Market Overview

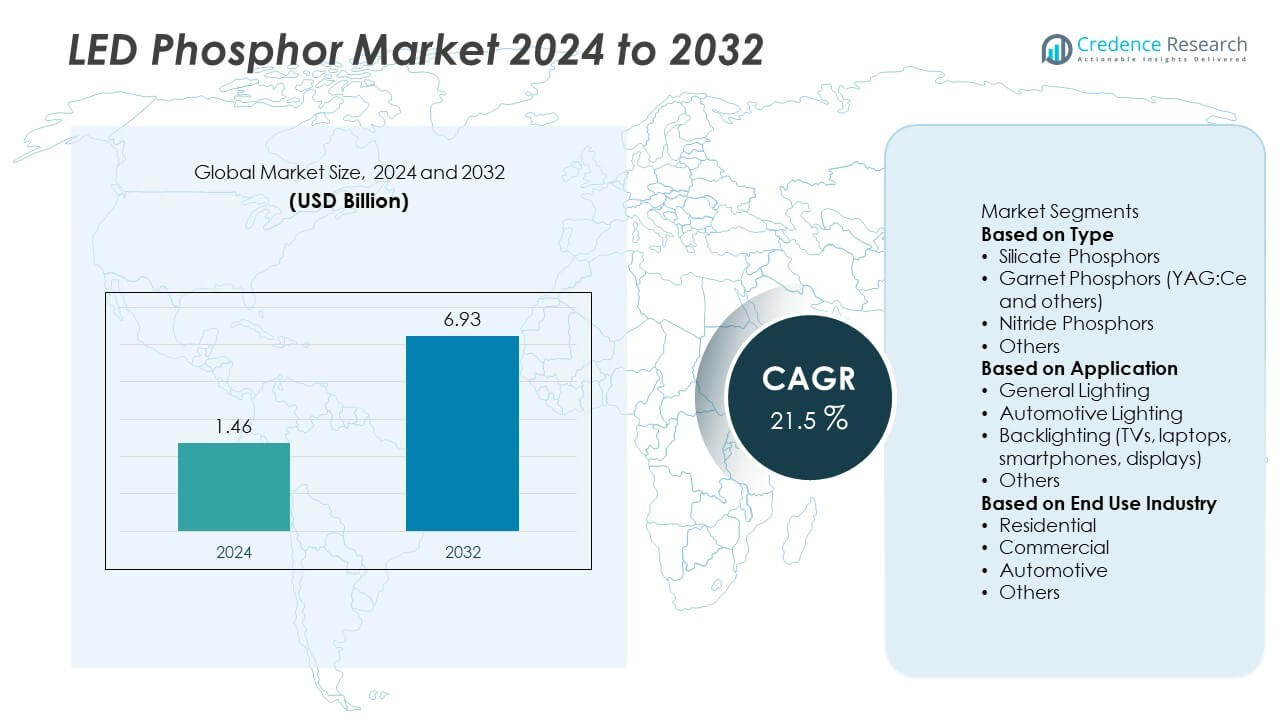

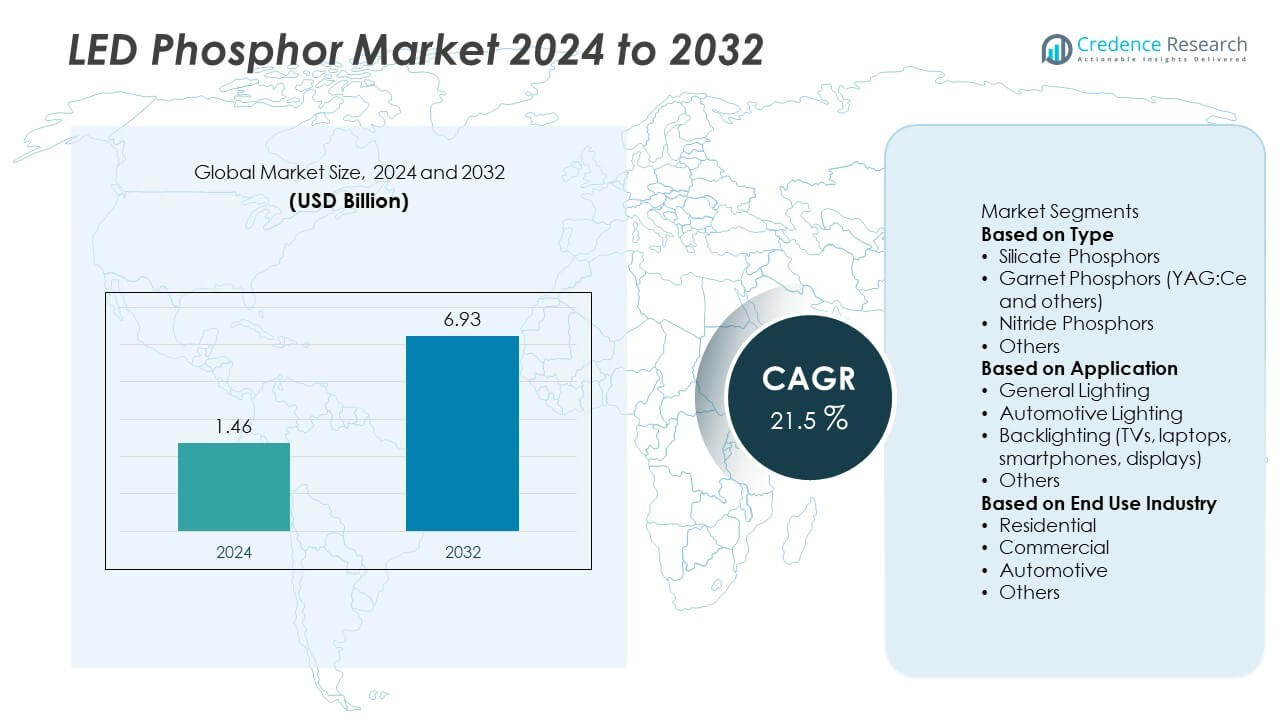

The LED Phosphor market was valued at USD 1.46 billion in 2024 and is projected to reach USD 6.93 billion by 2032, expanding at a CAGR of 21.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Phosphor Market Size 2024 |

USD 1.46 Billion |

| LED Phosphor Market, CAGR |

21.5% |

| LED Phosphor Market Size 2032 |

USD 6.93 Billion |

The top players in the LED Phosphor market include Nichia Corporation, Philips Lumileds Lighting Company, Osram Sylvania Inc. (OSRAM GmbH), Epistar Corporation, Stanley Electric Co. Ltd., General Electric Company, Avago Technologies, Edison Opto Corporation, Universal Display Corporation, and Kingbright Electronic Co. These companies focus on advanced phosphor technologies to enhance LED efficiency, color stability, and performance in automotive, general lighting, and backlighting applications. Regionally, Asia-Pacific dominated the market with 41% share in 2024, driven by large-scale electronics and automotive manufacturing. Europe followed with 27% share, supported by regulatory standards and high demand for energy-efficient lighting, while North America accounted for 22%, reinforced by strong adoption in commercial and residential sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The LED Phosphor market was valued at USD 1.46 billion in 2024 and is projected to reach USD 6.93 billion by 2032, growing at a CAGR of 21.5%.

- Strong demand from garnet phosphors, holding 43% share in 2024, drives adoption due to superior color rendering and efficiency in general and automotive lighting.

- A key trend is the shift toward nitride-based phosphors for high-performance LEDs, enabling improved brightness and stability, while opportunities expand in displays, automotive headlamps, and smart lighting applications.

- Leading players such as Nichia Corporation, Osram Sylvania Inc., Philips Lumileds, and Epistar compete through R&D in advanced formulations, strategic supply chain partnerships, and expansion into fast-growing Asian and European markets.

- Asia-Pacific led with 41% share in 2024, followed by Europe at 27% and North America at 22%, while Latin America held 6% and Middle East & Africa accounted for 4%, reflecting balanced global demand growth.

Market Segmentation Analysis:

By Type

Garnet phosphors, particularly YAG:Ce, dominated the LED phosphor market in 2024 with 42% share. Their leadership stems from excellent thermal stability, high efficiency, and widespread use in white LED production. YAG:Ce phosphors are the preferred choice for solid-state lighting and display backlighting, enabling consistent color rendering and brightness. Silicate phosphors followed with 28% share, valued for low-cost production and wide availability, especially in consumer electronics. Nitride phosphors held 22% share, driven by high color rendering index (CRI) applications, while other types accounted for 8%, serving niche and experimental uses.

- For instance, Nichia Corporation has developed high-efficacy LEDs, including the H6 series, which delivers excellent color quality with a CRI of 90+ while maintaining high luminous efficacy. This technology, which utilizes advanced phosphor technology such as narrowband red phosphor, is widely used in general solid-state lighting and other applications.

By Application

General lighting led the LED phosphor market in 2024 with 46% share, supported by rapid adoption of LEDs in residential, commercial, and industrial illumination. Energy efficiency targets and government initiatives globally have accelerated demand for phosphor-based LEDs in bulbs, streetlights, and architectural lighting. Backlighting for TVs, laptops, smartphones, and displays captured 32% share, fueled by growth in consumer electronics. Automotive lighting accounted for 18% share, driven by LED headlamps and interior lighting, while other applications, including specialty and portable lighting, made up 4% of the total market.

- For instance, OSRAM GmbH’s Oslon Black Flat LED family includes various multi-chip versions that enable high-beam performance with compact package sizes. Models like the Oslon Black Flat S KW2 can produce up to 980 lm at a 1 A drive current

By End Use Industry

The commercial sector dominated end-use demand in 2024 with 39% share, benefiting from large-scale adoption of LED lighting in offices, retail, and public infrastructure. Energy savings and long service life make LED phosphor lighting ideal for high-usage environments. Residential applications followed with 30% share, supported by rising consumer shift toward energy-efficient home lighting solutions. The automotive sector accounted for 21% share, fueled by integration of LED-based phosphor lighting in advanced headlamp systems. Other industries, including industrial and specialty applications, represented 10% share, reflecting steady but smaller-scale adoption.

Key Growth Drivers

Rising Adoption of Energy-Efficient Lighting

The global push toward energy efficiency is a primary driver for the LED phosphor market. Governments are phasing out incandescent and halogen lamps, accelerating LED adoption in residential, commercial, and industrial sectors. Phosphor-based LEDs deliver longer lifespans and higher brightness while reducing energy consumption by up to 80% compared to traditional lighting. This shift toward sustainable solutions, supported by subsidies and regulations, strengthens demand for advanced phosphor formulations. Growing replacement of legacy lighting systems across developing and developed economies ensures consistent market growth.

- For instance, Lumileds introduced Luxeon 5050 Square LEDs using YAG:Ce phosphor technology, achieving luminous efficacy above 180 lm/W at 1 W drive with lifetimes exceeding 50,000 hours, designed specifically for street and architectural lighting upgrades.

Expanding Consumer Electronics and Display Applications

The rapid growth of the consumer electronics sector boosts demand for LED phosphors, particularly in backlighting for TVs, laptops, and smartphones. Displays require precise phosphor formulations to ensure high brightness, accurate color rendering, and improved viewing experiences. With rising global demand for smart devices and advanced displays, phosphor-based LEDs remain critical to product performance. The expansion of 4K and OLED alternatives further drives innovation in phosphor technology. Consumer preference for compact, energy-efficient, and visually appealing electronics continues to reinforce this segment as a strong growth driver.

- For instance, Epistar Corporation supplies LED chips for consumer electronics like smartphone backlights, and its products are known for high efficiency and reliability. The specific performance characteristics of a final display, such as peak brightness and color consistency ratings

Growth in Automotive Lighting Applications

The automotive industry’s transition to LED-based lighting systems is a significant driver for the phosphor market. LED headlamps, taillights, and interior lights increasingly rely on phosphor technology to enhance brightness, color uniformity, and energy efficiency. Phosphor-based LEDs also improve safety by delivering superior illumination and longevity compared to halogen lamps. With electric vehicles integrating advanced lighting designs for aesthetics and efficiency, demand is accelerating. Regulatory emphasis on road safety and automaker focus on lightweight, durable solutions further support strong growth for LED phosphor in automotive applications.

Key Trends & Opportunities

Advancements in Phosphor Material Innovation

A major trend in the LED phosphor market is the development of advanced phosphor materials, such as nitride and oxynitride-based compounds. These materials offer high thermal stability, superior color rendering index, and long service life, making them ideal for demanding applications. Manufacturers are investing in R&D to create cost-effective formulations that enhance performance in displays, general lighting, and automotive systems. This innovation wave creates opportunities for differentiation and wider adoption, particularly in high-performance markets like medical lighting, automotive headlamps, and premium consumer electronics.

- For instance, Stanley Electric develops a wide range of high-performance automotive LEDs in various color temperatures and utilizes aluminum nitride (AlN) substrates to achieve high output levels in its separate UV-C LEDs.

Expansion in Smart Lighting and IoT Integration

The growing integration of smart lighting systems and IoT technologies offers new opportunities for LED phosphor demand. Smart homes, smart cities, and connected commercial buildings increasingly adopt LED-based systems due to their controllability and energy efficiency. Phosphor formulations that enable tunable white light and high color accuracy are critical for these applications. As IoT adoption expands globally, demand for phosphor-based LEDs in dynamic lighting environments is set to grow. This trend positions LED phosphors as essential enablers of modern, connected lighting ecosystems.

- For instance, Philips Lumileds introduced Luxeon Smart Module LEDs with phosphor technology supporting tunable white light from 2,200 K to 6,500 K, delivering color rendering index values above 90 and lifetime performance beyond 55,000 hours, optimized for smart lighting and connected IoT platforms.

Key Challenges

High Manufacturing and Material Costs

The production of advanced phosphor materials requires complex processes and high-purity raw materials, leading to elevated costs. Nitride and oxynitride phosphors, while offering superior performance, are particularly expensive, creating barriers for widespread adoption in cost-sensitive markets. Manufacturers face pricing pressures from cheaper LED alternatives, forcing them to balance innovation with affordability. Unless economies of scale are achieved, high production costs will continue to challenge the competitiveness of advanced phosphor solutions.

Competition from Emerging Lighting Technologies

The LED phosphor market faces growing competition from emerging lighting technologies such as OLED and quantum dot displays. OLED panels offer self-emissive lighting with superior color quality, reducing reliance on phosphor-coated LEDs in certain applications. Similarly, quantum dot technologies are gaining traction in display backlighting due to their enhanced brightness and color range. These alternatives create a threat to phosphor-based solutions in high-performance segments. To remain competitive, manufacturers must innovate with high-efficiency phosphors and expand into applications less vulnerable to substitution.

Regional Analysis

North America

North America accounted for 24% share of the LED phosphor market in 2024, driven by strong adoption of energy-efficient lighting and advanced display technologies. The United States leads demand, supported by government regulations phasing out traditional lamps and rapid adoption of LEDs in residential, commercial, and industrial sectors. Growth is also reinforced by high demand in consumer electronics and automotive applications. Canada contributes through smart city projects and energy-saving initiatives, while Mexico adds demand from expanding manufacturing industries. Continued innovation in high-performance phosphors positions North America as a significant contributor to global market growth.

Europe

Europe held 26% share of the LED phosphor market in 2024, supported by stringent environmental regulations and widespread adoption of energy-efficient lighting. Countries such as Germany, France, and the U.K. are key markets, driven by smart building initiatives and high demand for LED-based automotive lighting. The region’s automotive sector, known for its innovation, heavily utilizes phosphor-based LEDs in headlamps and interior lighting. Additionally, rising demand for advanced display technologies further fuels growth. With strong focus on sustainability and performance standards, Europe continues to represent a stable and innovation-driven market for LED phosphor adoption.

Asia-Pacific

Asia-Pacific dominated the LED phosphor market in 2024 with 38% share, fueled by large-scale electronics manufacturing, urbanization, and growing infrastructure development. China leads consumption due to extensive LED production capacity and demand in general lighting and display backlighting. Japan and South Korea drive adoption through advanced consumer electronics and automotive industries, while India adds demand through rapid electrification and urban expansion. Cost-effective production capabilities and supportive government policies reinforce the region’s leadership. With expanding exports and strong domestic consumption, Asia-Pacific remains the largest and fastest-growing market for LED phosphors.

Latin America

Latin America represented 7% share of the LED phosphor market in 2024, with Brazil and Mexico leading regional demand. Growth is supported by increasing adoption of energy-efficient lighting in residential and commercial sectors, along with rising consumer electronics demand. Government initiatives promoting energy conservation and modernization of public infrastructure contribute to market expansion. However, economic fluctuations and reliance on imports limit broader penetration. Despite these challenges, growing urbanization and industrial development ensure steady demand. Manufacturers are targeting mid-range LED phosphor solutions to address cost-sensitive markets, positioning Latin America as a steadily expanding regional segment.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the LED phosphor market in 2024, driven by infrastructure projects and rising demand for energy-efficient lighting. Gulf nations, particularly Saudi Arabia and the UAE, lead adoption through large-scale urban development and smart city initiatives. South Africa contributes through growing consumer electronics and automotive markets. Limited local production capacity results in reliance on imports, offering opportunities for global suppliers. Increasing focus on renewable energy and energy-efficient solutions supports gradual growth, positioning the region as an emerging market with long-term potential for LED phosphor applications.

Market Segmentations:

By Type

- Silicate Phosphors

- Garnet Phosphors (YAG:Ce and others)

- Nitride Phosphors

- Others

By Application

- General Lighting

- Automotive Lighting

- Backlighting (TVs, laptops, smartphones, displays)

- Others

By End Use Industry

- Residential

- Commercial

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the LED Phosphor market is shaped by leading players including Kingbright Electronic Co., Avago Technologies, Philips Lumileds Lighting Company, Epistar Corporation, Osram Sylvania Inc. (OSRAM GmbH), Universal Display Corporation, Stanley Electric Co. Ltd., Edison Opto Corporation, Nichia Corporation, and General Electric Company. These companies compete by developing advanced phosphor formulations that improve color rendering, efficiency, and thermal stability of LEDs. Strong investments in R&D support the production of nitride and garnet phosphors suited for automotive, backlighting, and general illumination. Strategic partnerships with electronics and automotive manufacturers strengthen supply chains, while e-commerce channels expand product accessibility across global markets. Sustainability initiatives, including eco-friendly phosphor production, further enhance competitiveness. Regional expansion, particularly in Asia-Pacific, remains central as the region drives LED adoption in residential, commercial, and automotive lighting. Overall, competition emphasizes innovation, manufacturing scale, and product performance to meet rising demand across diverse applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kingbright Electronic Co.

- Avago Technologies

- Philips Lumileds Lighting Company

- Epistar Corporation

- Osram Sylvania Inc. (OSRAM GmbH)

- Universal Display Corporation

- Stanley Electric Co. Ltd.

- Edison Opto Corporation

- Nichia Corporation

- General Electric Company

Recent Developments

- In September 2025, ams OSRAM launched its Vegalas™ Power PLPM7_455QA multi-die laser package achieving 42 W optical output and approx. 45% efficiency, signaling expansion into projection and light conversion technology.

- In August 2025, ams OSRAM (Osram / OSRAM GmbH) announced a UV-C LED achieving wall-plug efficiency of 10.2% with a lifespan over 20,000 hours, thanks to improved phosphor and emitter design optimizations.

- In 2025, Universal Display Corporation (UDC) announced its participation in SID Display Week to showcase its OLED / phosphorescent materials and display innovations.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for LED phosphors will rise with expansion in general lighting applications.

- Automotive lighting adoption will increase as LEDs replace halogen and HID systems.

- Backlighting in TVs, laptops, and smartphones will remain a steady growth segment.

- Nitride phosphors will gain momentum due to high efficiency and durability.

- Garnet-based phosphors will continue leading adoption across commercial and automotive uses.

- Asia-Pacific will sustain leadership driven by large-scale electronics and automotive manufacturing.

- Europe will expand steadily with regulatory support for energy-efficient lighting.

- North America will grow with rising smart lighting and automotive innovations.

- Companies will invest in R&D for better color stability and higher brightness.

- Competition from alternative light sources will push differentiation through performance and cost optimization.