Market Overview

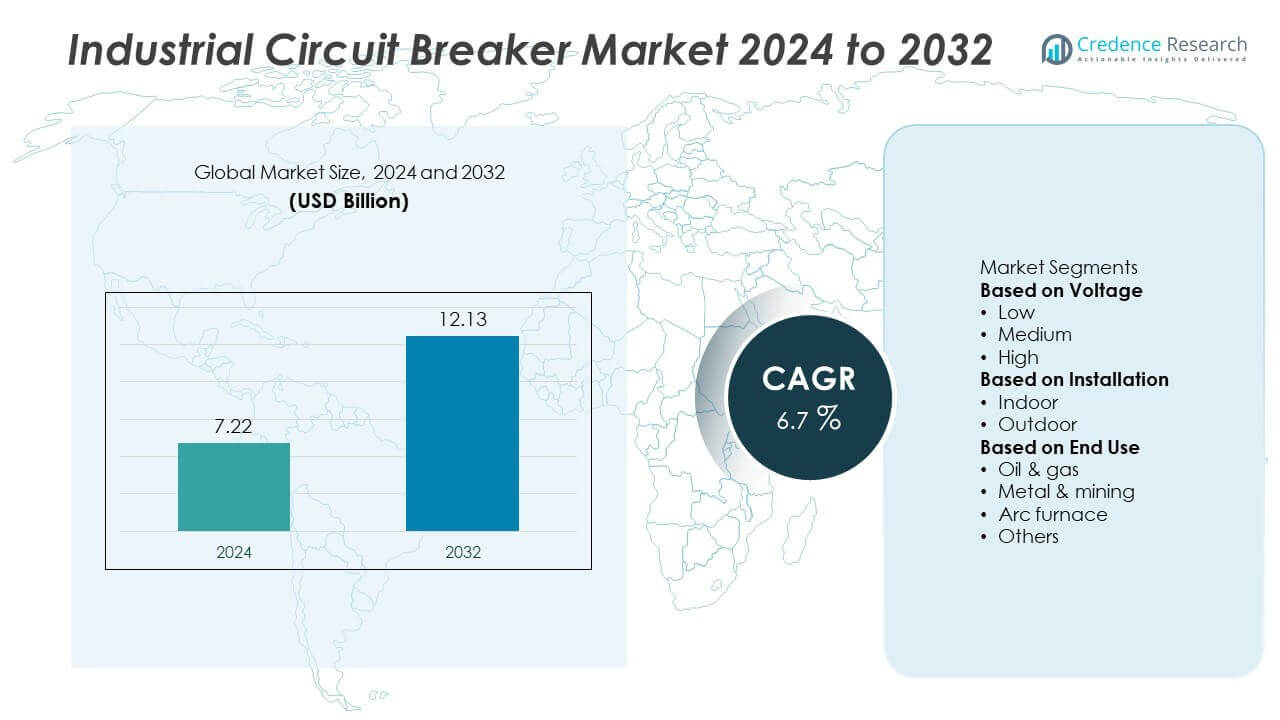

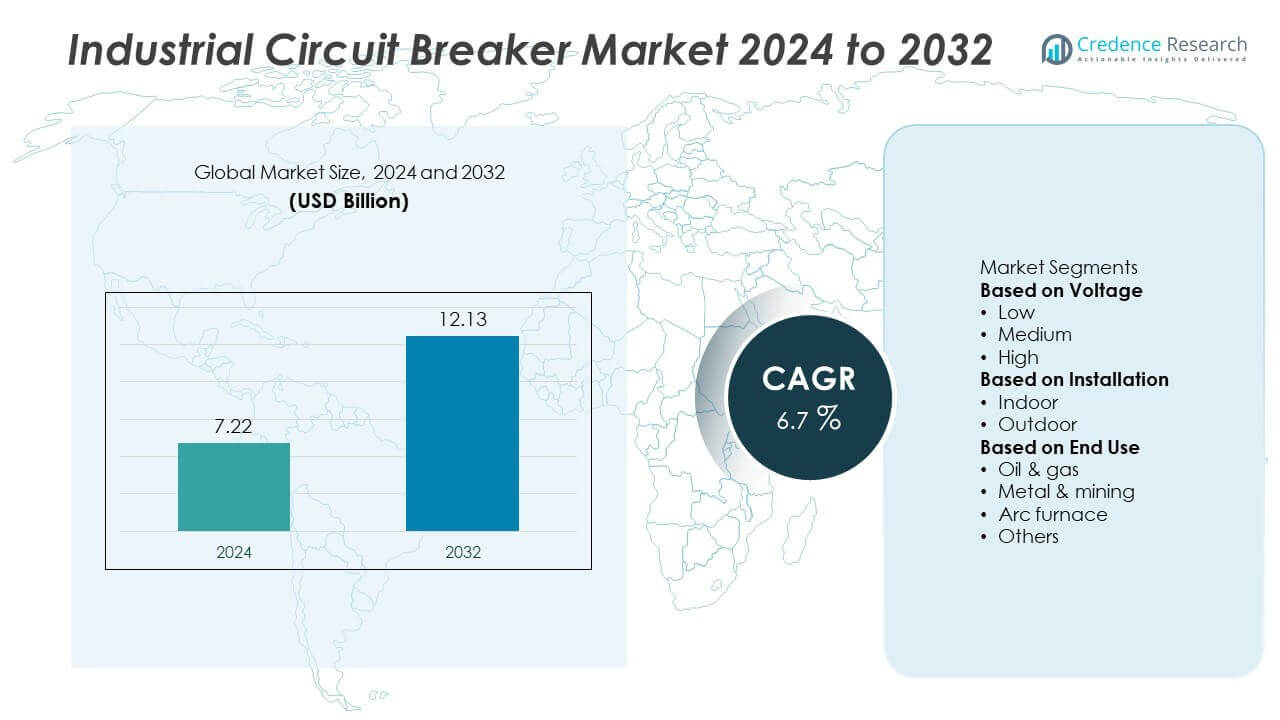

The global Industrial Circuit Breaker Market was valued at USD 7.22 billion in 2024 and is projected to reach USD 12.13 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Circuit Breaker Market Size 2024 |

USD 7.22 Billion |

| Industrial Circuit Breaker Market, CAGR |

6.7% |

| Industrial Circuit Breaker Market Size 2032 |

USD 12.13 Billion |

Industrial Circuit Breaker Market grows with rising demand for reliable power distribution across manufacturing, utilities, and infrastructure projects. Expanding industrialization and grid modernization initiatives drive adoption of advanced breakers that enhance safety and minimize downtime. Geographically, the Industrial Circuit Breaker Market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with widespread grid modernization projects, strong adoption of digital monitoring systems, and significant data center expansion. Europe focuses on eco-friendly, SF6-free breakers and infrastructure upgrades to support renewable energy integration. Asia-Pacific remains the fastest-growing region, driven by rapid industrialization, smart grid deployment, and government-led electrification programs in China and India. Latin America and Middle East & Africa witness rising investments in power distribution, oil & gas, and large infrastructure projects, creating opportunities for suppliers. Key players shaping the market include ABB, Fuji Electric, Eaton Corporation, GE, Hitachi, and Legrand, who emphasize innovation in smart circuit breakers, compact designs, and predictive maintenance solutions to address evolving industry needs and regulatory requirements while enhancing operational efficiency and grid reliability worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Industrial Circuit Breaker Market was valued at USD 7.22 billion in 2024 and is projected to reach USD 12.13 billion by 2032, growing at a CAGR of 6.7%.

- Rising demand for reliable power distribution across manufacturing, utilities, and infrastructure projects drives strong market growth.

- Market trends highlight adoption of IoT-enabled smart breakers, predictive maintenance features, and eco-friendly SF6-free designs to meet sustainability goals.

- Competitive landscape includes key players such as ABB, Eaton Corporation, Fuji Electric, GE, Hitachi, and Legrand focusing on innovation, compact designs, and digital monitoring solutions.

- High installation and maintenance costs act as restraints, limiting adoption among small and mid-sized enterprises and delaying upgrades in cost-sensitive regions.

- Asia-Pacific leads growth with rapid industrialization, renewable energy integration, and electrification programs, while North America and Europe benefit from grid modernization and regulatory compliance.

- Emerging markets in Latin America and Middle East & Africa show potential with rising infrastructure projects, energy diversification plans, and increased demand from oil & gas and mining sectors.

Market Drivers

Rising Demand for Reliable Power Distribution

Industrial Circuit Breaker Market benefits from growing demand for stable and reliable power distribution across manufacturing and processing industries. Expanding industrialization in developing economies drives the installation of advanced circuit protection systems. Power-intensive sectors such as oil & gas, mining, and automotive manufacturing require efficient circuit protection to prevent costly downtime. Governments focus on improving electrical infrastructure to support rapid urbanization and industrial growth. This drives adoption of circuit breakers that handle high current loads safely. It supports uninterrupted operations and reduces equipment damage risks.

- For instance, ABB’s SACE Emax series includes air circuit breakers with rated continuous current from 800 A to 6,300 A, and breaking capacities up to 150 kA at 440 V AC, 100 kA at 690 V AC, and 65 kA at 1,000 V AC.

Growth in Renewable Energy Integration and Grid Modernization

Industrial Circuit Breaker Market sees rising deployment of circuit breakers for renewable energy projects and smart grid upgrades. Solar and wind power plants need high-performance circuit protection for variable and fluctuating power output. Smart grids integrate advanced breakers to improve fault detection and minimize outage duration. Utilities invest in modern switchgear to meet rising electricity demand and ensure system stability. It strengthens grid reliability and facilitates smooth integration of distributed energy resources. Growing focus on energy efficiency further accelerates deployment of advanced circuit breaker solutions.

- For instance, Hitachi, Ltd. received an order for five 300 kV EconiQ SF₆-free circuit-breakers from Chubu Electric Power Grid. This was the first project in Japan where SF₆-free breakers would be installed at voltages of 275 kV and above, supporting Chubu Electric Power Grid’s decarbonization efforts rather than being specified exclusively for renewable grid connection projects.

Increasing Safety Regulations and Equipment Standards

Industrial Circuit Breaker Market grows with strict enforcement of electrical safety codes and standards by regulatory agencies. Industries adopt circuit breakers that meet IEC, ANSI, and other international standards to ensure compliance. Safety awareness pushes companies to replace outdated fuse systems with modern circuit breakers. Industrial facilities prioritize worker protection and asset safety through advanced fault interruption technology. It minimizes fire hazards and enhances operational reliability. This regulatory push creates sustained demand for technologically upgraded circuit protection devices.

Technological Advancements and Smart Monitoring Features

Industrial Circuit Breaker Market expands with rapid adoption of intelligent and digitally enabled breaker systems. Smart breakers offer features like remote monitoring, predictive maintenance, and real-time fault analytics. Digital control improves system diagnostics and reduces downtime during fault conditions. IoT-enabled devices enable plant managers to track power quality and optimize load distribution. It allows predictive replacement of components and improves energy efficiency across facilities. Rising investment in Industry 4.0 initiatives ensures strong demand for smart and connected circuit breaker solutions.

Market Trends

Market Trends

Adoption of Smart and Digitally Connected Circuit Breakers

Industrial Circuit Breaker Market experiences strong momentum toward smart and connected solutions with IoT capabilities. Intelligent breakers support predictive maintenance by monitoring current, voltage, and fault data in real time. This trend improves system reliability and allows faster response to electrical faults. Industries invest in digital solutions to enhance energy efficiency and reduce downtime. It enables seamless integration with automation and SCADA systems. Demand for advanced monitoring features continues to reshape product portfolios of leading manufacturers.

- For instance, Eaton Corporation rolled out its Power Defense molded case circuit breakers with built-in Power Xpert Release (PXR) electronic trip units, capable of measuring current up to 2,500 A and transmitting real-time event logs over Modbus and Ethernet/IP networks for predictive maintenance in industrial facilities.

Shift Toward Environmentally Friendly and Sustainable Designs

Industrial Circuit Breaker Market witnesses a transition toward eco-friendly breakers that eliminate SF6 and other harmful gases. Manufacturers develop vacuum and solid-state circuit breakers to minimize environmental impact. This trend supports global decarbonization goals and aligns with stricter environmental regulations. Industries seek solutions that reduce greenhouse gas emissions without compromising performance. It drives innovation in insulation and contact materials. Growing pressure to meet sustainability targets encourages adoption of green circuit protection technologies.

- For instance, GE Grid Solutions commissioned its g³ gas-insulated switchgear, which uses an eco-friendly g³ gas, for wind power substations in the UK. The g³ gas reduces the CO₂-equivalent emissions of the equipment’s insulating and switching medium by more than 99% compared to conventional SF₆ breakers while maintaining high performance, including short-circuit ratings up to 31.5 kA on certain 72.5 kV models.

Increasing Deployment in Renewable and Distributed Energy Systems

Industrial Circuit Breaker Market grows with rising use in solar farms, wind projects, and microgrids. Renewable installations require high-speed fault interruption to handle fluctuations in generation. Breakers with advanced arc-quenching technology ensure safe operations under variable loads. Utilities upgrade existing systems to manage distributed generation and maintain grid stability. It strengthens power reliability and reduces risks of large-scale outages. Growing investment in clean energy infrastructure fuels demand for high-performance circuit protection devices.

Expansion of Medium- and High-Voltage Applications

Industrial Circuit Breaker Market expands with growing use in heavy industries and large infrastructure projects. Demand for medium- and high-voltage breakers rises in transmission and distribution networks. Manufacturers focus on compact designs to optimize space in switchgear assemblies. Upgrades in aging infrastructure create opportunities for replacement and retrofitting solutions. It ensures safe handling of higher current levels and supports continuous operation. This trend drives innovation in arc-extinguishing technologies and insulation systems for robust performance.

Market Challenges Analysis

High Installation and Maintenance Costs Restraining Adoption

Industrial Circuit Breaker Market faces challenges due to high upfront costs of advanced circuit breakers. Installation expenses rise with complex wiring, switchgear integration, and compliance with safety standards. Small and mid-sized enterprises often delay upgrades due to budget constraints. Maintenance of high-voltage breakers requires skilled labor and periodic servicing, adding to operational expenses. It creates barriers for cost-sensitive industries in developing regions. Price pressure limits penetration of smart and digitally connected breaker systems despite their long-term benefits.

Supply Chain Disruptions and Raw Material Price Volatility

Industrial Circuit Breaker Market is affected by fluctuations in raw material prices, particularly copper and steel. Supply chain disruptions from geopolitical tensions and logistics issues delay production and project timelines. Manufacturers face difficulty maintaining stable pricing while ensuring product quality. It impacts profitability and slows new infrastructure deployments. Shortages of semiconductor components hinder availability of intelligent breaker solutions. These factors collectively pose a challenge to consistent market growth.

Market Opportunities

Rising Investments in Smart Grid and Infrastructure Projects

Industrial Circuit Breaker Market holds strong opportunities with increasing investments in grid modernization and infrastructure development. Governments fund large-scale transmission and distribution upgrades to support rising electricity demand. Modern grids require intelligent breakers that enable remote monitoring and fault isolation. Industries benefit from improved system reliability and faster restoration times. It creates a steady need for advanced circuit protection devices across urban and industrial projects. Expansion of power infrastructure in emerging economies further accelerates product demand.

Growing Adoption in Renewable Energy and Electrification Initiatives

Industrial Circuit Breaker Market gains growth potential from rapid renewable energy integration and electrification programs. Solar and wind farms require high-performance breakers for stable operations under fluctuating loads. Electrification of transport and manufacturing sectors drives deployment of medium- and high-voltage breaker systems. Manufacturers introduce eco-friendly, digital solutions to align with sustainability targets. It opens opportunities for innovation in vacuum and solid-state breaker technologies. Rising demand for efficient and safe power distribution supports long-term market expansion.

Market Segmentation Analysis:

By Voltage

Industrial Circuit Breaker Market is segmented into low voltage, medium voltage, and high voltage categories. Low-voltage breakers dominate due to widespread use in commercial facilities, manufacturing plants, and residential infrastructure. Medium-voltage breakers find strong demand in utilities, mining, and oil & gas operations where they handle larger current loads. High-voltage breakers serve critical roles in transmission and distribution networks, supporting uninterrupted power supply. It enables protection of transformers, substations, and grid infrastructure under high fault currents. Rising demand for grid stability and modernization fuels strong growth in the medium- and high-voltage segments. Manufacturers focus on compact and high-performance solutions to improve space efficiency and reduce installation complexity.

- For instance, Schneider Electric’s low-voltage molded case circuit breakers offer continuous current ratings up to 2500 amperes and short-circuit interrupting capabilities of up to 65 kiloamperes, ensuring reliable protection in commercial and industrial installations.

By Installation

Industrial Circuit Breaker Market by installation includes fixed-mounted and withdrawable circuit breakers. Fixed-mounted breakers are preferred for applications with limited space and stable load profiles. Withdrawable breakers are widely adopted in power plants and heavy industries where maintenance speed and replacement flexibility are priorities. It allows operators to minimize downtime during inspection or repair. Growing focus on safety and operational efficiency drives demand for withdrawable configurations in critical operations. Manufacturers develop plug-and-play designs to simplify retrofitting in existing switchgear systems. Both segments grow steadily, driven by modernization of legacy electrical infrastructure.

- For instance, Eaton’s fixed-mounted circuit breakers provide rated continuous currents up to 6300 amperes and can withstand short-circuit breaking currents up to 100 kiloamperes, offering robust protection in static setups.

By End Use

Industrial Circuit Breaker Market serves sectors such as manufacturing, utilities, transportation, oil & gas, and data centers. Manufacturing leads due to high electricity consumption and need for equipment protection. Utilities invest in advanced breakers to improve grid reliability and integrate renewable sources. Transportation projects, including metro systems and railways, require robust circuit protection for traction power systems. Oil & gas facilities rely on breakers to prevent downtime in high-risk environments. It also finds growing applications in data centers where uninterrupted power is critical. Expanding digitalization and infrastructure projects worldwide create a favorable outlook for all end-use segments.

Segments:

Based on Voltage

Based on Installation

Based on End Use

- Oil & gas

- Metal & mining

- Arc furnace

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 32% market share in the Industrial Circuit Breaker Market, driven by strong industrial infrastructure and high demand for reliable power systems. The U.S. leads the region with significant investments in grid modernization and advanced manufacturing. Canada follows with focus on renewable integration and mining sector development. The region benefits from stringent electrical safety standards that push adoption of technologically advanced breakers. It sees strong growth in IoT-enabled and predictive maintenance solutions as industries embrace digital transformation. Upgrades in aging transmission networks and rising data center construction further boost regional demand.

Europe

Europe accounts for 28% market share and shows steady adoption of sustainable and energy-efficient breaker solutions. Germany, France, and the U.K. lead deployment in power distribution and industrial automation projects. EU regulations encourage SF6-free and eco-friendly breaker technologies, driving innovation among key manufacturers. The region also benefits from increasing investments in offshore wind projects and electrification of transportation infrastructure. It experiences demand for compact, modular breakers suitable for space-constrained applications. Upgrading of aging grids in Eastern Europe provides additional growth opportunities.

Asia-Pacific

Asia-Pacific dominates with 34% market share, emerging as the fastest-growing regional market. China leads with rapid industrialization, large-scale manufacturing facilities, and extensive grid expansion projects. India follows with government-led electrification programs and infrastructure investments across urban and rural areas. Southeast Asian nations experience rising power demand and adopt circuit protection solutions in industrial clusters. It gains momentum from growth in renewable energy projects, including solar and wind farms. Increasing foreign investments in manufacturing hubs boost demand for high-performance and cost-efficient circuit breakers. Technological advancements and domestic production capabilities strengthen the region’s competitive position.

Latin America

Latin America holds 4% market share, supported by infrastructure modernization and industrial development projects. Brazil dominates with significant investments in transmission and distribution networks. Mexico and Argentina follow with rising manufacturing and energy sector activity. It benefits from government-led initiatives to expand electrification in rural regions and strengthen power reliability. Growth of mining and oil & gas sectors adds further demand for high-voltage circuit breakers. Limited local manufacturing capacity opens opportunities for international suppliers to expand presence in the region.

Middle East & Africa

Middle East & Africa capture 2% market share, with demand concentrated in the Gulf Cooperation Council (GCC) countries and South Africa. Large-scale infrastructure projects and energy diversification plans in Saudi Arabia and UAE drive adoption. It gains traction from oil & gas sector investments requiring advanced electrical protection systems. Africa sees demand growth from power generation projects aimed at improving electrification rates. Smart city initiatives and industrial park developments in the region also support future market expansion. Presence of international players offering customized solutions strengthens regional growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Electric

- GE

- Legrand

- Eaton Corporation

- Chint Electric

- Hitachi

- L&T Electrical & Automation

- ABB

- DILO Company

- C&S Electric

Competitive Analysis

Competitive landscape of the Industrial Circuit Breaker Market features leading players such as ABB, Eaton Corporation, Fuji Electric, GE, Hitachi, Legrand, Chint Electric, L&T Electrical & Automation, C&S Electric, and DILO Company competing on technology, reliability, and global reach. These companies focus on developing advanced circuit breakers with smart monitoring, predictive maintenance, and IoT integration to meet growing demand for efficient power distribution. Product innovation centers on compact designs, higher interrupting capacity, and eco-friendly SF6-free solutions that align with global sustainability goals. Strategic initiatives include mergers, acquisitions, and partnerships to strengthen distribution networks and expand manufacturing presence in high-growth regions. Key players invest heavily in research and development to enhance digital capabilities and improve grid resiliency for industrial customers. Strong after-sales support and service offerings also help maintain customer loyalty. Intense competition drives continuous improvement in quality, performance, and cost efficiency across the market.

Recent Developments

- In July 2025, ABB, released the SACE Emax 3 air circuit breaker, first air circuit breaker with Security Level 2 IEC 62443 cybersecurity certification.

- In April 2025, ABB, Introduced a circuit breaker solution for wind turbines (April 7, 2025). The solution integrates a 7,200 A Emax 2 air circuit breaker with a 3,200 A AF Contactor for high-power switching.

- In February 2025, ABB, enclosed OT Plus 63A-125A circuit breakers scheduled for release.

- In December 2024, Hitachi Energy, Ordered by Chubu Electric Power Grid to supply five units of 300 kV SF₆-free EconiQ circuit-breakers, marking Japan’s first deployment of SF₆-free breakers at 275 kV and above.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Installation, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and IoT-enabled circuit breakers will rise to support predictive maintenance.

- Grid modernization projects will boost adoption of advanced medium- and high-voltage breaker systems.

- Renewable energy expansion will drive need for fast fault-clearing and high-performance protection solutions.

- Manufacturers will focus on SF6-free and eco-friendly designs to meet sustainability regulations.

- Compact and modular circuit breakers will gain popularity for space-constrained industrial facilities.

- Digital monitoring and remote control capabilities will become standard in new installations.

- Growing electrification of transport and manufacturing sectors will create new opportunities for suppliers.

- Replacement of aging electrical infrastructure will accelerate demand in developed regions.

- Local production and strategic partnerships will expand market presence in emerging economies.

- Continuous R&D investment will enhance breaker reliability, efficiency, and lifecycle performance.

Market Trends

Market Trends