Market Overview:

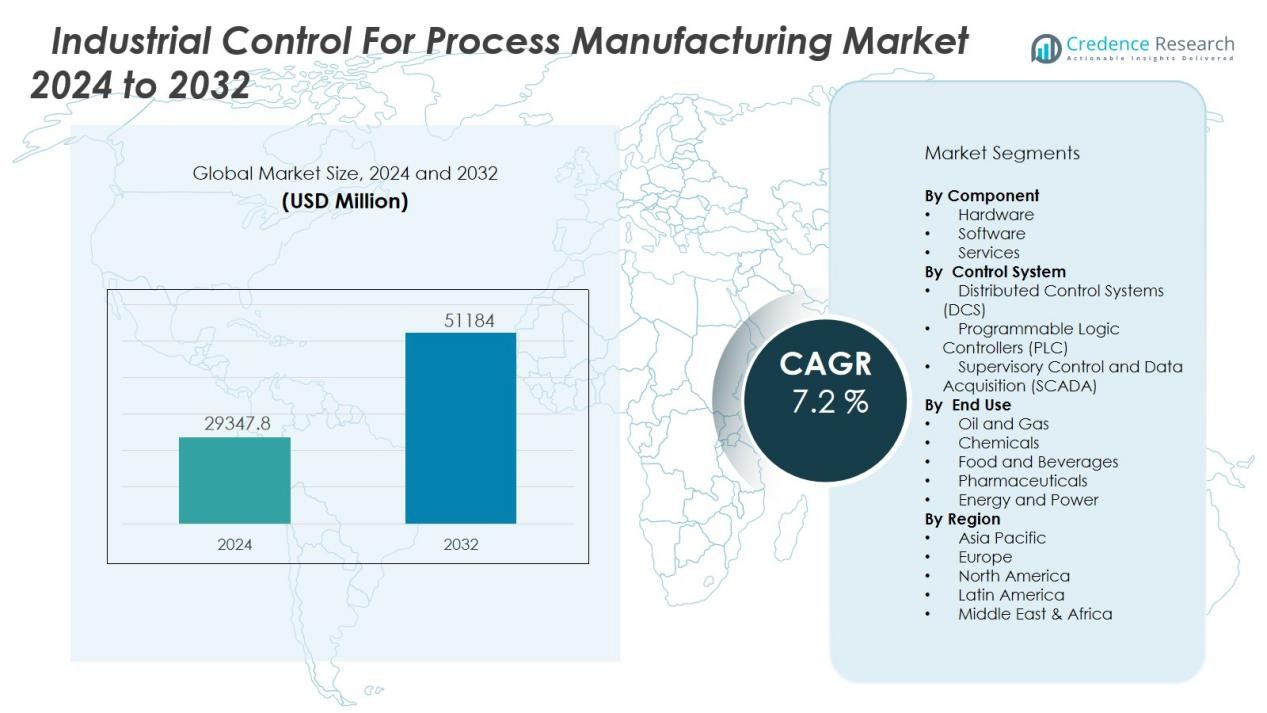

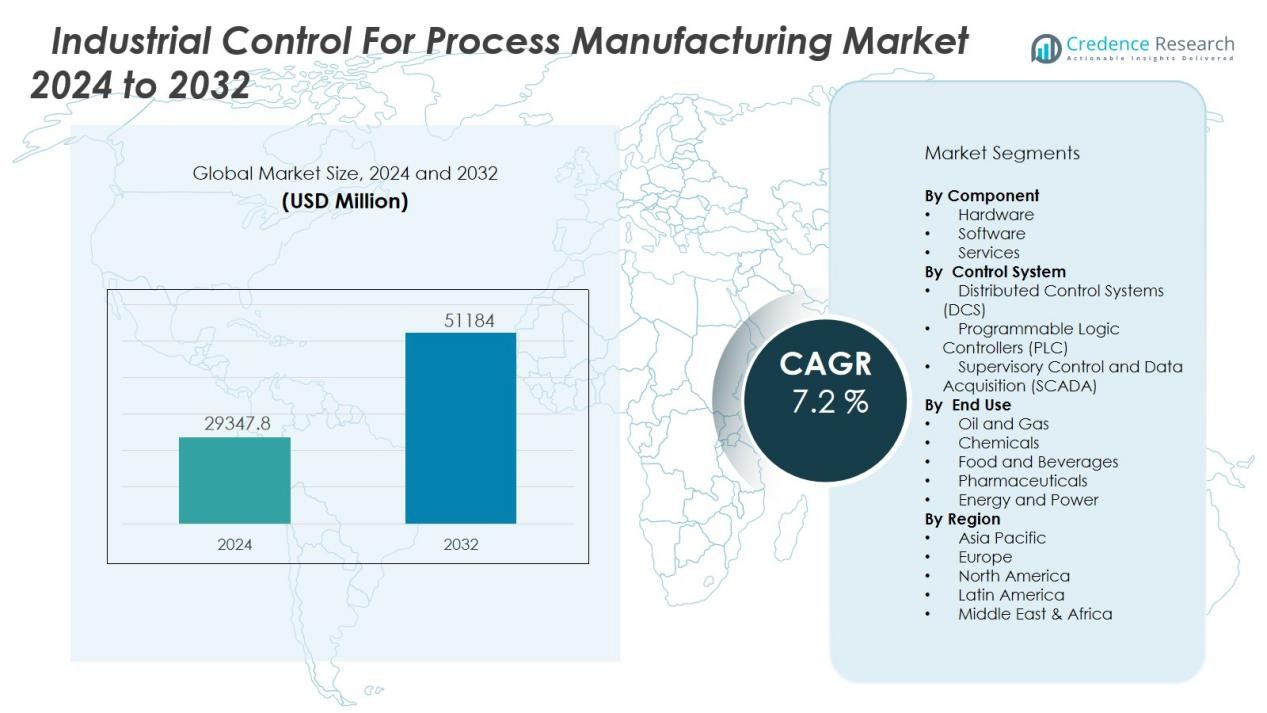

The industrial control for process manufacturing market size was valued at USD 29347.8 million in 2024 and is anticipated to reach USD 51184 million by 2032, at a CAGR of 7.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Control for Process Manufacturing Market Size 2024 |

USD 29347.8 Million |

| Industrial Control for Process Manufacturing Market, CAGR |

7.2 % |

| Industrial Control for Process Manufacturing Market Size 2032 |

USD 51184 Million |

Rising adoption of Industry 4.0, integration of IoT-enabled devices, and demand for predictive maintenance are driving market growth. Manufacturers are investing in distributed control systems (DCS), programmable logic controllers (PLC), and supervisory control and data acquisition (SCADA) systems to optimize production workflows and reduce downtime. The increasing need for real-time data analytics, coupled with the push for energy efficiency and sustainability, is also accelerating the deployment of advanced industrial control solutions.

Regionally, North America and Europe maintain significant market shares due to established industrial infrastructure, high technology adoption rates, and stringent compliance standards. The Asia-Pacific region is experiencing the fastest growth, supported by rapid industrialization in China, India, and Southeast Asia, coupled with strong government support for manufacturing modernization. Latin America and the Middle East & Africa are emerging markets, driven by infrastructure development and investments in process-intensive industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The industrial control for process manufacturing market was valued at USD 29,347.8 million in 2024 and is projected to reach USD 51,184 million by 2032, registering a CAGR of 7.2% from 2024 to 2032.

- Rising adoption of Industry 4.0 and smart manufacturing technologies is driving investment in automation, robotics, and advanced control platforms.

- Demand for distributed control systems (DCS), programmable logic controllers (PLC), and supervisory control and data acquisition (SCADA) systems is increasing to enhance workflow efficiency and reduce downtime.

- Stringent regulatory requirements in sectors such as pharmaceuticals, chemicals, and food processing are boosting the need for compliance-focused industrial control solutions.

- High implementation costs, complex integration with legacy systems, and skilled workforce shortages remain key challenges for wider adoption.

- Asia-Pacific leads with a market share exceeding 35%, followed by North America at over 30% and Europe at nearly 25%, reflecting strong regional growth potential.

- Emerging markets in Latin America and the Middle East & Africa are expanding rapidly, supported by industrial modernization programs and infrastructure development.

Market Drivers:

Adoption of Industry 4.0 and Smart Manufacturing Technologies:

The industrial control for process manufacturing market is experiencing strong momentum from the global shift toward Industry 4.0. Companies are investing in smart manufacturing systems that integrate automation, robotics, and advanced control platforms. These solutions enable real-time monitoring, predictive analytics, and seamless data exchange across production lines. The ability to enhance productivity while reducing operational risks is accelerating technology uptake in both developed and emerging economies.

- For instance, Siemens implemented its MindSphere IoT platform in its Amberg Electronics plant, connecting more than 1,000 machines and systems, resulting in a production quality rate of more than 99.998%.

Rising Demand for Operational Efficiency and Cost Optimization:

Intense competition in process industries is pushing manufacturers to improve efficiency and reduce production costs. Industrial control systems help streamline workflows, minimize waste, and ensure consistent product quality. By enabling precise process control and faster decision-making, these systems support lean manufacturing goals. It is increasingly common for companies to replace outdated systems with modern, scalable solutions that deliver measurable cost savings.

- For instance, Dow Chemical reduced its operational energy consumption by 4.5 million MMBtu annually after upgrading its process automation system at its Freeport, Texas facility, improving both efficiency and quality.

Stringent Regulatory Standards and Compliance Requirements;

Global regulatory bodies are imposing stricter quality, safety, and environmental standards on process manufacturing sectors. Industrial control solutions play a critical role in ensuring compliance by providing accurate process documentation, automated safety checks, and traceability. The ability to meet these standards while maintaining productivity is a significant driver for system adoption. Industries such as pharmaceuticals, chemicals, and food processing are leading adopters due to their highly regulated environments.

Growing Focus on Energy Efficiency and Sustainability Goals:

Sustainability targets are prompting manufacturers to optimize energy use and reduce carbon emissions. Advanced control systems enable better resource management by monitoring energy consumption and adjusting processes accordingly. It supports the integration of renewable energy sources into manufacturing operations without compromising process stability. This focus on sustainable production practices is creating strong demand for next-generation industrial control technologies.

Market Trends:

Integration of Advanced Analytics, AI, and IoT in Process Automation:

The industrial control for process manufacturing market is witnessing rapid integration of artificial intelligence, advanced analytics, and IoT technologies into control systems. These capabilities enable predictive maintenance, process optimization, and faster fault detection, reducing downtime and improving asset utilization. Manufacturers are leveraging digital twins and real-time simulation models to enhance decision-making and streamline production workflows. Cloud-based control platforms are gaining popularity, offering scalable, remote monitoring capabilities for global operations. Cybersecurity measures are becoming a key design priority as connected systems increase exposure to potential threats. The convergence of automation hardware with intelligent software solutions is reshaping operational strategies across process industries.

- For instance, at a polyethylene production plant, Emerson’s FIELDVUE™ diagnostics reduced annual preventive maintenance on five major assets by 333 hours.

Shift Toward Modular, Scalable, and Energy-Efficient Control Solutions:

Manufacturers are increasingly adopting modular and scalable control architectures that can adapt to changing production needs. This trend allows facilities to upgrade specific components without overhauling entire systems, reducing capital expenditures and improving flexibility. Energy-efficient designs are being prioritized to align with corporate sustainability goals and regulatory requirements. Vendors are introducing control solutions that optimize energy use while maintaining product quality and throughput. It is driving the adoption of variable frequency drives, advanced process controllers, and integrated energy management tools. Demand for solutions that combine environmental performance with operational resilience is expected to strengthen over the forecast period.

- For instance, ABB’s System 800xA distributed control system has been installed in over 12,000 facilities worldwide.

Market Challenges Analysis:

High Implementation Costs and Complex Integration Requirements:

The industrial control for process manufacturing market faces challenges from high upfront investment costs and complex integration processes. Deploying advanced control systems often requires significant capital expenditure on hardware, software, and skilled labor. Integrating new solutions with legacy infrastructure can be technically demanding and time-intensive, creating operational disruptions. Small and mid-sized manufacturers may delay adoption due to budget constraints and uncertainty over return on investment. The need for specialized expertise to manage installation and configuration further limits accessibility. These factors slow market penetration, particularly in cost-sensitive regions.

Cybersecurity Risks and Skilled Workforce Shortages:

Increasing connectivity in industrial control systems exposes manufacturing facilities to cybersecurity threats. Safeguarding networks against data breaches, ransomware, and unauthorized access is a growing priority, yet many organizations lack adequate protection measures. The shortage of skilled professionals capable of managing modern control technologies compounds this issue. It leads to operational vulnerabilities and underutilization of system capabilities. Rapid technological advancements also demand continuous training, which can strain resources. Addressing these challenges is critical for sustaining adoption and ensuring long-term operational resilience in the market.

Market Opportunities:

Expansion of Digital Transformation Initiatives in Process Industries:

The industrial control for process manufacturing market is positioned to benefit from the accelerating digital transformation across industries such as oil and gas, chemicals, food and beverage, and pharmaceuticals. Organizations are investing in advanced automation, AI-driven analytics, and connected control platforms to improve efficiency and agility. The adoption of digital twins, augmented reality, and remote monitoring solutions is creating new value streams. Emerging economies are driving demand through government-backed manufacturing modernization programs. It offers suppliers opportunities to deliver tailored solutions that meet both operational and regulatory needs. The growing preference for end-to-end automation platforms strengthens the market’s long-term growth potential.

Rising Focus on Green Manufacturing and Sustainable Practices:

Global sustainability goals are opening opportunities for energy-efficient and low-emission industrial control systems. Manufacturers are seeking solutions that optimize resource usage and reduce carbon footprints without compromising productivity. Integration of renewable energy sources into manufacturing processes is prompting demand for adaptable and intelligent control architectures. Vendors that offer systems capable of aligning with environmental compliance standards will gain a competitive advantage. The push for cleaner production technologies is expanding opportunities in both developed and emerging markets. Growing alignment between corporate ESG strategies and process control investments will fuel adoption in the years ahead.

Market Segmentation Analysis:

By Component:

The industrial control for process manufacturing market includes hardware, software, and services. Hardware dominates due to the widespread deployment of controllers, sensors, and communication devices in production facilities. Software demand is rising with the integration of analytics, monitoring platforms, and process optimization tools. Services such as installation, maintenance, and training are gaining traction as industries seek operational continuity and system upgrades.

- For instance, Siemens delivered over 1,200 SIMATIC S7-1500 controllers to BASF’s Ludwigshafen chemical complex, advancing manufacturing reliability and automation efficiency.

By Control System:

Distributed control systems (DCS) lead the market due to their suitability for complex, large-scale process environments. Programmable logic controllers (PLC) remain widely adopted for their flexibility and reliability in discrete and hybrid applications. Supervisory control and data acquisition (SCADA) systems are essential for real-time data visualization and remote process control. It is experiencing growth in integrated architectures that combine these systems for enhanced efficiency and centralized management.

- For instance, Siemens’ SIMATIC S7-1500 CPU 1516-3 can execute individual bit operations in as little as 10 ns, enabling high-speed control loops in demanding automation tasks.

By End Use:

Oil and gas, chemicals, food and beverages, pharmaceuticals, and energy and power are the major end-use industries. Oil and gas leads in adoption due to its demand for precise process control, safety, and reliability. The chemical sector relies on automation for consistent product quality and compliance with environmental regulations. Food and beverage industries use control systems to ensure hygiene, quality, and traceability. Pharmaceuticals prioritize process control to meet stringent safety and quality standards, driving consistent investment in automation technologies.

Segmentations:

By Component:

- Hardware

- Software

- Services

By Control System:

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Supervisory Control and Data Acquisition (SCADA)

By End Use:

- Oil and Gas

- Chemicals

- Food and Beverages

- Pharmaceuticals

- Energy and Power

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America and Europe :

North America holds a market share exceeding 30%, driven by advanced industrial infrastructure and high adoption of automation technologies. Europe accounts for a market share close to 25%, supported by strong manufacturing bases in Germany, France, and the United Kingdom. Both regions benefit from mature process industries, stringent safety regulations, and significant investments in Industry 4.0 initiatives. The industrial control for process manufacturing market in these geographies is further supported by the presence of global automation leaders and continuous innovation in AI, IoT, and cybersecurity. Government policies promoting energy efficiency and sustainability enhance adoption rates. Ongoing modernization of aging facilities ensures steady demand for upgraded control systems.

Asia-Pacific:

Asia-Pacific commands a market share surpassing 35%, driven by rapid industrialization in China, India, Japan, and Southeast Asian economies. Strong government-backed manufacturing programs, expanding infrastructure, and rising export-oriented production are fueling market expansion. The region’s focus on adopting smart manufacturing practices is accelerating investment in modern control systems. Local and global vendors are targeting this region with scalable, cost-effective solutions to cater to diverse industrial needs. The growth trajectory is further strengthened by the rising demand in energy, chemicals, and food processing sectors. It benefits from a large manufacturing workforce and increasing skill development initiatives.

Middle East & Africa and Latin America :

The Middle East & Africa hold a market share near 5%, while Latin America captures close to 7%, reflecting their emerging yet promising positions. Infrastructure development, oil and gas investments, and the establishment of new manufacturing plants are driving adoption. Brazil, Mexico, Saudi Arabia, and the UAE are leading growth through industrial modernization programs. These regions are attracting international automation providers aiming to tap into untapped process manufacturing capacity. It is supported by rising demand for efficient resource utilization and compliance with evolving regulatory frameworks. Strengthening regional supply chains is expected to accelerate adoption in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The industrial control for process manufacturing market is highly competitive, with global players leveraging technological innovation and strategic partnerships to strengthen their positions. Key participants include ABB Ltd., Honeywell International, Inc., Emerson Electric Co., Kawasaki Heavy Industries, Ltd., OMRON Corporation, Mitsubishi Electric Corporation, and Rockwell Automation, Inc. Competition is driven by the demand for advanced automation solutions, energy-efficient systems, and integrated control architectures. Companies focus on expanding their product portfolios with AI-enabled platforms, IoT integration, and predictive maintenance capabilities to meet evolving industry needs. It is characterized by continuous R&D investment, strong after-sales service networks, and tailored solutions for diverse end-use sectors. Market leaders actively pursue mergers, acquisitions, and collaborations to enhance geographic reach and technological capabilities, ensuring sustained growth in both mature and emerging markets.

Recent Developments:

- In August 2025, ABB Ltd. signed a multi-million-dollar long-term supply agreement with Noveon Magnetics, commencing deliveries of high-performance NdFeB magnets for North American manufacturing operations in sectors like data centers and HVAC.

- In July 2025, OMRON Corporation entered into a strategic partnership with Japan Activation Capital, Inc. to advance its sustainability and transformation initiatives outlined in its SF2030 plan.

- In May 2025, Rockwell Automation launched its EtherNet/IP In-cabinet Solution to help manufacturers build smarter, more efficient control panels, reducing wiring time and simplifying device integration.

Market Concentration & Characteristics:

The industrial control for process manufacturing market is moderately consolidated, with a mix of global leaders and regional players competing across diverse industry verticals. It is characterized by high entry barriers due to substantial capital requirements, complex integration needs, and the demand for specialized technical expertise. Leading companies focus on innovation in automation, IoT connectivity, AI-driven analytics, and energy-efficient solutions to strengthen their market positions. Strategic partnerships, mergers, and acquisitions are common to expand product portfolios and regional presence. Vendors differentiate through customized solutions that address specific industry requirements while ensuring compliance with regulatory standards. Continuous technological advancements and the push for digital transformation sustain competitive intensity.

Report Coverage:

The research report offers an in-depth analysis based on Component, Control System, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The market will witness increased adoption of AI-driven control systems to enhance predictive maintenance and process optimization.

- Integration of industrial IoT and real-time analytics will become standard in new control system deployments.

- Cloud-based industrial control platforms will gain traction for remote operations and global process coordination.

- Vendors will focus on modular and scalable architectures to meet evolving production requirements.

- Cybersecurity solutions for industrial control systems will see higher investment to safeguard connected operations.

- Sustainability initiatives will drive demand for energy-efficient and low-emission control technologies.

- Emerging economies will experience accelerated adoption driven by manufacturing modernization programs.

- Collaboration between automation providers and software developers will expand advanced process automation capabilities.

- Demand for workforce training and upskilling will grow to support complex system operation and maintenance.

- Continuous innovation in sensors, controllers, and analytics tools will strengthen overall market competitiveness.