| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Medical Device Contract Manufacturing Market Size 2024 |

USD 615.77 Million |

| Indonesia Medical Device Contract Manufacturing Market, CAGR |

10.70% |

| Indonesia Medical Device Contract Manufacturing Market Size 2032 |

USD 1,389.11 Million |

Market Overview

Indonesia Medical Device Contract Manufacturing Market size was valued at USD 615.77 million in 2024 and is anticipated to reach USD 1,389.11 million by 2032, at a CAGR of 10.70% during the forecast period (2024-2032).

The Indonesia medical device contract manufacturing market is driven by the increasing demand for healthcare services, government support, and growing awareness of advanced medical technologies. Indonesia’s large and rapidly expanding population, coupled with a rising middle class, has contributed to higher healthcare needs, boosting the demand for medical devices. The Indonesian government’s initiatives to improve healthcare infrastructure, along with favorable regulations promoting foreign investment, further stimulate the market. Additionally, the trend towards outsourcing manufacturing to reduce costs and enhance efficiency is gaining traction, as local and international companies look to leverage Indonesia’s cost-effective labor and favorable production conditions. The rise in chronic diseases and the aging population also drive the need for specialized medical devices. As global companies seek high-quality production at competitive prices, Indonesia’s medical device contract manufacturing sector is poised for continued growth, supported by innovation in product design and manufacturing technologies.

The geographical landscape of Indonesia’s medical device contract manufacturing market is shaped by the diverse industrial development across regions such as Java, Sumatra, Kalimantan, and Sulawesi. Java stands out as the central hub due to its advanced infrastructure, strong manufacturing base, and presence of major cities like Jakarta and Surabaya. Sumatra and Kalimantan are gaining momentum, supported by growing urbanization and healthcare demand, while Sulawesi shows potential for expansion as healthcare access improves. Key players driving the market include PT. Indofarma Tbk and PT. Kimia Farma Tbk, which are among the leading local manufacturers with established production capabilities. International players such as Siemens and PT. Schneider Electric also contribute through technological integration and partnerships. Additionally, Asahimas Chemical plays a significant role in supplying essential components and materials. These companies collectively support Indonesia’s growing capacity to manufacture high-quality medical devices for both domestic use and regional export.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Indonesia medical device contract manufacturing market was valued at USD 615.77 million in 2024 and is projected to reach USD 1,389.11 million by 2032, growing at a CAGR of 10.70%.

- The global medical device contract manufacturing market was valued at USD 79,181.52 million in 2024 and is expected to reach USD 1,90,413.88 million by 2032, growing at a CAGR of 11.59% during the forecast period (2024-2032).

- Rising demand for affordable and high-quality healthcare solutions is driving the need for contract manufacturing in the medical device sector.

- Increasing outsourcing by global medical device companies to reduce production costs is a key trend in the market.

- Companies are focusing on strategic partnerships and local collaborations to strengthen market presence and navigate regulatory processes.

- Regulatory complexity and supply chain limitations pose challenges for market players, particularly small and medium enterprises.

- Java remains the leading region for contract manufacturing due to its industrial infrastructure and presence of major manufacturers.

- Key players such as PT. Indofarma Tbk, PT. Kimia Farma Tbk, Siemens, and PT. Schneider Electric are driving innovation and technological advancement in the sector.

Report Scope

This report segments the Indonesia Medical Device Contract Manufacturing Market as follows:

Market Drivers

Growing Healthcare Demand

Indonesia’s healthcare demand is one of the primary drivers of the medical device contract manufacturing market. For instance, the BPJS-Kesehatan national health insurance program now covers over 258 million people, significantly boosting demand for medical devices. The country is experiencing a rapid urbanization process, which is accompanied by rising healthcare awareness. Additionally, an increasing middle class is contributing to higher disposable income, making access to healthcare more widespread. This expanding consumer base has resulted in a surge in demand for medical devices, from diagnostic tools to advanced surgical instruments, further fueling the need for local manufacturing capacity. Medical device manufacturers are increasingly looking to localize production to meet this demand efficiently and cost-effectively.

Government Support and Regulatory Environment

The Indonesian government plays a crucial role in supporting the medical device sector, creating a favorable environment for contract manufacturing. Various policies and initiatives aimed at improving the healthcare infrastructure and attracting foreign investment are contributing to the growth of the medical device market. For instance, the Local Content Requirements (TKDN) policy, introduced in 2021, mandates a minimum of 40% local content for medical devices in public procurement. Indonesia’s push for local manufacturing through policies that encourage foreign direct investent (FDI) has made the country an attractive destination for medical device companies. The government’s commitment to enhancing healthcare systems and its emphasis on promoting self-reliance in medical device production have led to the development of initiatives that ensure favorable market conditions for contract manufacturers. Furthermore, recent regulatory reforms and improvements in certification processes are helping streamline manufacturing activities and enhancing product quality.

Cost-Effective Labor and Operational Efficiency

One of the significant advantages that Indonesia offers to medical device contract manufacturers is its cost-effective labor force. The country’s relatively low labor costs compared to more developed nations make it an attractive location for both international and local companies seeking to lower production expenses. In addition to reduced labor costs, Indonesia offers manufacturers access to a competitive operational environment, with strategic locations, abundant natural resources, and supportive logistics infrastructure. The combination of affordable labor and efficient operational conditions makes Indonesia an ideal destination for outsourcing medical device manufacturing. This allows companies to maintain high-quality standards while reducing costs, leading to increased profitability and competitiveness in the global market.

Advancements in Technology and Innovation

Advancements in manufacturing technology and innovation are further driving the Indonesia medical device contract manufacturing market. The industry is evolving, with modern production techniques, automation, and digitization improving manufacturing efficiency, accuracy, and scale. Contract manufacturers are increasingly adopting state-of-the-art equipment and technologies such as 3D printing, robotics, and artificial intelligence to enhance product design, production speed, and quality. These technological advancements enable manufacturers to create more precise, innovative medical devices that meet global quality standards while staying cost-effective. As the demand for technologically advanced medical devices continues to grow, the ability to incorporate cutting-edge technologies into production processes will be critical for companies aiming to stay competitive in the market.

Market Trends

Focus on High-Quality Standards and Regulatory Compliance

In response to the growing demand for medical devices that meet international standards, there is a noticeable trend towards stricter adherence to quality control measures and regulatory compliance in Indonesia’s contract manufacturing sector. Companies are increasingly focusing on meeting global quality standards, such as ISO certifications and the Good Manufacturing Practice (GMP) guidelines, to ensure product safety and reliability. For instance, Indonesia’s recent regulatory updates mandate healthcare facilities to allocate budgets for medical device maintenance, ensuring long-term safety and efficacy. The Indonesian government has also tightened regulations in recent years, enhancing the importance of compliance with international standards. Manufacturers are investing in advanced technologies and robust quality management systems to ensure their products meet these higher standards, which is essential for both local market growth and access to international markets.

Outsourcing and Strategic Partnerships

A prominent trend in Indonesia’s medical device contract manufacturing market is the growing reliance on outsourcing and strategic partnerships. As global medical device companies aim to reduce production costs and focus on core competencies such as R&D and marketing, they are increasingly turning to third-party manufacturers for cost-effective, high-quality production. By outsourcing manufacturing operations, companies can tap into Indonesia’s competitive advantages, such as affordable labor and a skilled workforce. Additionally, strategic partnerships with local contract manufacturers enable international companies to navigate regulatory frameworks and optimize supply chain efficiency. This trend is expected to continue, with more global firms seeking to leverage Indonesia’s manufacturing capabilities for localized production, thereby expanding the market’s growth prospects.

Customization and Specialized Product Manufacturing

Another emerging trend is the growing demand for customized and specialized medical devices. As healthcare becomes more personalized and patient-centric, there is a shift towards the production of specialized devices tailored to individual needs, such as personalized prosthetics, orthotics, and diagnostic tools. Contract manufacturers in Indonesia are increasingly adopting flexible manufacturing processes that allow for customization at scale. By utilizing advanced production technologies such as 3D printing and computer-aided design (CAD), manufacturers are able to deliver specialized products faster and more cost-effectively. This trend reflects a broader global shift towards personalized healthcare and presents opportunities for Indonesia’s medical device contract manufacturers to differentiate themselves in a competitive market.

Increased Focus on Sustainable and Eco-Friendly Manufacturing

Sustainability is becoming an increasingly important trend within the medical device contract manufacturing industry in Indonesia. Companies are focusing on incorporating eco-friendly practices into their manufacturing processes to reduce environmental impact. This includes using sustainable materials, reducing energy consumption, and improving waste management practices. For instance, Indonesian healthcare market studies highlight efforts to reduce environmental impact through green manufacturing technologies. With growing awareness of environmental issues and stricter regulations in many global markets, manufacturers are adopting green manufacturing technologies and pursuing certifications such as ISO 14001 (Environmental Management Systems). This trend aligns with the increasing consumer and regulatory demand for sustainable products and is expected to be a key driver in shaping the future of Indonesia’s medical device manufacturing landscape.

Market Challenges Analysis

Regulatory Complexity and Compliance Challenges

One of the primary challenges faced by Indonesia’s medical device contract manufacturing market is navigating the complex regulatory landscape. Although the Indonesian government has implemented various initiatives to streamline regulations, the process of obtaining necessary approvals and certifications can still be time-consuming and cumbersome. For instance, recent regulatory updates mandate stricter post-market surveillance and clinical validation for high-risk medical devices. Manufacturers must comply with strict quality control standards, such as ISO certifications and Good Manufacturing Practice (GMP), in order to access both domestic and international markets. Additionally, fluctuations in regulatory requirements and the evolving nature of healthcare laws can complicate compliance efforts for companies. These regulatory hurdles can delay product launches and increase operational costs, posing a challenge for manufacturers seeking to remain competitive in the global market.

Supply Chain Disruptions and Raw Material Shortages

Another significant challenge in the Indonesian medical device contract manufacturing sector is the vulnerability of supply chains to disruptions and raw material shortages. The medical device industry heavily relies on a steady supply of high-quality raw materials, and any disruption in the supply chain can lead to delays in production and increased costs. Indonesia, being an emerging market, sometimes faces challenges related to the availability and cost of raw materials, particularly those that require specialized imports. Additionally, global supply chain disruptions, such as those experienced during the COVID-19 pandemic, have highlighted the risks of relying on external suppliers for critical components. Manufacturers must invest in strengthening their supply chain resilience and develop strategies to mitigate such risks, ensuring a consistent flow of materials for production.

Market Opportunities

The Indonesia medical device contract manufacturing market presents several key opportunities for growth, driven by the country’s expanding healthcare sector and favorable business environment. As the demand for medical devices increases due to an aging population, rising chronic diseases, and a growing middle class, there is a substantial opportunity for contract manufacturers to capitalize on this trend. The Indonesian government’s push for improving healthcare infrastructure and increasing access to medical services creates a promising landscape for medical device manufacturers. Additionally, with more global companies seeking to reduce production costs while maintaining high-quality standards, Indonesia’s cost-effective labor force and strategic location in Southeast Asia make it an attractive destination for outsourcing manufacturing. This positions Indonesia as a key player for companies looking to serve both local and regional markets.

Another significant opportunity lies in the growing trend towards personalized and specialized medical devices. As healthcare shifts towards more individualized care, there is an increasing need for customized products such as prosthetics, diagnostics, and surgical tools. Contract manufacturers in Indonesia can leverage advanced manufacturing technologies, including 3D printing and automation, to cater to these specialized needs. Furthermore, with the global emphasis on sustainability and eco-friendly production, manufacturers can differentiate themselves by adopting green manufacturing practices and aligning with environmental regulations. These opportunities, combined with the rising demand for high-quality, cost-effective medical devices, position Indonesia’s medical device contract manufacturing sector for continued growth and innovation in the years ahead.

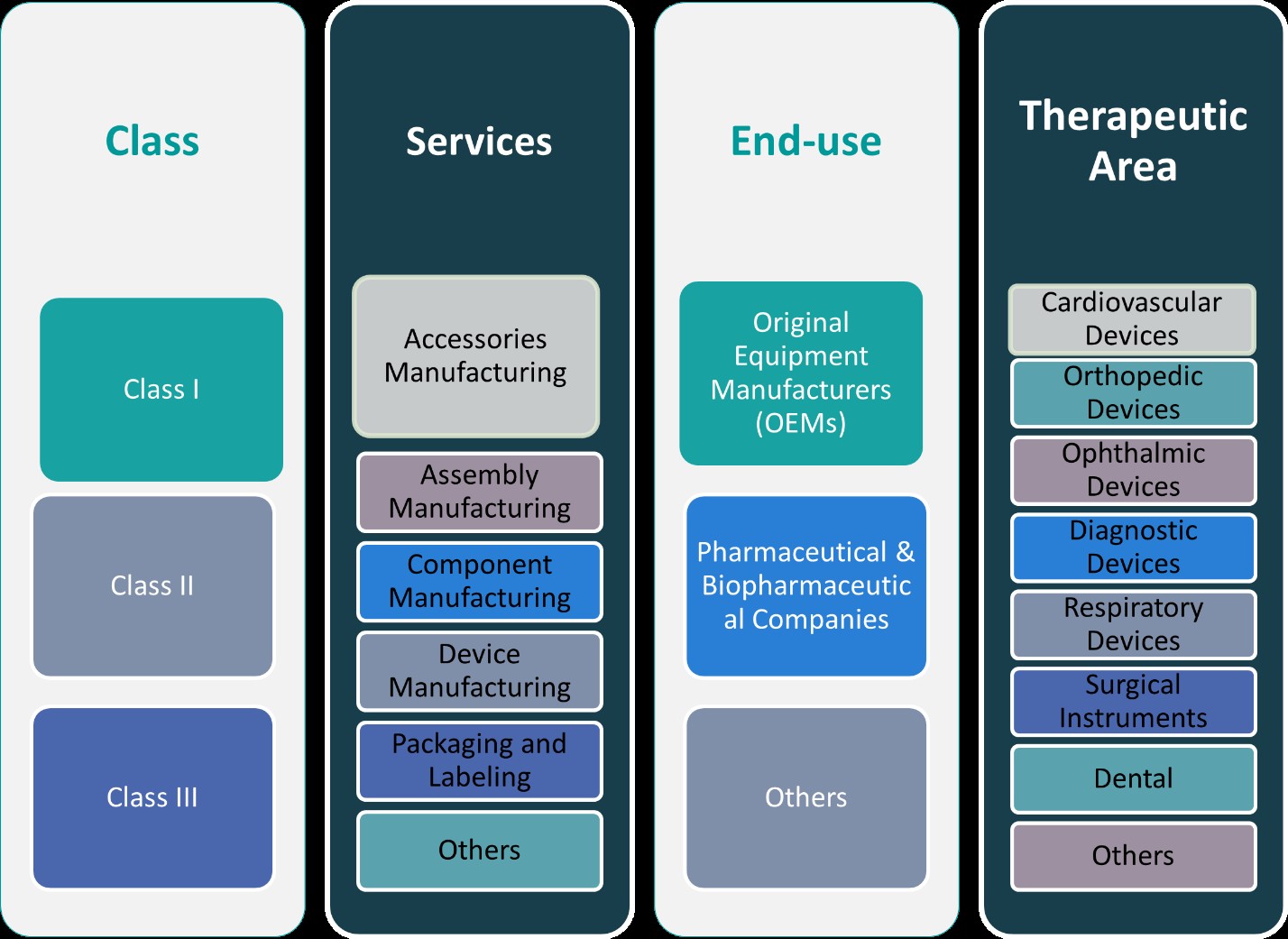

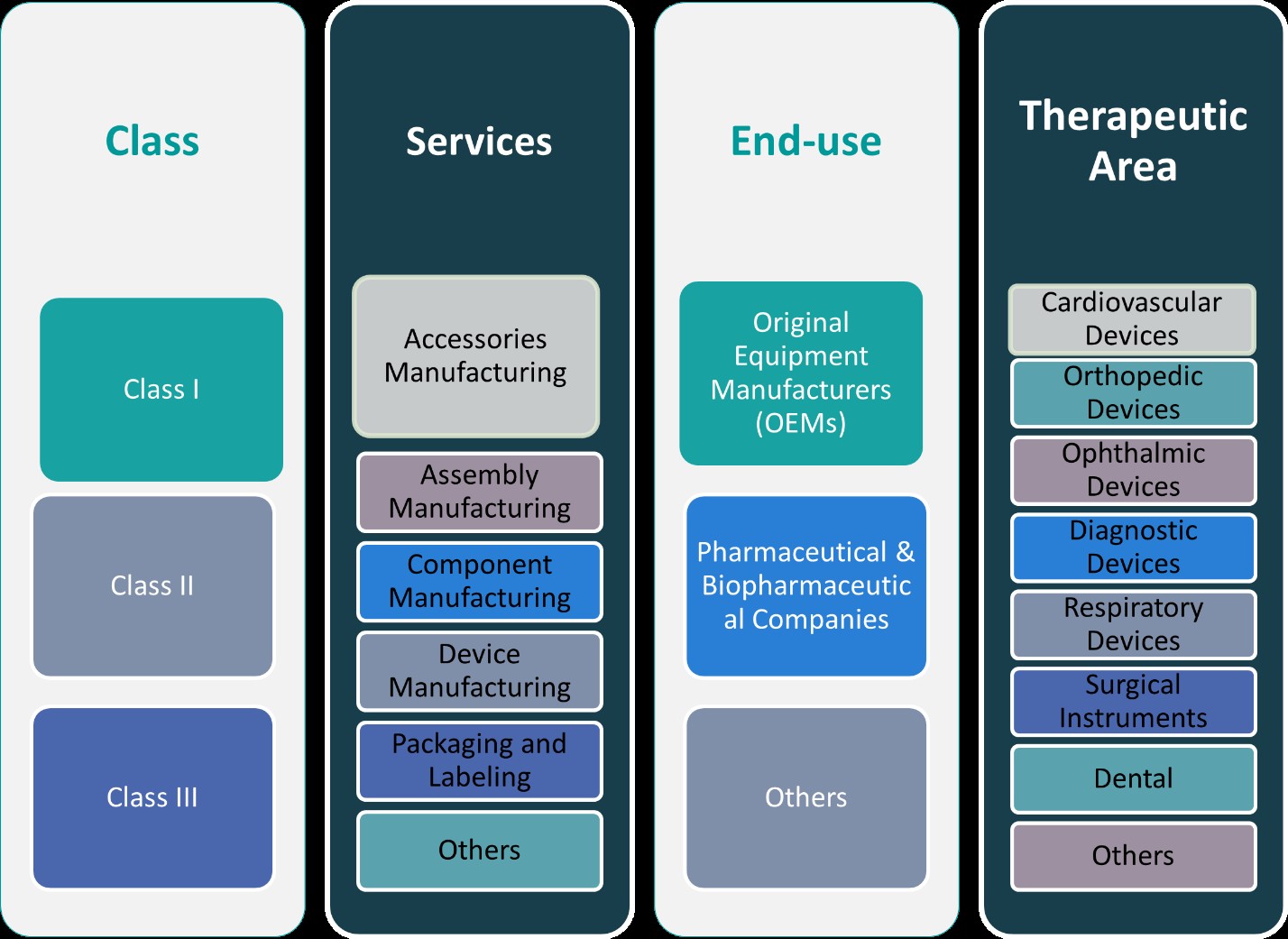

Market Segmentation Analysis:

By Class:

The medical device contract manufacturing market in Indonesia is categorized into three classes based on the risk associated with the devices: Class I, Class II, and Class III. Class I devices are low-risk products such as general hospital equipment, non-invasive devices, and simple diagnostic tools. These devices typically require less regulatory scrutiny and are less complex to manufacture, offering significant opportunities for local manufacturers focusing on cost-effective solutions. Class II devices, which include diagnostic machines, imaging systems, and certain surgical tools, are medium-risk products. They require more stringent regulatory approvals and higher-quality manufacturing processes. Manufacturers in this segment are increasingly adopting advanced technologies and quality management systems to meet the standards set by regulatory bodies. Finally, Class III devices are high-risk products such as pacemakers, implants, and life-support devices. These devices necessitate extensive testing, certification, and compliance with international standards. Manufacturers involved in Class III production are focused on ensuring precision, safety, and reliability, making this segment highly competitive but also lucrative for manufacturers that can meet the regulatory demands.

By Services:

In terms of services, the Indonesian medical device contract manufacturing market is divided into several key segments: accessories manufacturing, assembly manufacturing, component manufacturing, device manufacturing, packaging and labeling, and others. Accessories manufacturing focuses on producing complementary products like surgical instruments, diagnostic accessories, and other supportive devices. Assembly manufacturing involves the integration of various components into a finished product, which is essential for complex medical devices that require precision and customization. Component manufacturing involves the production of parts like electronic components, sensors, and mechanical parts that are essential in the functioning of medical devices. Device manufacturing covers the production of the complete medical device, such as diagnostic machines, therapeutic devices, and surgical equipment. Packaging and labeling is another critical service, ensuring devices are appropriately packaged, labeled, and compliant with regulatory requirements. Other segments include services like sterilization, testing, and product validation. The increasing demand for specialized and high-quality devices is driving the growth of these segments, particularly those focused on high-tech device manufacturing and regulatory compliance.

Segments:

Based on Class:

- Class I

- Class II

- Class III

Based on Services:

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Based on End- Use:

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others

Based on Therapeutic Area:

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Surgical Instruments

- Dental

- Others

Based on the Geography:

- Java

- Sumatra

- Kalimantan

- Sulawesi

Regional Analysis

Java

Java holds the largest market share, accounting for approximately 60% of the total medical device contract manufacturing market in Indonesia. The region’s dominance is driven by its well-developed healthcare infrastructure, presence of major manufacturing hubs, and concentration of key players in the medical device industry. Jakarta, as the capital and economic center, acts as a focal point for both domestic and international medical device companies. The robust healthcare system, coupled with substantial investments in local manufacturing capabilities, has established Java as a critical hub for medical device production.

Sumatra

Sumatra follows Java in terms of market share, capturing around 20% of the market. The region’s medical device contract manufacturing sector is primarily influenced by its growing urban centers, such as Medan and Palembang, and its proximity to industrial zones. Sumatra’s market share is further boosted by the region’s increasing demand for healthcare services due to a rising population and prevalence of chronic diseases. While Sumatra is not as industrialized as Java, its manufacturing capabilities are expanding rapidly, with increasing investments in medical device production facilities. As local healthcare demands grow, particularly for diagnostic and therapeutic devices, Sumatra is emerging as an attractive location for medical device contract manufacturing.

Kalimantan

In Kalimantan, the medical device contract manufacturing market is still in a developmental stage, holding a smaller share of approximately 10%. However, the region’s growing economic importance, driven by industries such as oil and gas, is creating a conducive environment for diversification into other sectors, including healthcare. Kalimantan is experiencing increasing healthcare demands, spurred by both an expanding population and greater awareness of medical technologies. The region’s market share is expected to grow in the coming years as infrastructure development improves and healthcare access increases, potentially attracting more investments in medical device manufacturing.

Sulawesi

Sulawesi holds a market share of around 10%, with a slower but steady growth trajectory. Sulawesi’s medical device manufacturing sector is still emerging, and the market is characterized by a need for improved healthcare infrastructure and technology. However, with a growing population and government efforts to expand healthcare access, Sulawesi is beginning to see a rise in local medical device manufacturing. The region’s market share may increase as demand for more specialized medical devices grows, particularly in areas like diagnostics, monitoring equipment, and surgical tools, driven by local healthcare providers’ efforts to upgrade their facilities and capabilities.

Key Player Analysis

- Indofarma Tbk

- Schneider Electric

- Siemens

- Asahimas Chemical

- Kimia Farma Tbk

Competitive Analysis

The competitive landscape of Indonesia’s medical device contract manufacturing market is shaped by a mix of established local firms and international players, each contributing to the sector’s growth through technological advancements, strategic investments, and manufacturing capabilities. Leading players such as PT. Indofarma Tbk, PT. Kimia Farma Tbk, Siemens, PT. Schneider Electric, and Asahimas Chemical play a pivotal role in strengthening the market through diversified product offerings, operational expertise, and regional presence. The market is marked by intense competition, where manufacturers strive to meet both domestic and international regulatory requirements while delivering cost-effective, high-quality products.

Firms are pursuing strategies such as innovation in production processes, investment in automation, and strengthening their supply chain networks to gain a competitive edge. Collaborations with healthcare providers, research institutions, and global medical device brands have become more common, aiming to boost technical know-how and product development. Additionally, there is a strong emphasis on gaining certifications and compliance with global standards like ISO and GMP, which is essential for gaining trust and expanding market reach. This environment encourages continuous improvement and positions Indonesia as an emerging hub in the global contract manufacturing landscape.

Recent Developments

- In February 2025, Jabil completed the acquisition of Pii, a contract development and manufacturing organization (CDMO) specializing in aseptic filling, lyophilization, and oral solid dose manufacturing.

- In November 2024, Integer completed the sale of its non-medical Electrochem business for $50 million, making it a pure-play medical technology company and allowing it to redeploy capital into high-growth medtech markets.

- In October 2024, At CPHI Milan 2024, Thermo Fisher launched its Accelerator Drug Development platform, a 360° CDMO and CRO offering. This service provides customizable manufacturing, clinical research, and supply chain solutions for small molecules, biologics, and cell and gene therapies, covering the full drug development lifecycle.

Market Concentration & Characteristics

The Indonesia medical device contract manufacturing market exhibits moderate to high market concentration, with a few well-established players dominating production capabilities, particularly in key regions such as Java. These companies benefit from advanced infrastructure, regulatory experience, and established relationships with healthcare institutions and international partners. The market is characterized by increasing demand for cost-effective and high-quality medical devices, prompting manufacturers to adopt advanced technologies such as automation, precision engineering, and lean production practices. Additionally, the market is defined by its responsiveness to evolving regulatory frameworks and its ability to meet both domestic and export requirements. Although large players hold a significant share, the sector is witnessing the entry of smaller and mid-sized firms, especially in emerging regions, encouraged by government support and rising healthcare needs. The blend of established expertise and emerging innovation creates a competitive yet collaborative environment, driving sustained growth and technological advancement within Indonesia’s contract manufacturing landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Class, Services, End-Use, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness sustained growth due to increasing demand for affordable healthcare solutions.

- Technological advancements will drive efficiency and precision in contract manufacturing processes.

- More international companies are likely to outsource production to Indonesian manufacturers.

- Regulatory reforms may simplify approval processes and attract foreign investment.

- The demand for customized and specialized medical devices will continue to rise.

- Adoption of sustainable and eco-friendly manufacturing practices will become more prominent.

- Investment in automation and digital technologies will enhance production capabilities.

- Emerging regions beyond Java will play a larger role in manufacturing expansion.

- Strategic partnerships and joint ventures will increase to strengthen local expertise.

- Compliance with global quality standards will remain a key focus for competitiveness.