1.Preface

1.1.Report Description

1.1.1.Purpose of the Report

1.1.2.Target Audience

1.1.3.USP and Key Offerings

1.2.Research Scope

1.3.Research Methodology

1.3.1.Phase I – Secondary Research

1.3.2.Phase II – Primary Research

1.3.3.Phase III – Expert Panel Review

1.3.4.Approach Adopted

1.3.4.1.Top-Down Approach

1.3.4.2.Bottom-Up Approach

1.3.5.Assumptions

1.4.Market Segmentation

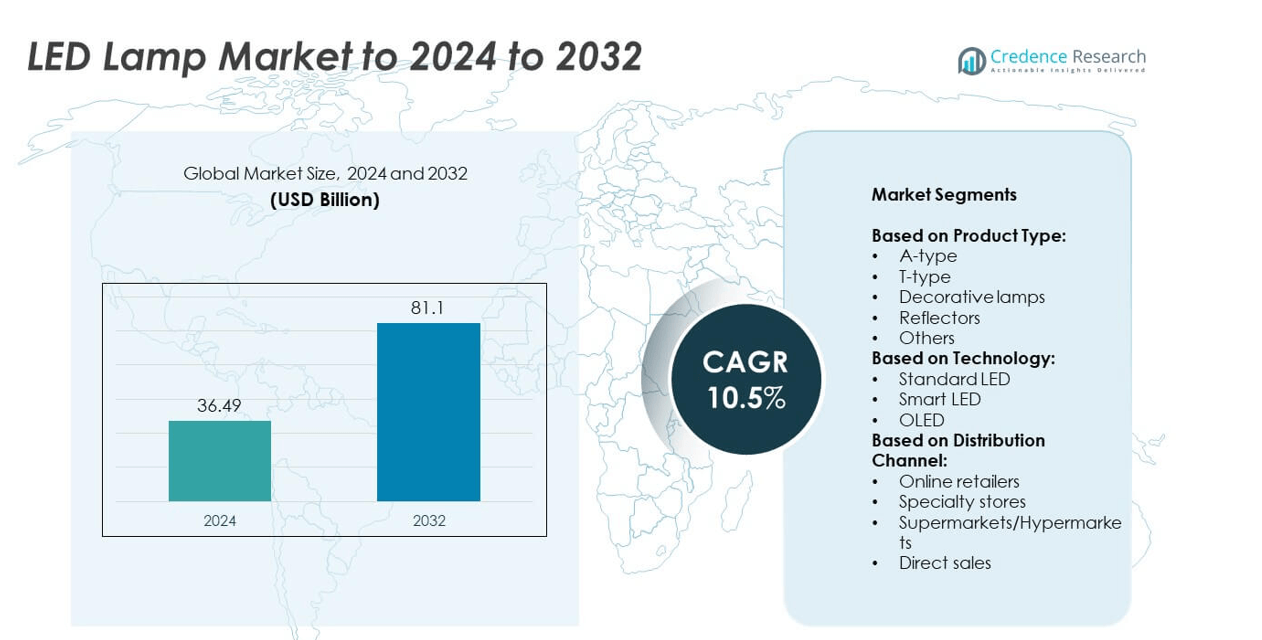

2.Executive Summary

2.1.Market Snapshot: Global LED Desk Lamp Market

3.Market Dynamics & Factors Analysis

3.1.Introduction

3.1.1. Global LED Desk Lamp Market Value, 2015-2027, (US$ Bn)

3.2.Market Dynamics

3.2.1.Key Growth Trends

3.2.2.Major Industry Challenges

3.2.3.Key Growth Pockets

3.3.Attractive Investment Proposition,2020

3.3.1.Distribution Channel

3.3.2.End-user

3.3.3.Geography

3.4.Porter’s Five Forces Analysis

3.4.1.Threat of New Entrants

3.4.2.Bargaining Power of Buyers/Consumers

3.4.3.Bargaining Power of Suppliers

3.4.4.Threat of Substitute Distribution Channels

3.4.5.Intensity of Competitive Rivalry

3.5.Value Chain Analysis

4.Market Positioning of Key Players, 2020

4.1.Company market share of key players, 2020

4.2.Top 6 Players

4.3.Top 3 Players

4.4.Major Strategies Adopted by Key Players

5.COVID 19 Impact Analysis

5.1.Global LED Desk Lamp Market Pre Vs Post COVID 19, 2019 – 2027

5.2.Impact on Import & Export

5.3.Impact on Demand & Supply

6.North America

6.1.North America LED Desk Lamp Market, by Country, 2015-2027(US$ Bn)

6.1.1.U.S.

6.1.2.Canada

6.1.3.Mexico

6.2.North America LED Desk Lamp Market, by Price Range, 2015-2027(US$ Bn)

6.2.1.Overview

6.2.2.Low (Below USD 25)

6.2.3.Medium (Between USD 25 to USD 100)

6.2.4.Above USD 100

6.3.North America LED Desk Lamp Market, by Application, 2015-2027(US$ Bn)

6.3.1.Overview

6.3.2.Reading Lamp

6.3.3.Decorative Lamp

6.4.North America LED Desk Lamp Market, by Distribution Channel, 2015-2027(US$ Bn)

6.4.1.Overview

6.4.2.Online

6.4.3.Offline

6.4.4.Other Distribution Channels

6.5.North America LED Desk Lamp Market, by End-user, 2015-2027(US$ Bn)

6.5.1.Overview

6.5.2.Household

6.5.3.Commercial

6.5.4.Other End-users

7.Europe

7.1.Europe LED Desk Lamp Market, by Country, 2015-2027(US$ Bn)

7.1.1.UK

7.1.2.France

7.1.3.Germany

7.1.4.Italy

7.1.5.Russia

7.1.6.Spain

7.1.7.Belgium

7.1.8.Netherland

7.1.9.Austria

7.1.10.Sweden

7.1.11.Poland

7.1.12.Denmark

7.1.13.Switzerland

7.1.14.Rest of Europe

7.2.Europe LED Desk Lamp Market, by Price Range, 2015-2027(US$ Bn)

7.2.1.Overview

7.2.2.Low (Below USD 25)

7.2.3.Medium (Between USD 25 to USD 100)

7.2.4.Above USD 100

7.3.Europe LED Desk Lamp Market, by Application, 2015-2027(US$ Bn)

7.3.1.Overview

7.3.2.Reading Lamp

7.3.3.Decorative Lamp

7.4.Europe LED Desk Lamp Market, by Distribution Channel, 2015-2027(US$ Bn)

7.4.1.Overview

7.4.2.Online

7.4.3.Offline

7.4.4.Other Distribution Channels

7.5.Europe LED Desk Lamp Market, by End-user, 2015-2027(US$ Bn)

7.5.1.Overview

7.5.2.Household

7.5.3.Commercial

7.5.4.Other End-users

8.Asia Pacific

8.1.Asia Pacific LED Desk Lamp Market, by Country, 2015-2027(US$ Bn)

8.1.1.China

8.1.2.Japan

8.1.3.South Korea

8.1.4.India

8.1.5.Australia

8.1.6.New Zealand

8.1.7.Taiwan

8.1.8.Southeast Asia

8.1.9.Central Asia

8.1.10.Rest of Asia Pacific

8.2.Asia Pacific LED Desk Lamp Market, by Price Range, 2015-2027(US$ Bn)

8.2.1.Overview

8.2.2.Low (Below USD 25)

8.2.3.Medium (Between USD 25 to USD 100)

8.2.4.Above USD 100

8.3.Asia Pacific LED Desk Lamp Market, by Application, 2015-2027(US$ Bn)

8.3.1.Overview

8.3.2.Reading Lamp

8.3.3.Decorative Lamp

8.4.Asia Pacific LED Desk Lamp Market, by Distribution Channel, 2015-2027(US$ Bn)

8.4.1.Overview

8.4.2.Online

8.4.3.Offline

8.4.4.Other Distribution Channels

8.5.Asia Pacific LED Desk Lamp Market, by End-user, 2015-2027(US$ Bn)

8.5.1.Overview

8.5.2.Household

8.5.3.Commercial

8.5.4.Other End-users

9.Latin America

9.1.Latin America LED Desk Lamp Market, by Country, 2015-2027(US$ Bn)

9.1.1.Brazil

9.1.2.Argentina

9.1.3.Peru

9.1.4.Chile

9.1.5.Colombia

9.1.6.Rest of Latin America

9.2.Latin America LED Desk Lamp Market, by Price Range, 2015-2027(US$ Bn)

9.2.1.Overview

9.2.2.Low (Below USD 25)

9.2.3.Medium (Between USD 25 to USD 100)

9.2.4.Above USD 100

9.3.Latin America LED Desk Lamp Market, by Application, 2015-2027(US$ Bn)

9.3.1.Overview

9.3.2.Reading Lamp

9.3.3.Decorative Lamp

9.4.Latin America LED Desk Lamp Market, by Distribution Channel, 2015-2027(US$ Bn)

9.4.1.Overview

9.4.2.Online

9.4.3.Offline

9.4.4.Other Distribution Channels

9.5.Latin America LED Desk Lamp Market, by End-user, 2015-2027(US$ Bn)

9.5.1.Overview

9.5.2.Household

9.5.3.Commercial

9.5.4.Other End-users

9.5.5.

10.Middle East

10.1.Middle East LED Desk Lamp Market, by Country, 2015-2027(US$ Bn)

10.1.1.UAE

10.1.2.KSA

10.1.3.Israel

10.1.4.Turkey

10.1.5.Iran

10.1.6.Rest of Middle East

10.2.Middle East LED Desk Lamp Market, by Price Range, 2015-2027(US$ Bn)

10.2.1.Overview

10.2.2.Low (Below USD 25)

10.2.3.Medium (Between USD 25 to USD 100)

10.2.4.Above USD 100

10.3.Middle East LED Desk Lamp Market, by Application, 2015-2027(US$ Bn)

10.3.1.Overview

10.3.2.Reading Lamp

10.3.3.Decorative Lamp

10.4.Middle East LED Desk Lamp Market, by Distribution Channel, 2015-2027(US$ Bn)

10.4.1.Overview

10.4.2.Online

10.4.3.Offline

10.4.4.Other Distribution Channels

10.5.Middle East LED Desk Lamp Market, by End-user, 2015-2027(US$ Bn)

10.5.1.Overview

10.5.2.Household

10.5.3.Commercial

10.5.4.Other End-users

11.Africa

11.1.Africa LED Desk Lamp Market, by Country, 2015-2027(US$ Bn)

11.1.1.South Africa

11.1.2.Egypt

11.1.3.Nigeria

11.1.4.Rest of Africa

11.2.Africa LED Desk Lamp Market, by Price Range, 2015-2027(US$ Bn)

11.2.1.Overview

11.2.2.Low (Below USD 25)

11.2.3.Medium (Between USD 25 to USD 100)

11.2.4.Above USD 100

11.3.Africa LED Desk Lamp Market, by Application, 2015-2027(US$ Bn)

11.3.1.Overview

11.3.2.Reading Lamp

11.3.3.Decorative Lamp

11.4.Africa LED Desk Lamp Market, by Distribution Channel, 2015-2027(US$ Bn)

11.4.1.Overview

11.4.2.Online

11.4.3.Offline

11.4.4.Other Distribution Channels

11.5.Africa LED Desk Lamp Market, by End-user, 2015-2027(US$ Bn)

11.5.1.Overview

11.5.2.Household

11.5.3.Commercial

11.5.4.Other End-users

12.Global

12.1.Global LED Desk Lamp Market, by Distribution Channel, 2015-2027(US$ Bn)

12.1.1.Overview

12.1.2.Online

12.1.3.Offline

12.2.Global LED Desk Lamp Market, by End-user, 2015-2027(US$ Bn)

12.2.1.Overview

12.2.2.Household

12.2.3.Commercial

12.2.4.End-user 3

12.2.5.Other End-users

13.Company Profiles

13.1.DP

13.2.Yingke

13.3.Liangliang

13.4.SYSKA LED

13.5.Donghia

13.6.Opple

13.7.Koninklijke Philips N.V.

13.8.OSRAM GmbH

13.9.Cree

13.10.Panasonic

13.11.Others

List of Figures

FIG. 1 Global LED Desk Lamp Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 Global LED Desk Lamp Market Segmentation

FIG. 4 Global LED Desk Lamp Market, by Distribution Channel, 2019 (US$ Bn)

FIG. 5 Global LED Desk Lamp Market, by End-user, 2019 (US$ Bn)

FIG. 6 Global LED Desk Lamp Market, by Geography, 2019 (US$ Bn)

FIG. 7 Attractive Investment Proposition, by Geography, 2019

FIG. 8 Global Market Positioning of Key LED Desk Lamp Market Manufacturers, 2019

FIG. 9 Global LED Desk Lamp Market Value Contribution, By Distribution Channel, 2020 & 2027 (Value %)

FIG. 10 Global LED Desk Lamp Market, by Online, Value, 2015-2027 (US$ Bn)

FIG. 11 Global LED Desk Lamp Market, by Offline, Value, 2015-2027 (US$ Bn)

FIG. 12 Global LED Desk Lamp Market, by Others, Value, 2015-2027 (US$ Bn)

FIG. 13 Global LED Desk Lamp Market Value Contribution, By End-user, 2020 & 2027 (Value %)

FIG. 14 Global LED Desk Lamp Market, by Household, Value, 2015-2027 (US$ Bn)

FIG. 15 Global LED Desk Lamp Market, by Commercial, Value, 2015-2027 (US$ Bn)

FIG. 16 Global LED Desk Lamp Market, by Others, Value, 2015-2027 (US$ Bn)

FIG. 17 U.S. LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 18 Rest of North America LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 19 U.K. LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 20 Germany LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 21 France LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 22 Rest of Europe LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 23 Japan LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 24 China LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 25 India LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 26 Rest of Asia Pacific LED Desk Lamp Market, 2015-2027 (US$ Bn)

FIG. 27 Middle East & Africa LED Desk Lamp Market, 2015-2027 (US$ Bn)

Latin America LED Desk Lamp Market, 2015-2027 (US$ Bn)

List of Tables

TABLE 1 Market Snapshot: Global Beauty Devices (LED Desk Lamp) Market

TABLE 2 Global LED Desk Lamp Market, by Distribution Channel, 2015-2027 (US$ Bn)

TABLE 3 Global LED Desk Lamp Market, by End-user, 2015-2027 (US$ Bn)

TABLE 4 Global LED Desk Lamp Market, by Geography, 2015-2027 (US$ Bn)

TABLE 5 North America LED Desk Lamp Market, by Distribution Channel, 2015-2027 (US$ Bn)

TABLE 6 North America LED Desk Lamp Market, by End-user, 2015-2027 (US$ Bn)

TABLE 7 North America LED Desk Lamp Market, by Country, 2015-2027 (US$ Bn)

TABLE 8 Europe LED Desk Lamp Market, by Distribution Channel, 2015-2027 (US$ Bn)

TABLE 9 Europe LED Desk Lamp Market, by End-user, 2015-2027 (US$ Bn)

TABLE 10 Europe LED Desk Lamp Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 11 Asia Pacific LED Desk Lamp Market, by Distribution Channel, 2015-2027 (US$ Bn)

TABLE 12 Asia Pacific LED Desk Lamp Market, by End-user, 2015-2027 (US$ Bn)

TABLE 13 Asia Pacific LED Desk Lamp Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 14 Latin America LED Desk Lamp Market, by Distribution Channel, 2015-2027 (US$ Bn)

TABLE 15 Latin America LED Desk Lamp Market, by End-user, 2015-2027 (US$ Bn)

TABLE 16 Latin America LED Desk Lamp Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 17 Middle East LED Desk Lamp Market, by Distribution Channel, 2015-2027 (US$ Bn)

TABLE 18 Middle East LED Desk Lamp Market, by End-user, 2015-2027 (US$ Bn)

TABLE 19 Middle East LED Desk Lamp Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 20 Africa LED Desk Lamp Market, by Distribution Channel, 2015-2027 (US$ Bn)

TABLE 21 Africa LED Desk Lamp Market, by End-user, 2015-2027 (US$ Bn)

TABLE 22 Africa LED Desk Lamp Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 23 DP: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments)

TABLE 24 Yingke: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments)

TABLE 25 Liangliang: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments)

TABLE 26 SYSKA LED.: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments)

TABLE 27 Donghia: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments)

TABLE 28 Opple: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments

TABLE 29 Koninklijke Philips N.V.: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments

TABLE 30 OSRAM GmbH: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments

TABLE 31 CREE: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments

TABLE 32 Panasonic: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments

TABLE 33 Company 11: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments

TABLE 34 Company 12: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments

TABLE 35 Company 13: Company Snapshot (Company Overview; Distribution Channel Portfolio; Financial Information; Key Developments