Market Overview:

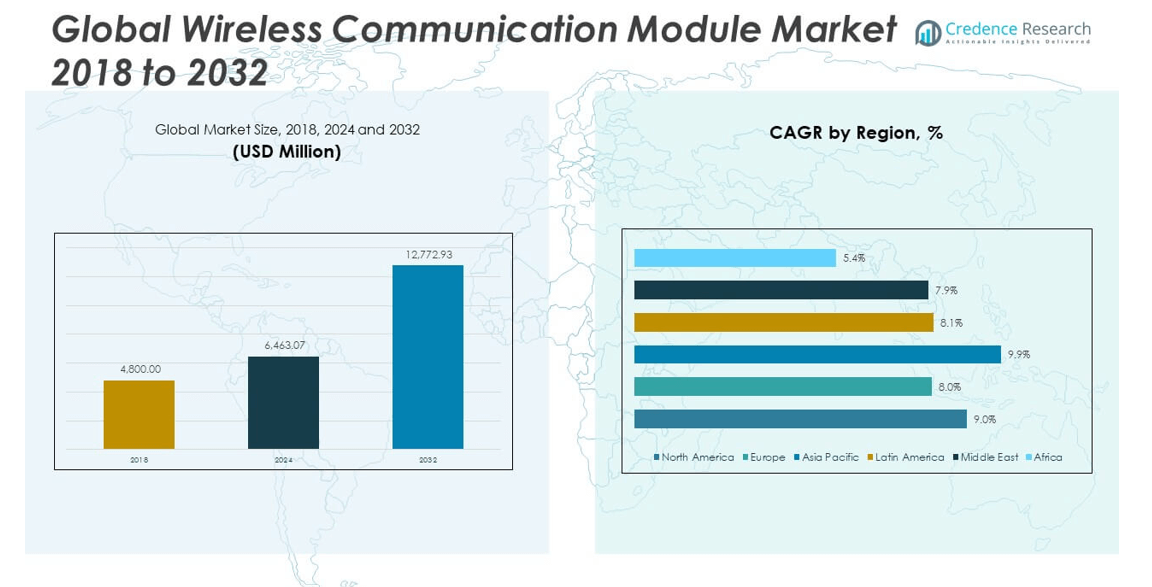

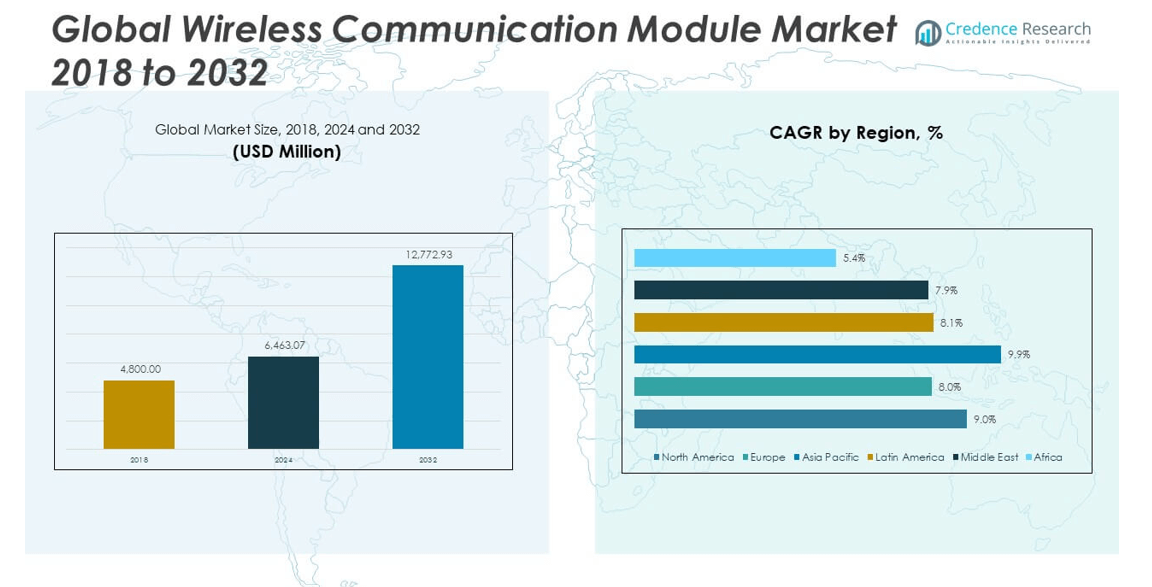

The Wireless Communication Module Market size was valued at USD 4,800.00 million in 2018, increased to USD 6,463.07 million in 2024, and is anticipated to reach USD 12,772.93 million by 2032, at a CAGR of 8.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless Communication Module Market Size 2024 |

USD 6,463.07 million |

| Wireless Communication Module Market, CAGR |

8.98% |

| Wireless Communication Module Market Size 2032 |

USD 12,772.93 million |

The growth of the Wireless Communication Module Market is primarily driven by the rapid adoption of Internet of Things (IoT) devices and advancements in wireless technologies like 5G. These modules are crucial for enabling seamless connectivity across industries, including automotive, healthcare, consumer electronics, and industrial automation. Increasing demand for smart homes, wearable devices, and connected cars is further fueling market growth. Additionally, the rise in cloud computing and data-driven services strengthens the need for faster and more efficient communication modules.

Geographically, North America and Europe hold significant shares in the Wireless Communication Module Market due to their mature technological infrastructure and high adoption of smart devices. The United States and Germany lead in industrial automation, IoT integration, and smart city initiatives. Meanwhile, the Asia-Pacific region, especially China and India, is emerging rapidly, driven by urbanization, rising disposable incomes, and a growing demand for connected consumer products. These countries are making substantial investments in wireless communication networks, supporting the expansion of the market in this region.

Market Insights:

- The Wireless Communication Module Market size was valued at USD 4,800.00 million in 2018, increased to USD 6,463.07 million in 2024, and is anticipated to reach USD 12,772.93 million by 2032, growing at a CAGR of 8.98% during the forecast period.

- The increasing adoption of IoT devices and advancements in wireless technologies like 5G drive the market’s growth. The demand for connected devices in sectors such as automotive, healthcare, and consumer electronics continues to rise.

- Security concerns in wireless communication systems and the challenge of ensuring low power consumption in large-scale deployments pose significant restraints in the market.

- North America and Europe dominate the market due to strong technological infrastructure and high adoption of smart devices, while the Asia Pacific region is rapidly emerging, particularly in China and India, driven by urbanization and industrial growth.

- The demand for smart homes, wearable devices, and connected cars further fuels market growth, with wireless modules enabling seamless communication across various industries.

- Regulatory compliance and inflationary pressures create economic frictions that may limit the expansion of the market, especially in developing regions.

- Investment in 5G networks and IoT applications in emerging markets such as Asia Pacific is expected to enhance market growth, with substantial contributions from countries like China, India, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Adoption of IoT Devices

The Wireless Communication Module Market benefits from the growing adoption of IoT devices across various sectors. These modules enable devices to connect to the internet, facilitating real-time communication. The increasing deployment of IoT in smart homes, healthcare, and industrial applications drives the market demand. IoT integration enhances operational efficiency and consumer experience, making it a crucial technology in modern systems. The market grows as industries realize the importance of wireless communication modules for seamless connectivity between devices.

- For example, MinewSemi, a leading module manufacturer, launched the ME54BS12 Bluetooth 6.0 moduleboasting a 128 MHz Arm Cortex-M33 processor, 1.5MB Flash, and 256KB RAM, supporting Bluetooth Mesh, Zigbee, Thread, and Matter protocols—illustrating the trend toward multi-protocol, high-performance modules designed for specific vertical applications like smart homes and industrial

Advancements in Wireless Communication Technologies

The advancement of wireless technologies, such as 5G and Wi-Fi 6, fuels the expansion of the Wireless Communication Module Market. These technologies provide faster data transfer speeds, reduced latency, and increased reliability, all of which enhance the capabilities of wireless communication modules. The demand for faster and more efficient data transmission is essential in supporting applications like autonomous vehicles, augmented reality, and remote healthcare services. Innovations in wireless communication technologies are transforming the market, driving growth and adoption.

- For instance, Wi-Fi 6 modules now deliver up to 9.6Gbps of throughputacross multiple channels, leveraging OFDMA for simultaneous multi-endpoint transmissions and TWT (Target Wake Time) for energy savings in battery-operated devices. WPA3 further enhances wireless security with 256-bit AES encryption as a baseline.

Demand for Smart and Connected Devices

Smart devices are increasingly embedded with wireless communication modules, leading to higher market demand. This trend is evident across consumer electronics, automotive, and healthcare sectors. In consumer electronics, wireless modules are integral to smartphones, wearables, and home automation systems. The automotive industry leverages these modules for connected vehicles, which enhances driving safety and convenience. As more devices become interconnected, the Wireless Communication Module Market continues to expand, meeting the demand for communication in diverse applications.

Government Initiatives and Investments in Communication Infrastructure

Governments across the globe are investing in advanced communication infrastructure, which contributes to the growth of the Wireless Communication Module Market. Programs aimed at deploying smart city technologies, improving wireless networks, and supporting digital transformation initiatives boost the market. These investments focus on expanding high-speed wireless networks and fostering the development of smart infrastructures. As governments push for digital economies, the adoption of wireless communication modules becomes essential in creating more connected environments.

Market Trends:

Growing Use of Wireless Communication in Industrial Automation

The trend toward industrial automation is a significant driver of the Wireless Communication Module Market. Industries are increasingly adopting automation technologies that rely on wireless communication for real-time monitoring and control of operations. Wireless communication modules enable seamless data exchange between machines and sensors, enhancing operational efficiency. Industries like manufacturing, logistics, and energy are integrating wireless modules to optimize performance and reduce downtime. As industrial automation continues to grow, the demand for wireless communication modules intensifies.

- For instance, at Hannover Messe 2023, Moxa showcased its industrial 5G solutions that achieved over 1 Gbps throughput and 50 ms recovery times using Virtual Router Redundancy Protocol (VRRP) in dual cellular configurations. This enabled seamless, real-time control in mission-critical environments such as rail and high-end manufacturing.

Integration with AI and Machine Learning for Enhanced Connectivity

The integration of AI and machine learning technologies with wireless communication modules is a growing trend. These technologies help improve the functionality of wireless communication systems by enhancing data analysis, predictive maintenance, and autonomous decision-making. AI-driven communication systems offer improved network management, optimizing bandwidth usage and reducing latency. As AI becomes more integrated with wireless communication systems, the demand for advanced modules that support these technologies continues to rise, offering higher performance and increased capabilities.

Rise of Low-Power Wide-Area Networks (LPWANs)

The Wireless Communication Module Market is witnessing the rise of Low-Power Wide-Area Networks (LPWANs), which are designed to support long-range communications with minimal power consumption. LPWANs are particularly useful in applications that require extended battery life, such as in remote monitoring and sensor-based systems. The adoption of LPWAN technologies allows industries to deploy large networks of connected devices with low energy consumption, making them ideal for applications like agriculture, smart cities, and logistics.

Evolution of Edge Computing in Wireless Systems

Edge computing is becoming a critical part of the Wireless Communication Module Market. By processing data closer to the source, edge computing reduces latency and bandwidth requirements, improving the overall efficiency of wireless communication systems. This trend is particularly important in applications requiring real-time decision-making, such as autonomous vehicles, robotics, and industrial automation. The integration of edge computing with wireless modules ensures faster data processing, which is essential for emerging applications in sectors like healthcare, manufacturing, and logistics.

- For instance, ClearBlade’s 2024 Intelligent Assets platform updates enable rapid GenAI chatbot deployment and high-availability edge clusters for industrial use cases, processing data locally to ensure sub-10ms response times.

Market Challenges Analysis:

Security Concerns in Wireless Communication Systems

One of the key challenges in the Wireless Communication Module Market is the growing concern over security. As the number of connected devices increases, so does the risk of cyberattacks and data breaches. Wireless communication systems are vulnerable to hacking, unauthorized access, and malicious activities that can compromise sensitive data. Ensuring the security of communication modules through encryption, secure protocols, and robust authentication methods is a critical requirement. The complexity of securing large-scale wireless communication networks presents ongoing challenges to market stakeholders.

High Energy Consumption in Large-Scale Deployments

Another challenge facing the Wireless Communication Module Market is the energy consumption of large-scale wireless communication systems. While advancements in low-power technologies have helped, some wireless modules still consume significant amounts of energy, especially in extensive networks. This can increase operational costs and reduce the overall efficiency of deployed systems. Developing energy-efficient communication modules that offer optimal performance without compromising battery life or increasing costs remains a crucial challenge in the market.

Market Opportunities:

Expansion of 5G Networks

The ongoing rollout of 5G networks presents a significant opportunity for the Wireless Communication Module Market. 5G networks promise faster data transfer speeds, lower latency, and greater connectivity, which are essential for emerging applications such as autonomous vehicles, smart cities, and industrial automation. The demand for communication modules that support 5G standards is expected to rise rapidly as telecom providers and enterprises deploy next-generation wireless networks. This trend opens up new growth opportunities for companies involved in the development of advanced wireless modules.

Increasing Demand for Connected Healthcare Solutions

The rise of telemedicine, remote patient monitoring, and connected healthcare devices offers substantial opportunities for the Wireless Communication Module Market. As the healthcare industry embraces digital transformation, wireless communication modules play a key role in enabling seamless connectivity between medical devices, sensors, and healthcare platforms. These modules ensure real-time data transmission, improving patient care and operational efficiency. With an increasing emphasis on remote healthcare services and personalized medicine, the market for wireless communication modules in healthcare continues to expand.

Market Segmentation Analysis:

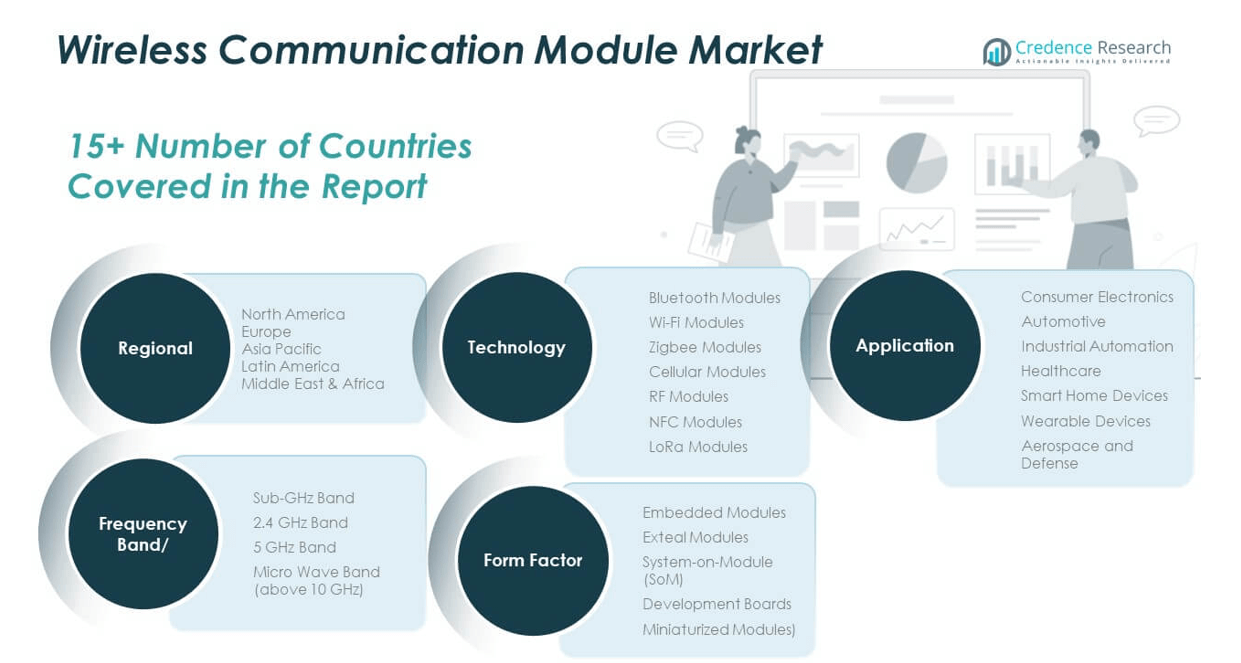

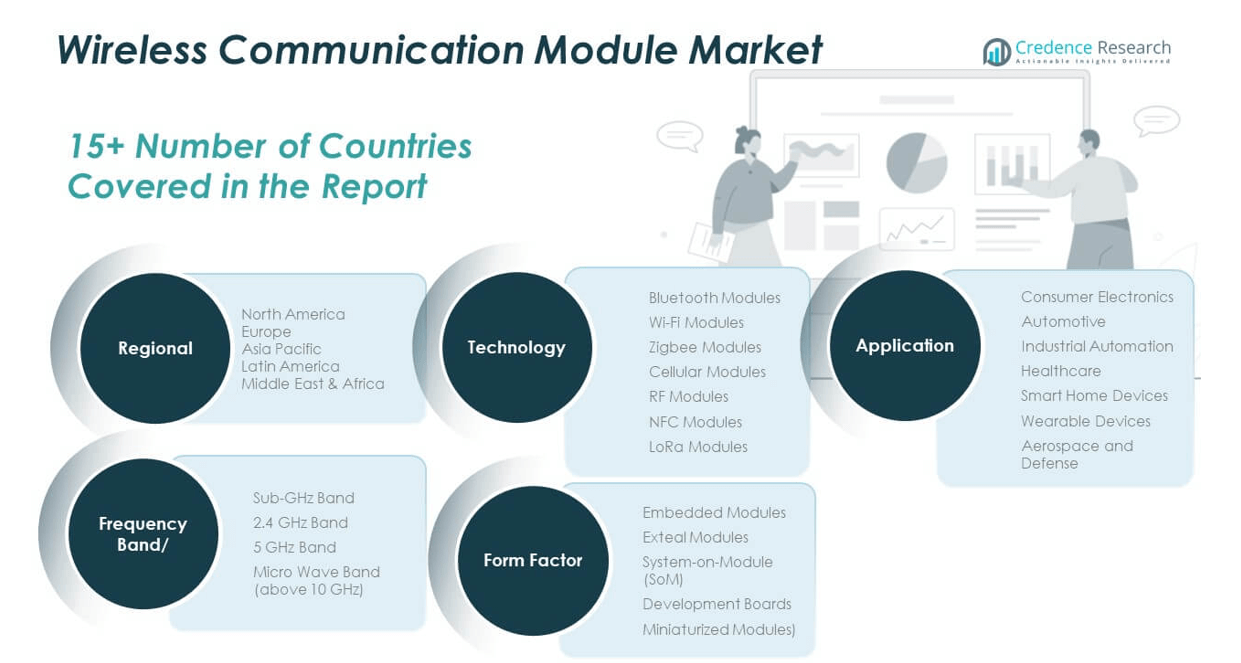

The Wireless Communication Module Market is segmented into several categories based on form factors, applications, frequency bands, and technologies.

By Form Factor Segments include embedded modules, external modules, system-on-module (SoM), development boards, and miniaturized modules. Embedded modules are widely used in industrial and consumer electronics due to their compact nature, while external modules offer more flexibility in terms of connectivity. SoM provides a complete communication system in a compact form, catering to space-sensitive applications.

- For instance, u-blox’s NORA-W2 Wi-Fi 4 and Bluetooth 5.2 embedded modules measure just 10.4 × 14.3 × 1.8 mm, enabling manufacturers to integrate robust wireless connectivity into consumer electronics, industrial sensors, and automation devices while minimizing PCB footprint.

By Application Segments highlight the versatility of wireless modules across industries. Consumer electronics dominate the market, with modules embedded in smartphones, wearables, and home automation devices. Automotive applications leverage wireless modules for connectivity and safety systems, while industrial automation and healthcare sectors benefit from real-time data transmission and remote monitoring. Smart home devices and wearable devices further enhance the market’s growth, driving demand for efficient wireless solutions. Aerospace and defense applications use advanced modules for communication in critical operations.

- For instance, Apple’s A15 Bionic chip integrates custom cellular, Wi-Fi 6, and Bluetooth 5.0 modules in the iPhone 13 family, supporting peak download speeds of up to 9.6 Gbps and ultra-low latency for consumer mobile experiences.

By Frequency Band Segments include the Sub-GHz, 2.4 GHz, 5 GHz, and microwave bands (above 10 GHz). Each frequency band serves specific needs, with the Sub-GHz band offering long-range communication, 2.4 GHz providing a balance of range and speed, and 5 GHz supporting high-speed, low-latency communication.

By Technology Segments comprise Bluetooth, Wi-Fi, Zigbee, cellular, RF, NFC, and LoRa modules. Bluetooth and Wi-Fi are essential for short-range communications in consumer electronics, while Zigbee and LoRa cater to low-power, wide-area networking. Cellular modules support mobile communication, and RF and NFC modules are used in various industrial and commercial applications. Each technology plays a crucial role in addressing the unique demands of the Wireless Communication Module Market.

Segmentation:

By Form Factor Segments:

- Embedded Modules

- External Modules

- System-on-Module (SoM)

- Development Boards

- Miniaturized Modules

By Application Segments:

- Consumer Electronics

- Automotive

- Industrial Automation

- Healthcare

- Smart Home Devices

- Wearable Devices

- Aerospace and Defense

By Frequency Band Segments:

- Sub-GHz Band

- 2.4 GHz Band

- 5 GHz Band

- Microwave Band (above 10 GHz)

By Technology Segments:

- Bluetooth Modules

- Wi-Fi Modules

- Zigbee Modules

- Cellular Modules

- RF Modules

- NFC Modules

- LoRa Modules

By Region Segments:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Wireless Communication Module Market size was valued at USD 1,365.60 million in 2018, increased to USD 1,810.27 million in 2024, and is anticipated to reach USD 3,571.33 million by 2032, at a CAGR of 9.0% during the forecast period. North America holds a significant market share of approximately 22.9% in the global Wireless Communication Module Market. The market is driven by the region’s strong technological infrastructure, rapid adoption of IoT, and extensive investments in 5G networks. The United States, being a major contributor, leads in demand for advanced communication systems, particularly in automotive, healthcare, and consumer electronics sectors. This trend is reinforced by government initiatives promoting the development of smart cities and digital transformation. North America’s market share will continue to grow as consumer demand for connected devices and the integration of wireless communication modules across industries remains high.

Europe

The Europe Wireless Communication Module Market size was valued at USD 1,035.84 million in 2018, increased to USD 1,328.63 million in 2024, and is anticipated to reach USD 2,446.69 million by 2032, at a CAGR of 8.0% during the forecast period. Europe holds a market share of approximately 20.5%. The market is driven by the demand for industrial automation, IoT integration, and the expansion of 5G networks. Countries like Germany, the UK, and France play a major role in the market, with Germany leading in smart manufacturing, automotive technologies, and IoT deployments. The European market benefits from its focus on sustainability, technological advancements, and high consumer adoption of smart devices. By 2032, Europe is expected to maintain a strong share of the market, driven by continued advancements in industrial automation and digital transformation.

Asia Pacific

The Asia Pacific Wireless Communication Module Market size was valued at USD 1,769.76 million in 2018, increased to USD 2,453.03 million in 2024, and is anticipated to reach USD 5,185.82 million by 2032, at a CAGR of 9.9% during the forecast period. Asia Pacific holds the largest market share, approximately 36.7%. The region benefits from rapid industrialization, urbanization, and a growing demand for connected devices. China and India lead the market due to large-scale investments in smart cities, IoT applications, and 5G infrastructure. The region is witnessing significant growth in industries such as automotive, healthcare, and consumer electronics. With the rise in the number of mobile devices, wearables, and IoT technologies, Asia Pacific will continue to dominate the market, capturing an even larger market share by 2032.

Latin America

The Latin America Wireless Communication Module Market size was valued at USD 330.72 million in 2018, increased to USD 441.36 million in 2024, and is anticipated to reach USD 814.53 million by 2032, at a CAGR of 8.1% during the forecast period. Latin America holds a market share of approximately 7.4%. The market is driven by the increasing demand for IoT devices, urbanization, and advancements in wireless communication technologies. Brazil and Mexico are the leading countries in this region, with significant investments in smart city projects, energy management systems, and industrial IoT solutions. The region will continue to see steady growth and capture a larger share of the market as connectivity solutions expand across various industries in the coming years.

Middle East

The Middle East Wireless Communication Module Market size was valued at USD 233.76 million in 2018, increased to USD 299.20 million in 2024, and is anticipated to reach USD 546.75 million by 2032, at a CAGR of 7.9% during the forecast period. The Middle East holds a market share of approximately 4.8%. The market is growing rapidly due to significant investments in infrastructure, smart city projects, and the adoption of IoT technologies. Countries like the UAE, Saudi Arabia, and Qatar lead the market, with substantial investments in digital transformation and wireless communication systems. The demand for connected devices in sectors such as healthcare, automotive, and energy is increasing, positioning the region for further growth in market share by 2032.

Africa

The Africa Wireless Communication Module Market size was valued at USD 64.32 million in 2018, increased to USD 130.58 million in 2024, and is anticipated to reach USD 207.81 million by 2032, at a CAGR of 5.4% during the forecast period. Africa holds a market share of approximately 2.0%. The market is showing signs of significant growth, driven by increasing mobile device penetration, rural connectivity projects, and advancements in wireless communication technologies. The demand for wireless communication modules is particularly strong in countries like South Africa and Nigeria, where there is growing investment in infrastructure and digital connectivity. Africa is expected to capture a larger portion of the global market share as mobile and IoT solutions expand across various industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Murata

- ROHM

- STMicroelectronics

- TDK

- FATEK

- NXP

- Siemens

- Microchip Technology

- ERL

Competitive Analysis:

The Wireless Communication Module Market is highly competitive, with several established players driving innovation and growth. Key market participants include companies like Qualcomm, Texas Instruments, Nordic Semiconductor, and Broadcom, which are leading in terms of technology advancements, product offerings, and strategic partnerships. These companies focus on providing reliable, high-performance wireless modules that support emerging technologies such as 5G, IoT, and industrial automation. Competitive strategies in the market involve continuous product development, mergers, and acquisitions to expand capabilities and enhance market presence. Companies are also focusing on offering cost-effective solutions to cater to a wide range of applications in automotive, consumer electronics, healthcare, and industrial sectors. With the increasing demand for connectivity and wireless solutions, competition will intensify as companies strive to meet evolving customer needs and capitalize on the growing market opportunities.

Recent Developments:

- In June 2025, STMicroelectronics announced the mass production of its ST67W611M1 Bluetooth/Wi-Fi module, developed in collaboration with Qualcomm. This marks the first product in ST’s and Qualcomm’s partnership, aiming to accelerate the integration of advanced wireless connectivity for IoT applications. The module supports Wi-Fi 6 and Bluetooth Low Energy 5.4, providing seamless solutions for both industrial and consumer devices

- In March 2025, Siemens entered into a new partnership with HMS Networks, with the Anybus Wireless Bolt 5G module successfully passing Siemens’ Device Interoperability Testing for 5G. This partnership enables Siemens to expand its portfolio of private 5G infrastructure and industrial wireless connectivity for demanding applications, with the Anybus Bolt showcased at the 2025 Hannover Messe in Germany.

- In April 2025, Murata launched and began mass production of its compact wireless communication module, Type 2FY. This new module features Infineon’s CYW55513 chip and supports Wi-Fi 6E across 2.4GHz, 5GHz, and 6GHz bands, as well as Bluetooth and Bluetooth Low Energy capabilities.

- In November 2023, ROHM completed the acquisition of Solar Frontier’s former Kunitomi Plant in Japan. While this acquisition primarily expands ROHM’s capacity for power semiconductor production, it signifies ROHM’s investment in its manufacturing footprint, which could impact its abilities in various product areas including wireless modules.

Market Concentration & Characteristics:

The Wireless Communication Module Market exhibits moderate concentration, with several key players holding significant shares, while also allowing room for regional and niche players. It is characterized by rapid technological advancements, particularly in 5G, IoT, and industrial automation sectors. The market is marked by high innovation, with companies focusing on enhancing data transfer speeds, reducing latency, and optimizing energy efficiency. Competition centers on product differentiation, with a strong emphasis on meeting the specific needs of various applications across industries like automotive, healthcare, and consumer electronics. Strategic collaborations, acquisitions, and investments in research and development are common among industry leaders, aiming to expand product portfolios and maintain competitive advantages.

Report Coverage:

The research report offers an in-depth analysis based on form factors, applications, frequency bands, and technologies. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Wireless Communication Module Market will continue to expand due to the increasing adoption of IoT devices across multiple industries.

- 5G technology will play a significant role in driving demand for faster, more reliable wireless communication modules.

- Growth in smart home technologies and connected consumer electronics will contribute to market expansion.

- Industrial automation and connected manufacturing systems will require advanced wireless modules for seamless operations.

- The healthcare sector’s shift toward connected medical devices will spur the demand for more reliable wireless communication solutions.

- Emerging markets in Asia Pacific will experience rapid growth, driven by urbanization and increasing disposable incomes.

- Strategic partnerships and acquisitions among market players will lead to enhanced product offerings and market consolidation.

- The expansion of cloud computing and edge computing technologies will boost the need for high-performance wireless communication modules.

- The rise in autonomous vehicles and connected automotive systems will be a key growth driver for the market.

- Sustainable wireless communication technologies with lower power consumption will gain traction due to environmental concerns and energy efficiency goals.