| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Soy-Based Chemicals Market Size 2024 |

USD 851.71 Million |

| India Soy-Based Chemicals Market, CAGR |

9.68% |

| India Soy-Based Chemicals Market Size 2032 |

USD 1,784.03 Million |

Market Overview

The India Soy-Based Chemicals Market is projected to grow from USD 851.71 million in 2024 to an estimated USD 1,784.03 million by 2032, with a compound annual growth rate (CAGR) of 9.68% from 2025 to 2032. The market is experiencing robust growth, driven by increasing demand for eco-friendly and sustainable chemical alternatives.

Key drivers propelling this growth include the rising demand for sustainable solutions, government incentives for bio-based products, and technological advancements in soy processing. These factors are fostering the widespread adoption of soy-based chemicals, particularly in the production of biofuels, plastics, and coatings. Additionally, growing environmental concerns and the shift towards circular economies are pushing businesses to incorporate soy-based alternatives into their products. The market is also benefiting from an increase in R&D efforts to enhance the performance and versatility of soy-based chemicals.

Geographically, India is poised for significant market expansion, driven by the growing demand for sustainable and renewable alternatives in manufacturing sectors. The market’s growth is particularly evident in regions with active industrial hubs, where eco-friendly solutions are becoming a key focus. Key players in the India Soy-Based Chemicals Market include companies such as Cargill Inc., BASF SE, and Archer Daniels Midland Company, which are focusing on developing innovative soy-based products to meet the growing demand in various industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Soy-Based Chemicals Market is projected to grow from USD 851.71 million in 2024 to USD 1,784.03 million by 2032, with a CAGR of 9.68% from 2025 to 2032, driven by increasing demand for sustainable, eco-friendly chemicals.

- The Global Soy-Based Chemicals Market is projected to grow from USD 28,996.80 million in 2024 to USD 52,069.72 million by 2032, with a CAGR of 7.59% from 2025 to 2032.

- Rising environmental concerns and government incentives for bio-based products are driving the adoption of soy-based chemicals across various industries like automotive, agriculture, and construction.

- Ongoing advancements in soy processing technologies are enhancing the efficiency, cost-effectiveness, and versatility of soy-based chemicals, supporting their market growth.

- High production costs associated with soy-based chemicals and a dependence on soybean supply can limit growth potential, especially in terms of price competitiveness with petroleum-based alternatives.

- The Indian government’s policies promoting renewable energy, green technologies, and sustainable practices are encouraging the adoption of soy-based chemicals across multiple sectors.

- North and West India are leading the market, driven by strong industrial hubs, soybean cultivation, and growing demand for eco-friendly solutions in manufacturing sectors.

- Leading companies such as Cargill Inc., BASF SE, and Archer Daniels Midland Company are focusing on innovation and expanding their product offerings to cater to the growing demand for soy-based chemicals in India.

Market Drivers

Technological Advancements in Soy Processing

Technological advancements in soy processing are another critical driver for the growth of the India Soy-Based Chemicals Market. Over the past few years, significant improvements in soy extraction and processing methods have enhanced the efficiency and quality of soy-based chemicals. Innovations such as enzymatic processing, solvent-free extraction methods, and the development of high-performance soy-based polymers are making these chemicals more versatile and applicable across various industries. The enhanced processing techniques have resulted in the reduction of production costs, making soy-based chemicals more competitive with traditional petroleum-based chemicals. Furthermore, technological improvements have led to the development of higher-quality soy-based products, with applications ranging from biofuels to lubricants, plastics, and even cosmetics. These advancements are expected to attract more manufacturers and industries to explore soy-based chemicals as an alternative, thereby driving market expansion. The ongoing R&D efforts to improve soy-based products’ functionality, sustainability, and cost-efficiency will continue to contribute to the overall market growth.

Growing Industrial Applications and Diverse End-Uses

The expanding range of industrial applications for soy-based chemicals is one of the most significant drivers of the market in India. Soy-based chemicals are increasingly being used in a variety of end-use industries, including automotive, agriculture, food and beverages, and construction. In the automotive sector, soy-based chemicals, such as soy-based foams and adhesives, are being used for manufacturing lightweight, eco-friendly components. In agriculture, soy-based chemicals are used in fertilizers, pesticides, and soil conditioners, supporting sustainable farming practices. Additionally, in the food industry, soy lecithin is widely used as an emulsifier in food products, while soy oil is employed in biodiesel production. The versatility of soy-based chemicals enables their use in an expanding number of applications, providing significant opportunities for market growth. As industries across these sectors continue to move towards more sustainable practices, the demand for soy-based chemicals is expected to rise. Furthermore, as consumer demand for products that align with sustainability goals grows, industries are increasingly adopting soy-based chemicals as a way to meet both regulatory requirements and consumer expectations. This widespread adoption across diverse sectors is a significant catalyst for the continued expansion of the India Soy-Based Chemicals Market.

Rising Demand for Sustainable and Eco-Friendly Products

The increasing demand for sustainable and eco-friendly products is one of the primary drivers of the India Soy-Based Chemicals Market. As environmental concerns continue to grow, both consumers and industries are increasingly focusing on adopting greener alternatives to petroleum-based chemicals. Soy-based chemicals, being renewable and biodegradable, offer significant advantages in reducing the environmental footprint of manufacturing processes. For instance, soy-based biodiesel has been shown to reduce greenhouse gas emissions by up to 86% compared to petroleum diesel. The shift towards sustainability is further supported by stricter environmental regulations, which encourage the use of bio-based materials in various industries, including automotive, construction, and agriculture. Additionally, consumers are becoming more conscientious of the environmental impact of their purchasing choices, leading companies to prioritize the development of eco-friendly products. As a result, the demand for soy-based chemicals, especially in the form of soy-based polymers, biofuels, and soy-based plastics, is rising rapidly. The growing preference for these alternatives is expected to further accelerate the growth of the market.

Government Initiatives and Regulatory Support

The Indian government’s emphasis on sustainable development and renewable energy is playing a crucial role in driving the adoption of soy-based chemicals. Several initiatives and policy frameworks have been introduced to promote the use of bio-based materials and encourage the development of green technologies. For instance, the National Biofuels Policy aims to achieve a 20% ethanol blending target by 2025, which includes the promotion of bio-based fuels such as soy biodiesel. Additionally, the Indian government has launched incentives for industries that focus on producing eco-friendly and sustainable chemicals. These regulatory supports, along with favorable policies, are pushing the industry to invest in and manufacture soy-based chemicals as a viable alternative to petroleum-based products. Government-led research and development (R&D) programs are also contributing to the growth of the market by fostering innovation in soy-based chemical formulations. The government’s proactive approach towards sustainable development ensures that soy-based chemicals are prioritized as an essential part of the country’s future growth.

Market Trends

Increase in Consumer Demand for Sustainable Products

There is a marked rise in consumer demand for sustainable products, driving a shift toward bio-based chemicals. In India, as environmental awareness grows, consumers are becoming more conscious of the products they purchase and their environmental impact. This is leading companies to adapt and incorporate more sustainable materials, including soy-based chemicals, into their products. Industries such as cosmetics, packaging, and food are experiencing an increasing demand for eco-friendly alternatives, especially in products like biodegradable plastics, natural emulsifiers, and soy-based food additives. Companies that align their product offerings with sustainability goals are more likely to gain a competitive edge in the market. This trend is also driven by changing consumer behavior and a broader cultural shift toward sustainability, which is expected to continue influencing market growth.

Government Support for Sustainable and Green Technologies

Government policies and initiatives promoting the adoption of green and sustainable technologies are playing a critical role in shaping the India Soy-Based Chemicals Market. The Indian government has introduced several measures to encourage the use of renewable and bio-based materials in various industries. For example, the National Biofuels Policy aims to boost the production and use of biofuels like soy-based biodiesel as part of India’s commitment to reducing dependence on fossil fuels and cutting greenhouse gas emissions. Additionally, government incentives and subsidies are being provided to manufacturers who focus on producing sustainable chemicals. These policies have not only encouraged industry players to develop soy-based products but have also enhanced research and development efforts to make these products more efficient and commercially viable. The supportive government environment is expected to continue driving innovation and expansion in the market, benefiting both local and international companies investing in soy-based chemical solutions.

Adoption of Bio-Based Polymers and Biofuels

One of the most significant trends in the India Soy-Based Chemicals Market is the increasing adoption of bio-based polymers and biofuels. With a growing focus on reducing the environmental impact of traditional petroleum-based chemicals, industries are shifting toward renewable alternatives. For instance, soy-based polymers, including soy-based polyols used in the production of polyurethanes, are gaining popularity due to their eco-friendly properties and enhanced biodegradability. Companies like Cargill Inc. have developed soy-based polyols that are being used in applications ranging from automotive components to coatings and packaging materials. Similarly, soy-based biofuels, particularly biodiesel, are playing a vital role in the country’s efforts to reduce carbon emissions and promote clean energy. The Indian government’s support for biofuel production through its National Biofuels Policy has further spurred this trend. The growing demand for sustainable, renewable energy sources is expected to fuel the growth of soy-based biofuels, positioning them as a key area for market expansion.

Technological Innovations in Soy Processing

Technological advancements in soy processing are significantly influencing the India Soy-Based Chemicals Market. Innovations in processing technologies are enabling more efficient extraction and refining of soybeans, resulting in higher-quality and cost-effective soy-based chemicals. For instance, enzymatic processing methods, which allow for more efficient oil extraction, have been adopted by companies like Archer Daniels Midland Company. Additionally, the development of solvent-free techniques is helping to lower production costs and improve product quality. Improvements in the production of soy-based polymers have led to their increased use in industries like automotive, construction, and packaging. As these technologies continue to evolve, they will further enhance the functionality, sustainability, and cost-effectiveness of soy-based chemicals, contributing to their growing adoption across multiple sectors.

Market Challenges

High Production Costs and Limited Infrastructure

The high production costs of soy-based chemicals in India are indeed a significant challenge. For instance, the costs associated with sourcing high-quality soybeans are influenced by fluctuating agricultural yields and market prices. Additionally, the extraction and processing technologies required for soy-based chemicals involve advanced methods such as enzymatic hydrolysis and fermentation, which demand specialized equipment and skilled labor. This adds to the overall production expenses. Moreover, the infrastructure for large-scale production remains underdeveloped. For example, there are limited facilities equipped to process soybeans into bio-based chemicals efficiently. This lack of infrastructure not only increases production costs but also restricts the scalability of operations, making it difficult for manufacturers to compete with the pricing of petroleum-based alternatives. Addressing these challenges requires investments in infrastructure development and advancements in cost-effective processing technologies. By overcoming these barriers, the Indian soy-based chemicals market can unlock its potential for broader industrial adoption.

Dependence on Soybean Supply and Agricultural Variability

Another significant challenge for the India Soy-Based Chemicals Market is its dependence on soybean supply, which is subject to agricultural variability and fluctuating crop yields. The production of soy-based chemicals heavily relies on the availability of soybeans, a commodity that can be impacted by climate change, fluctuating weather conditions, and changes in agricultural policies. India’s soybean farming is susceptible to inconsistent weather patterns, particularly in key growing regions, which can lead to crop failures or reduced yields in some years. Furthermore, the country faces competition for soybean production from other industries, such as animal feed and oil extraction, which also use soybeans as a primary raw material. These supply-side challenges make it difficult to maintain a stable and predictable supply of soybeans for soy-based chemicals production. As a result, market participants may face challenges in securing consistent raw materials, which can lead to price volatility and supply disruptions, ultimately affecting production costs and availability of soy-based chemicals in the market.

Market Opportunities

Expansion of Bio-Based Product Demand

The growing global shift towards sustainability presents a significant opportunity for the India Soy-Based Chemicals Market. As industries increasingly adopt eco-friendly and bio-based materials, soy-based chemicals are emerging as a viable alternative to petroleum-based products. This trend is particularly evident in sectors such as automotive, agriculture, packaging, and construction, where there is rising demand for sustainable solutions. With the Indian government’s strong emphasis on green technologies and renewable energy, there are significant opportunities for market players to develop and market soy-based chemicals that cater to this demand. The growth in consumer preferences for eco-friendly products, combined with government incentives for bio-based materials, creates an ideal environment for soy-based chemicals to flourish. Manufacturers have the opportunity to capture market share by producing innovative, high-performance, and cost-effective soy-based products, tapping into the rapidly growing demand for sustainable alternatives in diverse industries.

Increased Research and Development Investment

Another substantial market opportunity lies in increasing investments in research and development (R&D) to enhance the functionality and applications of soy-based chemicals. As the industry continues to evolve, there is a need for advanced processing technologies and product innovation to meet the specific demands of various industries. By focusing on R&D, companies can improve the quality and versatility of soy-based chemicals, making them more competitive against traditional petroleum-based chemicals. Opportunities exist for the development of new soy-based chemical products that can cater to niche markets, such as biodegradable plastics, specialty coatings, and high-performance polymers. As R&D efforts continue to advance, the India Soy-Based Chemicals Market can expand, offering innovative solutions that address both industrial and consumer demands for sustainable materials.

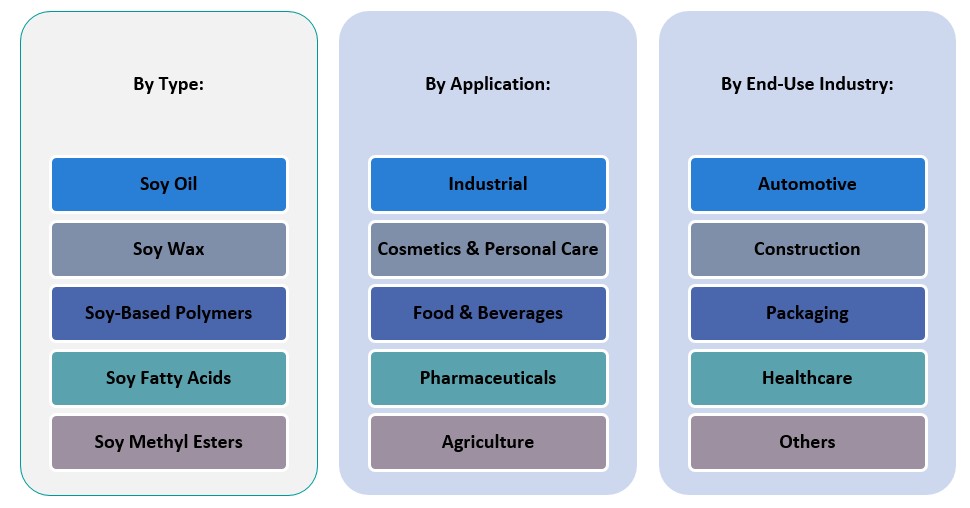

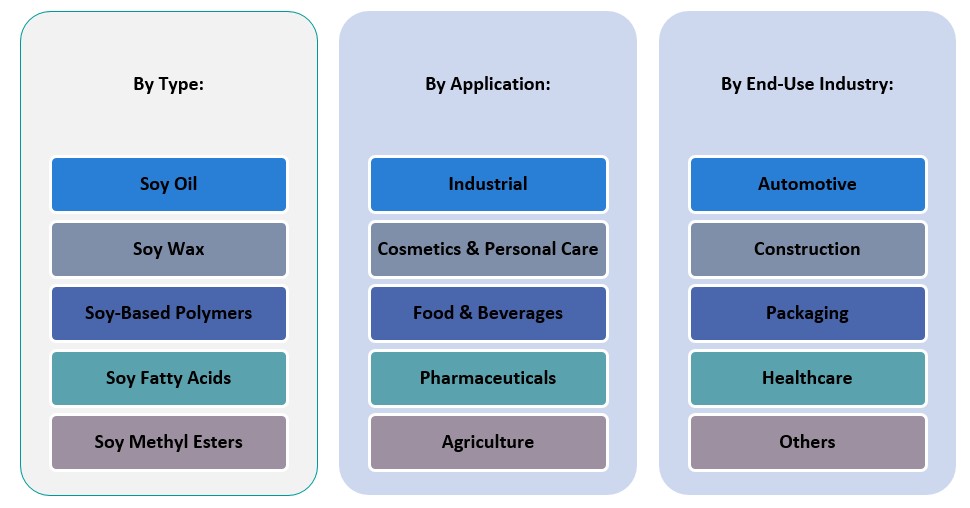

Market Segmentation Analysis

By Type

The soy-based chemicals market is primarily segmented by type into soy oil, soy wax, soy-based polymers, soy fatty acids, and soy methyl esters. Soy oil, which is widely used in biodiesel production and food additives, holds the largest share in the market. The growing demand for biofuels and renewable energy sources is driving the demand for soy oil. Soy wax is another prominent segment, used in candles, cosmetics, and coatings due to its renewable and biodegradable properties. Soy-based polymers, including polyols used in polyurethane production, are gaining traction in industries like automotive and construction for their environmental benefits over traditional polymers. Soy fatty acids find applications in lubricants, soaps, detergents, and pharmaceuticals, which are increasing due to the demand for sustainable alternatives. Finally, soy methyl esters, primarily used in biodiesel production, are experiencing steady growth as renewable energy solutions gain more adoption.

By Application

In terms of application, soy-based chemicals are widely used across various industries such as industrial, cosmetics and personal care, food and beverages, pharmaceuticals, and agriculture. In the industrial sector, soy-based chemicals are used in manufacturing bio-based products such as adhesives, coatings, and foams. The cosmetics and personal care industry is increasingly adopting soy wax and soy-based oils for skincare, haircare, and makeup products due to their natural, hypoallergenic properties. In the food and beverages sector, soy-based emulsifiers and additives are commonly used for their nutritional benefits and sustainability. Pharmaceuticals also rely on soy-based chemicals, particularly soy fatty acids and soy oil, in the production of medicines and supplements. Furthermore, the agriculture sector is adopting soy-based chemicals in fertilizers and pesticides, contributing to the market’s expansion due to the increasing focus on sustainable farming practices.

Segments

Based on Type

- Soy Oil

- Soy Wax

- Soy-Based Polymers

- Soy Fatty Acids

- Soy Methyl Esters

Based on Application

- Industrial

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Agriculture

Based on End Use Industry

- Automotive

- Construction

- Packaging

- Healthcare

- Others

Based on Region

- North India

- West India

- South India

- East India

- Central India

Regional Analysis

North India (35%)

North India holds the largest share of the soy-based chemicals market in India, accounting for approximately 35% of the total market. The region’s significant contribution is largely driven by the presence of major industrial hubs such as Delhi, Uttar Pradesh, and Haryana, which are home to a large number of manufacturing facilities. The automotive, construction, and packaging industries in these areas have a high demand for soy-based chemicals, particularly soy-based polymers, biofuels, and adhesives. Moreover, the government’s focus on promoting sustainable development through policies and incentives has spurred the adoption of bio-based materials in manufacturing processes. North India’s agricultural regions also play a crucial role, with soybeans being grown extensively, providing a reliable raw material source for soy-based chemicals.

West India (30%)

West India, comprising states such as Maharashtra, Gujarat, and Rajasthan, contributes to around 30% of the soy-based chemicals market. This region is known for its strong manufacturing base, especially in automotive, packaging, and construction sectors. Maharashtra, in particular, is a major hub for industries using soy-based chemicals, with the growing adoption of sustainable practices among manufacturers. The western region also benefits from a well-developed infrastructure and export-oriented industries, which contribute to the demand for soy-based chemicals. Furthermore, the agricultural sector in Gujarat and Maharashtra supports the cultivation of soybeans, enhancing the availability of raw materials for soy-based products.

Key players

- Wilmar International Limited

- IOI Corporation Berhad

- Godrej Agrovet Ltd.

- PT SMART Tbk

- KLK OLEO

- Shandong Yuwang Industrial Co., Ltd.

- Nihon Emulsion Co., Ltd.

- Fuji Oil Holdings Inc.

- Sime Darby Oils

- Toyo Kagaku Co., Ltd.

Competitive Analysis

The India Soy-Based Chemicals Market is highly competitive, with key players continuously expanding their product portfolios and enhancing their market presence. Wilmar International Limited and IOI Corporation Berhad are among the largest producers, leveraging their vast global networks and extensive product offerings to cater to various industries. Godrej Agrovet Ltd. and PT SMART Tbk are focusing on regional growth, emphasizing innovation in sustainable products and strong distribution channels. KLK OLEO, Shandong Yuwang Industrial Co., Ltd., and Nihon Emulsion Co., Ltd. are gaining traction by offering a range of soy-based chemicals that meet the growing demand for eco-friendly solutions. Fuji Oil Holdings Inc. and Sime Darby Oils maintain competitive edges through investments in R&D and production efficiency. Toyo Kagaku Co., Ltd. differentiates itself by offering specialized applications in industries such as packaging and automotive. These companies compete based on innovation, cost-efficiency, and sustainability in their product offerings.

Recent Developments

- On October 7, 2024, Evonik and BASF agreed on the first delivery of biomass-balanced ammonia, achieving a product carbon footprint reduction of over 65%. This collaboration supports Evonik’s sustainable product lines like VESTAMIN IPD eCO and VESTAMID eCO.

- On February 26, 2025, Arkema announced a 15% expansion of its polyvinylidene fluoride (PVDF) production capacity at its Calvert City, Kentucky plant. This $20 million investment aims to meet the growing demand for high-performance resins in electric vehicles and energy storage systems.

- On February 25, 2025, AkzoNobel offered to acquire powder coatings assets and the International Research Center from its subsidiary in India. This move is part of the company’s strategy to focus more on liquid paints and coatings in the Indian market.

- In February 2025, Perstorp Holding AB began ester production at its Amsterdam plant, marking a significant step in expanding its product offerings in the sustainable chemicals sector.

Market Concentration and Characteristics

The India Soy-Based Chemicals Market exhibits moderate concentration, with a mix of global and regional players vying for market share. Leading multinational companies such as Wilmar International Limited, IOI Corporation Berhad, and Godrej Agrovet Ltd. dominate the market due to their extensive product portfolios, strong distribution networks, and significant investments in research and development. However, the market also features several regional players like PT SMART Tbk and KLK OLEO, which are gaining ground by catering to local needs with tailored products. The market is characterized by a growing focus on sustainability and eco-friendly solutions, with increasing demand for bio-based chemicals in industries such as automotive, agriculture, and food processing. The players in this market differentiate themselves through innovation in soy-based chemical products, competitive pricing, and strong customer relationships, while also responding to government policies promoting renewable and sustainable products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable and eco-friendly products will continue to rise, driving the growth of soy-based chemicals in industries like automotive, packaging, and agriculture.

- Government initiatives aimed at promoting renewable energy and bio-based materials will create a favorable environment for soy-based chemicals, providing incentives and subsidies for manufacturers.

- As India’s soybean production increases, it will enhance the availability of raw materials for soy-based chemicals, ensuring consistent supply for manufacturers.

- Soy-based biofuels, particularly biodiesel, will gain popularity as a renewable energy source, benefiting from rising fuel prices and the country’s focus on reducing carbon emissions.

- Ongoing advancements in soy processing technologies will make soy-based chemicals more efficient, cost-effective, and competitive with traditional petroleum-based products.

- As consumers become more conscious of their environmental impact, there will be a growing demand for eco-friendly products, further fueling the soy-based chemicals market.

- Soy-based chemicals will find new applications across various sectors, including food packaging, cosmetics, and pharmaceuticals, expanding the market’s reach.

- Higher investments in research and development will result in the creation of innovative soy-based products, improving their functionality and opening new markets for manufacturers.

- Regions like North and West India will continue to drive market growth, supported by industrial development and agricultural activities that support the production of soy-based chemicals.

- As global demand for sustainable chemicals rises, Indian manufacturers will explore export opportunities, enhancing the country’s position in the international soy-based chemicals market.