Market Overview:

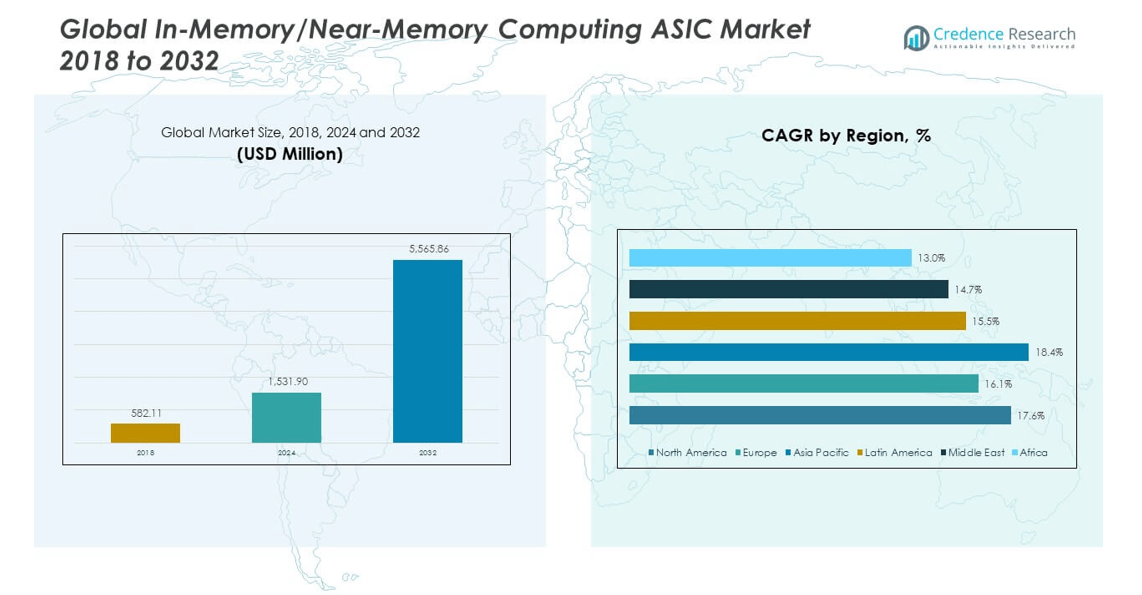

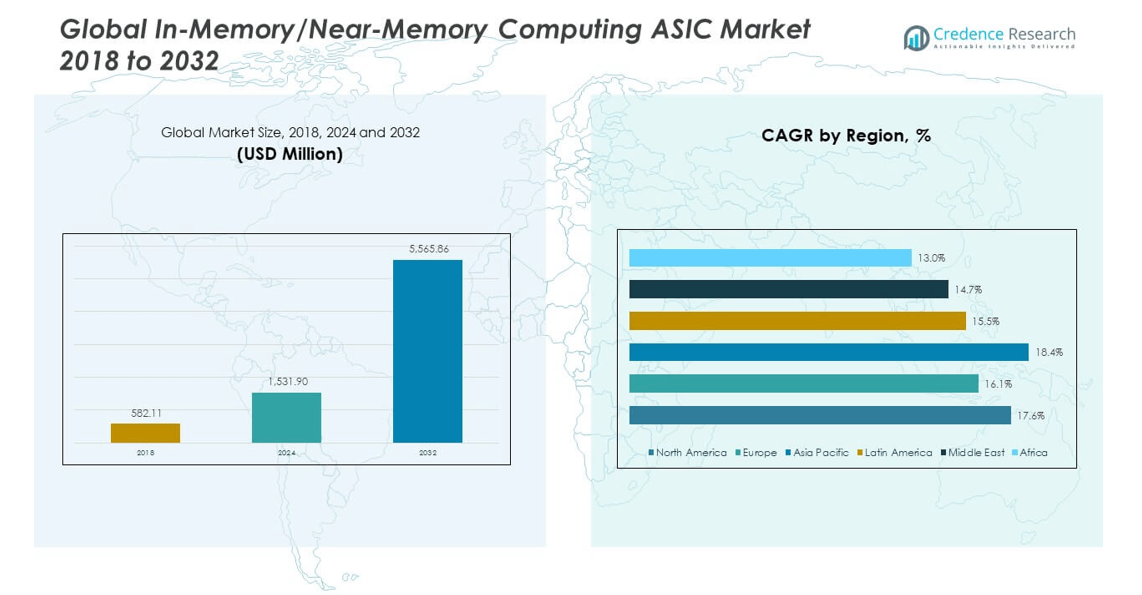

The Global In-Memory-Near-Memory Computing ASIC Market size was valued at USD 582.11 million in 2018 to USD 1,531.90 million in 2024 and is anticipated to reach USD 5,565.86 million by 2032, at a CAGR of 17.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In-Memory-Near-Memory Computing ASIC Market Size 2024 |

USD 1,531.90 million |

| In-Memory-Near-Memory Computing ASIC Market, CAGR |

17.50% |

| In-Memory-Near-Memory Computing ASIC Market Size 2032 |

USD 5,565.86 million |

The market is primarily driven by the increasing demand for high-performance computing, which is being fueled by the need for faster data processing in industries such as artificial intelligence, machine learning, and big data analytics. As data-intensive applications grow, there is a significant push toward optimizing memory performance to reduce latency and increase throughput. The adoption of in-memory and near-memory computing solutions in sectors like cloud computing and autonomous systems further supports this growth.

Regionally, North America dominates the market, driven by advancements in technology and the presence of key players in the semiconductor and computing sectors. The United States, in particular, is leading due to its robust technology infrastructure and high demand for data centers. Meanwhile, Asia-Pacific, with its growing tech industry in countries like China, Japan, and South Korea, is emerging as a key player, with significant investments in semiconductor R&D and memory solutions for advanced applications.

Market Insights:

- The Global In-Memory-Near-Memory Computing ASIC market size was valued at USD 11 million in 2018 to USD 1,531.90 million in 2024 and is anticipated to reach USD 5,565.86 million by 2032, at a CAGR of 17.50% during the forecast period.

- The increasing demand for high-performance computing in industries like AI, machine learning, and big data analytics is driving the market.

- Rising adoption of in-memory and near-memory solutions in cloud computing and autonomous systems further fuels market growth.

- High development costs and integration challenges with existing systems limit the adoption of these technologies in some industries.

- North America leads the market, driven by advancements in technology and a strong presence of key industry players, contributing to 35% of the global market share.

- Asia-Pacific is experiencing the highest growth, with countries like China, Japan, and South Korea making significant investments in memory solutions and semiconductor R&D.

- The growing focus on energy-efficient computing and the increasing need for real-time processing in edge computing applications are further enhancing market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Performance Computing:

The need for faster and more efficient computing solutions is a key driver of the Global In-Memory-Near-Memory Computing ASIC market. The growing prevalence of data-intensive applications in industries such as artificial intelligence (AI), machine learning, and big data analytics is driving the demand for high-performance computing. In-memory computing significantly reduces data latency, ensuring that large volumes of data are processed at much higher speeds, thus improving the performance of these systems.

- For example, IBM’s 2023 NorthPole research chip integrates AI compute directly within high-capacity (224 MB) on-chip SRAM memory arrays, performing multiply-and-accumulate (MAC) operations locally avoiding off-chip data transfers and achieving up to 25 times higher energy efficiencycompared to standard CPUs/GPUs for AI inference tasks.

Growth of Cloud Computing Infrastructure:

Cloud computing continues to expand globally, with businesses increasingly relying on cloud platforms for storage and computational power. The Global In-Memory-Near-Memory Computing ASIC market is benefiting from this trend as in-memory and near-memory solutions offer higher bandwidth and lower latency, essential for cloud-based services. By enabling faster access to data stored in the cloud, these solutions enhance user experiences and the performance of cloud applications.

- For example, Whalechip has partnered with Arteris to integrate the FlexNoC 5 interconnect IP into its custom ASICs for near-memory computing. This design reduces memory bottlenecks and enhances high-bandwidth operation. The ASICs optimize power consumption, shorten SoC development cycles, and support large-scale cloud AI workloads.

Adoption of Autonomous Systems and Edge Computing:

In sectors such as autonomous vehicles, industrial automation, and robotics, the need for low-latency and high-throughput computing solutions has become critical. The Global In-Memory-Near-Memory Computing ASIC market is seeing growth driven by these developments. In-memory and near-memory computing systems enhance the processing capabilities of autonomous systems, enabling real-time decision-making and reducing the time required to analyze vast amounts of data at the edge.

Need for Energy-Efficient Solutions:

Energy efficiency remains a significant factor in the development of next-generation computing solutions. The Global In-Memory-Near-Memory Computing ASIC market is being propelled by the demand for energy-efficient memory systems that reduce power consumption while enhancing processing speed. In-memory and near-memory computing ASICs provide a more efficient alternative to traditional memory solutions, as they allow data to be processed within memory, reducing the need for constant data transfers between memory and processing units.

Market Trends:

Integration of Memory and Processing Units:

A growing trend in the Global In-Memory-Near-Memory Computing ASIC market is the integration of memory and processing units into a single chip. This integration reduces the time spent in data transfer between separate units, thus enhancing system efficiency. By enabling faster data access and processing, this trend is becoming increasingly important in the development of high-performance computing devices, especially in data centers and cloud computing systems.

Miniaturization of In-Memory Computing Solutions:

Miniaturization has become a significant trend, with smaller and more compact in-memory computing solutions now being developed. This trend is driven by the need for portable and energy-efficient systems in industries like healthcare, automotive, and consumer electronics. The development of miniaturized Global In-Memory-Near-Memory Computing ASICs allows for the creation of smaller devices that offer high performance without compromising on processing power or memory capacity.

- For example: In edge AI devices, miniature memristor-based binarized neural processors have incorporated 32,768 memristors and a logic-in-memory precharge sense amplifier. These demonstrate robust, energy-efficient, and highly miniaturized solutions suitable for embedded AI and IoT applications.

Rise in Adoption of AI-Powered Memory Solutions:

With the increasing deployment of artificial intelligence (AI) in various sectors, there is a rising demand for AI-powered memory solutions. The Global In-Memory-Near-Memory Computing ASIC market is benefitting from this trend as these solutions provide the computational power required for AI applications. AI-powered in-memory computing systems allow for real-time data processing and enable the development of advanced AI models, thus meeting the growing computational needs of AI-driven industries.

- For example: ReRAM-based CIM accelerators used for large language models have demonstrated up to 2.3x reduction in inference times with up to 1.7x improvement in energy efficiency.

Increase in Focus on Customizable Solutions:

The demand for customizable solutions is becoming more prevalent in the Global In-Memory-Near-Memory Computing ASIC market. Companies are increasingly looking for in-memory and near-memory computing solutions that can be tailored to their specific computational needs. Customizable ASICs enable companies to optimize their systems for particular tasks, such as image processing, video rendering, or data encryption, allowing for more efficient and specialized operations.

Market Challenges:

High Development Costs:

One of the significant challenges facing the Global In-Memory-Near-Memory Computing ASIC market is the high cost associated with the development and production of these advanced chips. The research and development required to create efficient, high-performance ASICs demand substantial investment in both time and resources. Furthermore, the intricate nature of memory integration with processing units adds to the complexity and cost, limiting widespread adoption, especially in smaller enterprises with limited budgets.

Technological Complexity and Integration Issues:

The integration of in-memory and near-memory computing solutions with existing systems presents technological challenges. Companies may face difficulties when attempting to integrate these advanced memory solutions into legacy systems, as compatibility issues and performance optimization become key concerns. Additionally, achieving the desired performance levels while maintaining system stability can be technically demanding, further limiting the rapid adoption of these solutions in certain industries.

Market Opportunities:

Expanding Applications in Edge Computing:

The rise of edge computing presents a significant opportunity for the Global In-Memory-Near-Memory Computing ASIC market. As more industries look to process data at the edge rather than in centralized cloud systems, the demand for high-speed, low-latency memory solutions will continue to grow. These advanced computing solutions offer a powerful way to optimize edge computing devices, enabling them to process and analyze data in real time, thus opening new avenues for growth in sectors like autonomous vehicles, smart cities, and industrial IoT.

Emerging Markets in Asia-Pacific:

The Asia-Pacific region presents a substantial opportunity for the Global In-Memory-Near-Memory Computing ASIC market due to the increasing investments in technology and infrastructure. Countries such as China, India, and Japan are heavily investing in AI, big data analytics, and cloud computing, creating a fertile ground for the adoption of advanced computing solutions. The growing tech industry in these emerging markets presents a significant opportunity for vendors to expand their footprint and cater to the demand for high-performance computing solutions.

Market Segmentation Analysis:

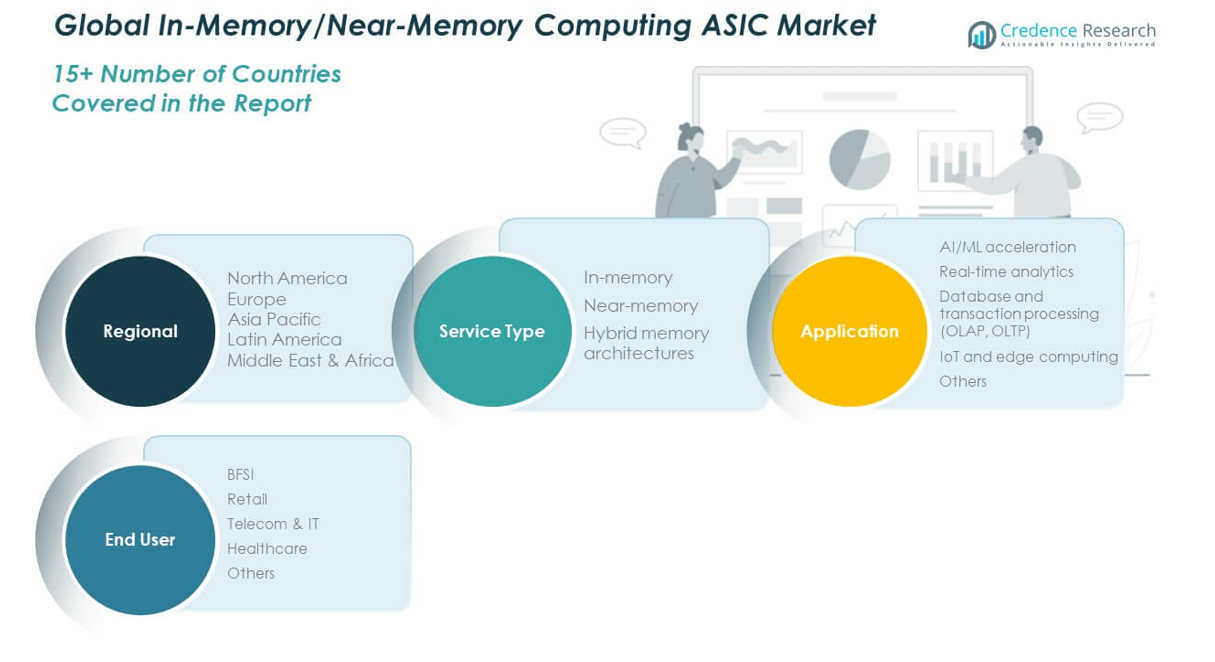

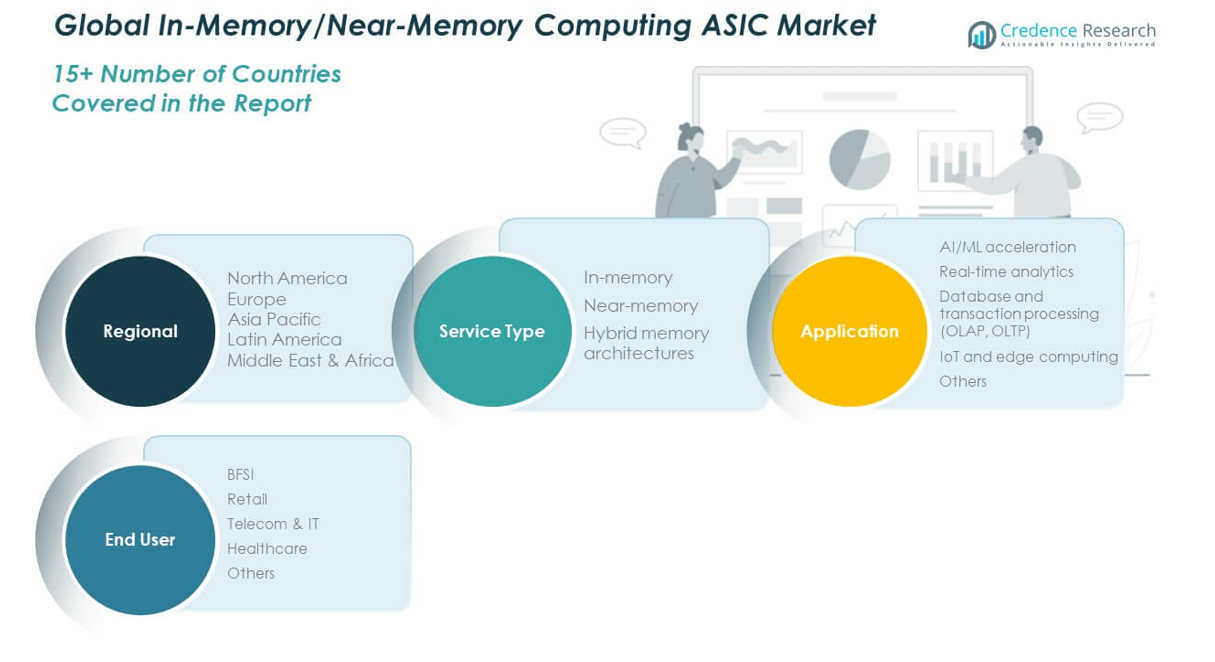

The Global In-Memory-Near-Memory Computing ASIC market is segmented by service type, application, and end-user, each contributing to its overall growth.

By service type, the market is primarily divided into three segments: in-memory, near-memory, and hybrid memory architectures. In-memory computing offers significant performance improvements by reducing data access latency, while near-memory computing optimizes memory usage by placing memory closer to processing units. Hybrid memory architectures combine the strengths of both in-memory and near-memory solutions, addressing a wider range of applications with varying requirements.

- For example, GSI Technology’s Gemini-II® APU (Associative Processing Unit) ASIC features 6MB of associative compute memory and 96MB of distributed SRAM, delivering up to 184 TOPS (8-bit adds) per device by performing computations directly within memory arrays. This in-memory architecture eliminates the traditional data movement bottleneck and enables massive parallelism for AI and search workloads.

By application segments, the market sees major adoption in AI/ML acceleration, where it enhances processing speeds for machine learning models. Real-time analytics and database and transaction processing (OLAP, OLTP) benefit from reduced latency and faster data access. IoT and edge computing applications rely on these memory solutions to enable faster decision-making at the edge. The others category includes applications like autonomous systems and industrial automation.

- For example, The NVIDIA Jetson AGX Orin (2023) platform integrates 2048 CUDA cores, 64 Tensor cores, and 32GB of unified memory, delivering 275 TOPS of AI performance for edge computing. This enables real-time sensor fusion and decision-making in autonomous robotics and drones applications. These specifications and performance figures are confirmed in NVIDIA’s official product datasheets and technical briefs.

By End-user segments include industries such as BFSI, where data security and transaction speeds are crucial; retail, focusing on customer behavior analysis and inventory management; telecom & IT, which require high-speed data processing; and healthcare, where real-time data access is critical for diagnostics and patient care. The others segment captures emerging sectors adopting advanced memory solutions for various use cases.

Segmentation:

By Service Type Segments

- In-memory

- Near-memory

- Hybrid memory architectures

By Application Segments

- AI/ML acceleration

- Real-time analytics

- Database and transaction processing (OLAP, OLTP)

- IoT and edge computing

- Others

By End-User Segments

- BFSI

- Retail

- Telecom & IT

- Healthcare

- Others

By Region Segment

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Analysis:

The North America Global In-Memory-Near-Memory Computing ASIC market size was valued at USD 181.17 million in 2018, reaching USD 469.83 million in 2024, and is anticipated to reach USD 1,713.72 million by 2032, at a CAGR of 17.6% during the forecast period. The North American market leads in the adoption of advanced computing solutions, primarily due to the region’s well-established technology infrastructure and its strong presence in sectors such as cloud computing, AI, and big data analytics. The United States, as a key market, continues to drive demand for high-performance computing solutions, particularly in industries like healthcare, automotive, and finance. North America holds the largest market share, representing approximately 35% of the global market.

Europe Regional Analysis:

The Europe Global In-Memory-Near-Memory Computing ASIC market size was valued at USD 106.21 million in 2018, reaching USD 263.83 million in 2024, and is anticipated to reach USD 869.51 million by 2032, at a CAGR of 16.1% during the forecast period. Europe has been focusing heavily on technological advancements and sustainability, with a growing demand for energy-efficient solutions in industries such as automotive, manufacturing, and telecommunications. The region’s strong manufacturing base and increasing investments in AI and data-driven technologies are contributing to the market’s growth. Europe is expected to capture around 18% of the global market share, driven by both industrial applications and academic research in advanced computing.

Asia Pacific Regional Analysis:

The Asia Pacific Global In-Memory-Near-Memory Computing ASIC market size was valued at USD 248.70 million in 2018, reaching USD 679.20 million in 2024, and is anticipated to reach USD 2,621.57 million by 2032, at a CAGR of 18.4% during the forecast period. Asia Pacific is poised to experience the highest growth rate due to the increasing demand for high-performance computing solutions in emerging markets like China, India, and Japan. The rapid expansion of AI, IoT, and cloud computing in these countries has significantly increased the need for faster data processing and memory optimization solutions. Asia Pacific holds a substantial share of the global market, estimated at 40%, due to its dynamic tech ecosystem.

Latin America Regional Analysis:

The Latin America Global In-Memory-Near-Memory Computing ASIC market size was valued at USD 24.65 million in 2018, reaching USD 63.96 million in 2024, and is anticipated to reach USD 202.56 million by 2032, at a CAGR of 15.5% during the forecast period. Latin America is witnessing a steady rise in the adoption of advanced computing technologies, especially in sectors like manufacturing, telecommunications, and energy. Brazil and Mexico, as the leading countries in the region, are heavily investing in digital transformation, fostering the demand for faster and more efficient computing solutions. Despite being a smaller market compared to other regions, Latin America’s growth prospects are significant, accounting for approximately 3% of the global market share.

Middle East Regional Analysis:

The Middle East Global In-Memory-Near-Memory Computing ASIC market size was valued at USD 14.69 million in 2018, reaching USD 34.96 million in 2024, and is anticipated to reach USD 104.77 million by 2032, at a CAGR of 14.7% during the forecast period. The Middle East is increasingly embracing technological innovations, with countries like the UAE and Saudi Arabia leading the charge in adopting AI, cloud computing, and digital infrastructure. Investments in smart city projects, industrial automation, and AI-driven applications are accelerating the adoption of high-performance computing solutions. The Middle East holds a smaller share, representing about 2% of the global market.

Africa Regional Analysis:

The Africa Global In-Memory-Near-Memory Computing ASIC market size was valued at USD 6.70 million in 2018, reaching USD 20.12 million in 2024, and is anticipated to reach USD 53.73 million by 2032, at a CAGR of 13.0% during the forecast period. Africa is witnessing gradual adoption of advanced computing solutions, driven by increasing digitalization across several industries, including telecom, manufacturing, and banking. Key markets in South Africa, Nigeria, and Kenya are making significant strides in digital infrastructure, boosting the demand for efficient computing technologies. The region’s market share is approximately 1% of the global total.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Samsung Electronics

- SK hynix

- Micron Technology

- Intel

- IBM

- TSMC

- Synopsys

- Cadence

- GSI Technology

- Graphcore

Competitive Analysis:

The Global In-Memory-Near-Memory Computing ASIC market is highly competitive, with several key players leading the industry. Major companies in this space focus on providing high-performance computing solutions that reduce latency and improve data processing speed. These companies invest heavily in research and development to advance memory technologies and optimize integration between memory and processing units. Leading players in the market are capitalizing on trends such as AI, cloud computing, and data center expansion. Competition is intensifying as more organizations adopt advanced computing solutions for industries like autonomous systems, industrial automation, and edge computing. These companies are also targeting emerging markets, particularly in Asia Pacific and Latin America, where technology adoption is growing rapidly. The market remains dynamic with significant opportunities for both established players and new entrants to innovate and expand their offerings.

Recent Developments:

- In July 2025, Arteris, a leader in system IP technology, announced that Whalechip has licensed its FlexNoC 5 network-on-chip (NoC) interconnect IP. This agreement marks a significant partnership between Arteris and Whalechip to design a custom ASIC targeting advanced near-memory computing architectures.

- In March 2025, Micron Technology launched new HBM3E and SOCAMM (Small Outline Compression Attached Memory Module) products, becoming the first memory provider to ship both for AI servers. These innovations, developed in collaboration with NVIDIA, are central to next-generation GPUs and AI servers that demand fast, high-bandwidth, and energy-efficient memory.

- In August 2024, SK hynix showcased its Accelerator-in-Memory (AiM) solution at Hot Chips 2024. The presentation highlighted a GDDR6 AiM card using Xilinx Virtex FPGAs, designed to address the memory bottlenecks crucial for large AI models and LLMs. SK hynix also expanded its AiM prototype to 32GB by using 32 AiM packages, demonstrating significant progress toward commercial high-capacity in-memory computing products

- In June 2024, Samsung Electronics made headlines with plans for an AI accelerator featuring strong in-memory processing capabilities. During the ISC 2024 conference, a presentation suggested Samsung is developing an AI chip that leverages a RISC-V CPU and heavy in-memory processing to alleviate memory bandwidth issues, especially in AI and scientific computing contexts.

Market Concentration & Characteristics:

The Global In-Memory-Near-Memory Computing ASIC market exhibits a moderate concentration, with key players commanding substantial market share. Large semiconductor companies dominate the market, supported by their advanced manufacturing capabilities and significant R&D investments. The market is characterized by high innovation, with continuous advancements in memory integration technologies and increasing demand from sectors like AI, cloud computing, and big data. However, new entrants and regional players are emerging, creating a more diverse competitive landscape. Companies compete primarily on the basis of product performance, energy efficiency, and cost-effectiveness, while also catering to the evolving needs of high-performance computing applications across various industries.

Report Coverage:

The research report offers an in-depth analysis based on Service Type, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global In-Memory-Near-Memory Computing ASIC market is expected to see rapid growth due to the increasing demand for high-performance computing in AI and machine learning applications.

- North America will continue to lead the market, driven by technological advancements and a strong presence of key industry players.

- Asia-Pacific will experience the highest growth, supported by increasing investments in semiconductor R&D and expanding demand for memory solutions.

- The adoption of these computing solutions in cloud computing infrastructure will significantly boost market growth.

- Increased focus on energy-efficient computing technologies will drive further innovations in memory systems.

- The rise of autonomous systems and edge computing will create new opportunities for memory solutions in real-time processing applications.

- Competition will intensify as both established companies and new entrants look to capture market share in emerging regions.

- The growing need for faster data processing in big data analytics will fuel the demand for in-memory and near-memory computing solutions.

- Advancements in miniaturization will make these solutions more accessible to a wider range of industries, including consumer electronics and healthcare.

- With the increasing adoption of smart city technologies, the demand for efficient memory solutions will expand, particularly in urban infrastructure projects.