Market Overview:

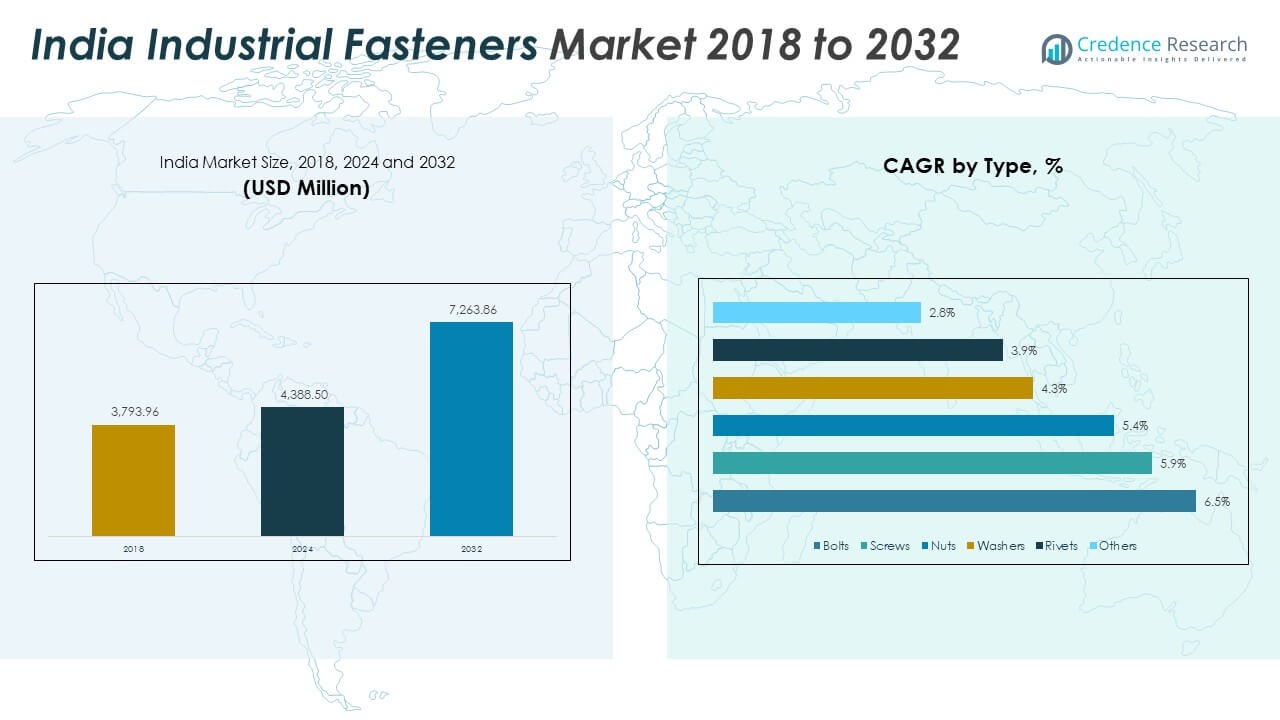

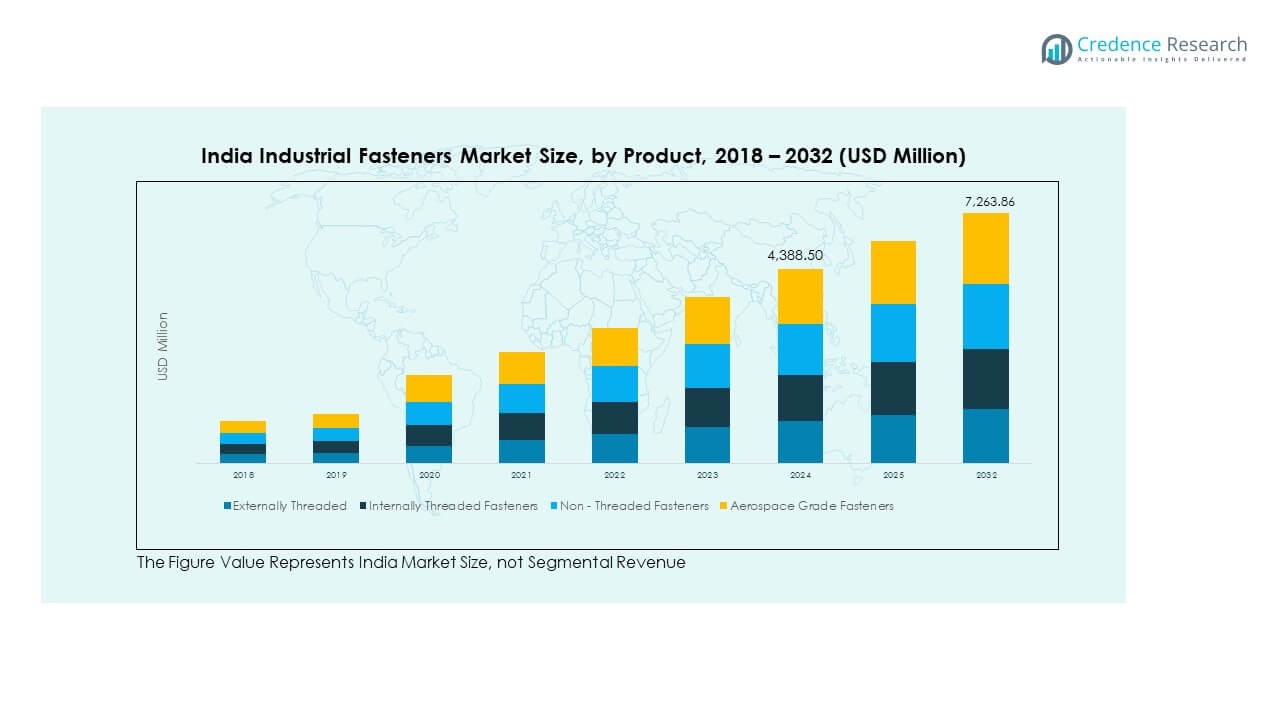

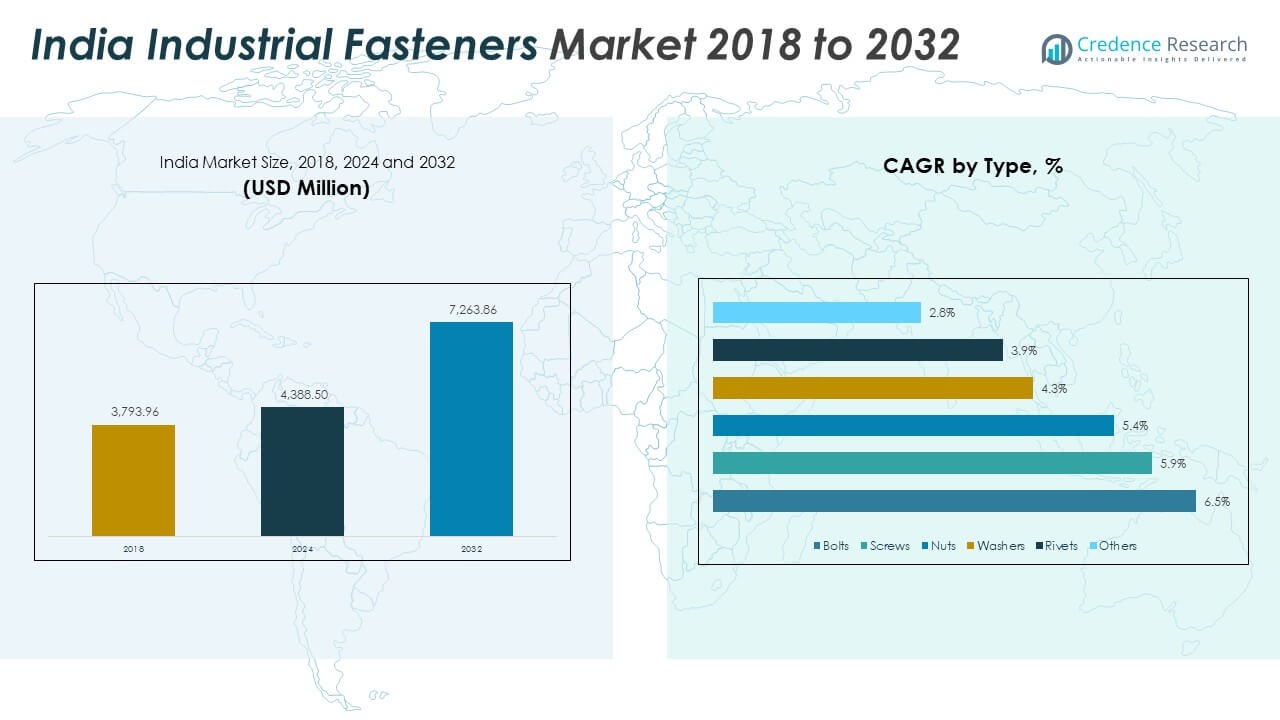

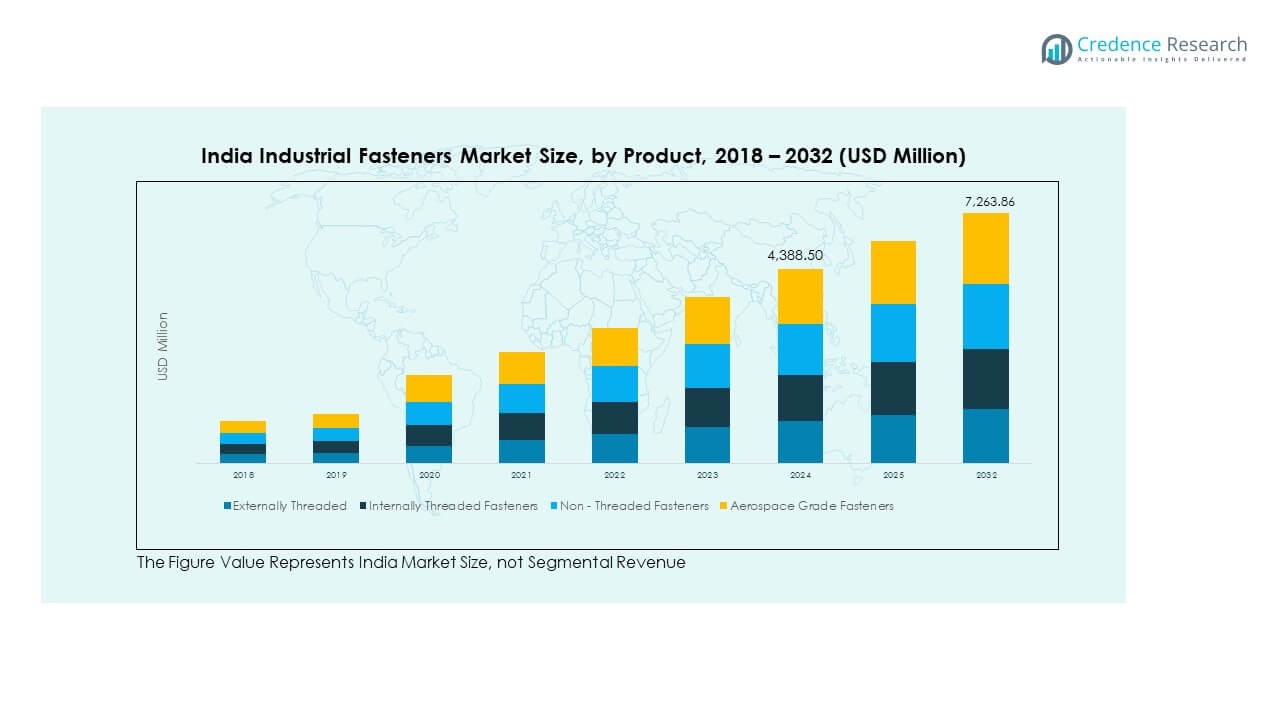

The India Industrial Fasteners Market size was valued at USD 3,793.96 million in 2018 to USD 4,388.50 million in 2024 and is anticipated to reach USD 7,263.86 million by 2032, at a CAGR of 6.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Industrial Fasteners Market Size 2024 |

USD 4,388.50 Million |

| India Industrial Fasteners Market, CAGR |

6.50% |

| India Industrial Fasteners Market Size 2032 |

USD 7,263.86 Million |

The market growth is supported by strong demand from automotive, construction, and manufacturing industries. Expanding infrastructure projects and housing developments in urban and semi-urban regions increase the need for fasteners. Growing adoption of advanced materials and lightweight fasteners further strengthens the industry. Rising industrial automation and modern machinery production also boost fastener consumption, enhancing efficiency and durability across sectors. A strong supply chain network and availability of low-cost manufacturing provide an added advantage for India.

Geographically, India’s fasteners market benefits from strong industrial bases in states like Maharashtra, Gujarat, and Tamil Nadu. Northern states such as Haryana and Uttar Pradesh also show strong demand, driven by automotive hubs and construction projects. Emerging regions in eastern and southern India are experiencing growth due to government initiatives supporting infrastructure and manufacturing expansion. Urbanization, coupled with the “Make in India” initiative, creates balanced growth across developed and emerging regions, making India a competitive player in global fasteners manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Industrial Fasteners Market was valued at USD 3,793.96 million in 2018, reached USD 4,388.50 million in 2024, and is projected to hit USD 7,263.86 million by 2032, growing at a CAGR of 6.50%.

- The northern region leads with 36% share, supported by automotive and engineering hubs, while the western region holds 28% due to industrial bases in Maharashtra and Gujarat. The southern region follows with 22%, led by aerospace and electronics demand.

- The eastern region holds 14% share and is the fastest-growing, driven by steel plants, construction, and infrastructure expansion.

- Externally threaded fasteners dominate with 40% share, reflecting their wide use in automotive and machinery. Internally threaded fasteners account for 25%, serving precision-driven applications.

- Non-threaded fasteners hold 20% share, while aerospace-grade fasteners capture 15%, supported by growth in defense and aviation.

Market Drivers:

Strong Growth in Automotive Production and Component Demand:

The India Industrial Fasteners Market is strongly supported by the automotive industry. Rapid expansion of passenger and commercial vehicle production drives high-volume demand for fasteners. Rising consumer preference for personal vehicles further boosts production across auto hubs. Global automotive firms setting up plants in India create a multiplier effect on demand. Suppliers are innovating with lightweight and high-strength fasteners to meet industry requirements. Electric vehicle manufacturing also increases the need for precision fasteners. The industry strengthens its role as a vital supplier to the automotive supply chain.

- For instance, ARaymond India is a preferred supplier of automotive fasteners to Bajaj Auto, manufacturing over 70% of parts locally and supporting the assembly of millions of motorcycles and three-wheelers annually across India. Suppliers are innovating with lightweight and high-strength fasteners to meet industry requirements. Electric vehicle manufacturing also increases the need for precision fasteners.

Infrastructure Expansion and Rapid Urbanization Stimulating Demand:

Large-scale infrastructure projects create a strong push for fasteners in construction and engineering. Government-led investments in highways, metro systems, and airports increase industrial consumption. Urban housing projects and smart city initiatives contribute to steady growth. Contractors prefer high-quality fasteners that offer durability in large structures. Demand extends to bridges, industrial parks, and power plants. Urbanization also supports furniture, electrical, and appliances industries that require fasteners. The construction sector reinforces the growth of the India Industrial Fasteners Market with long-term demand.

- For instance, Super Screws Pvt. Ltd from Haryana signed an MoU with Mitsuchi Corporation in 2024 to jointly manufacture specialized cold-forged fasteners for infrastructure projects, enhancing production capacity with precision tolerances supporting rapid urban development. Urbanization also supports furniture, electrical, and appliances industries that require fasteners.

Rising Manufacturing Output and Industrialization in Emerging Sectors:

Growing industrialization is driving higher consumption of industrial fasteners in manufacturing units. Sectors such as machinery, textiles, and energy require specialized fasteners for assembly and maintenance. Expansion of defense production facilities adds new dimensions to demand. Manufacturers are investing in capacity to support engineering exports. Industrial clusters in Gujarat, Maharashtra, and Tamil Nadu ensure a consistent supply base. Small and medium enterprises are also strengthening demand at regional levels. The market benefits from wider application scope across industries with diverse requirements.

Technological Innovations and Adoption of Advanced Materials:

Innovation in design and materials boosts the quality and strength of fasteners. Use of alloys, stainless steel, and composites enhances resistance and longevity. Technology-driven manufacturing improves precision and performance. Export markets prefer advanced fasteners meeting international standards. Automation in production increases consistency and lowers defects. Demand for custom-engineered fasteners supports the growth of specialized suppliers. It expands the market by catering to niche applications in aerospace and defense.

Market Trends:

Rising Demand for Customized and Application-Specific Fasteners:

Customers increasingly seek fasteners tailored to specialized applications. Aerospace, defense, and electronics industries demand products with exact tolerances. Customized fasteners ensure efficiency and reliability in critical systems. Manufacturers are adopting flexible production processes to meet unique orders. Export opportunities grow with international buyers preferring tailored products. Small and mid-sized suppliers are entering the customized solutions space. The India Industrial Fasteners Market reflects this trend by diversifying its product range.

Shift Toward High-Performance Coatings and Corrosion Resistance:

Fasteners with advanced coatings are gaining preference in harsh environments. Oil and gas, marine, and construction projects require products with extended durability. Zinc, nickel, and specialized chemical coatings improve corrosion resistance. Firms invest in eco-friendly plating processes that meet environmental regulations. Demand grows for fasteners with anti-rust properties in humid regions. Manufacturers integrate testing and certifications to assure long-term performance. It creates opportunities for innovation in surface treatment technologies.

- For instance, AN Fasteners in India offers surface-treated fasteners with eco-friendly coatings that significantly improve rust resistance, passing ASTM B117 salt spray tests beyond 1,000 hours, ensuring long-term durability in humid and marine environments. Firms invest in eco-friendly plating processes that meet environmental regulations.

Expansion of Online Distribution and E-Commerce Platforms:

Digital platforms are transforming procurement practices in industrial supply chains. Buyers prefer online portals for efficiency and transparency. E-commerce provides access to a wider variety of fasteners with real-time availability. SMEs benefit from easier procurement channels at competitive pricing. Online marketplaces support bulk orders and customization requests. Logistics advancements improve delivery to remote industrial regions. The India Industrial Fasteners Market adapts by integrating digital distribution strategies.

Increasing Global Trade and Export Opportunities for Indian Suppliers:

India is emerging as a key exporter of industrial fasteners. Competitive pricing and manufacturing scale support global expansion. Buyers from North America, Europe, and Asia-Pacific source from Indian firms. Compliance with ISO and ASTM standards increases trust in exports. Trade agreements boost access to international markets. Manufacturers are investing in global certifications to enhance credibility. It positions India as a reliable player in the global supply chain.

Market Challenges Analysis:

Fluctuations in Raw Material Prices and Supply Constraints:

The India Industrial Fasteners Market faces cost volatility linked to raw materials like steel, aluminum, and alloys. Global price swings impact production margins for manufacturers. Small players struggle with bulk procurement compared to larger firms. Unstable supply chains, driven by global disruptions, worsen the challenge. Dependency on imports for specialized materials adds pressure. Rising transportation costs influence the overall pricing structure. It restricts the ability of local suppliers to remain competitive in both domestic and export markets.

Intense Market Competition and Pressure on Quality Standards:

Strong competition from domestic and international firms challenges profitability. Unorganized players create pricing pressures with low-cost alternatives. Maintaining quality standards becomes difficult for smaller manufacturers. Customers prefer certified products, limiting the market for uncertified suppliers. Rapid technological shifts demand investment in new machinery and testing. Firms unable to adapt risk losing contracts to global rivals. The India Industrial Fasteners Market must balance affordability with strict quality expectations across industries.

Market Opportunities:

Rising Demand from Renewable Energy and Electric Vehicle Sectors:

The transition to clean energy sources supports new opportunities for fasteners. Wind turbines, solar projects, and electric vehicles require specialized fastening solutions. Lightweight, durable fasteners are crucial for meeting performance goals. Indian suppliers can expand by catering to these sectors. Partnerships with renewable energy firms create long-term growth potential. It allows firms to diversify beyond traditional markets. The India Industrial Fasteners Market benefits from innovation in sustainable applications.

Government Initiatives and Export Promotion Creating Growth Prospects:

Government policies such as “Make in India” support local manufacturing capacity. Export promotion councils provide assistance for global certifications and trade fairs. Incentives encourage firms to scale production and expand exports. Trade opportunities open new markets for specialized fasteners worldwide. Infrastructure and industrial investments create strong domestic demand. Policy support strengthens India’s global competitiveness in fasteners. It offers a dual advantage of growth in domestic and international markets.

Market Segmentation Analysis:

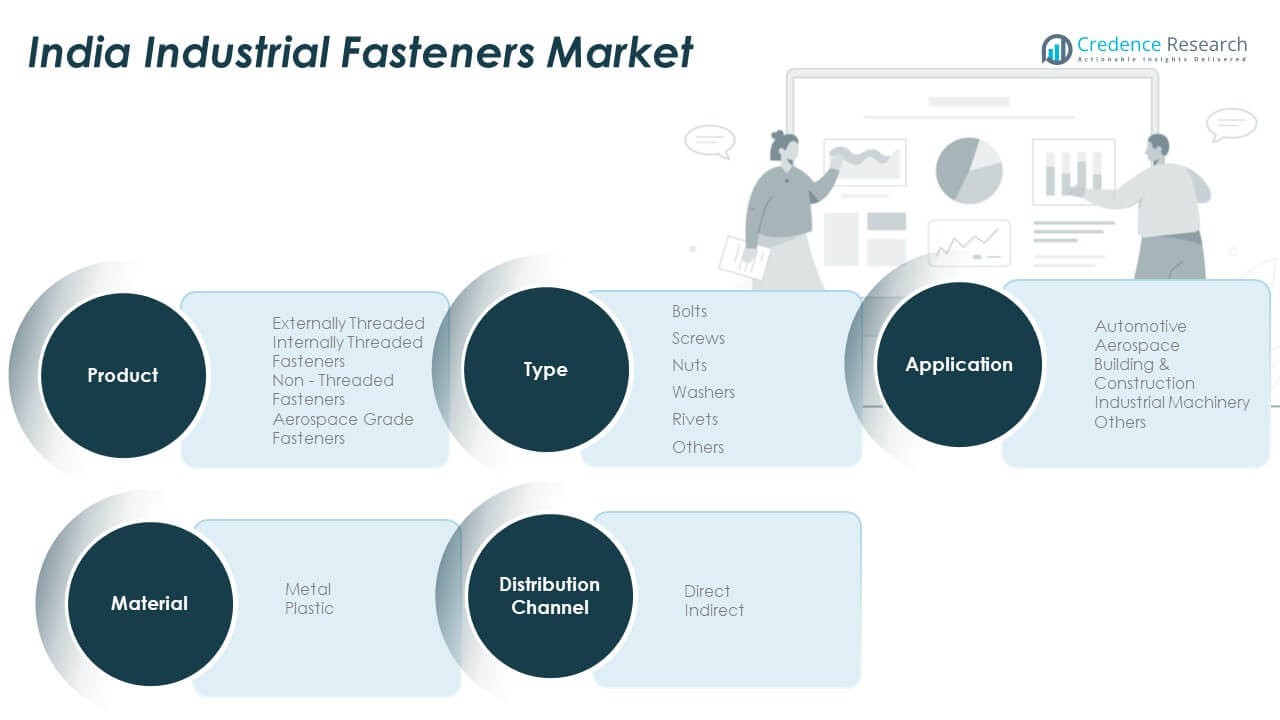

By Type and Product

The India Industrial Fasteners Market demonstrates strong demand across bolts, screws, nuts, washers, rivets, and other categories. Bolts and screws dominate usage due to their wide application in automotive and construction. Nuts and washers support structural integrity in machinery and infrastructure. Rivets and specialized fasteners gain traction in aerospace and heavy engineering. By product, externally threaded fasteners lead the market with extensive adoption in automotive and industrial machinery. Internally threaded fasteners support precision applications, while non-threaded fasteners address structural needs. Aerospace-grade fasteners cater to defense and aviation, emphasizing durability and strength.

- For instance, Bhansali Component & Fasteners, a company with over four decades of experience, employs precision machining to produce a variety of high-strength, stainless steel fasteners. These are used across various sectors like automotive, aerospace, and heavy machinery, ensuring consistent quality. General trends in the industry show nuts and washers are used for structural integrity, while specialized fasteners like rivets are gaining traction in demanding fields such as aerospace.

By Material

The market is primarily driven by metal fasteners, supported by steel and alloy-based products. Metal dominates due to high tensile strength, durability, and cost-effectiveness in industrial and construction applications. Stainless steel fasteners remain preferred for corrosion resistance and reliability in critical environments. Plastic fasteners, while smaller in share, are gaining demand in electronics and lightweight automotive applications. They provide flexibility, insulation, and cost advantages in niche areas. It benefits from a balanced mix of materials, allowing suppliers to serve diverse end-use industries.

- FOR INSTANCE, Hilton Steel is a leading Indian manufacturer and supplier of corrosion-resistant fasteners and forged components for various industrial applications. Stainless steel remains a preferred material for fasteners due to its corrosion resistance and reliability in critical environments.

By Application and Distribution Channel

Automotive leads the market, supported by strong domestic vehicle production and export demand. Aerospace emerges as a key segment, requiring precision-engineered fasteners for safety and performance. Building and construction also contribute significantly, driven by infrastructure expansion across India. Industrial machinery provides steady demand, ensuring long-term consumption of specialized fasteners. Other segments, such as electronics and furniture, add to market diversification. Direct distribution channels dominate with established supplier-buyer relationships, while indirect channels gain share through online platforms and distributors. It reflects a well-structured segmentation that balances traditional demand with emerging opportunities.

Segmentation:

By Type

- Bolts

- Screws

- Nuts

- Washers

- Rivets

- Others

By Product

- Externally Threaded

- Internally Threaded Fasteners

- Non-Threaded Fasteners

- Aerospace Grade Fasteners

By Material

By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Others

By Distribution Channel

Regional Analysis:

Northern Region Leading with Strong Automotive and Industrial Base

The northern region holds the largest share of the India Industrial Fasteners Market with around 36%. Haryana, Punjab, and Uttar Pradesh are key hubs for automotive and engineering industries, driving high-volume demand for fasteners. Gurgaon and Faridabad host major automotive OEMs and tier-1 suppliers, creating consistent consumption. The presence of industrial clusters further strengthens regional growth. Government-backed infrastructure projects in Delhi NCR support construction-related demand. It continues to maintain leadership due to its strong manufacturing ecosystem and strategic location.

Western Region Expanding with Manufacturing and Infrastructure Growth

The western region accounts for nearly 28% of the India Industrial Fasteners Market. Maharashtra and Gujarat are major contributors, supported by strong industrial bases and port infrastructure. Automotive production in Pune and Aurangabad drives steady demand. Gujarat supports industrial machinery and energy projects, increasing the need for durable fasteners. Construction of highways, smart cities, and industrial corridors reinforces the market footprint. It benefits from export opportunities due to efficient logistics and global trade access.

Southern and Eastern Regions Emerging as High-Growth Markets

The southern region captures about 22% share of the India Industrial Fasteners Market, driven by Tamil Nadu and Karnataka. Strong presence of automotive, aerospace, and electronics industries increases demand for advanced fasteners. Chennai and Bangalore remain critical centers for both domestic and export-oriented production. The eastern region holds nearly 14% share, led by West Bengal and Odisha, where construction and heavy industries fuel growth. Rising investments in steel plants and industrial corridors support consumption. It shows high growth potential as infrastructure development accelerates in tier-2 and tier-3 cities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The India Industrial Fasteners Market is highly competitive with strong participation from domestic and global players. Large companies such as Sundram Fasteners Limited, Sterling Tools Limited, and Deepak Fasteners Limited dominate organized production, while smaller firms cater to niche applications and price-sensitive segments. International manufacturers strengthen competition by offering certified products for aerospace and defense. It faces constant innovation with players investing in advanced materials, coatings, and lightweight fasteners. The presence of unorganized suppliers exerts pricing pressure, forcing larger firms to focus on quality, technology, and distribution networks. Strategic partnerships and export expansion remain central to market positioning.

Recent Developments:

- In February 2025, Universal Precision Screws exhibited at Fastener Fair Global 2025 in Stuttgart, Germany, showcasing their latest innovations and reinforcing their commitment to the international fastener industry.

- In March 2025, Deepak Fasteners Limited reported improved financial performance and growth in operations, with sustained production increases from their Madhya Pradesh plant, though no specific product launch or acquisition was detailed.

- KOVA Fasteners Pvt. Ltd. continues to emphasize quality and production capabilities as a certified manufacturer, focusing on state-of-the-art technology and customer service in their ongoing operations, without specific announcements of new launches or acquisitions recently.

Report Coverage:

The research report offers an in-depth analysis based on type, product, material, application, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising automotive production will continue to drive strong demand for fasteners.

- Aerospace-grade fasteners will expand with defense and aviation industry growth.

- Infrastructure development will sustain steady consumption across construction applications.

- Export opportunities will grow as Indian suppliers achieve international certifications.

- Customized and application-specific fasteners will gain wider adoption.

- Plastic and lightweight fasteners will see increased usage in electronics and EVs.

- Online distribution channels will enhance accessibility for SMEs and buyers.

- Advanced coatings and corrosion-resistant products will strengthen performance standards.

- Government initiatives will boost domestic manufacturing capacity and reduce import dependency.

- Regional industrial clusters will remain pivotal in shaping supply and demand dynamics.