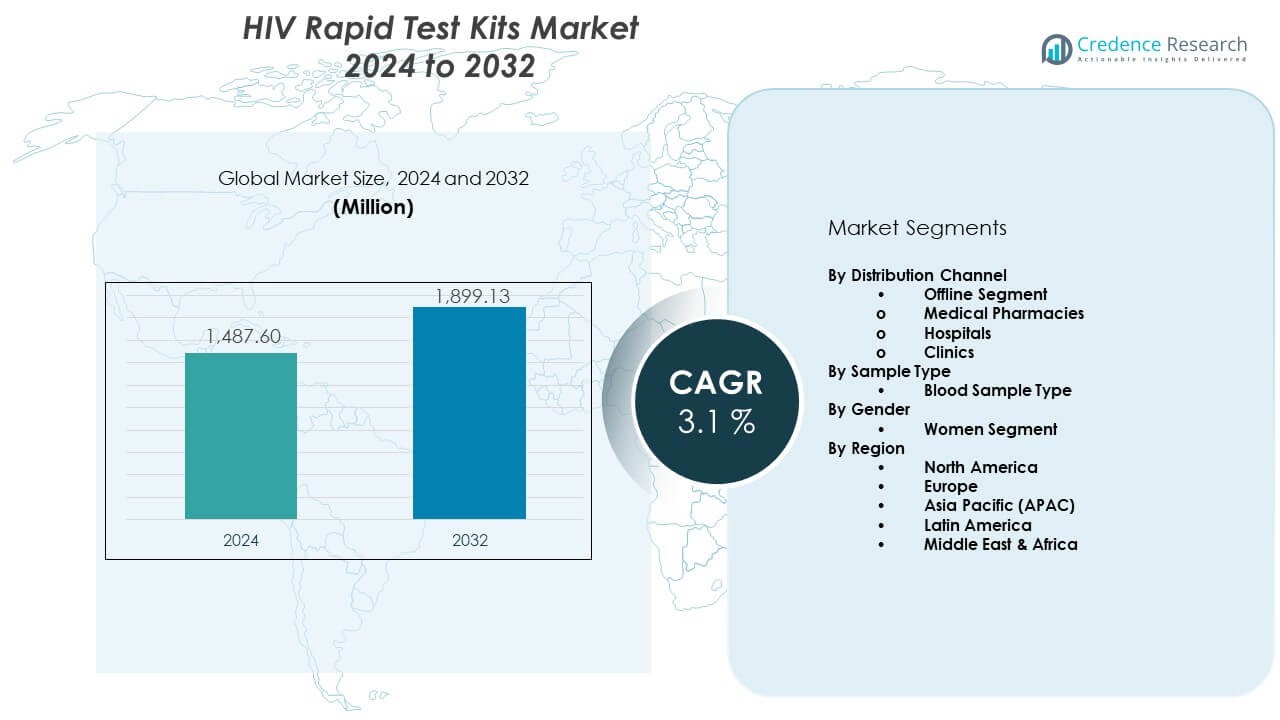

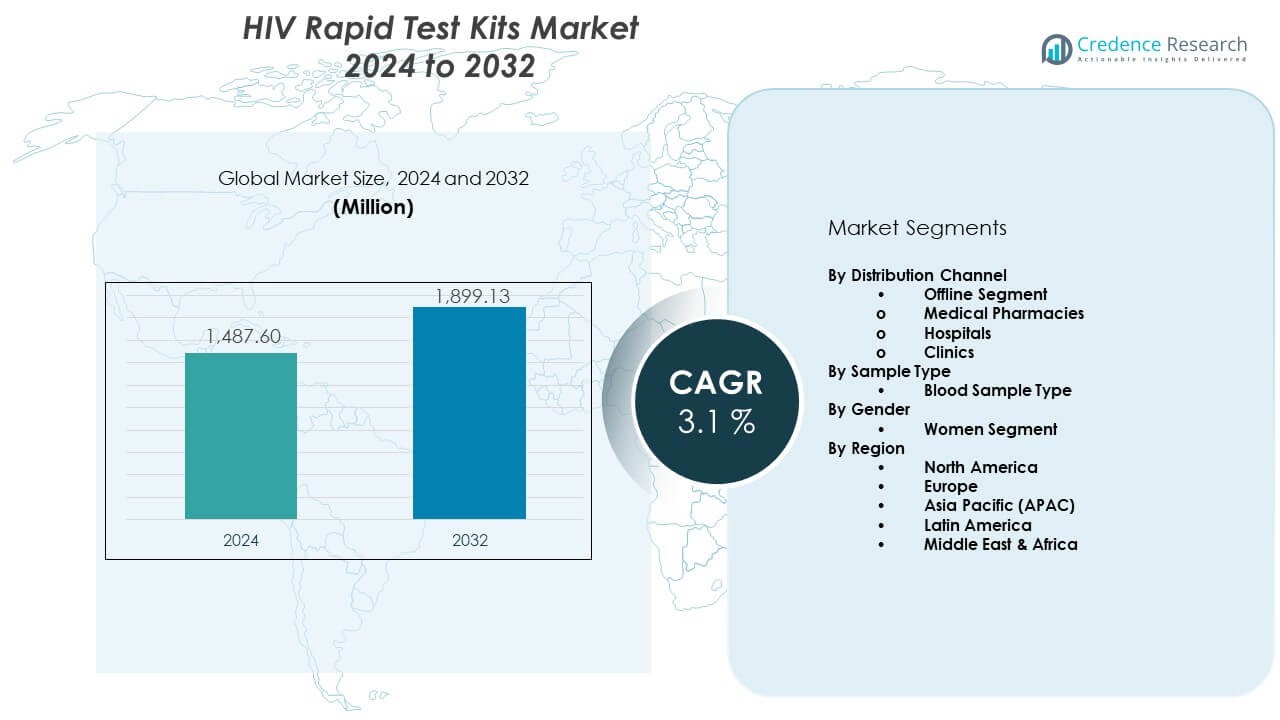

The HIV Rapid Test Kits Market is projected to grow from USD 1487.6 million in 2024 to an estimated USD 1899.13 million by 2032, with a compound annual growth rate (CAGR) of 3.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| HIV Rapid Test Kits Market Size 2024 |

USD 1487.6 Million |

| HIV Rapid Test Kits Market, CAGR |

3.1% |

| HIV Rapid Test Kits Market Size 2032 |

USD 1899.13 Million |

Growing demand for early detection drives the HIV Rapid Test Kits Market. Governments run screening initiatives to support timely diagnosis. Healthcare facilities invest in point-of-care tools that offer quick and reliable results. Community groups promote self-testing kits to expand access in remote regions. Rising focus on preventing late-stage HIV cases pushes stakeholders to distribute more user-friendly testing formats. Manufacturers launch improved kits with shorter wait times and higher accuracy. Strong supply chains support wider testing coverage across public and private programs.

North America leads the HIV Rapid Test Kits Market due to strong screening programs and high access to healthcare facilities. Europe follows with structured testing frameworks and strong public health initiatives. Asia Pacific emerges as the fastest-growing region as countries expand outreach programs and community-based testing networks. Africa shows rising adoption supported by international health agencies and national HIV control strategies. Latin America progresses steadily as governments strengthen awareness campaigns and upgrade diagnostic capacity. Each region advances at different speeds based on healthcare readiness and public health priorities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The HIV Rapid Test Kits Market was valued at USD 1487.6 million in 2024 and is projected to reach USD 1899.13 million by 2032, advancing at a 1% CAGR, supported by strong adoption of quick screening tools across global health systems.

- North America holds 35%, Europe 28%, and Asia Pacific 25% of the market share, driven by structured screening programs, strong diagnostic infrastructure, and expanding national testing initiatives.

- Asia Pacific is the fastest-growing region with 25% share, supported by large-scale outreach programs, community testing networks, and rising awareness in underserved populations.

- The blood sample segment leads with the highest share, supported by stronger accuracy and widespread clinical use across high-volume screening environments.

- The women segment holds a large share, driven by routine HIV testing in reproductive health programs and consistent engagement with clinic-based screening services.

Market Drivers:

Market Drivers:

Growing Demand for Faster HIV Screening Across Public and Private Healthcare Settings

The HIV Rapid Test Kits Market expands through rising need for quick diagnosis across clinics, hospitals, and outreach programs. Governments run screening drives to identify infections at earlier stages. Healthcare workers prefer rapid kits that reduce waiting time for confirmatory steps. Community groups use simple kits for door-to-door awareness campaigns. It helps increase testing uptake in areas with limited laboratory infrastructure. Self-test devices support wider access for people who avoid facility visits. Public health agencies focus on reducing undiagnosed cases through wider distribution. Strong adoption trends push demand across high-burden regions.

- For instance, OraQuick from OraSure Technologies delivers HIV-1/2 results within 20 minutes from oral fluid, plasma, or whole blood, enabling patients to learn their status in a single visit.

Rising Preference for Point-of-Care Testing That Supports Immediate Clinical Decision-Making

Point-of-care methods strengthen early detection and treatment planning within the HIV Rapid Test Kits Market. Clinics use rapid kits to shorten patient waiting time and improve counselling workflows. Emergency departments rely on fast results during sensitive cases. Mobile health teams carry compact devices for remote testing. It supports efficient linkages to care after screening. Governments promote point-of-care tools to improve national testing targets. Manufacturers design user-friendly formats to expand adoption. Growth accelerates through funding programs that prioritize rapid diagnostics.

- For instance, Emergency wards and mobile health units use compact kits like OraQuick to perform rapid screening without lab setup. Health workers trust kits with over 99% sensitivity and specificity.

Increasing Focus on Self-Testing Tools That Improve Privacy, Control, and Accessibility

Self-testing gains strong attention due to rising interest in private diagnosis. The HIV Rapid Test Kits Market benefits from wider acceptance among young adults and high-risk groups. People use home kits to avoid social discomfort linked to in-clinic testing. User instructions are simplified to support accurate self-screening. It helps expand coverage in rural and semi-urban regions with fewer facilities. Global health organizations support self-test distribution models. Manufacturers upgrade sensitivity levels in new self-test versions. Wider retail and online availability strengthens growth momentum.

Growing Support from Global Health Agencies and National HIV Elimination Programs

International agencies support rapid testing initiatives to reduce late-stage infections. The HIV Rapid Test Kits Market moves forward through public funding and supply chain support. Many governments integrate rapid tests into national HIV prevention goals. Tender-based procurement helps distribute large kit volumes at scale. It improves testing frequency in high-prevalence zones. Training programs equip healthcare workers with correct kit-handling skills. Community-based organizations expand outreach through structured testing events. Long-term health budgets continue to support rapid diagnostic procurement.

Market Trends:

Rising Use of Digital Connectivity Features That Support Better Test Reporting and Data Tracking

Digital integration emerges as a major shift across the HIV Rapid Test Kits Market. New platforms link rapid kits to mobile apps for automated reporting. Health workers upload results to centralized dashboards for real-time tracking. It supports stronger surveillance across remote districts. Nations use digital insights to plan high-priority screening zones. Tech-enabled solutions help reduce manual errors during recording. Innovation pushes companies to pair kits with Bluetooth-enabled accessories. Data management enhancements reshape future distribution strategies.

- For instance, modern self-test programs pair kit usage with apps to upload results into central databases, speeding up follow-up. Recent reviews describe future HIV self-testing technologies using improved biosensing and miniaturized instruments, enabling better sensitivity and easier result reading across varied settings.

Increasing Product Diversification Through Multiplex Test Kits for Broader Health Screening

Companies develop multiplex kits that detect HIV along with other infections in a single sample. The HIV Rapid Test Kits Market benefits from broader utility across primary care units. Clinics prefer multi-marker tools to save time during busy hours. It improves diagnostic workflow efficiency for frontline teams. Developers upgrade cartridge design for better sensitivity. Governments evaluate multiplex use for combined disease screening drives. It helps reduce costs linked to multiple test rounds. Growth aligns with demand for integrated healthcare solutions.

- For instance, some rapid diagnostic tools under development aim to detect HIV along with other diseases in one sample. Reviews note growth in dual HIV/syphilis RDTs and combined screening tools.

Growing Shift Toward Ultra-Sensitive Kits Designed for Early Infection Identification

Early detection gains traction through advanced kit formulations. The HIV Rapid Test Kits Market adopts designs capable of sensing low viral markers. New materials improve antibody recognition accuracy. It helps reduce false-negative outcomes during early stages. Hospitals prefer ultra-sensitive kits for high-risk patient groups. Research programs evaluate next-generation formats using improved detection chemistry. Kits with shortened reaction time attract strong government interest. Precision-focused upgrades set new performance standards.

Expansion of Distribution Through Retail Pharmacies, E-Commerce Platforms, and Community Channels

The retail and online ecosystem helps broaden access to HIV screening tools. The HIV Rapid Test Kits Market grows through rising e-commerce penetration. Pharmacies stock self-test kits to support walk-in purchases. It improves access for users seeking discreet purchase options. Online platforms expand distribution in rural areas. Community organizations add pop-up kiosks during awareness campaigns. Broader availability improves testing frequency among underserved groups. Cross-channel supply models strengthen long-term adoption.

Market Challenges Analysis:

Persistent Issues in Test Accuracy, False Results, and Limited User Awareness Across High-Burden Regions

Accuracy concerns affect adoption in certain segments of the HIV Rapid Test Kits Market. Users often interpret results incorrectly due to low awareness. Community programs face difficulty in training large volunteer groups. It creates challenges during mass screening campaigns. Remote regions lack consistent access to high-quality kits. Some countries struggle with counterfeit products entering informal markets. Governments work to impose stricter quality control rules. Overall reliability issues require sustained improvement efforts.

Uneven Access, Regulatory Gaps, and Supply-Chain Constraints That Slow Market Expansion

Uneven infrastructure delays growth across many developing regions. Regulatory frameworks differ widely, creating approval delays for new kits in the HIV Rapid Test Kits Market. It raises costs for companies entering new territories. Supply-chain issues disrupt distribution during emergencies. Health agencies face budget limits during procurement cycles. Rural areas lack cold-chain systems for certain formats. Limited healthcare staffing slows rollout of testing initiatives. Market expansion depends on stronger structural support.

Market Opportunities:

Expansion of Self-Testing Models, Community Outreach Networks, and Retail-Driven Distribution Across Emerging Markets

Growing adoption of self-testing formats presents strong potential for the HIV Rapid Test Kits Market. Wider use of retail pharmacies and online platforms expands reach. It supports people who prefer private testing options. Community health workers help distribute kits in underserved zones. Manufacturers develop compact kits suited for travel and emergency use. Faster approvals for self-test formats support scale-up. Private brands invest in wider packaging options to attract new users. Emerging markets offer strong room for future penetration.

Rising Adoption of Next-Generation Diagnostic Technologies and High-Sensitivity Solutions for Earlier Detection

Advanced materials and upgraded detection chemistry help shape strong opportunities. The HIV Rapid Test Kits Market benefits from innovations targeting ultra-early diagnosis. It supports clinical teams during sensitive screening scenarios. Automated readers improve result interpretation accuracy. Developers create more durable kits suited for harsh conditions. Governments look for cost-efficient high-sensitivity tools to strengthen national programs. Better performance metrics support long-term testing expansion. Technology-focused upgrades open new growth avenues.

Market Segmentation Analysis:

By Distribution Channel

The HIV Rapid Test Kits Market gains strong support from the offline segment, driven by high reliance on established healthcare points. Medical pharmacies supply rapid kits to walk-in users who prefer instant access without appointments. Hospitals manage large testing loads during routine screening and emergency care. Clinics integrate rapid kits into preventive programs and follow-up tests. It strengthens patient pathways by offering immediate results that guide counselling and treatment decisions. Offline distribution holds a strong footprint due to trust, accessibility, and supervised testing environments. Broad in-person support continues to anchor demand across diverse user groups.

- For instance, many hospitals trust rapid point-of-care tests like the Determine HIV-1/2(which uses whole blood, serum, or plasma) or the OraQuick test (which can use oral fluid or blood) for consistent accuracy in routine diagnostics.

By Sample Type

Blood sample testing maintains dominance due to strong accuracy levels and consistent performance across diverse scenarios. Healthcare teams rely on blood-based kits during outreach drives and structured screening programs. It supports sensitive detection across early and late infection stages. Many national guidelines endorse blood formats for standardized use. Manufacturers continue to refine designs that shorten reaction times. Community workers prefer blood kits for high-volume testing sessions. Hospitals adopt blood formats during routine diagnostics to ensure dependable outcomes. The blood segment retains leadership through strong clinical acceptance and proven reliability.

- For example, Abbott’s Determine HIV-1/2 test has shown sensitivity and specificity close to 99–100% in various field evaluations.

By Gender

Women represent a large market share due to targeted testing programs during reproductive health visits. Clinics run routine HIV screening during prenatal care, family planning, and general wellness checks. It improves early diagnosis rates across female populations. Public health campaigns direct strong attention toward women in high-burden regions. Community workers conduct door-to-door visits to support wide testing coverage. Hospitals integrate HIV screening into broader maternal health packages. Rising awareness strengthens testing behavior among women. The segment continues to expand through structured healthcare engagement and prioritized testing strategies.

Segmentation:

By Distribution Channel

- Offline Segment

- Medical Pharmacies

- Hospitals

- Clinics

By Sample Type

By Gender

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America leads the HIV Rapid Test Kits Market with nearly 35% share, supported by strong diagnostic infrastructure and high screening awareness. Healthcare systems run structured testing programs across hospitals, clinics, and community centers. It gains momentum from self-testing adoption and strong reimbursement coverage. Government agencies promote routine HIV testing across high-risk groups. Europe follows with around 28% share, driven by national prevention strategies and broad supply networks. Public health institutions integrate rapid kits into early-diagnosis models. Strong regulatory standards help maintain consistent product quality across both regions.

Asia Pacific

Asia Pacific holds roughly 25% share and ranks as the fastest-growing region due to expanding outreach campaigns and large underserved populations. Governments promote community-level testing to reduce late-stage infections. It benefits from rising investments in primary healthcare and urban screening initiatives. Many countries add rapid kits to nationwide awareness programs for high-burden districts. Self-test acceptance grows among younger groups seeking privacy. Hospitals integrate rapid kits into digital reporting platforms to track screening progress. Growth strengthens through improved distribution across rural and semi-urban locations.

Latin America and Middle East & Africa

Latin America accounts for nearly 7% share, supported by public health campaigns and expanding clinic networks. Countries adopt rapid kits to improve early detection among vulnerable groups. It progresses steadily through partnerships between government bodies and nonprofit health agencies. The Middle East & Africa region holds close to 5% share, yet demand rises due to high infection prevalence in several nations. International health organizations assist with procurement, training, and awareness drives. Community testers rely heavily on rapid kits during mobile outreach programs. Gradual improvements in supply chains help expand access across remote areas.

Key Player Analysis:

- Abbott Laboratories

- Bio-Rad Laboratories

- bioMérieux

- OraSure Technologies

- Biosynex SA

- ChemBio Diagnostics

- Beckman Coulter

- Hoffmann-La Roche Ltd

- QIAGEN GmbH

- Siemens Healthineers AG

- Meridian Bioscience Inc.

- Hologic Inc.

- DiaSorin S.p.A.

Competitive Analysis:

The HIV Rapid Test Kits Market shows strong competition driven by global diagnostics companies with large product portfolios and wide distribution reach. Leading players focus on rapid detection accuracy, shorter result times, and improved ease of use. It benefits from steady investments in point-of-care technologies and self-testing solutions. Companies expand their presence through regulatory approvals and targeted partnerships. Innovation in ultra-sensitive detection materials remains a key differentiator. Manufacturers strengthen their competitive stance through supply-chain expansion in high-burden regions. Public sector procurement programs influence pricing and volume competition. Growing emphasis on digital reporting and integrated platforms further shapes rivalry across the market landscape.

Recent Developments:

- In February 2025, DiaSorin S.p.A. saw the World Health Organization publish version 5.0 of the public report for the Murex HIV Ag/Ab Combination assay, confirming its continued listing on the WHO prequalified in vitro diagnostics roster and describing it as a qualitative 4th‑generation sandwich enzyme immunoassay for HIV p24 antigen and HIV‑1/2 antibodies, used for donor screening and diagnosis; while not a brand‑new product, this 2025 prequalification update reinforces Murex’s role in global HIV screening programs within the HIV diagnostics market.

- In November 2024, Siemens Healthineers AG obtained U.S. FDA clearance for its Atellica IM HIV Ag/Ab Combo (CHIV) assay on the Atellica CI Analyzer, with the 510(k) summary prepared on 6 November 2024, extending its 4th‑generation chemiluminescent HIV combo assay (simultaneous p24 antigen and HIV‑1/2 antibody detection) to the Atellica CI platform and demonstrating clinical sensitivity around 99.78% and clinical specificity about 99.76% across low‑ and high‑risk populations in multicenter studies.

- In April 2024, QIAGEN GmbH received national approval in Thailand for the NeuMoDx HIV‑1 Quant Assay, completing the blood‑borne virus test menu (HIV‑1, HBV, HCV) on its fully automated NeuMoDx molecular platform in that country and enabling quantitative HIV‑1 RNA testing for diagnosis, acute infection detection, and antiretroviral therapy monitoring with random‑access, sample‑to‑result automation for clinical laboratories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Distribution Channel, By Sample Type, and By Gender. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future Outlook:

- Broader reliance on self-testing tools will support strong adoption across new user groups.

- Expansion of digital result interpretation will improve accuracy and reduce reporting errors.

- Stronger government procurement programs will drive steady demand in high-burden regions.

- New ultra-sensitive kits will enhance early detection and strengthen clinical confidence.

- Retail and online distribution will widen access for underserved populations.

- Community health campaigns will increase awareness and testing frequency.

- Product innovation will focus on shorter reaction times and simpler instructions.

- Regulatory support will help accelerate launch timelines for updated testing formats.

- Integration with mobile data systems will improve disease monitoring coordination.

- Market presence of global diagnostics firms will expand through targeted partnerships.

Market Drivers:

Market Drivers: