Market Overview

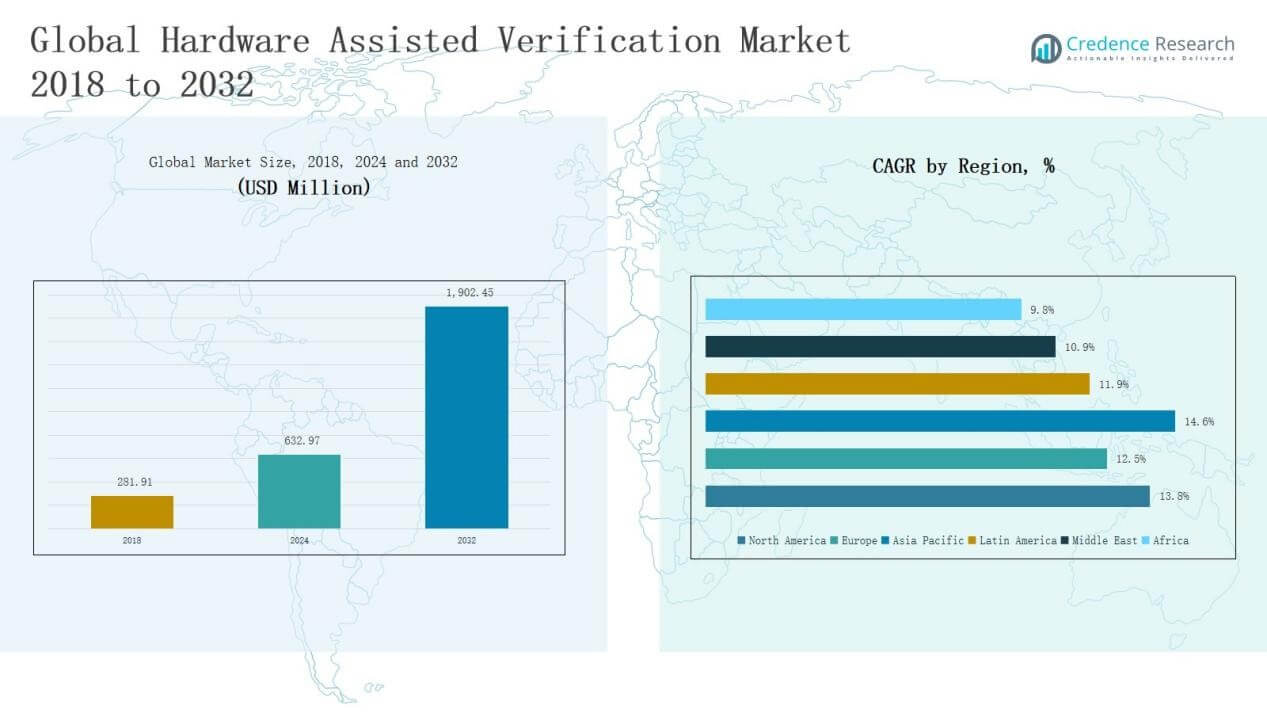

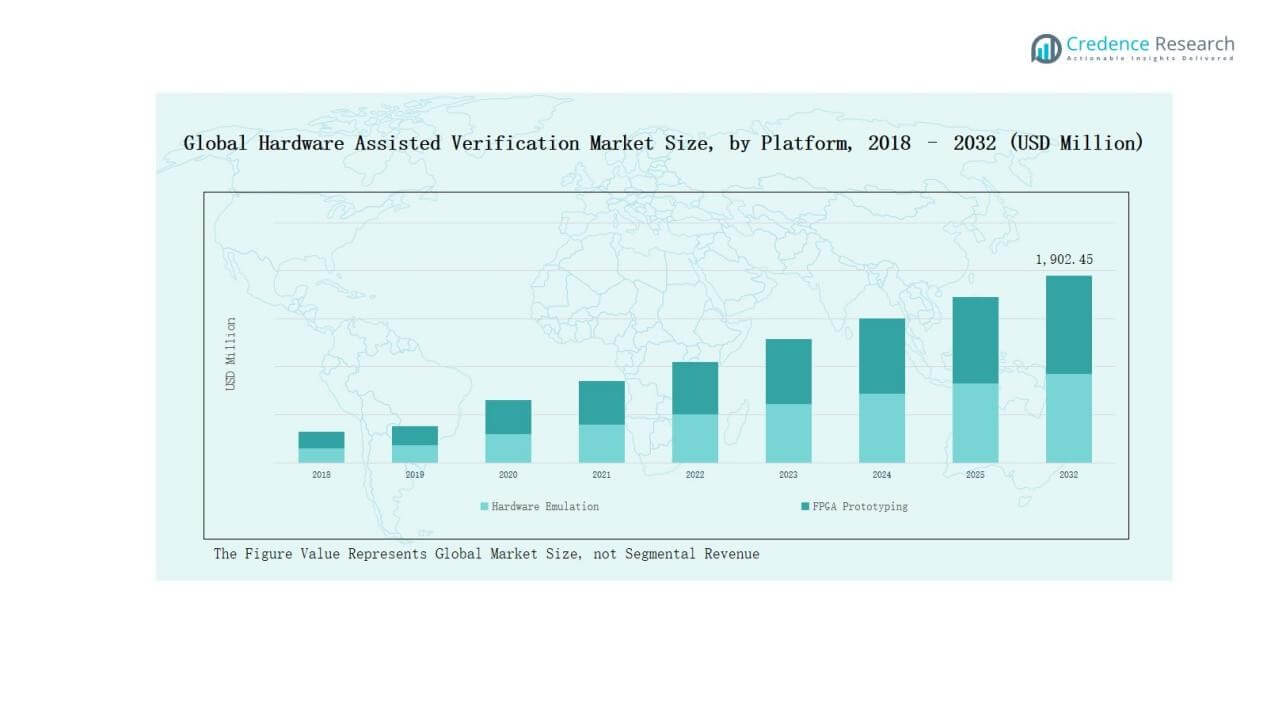

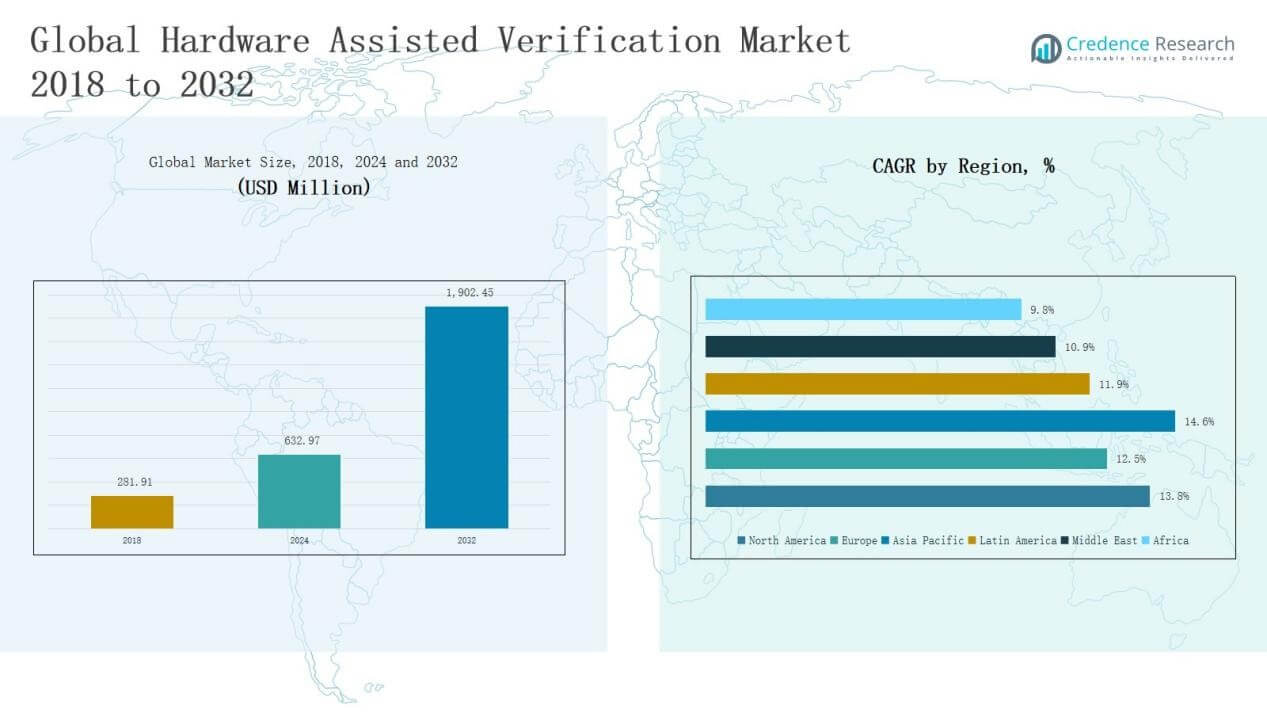

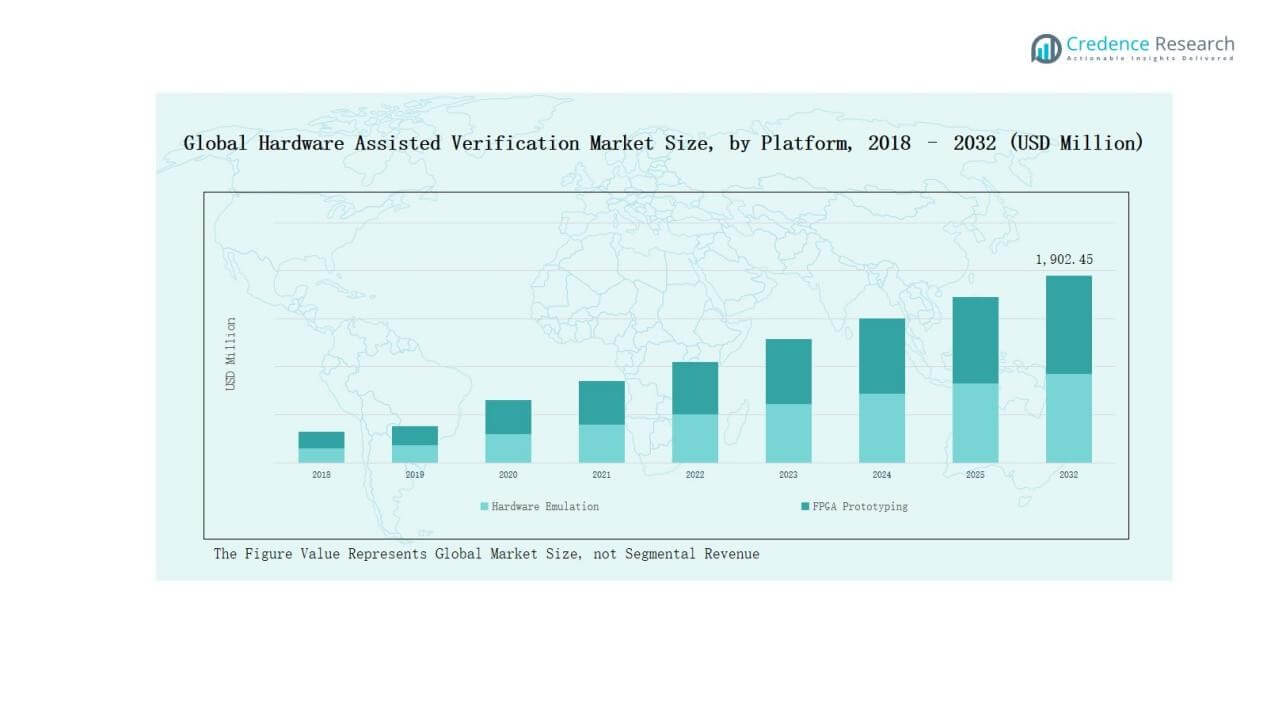

Hardware Assisted Verification Market size was valued at USD 281.91 million in 2018, reached USD 632.97 million in 2024, and is anticipated to reach USD 1,902.45 million by 2032, growing at a CAGR of 13.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hardware Assisted Verification Market Size 2024 |

USD 632.97 Million |

| Hardware Assisted Verification Market, CAGR |

13.74% |

| Hardware Assisted Verification Market Size 2032 |

USD 1,902.45 Million |

The Hardware Assisted Verification Market is shaped by prominent players such as Siemens AG, Cadence Design Systems Inc., SynaptiCAD Sales Inc., Real Intent Inc., Fishtail Design Automation, Hardent, and Innovative Logic, each strengthening their competitive position through advanced emulation platforms, FPGA prototyping tools, and specialized verification solutions. These companies focus on reducing design risks, enhancing debug automation, and supporting complex SoC and AI-driven semiconductor workflows. Regionally, Asia Pacific emerged as the leading market in 2024, commanding 45% share, driven by strong semiconductor manufacturing ecosystems in China, Japan, South Korea, and Taiwan, alongside growing adoption in automotive and telecom applications.

Market Insights

- The Hardware Assisted Verification Market grew from USD 281.91 million in 2018 to USD 632.97 million in 2024, and will reach USD 1,902.45 million by 2032 at 74% CAGR.

- Hardware Emulation led by platform with 62% share in 2024, driven by SoC and AI design complexity, while FPGA prototyping gained traction for flexible, cost-efficient early-stage validation.

- By application, the automotive sector held 28% share in 2024, supported by ADAS, EV systems, and autonomous driving, followed by consumer electronics with 22% share.

- Asia Pacific commanded 45% share in 2024, fueled by semiconductor hubs in China, Japan, South Korea, and Taiwan, while North America and Europe accounted for 28% and 19% respectively.

- Key players such as Siemens AG, Cadence Design Systems Inc., SynaptiCAD, Real Intent, Fishtail Design Automation, Hardent, and Innovative Logic drive competition with advanced emulation platforms and specialized verification tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Platform

Hardware Emulation dominated the hardware assisted verification market in 2024, holding nearly 62% share. Its leadership is fueled by rising demand for complex SoC and ASIC validation, especially in semiconductor and AI-driven chip designs. Companies rely on emulation to shorten verification cycles, reduce risks, and accelerate product launches. FPGA prototyping follows as a flexible, cost-efficient option, widely adopted for early-stage design validation, firmware testing, and academic research, supporting innovation in smaller enterprises and research institutions.

- For instance, Siemens EDA reported broader adoption of its Veloce Strato+ platform among semiconductor firms for validating 5G and datacenter processors, highlighting the scalability of emulation in handling complex computing architectures.

By Application

The automotive sector led the market with around 28% share in 2024, supported by the growing need for ADAS, EV power electronics, and autonomous driving systems. Hardware emulation platforms enable automakers to validate safety-critical electronics under strict regulatory standards. Consumer electronics followed with about 22% share, driven by smartphones, wearables, and IoT devices with shorter product lifecycles. Industrial, aerospace & defense, medical, and telecom segments together formed significant demand, emphasizing reliability, compliance, and performance in mission-critical and connected applications.

- For instance, Synopsys collaborated with Nvidia to optimize its ZeBu emulation platform for AI and GPU workloads, enhancing verification efficiency for advanced accelerators.

Market Overview

Key Growth Drivers

Rising Complexity in Semiconductor Designs

The increasing complexity of semiconductor devices, particularly SoCs and ASICs, drives strong demand for hardware assisted verification. Companies rely on emulation and prototyping platforms to validate performance, functionality, and reliability before production. Growth in AI-enabled processors, 5G chipsets, and high-performance computing systems adds urgency for advanced verification methods. This driver ensures faster time-to-market and lower risk of costly re-spins, positioning hardware assisted solutions as critical tools for semiconductor manufacturers worldwide.

- For instance, NVIDIA leveraged Cadence Palladium Z2 emulation platforms to verify AI workloads for its data center accelerators, supporting complex neural network validation ahead of tape-out.

Automotive Electrification and ADAS Adoption

The automotive sector’s shift toward electric vehicles and advanced driver assistance systems (ADAS) significantly boosts market demand. Automakers and suppliers use verification platforms to ensure safety-critical electronic control units meet regulatory and performance standards. Complex automotive chips supporting autonomous driving, battery management, and infotainment systems require rigorous testing through emulation and prototyping. Government mandates on safety compliance further accelerate adoption. This growing reliance on verification platforms cements automotive as a key application driving sustained market expansion.

- For instance, Siemens introduced new EDA solutions within its Tessent platform to verify automotive ICs designed for ADAS and EV battery management systems.

Accelerating 5G and Telecom Infrastructure Deployment

Telecom companies expanding 5G networks and next-generation communication systems represent a major growth driver. Hardware assisted verification is vital for testing SoCs and network processors used in base stations, routers, and edge computing devices. Rising demand for low-latency, high-bandwidth connectivity requires chips with flawless performance and reliability. Emulation platforms help telecom vendors manage design complexity while ensuring standards compliance. The ongoing global 5G rollout, combined with investments in network virtualization, sustains the demand for advanced verification solutions.

Key Trends & Opportunities

Expansion of AI-Integrated Verification Platforms

A notable trend is the integration of artificial intelligence into verification platforms, enabling predictive analysis and automated debugging. AI-driven solutions improve accuracy, shorten test cycles, and optimize resource utilization. Vendors leverage machine learning models to identify design flaws early and recommend corrective actions. This trend aligns with broader industry adoption of AI in semiconductor workflows. The opportunity lies in offering intelligent verification systems that reduce engineering costs while improving efficiency across automotive, telecom, and consumer electronics sectors.

- For instance, Synopsys introduced its VSO.ai platform, which leverages reinforcement learning to optimize verification regressions and significantly shorten simulation runtimes.

Growth of FPGA-Based Prototyping in Start-Ups and R&D

FPGA prototyping is gaining traction among start-ups, research institutions, and smaller semiconductor firms due to its flexibility and cost-efficiency. Unlike large-scale hardware emulation, FPGA platforms offer scalable solutions for early-stage design testing, firmware validation, and academic projects. This trend opens opportunities for vendors to target emerging innovators, especially in AI accelerators, IoT solutions, and edge devices. Expanding academic-industry collaborations and rising government funding for semiconductor research further strengthen this opportunity, ensuring wider adoption beyond large enterprises.

- For instance, Intel introduced its Agilex FPGA family, enabling developers to prototype edge AI inference engines with reduced power consumption.

Key Challenges

High Implementation and Operational Costs

The adoption of hardware assisted verification faces a significant barrier due to high costs associated with emulation platforms and maintenance. Small and mid-sized companies often struggle with the financial investment required for advanced systems. Operational expenses, including specialized personnel and infrastructure requirements, add to the challenge. While larger semiconductor firms can justify the expense, smaller players may delay adoption, limiting market penetration. Cost-efficiency innovations and subscription-based models could help mitigate this constraint in the future.

Skill Shortages and Talent Gaps

A shortage of skilled engineers with expertise in hardware verification presents another critical challenge. Advanced emulation and prototyping tools require specialized training, and the talent pool remains limited. This gap slows adoption, particularly in emerging economies where technical resources are scarce. Companies face delays in design validation, increasing project timelines and costs. Vendors and academic institutions must collaborate to expand training programs, certifications, and accessible knowledge-sharing platforms to address this long-term bottleneck.

Complexity of Integrating Verification Tools

Integration challenges arise when companies attempt to align hardware assisted verification platforms with existing EDA tools and workflows. Compatibility issues, lengthy customization, and interoperability limitations hinder seamless adoption. Firms often need dedicated teams to manage integration, raising costs and slowing project execution. This complexity can deter adoption in smaller firms and industries with limited technical bandwidth. Market growth depends on vendors offering more interoperable, plug-and-play solutions that reduce integration hurdles and improve workflow efficiency.

Regional Analysis

North America

North America held a leading position in the hardware assisted verification market, valued at USD 80.41 million in 2018, rising to USD 177.67 million in 2024, and projected to reach USD 536.30 million by 2032, growing at a CAGR of 13.8%. The region accounted for nearly 28% share in 2024, supported by strong semiconductor demand, robust R&D investments, and early adoption of emulation platforms. The U.S. remains the key driver, fueled by advanced chip design for AI, automotive electronics, and 5G infrastructure.

Europe

Europe’s hardware assisted verification market was valued at USD 55.04 million in 2018, expanded to USD 117.10 million in 2024, and is expected to reach USD 321.53 million by 2032, recording a CAGR of 12.5%. The region represented around 19% share in 2024, driven by stringent regulatory standards, strong automotive electronics demand, and growth in aerospace and industrial automation. Countries like Germany and France dominate due to advanced semiconductor design hubs, while the UK and Italy contribute through expanding consumer electronics and IoT sectors.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, with the market valued at USD 123.29 million in 2018, reaching USD 287.04 million in 2024, and projected at USD 915.31 million by 2032, advancing at a CAGR of 14.6%. The region captured nearly 45% share in 2024, supported by robust chip manufacturing ecosystems in China, Taiwan, South Korea, and Japan. Rising EV production, 5G deployment, and consumer electronics demand further accelerate growth. India and Southeast Asia are also gaining momentum with expanding semiconductor design outsourcing.

Latin America

Latin America’s hardware assisted verification market reached USD 12.75 million in 2018, rose to USD 28.26 million in 2024, and is anticipated to hit USD 74.74 million by 2032, reflecting a CAGR of 11.9%. The region accounted for nearly 4% share in 2024, with Brazil driving growth through automotive and telecom adoption. Mexico contributes via manufacturing outsourcing and industrial automation demand. Despite challenges of limited infrastructure and high costs, rising electronics imports and growing local R&D investments enhance long-term opportunities.

Middle East

The Middle East market stood at USD 6.83 million in 2018, increased to USD 13.82 million in 2024, and is forecast to reach USD 33.92 million by 2032, expanding at a CAGR of 10.9%. With around 2% share in 2024, growth is supported by rising investments in defense technologies, telecom infrastructure, and smart city projects. GCC countries lead demand through heavy digital transformation spending, while Israel drives adoption with semiconductor R&D capabilities. Strategic government initiatives continue to encourage broader adoption in critical applications.

Africa

Africa’s hardware assisted verification market recorded USD 3.59 million in 2018, rose to USD 9.08 million in 2024, and is projected to reach USD 20.66 million by 2032, growing at a CAGR of 9.8%. The region held approximately 2% share in 2024, with South Africa driving demand in telecom and industrial applications. Expanding healthcare digitization and growing interest in consumer electronics support gradual adoption. However, high costs and limited technical expertise remain barriers. Continued government focus on digital infrastructure opens long-term growth avenues.

Market Segmentations:

By Platform

- Hardware Emulation

- FPGA Prototyping

By Application

- Automotive

- Consumer Electronics

- Industrial

- Aerospace & Defense

- Medical

- Telecom

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The hardware assisted verification market is moderately consolidated, with global players focusing on technological advancements, strategic partnerships, and product portfolio expansion to strengthen their positions. Leading companies such as Siemens AG, Cadence Design Systems Inc., SynaptiCAD Sales Inc., Real Intent Inc., Fishtail Design Automation, Hardent, and Innovative Logic dominate through specialized verification tools, scalable emulation platforms, and strong customer support. Siemens and Cadence lead with broad EDA ecosystems and high-end hardware emulation solutions tailored for complex SoC designs, while smaller firms emphasize niche capabilities such as power analysis, debug automation, and FPGA prototyping. Competitive strategies include mergers, acquisitions, and collaborations with semiconductor foundries, automakers, and telecom providers to address industry-specific demands. Vendors also invest in AI-driven verification platforms to enhance efficiency and reduce design risks. Growing competition in Asia Pacific, driven by local semiconductor innovation, further pressures established players to expand regional presence and improve cost-effective offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In February 2025, Synopsys launched the HAPS-200 prototyping and ZeBu-200 emulation systems, alongside enhanced ZeBu Server 5 capabilities to strengthen its hardware-assisted verification portfolio.

- In April 2024, Cadence unveiled Palladium Z3 and Protium X3 systems to boost pre-silicon hardware verification and software validation.

- In February 2025, Siemens Cre8Ventures formed a strategic partnership with Sindermann Consulting to support semiconductor innovation (including areas tied to verification).

- In 2025, Siemens EDA announced new generative and agentic AI tools integrated into its EDA portfolio to enhance verification flows.

Report Coverage

The research report offers an in-depth analysis based on Platform, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as semiconductor designs grow more complex across SoCs and AI processors.

- Automotive adoption will expand with greater reliance on ADAS, EV systems, and autonomous driving.

- Telecom applications will strengthen as 5G networks and next-generation communication systems mature.

- FPGA prototyping will gain traction among start-ups and research institutions for cost-effective design.

- AI integration in verification tools will improve accuracy, debugging speed, and resource optimization.

- Medical electronics will create opportunities through advanced diagnostic devices and wearable technologies.

- Aerospace and defense adoption will grow with rising investments in mission-critical and satellite systems.

- Regional growth will accelerate in Asia Pacific due to strong semiconductor manufacturing ecosystems.

- Vendors will focus on interoperability to ease integration challenges across EDA and design workflows.

- Cloud-based verification platforms will expand, supporting distributed teams and global collaboration.