Market Overview

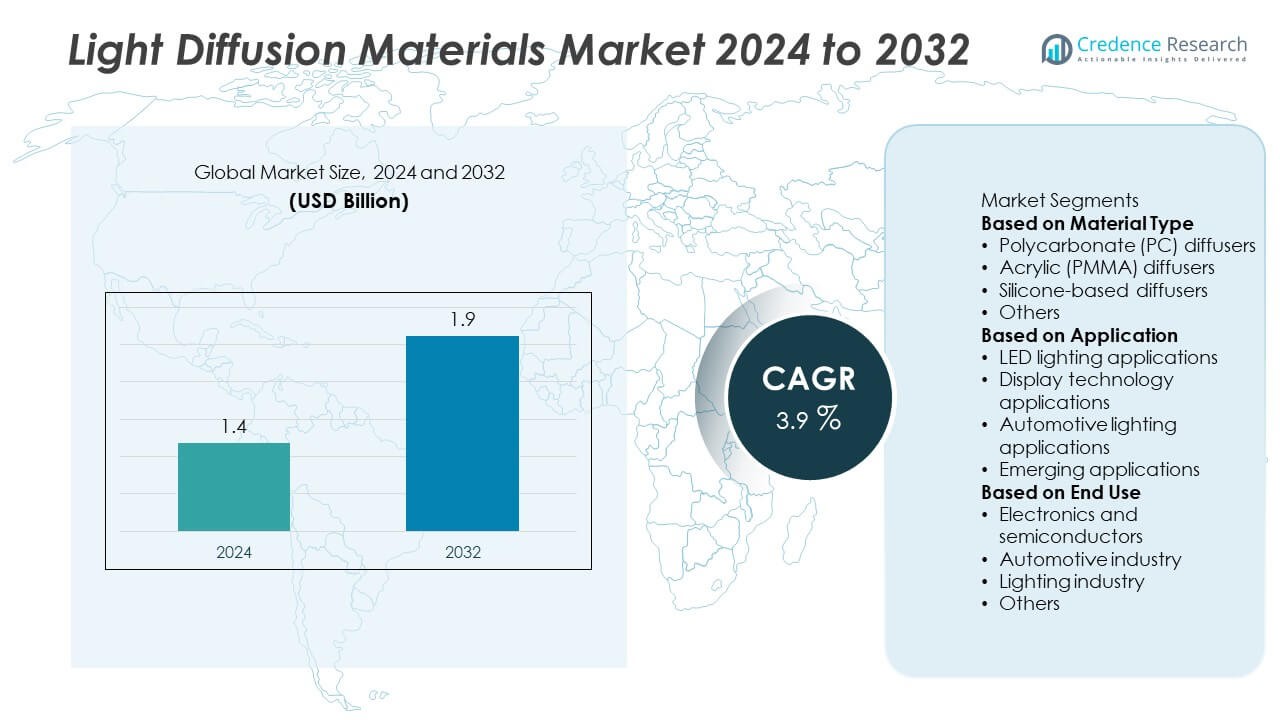

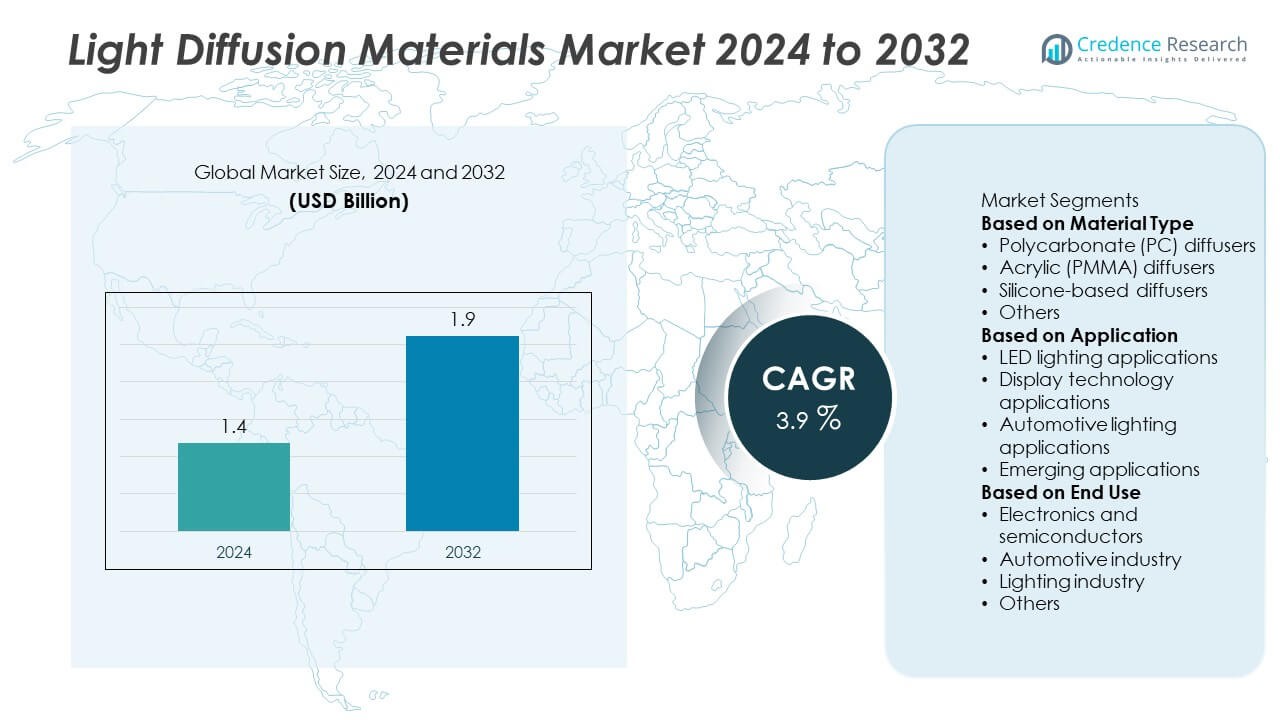

Light Diffusion Materials Market size was valued at USD 1.4 billion in 2024 and is anticipated to reach USD 1.9 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Light Diffusion Materials Market Size 2024 |

USD 1.4 Billion |

| Light Diffusion Materials Market, CAGR |

3.9% |

| Light Diffusion Materials Market Size 2032 |

USD 1.9 Billion |

The light diffusion materials market is driven by leading players such as BrightView Technologies, AC Plastics, SABIC, Haining Gensin Plastic Sheet Co., Ltd., Sekisui Kasei (TECHPOLYMER), Covestro AG, Plaskolite, Luminit LLC, Dai Nippon Printing Co., Ltd., and Curbell Plastics, Inc. These companies compete through innovations in polycarbonate, acrylic, and silicone-based diffusers to meet demand across lighting, electronics, and automotive sectors. Regionally, Asia-Pacific led the market with 37% share in 2024, supported by rapid industrialization and strong consumer electronics production. North America followed with 30% share, driven by LED adoption and infrastructure projects, while Europe accounted for 25% share, supported by sustainability initiatives and advanced automotive applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The light diffusion materials market was valued at USD 1.4 billion in 2024 and is projected to reach USD 1.9 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

- Rising demand from LED lighting applications, which accounted for over 50% share in 2024, is a major driver, supported by energy-efficiency mandates and adoption across residential, commercial, and industrial sectors.

- A key trend is the shift toward sustainable and recyclable polymers, with manufacturers focusing on eco-friendly solutions while also exploring new opportunities in smart devices and wearable electronics.

- The market is competitive with players such as SABIC, Covestro AG, Plaskolite, Luminit LLC, and BrightView Technologies leading innovations, while regional firms like Sekisui Kasei and Haining Gensin Plastic Sheet Co., Ltd. strengthen local supply networks.

- Asia-Pacific leads with 37% share, followed by North America at 30% and Europe at 25%, while polycarbonate (PC) diffusers dominated by material type with 45% share in 2024.

Market Segmentation Analysis:

By Material Type

Polycarbonate (PC) diffusers dominated the light diffusion materials market in 2024, securing over 45% share. Their dominance is driven by superior impact resistance, lightweight properties, and high thermal stability, making them ideal for LED fixtures and automotive lighting systems. PC diffusers also offer excellent optical clarity and dimensional stability, which support widespread use in architectural and commercial lighting. Acrylic (PMMA) diffusers follow, valued for superior transparency in display applications, while silicone-based materials cater to high-temperature environments. The versatility and cost-effectiveness of PC diffusers ensure their continued leadership across multiple industrial applications.

- For instance, Covestro’s Makrolon® polycarbonate grades for lighting deliver light transmission values above 88%, with Vicat softening points exceeding 145 °C, and impact resistance over 800 J/m, making them widely used in automotive headlamps and LED luminaires.

By Application

LED lighting applications accounted for more than 50% share of the light diffusion materials market in 2024, making it the dominant segment. Rapid global adoption of energy-efficient LED systems in residential, commercial, and industrial spaces drives this growth. Light diffusion materials enhance uniform brightness, reduce glare, and improve visual comfort, supporting high demand across architectural and decorative lighting. Display technology follows as a key segment, with growing use in smartphones, tablets, and televisions. Automotive lighting and emerging applications, including smart wearables and medical devices, are expanding but remain secondary to LED lighting’s large-scale adoption.

- For instance, Luminit’s Light Shaping Diffusers used in LED lighting applications provide diffusion angles ranging from 1° to 100°, with optical transmission rates up to 92%, ensuring uniform illumination and glare reduction in architectural and commercial fixtures.

By End Use

The lighting industry held the leading position in 2024, capturing over 48% share of the light diffusion materials market. Strong demand for LED-based solutions in residential, commercial, and outdoor lighting systems supports this dominance. The industry leverages PC and PMMA diffusers to improve light uniformity and energy efficiency, aligning with global sustainability targets. The electronics and semiconductor sector also represents significant demand, particularly for display technologies. Automotive lighting applications continue to expand with rising adoption of LED headlights and ambient systems. While “others” remain niche, the lighting industry’s broad use cases reinforce its dominant role in market growth.

Key Growth Drivers

Rising Adoption of LED Lighting

The global shift toward energy-efficient LED lighting is a primary growth driver for light diffusion materials. LEDs require materials that enhance brightness uniformity, reduce glare, and improve aesthetics in residential, commercial, and industrial spaces. Governments promoting energy conservation and phasing out conventional lighting technologies strengthen this adoption. Polycarbonate and acrylic diffusers are widely used to meet optical and design needs. As urbanization and smart building projects expand, the demand for efficient light diffusion solutions will continue to rise, firmly supporting market growth over the forecast period.

- For instance, Plaskolite’s OPTIX LED diffusers achieve light transmission levels above 88% while maintaining haze values up to 96%, enabling uniform illumination and reduced hot spots in LED panels and architectural fixtures.

Expansion of Display Technologies

Growth in consumer electronics and display technologies is fueling demand for light diffusion materials. Smartphones, tablets, laptops, and flat-panel televisions require high-performance diffusers for improved visibility and visual comfort. The rising demand for advanced display features, including higher brightness and color accuracy, supports wider integration of diffusion films and sheets. With global consumer electronics markets expanding, manufacturers are increasingly focused on lightweight and durable solutions. This trend ensures steady demand from electronics and semiconductor industries, strengthening the role of diffusion materials in next-generation display applications.

- For instance, Dai Nippon Printing (DNP) produces high-performance optical films for LCD panels that improve brightness uniformity and reduce glare in 4K and 8K televisions and high-resolution laptop displays.

Advancements in Automotive Lighting

Automotive lighting innovations are driving significant opportunities for light diffusion materials. The increasing use of LEDs in headlights, interior ambient lighting, and rear lamps creates consistent demand for diffusers that provide uniform brightness and design flexibility. Materials such as polycarbonate and silicone-based diffusers deliver heat resistance and durability required in harsh automotive environments. Rising adoption of advanced driver assistance systems (ADAS) and vehicle electrification further expands lighting requirements. As automakers continue to integrate energy-efficient and visually appealing lighting designs, the automotive sector will remain a strong growth driver for diffusion material adoption.

Key Trends & Opportunities

Shift Toward Sustainable Materials

Sustainability is shaping material innovation, with manufacturers developing recyclable and eco-friendly light diffusers. Growing environmental regulations and consumer preference for green products are accelerating adoption of bio-based and recyclable polymers. Lighting and electronics companies are increasingly focusing on circular economy practices, driving demand for diffusion materials with lower environmental footprints. This trend presents opportunities for companies to differentiate through sustainable product lines. As global industries prioritize ESG goals, eco-friendly diffusers will gain wider traction, aligning with long-term sustainability requirements in lighting, automotive, and display markets.

- For instance, SABIC has developed LEXAN™ resins for automotive lighting applications, which offer high light transmission (up to 90%), exceptional impact resistance, and dimensional stability.

Emerging Applications in Smart Devices

Light diffusion materials are finding new opportunities in emerging applications such as wearable electronics, medical devices, and smart home solutions. Wearables require thin and lightweight diffusion layers for displays and sensors, while medical devices benefit from enhanced visibility and optical performance. Smart homes, integrating connected lighting systems, also boost demand for advanced diffusers. These emerging segments, though smaller compared to traditional markets, represent high-growth areas for manufacturers. Continuous innovation to meet specific functional needs will allow light diffusion materials to penetrate niche but rapidly expanding application areas worldwide.

- For instance, BrightView Technologies supplies micro-structured optical films with high transmission and thin form factors for applications in advanced displays, 3D sensing, AR/VR, and automotive systems, where they enable enhanced brightness, uniformity, and efficiency.

Key Challenges

High Production and Material Costs

The cost of advanced light diffusion materials poses a key challenge to widespread adoption. High-performance polymers like silicone and specialty grades of polycarbonate are expensive, limiting their use in cost-sensitive markets. For manufacturers in developing economies, balancing performance with affordability remains difficult. Rising raw material prices also affect production economics, particularly for large-scale applications such as lighting and displays. Companies must focus on cost optimization while maintaining quality, as high costs may restrict market expansion and reduce competitiveness in regions dominated by low-cost alternatives.

Intense Competition from Substitute Materials

Light diffusion materials face competition from alternative technologies such as coated glass, reflective films, and traditional plastic solutions. These substitutes often provide acceptable performance at lower costs, making them attractive for certain applications. In display technologies, competing optical films can reduce reliance on dedicated diffusion layers. The presence of numerous low-cost local suppliers in emerging markets further intensifies competition. To overcome this challenge, manufacturers must differentiate through superior performance, durability, and sustainability. Stronger emphasis on product innovation and partnerships with end-use industries will be essential to maintaining market share.

Regional Analysis

North America

North America held over 30% share of the light diffusion materials market in 2024, driven by strong adoption in LED lighting, advanced display technologies, and automotive applications. The United States leads regional demand, supported by large-scale infrastructure upgrades and high penetration of energy-efficient lighting in commercial and residential sectors. The region’s well-established electronics and automotive industries also contribute to sustained usage of polycarbonate and acrylic diffusers. Increasing emphasis on smart home technologies and sustainable building solutions further supports growth. Continuous innovation from regional manufacturers ensures North America maintains a leading position in the global market.

Europe

Europe accounted for more than 25% share of the light diffusion materials market in 2024, supported by strict energy-efficiency regulations and widespread adoption of LED-based systems. Countries such as Germany, France, and the UK drive demand through advanced automotive lighting and strong consumer electronics markets. The region’s emphasis on sustainability is pushing adoption of recyclable and eco-friendly diffusion materials, particularly in the lighting industry. Additionally, Europe’s strong base in automotive manufacturing fuels demand for durable, heat-resistant diffusers. With increasing integration of smart lighting in public infrastructure, the region continues to play a critical role in market growth.

Asia-Pacific

Asia-Pacific dominated the light diffusion materials market with over 37% share in 2024, making it the largest regional market. Rapid industrialization, urbanization, and infrastructure growth in China, India, Japan, and South Korea are key drivers. Expanding consumer electronics production, particularly in display panels and smartphones, supports massive demand for diffusion films and sheets. The automotive sector is also witnessing rising integration of LED lighting systems, further boosting material adoption. Cost-effective manufacturing capabilities in the region encourage large-scale production of polycarbonate and PMMA diffusers. Asia-Pacific’s strong export base ensures its continued dominance and fastest growth in the global market.

Latin America

Latin America captured over 5% share of the light diffusion materials market in 2024, supported by growing adoption of LED lighting in Brazil and Mexico. The region’s increasing focus on urban development projects and government-backed energy-efficiency programs drive demand for polycarbonate and acrylic diffusers. Consumer electronics penetration is expanding, with rising sales of televisions, smartphones, and smart home devices. Automotive lighting also contributes to growth, particularly in Brazil’s automotive industry. However, limited access to advanced diffusion technologies and higher costs pose challenges. Despite this, steady urbanization and infrastructure development sustain moderate growth in the regional market.

Middle East & Africa

The Middle East & Africa region accounted for around 3% share of the light diffusion materials market in 2024. Growth is primarily supported by rising investments in LED-based lighting for commercial spaces, infrastructure projects, and urban developments in Gulf countries. The automotive industry, particularly in South Africa and the UAE, is adopting advanced lighting solutions, driving additional demand for diffusion materials. However, limited manufacturing bases and reliance on imports restrict wider market penetration. Affordable and durable materials dominate sales, while premium silicone-based diffusers see selective adoption. Long-term opportunities remain strong, driven by ongoing infrastructure expansion and diversification initiatives.

Market Segmentations:

By Material Type

- Polycarbonate (PC) diffusers

- Acrylic (PMMA) diffusers

- Silicone-based diffusers

- Others

By Application

- LED lighting applications

- Display technology applications

- Automotive lighting applications

- Emerging applications

By End Use

- Electronics and semiconductors

- Automotive industry

- Lighting industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the light diffusion materials market features major players such as BrightView Technologies, AC Plastics, SABIC, Haining Gensin Plastic Sheet Co., Ltd., Sekisui Kasei (TECHPOLYMER), Covestro AG, Plaskolite, Luminit LLC, Dai Nippon Printing Co., Ltd., and Curbell Plastics, Inc. These companies focus on material innovation, optical performance, and cost efficiency to strengthen their market positions. Global leaders like SABIC and Covestro AG emphasize advanced polycarbonate solutions with high durability and optical clarity, targeting lighting and display industries. Companies such as Luminit LLC and BrightView Technologies specialize in microstructured optical films, enhancing diffusion efficiency in electronics and LED systems. Plaskolite and Curbell Plastics dominate the acrylic diffusion sheet market, catering to construction and signage. Meanwhile, Sekisui Kasei and Dai Nippon Printing leverage technological expertise to deliver innovative products in display and automotive applications. Intense competition drives continuous R&D investments, partnerships, and regional expansions, ensuring steady innovation and broadening global reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BrightView Technologies

- AC Plastics

- SABIC

- Haining Gensin Plastic Sheet Co., Ltd.

- Sekisui Kasei (TECHPOLYMER)

- Covestro AG

- Plaskolite

- Luminit LLC

- Dai Nippon Printing Co., Ltd.

- Curbell Plastics, Inc.

Recent Developments

- In July 2025, BrightView Technologies launched a new line of optical films aimed at improving flash and sensor performance in smartphones and tablets.

- In June 2025, Covestro began promoting its “Material E” concept, intended to bring new functionalities to lighting and building materials, including diffusion applications.

- In 2025, Luminit Inc. unveiled advanced optical solutions at Photonics West, including new micro-optics and windshield HUD diffusers.

- In 2024, Covestro announced it would showcase a range of innovative polycarbonate and diffusion materials at Light + Building 2024.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption of LED lighting across sectors.

- Polycarbonate diffusers will continue to dominate due to durability and optical performance.

- Acrylic diffusers will see growth in display technologies requiring high transparency.

- Silicone-based diffusers will gain traction in automotive and high-temperature applications.

- Asia-Pacific will maintain leadership, supported by electronics and industrial growth.

- North America will grow with smart lighting and infrastructure modernization projects.

- Europe will strengthen adoption through sustainability initiatives and automotive innovations.

- Manufacturers will invest in recyclable and eco-friendly material development.

- Emerging applications in smart devices and wearables will drive new opportunities.

- Competition will intensify as global and regional players expand product portfolios.