Market Overview:

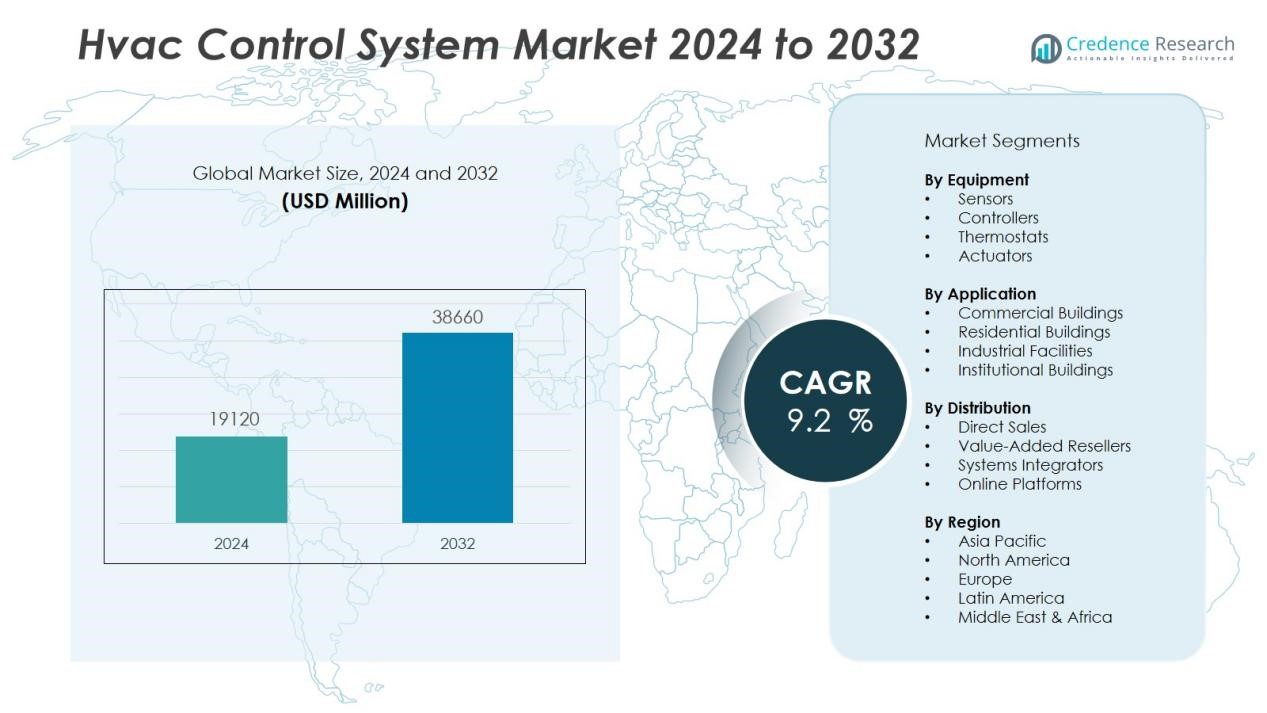

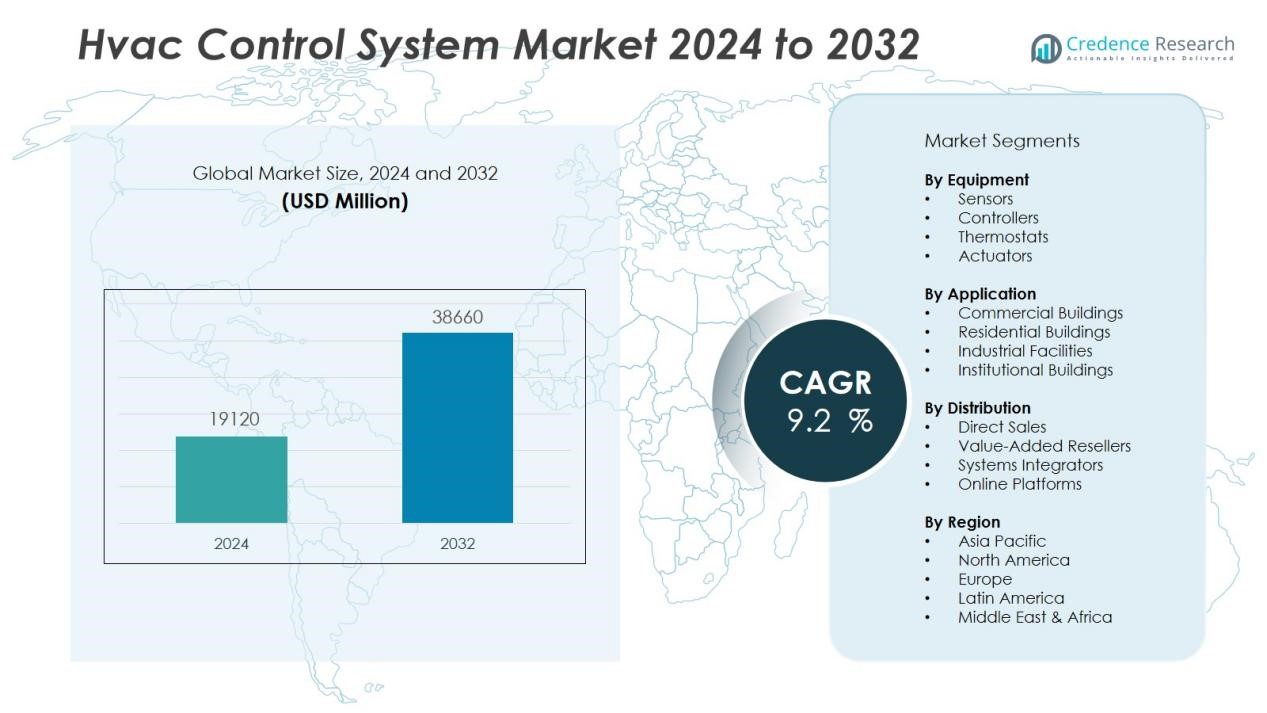

The Hvac control system market size was valued at USD 19120 million in 2024 and is anticipated to reach USD 38660 million by 2032, at a CAGR of 9.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| HVAC Control System Market Size 2024 |

USD 19120 Million |

| HVAC Control System Market, CAGR |

9.2 % |

| HVAC Control System Market Size 2032 |

USD 38660 Million |

Key drivers shaping the HVAC control system market include the surging demand for smart building technologies, rapid urbanization, and stringent government regulations targeting reduced carbon emissions. Advanced control systems that leverage IoT connectivity, data analytics, and automation allow building owners to optimize HVAC performance, lower maintenance costs, and minimize energy consumption. Manufacturers focus on developing integrated solutions, including wireless sensors and cloud-based platforms, to meet evolving customer requirements and facilitate seamless integration with existing building management systems.

Regionally, North America leads the HVAC control system market, supported by robust infrastructure, widespread adoption of smart homes, and strong regulatory mandates on energy efficiency. Key industry participants such as Carrier Corporation, Mitsubishi Electric Corporation, DAIKIN INDUSTRIES Ltd., and Johnson Controls hold significant market positions. Europe follows, driven by substantial investments in green buildings and sustainable construction practices, with notable players including Fujitsu, Rheem Manufacturing Company, and SAMSUNG. The Asia Pacific region demonstrates rapid growth, fueled by expanding construction activity, rising disposable incomes, and increased government support for energy-efficient infrastructure, with Haier Group also contributing to market momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The HVAC control system market reached USD 19,120 million in 2024 and will double by 2032, driven by smart building adoption.

- Stringent global regulations on energy efficiency and carbon emissions accelerate demand for advanced, integrated control technologies.

- IoT connectivity, wireless sensors, and cloud-based platforms enable predictive maintenance and seamless integration with building management systems.

- North America leads with a 38% market share, supported by robust infrastructure, while Europe holds 31% and Asia Pacific 22%.

- Leading companies include Carrier Corporation, Mitsubishi Electric Corporation, DAIKIN INDUSTRIES Ltd., Johnson Controls, Fujitsu, Rheem Manufacturing Company, SAMSUNG, and Haier Group.

- High initial costs and integration complexity challenge adoption, especially for older buildings and small to mid-sized businesses.

- Rising concerns over cybersecurity and data privacy influence market strategies, requiring strong digital protection measures for IoT-enabled HVAC systems.

Market Drivers:

Increasing Emphasis on Energy Efficiency and Regulatory Compliance:

Global efforts to reduce carbon emissions and energy consumption have accelerated investment in advanced HVAC control technologies. Stricter building codes and regulatory mandates require adoption of energy-efficient systems, prompting facility managers and property owners to upgrade legacy infrastructure. The HVAC control system market benefits from policies promoting green building certification, such as LEED and BREEAM, which encourage integration of smart controls. It enables automated scheduling, real-time monitoring, and performance optimization, aligning with evolving compliance requirements.

- For instance, Carrier’s Infinity® Variable-Speed Ultimate Cold Climate Heat Pump, featuring Greenspeed® Intelligence, achieved a SEER2 rating of 21.2 and is recognized as the highest rated DOE cold climate heat pump, enabling superior energy efficiency in even the coldest climates.

Rapid Growth in Smart Building and IoT Adoption:

Rising adoption of smart building technologies and IoT-based solutions is driving transformation across the HVAC control system market. Smart sensors, wireless communication protocols, and cloud-based platforms offer granular control and remote management capabilities. Building owners seek to leverage data-driven insights for predictive maintenance, energy optimization, and enhanced occupant comfort. This shift increases demand for integrated HVAC control systems that seamlessly interact with other building management technologies.

- For instance, Siemens launched new wireless, battery-operated sensors with Thread protocol for building management systems, providing CO2 measurement with a precision of ±2% and covering a CO2 concentration range of 0–5,000ppm, enabling automated IAQ control and rapid reconfiguration for changing building layouts.

Expansion of Commercial and Industrial Infrastructure Globally:

Robust growth in commercial spaces—including offices, healthcare, and retail—fuels deployment of modern HVAC control systems. Emerging economies in Asia Pacific and the Middle East see rapid urban development and significant investments in infrastructure, supporting market expansion. The HVAC control system market capitalizes on increasing demand for centralized climate control, improved indoor air quality, and scalable solutions in large facilities. It addresses complex operational needs through flexible and customizable platforms.

Heightened Focus on Occupant Health, Comfort, and Indoor Air Quality:

Post-pandemic priorities have intensified the spotlight on indoor air quality and occupant wellness. HVAC control systems now incorporate advanced air filtration, humidity regulation, and occupancy-based ventilation strategies. Organizations and building owners aim to create healthier environments by reducing airborne pathogens and ensuring thermal comfort. This focus strengthens the adoption of intelligent controls that respond dynamically to changing occupancy and environmental conditions.

Market Trends:

Adoption of AI-Driven Predictive Controls and Data Analytics:

Rapid advances in artificial intelligence and data analytics are redefining the capabilities of HVAC control systems. The integration of AI enables predictive maintenance, automatic fault detection, and dynamic system optimization, reducing downtime and operational costs. Building operators use real-time data from connected sensors to forecast usage patterns and adjust climate control settings proactively. The HVAC control system market benefits from this shift toward intelligent automation, with manufacturers developing algorithms that learn user preferences and adapt system performance. These features extend equipment life, maximize energy savings, and improve occupant comfort. Market leaders prioritize scalable software solutions that integrate easily with other smart building technologies.

- For instance, C3 AI deployed its reliability solution for 165 chillers at a Fortune 500 manufacturer, predicting failures with 73% precision and 71% recall, and configured this system in just 4 days.

Integration of Wireless, Cloud-Based, and Open Protocol Solutions:

Market demand for flexible and scalable HVAC control systems drives innovation in wireless communication, cloud connectivity, and open protocols. Manufacturers focus on developing solutions that enable remote access, centralized control, and seamless upgrades, minimizing installation complexity and future-proofing investments. The HVAC control system market sees rising adoption of open-source communication standards, such as BACnet and Modbus, to ensure interoperability between various building automation platforms. End users expect seamless connectivity with lighting, security, and energy management systems, fueling demand for unified control environments. Cloud-based platforms empower facilities teams with anytime, anywhere access and advanced analytics, supporting informed decision-making and proactive system management. This trend accelerates digital transformation across the built environment.

- For instance, Johnson Controls’ Metasys platform supports up to 25,000 BACnet objects within a single workstation, enabling seamless integration and management of both proprietary and third-party devices across expansive and complex building environments.

Market Challenges Analysis:

High Initial Investment and Integration Complexity Impede Adoption:

Upgrading to advanced HVAC control systems often requires substantial upfront capital, deterring small and mid-sized businesses from investing. Integration with legacy infrastructure poses technical challenges and increases project timelines, particularly in older buildings lacking modern wiring or digital interfaces. The HVAC control system market contends with reluctance from stakeholders who must justify return on investment amid budget constraints. System complexity may necessitate specialized installation and maintenance expertise, raising operational costs. Businesses must balance the benefits of automation and energy efficiency against the realities of long payback periods. This financial barrier slows widespread adoption and limits market penetration in cost-sensitive segments.

Cybersecurity Risks and Data Privacy Concerns Undermine User Confidence:

Expanding use of IoT-enabled controls and cloud-based platforms exposes the HVAC control system market to heightened cybersecurity risks. Unauthorized access, data breaches, and malware threaten the integrity of building operations and occupant privacy. Organizations require robust security protocols, real-time monitoring, and compliance with data protection standards to ensure trust. It faces growing pressure to implement multi-layered defense mechanisms that evolve alongside emerging threats. Hesitation to deploy connected systems persists where stakeholders lack confidence in the security of digital infrastructure. Addressing these concerns is critical for sustaining market growth and maintaining user trust in intelligent building technologies.

Market Opportunities:

Rising Demand for Smart Buildings and Energy Efficiency Solutions:

Expanding urbanization and the construction of smart buildings create significant opportunities for the HVAC control system market. Governments and industry leaders prioritize energy-efficient solutions to meet strict sustainability mandates and reduce operational costs. Integration of advanced sensors, IoT connectivity, and cloud-based analytics transforms HVAC control systems into intelligent, adaptive networks. These developments support real-time monitoring, remote diagnostics, and automated adjustments, optimizing comfort and reducing energy consumption. The market benefits from robust investment in building automation across commercial, industrial, and residential sectors. Increasing adoption of green certification programs such as LEED drives demand for innovative HVAC control solutions tailored to high-performance buildings.

Growing Adoption of Wireless Technologies and Predictive Maintenance Platforms:

Rapid advancements in wireless communication and predictive maintenance platforms create further growth avenues for the HVAC control system market. Manufacturers develop wireless controllers, smart thermostats, and app-based interfaces that simplify installation and provide enhanced flexibility in both retrofits and new projects. It enables predictive analytics for equipment health monitoring, reducing downtime and extending system lifespan. Data-driven insights from connected devices empower building managers to implement proactive maintenance strategies and optimize HVAC performance. Expansion of 5G infrastructure and edge computing unlocks real-time, scalable control across multiple facilities. Rising awareness of indoor air quality also fuels demand for HVAC controls that support air purification and environmental monitoring.

Market Segmentation Analysis:

By Equipment:

The HVAC control system market features a diverse range of equipment, including sensors, controllers, thermostats, and actuators. Sensors and controllers account for the largest share, driven by rapid adoption of smart and energy-efficient technologies in modern buildings. Thermostats, both programmable and smart, remain integral to residential and commercial applications, enabling users to regulate temperature with precision. Actuators facilitate automated adjustments across ventilation and airflow systems, supporting optimal indoor conditions. The trend toward integrating multiple equipment types in unified systems accelerates innovation and enhances overall performance.

- For instance, Johnson Controls’ M9220 Series electric actuators deliver up to 177lb·in (20N·m) torque and are rated for 60,000 full stroke cycles and 1,500,000 repositioning actions, ensuring high durability and precise automation.

By Application:

The market addresses a broad spectrum of applications, with commercial buildings representing the leading segment. High-rise offices, shopping malls, and healthcare facilities demand advanced HVAC control solutions to optimize energy use and maintain comfort. The residential sector shows steady growth, fueled by rising awareness of indoor air quality and convenience. Industrial applications prioritize robust systems for precise climate management in manufacturing and data center environments. It adapts to sector-specific needs by delivering tailored solutions that maximize efficiency and regulatory compliance.

- For instance, the adoption of precision cooling solutions by major data centers such as those managed by Vertiv enabled operational temperature accuracy to within ±0.5°C across critical rooms, supporting uninterrupted IT workloads while maintaining optimized power usage in 2025.

By Distribution:

Direct sales and distribution through specialized channels dominate the HVAC control system market. Leading manufacturers partner with value-added resellers, systems integrators, and OEMs to expand market reach. Online platforms and e-commerce channels gain traction, supporting quick procurement for both commercial and residential customers. The market relies on a strong network of authorized distributors and technical service providers to ensure effective installation, maintenance, and technical support.

Segmentations:

By Equipment:

- Sensors

- Controllers

- Thermostats

- Actuators

By Application:

- Commercial Buildings

- Residential Buildings

- Industrial Facilities

- Institutional Buildings

By Distribution:

- Direct Sales

- Value-Added Resellers

- Systems Integrators

- Online Platforms

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds a 38% share of the global HVAC control system market, supported by advanced infrastructure and strong regulatory frameworks. The region benefits from extensive adoption of smart building technologies and aggressive energy efficiency initiatives in the United States and Canada. Major cities implement building automation solutions to reduce energy consumption and comply with evolving sustainability mandates. The presence of leading manufacturers and robust R&D activity accelerates innovation in wireless controls, cloud-based analytics, and predictive maintenance platforms. Government incentives for green construction and LEED certification drive continuous upgrades in commercial, industrial, and residential spaces. It witnesses high demand for HVAC controls that support integration with broader building management systems.

Europe:

Europe accounts for 31% share of the HVAC control system market, driven by stringent regulations on energy performance and building emissions. The European Union enforces rigorous standards, prompting widespread adoption of advanced HVAC control systems across commercial and institutional buildings. Smart city projects and public sector investments contribute to rapid digitalization of infrastructure in countries such as Germany, France, and the United Kingdom. Local manufacturers partner with technology firms to deliver interoperable, scalable solutions tailored for energy optimization. It experiences increased demand for retrofitting in aging structures to achieve energy savings and meet decarbonization targets. Emphasis on indoor air quality and occupant comfort further supports adoption of intelligent HVAC control systems.

Asia Pacific:

Asia Pacific secures a 22% share of the HVAC control system market, propelled by rapid urbanization and booming construction activity. The region benefits from large-scale infrastructure projects and rising investments in smart city development across China, India, Japan, and Southeast Asia. Growing awareness of energy efficiency and government support for sustainable building practices accelerate the shift toward intelligent HVAC controls. The expanding manufacturing sector increases demand for sophisticated climate control and monitoring solutions. It offers strong growth prospects for global and regional players, supported by a rising middle class and expanding commercial real estate sector. Increasing investments in R&D and digital infrastructure strengthen market competitiveness and drive ongoing product innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Carrier Corporation

- Mitsubishi Electric Corporation

- DAIKIN INDUSTRIES Ltd.

- Fujitsu

- Rheem Manufacturing Company

- SAMSUNG

- Haier Group

- Johnson Controls

- LG Electronics

- Panasonic Corporation

- AAON

- Lennox International Inc.

Competitive Analysis:

The HVAC control system market features a dynamic competitive landscape shaped by global leaders and strong regional players. Carrier Corporation, Mitsubishi Electric Corporation, DAIKIN INDUSTRIES Ltd., Fujitsu, Rheem Manufacturing Company, SAMSUNG, Haier Group, and Johnson Controls dominate with diverse product portfolios and established global reach. These companies invest heavily in research and development to introduce advanced, energy-efficient control systems and digital solutions. It witnesses intense competition in the commercial and industrial segments, where customization, reliability, and integration capabilities set market leaders apart. Strategic partnerships, mergers, and acquisitions support rapid innovation and market expansion. Regional players focus on tailored solutions to address local climate needs and regulatory requirements, while global companies leverage economies of scale and strong distribution networks to maintain market share.

Recent Developments:

- In July, 2025: Carrier Transicold expanded its Supra HE range with two new multi-temperature units, targeting smarter fleet refrigeration.

- In October, 2024: Daikin launched the Compact L air handling unit range, expanding its advanced ventilation solutions for the compact segment.

- In April 2025, LG and Kia collaborated to showcase the Spielraum concept car at the Seoul Mobility Show, integrating AI-driven smart home solutions with automotive platforms.

Market Concentration & Characteristics:

The HVAC control system market demonstrates moderate concentration, with leading players holding significant influence through technological innovation and broad product portfolios. It features a competitive landscape shaped by global corporations such as Johnson Controls, Honeywell International, Siemens, Schneider Electric, and Emerson Electric, alongside regional specialists. The market’s key characteristics include a strong emphasis on R&D, rapid integration of IoT and cloud technologies, and increasing demand for customized solutions across commercial, industrial, and residential sectors. Strong regulatory frameworks and sustainability initiatives further shape competitive strategies. Companies prioritize partnerships, mergers, and product launches to expand reach and address evolving customer requirements.

Report Coverage:

The research report offers an in-depth analysis based on Equipment, Application, Distribution and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for predictive maintenance platforms will accelerate, enabling real‐time fault detection and reducing equipment downtime.

- Cloud‑based analytics will drive smarter decision‑making through remote performance monitoring and trend forecasting.

- Integration of HVAC controls with building energy management systems will become standard in commercial and industrial facilities.

- Wireless protocols and mesh networks will offer greater installation flexibility and lower wiring costs in retrofit and new builds.

- Focus on indoor air quality will heighten, prompting demand for controls that support sensors for CO₂, humidity, and particulates.

- Edge computing will gain traction, letting on‑site devices process data locally and reducing latency for rapid control responses.

- Demand for scalable, modular control solutions will grow to meet diverse building sizes and sector segments.

- Companies will form partnerships and alliances with smart hardware and software providers to deliver holistic building automation.

- Governments will enforce stricter energy and emissions standards, increasing adoption of intelligent controls.

- Use of artificial intelligence and machine learning will refine predictive models, optimize energy usage, and tailor system behavior for occupant comfort.