Market Overview:

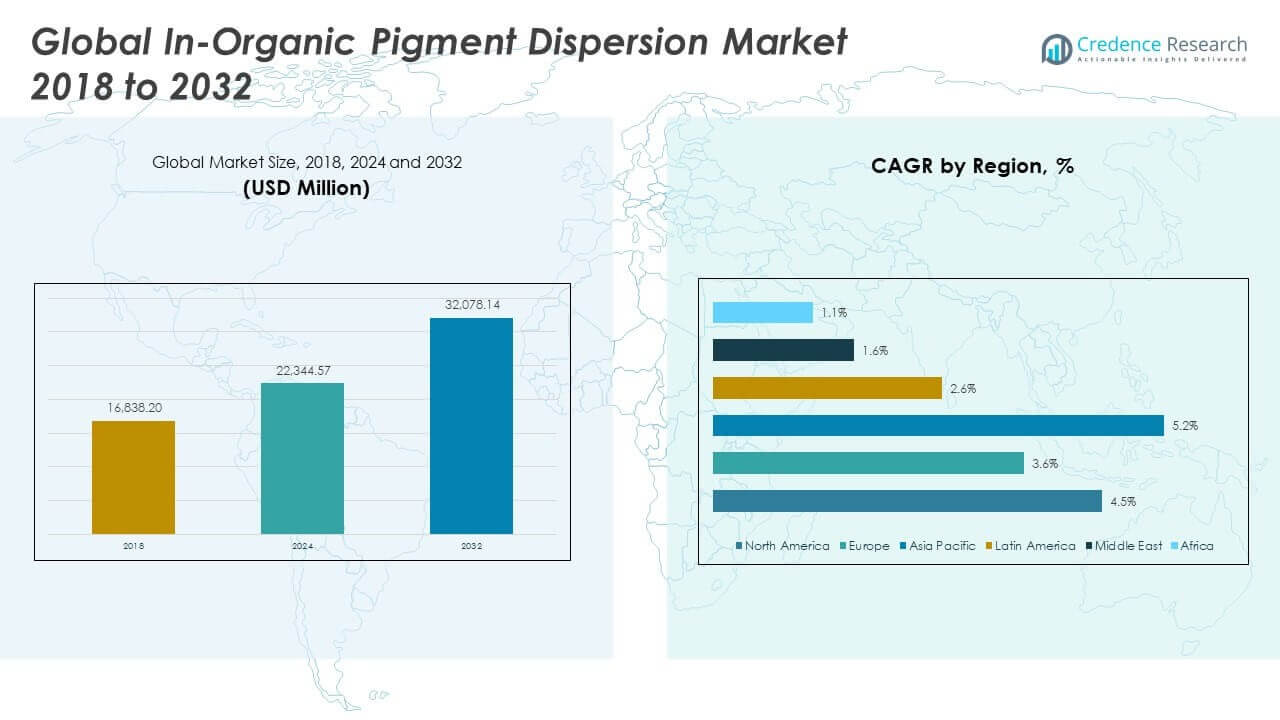

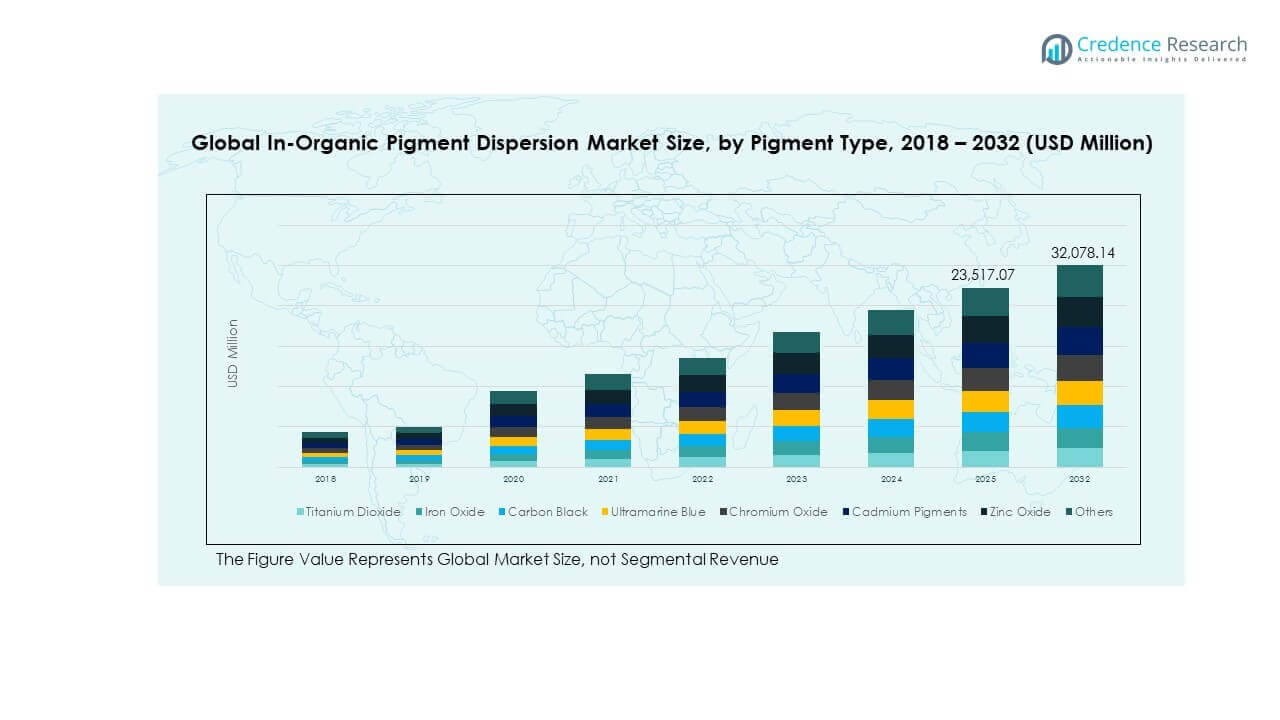

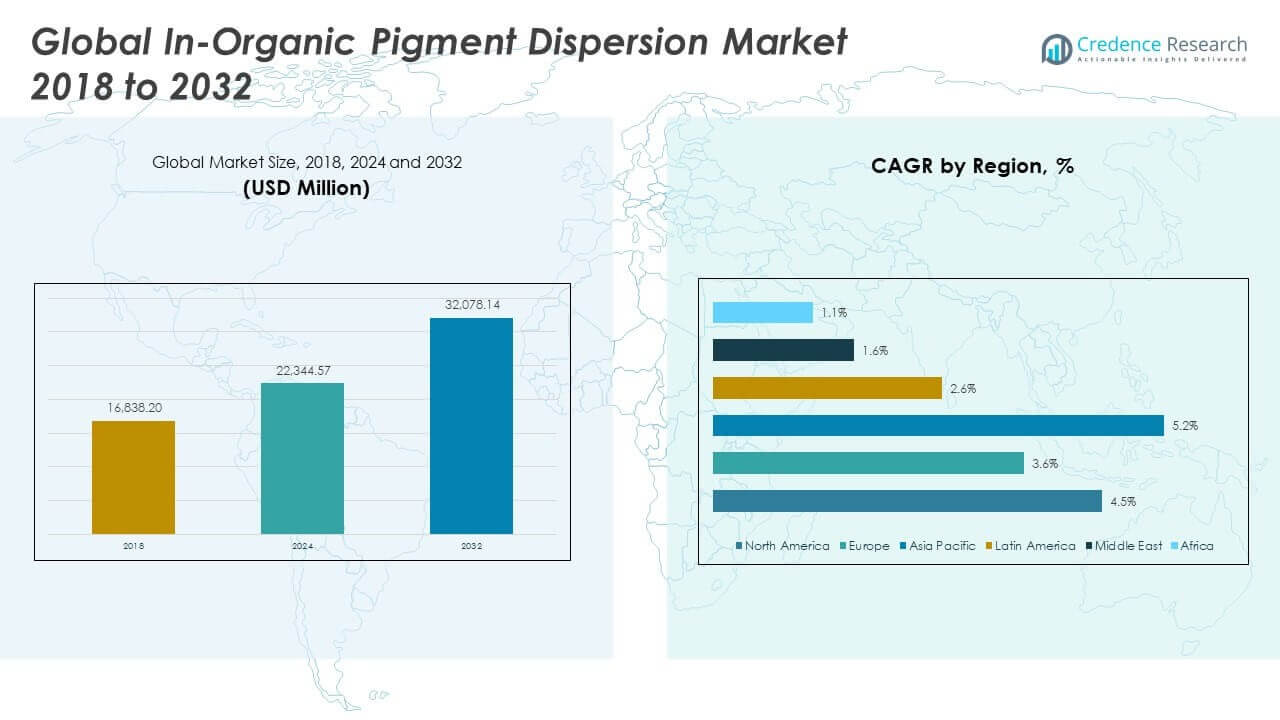

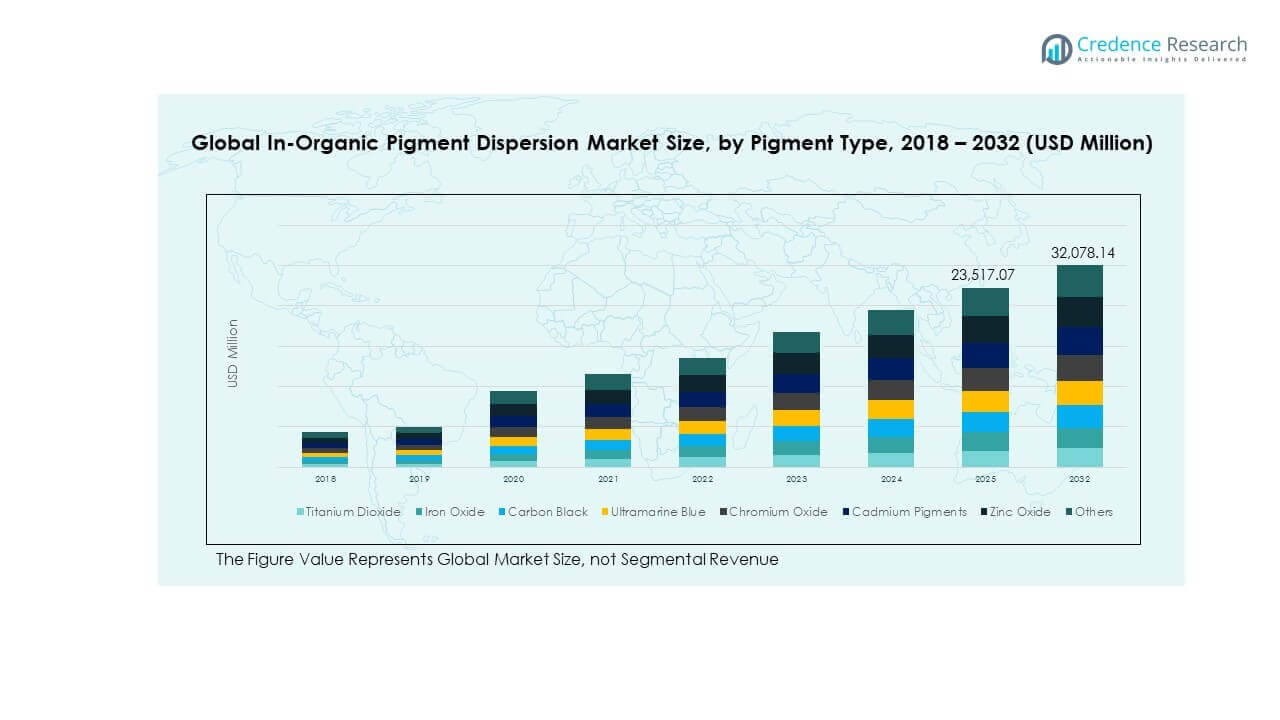

The Global In-Organic Pigment Dispersion Market size was valued at USD 16,838.20 million in 2018 to USD 22,344.57 million in 2024 and is anticipated to reach USD 32,078.14 million by 2032, at a CAGR of 4.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In-Organic Pigment Dispersion Market Size 2024 |

USD 22,344.57 Million |

| In-Organic Pigment Dispersion Market, CAGR |

4.53% |

| In-Organic Pigment Dispersion Market Size 2032 |

USD 32,078.14 Million |

Growth in this market is driven by rising demand across construction, automotive, and packaging industries, where inorganic pigment dispersions are widely used for their durability, chemical resistance, and color stability. Expanding infrastructure projects, increasing automotive production, and the need for sustainable and high-performance coatings are strengthening market growth. Environmental regulations are also encouraging the adoption of advanced inorganic pigment formulations, as industries aim to reduce volatile organic compound emissions while maintaining product efficiency and long-lasting finishes.

Regionally, Asia-Pacific dominates the market due to robust manufacturing activity, large-scale infrastructure development, and strong presence of key end-use industries in China, India, and Japan. North America and Europe show steady growth, supported by advancements in eco-friendly pigment technologies and strict environmental regulations. Meanwhile, Latin America and the Middle East & Africa are emerging markets, benefiting from rapid urbanization, rising construction activities, and increased industrialization that boost demand for durable pigments in coatings, plastics, and other applications.

Market Insights:

- The Global In-Organic Pigment Dispersion Market was valued at USD 16,838.20 million in 2018, reached USD 22,344.57 million in 2024, and is projected to attain USD 32,078.14 million by 2032, expanding at a CAGR of 4.53%.

- Asia Pacific held the largest regional share of 45.72% in 2024, driven by large-scale construction, automotive, and plastics industries. Europe followed with 27.60%, supported by strong regulations and advanced coatings demand, while North America held 18.38% due to industrial infrastructure and automotive coatings.

- Asia Pacific is also the fastest-growing region, expanding at 5.3% CAGR, propelled by infrastructure development, rapid urbanization, and rising consumer goods demand across China, India, and Southeast Asia.

- Titanium dioxide accounted for 41% of the pigment type share, reflecting its dominant use in paints, coatings, plastics, and construction applications, where opacity and brightness are critical. Iron oxide held 25%, and carbon black represented 15%, both widely used in construction, plastics, inks, and coatings requiring durability and tint strength.

- Paints & coatings commanded the largest application share at 46%, followed by plastics at 22%, demonstrating the continued importance of these industries in driving demand for inorganic pigment dispersions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Applications Across Construction and Automotive Industries

The Global In-Organic Pigment Dispersion Market is strongly driven by its wide applications in construction and automotive industries. Coatings and paints that incorporate inorganic pigment dispersions deliver high durability and resistance to harsh environments. The growing construction sector demands products with color stability, weather resistance, and cost efficiency. Automotive manufacturers depend on pigment dispersions for coatings that improve aesthetics and protect surfaces from corrosion. Demand from infrastructure development projects continues to create long-term opportunities for suppliers. The growing need for energy-efficient and sustainable buildings further boosts consumption. Rising disposable incomes in developing economies accelerate vehicle demand, strengthening growth prospects. It remains essential for manufacturers to tailor pigments to meet the strict requirements of these end-use sectors.

Rising Demand in Packaging and Consumer Goods

The packaging sector contributes significantly to the expansion of the Global In-Organic Pigment Dispersion Market. Pigment dispersions ensure long-lasting print quality, vibrant colors, and resistance to chemical interactions in packaging materials. The increasing popularity of branded packaging in food, beverages, and personal care industries fuels adoption. Consumer preferences for visually appealing and durable packaging solutions continue to drive growth. Retailers and manufacturers use pigment dispersions to enhance shelf appeal and improve product differentiation. Sustainability trends encourage the use of environmentally safe pigments in packaging inks. Growing e-commerce activity further raises the demand for durable packaging solutions. It positions the packaging industry as a consistent driver of market expansion.

Focus on Environmental Regulations and Sustainable Solutions

Regulatory frameworks across developed economies play a critical role in shaping the Global In-Organic Pigment Dispersion Market. Stricter controls on emissions and VOC levels create pressure for industries to adopt eco-friendly pigments. Manufacturers invest in innovative formulations that meet compliance requirements while ensuring performance. The emphasis on greener solutions encourages the replacement of solvent-based products with water-based alternatives. End users prefer materials with low environmental impact, aligning with global sustainability goals. The demand for recyclable and non-toxic pigment dispersions continues to rise. Governments and industry bodies promote awareness regarding eco-friendly products. It drives continuous research and development investments across leading pigment producers.

- For instance, according to the U.S. Environmental Protection Agency, water-based pigment inks used in packaging applications can cut VOC emissions by up to 90% compared to solvent-based inks, and are often formulated to meet EU REACH, FDA, and Swiss regulatory standards for packaging safety

Growth in Industrialization and Emerging Economies

Rapid industrialization in developing regions directly supports the expansion of the Global In-Organic Pigment Dispersion Market. Infrastructure development, urbanization, and rising industrial activities increase the need for durable coatings, plastics, and printing materials. Countries like China, India, and Brazil show significant consumption growth. Local manufacturing industries demand cost-effective pigments for large-scale production. Economic growth in emerging markets increases demand for consumer goods, housing, and automobiles. Small and medium enterprises actively invest in pigment solutions to meet expanding domestic requirements. Global producers expand operations in these regions to capitalize on demand growth. It ensures stronger supply chains and market penetration for both established and new entrants.

- For instance, in October 2024, Sudarshan Chemical Industries Ltd. announced a definitive agreement to acquire the German pigment manufacturer Heubach Group, resulting in a pigment powerhouse with 19 manufacturing sites globally, including major production facilities in India, Europe, and the Americas.

Market Trends

Innovation in High-Performance Pigment Technologies

The Global In-Organic Pigment Dispersion Market is witnessing a clear trend toward advanced pigment technologies. Manufacturers develop products with enhanced color fastness, heat stability, and chemical resistance. These innovations cater to industries requiring long-lasting and high-quality finishes. Automotive and aerospace sectors demand pigments that can withstand extreme environments. Nanotechnology integration improves dispersion quality and efficiency. Research into multifunctional pigments enhances usability across coatings, plastics, and textiles. High-performance pigments reduce the need for frequent applications, saving costs and resources. It enables producers to address industry-specific challenges while enhancing competitiveness in global markets.

- For instance, in April 2024, Sun Chemical introduced its INTENZA® Hana effect pigments at in-cosmetics Global in Paris. These new pigments deliver three shades featuring unique two-tone effects, produced using 100% USA-sourced mica and FDA-certified colors, with properties specifically engineered to deliver high chroma, enhanced bleed resistance, and minimized skin staining for cosmetic and personal care formulations

Integration of Digital Printing and Advanced Inks

A growing trend in the Global In-Organic Pigment Dispersion Market is the rising adoption of digital printing. The demand for pigment dispersions suitable for advanced inkjet systems continues to increase. Packaging and textile industries embrace digital printing for flexibility and customization. Dispersions tailored for digital inks provide superior dispersion stability and vivid colors. The expansion of e-commerce drives the demand for high-quality printed packaging. Printers and converters prefer dispersions that ensure efficiency and reduce waste. Continuous research focuses on improving compatibility with different substrates. It creates significant opportunities for pigment producers to expand into high-value printing applications.

- For instance, Clariant reported in its 2023 Integrated Report a reduction in “Days Away, Restricted, or Transferred” (DART) accident rates by over 46% and an increase in its Customer Net Promoter Score from 42 to 45, surpassing industry averages. These improvements are linked to investments in digital inkjet technology and customer-focused pigment dispersions, with the Catalysts business segment achieving 9% growth in local currency due to higher volumes and positive pricing actions.

Rising Popularity of Smart and Functional Coatings

Smart coatings are emerging as a major trend in the Global In-Organic Pigment Dispersion Market. Pigment dispersions designed for functional coatings enhance properties like UV resistance, anti-corrosion, and antimicrobial features. Industries adopt smart coatings to meet customer expectations for performance and safety. Construction projects increasingly demand self-cleaning and weather-resistant finishes. Healthcare and consumer goods sectors explore coatings that integrate antimicrobial pigments. The trend emphasizes the role of pigments beyond aesthetics, focusing on performance. It encourages continuous research into hybrid and multifunctional solutions. The shift toward smart coatings positions pigment dispersions as enablers of advanced material technologies.

Regional Supply Chain Expansion and Strategic Collaborations

Another key trend in the Global In-Organic Pigment Dispersion Market is the expansion of regional supply chains. Global players collaborate with local manufacturers to strengthen distribution and reduce costs. Investments in regional facilities ensure faster delivery and compliance with local regulations. Strategic collaborations enhance innovation and knowledge-sharing between companies. Demand in emerging economies encourages global producers to build stronger partnerships. Local supply availability improves competitiveness in price-sensitive markets. These collaborations also support customization for region-specific applications. It drives both efficiency and adaptability, strengthening the overall market structure.

Market Challenges Analysis

Environmental Compliance and Regulatory Pressure

The Global In-Organic Pigment Dispersion Market faces significant challenges due to environmental compliance. Stringent regulations in North America and Europe restrict the use of hazardous materials. Producers must develop eco-friendly dispersions while maintaining performance standards. Research and development costs rise as companies invest in sustainable alternatives. Smaller manufacturers struggle to align with compliance demands due to high investment requirements. Failure to meet regulatory standards risks losing market share and brand reputation. Import restrictions in regulated regions further complicate international trade. It creates pressure on producers to adopt innovation-driven strategies while controlling costs.

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in raw material prices remain a critical challenge for the Global In-Organic Pigment Dispersion Market. The dependence on minerals, metals, and specialty chemicals makes the sector vulnerable to supply chain risks. Rising geopolitical tensions and trade restrictions affect raw material availability. Transportation delays further disrupt supply consistency. Manufacturers face difficulties in maintaining price stability for end users. Volatility discourages smaller producers from scaling operations due to uncertainty. Global supply chain disruptions push companies to diversify sourcing strategies. It forces businesses to explore regional alternatives while balancing quality and cost efficiency.

Market Opportunities

Emerging Applications in Renewable Energy and Electronics

The Global In-Organic Pigment Dispersion Market offers growth opportunities in renewable energy and electronics applications. Pigments with thermal stability and conductivity properties find use in photovoltaic panels and electronic devices. The shift toward renewable technologies accelerates demand for advanced dispersions. Electronics manufacturers seek pigments that enhance performance while meeting safety standards. Growing global investment in clean energy strengthens long-term prospects. Producers capable of supplying high-performance dispersions gain competitive advantage in these sectors. The expansion of electronics and energy markets supports consistent revenue growth. It reinforces the role of pigment dispersions in next-generation technologies.

Expansion Potential in Latin America and Middle East & Africa

The Global In-Organic Pigment Dispersion Market has promising opportunities in Latin America and Middle East & Africa. Urbanization, construction growth, and infrastructure investment fuel demand in these regions. Rising consumer demand for durable goods boosts adoption across industries. Governments invest in housing and industrial projects, expanding pigment requirements. Regional industries show openness to cost-effective solutions, creating entry points for new suppliers. Partnerships with local firms help global producers strengthen distribution channels. Population growth further increases demand for housing, packaging, and consumer products. It positions these emerging regions as vital contributors to long-term global growth.

Market Segmentation Analysis:

By pigment type, the Global In-Organic Pigment Dispersion Market is led by titanium dioxide, which holds significant demand due to its brightness, opacity, and use across coatings, plastics, and construction materials. Iron oxide pigments contribute steadily with applications in architectural coatings, construction, and plastics requiring durability and color stability. Carbon black finds strong demand in printing inks, plastics, and coatings for its conductivity and tinting properties. Ultramarine blue and chromium oxide cater to niche applications in cosmetics, ceramics, and high-performance coatings. Cadmium pigments serve specialized markets needing intense, long-lasting colors. Zinc oxide supports coatings, plastics, and cosmetic applications. Other pigment types address tailored needs across diverse industries.

- For example, Chemours is recognized as a leading producer of titanium dioxide in North America, employing the chloride process across its major facilities. The company maintains market leadership, with industry sources reporting annual production in the range of several hundred thousand tons for 2024, rather than the 1,000 kilotonnes sometimes cited. Its operations emphasize high-quality pigment output and consistent supply, reinforcing its strong position in the regional market.

By application, the Global In-Organic Pigment Dispersion Market shows dominance in paints and coatings, driven by construction, automotive, and industrial projects. Printing inks segment gains traction from packaging and digital printing advancements. Plastics demonstrate consistent consumption with growth in consumer goods, automotive parts, and packaging. Construction materials utilize pigments for aesthetic and protective finishes in infrastructure projects. Ceramics and glass rely on dispersions for color stability and decorative purposes. Cosmetics integrate inorganic pigments for safety and long-lasting color effects. Other applications, including textiles and specialty chemicals, further enhance the overall market scope.

- For instance, in May 2024, PPG Industries launched a new line of automobile pigments engineered for enhanced color vitality and durability. These pigments set a new benchmark for performance in automotive and industrial OEM coatings, reinforcing PPG’s commitment to innovation and high-quality pigment solutions, according to an official company announcement.

Segmentation:

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global In-Organic Pigment Dispersion Market size was valued at USD 3,171.39 million in 2018 to USD 4,107.15 million in 2024 and is anticipated to reach USD 5,934.78 million by 2032, at a CAGR of 4.6% during the forecast period. North America holds 18.38% of the global market share in 2024. The region benefits from advanced industrial infrastructure, strong automotive production, and established construction activities. Demand for eco-friendly pigment dispersions is rising due to strict environmental regulations. The U.S. dominates regional growth with a robust coatings and plastics industry. Canada shows steady expansion through construction projects and packaging demand. Mexico strengthens its role with rising manufacturing capacity and cost-competitive production. It continues to adopt sustainable pigments aligned with innovation and regulatory standards.

Europe

The Europe Global In-Organic Pigment Dispersion Market size was valued at USD 4,819.67 million in 2018 to USD 6,167.25 million in 2024 and is anticipated to reach USD 8,340.53 million by 2032, at a CAGR of 3.8% during the forecast period. Europe accounts for 27.60% of the global market share in 2024. The region is shaped by advanced manufacturing sectors and strong adherence to environmental policies. Germany leads growth with automotive and specialty coatings industries. France and Italy support demand with architectural coatings and packaging applications. The UK contributes through high-quality inks and plastics manufacturing. Eastern Europe shows rising opportunities in construction and industrial projects. Innovation in eco-friendly pigment dispersions gains priority due to REACH compliance. It positions Europe as a region emphasizing quality, sustainability, and regulatory alignment.

Asia Pacific

The Asia Pacific Global In-Organic Pigment Dispersion Market size was valued at USD 7,429.59 million in 2018 to USD 10,219.71 million in 2024 and is anticipated to reach USD 15,558.19 million by 2032, at a CAGR of 5.3% during the forecast period. Asia Pacific holds the largest market share of 45.72% in 2024. China leads growth with its vast construction, automotive, and plastics industries. India shows rapid expansion with infrastructure projects and consumer goods demand. Japan and South Korea invest in high-performance pigments for advanced applications. Southeast Asia emerges as a strong hub with rising industrialization and urbanization. Regional demand is fueled by population growth and rising disposable incomes. Manufacturers expand capacity in this region to meet local needs. It maintains its dominance by combining scale, cost efficiency, and growing technological advancements.

Latin America

The Latin America Global In-Organic Pigment Dispersion Market size was valued at USD 759.79 million in 2018 to USD 995.13 million in 2024 and is anticipated to reach USD 1,256.69 million by 2032, at a CAGR of 2.9% during the forecast period. Latin America accounts for 4.45% of the global market share in 2024. Brazil leads regional demand due to its growing construction and automotive industries. Argentina supports expansion with industrial coatings and plastics production. Demand for durable pigments in packaging continues to strengthen. Rising urbanization drives steady growth in architectural coatings. Infrastructure projects supported by government initiatives improve long-term opportunities. However, economic fluctuations create challenges for consistent market expansion. It offers growth potential for manufacturers through cost-efficient and durable pigment dispersions.

Middle East

The Middle East Global In-Organic Pigment Dispersion Market size was valued at USD 408.06 million in 2018 to USD 487.73 million in 2024 and is anticipated to reach USD 571.87 million by 2032, at a CAGR of 1.9% during the forecast period. The Middle East contributes 2.18% of the global market share in 2024. The region’s demand is driven by large-scale construction and infrastructure development. GCC countries dominate with megaprojects and real estate investments. Turkey supports regional expansion through industrial and manufacturing activities. Israel shows progress in specialty coatings and plastics. Oil-dependent economies seek diversification, fueling investments in housing and industrial coatings. Sustainability awareness influences demand for eco-friendly pigment dispersions. It demonstrates moderate growth potential supported by construction-driven demand.

Africa

The Africa Global In-Organic Pigment Dispersion Market size was valued at USD 249.71 million in 2018 to USD 367.59 million in 2024 and is anticipated to reach USD 416.09 million by 2032, at a CAGR of 1.4% during the forecast period. Africa represents 1.64% of the global market share in 2024. South Africa dominates with coatings and construction sectors contributing to demand. Egypt expands market scope through packaging and infrastructure projects. Rising urbanization creates steady demand for affordable coatings and durable pigments. Limited industrial base restricts large-scale consumption compared to other regions. Imports remain critical to fulfilling pigment requirements across industries. Local manufacturing capacity is gradually improving with regional investments. It holds untapped potential, particularly in construction and consumer goods markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Clariant AG

- DIC Corporation

- Heubach GmbH

- Venator Materials PLC

- Lanxess AG

- Ferro Corporation

- Pidilite Industries

- Huntsman Corporation

- Sudarshan Chemical Industries

- Cabot Corporation

Competitive Analysis:

The Global In-Organic Pigment Dispersion Market features a highly competitive landscape with multinational corporations and regional players focusing on product innovation, sustainability, and supply chain strength. Leading companies such as BASF SE, Clariant AG, DIC Corporation, and Heubach GmbH emphasize research and development to deliver high-performance, eco-friendly dispersions that comply with strict regulations. Venator Materials PLC, Lanxess AG, and Ferro Corporation strengthen their positions through mergers, acquisitions, and regional expansions. Huntsman Corporation, Sudarshan Chemical Industries, and Cabot Corporation diversify portfolios to meet demand across coatings, plastics, packaging, and construction. Pidilite Industries leverages regional expertise to capture domestic markets. Competitive intensity is driven by the need to balance cost efficiency with advanced product performance. It underscores the importance of strategic partnerships, innovation in pigment formulations, and geographic expansion to maintain long-term market leadership.

Recent Developments:

- In June 2025, Clariant AG launched HOSTAPHAT OPS 100, a dispersing agent specifically developed for metal-containing pigments and their dispersions, supporting advanced pigment preparations in industrial coatings and related markets.

- In May 2025, BASF SE introduced Pluriol® A 2400 I, a new reactive polyethylene glycol designed for polycarboxylate ethers used in construction, which also serves as a dispersant for inorganic pigments, helping deliver higher performance and improved sustainability for pigment dispersion applications in Europe.

- In March 2025, Sudarshan Chemical Industries Limited (SCIL) announced the successful completion of its acquisition of the Germany-based Heubach Group, executed through its wholly owned subsidiary, Sudarshan Europe, utilizing a combination of asset and share transactions. In this development, SCIL significantly expanded its product portfolio and gained access to a globally diversified manufacturing and distribution network with reach across 19 international locations.

Report Coverage:

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will grow steadily in coatings and construction, driven by infrastructure and industrial development.

- Innovation in eco-friendly pigment dispersions will remain central to meeting regulatory compliance.

- Packaging applications will expand with rising e-commerce and branding requirements across industries.

- Automotive and aerospace sectors will adopt advanced pigments for performance and durability improvements.

- Digital printing inks will boost opportunities, supported by customization and flexible production trends.

- Regional growth will intensify in Asia Pacific, driven by large-scale manufacturing and urbanization.

- Strategic mergers and acquisitions will strengthen market consolidation and expand product portfolios.

- Sustainability initiatives will drive investments in water-based and low-VOC pigment dispersions.

- Emerging economies in Latin America, the Middle East, and Africa will provide new opportunities.

- Technological advancements in nanostructured pigments will create value-added solutions across end-use industries.