Market Overview

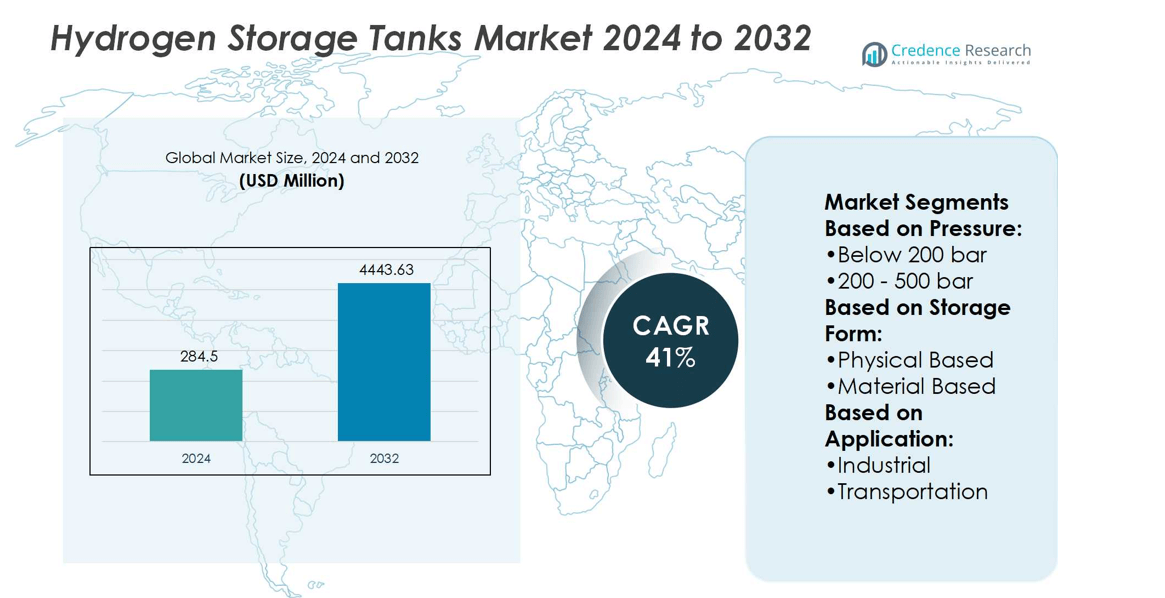

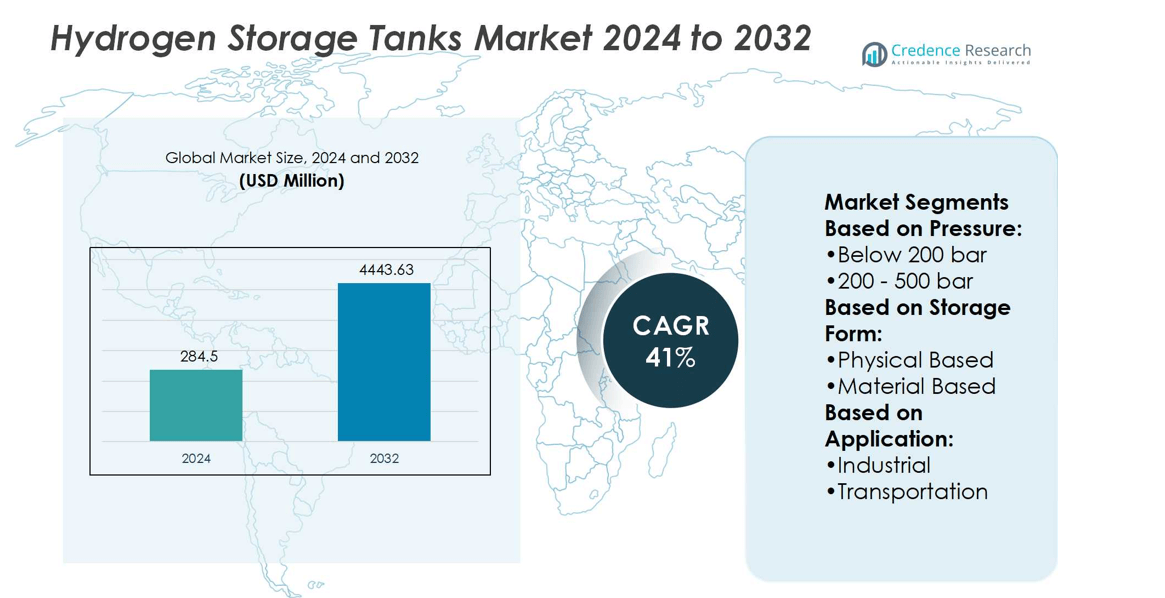

Hydrogen Storage Tanks Market size was valued at USD 284.5 million in 2024 and is anticipated to reach USD 4443.63 million by 2032, at a CAGR of 41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Storage Tanks Market Size 2024 |

USD 284.5 million |

| Hydrogen Storage Tanks Market, CAGR |

41% |

| Hydrogen Storage Tanks Market Size 2032 |

USD 4443.63 million |

The Hydrogen Storage Tanks Market grows through strong government support, rising investments in clean energy, and expanding adoption across industrial and transportation sectors. Demand increases as high-pressure systems above 500 bar enable longer ranges and faster refueling for fuel cell vehicles, railways, and marine applications. Lightweight composite materials and advanced polymers drive innovation, reducing weight while improving durability and safety. Digital monitoring, IoT-enabled systems, and predictive analytics enhance reliability and compliance with strict regulations. Expanding hydrogen corridors, renewable integration, and cross-border trade projects further strengthen market momentum, positioning storage tanks as a vital element in global decarbonization strategies.

The Hydrogen Storage Tanks Market shows strong geographical presence with Asia Pacific holding the largest share, driven by large-scale hydrogen adoption in mobility and industry. Europe follows with strict emission regulations and cross-border projects, while North America advances through hydrogen hubs and mobility pilots. Latin America and the Middle East & Africa record emerging opportunities supported by renewable projects and industrial demand. Key players include BayoTech, NPROXX, Hexagon Purus, Luxfer Gas Cylinders, Plastic Omnium, Mahytec, Doosan Mobility Innovation, ECS, Hensoldt, and Pragma Industries.

Market Insights

- Hydrogen Storage Tanks Market size was USD 284.5 million in 2024 and will reach USD 4443.63 million by 2032, at a CAGR of 41%.

- Strong government support and rising clean energy investments drive adoption across industrial and mobility sectors.

- High-pressure tanks above 500 bar gain demand for longer ranges and faster refueling in transport.

- Lightweight composites and advanced polymers reduce weight while improving durability and safety.

- Key players focus on innovation, partnerships, and advanced designs to strengthen competitiveness.

- High production costs and infrastructure gaps act as restraints for wider adoption.

- Asia Pacific leads the market, followed by Europe and North America, with Latin America and Middle East & Africa emerging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Investments in Clean Energy Infrastructure and Decarbonization Efforts

The Hydrogen Storage Tanks Market benefits from major investments in clean energy projects and national hydrogen strategies. Governments promote hydrogen hubs, corridors, and large-scale industrial projects to accelerate decarbonization goals. These initiatives create consistent demand for storage systems that ensure safe, efficient, and scalable solutions. It supports renewable integration and strengthens hydrogen’s role as an energy carrier across industries. Fuel cell vehicles and industrial users drive procurement of advanced storage tanks. This alignment with global sustainability policies secures long-term growth opportunities.

- For instance, companies like Hexagon Purus and NPROXX produce Type IV hydrogen tanks certified for up to 700 bar pressure, enabling deployment in fuel cell buses across Europe. These tanks, which weigh significantly less than steel alternatives, are integrated into vehicles to ensure safe onboard hydrogen storage.

Advancements in High-Pressure and Lightweight Composite Technologies

Technological progress remains a strong driver for the Hydrogen Storage Tanks Market. Manufacturers develop high-pressure systems above 500 bar that extend driving range and cut refueling times. Lightweight composite tanks reduce overall vehicle weight, enhancing fuel efficiency and operational safety. It enables automakers and transport operators to deploy hydrogen solutions at scale. Research into durable polymers and carbon fiber reinforcements further increases lifespan and reliability. These innovations strengthen adoption in mobility and industrial applications.

- For instance, Plastic Omnium has developed Type IV hydrogen storage tanks capable of 700 bar pressure, with carbon fiber windings that reduce weight by 30%, and its facility in Brussels now produces more than 80,000 high-pressure tanks annually for mobility applications.

Expanding Adoption Across Transportation, Industry, and Power Generation

The Hydrogen Storage Tanks Market records strong demand from automotive, railway, marine, and stationary power sectors. Fuel cell vehicles require reliable high-pressure tanks to meet performance expectations. Industries such as steel, chemicals, and refineries utilize hydrogen storage for process efficiency and emission reduction. It also plays a role in backup power generation, supporting energy resilience for critical infrastructure. Marine and rail transport adopt hydrogen solutions to comply with emission regulations. This multi-sector integration enhances market stability.

Growing Emphasis on Safety Standards and Smart Monitoring Systems

Strict regulatory frameworks push the Hydrogen Storage Tanks Market toward safer and smarter solutions. Governments enforce certification standards for pressure ratings, leak-proof designs, and durability testing. It drives companies to integrate digital sensors, predictive analytics, and IoT-based monitoring systems. Real-time diagnostics reduce risks while improving operational performance. Industry partnerships focus on developing globally harmonized standards for storage and transport. These measures improve trust and accelerate broader market adoption.

Market Trends

Increasing Integration of Hydrogen Storage with Mobility and Transportation Networks

The Hydrogen Storage Tanks Market shows strong momentum in mobility adoption across vehicles, railways, and marine fleets. Fuel cell cars and buses demand advanced high-pressure storage systems that support long ranges and fast refueling. Railway operators integrate hydrogen-powered locomotives on regional routes to reduce emissions and meet policy targets. It creates steady demand for tanks capable of withstanding frequent operational cycles. Marine industries explore hydrogen storage solutions for ferries and cargo vessels under strict emission rules. This transport integration strengthens hydrogen’s role in the global energy transition.

- For instance, BayoTech hydrogen generation system (H2-1000) produces up to 1,000 kilograms of hydrogen per day, their transport modules (like the GSM30-250) hold significantly smaller amounts, enabling efficient hydrogen delivery to end-users.

Advancements in Digital Monitoring and Smart Safety Features

Technology integration marks a vital trend in the Hydrogen Storage Tanks Market. Companies deploy IoT-enabled sensors that track pressure, temperature, and leakage in real time. Predictive analytics tools provide early warnings, minimizing downtime and enhancing reliability. It supports compliance with evolving safety standards and boosts operational trust among users. Digital monitoring also enables remote management for large-scale industrial projects. These innovations redefine performance expectations and drive long-term market confidence.

- For instance, Pragma Mobility developed the Alpha Neo fuel cell e-bike, which uses a removable hydrogen pack with 67 grams of hydrogen at 300 bar. This provides an energy capacity of 1,200 Wh (1.2 kWh), enabling a range of up to 150 kilometers.

Rising Use of Lightweight Materials and Composite Innovations

Material innovation continues to influence the Hydrogen Storage Tanks Market. Carbon fiber composites replace traditional steel, reducing tank weight while maintaining high-pressure resistance. This shift improves fuel efficiency in vehicles and lowers handling costs for industrial users. It also extends product lifespan, reducing replacement frequency and overall operating costs. Manufacturers focus on advanced resin systems and polymer blends for added durability. These material improvements make storage solutions more adaptable across applications.

Expansion of Hydrogen Infrastructure and Cross-Border Trade Projects

Infrastructure growth stands as a defining trend for the Hydrogen Storage Tanks Market. Governments and private players invest in hydrogen refueling stations, pipelines, and cross-border corridors. It ensures reliable supply for both mobility and industrial sectors. Large-scale trade agreements support storage solutions that enable secure transport across regions. Energy hubs in Asia, Europe, and North America prioritize tank deployment for long-haul logistics. This infrastructure expansion strengthens global supply chains and accelerates adoption.

Market Challenges Analysis

High Production Costs and Limited Economies of Scale Restrict Wider Deployment

The Hydrogen Storage Tanks Market faces significant challenges due to high manufacturing costs and complex material requirements. Advanced composite tanks demand carbon fiber and specialized polymers, which raise production expenses. Limited economies of scale prevent cost reductions, making hydrogen systems less competitive against conventional energy solutions. It creates barriers for adoption in cost-sensitive industries such as public transport and small-scale manufacturing. Procurement budgets in emerging economies often struggle to support large-scale deployment. This cost challenge continues to restrict faster commercialization and wider market penetration.

Infrastructure Gaps, Safety Concerns, and Regulatory Barriers Slow Adoption

Infrastructure limitations remain a critical hurdle for the Hydrogen Storage Tanks Market. Refueling stations and transport corridors are still underdeveloped in many regions, creating bottlenecks in distribution. It slows adoption in mobility sectors that require reliable access to hydrogen supply networks. Safety concerns around high-pressure storage, risk of leakage, and accident prevention demand strict compliance with standards. Regulatory fragmentation across countries complicates certification, testing, and cross-border trade. These factors raise operational risks and slow the global scaling of hydrogen storage solutions.

Market Opportunities

Expansion into Emerging Economies and Growing Renewable Integration

The Hydrogen Storage Tanks Market presents strong opportunities in emerging economies investing in clean energy transitions. Countries in Asia, Latin America, and the Middle East expand hydrogen corridors to support industrial and mobility applications. It enables storage solutions to become integral to renewable integration, ensuring stable supply from solar and wind projects. Governments provide funding and policy support for infrastructure that favors tank adoption. Local manufacturing and technology transfer create further opportunities for cost reduction. This expansion into new markets increases demand for scalable and reliable storage systems.

Advancements in Mobility Applications and Long-Distance Transport Solutions

Rapid innovation in mobility and logistics creates opportunities for the Hydrogen Storage Tanks Market. Automakers invest in fuel cell vehicles that require durable high-pressure tanks to meet performance standards. It supports extended ranges for buses, trucks, and trains, boosting adoption across transportation fleets. Marine and aviation sectors explore hydrogen storage for long-distance routes, creating demand for advanced tank designs. Industrial logistics and cross-border trade benefit from high-capacity storage solutions that enable safe bulk transport. These advancements broaden hydrogen’s role in global decarbonization strategies and open new commercial prospects.

Market Segmentation Analysis:

By Pressure

The Hydrogen Storage Tanks Market divides into below 200 bar, 200–500 bar, and above 500 bar categories. Tanks below 200 bar serve stationary and low-pressure applications, including backup systems and small-scale industrial operations. The 200–500 bar range dominates mid-level adoption, balancing safety, energy density, and affordability. It remains widely used in industrial sectors where performance reliability and operational efficiency are priorities. Above 500 bar tanks gain momentum in advanced transportation, supporting longer ranges and reduced refueling time for fuel cell vehicles, railways, and marine uses. This high-pressure category attracts strong investment from mobility stakeholders seeking scalable solutions.

- For instance, Luxfer Gas Cylinders manufactures Type III and Type IV hydrogen tanks certified for up to 700 bar, with individual cylinders holding smaller amounts of hydrogen and bundles of cylinders storing up to 84 kilograms.

By Storage Form

The Hydrogen Storage Tanks Market segments into physical-based and material-based storage forms. Physical storage, including compressed and cryogenic methods, is the most established and widely deployed option. It supports applications in both industrial and transportation sectors with proven reliability. Material-based storage, such as metal hydrides and chemical carriers, is under development for enhanced safety and compactness. It offers potential advantages in weight reduction and energy density, addressing future mobility requirements. Research partnerships and pilot projects drive innovation in this segment, aiming for commercial readiness.

- For instance, Doosan Mobility Innovation’s hydrogen fuel cell drones use 350 bar composite storage tanks with capacities of either 7 liters or 10.8 liters, enabling flight times of up to 120 minutes.

By Application

The Hydrogen Storage Tanks Market addresses two primary application categories: industrial and transportation. Industrial users adopt storage systems for chemical production, steelmaking, refineries, and power generation. It ensures hydrogen supply stability for processes where decarbonization remains a priority. Transportation applications drive rapid adoption through fuel cell vehicles, buses, trucks, and trains requiring advanced tanks for performance consistency. Marine and aviation sectors explore new storage technologies to meet global emission targets. This application diversity enhances market resilience and strengthens growth potential.

Segments:

Based on Pressure:

- Below 200 bar

- 200 – 500 bar

Based on Storage Form:

- Physical Based

- Material Based

Based on Application:

- Industrial

- Transportation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 18% of the Hydrogen Storage Tanks Market, with the United States and Canada at the forefront. Federal and state initiatives promote hydrogen hubs, mobility pilots, and industrial decarbonization. The U.S. supports hydrogen in heavy-duty trucking, aviation, and stationary power, creating strong demand for advanced tanks. Canada invests in hydrogen corridors linking major provinces, emphasizing cross-border integration with the U.S. It creates opportunities for high-pressure and cryogenic storage across transportation and industrial sectors. Companies in the region pioneer innovations in carbon fiber composites and safety monitoring systems. This focus on technology development and infrastructure expansion secures steady market growth.

Europe

Europe represents 28% of the Hydrogen Storage Tanks Market, supported by strict emission regulations and cross-border hydrogen trade initiatives. The European Union prioritizes green hydrogen adoption across industries and mobility to meet climate neutrality goals. Germany, France, and the Netherlands lead investment in hydrogen refueling infrastructure and storage innovation. It benefits from advanced R&D in lightweight composite tanks and digital monitoring systems. Regional projects focus on integrating storage with renewable energy hubs, ensuring consistent supply. The growth of hydrogen corridors across borders promotes large-scale adoption of high-capacity storage systems. Europe’s regulatory environment and collaborative projects sustain its strong position.

Asia Pacific

Asia Pacific holds the largest share of the Hydrogen Storage Tanks Market at 40%. The region leads adoption through large-scale hydrogen infrastructure projects in Japan, China, South Korea, and Australia. Governments actively fund hydrogen corridors, fuel cell vehicle deployment, and industrial decarbonization programs. It supports widespread use of high-pressure storage tanks in mobility, energy, and chemical sectors. Japan invests heavily in 700-bar storage for fuel cell cars, while China expands refueling stations across major urban clusters. South Korea develops hydrogen-powered rail and marine systems, further strengthening demand. With strong policy backing and industrial partnerships, Asia Pacific maintains leadership and sets global benchmarks for hydrogen deployment.

Latin America

Latin America holds 8% of the Hydrogen Storage Tanks Market, with growth led by Brazil, Chile, and Argentina. Governments emphasize hydrogen for renewable integration and industrial decarbonization. Chile develops one of the world’s largest green hydrogen initiatives, creating demand for high-capacity storage tanks. Brazil explores hydrogen adoption in transportation and heavy industries, while Argentina pursues pilot projects for clean fuel export. It creates opportunities for both physical-based and material-based storage systems. Infrastructure development remains in early stages, but international partnerships accelerate progress. Latin America’s market share is expected to grow steadily with global energy transition.

Middle East & Africa

The Middle East & Africa region captures 6% of the Hydrogen Storage Tanks Market. Countries such as Saudi Arabia, the UAE, and South Africa invest in large-scale green hydrogen projects. It supports demand for storage tanks in both industrial applications and export-oriented projects. Saudi Arabia develops NEOM, one of the largest hydrogen hubs, requiring advanced tank deployment for global trade. The UAE focuses on hydrogen in power generation and mobility, with South Africa targeting industrial and mining applications. Limited infrastructure poses challenges, yet strong investment momentum drives growth. International collaborations enhance the region’s role in future hydrogen supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ECS

- Plastic Omnium

- BayoTech

- Hensoldt

- Pragma Industries

- Luxfer Gas Cylinders

- Doosan Mobility Innovation

- Hexagon Purus

- Mahytec

- NPROXX

Competitive Analysis

The Hydrogen Storage Tanks Market players including BayoTech, Doosan Mobility Innovation, ECS, Hensoldt, Hexagon Purus, Luxfer Gas Cylinders, Mahytec, NPROXX, Plastic Omnium, and Pragma Industries. The Hydrogen Storage Tanks Market demonstrates a highly competitive landscape driven by innovation, regulatory compliance, and global energy transition goals. Companies emphasize advancements in high-pressure systems, lightweight composite materials, and digital monitoring solutions to strengthen performance and safety. Strategic partnerships with automakers, energy providers, and infrastructure developers support large-scale deployment across transportation, industrial, and power sectors. It benefits from rising investment in hydrogen corridors, mobility projects, and renewable integration, which increase demand for reliable storage systems. Continuous research into material efficiency and durability ensures long-term market growth. Competition focuses on delivering scalable, cost-effective, and technologically advanced solutions that align with evolving sustainability targets.

Recent Developments

- In November 2024, Hexagon Purus was once again selected by New Flyer to provide hydrogen cylinders for North America’s zero-emission transit buses. Hexagon Purus will deliver its Type 4 hydrogen storage cylinders for use in the transit buses, which can travel up to 600 kilometers on a single refueling.

- In October 2024, Celly and UMOE Advanced Composites AS introduced an advanced hydrogen transportation trailer to the U.S. market. Designed to safely and efficiently transport large volumes of hydrogen, this trailer builds on UMOE’s successful six-year track record in Europe.

- In October 2024, Tenaris reaffirmed its role in advancing hydrogen transportation research by participating in the Hydrogenius Symposium and the HyLINE II JIP. Following the symposium, Tenaris joined the HyLINE II JIP, a five-year initiative focusing on the material integrity of welded joints in offshore hydrogen pipelines, collaborating with key industrial partners.

- In April 2024, NPROXX displayed its hydrogen storage solutions at Hannover Messe, demonstrating advanced technologies like lightweight composite tanks. The company highlighted its role in promoting hydrogen adoption across various sectors, engaging with industry leaders to foster collaboration.

Report Coverage

The research report offers an in-depth analysis based on Pressure, Storage Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-pressure tanks above 500 bar will rise with fuel cell vehicle expansion.

- Lightweight composite materials will gain preference to improve efficiency and durability.

- Hydrogen corridors and refueling infrastructure will drive adoption across global regions.

- Digital monitoring and IoT-based systems will become standard for safety and reliability.

- Industrial users in steel, chemicals, and refineries will expand hydrogen storage investments.

- Marine and rail transport sectors will adopt advanced storage systems to meet emission targets.

- Material-based storage solutions will progress toward commercial readiness in niche applications.

- Strategic partnerships will increase between technology providers, automakers, and energy companies.

- Government policies and subsidies will continue to accelerate large-scale storage deployment.

- Global trade networks will expand, requiring advanced storage systems for cross-border hydrogen transport.