| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Industrial Solvents Market Size 2024 |

USD 1,018.07 Million |

| India Industrial Solvents Market, CAGR |

9.33% |

| India Industrial Solvents Market Size 2032 |

USD 2,077.94 Million |

Market Overview

India Industrial Solvents Market size was valued at USD 1,018.07 million in 2024 and is anticipated to reach USD 2,077.94 million by 2032, at a CAGR of 9.33% during the forecast period (2024-2032).

The India Industrial Solvents market is driven by the expanding manufacturing sector, particularly in chemicals, pharmaceuticals, and coatings industries, which increasingly rely on solvents for production processes. Rising demand for industrial paints, coatings, and adhesives, particularly in automotive and construction sectors, further fuels market growth. Additionally, the growing focus on sustainable and eco-friendly solvents, spurred by stringent environmental regulations and consumer preference for green products, is shaping the market landscape. The rise of industrialization and urbanization in India, coupled with rapid growth in sectors like automotive, electronics, and textiles, continues to drive the demand for solvents. Innovations in solvent formulations, aimed at improving efficiency and reducing environmental impact, are also contributing to market expansion. Moreover, the increasing use of industrial solvents in cleaning and degreasing applications across various industries is supporting the overall market growth trajectory in India.

Geographical analysis of the India Industrial Solvents market reveals strong regional demand across Northern, Western, Southern, and Eastern India, with the Western region leading due to its industrial base, particularly in states like Gujarat and Maharashtra. The Northern region, including Delhi and Haryana, is driven by pharmaceuticals and automotive industries, while the Southern region, with key states like Tamil Nadu and Karnataka, has a growing demand due to its manufacturing and chemical sectors. The Eastern region, though smaller in comparison, is experiencing growth through infrastructure development and industrial projects. Key players in the Indian Industrial Solvents market include global and domestic giants such as Reliance Industries Limited, Tata Chemicals Ltd., and Formosa Plastics Corporation. International companies like Sinopec Group, Mitsubishi Chemical Holdings, and LG Chem Ltd. also play a significant role in the market, offering a wide range of industrial solvents to meet the diverse needs of various industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Industrial Solvents market was valued at USD 1,018.07 million in 2024 and is expected to reach USD 2,077.94 million by 2032, growing at a CAGR of 9.33% from 2024 to 2032.

- The global industrial solvents market was valued at USD 34,660.50 million in 2024 and is expected to reach USD 60,647.79 million by 2032, growing at a CAGR of 7.24% during the forecast period (2024-2032).

- Increasing industrialization and rapid urbanization are key drivers boosting demand across sectors like paints and coatings, automotive, and pharmaceuticals.

- A growing shift toward eco-friendly and bio-based solvents is one of the key market trends, with increasing adoption across various industries.

- Technological advancements in solvent recovery and recycling are enhancing sustainability and reducing operational costs for industries.

- Intense competition from both domestic and international players, such as Reliance Industries, Sinopec Group, and Mitsubishi Chemical Holdings, is driving innovation.

- Stringent environmental regulations and the high cost of eco-friendly alternatives may hinder market growth.

- The Western region dominates the market due to its strong industrial base, followed by the Northern and Southern regions, with the Eastern region witnessing steady growth.

Report Scope

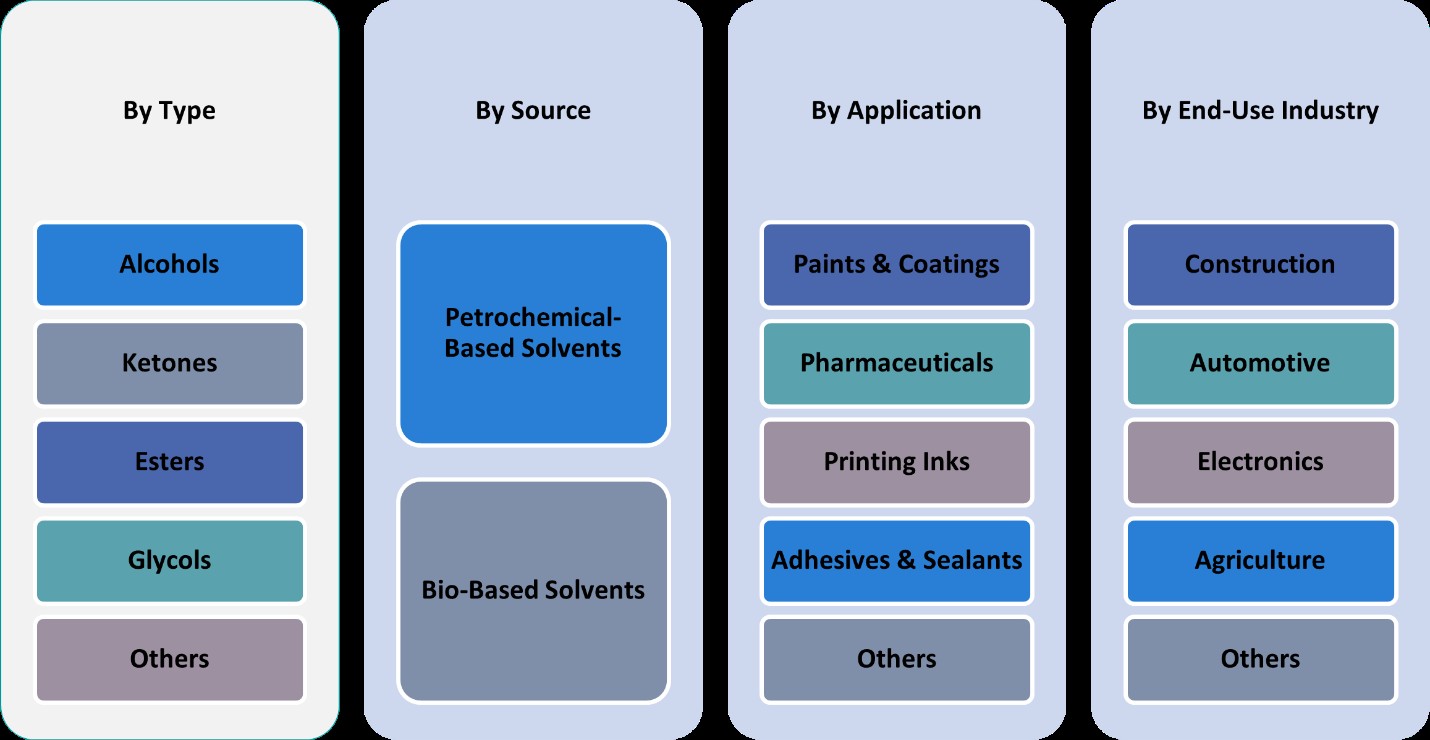

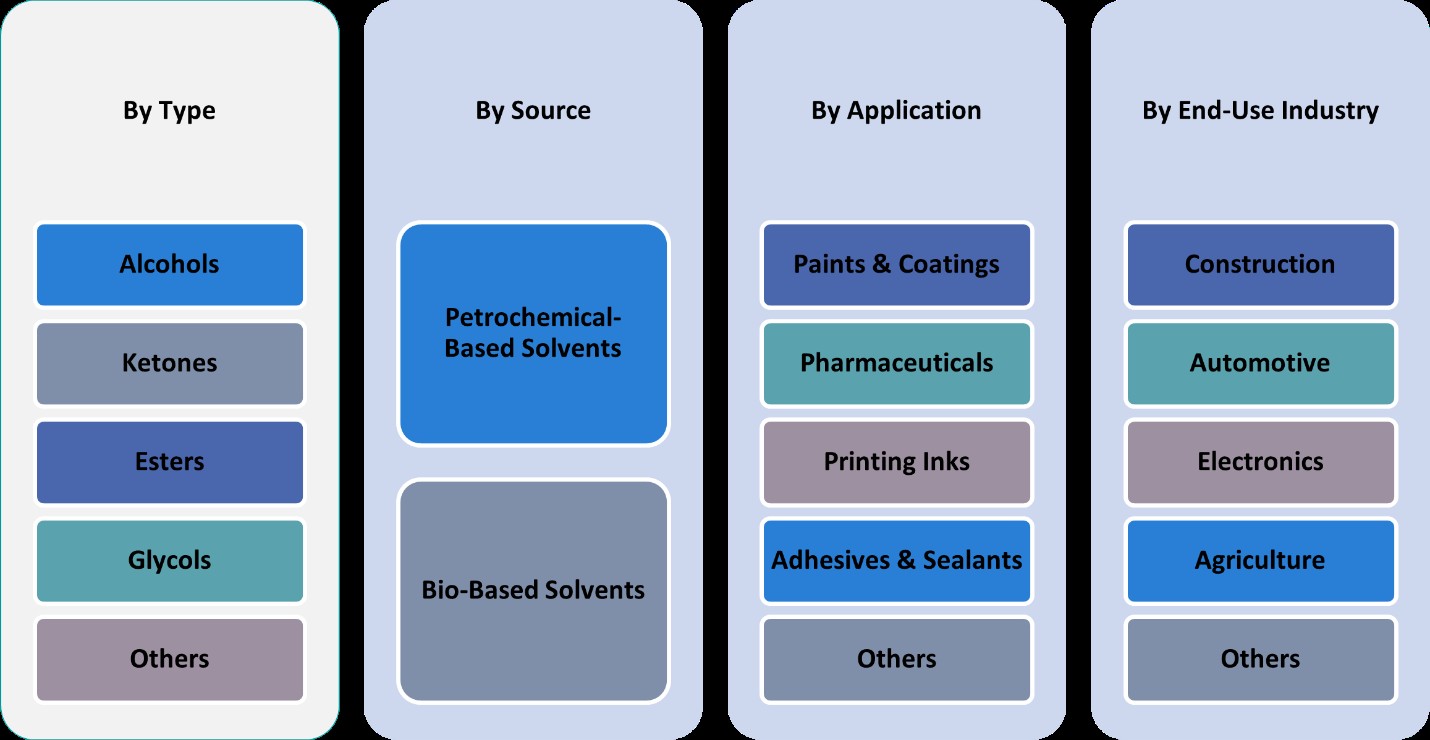

This report segments the India Industrial Solvents Market as follows:

Market Drivers

Growing Industrialization and Manufacturing Sectors

India’s industrial growth is a significant driver for the demand for industrial solvents. As the country continues to expand its manufacturing capabilities across various industries, including chemicals, textiles, automotive, and electronics, the demand for industrial solvents has surged. Solvents play a crucial role in production processes such as mixing, dissolving, and formulating products like paints, coatings, adhesives, and pharmaceuticals. With the government’s initiatives like “Make in India” and the push towards manufacturing self-sufficiency, industrial activities in India are expected to grow steadily. This growth directly correlates to a higher demand for solvents, particularly in the automotive and construction sectors, where coatings and adhesives are essential. As more factories and production units come up across the country, solvent usage is likely to witness consistent increases.

Expansion of End-Use Industries

The growth of key end-use industries is another significant factor driving the demand for industrial solvents. Key sectors such as pharmaceuticals, paints and coatings, adhesives, and chemicals rely heavily on solvents for the formulation of products and production processes. For instance, the India Industrial Development Report highlights the pharmaceutical sector’s rapid expansion, driven by increasing healthcare demand and India’s leadership in generic drug manufacturing. The paints and coatings industry is also benefiting from rapid urbanization, with a surge in demand for decorative and industrial coatings. The automotive sector further contributes to the rising demand for solvents, where they are used in automotive paints and surface treatments. As these industries expand, solvent consumption is expected to grow, thereby driving the overall market demand in India.

Regulatory Push for Eco-friendly Solutions

The rising emphasis on sustainability and environmental regulations is significantly influencing the India Industrial Solvents market. The Indian government has imposed stricter environmental norms, including regulations on VOC (volatile organic compound) emissions from solvents. For instance, India’s Green and Bio-solvents Market report highlights the growing adoption of bio-based solvents due to regulatory pressures and sustainability commitments. This has encouraged manufacturers to innovate and develop more environmentally friendly solvents, such as bio-based and water-based alternatives, to comply with environmental standards. These green solvents are gaining traction due to their lower environmental impact and safer use in industrial processes. Additionally, consumers are becoming more aware of environmental concerns, pushing companies to adopt eco-friendly practices. This shift towards sustainable solvents is not only supporting market growth but also opening up new opportunities for companies that are able to innovate and meet these changing demands.

Technological Advancements and Product Innovations

Technological advancements and continuous innovation in solvent formulations are major drivers of the India Industrial Solvents market. Manufacturers are investing in research and development to produce high-performance solvents that offer better efficiency, lower toxicity, and improved environmental profiles. Innovations include solvents with better dissolving power, enhanced compatibility with various production systems, and reduced hazardous content, which align with growing regulatory demands. Furthermore, advancements in solvent recycling technologies are reducing waste and improving the sustainability of solvent use. These innovations not only benefit environmental goals but also help reduce production costs for manufacturers. As industries in India continue to adopt cutting-edge technologies in production processes, the demand for high-quality, specialized solvents is expected to increase.

Market Trends

Shift Toward Green and Bio-based Solvents

The Indian industrial solvents market is undergoing a substantial shift as industries increasingly focus on sustainability and regulatory compliance. With growing concerns about environmental pollution, the market is seeing a rapid shift towards green and bio-based solvents. These solvents, derived from renewable natural resources such as plants, algae, or other organic materials, are gaining traction due to their reduced toxicity, lower volatile organic compound (VOC) emissions, and overall lower environmental impact compared to traditional petrochemical-based solvents. Industries like paints and coatings, pharmaceuticals, and industrial cleaning are the largest adopters of these bio-based alternatives. The transition to green solvents is further driven by the Indian government’s push for sustainability through stricter environmental regulations and the global trend towards eco-friendly manufacturing processes. Manufacturers are increasingly required to reduce their carbon footprint, and bio-based solvents provide a viable solution.

Growth in Industrial Cleaning Applications

The industrial cleaning sector in India is experiencing substantial growth, which is directly influencing the demand for industrial solvents. As manufacturing activities increase and industries expand, the need for cleaning and degreasing equipment, machinery, and production lines becomes more critical. For instance, the India Industrial Cleaning Solvents Market report highlights the increasing demand for cleaning solvents due to rising industrial activities and regulatory hygiene standards. Industrial cleaning solvents are essential for maintaining machinery, ensuring safety standards, and preventing equipment breakdowns. The demand for industrial cleaning solvents in India is driven by the growth of manufacturing sectors such as automotive, food processing, and pharmaceuticals, where cleanliness and sanitation are critical. Additionally, stringent regulatory requirements for hygiene and cleanliness, particularly in industries like food and pharmaceuticals, are further boosting the demand for effective and efficient cleaning solvents. Hydrocarbon solvents, which are traditionally used for industrial cleaning applications, continue to dominate this segment. However, bio-based cleaning solvents are emerging as a fast-growing category, driven by their environmental benefits and regulatory advantages. The increasing adoption of these eco-friendly solvents reflects the broader trend toward sustainability and environmental responsibility in India’s industrial landscape.

Regional Market Dynamics and Sectoral Growth

India’s industrial solvents market is also characterized by regional dynamics that shape consumption patterns. For instance, West India, in particular, continues to dominate the market due to its industrial concentration, particularly in sectors like pharmaceuticals, paints and coatings, and agriculture. The region is projected to account for over 1.2 million tons of solvent consumption by 2024. This dominance is driven by the high number of manufacturing plants, chemical facilities, and production units located in states such as Gujarat and Maharashtra. These regions have a well-established industrial base, strong infrastructure, and easy access to raw materials, which makes them hubs for industrial solvent consumption. The paints and coatings sector remains a key consumer of solvents, particularly in urban development and infrastructure projects, where high-quality coatings and adhesives are in demand. With increasing urbanization, the demand for paints and coatings, especially for construction and automotive applications, is expected to drive significant growth in solvent consumption. The automotive industry, in particular, contributes significantly to the demand for solvents used in automotive coatings and surface treatments.

Technological Advancements in Solvent Recovery

Another key trend in the Indian industrial solvents market is the increasing adoption of solvent recovery technologies. As industrial solvents are used extensively in various applications such as cleaning, degreasing, and chemical processing, the need for efficient solvent management systems has become critical. Technological innovations in solvent recovery, such as advanced distillation, filtration, and adsorption techniques, are enabling industries to recycle and reuse solvents, thereby reducing waste and cutting operational costs. These technologies help industries meet both environmental and economic goals by minimizing the need for fresh solvent supplies and reducing hazardous waste. The adoption of solvent recovery systems is particularly prominent in industries with high solvent consumption, such as automotive, pharmaceuticals, and industrial cleaning. These recovery systems contribute to a circular economy approach by extending the lifecycle of solvents and reducing overall production costs. Moreover, with increasing regulatory pressures regarding waste disposal and emissions, these recovery technologies help companies comply with stringent environmental standards. The demand for solvent recovery solutions is expected to rise as industries seek to enhance sustainability, reduce costs, and comply with increasingly strict environmental regulations.

Market Challenges Analysis

Stringent Environmental Regulations and Compliance Costs

One of the primary challenges facing the India Industrial Solvents market is the increasing pressure from environmental regulations. The Indian government has introduced stricter standards related to the emission of volatile organic compounds (VOCs) and the disposal of hazardous waste generated during the use of solvents. For instance, a study on environmental regulatory compliance in India highlights the growing enforcement of pollution control measures, requiring industries to adopt cleaner technologies and sustainable practices. This regulatory landscape is pushing manufacturers to invest in cleaner technologies and adopt eco-friendly solvents. However, the transition to green solvents or the implementation of VOC control technologies involves significant upfront costs, which can be a barrier, especially for small and medium-sized enterprises (SMEs). While regulatory compliance is essential for sustainable growth, it adds financial and operational pressure on manufacturers to innovate and upgrade their production facilities, leading to increased operational costs.

Fluctuating Raw Material Prices and Supply Chain Disruptions

The volatility of raw material prices is another challenge that impacts the India Industrial Solvents market. Solvents are derived from petrochemical products, and the prices of these raw materials can fluctuate significantly due to global oil price changes, geopolitical tensions, and supply chain disruptions. Such price volatility directly affects the production costs of solvents, making it challenging for manufacturers to maintain price stability and profitability. Additionally, disruptions in the supply chain, whether due to natural disasters, transportation issues, or global trade restrictions, can cause delays in solvent availability, further exacerbating challenges in inventory management and production schedules. These issues often lead to production slowdowns, affecting the overall supply and demand balance in the market.

Market Opportunities

The India Industrial Solvents market presents significant growth opportunities driven by a variety of factors. As industrialization continues to expand across the country, there is an increasing demand for solvents in various sectors such as chemicals, paints and coatings, pharmaceuticals, and automotive. The government’s “Make in India” initiative, which aims to boost domestic manufacturing, coupled with rapid urbanization, provides a fertile ground for growth in these sectors. The paints and coatings industry, in particular, is experiencing a boom, with growing demand for high-quality finishes in construction and automotive applications. This trend is expected to drive the consumption of industrial solvents, especially those used in coatings, adhesives, and other surface treatment processes. Furthermore, the rise in demand for pharmaceuticals and the increasing adoption of advanced pharmaceutical production technologies will likely boost the demand for solvents in drug formulation and manufacturing processes.

Additionally, the growing shift towards sustainable and eco-friendly practices presents substantial opportunities for the market. There is an increasing preference for bio-based and green solvents, driven by both regulatory pressures and changing consumer preferences for environmentally responsible products. As governments implement stricter environmental regulations, industries are incentivized to adopt greener alternatives that comply with new VOC (volatile organic compounds) emission standards. This trend is leading to innovations in bio-based solvents, offering a competitive edge to manufacturers who can offer environmentally friendly solutions. The growing focus on circular economy principles, particularly in solvent recovery and recycling, also offers opportunities for businesses to develop solutions that promote resource efficiency and minimize waste. Overall, as industries strive for sustainability and efficiency, there is a clear and expanding opportunity for growth in India’s industrial solvents market.

Market Segmentation Analysis:

By Type:

The India Industrial Solvents market can be categorized based on the type of solvent, with major segments including alcohols, ketones, esters, glycols, and others. Among these, alcohols hold a significant share due to their versatility and wide usage across various industries. Alcohols like ethanol and isopropyl alcohol are commonly used in pharmaceuticals, cleaning, and paints and coatings due to their ability to dissolve a wide range of substances. Ketones, particularly acetone, are also extensively used in paints and coatings and as cleaning agents due to their strong solvency power. Esters, such as ethyl acetate, are favored in the production of adhesives, coatings, and printing inks for their low toxicity and excellent evaporation rates. Glycols, primarily ethylene glycol, are used in antifreeze formulations and as a base in various industrial applications. The “others” category includes solvents such as hydrocarbons and terpenes, which find applications in specialized sectors like agriculture and personal care products. The diverse range of solvent types caters to various industrial needs, driving growth across all segments.

By Application:

The India Industrial Solvents market is also segmented based on application, including paints and coatings, pharmaceuticals, printing inks, adhesives and sealants, and others. The paints and coatings sector is the largest consumer of industrial solvents, driven by the rapid growth of the construction, automotive, and infrastructure industries. Solvents such as alcohols and ketones are commonly used in coatings to facilitate smooth application and improve finish quality. The pharmaceuticals segment is another major contributor to the market, with solvents playing a crucial role in drug formulation, extraction, and purification processes. As India’s pharmaceutical industry continues to expand, driven by increasing domestic and global demand, the demand for solvents is expected to rise. Printing inks and adhesives and sealants are also prominent sectors utilizing industrial solvents for their ability to dissolve resins, pigments, and binders. In addition, specialized applications like cleaning, agriculture, and personal care are contributing to the “others” category. The diverse application landscape ensures that the industrial solvents market remains robust and dynamic across various sectors in India.

Segments:

Based on Type:

- Alcohols

- Ketones

- Esters

- Glycols

- Others

Based on Application:

- Paints & Coatings

- Pharmaceuticals

- Printing Inks

- Adhesives & Sealants

- Others

Based on End- Use:

- Construction

- Automotive

- Electronics

- Agriculture

- Others

Based on Source:

- Petrochemical-Based Solvents

- Bio-Based Solvents

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Western Region

The Western region of India holds the largest market share in the industrial solvents sector, contributing more than 35% to the overall market. This dominance is largely attributed to the region’s strong industrial base, particularly in states like Gujarat, Maharashtra, and Rajasthan. Gujarat is home to some of the country’s largest chemical and pharmaceutical manufacturing hubs, making it a key driver of solvent demand. Maharashtra, with its booming automotive, coatings, and construction industries, further strengthens the demand for solvents, especially for paints and coatings, adhesives, and automotive finishes. The rapid industrialization in this region and its proximity to major ports also facilitate the availability of raw materials and export activities, enhancing the market’s growth prospects.

Northern Region

The Northern region accounts for approximately 25% of the India Industrial Solvents market. Key states like Delhi, Haryana, and Punjab are critical to the region’s industrial activities, with manufacturing sectors such as textiles, automotive, and chemicals driving solvent consumption. Delhi and its surrounding areas are significant hubs for pharmaceuticals, where solvents play an integral role in drug formulation and production. Additionally, the automotive sector in Haryana, particularly in areas like Gurgaon, further fuels the demand for solvents used in coatings and adhesives. As industrial growth continues in this region, especially with the development of infrastructure and smart city projects, the demand for solvents is expected to rise in tandem.

Southern Region

The Southern region of India holds a market share of around 20%, with key states such as Tamil Nadu, Karnataka, and Andhra Pradesh leading the demand for industrial solvents. Tamil Nadu, a manufacturing powerhouse, plays a significant role in the automotive, textiles, and paints sectors. Bengaluru, known for its tech and chemical industries, further contributes to the consumption of solvents, particularly in electronics manufacturing and pharmaceuticals. The Southern region is also home to several large industrial cleaning and agrochemical companies, driving demand for solvents used in formulations and cleaning applications. As industrialization continues to spread across this region, the market share for solvents is expected to increase.

Eastern Region

The Eastern region contributes approximately 15% to the overall market for industrial solvents, with key states like West Bengal, Odisha, and Bihar contributing to market growth. While this region has traditionally been less industrialized compared to the Western and Northern regions, it is witnessing a surge in demand driven by infrastructure development, industrial projects, and expanding manufacturing sectors. Kolkata, a major industrial city, plays a significant role in the demand for solvents, especially in the pharmaceutical and chemical industries. As the government pushes for the development of industrial corridors and economic zones in the East, the demand for industrial solvents is expected to grow steadily, contributing to the overall market expansion.

Key Player Analysis

- India National Petroleum Corporation (CNPC)

- Formosa Plastics Corporation

- Reliance Industries Limited

- Sinopec Group

- Mitsubishi Chemical Holdings Corporation

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- LG Chem Ltd.

- Tata Chemicals Ltd.

- SK Innovation Co., Ltd.

Competitive Analysis

The India Industrial Solvents market is highly competitive, with a mix of domestic and international players striving to capture a share of the growing demand. Leading companies in this space include Reliance Industries Limited, Tata Chemicals Ltd., Formosa Plastics Corporation, Sinopec Group, Mitsubishi Chemical Holdings Corporation, Sumitomo Chemical Co., Ltd., Toray Industries, Inc., LG Chem Ltd., and SK Innovation Co., Ltd. These companies leverage their strong manufacturing capabilities, extensive distribution networks, and innovative product portfolios to maintain a competitive edge. To stay ahead in the market, players are increasingly emphasizing product diversification, focusing on sectors such as paints, coatings, pharmaceuticals, and automotive, which are major consumers of industrial solvents. The competition is also fueled by the growing shift towards eco-friendly and bio-based solvents, with companies striving to develop environmentally sustainable alternatives to traditional solvents. Price competition, stringent quality control, and the ability to meet regulatory standards are critical factors influencing market dynamics. Additionally, technological advancements in solvent recovery and recycling have become a key strategy, as manufacturers seek to reduce costs and minimize environmental impact. As the market continues to expand, companies are investing in R&D and forging strategic partnerships to enhance their product portfolios and improve their market positioning.

Recent Developments

- In April 2025, Eastman announced off-list price increases for several EOD (Ethylene Oxide Derivatives) solvents, including Eastman™ DB Solvent, effective April 7, 2025, reflecting ongoing cost and market pressures.

- In March 2025, BASF reported generating approximately €11 billion in 2024 sales from products launched in the past five years, driven by R&D focused on sustainability, biodegradable materials, and digital transformation. The company filed 1,159 new patents in 2024, with 45% targeting sustainability. R&D investment in 2024 was €2.1 billion, with a similar budget planned for 2025.

- In March and April 2025, Shell is restructuring its global chemicals business to boost profitability and reduce capital spending by 2030. This includes exploring strategic partnerships in the U.S., potentially closing some European assets, and selling existing assets like the Singapore refinery and chemical complex. The company aims to streamline operations, focus on core businesses, and improve returns for shareholders.

- In March 2025, BASF is expanding its production capacity for aminic antioxidants at its Puebla, Mexico site, targeting the growing demand for long-life lubricants. The project is set for completion in 2026.

- In March 2025, ExxonMobil announced a $100 million upgrade to its Baton Rouge, Louisiana plant to produce ultra-high-purity (99.999%) isopropyl alcohol (IPA) for the semiconductor industry by 2027.

- In March 2024, Dow announced plans to invest in new ethylene derivatives capacity-including carbonate solvents-on the U.S. Gulf Coast. This investment, supported by the U.S. Department of Energy, aims to supply carbonate solvents for lithium-ion batteries, supporting the domestic EV and energy storage market. The facility will capture over 90% of CO₂ from ethylene oxide production, aligning with sustainability goals.

Market Concentration & Characteristics

The India Industrial Solvents market is moderately concentrated, with a mix of large multinational corporations and regional players dominating the landscape. The market is characterized by a competitive environment, where companies compete on factors such as product quality, pricing, and innovation. Larger players often have the advantage of established distribution networks, extensive product portfolios, and the ability to scale operations efficiently. However, regional players are also gaining traction by focusing on niche markets and providing specialized solvent solutions tailored to local industries. The market is increasingly driven by trends like sustainability and the shift toward eco-friendly solvents, which has prompted both multinational and domestic companies to invest in research and development to meet regulatory requirements and consumer demands. The demand for bio-based and green solvents is growing, further influencing market dynamics. Overall, the India Industrial Solvents market is evolving, with players continuing to adapt to changing industry requirements and competitive pressures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Industrial Solvents market is projected to grow at a robust pace, driven by increasing industrial activities across sectors like paints, coatings, and pharmaceuticals.

- A significant shift toward eco-friendly and bio-based solvents is anticipated, aligning with global sustainability trends and stricter environmental regulations.

- Technological advancements in solvent recovery and recycling are expected to enhance operational efficiencies and reduce environmental impact.

- The demand for specialty solvents tailored for specific applications, such as electronics manufacturing and high-performance coatings, is on the rise.

- Regulatory pressures concerning volatile organic compound (VOC) emissions are prompting industries to adopt low-VOC and water-based solvent alternatives.

- The pharmaceutical sector’s growth, fueled by increasing healthcare needs, is driving the demand for high-purity solvents in drug formulation processes.

- Fluctuating raw material prices, particularly for petrochemical-based feedstocks, may impact production costs and profitability.

- The expansion of the automotive and construction industries is expected to bolster the demand for solvents in coatings and adhesives applications.

- Government initiatives promoting the chemical industry, including allowing 100% foreign direct investment, are likely to stimulate market growth.

- The market’s competitive landscape is intensifying, with companies focusing on innovation, sustainability, and regulatory compliance to maintain a competitive edge.