Market Overview:

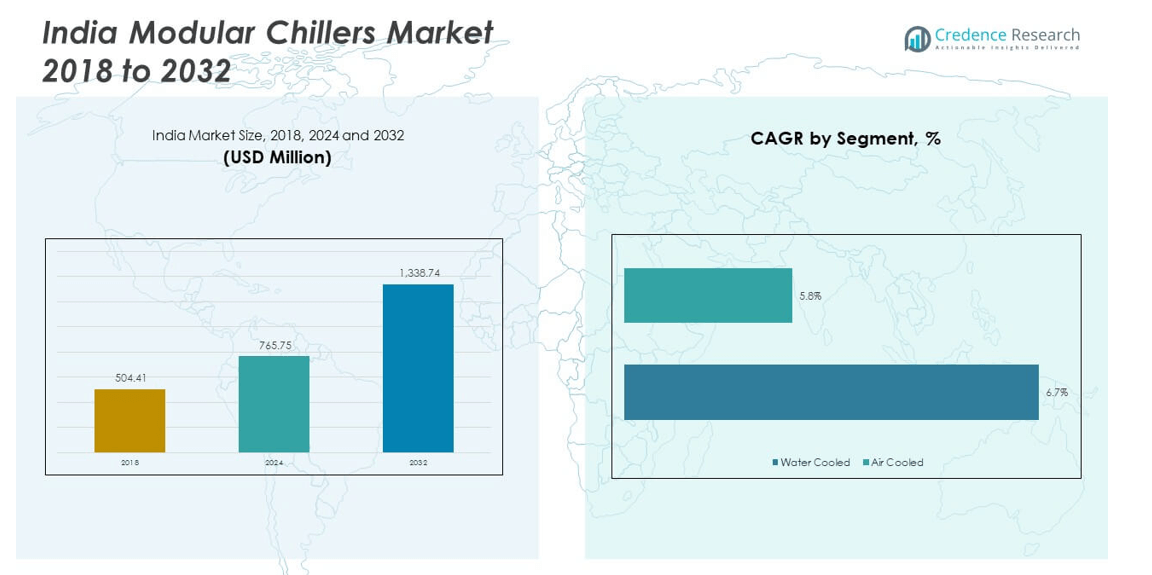

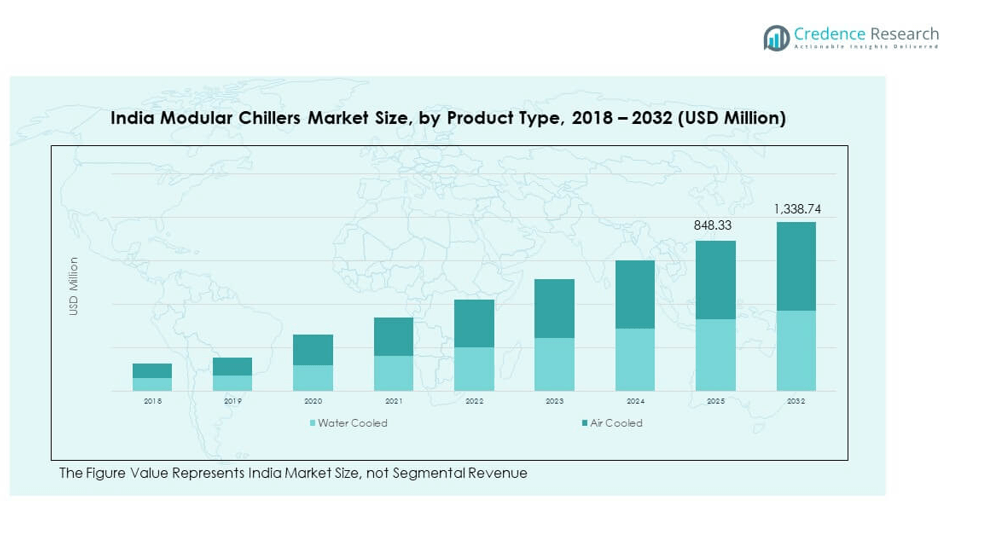

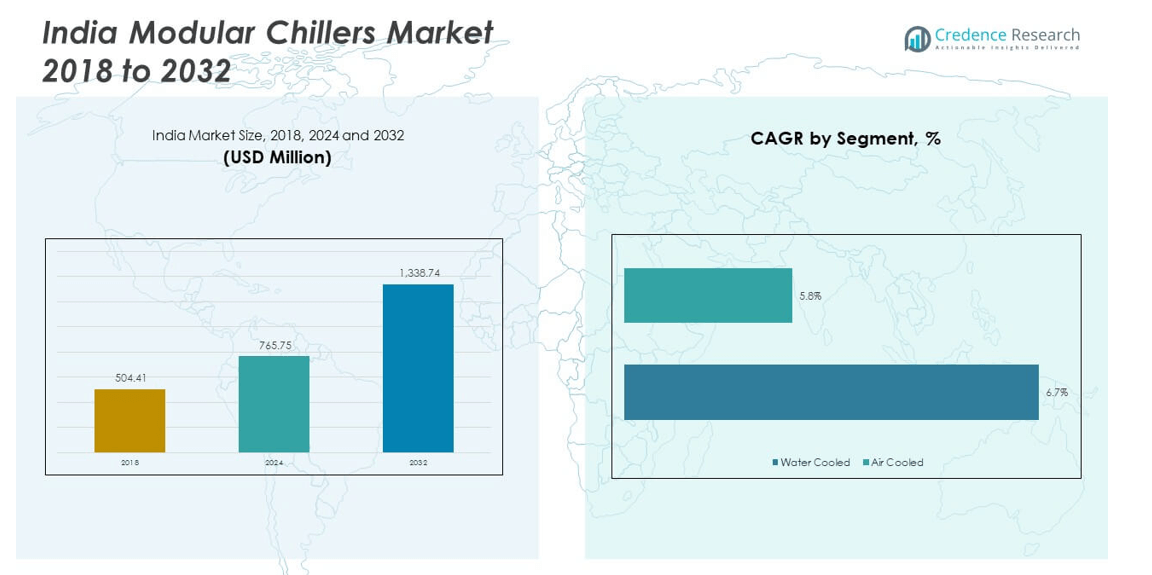

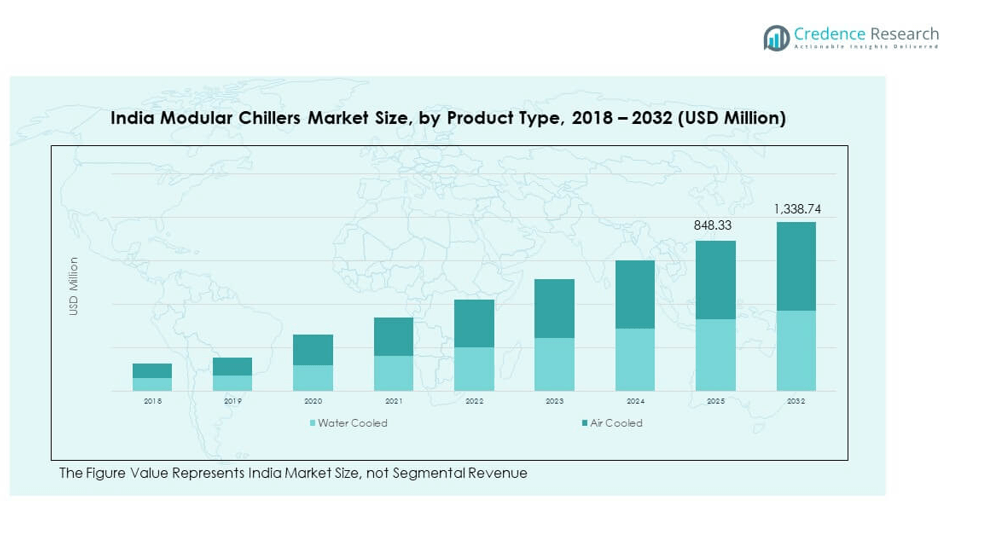

The India Modular Chillers Market size was valued at USD 504.41 million in 2018 to USD 765.75 million in 2024 and is anticipated to reach USD 1,338.74 million by 2032, at a CAGR of 6.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Modular Chillers Market Size 2024 |

USD 765.75 million |

| India Modular Chillers Market, CAGR |

6.73% |

| India Modular Chillers Market Size 2032 |

USD 1,338.74 million |

The market is gaining momentum due to increasing demand for HVAC solutions in commercial, industrial, and residential sectors. Growing urbanization, rising infrastructure projects, and a strong focus on sustainable cooling systems fuel the adoption of modular chillers. Government initiatives for energy efficiency and stricter environmental regulations encourage industries to shift toward advanced cooling technologies. Modular systems attract buyers with benefits like scalability, reduced maintenance, and energy efficiency, making them suitable for large-scale facilities, data centers, and healthcare applications.

Geographically, urban and industrial hubs such as Delhi NCR, Mumbai, and Bengaluru lead market adoption, driven by rapid construction activities and data center expansion. Southern India is emerging strongly due to growing IT parks and residential projects, supported by increasing investments in real estate and infrastructure. Tier-II cities are also witnessing rising adoption as modern building projects expand. This regional spread highlights the importance of both established and emerging urban centers in shaping the overall growth of the India Modular Chillers Market.

Market Insights:

- The India Modular Chillers Market was valued at USD 504.41 million in 2018, reached USD 765.75 million in 2024, and is projected to touch USD 1,338.74 million by 2032, growing at a CAGR of 6.73%.

- Northern India led with 38% share in 2024, supported by Delhi NCR’s commercial hubs; Southern India followed with 29%, driven by IT parks and real estate; Western India held 21%, anchored by strong industrial bases.

- Eastern India, with 12% share, is the fastest-growing region, fueled by urbanization, government infrastructure projects, and emerging residential demand.

- Water-cooled chillers accounted for about 62% share in 2024, reflecting demand from hospitals, data centers, and large commercial complexes needing high-capacity and efficient cooling.

- Air-cooled chillers held around 38% share in 2024, gaining traction in mid-sized commercial and residential spaces due to easier installation, lower maintenance, and suitability in regions with water constraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Urbanization and Expanding Commercial Infrastructure Stimulate Modular Chiller Adoption:

Rapid urbanization and expansion of commercial buildings drive strong demand for modular chillers. The construction of shopping malls, corporate offices, airports, and metro projects accelerates adoption of scalable cooling systems. Developers prioritize cost-effective and energy-efficient solutions for large facilities. The India Modular Chillers Market benefits from these requirements as it meets both sustainability and operational needs. Real estate investments in tier-I and tier-II cities reinforce this demand. Healthcare institutions and educational campuses also prefer modular chillers due to their adaptability. Continuous infrastructure expansion ensures steady growth momentum for the market.

- For instance, Carrier India launched its Made in India 30 RB Air-Cooled Modular Scroll Chiller in 2024, which can combine up to 16 units in one module to ensure seamless operation across temperature ranges from 10°C to 48°C, catering specifically to commercial infrastructure like malls, metro, and corporate offices. This chiller features shell and tube heat exchangers that maintain operation even with poor water quality, aligning perfectly with large facilities’ sustainability and operational needs.

Rising Focus on Energy Efficiency and Sustainable Cooling Technologies:

Energy efficiency is becoming a top priority for industries, pushing adoption of advanced cooling systems. Modular chillers support compliance with environmental regulations while reducing operational costs. Governments encourage sustainable infrastructure with energy-efficient building codes and incentives. The India Modular Chillers Market benefits by aligning with these mandates and customer preferences. Facility managers prefer modular systems that consume less power and optimize cooling. Integration with building automation systems enhances energy monitoring. This shift drives demand from both private and public sector projects. Companies adopting green initiatives further accelerate market penetration.

- For instance, India’s Bureau of Energy Efficiency (BEE) and partners have mandated labeling programs since 2023, driving the adoption of high-performing energy-efficient chillers. Facility managers favor modular chillers that consume less power and are integrated into building automation systems for optimal energy use, while private and public sectors prioritize compliance with sustainability mandates.

Strong Growth in Data Centers and IT Infrastructure Demands Scalable Cooling Solutions:

The surge in cloud services, digitalization, and IT parks increases demand for modular chillers. Data centers require precise cooling solutions to manage heat loads effectively. Modular systems offer scalability, making them ideal for expanding facilities. The India Modular Chillers Market is witnessing high adoption across IT hubs such as Bengaluru and Hyderabad. Energy reliability and cost efficiency remain key decision factors. Developers seek systems that adapt to changing capacity needs without disruption. Growing foreign investments in IT infrastructure strengthen this demand further. Continuous technological upgrades sustain the relevance of modular chillers in the sector.

Industrial Expansion and Rising Manufacturing Activity Bolster Market Growth:

India’s manufacturing sector is expanding across automotive, pharmaceuticals, food processing, and chemicals. These industries require reliable process cooling, fueling modular chiller demand. The India Modular Chillers Market gains traction as modular units provide operational reliability and low downtime. Scalability enables facilities to adjust capacity as production scales up. Government schemes supporting “Make in India” stimulate investments in modern plants. Industrial hubs in western and southern India show strong adoption rates. Rising exports also push manufacturers to upgrade cooling systems for quality assurance. Long-term industrial growth ensures consistent demand for modular chillers.

Market Trends:

Integration of Smart Technologies and IoT for Advanced Cooling Control:

The adoption of smart technologies is reshaping modular chiller operations. IoT integration allows remote monitoring, predictive maintenance, and energy optimization. Facility managers benefit from real-time data to reduce downtime and improve efficiency. The India Modular Chillers Market incorporates these technologies to align with digital transformation goals. Smart sensors help optimize cooling load distribution. Predictive analytics lowers maintenance costs while improving performance. Such innovations improve customer trust and expand adoption across industries. This trend ensures long-term competitiveness of modular chillers in advanced infrastructure projects.

- For example, BlueStar launched an IoT pilot installing sensors on 600 chillers to enable centralized remote monitoring and predictive maintenance, reducing downtime and servicing costs. These IoT-enabled chillers provide over 200 data points for analytics, enabling optimized energy use and compliance reporting. Smart sensors facilitate adaptive cooling load distribution, and building management systems use real-time data to coordinate equipment for maximum efficiency.

Shift Toward Hybrid and Renewable Energy-Based Cooling Systems:

Sustainability concerns are accelerating the shift to hybrid and renewable-powered chillers. Companies explore integration with solar and other clean energy sources. The India Modular Chillers Market reflects this shift as firms reduce reliance on grid electricity. Hybrid models offer stable performance while lowering environmental impact. Growing renewable energy capacity supports wider adoption of these solutions. Facilities benefit from reduced energy bills and long-term cost stability. Government incentives for clean energy encourage more investments in hybrid cooling. This trend enhances the eco-friendly appeal of modular chiller solutions.

- For instance, Rockwell Industries launched ‘Chillermill’, the world’s first hybrid (solar and wind) energy-powered vaccine chiller/freezer, with battery storage enabling 24/7 operation in remote areas lacking stable electricity. This hybrid system reduces reliance on grid electricity, lowers environmental impact, and supports facilities with sustainable energy solutions. Government incentives promote such clean energy-powered chillers, advancing investments in hybrid cooling technologies and enhancing modular chillers’ eco-friendly appeal.

Customization and Modular Flexibility for Diverse End-User Requirements:

End users increasingly demand tailored solutions to fit diverse operational needs. Modular chillers offer flexibility in capacity expansion and design customization. The India Modular Chillers Market adapts to this demand by delivering scalable systems. Industries such as healthcare, data centers, and hospitality prefer modularity to meet unique cooling loads. Flexible configurations reduce installation costs and optimize space usage. Manufacturers develop systems that allow seamless integration with existing infrastructure. Customization enhances efficiency and reliability across applications. This trend reinforces modular chillers as a preferred choice over conventional units.

Growing Adoption in Residential and Smart City Developments:

Smart city projects and modern residential complexes are opening new market segments. Modular chillers are chosen for their efficiency, space-saving design, and scalability. The India Modular Chillers Market is witnessing rising installations in high-end residential complexes. Smart homes and community projects integrate modular cooling for sustainable living. Real estate developers prefer these systems for long-term value creation. Rapid population growth in urban centers boosts adoption rates. Demand is expected to rise further with government-backed housing initiatives. This trend expands the scope of modular chillers into new consumer-driven markets.

Market Challenges Analysis:

High Initial Capital Investment and Cost Barriers Restrict Broader Adoption:

The upfront cost of modular chillers remains a significant challenge for small and medium enterprises. Many businesses hesitate to invest due to limited capital budgets. The India Modular Chillers Market faces resistance from cost-sensitive buyers despite long-term savings. Conventional chillers often appear cheaper at the start, influencing decision-making. Lack of awareness about lifecycle cost benefits adds to this challenge. Finance constraints in emerging urban regions delay adoption. Rising raw material prices further elevate product costs. Such barriers slow down widespread penetration among smaller organizations.

Infrastructure Gaps and Limited Awareness of Advanced Cooling Solutions:

Adoption is often slowed by infrastructure readiness and technical knowledge gaps. Many regions lack skilled technicians for installation and maintenance. The India Modular Chillers Market requires better awareness programs to educate users on efficiency benefits. Facility operators sometimes underestimate the long-term gains of modular systems. Poor integration with older buildings creates additional hurdles. Delays in procurement and project approvals add to challenges. Smaller cities lag in adoption compared to metro hubs due to limited resources. Overcoming these issues requires collaboration between manufacturers, policymakers, and training institutions.

Market Opportunities:

Expansion of Green Building Projects and Sustainability Initiatives Drives Future Growth:

The rise in green building certifications is creating strong opportunities for modular chillers. Developers seek cooling systems that align with energy efficiency standards. The India Modular Chillers Market is well-positioned to benefit from these initiatives. Governments and corporates emphasize carbon reduction strategies, increasing demand for sustainable solutions. Green-certified projects across metro cities favor modular systems for compliance. Growing investor interest in sustainable real estate strengthens adoption further. The market is expected to gain momentum as environmental concerns rise globally.

Increasing Demand from Emerging Tier-II and Tier-III Cities Expands Market Scope:

Smaller cities are witnessing rapid construction growth in residential and commercial sectors. Modular chillers offer scalable solutions for such emerging regions. The India Modular Chillers Market can capitalize on this demand to expand beyond metro hubs. Rising disposable income and modern lifestyle adoption support market penetration. Smart city development projects further stimulate adoption in smaller urban centers. Manufacturers focusing on regional distribution networks will strengthen their reach. These opportunities highlight the potential for deeper market penetration in underexplored regions.

Market Segmentation Analysis:

By Product Type

Water-cooled chillers hold a significant share due to their efficiency in large-scale facilities. These systems are preferred in data centers, hospitals, and commercial complexes where high-capacity cooling is critical. The India Modular Chillers Market also sees strong adoption of air-cooled chillers, particularly in regions with limited water availability. Air-cooled models attract demand in mid-sized commercial spaces and residential projects. Their easier installation and lower maintenance support faster uptake in urban areas. Both product types remain vital for diverse cooling requirements across sectors.

- For example, Refcon Chillers supplies smart, water-cooled industrial chillers optimized for India’s conditions, widely used in hospitals and data centers to ensure consistent high-capacity cooling. These chillers incorporate advanced scroll compressors and IoT-enabled controls for improved system management. In contrast, air-cooled chillers like Carrier India’s 30 RB modular scroll models are preferred in areas with limited water availability, notable for easy installation and reduced maintenance in mid-sized commercial and residential projects.

By Application

Cooling dominates the application segment, driven by rising demand from commercial and industrial facilities. Modular chillers deliver scalable and reliable solutions for data centers, offices, and manufacturing plants. The India Modular Chillers Market benefits from increasing adoption of cooling systems aligned with energy efficiency mandates. Simultaneous heating is an emerging segment, gaining traction in advanced infrastructure projects. It supports energy reuse and sustainability goals in modern buildings. This segment is expected to expand further with rising green building initiatives.

- For instance, Modular chillers are deployed in data centers, offices, and manufacturing plants, as shown by Johnson Controls’ report of strong 2024 sales and a record total backlog driven by robust data center demand. The India Modular Chillers Market is also seeing growth in simultaneous heating applications, which supports energy reuse and sustainability in advanced buildings, aligning with increasing green building initiatives across infrastructure projects.

By End User

Commercial establishments lead the market, supported by rapid expansion of corporate offices, malls, and healthcare facilities. Industrial users also represent a strong share, with demand from manufacturing, pharmaceuticals, and food processing. The India Modular Chillers Market gains steady growth from the residential segment, particularly in high-rise apartments and gated communities. Rising disposable income and smart city projects enhance this adoption. Each end-user category demonstrates distinct growth dynamics, strengthening overall market demand.

Segmentation:

By Product Type

By Application

- Cooling

- Simultaneous Heating

By End User

- Commercial

- Industrial

- Residential

By Country (for revenue analysis and trade insights)

- Country-wise Revenue

- Country-wise Import Revenue

- Country-wise Export Revenue

Regional Analysis:

Northern India – Strong Leadership in Market Share

Northern India commands the largest share of the India Modular Chillers Market with around 38%. The region’s dominance stems from large-scale commercial infrastructure, including office complexes, airports, and shopping malls. Delhi NCR, with its concentration of IT hubs and real estate developments, remains a key driver. Healthcare facilities and educational institutions also boost adoption of modular chillers. Strong government investments in infrastructure projects further strengthen the region’s leadership. It continues to act as the central hub for advanced cooling solutions in the country.

Southern India – Expanding Presence with IT and Real Estate Growth

Southern India holds nearly 29% of the market share, supported by strong IT and real estate growth. Cities like Bengaluru, Hyderabad, and Chennai lead demand due to the expansion of IT parks and data centers. The India Modular Chillers Market benefits from large-scale residential projects and hospitality growth in this region. Scalability and energy efficiency make modular chillers attractive for urban developers. State-backed investments in smart cities and metro projects enhance adoption. The region is set to witness sustained growth through continuous infrastructure modernization.

Western and Eastern India – Emerging Growth Frontiers

Western India accounts for about 21% of the market share, driven by industrial hubs in Maharashtra and Gujarat. The manufacturing sector, including pharmaceuticals and automotive, generates consistent demand for process cooling. Eastern India contributes around 12%, with demand rising in developing states due to growing urbanization. The India Modular Chillers Market finds opportunities here through new residential projects and government-led infrastructure initiatives. It remains an emerging frontier with potential for expansion as awareness of modular solutions grows. Together, these regions expand the market’s overall footprint across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The India Modular Chillers Market is characterized by the presence of established domestic players and global brands competing on efficiency, scalability, and technology. Companies such as Blue Star, Voltas, Daikin India, Thermax, and Kirloskar Chillers lead with broad product portfolios and strong service networks. Local manufacturers like Reynold India and Chillmax Technologies enhance competitiveness with cost-effective solutions and regional presence. It is driven by investments in R&D, strategic partnerships, and expansion into new application areas such as data centers and smart buildings. Competitive intensity remains high, with companies focusing on energy efficiency, advanced control systems, and modular flexibility to differentiate. Price competitiveness and after-sales support remain vital to customer retention. Continuous innovation ensures that both multinational and domestic firms maintain strong positions across diverse end-user segments.

Recent Developments:

- In June 2025, Thermax Limited inaugurated a pilot facility in Pune focused on Solid Oxide Electrolyser Cell (SOEC) technology as part of its green hydrogen strategy, collaborating with UK-based CERES to develop modular, efficient energy solutions over the next year.

- In February 2025, Blue Star Limited launched a comprehensive range of 150 air conditioner models, including inverter, fixed-speed, and window ACs, with a focus on Smart WiFi and Heavy-Duty segments to meet growing demand across India, priced starting at ₹28,990.

- In March 2025, Voltas Limited showcased and launched new energy-efficient commercial refrigeration products, including a new range of 5-star hard-top convertible models and water coolers at the AAHAR 2025 exhibition in Delhi, emphasizing sustainability and cost-efficiency.

- Kirloskar Chillers marked a milestone by being the first in India to offer chillers using the low-GWP refrigerant R1234ze(E), promoting environmental sustainability through reduced greenhouse gas emissions, with installations available since 2017 across multiple regions including India and the Middle East.

- Reynold India Pvt. Ltd. continues to strengthen its presence with advanced, energy-efficient industrial chillers engineered for diverse applications, backed by ISO certification and global quality standards, manufacturing at its advanced Haridwar Noida facility.

- In December 2024, Daikin India formed a joint venture with Taiwanese company Rechi Precision to manufacture rotary inverter compressors in India, with operations expected to begin by the end of FY2025 at a new facility in Sri City, Andhra Pradesh, aiming to meet growing compressor demand.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of modular chillers in data centers will strengthen long-term demand.

- Increased focus on energy efficiency will drive upgrades across commercial facilities.

- Integration of IoT and smart controls will enhance system optimization and monitoring.

- Expansion of smart city projects will create sustained opportunities for manufacturers.

- Growing real estate development in tier-II cities will expand the customer base.

- Hybrid and renewable-powered chillers will gain momentum in green building projects.

- Industrial manufacturing expansion will drive demand for scalable cooling solutions.

- Competitive pricing and after-sales services will remain crucial for customer loyalty.

- Domestic production capacity expansion will reduce reliance on imports.

- Product innovations will continue shaping customer preference for flexible solutions.