Market Overview

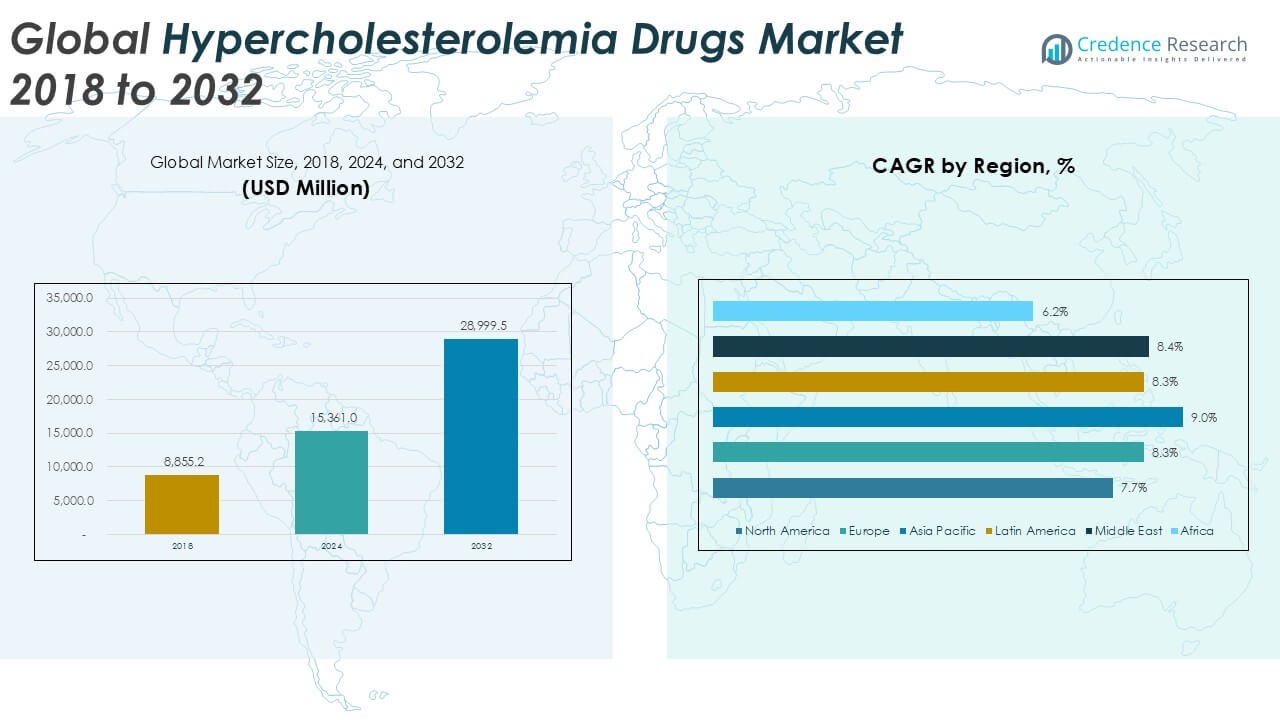

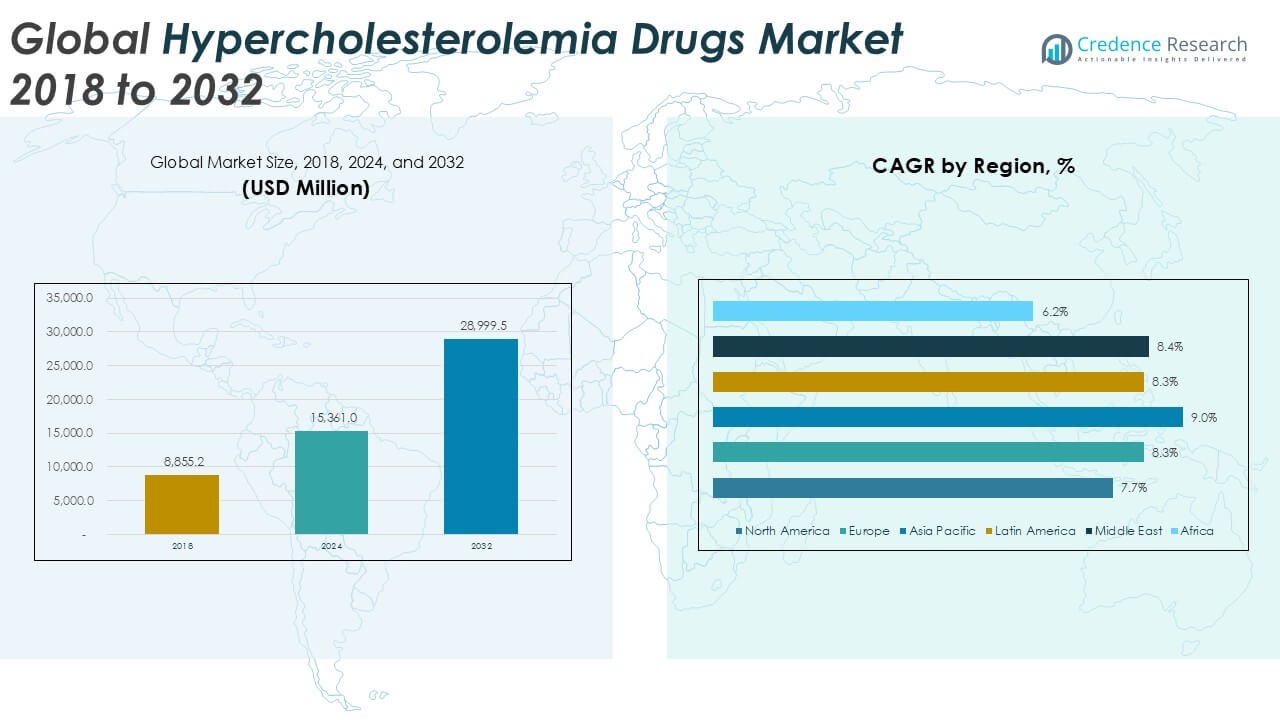

The Hypercholesterolemia Drugs market size was valued at USD 8,855.2 million in 2018, increased to USD 15,361.0 million in 2024, and is anticipated to reach USD 28,999.5 million by 2032, at a CAGR of 8.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hypercholesterolemia Drugs Market Size 2024 |

USD 15,361.0 Million |

| Hypercholesterolemia Drugs Market, CAGR |

8.23% |

| Hypercholesterolemia Drugs Market Size 2032 |

USD 28,999.5 Million |

The Hypercholesterolemia Drugs market is highly competitive, with leading players such as Pfizer Inc., Merck & Co., Inc., Sanofi S.A., Amgen Inc., AstraZeneca, AbbVie Inc., and Eli Lilly and Company driving innovation and market growth. These companies maintain strong positions through extensive product portfolios, strategic partnerships, and ongoing investment in novel lipid-lowering therapies, including PCSK9 inhibitors and combination drugs. North America dominates the global market, accounting for 31.2% of total revenue in 2024, supported by advanced healthcare infrastructure, high diagnosis rates, and favorable reimbursement policies. Europe and Asia Pacific follow, with rising demand driven by increasing cardiovascular disease prevalence and expanding healthcare access. As the market evolves, continued advancements in biologics and greater penetration in emerging economies are expected to shape the competitive landscape further.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hypercholesterolemia drugs market was valued at USD 15,361.0 million in 2024 and is projected to reach USD 28,999.5 million by 2032, growing at a CAGR of 8.23% during the forecast period.

- Rising prevalence of cardiovascular diseases, obesity, and sedentary lifestyles is significantly driving demand for cholesterol-lowering drugs globally.

- Trends such as increased adoption of PCSK9 inhibitors and combination therapies, along with digital health integration for patient monitoring, are reshaping the treatment landscape.

- Key players including Pfizer, Merck, Sanofi, and Amgen dominate the market, while generic manufacturers are intensifying price-based competition; however, high costs of biologics and poor patient adherence remain major restraints.

- North America held the largest regional share at 31.2% in 2024, followed by Asia Pacific at 26.0%; by drug class, statins accounted for the highest segment share due to their proven efficacy and widespread usage.

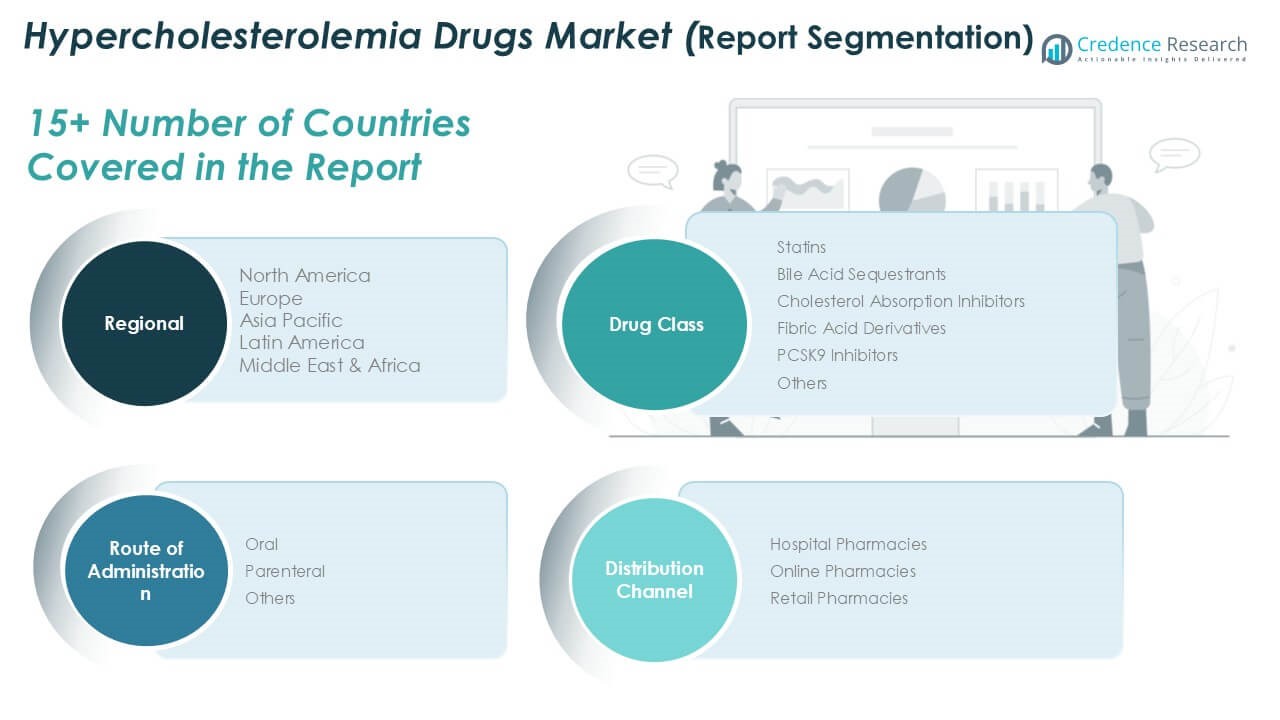

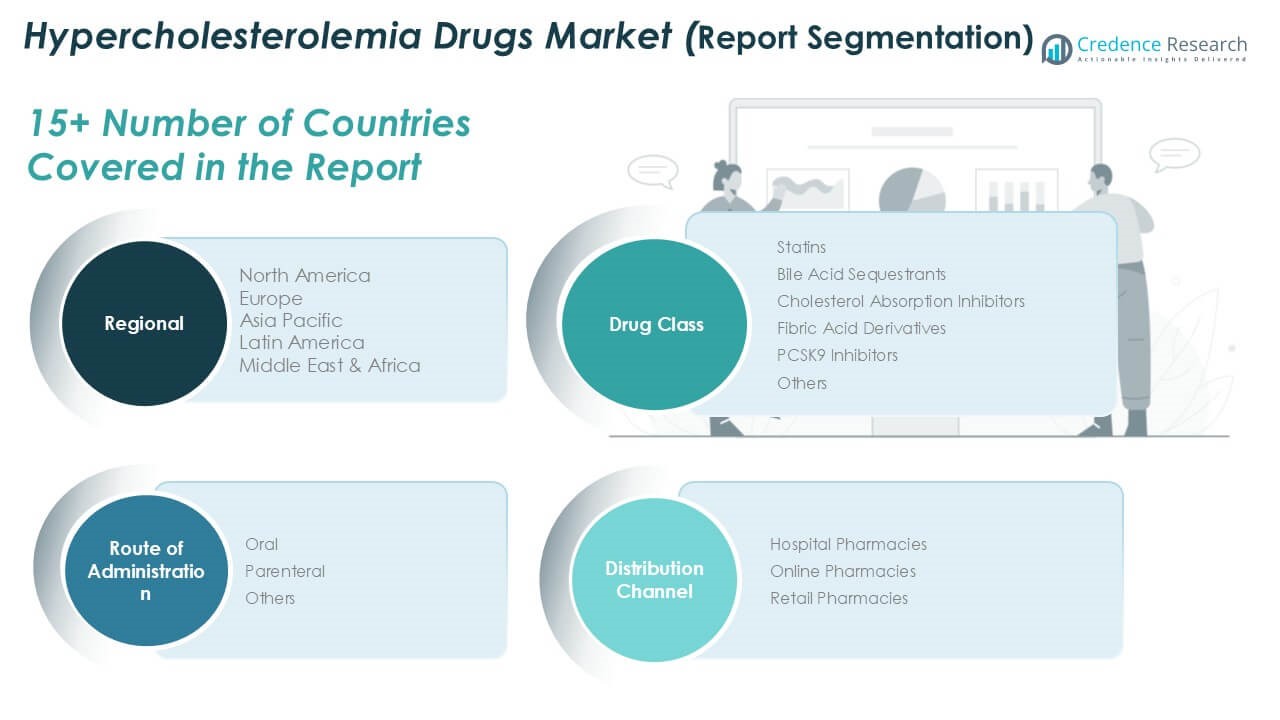

Market Segmentation Analysis:

By Drug Class:

The Statins segment dominated the hypercholesterolemia drugs market, accounting for the largest market share in 2024 due to their proven efficacy, cost-effectiveness, and widespread prescription. Statins remain the first-line treatment for lowering LDL cholesterol and reducing cardiovascular risk, particularly in aging populations. Their long-standing clinical acceptance and availability in generic forms support high demand globally. While newer drug classes like PCSK9 inhibitors are gaining attention for high-risk patients or those with statin intolerance, high costs and limited accessibility currently restrain their broader adoption, leaving statins at the forefront of therapeutic use.

- For instance, Pfizer’s atorvastatin (Lipitor), one of the most prescribed statins globally, reached over 15.7 million prescriptions in the United States alone in 2022, making it a cornerstone of lipid-lowering therapy in clinical practice according to the U.S. Centers for Medicare & Medicaid Services (CMS) drug utilization data.

By Route of Administration

Oral administration emerged as the dominant route in the hypercholesterolemia drugs market, holding the highest market share in 2024. This dominance is driven by the convenience, ease of dosing, and patient compliance associated with oral drugs, particularly statins, which are widely prescribed in tablet form. Most hypercholesterolemia therapies are developed for oral intake, making them suitable for long-term management. While parenteral options such as PCSK9 inhibitors are gaining momentum for specific patient groups, their uptake remains limited due to higher costs, injection-related discomfort, and the need for clinical supervision.

- For instance, Merck’s ezetimibe-based oral therapy (marketed as Zetia) recorded 7.2 million prescriptions in the U.S. in 2022, illustrating sustained demand for convenient oral dosage forms among patients and prescribers, according to IQVIA data.

By Distribution Channel

Hospital pharmacies led the market by distribution channel in 2024, capturing the largest share due to increased hospital-based prescriptions and the management of severe cases requiring PCSK9 inhibitors or combination therapies. Hospitals play a vital role in initiating advanced treatments and monitoring complex lipid profiles in high-risk patients. However, retail pharmacies and online pharmacies are gaining ground, supported by rising outpatient visits and the shift toward home-based chronic care. Online pharmacies, in particular, are expanding their footprint due to convenience and growing digital health adoption, though regulatory oversight and drug authenticity remain key challenges.

Key Growth Drivers

Rising Prevalence of Cardiovascular and Lifestyle Diseases

The global rise in cardiovascular diseases and lifestyle-related disorders such as obesity, diabetes, and sedentary behavior has significantly increased the incidence of hypercholesterolemia. This surge in patient population is driving demand for lipid-lowering therapies, particularly statins and emerging biologics. Aging populations and urbanization trends contribute to poor dietary habits and lack of physical activity, further exacerbating cholesterol-related health issues. As a result, healthcare providers are increasingly adopting pharmacological interventions for prevention and treatment, boosting the growth of the hypercholesterolemia drugs market.

- For instance, Amgen’s PCSK9 inhibitor, Repatha (evolocumab), has been prescribed to over 1.2 million patients globally since its launch, with a significant proportion attributed to high-risk cardiovascular populations, according to Amgen’s 2023 annual report.

Technological Advancements and Novel Drug Development

Continuous research and development in the pharmaceutical sector have led to the introduction of innovative therapies, including PCSK9 inhibitors, bempedoic acid, and gene-silencing treatments. These advanced drugs offer superior efficacy and are targeted at high-risk patients who do not respond well to traditional statins. Such innovations not only expand treatment options but also address unmet medical needs, particularly in cases of familial hypercholesterolemia. Ongoing clinical trials and regulatory approvals are expected to bring more novel therapeutics to market, accelerating overall market growth.

- For instance, Novartis’ inclisiran (Leqvio), a small interfering RNA therapy targeting PCSK9 synthesis, has completed over 9,500 patient enrollments across the ORION clinical trial program, providing long-term LDL-C lowering with biannual dosing, as reported in the ORION-4 study and FDA submission documents.

Government Initiatives and Awareness Programs

Public health campaigns and government-led initiatives aimed at reducing cardiovascular disease burden have played a pivotal role in driving demand for cholesterol-lowering drugs. Organizations such as the World Health Organization and national health agencies are promoting early screening, routine lipid profiling, and preventive medication. Increased funding, insurance coverage, and reimbursement policies have further improved patient access to treatment. Such systemic support is creating favorable conditions for market expansion, especially in developing economies witnessing growing health infrastructure.

Key Trends & Opportunities

Growing Adoption of Biologics and Combination Therapies

The market is witnessing a significant shift toward biologics such as PCSK9 inhibitors and novel combination therapies that enhance efficacy and improve patient outcomes. These drugs, though currently expensive, are being increasingly prescribed to patients who are statin-intolerant or have severe hyperlipidemia. As clinical evidence supporting these therapies grows, manufacturers are investing in scalable production and cost-reduction strategies. This trend presents an opportunity for biopharmaceutical firms to penetrate new segments and expand their portfolio in the high-risk cardiovascular patient population.

- For instance, Sanofi and Regeneron’s Praluent (alirocumab) has demonstrated LDL-C reductions of up to 62% in over 18,000 patients enrolled in the ODYSSEY outcomes trial, positioning the biologic as a validated adjunctive therapy in statin-resistant cases, according to data published in the New England Journal of Medicine.

Expansion in Emerging Markets

Emerging economies across Asia Pacific, Latin America, and the Middle East represent untapped potential for hypercholesterolemia drug manufacturers. Rising healthcare expenditure, expanding insurance coverage, and improving public awareness in these regions are creating conducive environments for market entry and growth. Moreover, the prevalence of lifestyle-related diseases is rising rapidly in these regions due to urbanization and dietary changes. Pharmaceutical companies focusing on affordable drug options and strategic partnerships with local distributors can effectively leverage these opportunities to expand their global footprint.

- For instance, Lupin Pharmaceuticals launched its generic version of atorvastatin in India and reached a monthly production capacity of 30 million tablets by mid-2023, enabling large-scale supply at reduced prices and contributing to the treatment of hypercholesterolemia in cost-sensitive markets, as confirmed in its annual manufacturing disclosure.

Digital Health Integration and Remote Monitoring

The integration of digital health technologies such as mobile health apps, wearable devices, and telemedicine platforms is enhancing patient adherence to hypercholesterolemia treatment. These tools enable regular monitoring of cholesterol levels, medication reminders, and virtual consultations, improving treatment outcomes. Digital platforms also facilitate real-time data collection and patient engagement, which is vital for chronic disease management. As digital infrastructure matures, pharmaceutical companies can collaborate with health tech firms to offer value-added services and enhance drug adherence across patient groups.

Key Challenges

High Cost of Advanced Therapies

While PCSK9 inhibitors and other biologics offer substantial benefits for managing severe hypercholesterolemia, their high cost remains a major barrier to widespread adoption. These therapies are often unaffordable for patients without comprehensive insurance coverage, particularly in low- and middle-income countries. The lack of generic alternatives further limits accessibility. This cost burden not only affects patient adherence but also places financial strain on healthcare systems, slowing the pace of market penetration for newer, more effective treatments.

Patient Non-Adherence and Discontinuation Rates

Long-term adherence to cholesterol-lowering drugs remains a significant challenge, especially among asymptomatic patients who do not perceive immediate health benefits. Side effects, pill fatigue, and lack of education about cardiovascular risks contribute to poor medication compliance. Non-adherence leads to suboptimal clinical outcomes, increased disease burden, and higher healthcare costs. Pharmaceutical companies and healthcare providers must work collaboratively to improve patient education, simplify treatment regimens, and implement adherence programs to address this persistent issue.

Regulatory Hurdles and Delayed Approvals

The hypercholesterolemia drugs market faces stringent regulatory environments, with prolonged approval timelines and complex clinical trial requirements. Regulatory agencies demand robust data on safety, efficacy, and long-term outcomes, which can delay product launches and inflate development costs. Additionally, changing regulatory standards across different regions add complexity for multinational pharmaceutical firms. These challenges hinder innovation and market agility, particularly for small to mid-sized biotech companies seeking to introduce novel therapies.

Regional Analysis

North America

North America held the largest share in the hypercholesterolemia drugs market, accounting for approximately 31.2% in 2024. The market was valued at USD 2,843.40 million in 2018 and reached USD 4,793.52 million in 2024, with projections to expand to USD 8,699.84 million by 2032, growing at a CAGR of 7.7%. The region’s dominance stems from high awareness of cardiovascular risks, widespread adoption of statins and biologics, and a well-established healthcare infrastructure. Additionally, favorable reimbursement policies and the presence of major pharmaceutical players further boost drug accessibility and treatment adherence across the U.S. and Canada.

Europe

Europe captured around 21.9% of the global hypercholesterolemia drugs market in 2024. The market increased from USD 1,928.66 million in 2018 to USD 3,357.49 million in 2024, and is forecasted to reach USD 6,368.28 million by 2032, at a CAGR of 8.3%. Rising geriatric populations and increasing awareness of lipid disorders are propelling drug consumption across countries such as Germany, France, and the UK. Government-backed preventive health programs and growing acceptance of combination therapies are further strengthening the region’s market growth. Europe also benefits from a strong regulatory environment and expanding generic drug availability.

Asia Pacific

Asia Pacific accounted for approximately 26.0% of the global hypercholesterolemia drugs market in 2024 and is projected to witness the fastest growth, with a CAGR of 9.0%. The market rose from USD 2,194.31 million in 2018 to USD 3,989.48 million in 2024, and is expected to reach USD 7,992.25 million by 2032. The region’s rapid urbanization, dietary shifts, and increasing incidence of cardiovascular diseases are fueling demand for cholesterol-lowering drugs. Countries like China, India, and Japan are experiencing significant improvements in healthcare infrastructure and drug accessibility, supported by government initiatives to combat non-communicable diseases.

Latin America

Latin America contributed about 11.3% to the global hypercholesterolemia drugs market in 2024. The market expanded from USD 996.21 million in 2018 to USD 1,734.04 million in 2024, and is projected to reach USD 3,288.54 million by 2032, growing at a CAGR of 8.3%. Increasing prevalence of obesity, diabetes, and hypertension, especially in Brazil and Mexico, is driving demand for lipid-lowering therapies. Although healthcare expenditure remains limited in some parts of the region, expanding insurance coverage and greater awareness of cardiovascular risks are gradually improving patient access to treatment.

Middle East

Middle East accounted for 5.4% of the hypercholesterolemia drugs market in 2024. The market grew from USD 478.18 million in 2018 to USD 836.74 million in 2024, and is anticipated to reach USD 1,597.87 million by 2032, registering a CAGR of 8.4%. Lifestyle-related disorders, including high cholesterol and obesity, are increasingly prevalent due to sedentary habits and dietary patterns. The region is investing in healthcare modernization and chronic disease management, particularly in the Gulf Cooperation Council (GCC) countries. However, pricing pressures and unequal healthcare access across subregions may hinder consistent market expansion.

Africa

Africa represented the smallest share, about 4.2% of the global hypercholesterolemia drugs market in 2024. The market rose from USD 414.42 million in 2018 to USD 649.77 million in 2024, and is forecasted to reach USD 1,052.68 million by 2032, growing at a CAGR of 6.2%. Limited healthcare infrastructure and low awareness of cholesterol-related risks restrict market growth in several African nations. Nonetheless, urbanization and growing burden of cardiovascular diseases are creating pockets of opportunity. International health organizations and local governments are beginning to address these gaps, promoting early diagnosis and treatment accessibility.

Market Segmentations:

By Drug Class

- Statins

- Bile Acid Sequestrants

- Cholesterol Absorption Inhibitors

- Fibric Acid Derivatives

- PCSK9 Inhibitors

- Others

By Route of Administration

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Africa

- Middle East

Competitive Landscape

The hypercholesterolemia drugs market is characterized by intense competition, with major pharmaceutical players focusing on product innovation, strategic partnerships, and market expansion to strengthen their position. Key companies such as Pfizer Inc., Merck & Co., Inc., Sanofi S.A., Amgen Inc., and AstraZeneca lead the market with robust portfolios that include widely prescribed statins and emerging biologics like PCSK9 inhibitors. These firms invest heavily in R&D to develop next-generation lipid-lowering therapies targeting patients with statin intolerance or high cardiovascular risk. Strategic collaborations, licensing agreements, and acquisitions are common approaches to accelerate drug development and expand global reach. Additionally, generic manufacturers such as Lupin Pharmaceuticals are increasing competition by offering cost-effective alternatives, especially in developing regions. Market players are also leveraging digital tools to enhance patient adherence and engagement. As regulatory approvals for novel drugs continue, the competitive landscape is expected to evolve, driven by innovation, pricing strategies, and the need for differentiated therapeutic solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AbbVie Inc.

- Aegerion Pharmaceuticals

- Amgen Inc.

- AstraZeneca

- Eli Lilly and Company

- Lupin Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- Sanofi S.A.

- Shore Therapeutics, Inc.

Recent Developments

- In April 2025, Novartis announced an investment of USD 23 billion to construct and expand ten facilities in the U.S. aimed at increasing production of Leqvio, its cholesterol-lowering medication. This expansion is a response to rising demand and intends to strengthen global supply chains.

- In March 2024, The FDA granted approval for Praulent (Alirocumab) injections for pediatric patients with elevated cholesterol levels. This authorization allows for earlier intervention in managing LDL-C levels in kids, potentially lowering long-term cardiovascular risks.

- In November 2023, Eli Lilly and Company announced the FDA approval of Zepbound (tirzepatide) injection, the first and only obesity treatment activating both GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) hormone receptors. This approval significantly expanded Eli Lilly’s therapeutic portfolio and potentially strengthened its market presence.

- In November 2023, Lupin Limited announced that its Abbreviated New Drug Application for Pitavastatin Tablets (1 mg, 2 mg, 4 mg) received FDA approval. These tablets are prescribed to lower LDL cholesterol alongside dietary changes. This approval permits Lupin to sell a generic version of Livalo tablets in the U.S.

- In 2023, AstraZeneca took a noteworthy step by formalizing an acquisition deal with CinCor Pharma, Inc., a clinical-stage biopharmaceutical firm situated in the United States. CinCor Pharma distinguishes itself through its expertise in crafting cutting-edge therapeutics tailored to address uncontrolled hypertension and persistent kidney disease, with a core focus on ensuring safety and effectiveness in its medications.

Market Concentration & Characteristics

The Hypercholesterolemia Drugs Market exhibits moderate to high market concentration, with a few major pharmaceutical companies holding significant revenue shares. It is characterized by strong brand loyalty, patent-protected blockbuster drugs, and a steady demand for long-term therapies. Statins dominate due to their clinical efficacy and cost efficiency, while biologics such as PCSK9 inhibitors are gaining traction in high-risk patient groups. The market shows a stable growth trajectory supported by rising cardiovascular disease prevalence and expanding screening programs. It maintains a balance between branded and generic formulations, though entry barriers remain high due to stringent regulatory requirements and costly R&D. Companies prioritize product innovation, strategic alliances, and geographic expansion to maintain competitiveness. It benefits from a consistent patient base requiring chronic management, which sustains prescription volumes. Regional disparities in access and pricing continue to influence adoption rates, especially in developing economies.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Route of Administration, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by rising global incidence of cardiovascular and lifestyle-related diseases.

- Increasing adoption of biologics and next-generation lipid-lowering therapies will expand treatment options.

- PCSK9 inhibitors and gene-silencing drugs are likely to see higher uptake among high-risk and statin-intolerant patients.

- Growing awareness and early diagnosis initiatives will improve patient access to cholesterol-lowering medications.

- Emerging economies will present strong growth opportunities due to improving healthcare infrastructure and affordability.

- Strategic collaborations between pharmaceutical companies and digital health providers will enhance treatment adherence.

- Generic drug penetration will increase in price-sensitive markets, intensifying competition and lowering treatment costs.

- Ongoing research and development efforts will result in more combination therapies and targeted treatment approaches.

- Government policies focused on preventive cardiovascular care will support long-term market expansion.

- The market will experience increased focus on personalized medicine and real-world evidence to guide clinical decisions.