Market Overview:

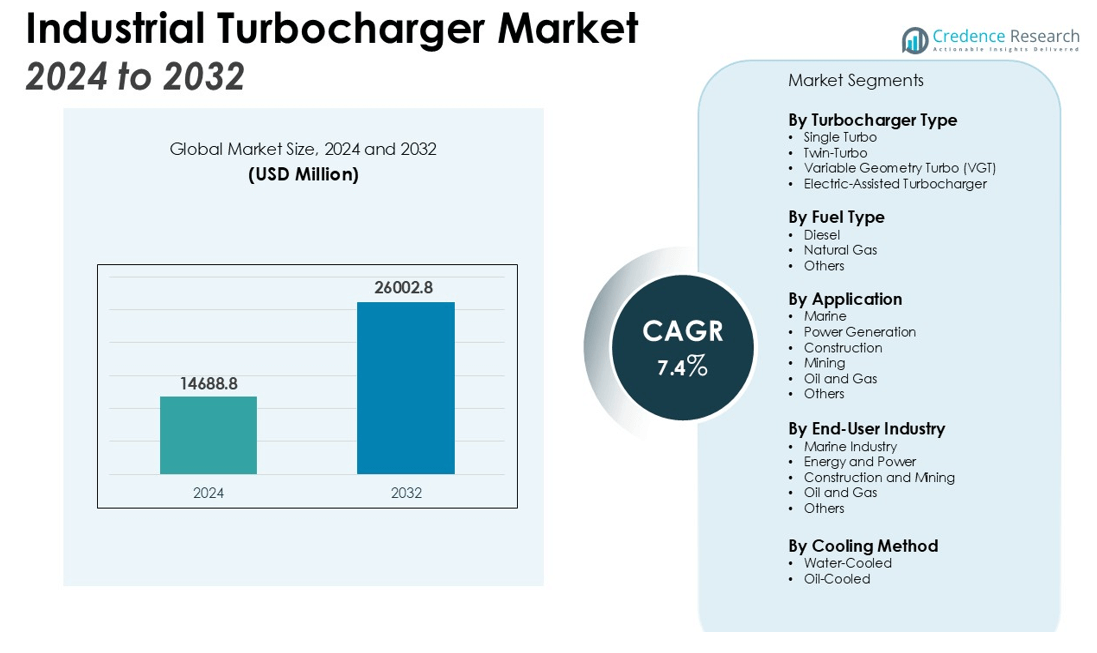

The Industrial Turbocharger Market size was valued at USD 14688.8 million in 2024 and is anticipated to reach USD 26002.8 million by 2032, at a CAGR of 7.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Turbocharger Market Size 2024 |

USD 14688.8 million |

| Industrial Turbocharger Market, CAGR |

7.4% |

| Industrial Turbocharger Market Size 2032 |

SD 26002.8 million |

Market growth is primarily driven by advancements in turbocharger technology, including the development of variable geometry and electric-assisted turbochargers, which improve engine performance and operational flexibility. Stringent emission norms set by regulatory authorities, coupled with the global push toward sustainability, are accelerating the shift toward high-efficiency turbocharging solutions. Expanding industrial infrastructure and the need for reliable, high-performance equipment in heavy machinery are further contributing to market expansion. The increasing integration of digital monitoring and predictive maintenance systems in turbocharger units is also enhancing operational efficiency and reducing downtime.

Regionally, Asia-Pacific dominates the Industrial Turbocharger Market, supported by large-scale manufacturing, industrialization, and growing investments in marine and power generation sectors. Europe follows with strong demand driven by environmental regulations and technological innovation, while North America maintains steady growth supported by the modernization of industrial equipment and the adoption of clean energy solutions.

Market Insights:

- The Industrial Turbocharger Market was valued at USD 14,688.8 million and is projected to reach USD 26,002.8 million, growing at a CAGR of 7.4% during the forecast period.

- Stringent emission regulations are accelerating the adoption of variable geometry and electric-assisted turbochargers, enabling compliance without reducing performance.

- Rising demand for fuel efficiency is driving investment in high-performance turbochargers, lowering operational costs and supporting sustainability targets.

- Technological innovations such as advanced materials, precision engineering, and predictive maintenance systems are improving durability and reducing downtime.

- High manufacturing costs and complex design requirements remain challenges, particularly for smaller manufacturers with limited resources.

- Asia-Pacific holds 46% of the market share, led by industrialization, manufacturing growth, and strong demand from marine and power generation sectors.

- Europe holds 28% and North America 19%, with both regions benefiting from modernization efforts, environmental compliance, and adoption of cleaner energy solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Regulations Driving Advanced Turbocharger Adoption

The Industrial Turbocharger Market is experiencing strong growth due to increasingly strict emission standards set by regulatory bodies worldwide. Industries such as marine, power generation, and heavy machinery are adopting advanced turbocharging systems to reduce harmful emissions while maintaining high performance. Variable geometry and electric-assisted turbochargers are enabling compliance without compromising operational efficiency. This regulatory pressure is fostering continuous innovation in design and manufacturing processes.

- For instance, with over 50 million units deployed, Garrett Motion’s Variable Geometry Turbo (VNT) is a key technology for auto manufacturers seeking to improve fuel efficiency and lower emissions.

Rising Demand for Energy Efficiency and Fuel Optimization

Fuel efficiency remains a key priority for industrial operators, and turbochargers play a critical role in achieving this goal. By enabling engines to produce more power from smaller displacements, they significantly lower fuel consumption and operational costs. Industries are increasingly investing in high-performance turbochargers to meet production targets with reduced energy inputs. It is also supporting sustainability targets while enhancing cost competitiveness in global markets.

Technological Advancements Enhancing Performance and Reliability

improvements in turbocharger technology are boosting their adoption across diverse industrial applications. Innovations such as advanced materials, precision engineering, and integrated monitoring systems are increasing durability and reducing maintenance requirements. The introduction of predictive maintenance capabilities ensures minimal downtime, improving overall productivity. These advancements are strengthening the market’s position as a preferred choice for modern industrial engines.

Expanding Industrial Infrastructure and Heavy-Duty Applications

Rapid industrialization and infrastructure development are creating sustained demand for heavy-duty equipment equipped with high-efficiency turbochargers. The market is benefiting from large-scale projects in construction, mining, and energy generation, where reliability and performance are critical. Turbochargers are enabling these sectors to operate machinery at optimal output under challenging conditions. This growing application scope continues to reinforce the importance of turbocharger technology in industrial operations.

- For instance, Volvo Trucks’ new D17 engine, developed for the most demanding transport assignments, is equipped with a single efficient turbocharger that helps it deliver up to 780 horsepower.

Market Trends:

Integration of Digital Monitoring and Predictive Maintenance Solutions

The Industrial Turbocharger Market is witnessing a shift toward digital integration, with manufacturers incorporating advanced monitoring systems and predictive maintenance capabilities into turbocharger units. These technologies enable real-time performance tracking, early detection of faults, and optimized servicing schedules, reducing downtime and operational costs. The adoption of IoT-enabled sensors and analytics platforms is improving reliability and extending product life cycles. It is also helping operators make data-driven decisions to maximize fuel efficiency and meet regulatory requirements. This trend is particularly strong in sectors such as marine, power generation, and heavy machinery, where operational continuity is critical.

- For instance, the TruCare predictive maintenance platform from Singapore’s Tru-Marine was successfully trialed on 4 Pacific International Lines container ships, using IoT technologies and digital twins to detect anomalies and pre-empt costly turbocharger failures.

Growing Adoption of High-Efficiency and Electrified Turbocharger Technologies

A significant trend in the Industrial Turbocharger Market is the transition toward high-efficiency and electrified turbocharging solutions to meet evolving environmental and performance standards. Variable geometry, twin-scroll, and electric-assisted turbochargers are gaining traction for their ability to deliver rapid response, improved fuel economy, and reduced emissions. It is driving innovation in design, with a focus on lightweight materials and advanced manufacturing techniques to enhance durability under extreme conditions. The shift is supported by rising investments in research and development aimed at creating turbochargers capable of performing efficiently in hybrid and alternative-fuel-powered industrial engines. This evolution is reshaping competitive dynamics, with manufacturers differentiating through performance, sustainability, and advanced engineering capabilities.

- For instance, in a test on an Audi vehicle, Garrett Motion’s E-Turbo technology improved the 0-100 kph acceleration time from 11.0 seconds down to 8.8 seconds.

Market Challenges Analysis:

High Manufacturing Costs and Complex Design Requirements

The Industrial Turbocharger Market faces challenges due to the high cost of manufacturing and the complexity of advanced turbocharger designs. Precision engineering, advanced materials, and stringent quality control standards increase production expenses. It also requires significant investment in research and development to meet evolving performance and emission requirements. Smaller manufacturers often struggle to compete with established players due to limited technological and financial resources. These cost-related barriers can slow adoption, particularly in price-sensitive markets.

Maintenance Demands and Operational Downtime Risks

Maintaining industrial turbochargers involves specialized skills, advanced diagnostic tools, and timely servicing to ensure consistent performance. The Industrial Turbocharger Market is impacted by operational downtime risks when maintenance is delayed or performed incorrectly. Harsh operating conditions in sectors such as marine, mining, and power generation can accelerate wear, leading to higher maintenance frequency. It increases the total cost of ownership and can disrupt critical operations. Limited availability of skilled technicians in certain regions further complicates maintenance, creating potential operational inefficiencies.

Market Opportunities:

Rising Demand from Renewable and Hybrid Power Systems

The Industrial Turbocharger Market holds significant potential in supporting renewable and hybrid power generation systems. Growing adoption of gas engines in renewable energy projects is creating opportunities for advanced turbocharger integration to enhance efficiency and output. It enables optimized fuel usage and reduced emissions, aligning with global sustainability goals. Hybrid-powered industrial equipment also benefits from electric-assisted turbochargers, improving responsiveness and load-handling capabilities. The transition toward cleaner industrial operations is expected to expand demand in this segment.

Expansion in Emerging Industrial and Maritime Markets

Emerging economies with rapid industrialization and maritime trade growth present untapped opportunities for turbocharger manufacturers. The Industrial Turbocharger Market is poised to benefit from infrastructure development projects, increased port activities, and expanding manufacturing bases. It creates demand for reliable, high-performance turbochargers in heavy machinery, marine vessels, and power plants. Strategic partnerships and localized manufacturing can help companies capture market share in these regions. Investment in application-specific product innovations will further strengthen growth prospects in these high-potential markets.

Market Segmentation Analysis:

By Turbocharger Type

The Industrial Turbocharger Market is segmented into single turbo, twin-turbo, variable geometry turbo (VGT), and electric-assisted turbochargers. Single turbo units dominate due to their cost-effectiveness and suitability for a wide range of industrial engines. VGT and electric-assisted technologies are gaining traction for their ability to enhance efficiency, improve throttle response, and meet stringent emission standards. It is witnessing rising adoption of advanced turbo types in heavy-duty applications where performance and fuel economy are critical.

- For instance, specific models in BorgWarner’s AirWerks series of single turbochargers are engineered to support up to 1,875 horsepower per unit.

By Fuel Type

The market is categorized into diesel, natural gas, and others. Diesel engines account for the largest share due to their extensive use in marine, construction, and power generation sectors. Natural gas turbochargers are expanding in adoption, supported by the global transition toward cleaner fuel alternatives. It is seeing strong investment in turbocharger solutions optimized for alternative fuels to support sustainability goals and regulatory compliance.

- For instance, Mitsubishi Heavy Industries, Ltd. (MHI) developed the MET83MAG hybrid turbocharger, which has a maximum power output of 754 kilowatts.

By Application

Applications include marine, power generation, construction, mining, oil and gas, and others. The marine sector leads due to the need for high-powered engines with low emissions in shipping and offshore operations. Power generation follows, driven by demand for efficient engines in industrial plants and renewable energy projects. It is also benefiting from growing deployment in construction and mining machinery, where durability and consistent performance are essential under demanding conditions.

Segmentations:

By Turbocharger Type

- Single Turbo

- Twin-Turbo

- Variable Geometry Turbo (VGT)

- Electric-Assisted Turbocharger

By Fuel Type

- Diesel

- Natural Gas

- Others

By Application

- Marine

- Power Generation

- Construction

- Mining

- Oil and Gas

- Others

By End-User Industry

- Marine Industry

- Energy and Power

- Construction and Mining

- Oil and Gas

- Others

By Cooling Method

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific Leading with Strong Industrial and Maritime Demand

Asia-Pacific accounted for 46% of the Industrial Turbocharger Market, maintaining its position as the largest regional market. The region’s dominance is driven by rapid industrialization, large-scale manufacturing, and expanding maritime trade. High demand from marine, power generation, and construction sectors is fueling adoption of advanced turbocharging solutions. It is also supported by significant investments in port infrastructure, shipbuilding, and industrial machinery upgrades. Countries such as China, Japan, and South Korea are leading in both consumption and production, supported by robust domestic manufacturing capabilities. Government initiatives promoting energy efficiency and low-emission technologies further strengthen regional growth prospects.

Europe Advancing Through Technological Innovation and Environmental Compliance

Europe held 28% of the Industrial Turbocharger Market, supported by stringent environmental regulations and advanced engineering expertise. Strong adoption of variable geometry and electric-assisted turbochargers is enhancing industrial engine performance while meeting emission standards. The Industrial Turbocharger Market in Europe benefits from a highly skilled workforce and established manufacturing infrastructure. It is further boosted by investments in sustainable industrial technologies and modernization of marine fleets. Germany, the UK, and Norway are notable contributors, with high demand from shipping, energy, and heavy machinery industries.

North America Benefiting from Modernization and Energy Transition

North America captured 19% of the Industrial Turbocharger Market, reflecting steady regional growth. The modernization of industrial equipment and adoption of cleaner energy solutions are key drivers in this market. Strong demand from marine, mining, and oil and gas sectors is creating opportunities for advanced turbocharger deployment. It is also driven by infrastructure renewal projects and replacement of outdated equipment with fuel-efficient alternatives. The United States leads regional adoption, while Canada shows growing interest in turbocharger integration for hybrid and gas-powered industrial engines. Ongoing investments in renewable and LNG-powered maritime fleets further support long-term market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Industrial Turbocharger Market is characterized by intense competition, with global and regional players focusing on technological advancements, product efficiency, and compliance with emission standards. Leading companies are investing in research and development to introduce variable geometry and electric-assisted turbochargers that enhance performance and fuel efficiency. It is also witnessing strategic partnerships, mergers, and supply agreements aimed at expanding market presence and customer base. Manufacturers are emphasizing durability, predictive maintenance integration, and adaptability to multiple fuel types to cater to diverse industrial applications. Competition is further driven by the need to serve high-demand sectors such as marine, power generation, and heavy machinery under stringent environmental regulations. Strong aftersales service networks and localized production capabilities are emerging as key differentiators, enabling companies to meet specific regional requirements while maintaining cost efficiency and operational reliability.

Recent Developments:

- In August 2025, IHI Corporation finalized the transfer of its Materials Handling System Business from its subsidiary, IHI Transport Machinery Co., Ltd.

- In July 2025, Dana Inc. expanded its Victor Reinz product line to include customized sealing solutions for modern Chinese vehicle brands like Geely.

- In July 2025, Honeywell announced its acquisition of the Li-ion Tamer business from Nexceris, a company that provides off-gas detection solutions for lithium-ion batteries.

Market Concentration & Characteristics:

The Industrial Turbocharger Market exhibits a moderately consolidated structure, with a few global players holding significant market share alongside several regional manufacturers serving niche applications. It is defined by high entry barriers due to substantial capital investment, advanced engineering requirements, and strict regulatory compliance. Leading companies focus on innovation in variable geometry and electric-assisted technologies to enhance efficiency and meet emission standards. The market is characterized by long product lifecycles, high durability requirements, and strong demand from sectors such as marine, power generation, and heavy machinery. Competitive advantage is often achieved through technological expertise, customization capabilities, and robust aftersales service networks.

Report Coverage:

The research report offers an in-depth analysis based on Turbocharger Type, Fuel Type, Application, End-User Industry, Cooling Method and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see rising adoption of variable geometry and electric-assisted turbochargers to meet stricter emission norms and improve efficiency.

- Integration of IoT-enabled monitoring and predictive maintenance systems will become standard to enhance reliability and reduce downtime.

- Demand from marine, power generation, and heavy machinery sectors will remain strong due to operational efficiency requirements.

- Natural gas and alternative fuel-compatible turbochargers will gain traction as industries shift toward cleaner energy sources.

- Manufacturers will increase investment in lightweight, durable materials to enhance performance in high-stress industrial environments.

- Regional production facilities will expand to meet localized demand and reduce supply chain vulnerabilities.

- Hybrid-powered industrial equipment will drive demand for advanced turbocharging solutions with faster response times.

- Customization for sector-specific applications will emerge as a competitive differentiator among key players.

- Strategic partnerships between turbocharger manufacturers and engine OEMs will strengthen to ensure integrated performance solutions.

- Technological advancements will continue to align with global sustainability goals, creating long-term growth opportunities across industrial sectors.