Market Overview

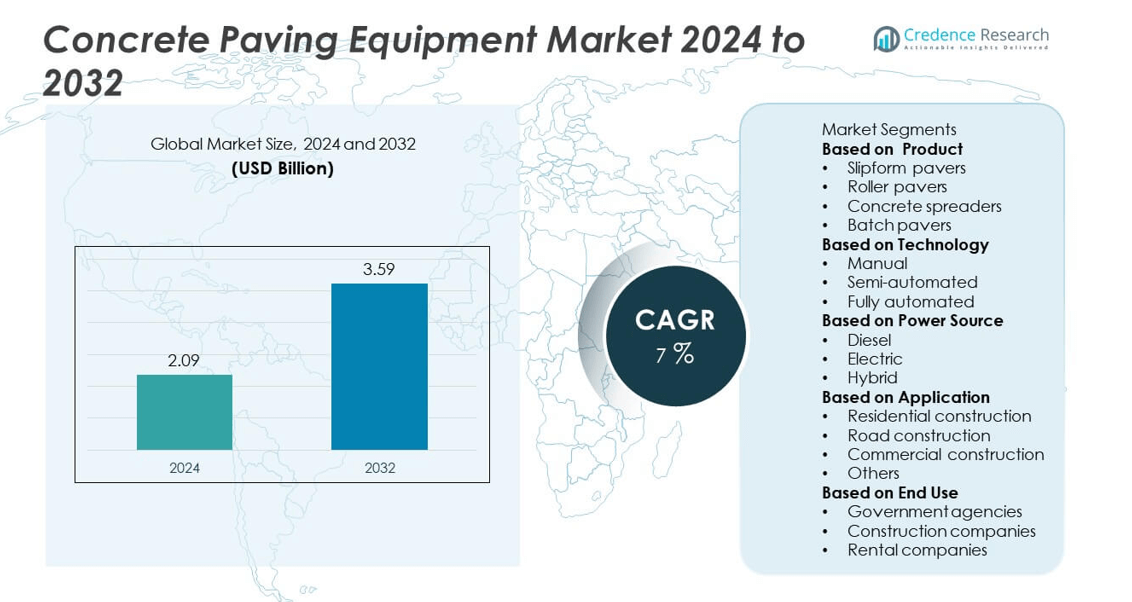

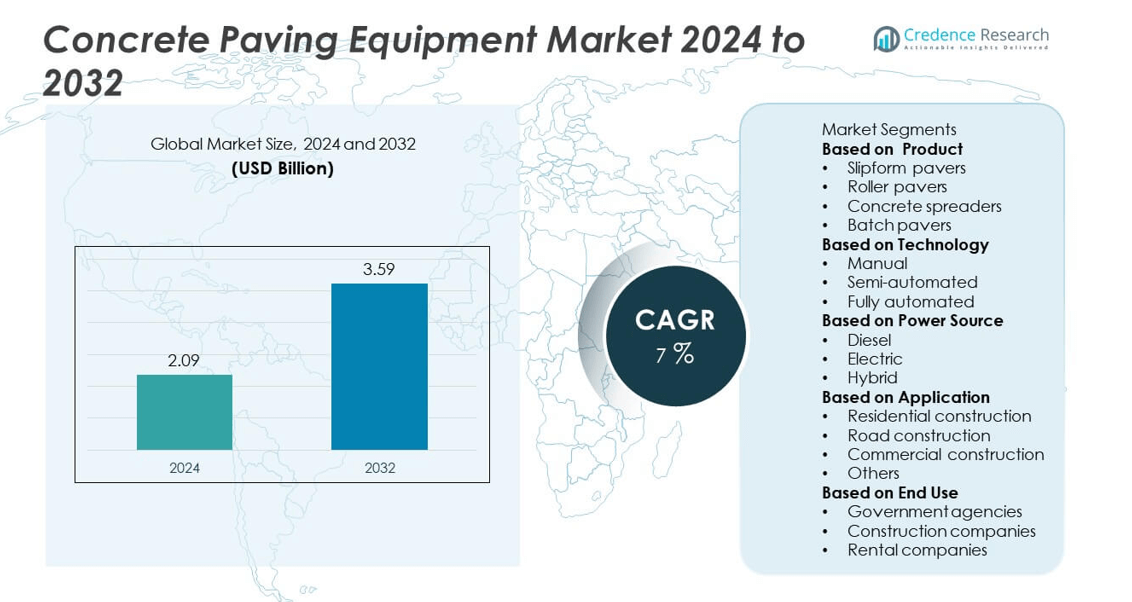

The global concrete paving equipment market was valued at USD 2.09 billion in 2024 and is projected to reach USD 3.59 billion by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Paving Equipment Market Size 2024 |

USD 2.09 billion |

| Concrete Paving Equipment Market, CAGR |

7% |

| Concrete Paving Equipment Market Size 2032 |

USD 3.59 billion |

The concrete paving equipment market is led by major players such as SCHWING Stetter India, CMI Roadbuilding Inc., XCMG Group, Bid-well (Terex Corporation), Caterpillar, Wirtgen Group (John Deere), Gomaco Corporation, SANY Group, Ammann Group, and BESSER. These companies maintain strong market positions through advanced paving technologies, extensive product lines, and global distribution capabilities. Asia-Pacific emerged as the leading regional market with a 34% share in 2024, driven by rapid infrastructure expansion and industrial growth. North America followed with a 33% share, supported by heavy investments in highway and urban road construction, while Europe, with a 27% share, benefited from sustainable construction practices and modernization of transportation networks.

Market Insights

- The concrete paving equipment market was valued at USD 2.09 billion in 2024 and is projected to reach USD 3.59 billion by 2032, growing at a CAGR of 7% during the forecast period.

- Increasing investments in road, highway, and airport construction are driving demand for efficient and high-performance paving equipment across both developed and developing regions.

- Market trends show a rising shift toward automation, 3D machine control systems, and hybrid-powered paving solutions aimed at improving precision, productivity, and sustainability.

- The market is moderately consolidated, with key players such as Caterpillar, Wirtgen Group, SANY Group, and Gomaco Corporation focusing on innovation, digital integration, and expansion into emerging infrastructure markets.

- Asia-Pacific led with a 34% share in 2024, followed by North America at 33% and Europe at 27%, while the slipform pavers segment dominated with a 46% share due to its widespread use in large-scale road and runway projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The slipform pavers segment dominated the concrete paving equipment market in 2024 with a 46% share, driven by their superior efficiency, precision, and ability to deliver continuous, uniform pavement surfaces. Widely used in highway, runway, and large-scale road construction, slipform pavers reduce labor dependency and enhance productivity. The integration of GPS-guided control systems and real-time performance monitoring further supports their adoption. Growing demand for durable concrete pavements and large public infrastructure projects is expected to sustain strong growth for slipform pavers across both developed and emerging regions.

- For instance, Gomaco Corporation developed its GP3 Slipform Paver equipped with the G+ control system, capable of paving widths up to 9.1 meters with a 3D stringless guidance system.

By Technology

The semi-automated segment held a 49% share of the concrete paving equipment market in 2024, supported by its balance of cost efficiency and operational control. Semi-automated pavers combine manual oversight with automated features, ensuring accuracy and productivity without the high capital costs associated with fully automated systems. Contractors prefer these machines for their flexibility and ease of use in mid- to large-scale projects. The ongoing shift toward digital control systems and precision paving is encouraging manufacturers to enhance semi-automated models with advanced sensors and hydraulic controls.

- For instance, Caterpillar offers the PM310 Cold Planer with integrated Cat Grade technology for precision milling, while its AP655F paver includes the Cat Grade Control option to control mat thickness. Both machines also incorporate features like Eco-mode and automatic engine speed control to boost fuel efficiency.

By Power Source

The diesel segment accounted for a 67% share of the market in 2024, driven by its widespread use in heavy-duty paving applications. Diesel-powered machines deliver high torque and long operating life, making them ideal for highway and industrial paving projects. The easy availability of fuel and proven engine performance continue to support their dominance. However, electric and hybrid equipment are gaining traction as construction firms adopt greener alternatives. Regulatory pressure to reduce emissions and operational costs is encouraging the gradual transition toward energy-efficient hybrid paving systems.

Key Growth Drivers

Rising Infrastructure Development and Road Expansion Projects

The surge in global infrastructure investment, particularly in highways, expressways, and airport runways, is driving demand for concrete paving equipment. Governments are prioritizing durable and low-maintenance concrete pavements for long-term cost efficiency. Developing countries are witnessing major growth in urban road networks and industrial zones. These projects require advanced slipform and roller pavers to ensure precision, speed, and quality. Increased public-private partnerships and government-backed transport initiatives continue to support sustained equipment demand worldwide.

- For instance, Wirtgen Group’s SP 1600 slipform paver was used by Patel Infrastructure on a section of the Vadodara-Mumbai Expressway and achieved several world records, including paving an 18.75-meter width over 2.56 kilometers within 24 hours.

Technological Advancements in Paving Automation

Technological innovation, including 3D machine control, GPS integration, and real-time performance monitoring, is reshaping the concrete paving equipment market. Automated systems enhance accuracy, reduce material wastage, and optimize labor productivity. Manufacturers are introducing smart controls and automated leveling systems to meet rising demands for precision and efficiency in large-scale projects. These advancements are enabling faster project completion and improving pavement quality, making automation a major growth catalyst across both developed and emerging construction markets.

- For instance, Gomaco Corporation integrated its G+ Connect 3D stringless control system into the GP4 Slipform Paver, delivering elevation accuracy within ±3 millimeters during continuous paving over 15 kilometers of concrete highway in Kansas.

Shift Toward Sustainable and Energy-Efficient Equipment

Growing environmental regulations and sustainability goals are pushing manufacturers to develop energy-efficient and low-emission paving solutions. The adoption of hybrid and electric power systems is reducing fuel consumption and operational costs. Construction companies are increasingly choosing eco-friendly machines to align with green construction standards. Additionally, the integration of advanced hydraulic systems and lightweight components enhances efficiency and reduces environmental impact. This trend supports the transition toward sustainable infrastructure development and energy-conscious construction practices.

Key Trends and Opportunities

Adoption of 3D Machine Control and Digital Paving Solutions

The increasing use of 3D machine control systems is improving accuracy and operational efficiency in paving projects. Digital paving technology enables automated surface grading, material optimization, and precise alignment. These advancements help contractors achieve consistent pavement thickness and smoothness, minimizing rework. Growing digitalization in construction, combined with IoT connectivity and real-time monitoring, is creating new opportunities for technology-driven equipment. This trend is expected to accelerate as infrastructure projects demand higher precision and productivity.

- For instance, the Wirtgen Group integrated its AutoPilot 2.0 3D control system with the SP 15i and SP 25i slipform pavers to enable high-precision, stringless paving of profiles like concrete safety barriers and curbs. The AutoPilot 2.0 system uses a satellite-based Global Navigation Satellite System (GNSS) to guide the paver along a virtual stringline, which increases paving accuracy and efficiency.

Expansion of Electric and Hybrid Equipment Lines

The market is witnessing growing interest in electric and hybrid paving equipment as sustainability becomes a key focus. Manufacturers are investing in research to reduce emissions and improve fuel economy without compromising performance. Hybrid models provide efficient energy use and lower maintenance requirements, aligning with global carbon reduction initiatives. The shift toward clean energy-powered machines presents new opportunities, especially in regions implementing strict environmental standards and infrastructure modernization programs.

- For instance, Caterpillar Inc. unveiled its CAT AP455 Track Paver featuring an exclusive Eco-mode and Automatic Engine Speed Control that reduce fuel consumption and lower sound levels.

Key Challenges

High Initial Costs and Maintenance Requirements

The substantial upfront investment and ongoing maintenance costs of advanced paving equipment remain major barriers for smaller contractors. High-performance slipform and automated systems require significant capital and specialized training for operation. These factors limit adoption in cost-sensitive markets. Additionally, the maintenance of hydraulic and electronic control systems adds to operational expenses. Rental services and financing options are helping mitigate this challenge, but cost barriers continue to affect overall market penetration.

Shortage of Skilled Operators and Technical Expertise

The effective operation of semi-automated and fully automated paving equipment demands skilled technicians and trained operators. Many developing regions face a shortage of trained labor capable of managing complex digital and hydraulic systems. This skill gap leads to underutilization of advanced features and reduced operational efficiency. The lack of structured training programs in equipment handling and maintenance further exacerbates the issue. Industry stakeholders are increasingly investing in operator training and certification to bridge this gap and improve overall productivity.

Regional Analysis

North America

North America held a 33% share of the concrete paving equipment market in 2024, driven by strong infrastructure investments and the expansion of transportation networks. The United States leads the region, supported by federal funding for highway rehabilitation, airport runway upgrades, and smart city projects. The growing use of automated and GPS-guided slipform pavers enhances construction efficiency and precision. Canada also contributes significantly, with government-led programs promoting durable concrete pavement solutions for urban and industrial applications. High demand for advanced, fuel-efficient, and low-emission paving equipment continues to strengthen market growth.

Europe

Europe accounted for a 27% share of the concrete paving equipment market in 2024, supported by the region’s focus on sustainable construction practices and road infrastructure modernization. Countries such as Germany, France, and the United Kingdom are leading adopters of automated paving technology and energy-efficient machines. Government policies emphasizing carbon reduction and the use of durable, low-maintenance materials are driving concrete road adoption. Increasing infrastructure renovation projects and the integration of 3D paving technologies are further propelling market expansion. Manufacturers continue to prioritize innovation to meet Europe’s evolving construction efficiency standards.

Asia-Pacific

Asia-Pacific dominated the concrete paving equipment market with a 34% share in 2024, fueled by rapid urbanization, industrialization, and government-driven infrastructure projects. China, India, and Japan are major contributors, with large-scale road, bridge, and airport construction initiatives. The region’s growing emphasis on smart infrastructure and public transport development continues to boost demand. Expanding highway networks and industrial zones are also supporting the adoption of high-performance slipform and roller pavers. Favorable government policies, coupled with the presence of cost-effective manufacturing and rental options, further reinforce Asia-Pacific’s leadership in the global market.

Latin America

Latin America held a 4% share of the concrete paving equipment market in 2024, driven by expanding investments in road and airport construction. Brazil and Mexico are key contributors, with ongoing public works focused on modernizing urban infrastructure and logistics routes. Governments are increasingly favoring concrete pavements for durability and reduced lifecycle costs. The market is seeing gradual adoption of automated and energy-efficient pavers as construction activity rises. Despite economic fluctuations, supportive infrastructure development programs and foreign investments continue to create growth opportunities across the regional market.

Middle East and Africa

The Middle East and Africa region accounted for a 2% share of the concrete paving equipment market in 2024, supported by infrastructure expansion in Saudi Arabia, the United Arab Emirates, and South Africa. Major construction projects, including industrial zones, highways, and smart city developments, are driving equipment demand. The region is witnessing growing interest in advanced slipform and hybrid paving machines to enhance efficiency and reduce emissions. Government-backed road development and diversification projects under Vision 2030 and similar initiatives are expected to accelerate market growth across both construction and urban development sectors.

Market Segmentations:

By Product

- Slipform pavers

- Roller pavers

- Concrete spreaders

- Batch pavers

By Technology

- Manual

- Semi-automated

- Fully automated

By Power Source

By Application

- Residential construction

- Road construction

- Commercial construction

- Others

By End Use

- Government agencies

- Construction companies

- Rental companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete paving equipment market includes key players such as SCHWING Stetter India, CMI Roadbuilding Inc., XCMG Group, Bid-well (Terex Corporation), Caterpillar, Wirtgen Group (John Deere), Gomaco Corporation, SANY Group, Ammann Group, and BESSER. These companies dominate the market through robust product portfolios, extensive distribution networks, and strong global presence. Competition focuses on product innovation, automation, and fuel-efficient designs to enhance productivity and precision. Leading manufacturers are investing in 3D machine control systems, digital monitoring, and eco-friendly engines to align with evolving construction standards. Strategic mergers, partnerships, and R&D initiatives are helping players expand their customer base and regional footprint. The growing shift toward fully automated and hybrid paving solutions is further intensifying competition as companies strive to deliver technologically advanced and cost-effective equipment tailored for modern infrastructure projects worldwide.

Key Player Analysis

Recent Developments

- In April 2025, SCHWING Stetter India partnered with MAX-Truder GmbH to expand precast concrete production capabilities in India, combining extrusion tech with Indian equipment know-how.

- In March 2025, SCHWING Stetter India signed an MoU with IIT Madras for collaboration on sustainable construction and low-carbon concrete technologies.

- In June 2024, Ammann acquired the paving division, AG Pavers of Volvo Construction Equipment. This acquisition also includes ABG’s plant located in Hameln, Germany.

- In March 2024, CMI Roadbuilding Inc. introduced the Cedarapids Magnum “Bullet” 150 super-portable drum mix plant, with a 150 tph capacity and redesigned setup time target (2 days with hot mix storage).

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Power Source, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing global infrastructure and transportation development projects.

- Automation and 3D machine control technologies will enhance paving precision and operational efficiency.

- Hybrid and electric paving equipment will gain popularity due to emission reduction goals.

- Demand for slipform pavers will remain high in large-scale road and airport construction.

- Asia-Pacific will continue leading growth, supported by rapid urbanization and industrial expansion.

- North America will see strong demand from highway modernization and smart city projects.

- Manufacturers will focus on digital monitoring and remote operation capabilities for better performance.

- Rental and leasing services will increase as contractors seek cost-effective equipment access.

- Sustainable manufacturing practices will influence product design and development strategies.

- Strategic partnerships and mergers among global players will strengthen market competitiveness and technology integration.