Market Overview

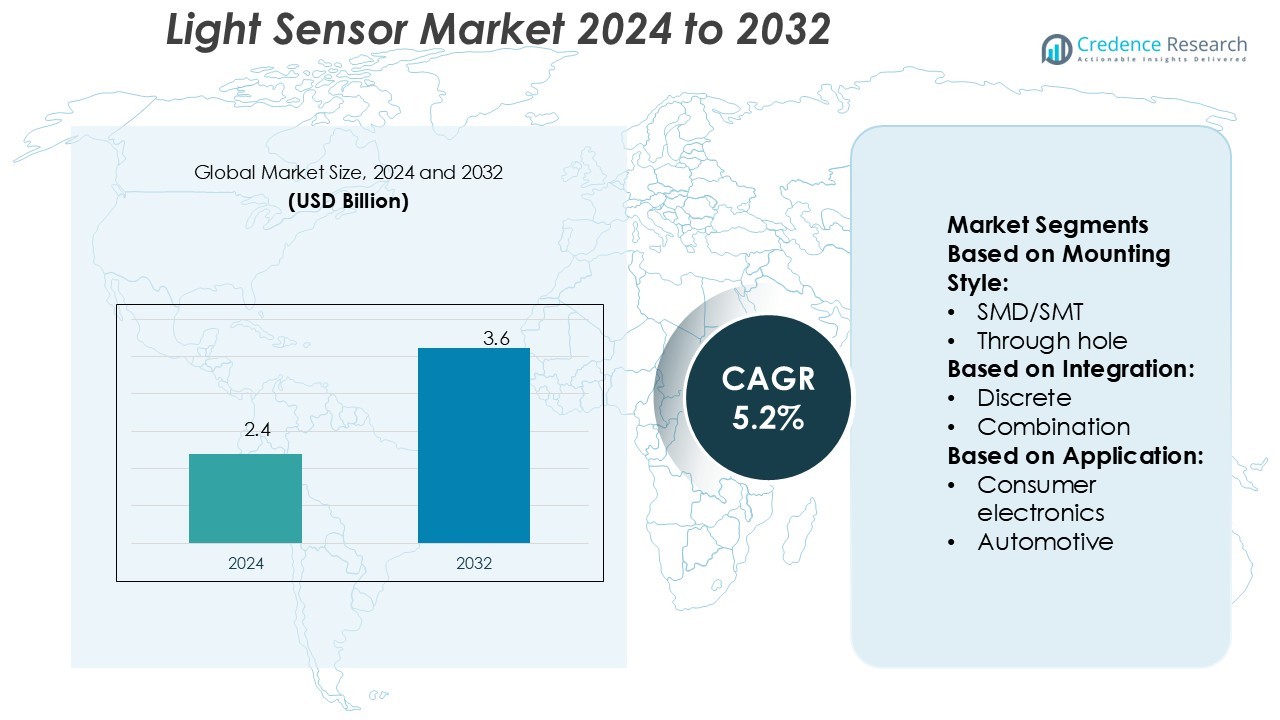

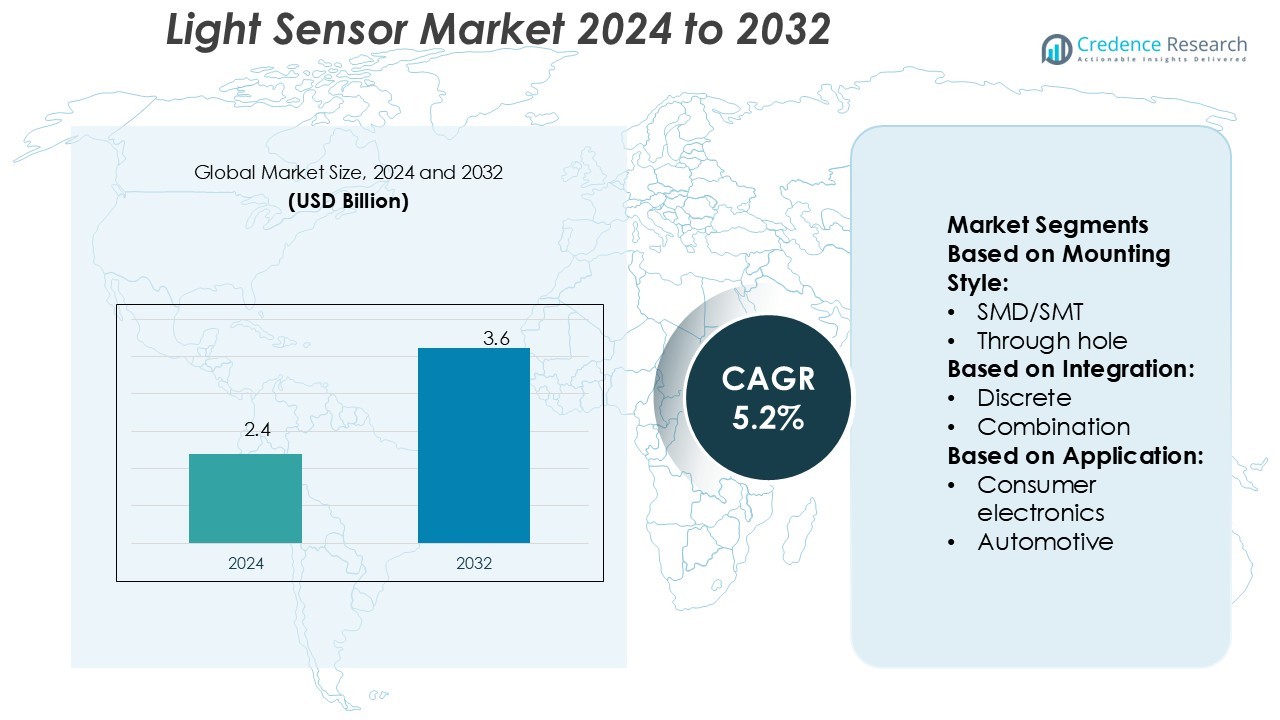

Light Sensor Market size was valued USD 2.4 billion in 2024 and is anticipated to reach USD 3.6 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Light Sensor Market Size 2024 |

USD 2.4 Billion |

| Light Sensor Market, CAGR |

5.2% |

| Light Sensor Market Size 2032 |

USD 3.6 Billion |

The light sensor market is driven by strong competition among leading players including ELAN Microelectronics Corp., Sitronix Technology Corporation, SAMSUNG, ROHM CO., LTD., STMicroelectronics, SHARP CORPORATION, EVERLIGHT ELECTRONICS CO., LTD., Analog Devices, Inc., ams-OSRAM AG, and Broadcom. These companies focus on innovation, large-scale manufacturing, and integration of advanced sensing technologies across consumer electronics, automotive, and industrial applications. Asia-Pacific leads the global market with a 34% share, supported by its strong semiconductor base, large-scale consumer electronics production, and growing adoption of smart devices. This regional dominance positions Asia-Pacific as the central hub for future market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Light Sensor Market size was valued at USD 2.4 billion in 2024 and is anticipated to reach USD 3.6 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

- Market growth is driven by rising demand in consumer electronics, where smartphones, wearables, and laptops account for the largest segment share, supported by applications in automotive safety and industrial automation.

- Key trends include miniaturization of sensors, integration with IoT and AI technologies, and growing adoption in smart homes, which enhance energy efficiency and create new opportunities for multifunctional sensor designs.

- The market remains highly competitive with top players focusing on innovation, cost efficiency, and global expansion, while restraints such as price sensitivity in emerging markets and integration complexity pose challenges.

- Asia-Pacific leads with a 34% share, followed by North America at 32% and Europe at 27%, positioning the region as the hub for future expansion and large-scale sensor production.

Market Segmentation Analysis:

By Mounting Style

In the light sensor market, the SMD/SMT segment dominates with a share exceeding 55%. Its strong adoption stems from compact design, ease of integration, and suitability for high-volume consumer electronics production. Through-hole sensors retain relevance in industrial equipment, offering durability in harsh conditions. However, the miniaturization trend in electronics supports the faster growth of SMD/SMT. Other mounting styles serve niche uses but remain limited. High demand for smartphones, wearables, and IoT devices drives preference for SMD/SMT sensors, ensuring continued dominance in future adoption cycles.

- For instance, Cree Lighting’s OSQ Series area luminaire delivers between 4,000 and 85,000 lumens and reaches up to 171 LPW efficacy in outdoor lighting applications.

By Integration

The discrete segment leads with a market share of nearly 60%, driven by cost efficiency and flexibility across diverse applications. Discrete sensors allow manufacturers to design tailored solutions in automotive, industrial, and healthcare systems. The combination segment is growing quickly, fueled by demand for multi-functional modules in smart devices. Integration with microcontrollers and advanced chipsets increases adoption in connected ecosystems. While discrete sensors dominate due to versatility, the shift toward energy-efficient integrated systems ensures strong opportunities for combination solutions, especially in consumer electronics and automation platforms.

- For instance, OSRAM’s OSLON™ UV 3535 UV-C LED, a compact and durable device designed for disinfection and treatment solutions, delivering a significant 115 milliwatt optical output at a peak wavelength of 265 nanometers and a long operating lifetime of over 20,000 hours.

By Application

Consumer electronics hold the largest share at above 40%, supported by rapid integration of light sensors in smartphones, laptops, and wearables. Growth in automotive applications, particularly for advanced driver-assistance systems and adaptive lighting, is accelerating adoption. Industrial uses benefit from sensors in smart manufacturing and energy-efficient systems. Home automation and healthcare applications are expanding as connected devices proliferate. Entertainment and security segments also strengthen demand for precision sensing. Consumer electronics continue to dominate the light sensor market, with innovation in display brightness control and energy savings driving consistent expansion.

Key Growth Drivers

Rising Demand in Consumer Electronics

The growing penetration of smartphones, tablets, laptops, and wearables drives the adoption of light sensors. These devices rely on sensors for automatic brightness adjustment, camera performance, and energy efficiency. Consumer preference for feature-rich electronics accelerates sensor integration across mid-range and premium categories. The demand for IoT-enabled gadgets and AR/VR devices also adds momentum. This segment remains a core driver of market expansion, as manufacturers continue to enhance device performance and deliver improved user experiences with advanced sensor technology.

- For instance, GE’s Cync Direct Connect smart bulbs operate on the 2.4 GHz Wi-Fi band and require no hub. GE’s Daintree WIZ100 wireless module integrates PIR sensing inside a fixture and communicates via low-power wireless to control nodes.

Expansion of Automotive Applications

Automotive innovation creates significant demand for light sensors in adaptive headlights, driver-assistance systems, and in-cabin lighting. Automakers increasingly adopt sensors to meet safety standards and enhance user comfort. The shift toward electric and autonomous vehicles further boosts integration, supporting energy-efficient lighting and advanced driver monitoring features. Governments also enforce regulations that encourage sensor adoption for improved road safety. With rising global vehicle production and adoption of EVs, the automotive sector is emerging as a leading growth driver for the light sensor market.

- For instance, Hubbell’s NX Distributed Intelligence™ platform uses NX Area Controllers to manage up to 1,000 NX devices (including luminaires, sensors, and switches) in wired, wireless, or hybrid mode.

Adoption in Smart Homes and Industrial Automation

The rapid growth of smart homes and industrial automation significantly contributes to light sensor market expansion. Smart lighting systems, energy management platforms, and home security devices rely heavily on sensor integration. Industrial automation uses sensors for energy-efficient lighting control and production monitoring. Growing consumer awareness of sustainability also supports this adoption. In both residential and industrial settings, light sensors enhance operational efficiency and reduce costs, making them an essential component of modern infrastructure and a key driver of future growth.

Key Trends & Opportunities

Integration with IoT and AI Technologies

The integration of light sensors with IoT and AI platforms is reshaping market opportunities. Smart devices and connected ecosystems use sensors for real-time monitoring and automation. AI-driven analytics enhance sensor accuracy and enable predictive adjustments in applications such as healthcare and industrial systems. This trend supports the creation of intelligent environments with energy-efficient lighting and adaptive systems. The convergence of IoT and AI expands the scope of light sensor applications, offering manufacturers opportunities to deliver innovative, value-added solutions.

- For instance, Nichia and Infineon launched a micro-LED matrix (µPLS) with 16,384 individual LEDs controlled via a driver IC, enabling high-definition adaptive lighting in automotive use.

Shift Toward Miniaturization and Multi-Functionality

Growing demand for compact, multifunctional components drives light sensor innovation. Manufacturers are developing miniaturized sensors with enhanced performance to support wearables, portable medical devices, and compact electronics. Multi-functional designs that combine light, proximity, and ambient sensing deliver cost and space efficiency. This trend aligns with consumer expectations for slim, high-performing devices and industrial needs for integrated solutions. The focus on miniaturization not only improves design flexibility but also creates opportunities for broader adoption across emerging applications such as drones and AR/VR systems.

- For instance, Inventronics (the company that now owns the former Osram HubSense product line) offers the QBM IoT Gateway, which supports up to 200 nodes (including LED drivers and sensors) in a single qualified Bluetooth mesh network, enabling robust control in wholesale-scale lighting installations.

Key Challenges

Price Sensitivity in Emerging Markets

High competition and cost constraints in emerging economies pose a challenge for light sensor manufacturers. Consumer electronics and industrial products in these regions often prioritize affordability, limiting adoption of advanced sensors. Price-sensitive buyers restrict demand for high-performance solutions, pressuring manufacturers to balance innovation with cost efficiency. This challenge impacts profit margins and slows the adoption of premium technologies in certain markets. Companies need strategies to optimize production costs and develop scalable models to capture opportunities without compromising profitability.

Complexity in Integration and Calibration

Integrating light sensors into diverse devices and systems presents technical challenges, especially in ensuring calibration accuracy and consistent performance. Variations in lighting conditions across applications demand advanced sensor designs, which increase development complexity. Improper integration can lead to performance issues, reducing efficiency in automotive, healthcare, or industrial applications. The need for precise calibration also raises production costs and lengthens product development cycles. Overcoming these challenges requires investment in R&D and strong collaboration with device manufacturers to ensure seamless integration and reliability.

Regional Analysis

North America

North America holds a market share of 32%, driven by strong adoption in consumer electronics, automotive, and industrial applications. The United States leads the region with advanced R&D, strong semiconductor presence, and high consumer demand for connected devices. Growth in smart homes, EVs, and automation enhances sensor integration. Canada contributes through rising healthcare applications, while Mexico benefits from expanding electronics manufacturing. Stringent energy efficiency regulations also support adoption. With well-established infrastructure and rising investments in smart technologies, North America maintains a leading position in the light sensor market.

Europe

Europe accounts for 27% of the market, supported by high demand in automotive and industrial sectors. Germany leads with strong automotive innovation, integrating light sensors into ADAS, adaptive headlights, and EV platforms. France and the UK contribute through industrial automation and consumer electronics adoption. Sustainability policies and energy efficiency directives further encourage sensor use in smart lighting and building automation. Rising investments in healthcare technology also strengthen regional demand. With robust manufacturing capabilities and regulatory support, Europe remains a key contributor to the growth of the light sensor market.

Asia-Pacific

Asia-Pacific dominates the light sensor market with a 34% share, driven by large-scale consumer electronics manufacturing and rising adoption across sectors. China, Japan, and South Korea lead with strong semiconductor industries and high-volume production of smartphones and wearables. India shows rapid growth in smart homes and automotive applications, supported by expanding industrial automation. Increasing urbanization and rising disposable income accelerate demand for connected devices. The region also benefits from government support for digitalization and energy efficiency initiatives. Asia-Pacific’s leadership is sustained by its production strength and growing consumer base.

Latin America

Latin America represents 3% of the light sensor market, with Brazil and Mexico leading adoption. The region benefits from rising demand for consumer electronics, smart lighting, and security applications. Brazil’s growing automotive sector integrates light sensors in ADAS and in-vehicle systems, while Mexico strengthens adoption through electronics assembly industries. However, economic fluctuations and limited local R&D slow overall growth. Increasing focus on energy efficiency and digital transformation provides opportunities for expansion. With a growing middle-class population and rising connected device usage, Latin America shows steady potential in the light sensor market.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, with growth fueled by smart city projects and increasing adoption of connected devices. Gulf countries, particularly the UAE and Saudi Arabia, invest heavily in automation, smart lighting, and building management systems. Industrial automation in South Africa also drives demand. However, limited local manufacturing and dependence on imports restrain faster adoption. Rising digitalization, coupled with government-backed infrastructure initiatives, positions the region as an emerging market. MEA offers long-term opportunities for light sensor suppliers targeting energy-efficient and sustainable technologies.

Market Segmentations:

By Mounting Style:

By Integration:

By Application:

- Consumer electronics

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the light sensor market features prominent players such as ELAN Microelectronics Corp., Sitronix Technology Corporation, SAMSUNG, ROHM CO., LTD., STMicroelectronics, SHARP CORPORATION, EVERLIGHT ELECTRONICS CO., LTD., Analog Devices, Inc., ams-OSRAM AG, and Broadcom. The light sensor market is highly competitive, shaped by continuous innovation, strong manufacturing capabilities, and rising demand across multiple industries. Companies focus on advancing sensor accuracy, reducing power consumption, and developing multifunctional solutions to meet the needs of consumer electronics, automotive systems, and industrial automation. Growing adoption of IoT devices and smart home technologies further intensifies competition, pushing firms to enhance integration and scalability. Market participants also invest in R&D, strategic partnerships, and regional expansions to strengthen their global presence. The competitive environment emphasizes product differentiation, cost efficiency, and alignment with energy efficiency regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ELAN Microelectronics Corp.

- Sitronix Technology Corporation

- SAMSUNG

- ROHM CO., LTD.

- STMicroelectronics

- SHARP CORPORATION

- EVERLIGHT ELECTRONICS CO., LTD.

- Analog Devices, Inc.

- ams-OSRAM AG

- Broadcom

Recent Developments

- In May 2025, Vishay Intertechnology, Inc. introduced the VEML4031X00, an AEC-Q100 qualified ambient light sensor designed for automotive applications. The sensor integrates an ambient light sensing (ALS) photodiode and an infrared (IR) photodiode within a compact surface-mount package measuring 4.38 mm × 1.45 mm × 0.6 mm.

- In April 2025, Sony Electronics announced the AS-DT1, a compact and lightweight LiDAR depth sensor designed for precise 3D measurement. The AS-DT1 uses Sony’s proprietary Direct Time of Flight (dToF) LiDAR technology. This system measures distance by calculating how long it takes for light to reflect off a surface.

- In March 2025, EarthTronics introduced EarthConnect area light sensors with extended outdoor range for commercial lighting applications. These features provide the ability to control exterior lighting from a smartphone or device with multiple energy-saving functions that help to increase the effectiveness of a security lighting system.

- In May 2024, Lumotive, a pioneer in optical semiconductor technology, and Hokuyo Automatic Co., Ltd., a global leader in sensors and automation, announced the commercial release of the YLM-10LX 3D lidar sensor.

Report Coverage

The research report offers an in-depth analysis based on Mounting Style, Integration, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for light sensors will rise with increasing adoption of smart consumer electronics.

- Automotive applications will expand as EVs and autonomous vehicles integrate advanced lighting systems.

- Industrial automation will drive greater usage of sensors in energy-efficient production environments.

- Smart home adoption will create strong demand for light sensors in connected lighting systems.

- Healthcare applications will grow as sensors support portable medical devices and monitoring tools.

- Miniaturization of sensors will enhance adoption in wearables, AR/VR, and compact electronics.

- Integration with IoT and AI will strengthen predictive and adaptive applications across industries.

- Sustainability initiatives will boost demand for sensors enabling energy-efficient lighting solutions.

- Emerging economies will present new opportunities as digitalization and smart infrastructure expand.

- Continuous innovation and R&D will shape market competitiveness and support broader adoption.