Market Overview

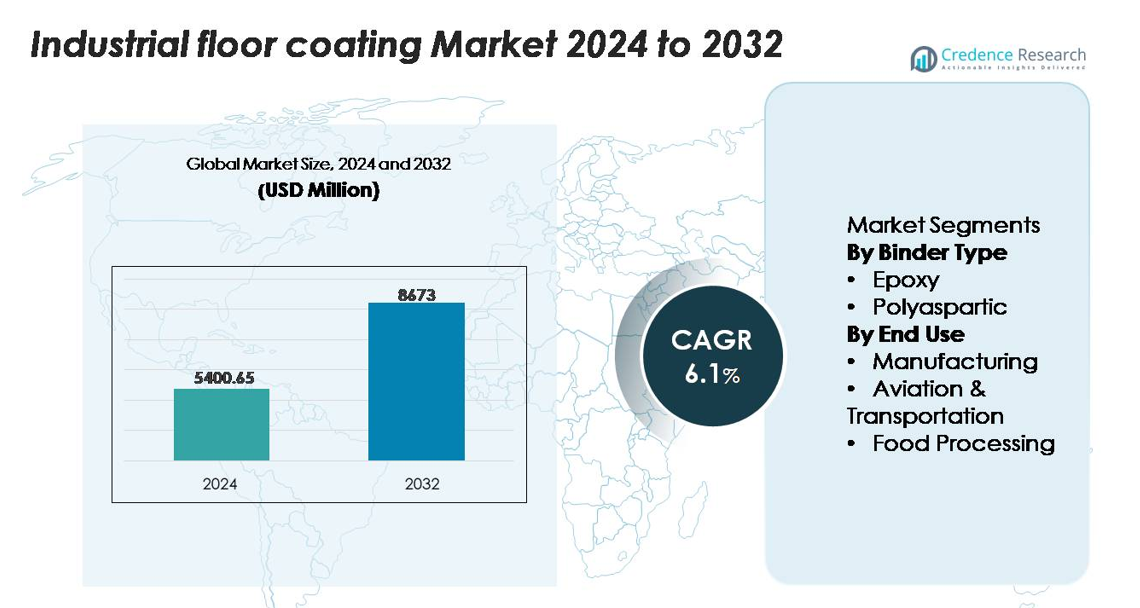

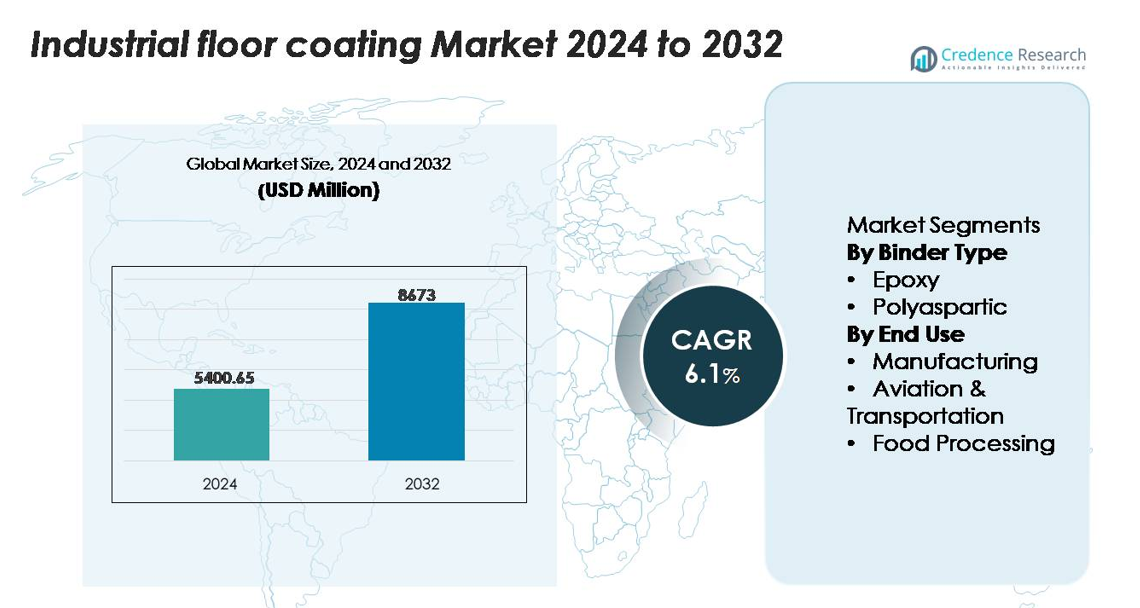

The industrial floor coating market was valued at USD 5,400.65 million in 2024 and is anticipated to reach USD 8,673.00 million by 2032, registering a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Floor Coating Market Size 2024 |

USD 5,400.65 million |

| Industrial Floor Coating Market, CAGR |

6.1% |

| Industrial Floor Coating Market Size 2032 |

USD 8,673.00 million |

The industrial floor coating market is led by globally established manufacturers such as PPG Industries, The Sherwin-Williams Company, Sika AG, RPM International, and BASF SE, each offering extensive epoxy and polyaspartic portfolios for heavy-duty industrial environments. These companies maintain strong distribution networks, advanced resin technologies, and specialized formulation capabilities that support large-scale manufacturing, logistics, and processing facilities. Asia-Pacific leads the global market with an exact share of 37%, driven by rapid industrialization and ongoing factory expansion across China, India, and Southeast Asia. North America and Europe follow, supported by stringent safety standards and high demand for durable, compliance-focused flooring systems.

Market Insights

- The industrial floor coating market reached USD 5,400.65 million in 2024 and is projected to hit USD 8,673.00 million by 2032, registering a steady CAGR of 6.1% during the forecast period.

- Strong demand from manufacturing facilities, the dominant end-use segment with over 40% share, drives market growth as industries expand production capacity and prioritize durable, chemical-resistant flooring that reduces downtime.

- Key trends include rising adoption of low-VOC sustainable coatings, rapid-cure polyaspartic systems, and smart flooring solutions that integrate monitoring capabilities for safety and predictive maintenance.

- Competition intensifies as leading players—PPG Industries, Sherwin-Williams, Sika, RPM International, and BASF—expand high-performance resin technologies while facing restraints such as high installation costs and operational downtime during floor preparation.

- Asia-Pacific leads with 37% share, followed by North America (33%) and Europe (27%), supported by strong industrial infrastructure, while epoxy coatings dominate the binder type segment with the largest market share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Binder Type (Epoxy, Polyaspartic)

Epoxy coatings dominate the industrial floor coating market, holding the largest share due to their exceptional durability, strong chemical resistance, and suitability for heavy mechanical loads. They remain the preferred choice across facilities requiring long service life and low maintenance. Their ability to withstand abrasion, oils, and corrosive agents reinforces widespread adoption in high-traffic production zones. Polyaspartic coatings, while growing steadily, primarily appeal to projects demanding faster cure times and UV stability. However, epoxy’s cost-performance advantage, versatility across substrates, and extensive proven field performance continue to position it as the leading binder type globally.

- For instance, Sherwin-Williams’ ArmorSeal 1000 HS is a high-solids, heavy-duty epoxy coating known for its exceptional resistance to abrasion, impact, corrosion, and chemical attack, making it suitable for demanding industrial and manufacturing environments.

By End Use (Manufacturing, Aviation & Transportation, Food Processing)

Manufacturing remains the dominant end-use segment, accounting for the largest share due to continuous investments in factory expansions, process automation, and safety compliance. Facilities require high-performance floors resistant to chemicals, impacts, forklifts, and thermal shock, driving strong adoption of epoxy-based systems. Aviation and transportation facilities increasingly adopt advanced coatings for hangars, maintenance bays, and logistics hubs where load-bearing and anti-skid properties are critical. In food processing environments, demand rises for hygienic, seamless, antimicrobial flooring aligned with strict sanitation standards, though manufacturing maintains leadership owing to its extensive and diverse facility footprint.

- For instance, PPG’s Amerlock® 400 epoxy system demonstrates an impact resistance of 24 inch-pounds (direct impact), making it suitable for tough industrial facilities, bridges, and other exposures where surface tolerance and corrosion protection are needed, but where extremely high compressive strength isn’t the primary engineering requirement.

Key Growth Drivers

Expansion of Industrial Infrastructure and Modernization Initiatives

The rapid expansion of manufacturing, logistics, and processing infrastructure continues to create strong demand for high-performance industrial floor coatings. Global initiatives focused on factory automation, layout modernization, and compliance-driven upgrades are pushing facilities to replace conventional flooring with long-lasting, chemical-resistant systems. As operational throughput increases, industries prioritize flooring capable of handling heavy equipment, constant foot traffic, and exposure to oils, solvents, and mechanical vibration. Investment in new production lines, warehousing complexes, and industrial parks—particularly in emerging economies—further amplifies adoption. Governments encouraging industrial corridor developments and export-oriented manufacturing also accelerate the shift toward durable coatings with long lifecycle value. This modernization trend supports sustained growth as companies seek flooring that enhances worker safety, sustains performance under continuous load cycles, and minimizes downtime associated with repair or resurfacing.

- For instance, Sherwin-Williams’ ArmorSeal® 650 SL/RC is a two-component, heavy-duty epoxy floor coating, not a polyurethane, which is used in high-throughput industrial modernization projects.

Rising Emphasis on Workplace Safety, Hygiene, and Regulatory Compliance

Industrial facilities face increasing pressure to adhere to stringent safety, sanitation, and environmental standards, driving higher adoption of durable floor coating systems. Regulatory frameworks governing slip resistance, epoxy VOC emissions, chemical spill containment, and workplace hygiene encourage facility owners to invest in high-quality coatings. Seamless flooring solutions help reduce dust, bacterial growth, and contamination risks, making them essential in sensitive environments such as food processing, pharmaceuticals, and high-precision assembly units. The ability of advanced coatings to maintain surface integrity and enhance lighting reflectivity further supports safer working conditions. Compliance audits and certifications increasingly require floors that withstand abrasion, thermal cycling, and aggressive cleaning agents. As industries pursue improved risk management and safety standardization, demand for coatings engineered for compliance, predictability, and long-term reliability continues to rise, reinforcing their role as a critical operational investment.

- For instance, BASF’s MasterTop 1324 polyurethane flooring system is formulated with VOC levels below 15 g/L and delivers slip resistance meeting DIN 51130 R11 standards, while maintaining abrasion loss of 42 mg under ASTM D4060 testing—performance levels that help facilities pass hygiene and safety audits in pharmaceutical and food-grade environments.

Increased Adoption of High-Performance and Rapid-Cure Coating Technologies

Technological advancements in coating formulations—such as self-leveling epoxies, polyaspartic rapid-cure systems, and abrasion-enhanced hybrids—are strengthening market growth. Facilities increasingly prioritize coatings that minimize installation downtime while delivering superior mechanical and chemical resistance. Rapid-cure polyaspartics enable overnight turnaround in active manufacturing units, while advanced epoxies offer improved bonding, reduced maintenance cycles, and extended floor life. Innovation in low-odor and low-VOC technologies also drives demand across enclosed industrial environments where air quality matters. The availability of systems designed for freezer rooms, high-temperature zones, and forklift-intensive environments further expands application flexibility. As industries shift toward performance-optimized infrastructure, coating manufacturers respond with solutions that combine durability, cure-speed efficiency, and environmental compliance. These innovations accelerate upgrades in both new construction and refurbishment projects.

Key Trends & Opportunities

Growing Shift Toward Sustainable, Low-VOC, and Eco-Friendly Coatings

Sustainability priorities are reshaping industrial procurement strategies, creating opportunities for low-VOC, solvent-free, and bio-based coating technologies. Environmental regulations targeting emissions, indoor air quality, and chemical handling drive adoption of eco-conscious solutions without compromising performance. Manufacturers are developing greener formulations with advanced resin chemistries, extended pot life, and reduced hazardous components. Industries seeking green building certifications increasingly deploy coatings that contribute to healthier work environments and reduce long-term environmental impact. Demand is also rising for recyclable packaging, energy-efficient curing systems, and coatings that enhance facility sustainability scores. As corporate ESG commitments expand globally, the preference for environmentally responsible flooring solutions positions sustainable coating technologies as a major long-term growth opportunity.

- For instance, PPG’s SIGMAGUARD® 790 is a high-solids, two-component, polyamine-cured epoxy coating used for tank lining applications.

Increased Demand for Advanced Aesthetic and Functional Flooring Systems

Industrial facilities are moving beyond purely functional flooring requirements and adopting coatings that also enhance aesthetics, branding, and functional zoning. Technologies such as high-gloss epoxies, metallic finishes, anti-static layers, and color-coded safety demarcations enable facilities to improve workflow visibility and operational efficiency. The trend extends to warehouses, logistics hubs, and precision engineering units, where visual management improves safety and supports lean operations. Decorative yet durable coatings are gaining traction in showrooms, food facilities, and service workshops seeking professional, clean, and high-impact environments. Additionally, the integration of reflective and light-enhancing flooring reduces energy consumption by optimizing illumination. The growing interest in functional aesthetics unlocks new opportunities for coatings engineered with advanced textures, customizable finishes, and ergonomic benefits.

Rising Adoption of Smart Flooring and Condition-Monitoring Solutions

Digital transformation is making inroads into industrial flooring through embedded sensors, smart overlays, and condition-monitoring technologies. Facilities increasingly evaluate solutions that track floor vibration, temperature, load distribution, or surface degradation in real time. These systems help predict maintenance needs, reduce downtime, and enhance asset protection in high-value production environments. Smart coatings that detect chemical spills, moisture ingress, or wear patterns offer operational and safety advantages, particularly in electronics, food processing, and heavy manufacturing. As Industry 4.0 expands across global industrial networks, integrating flooring within broader IoT ecosystems presents a significant emerging opportunity for innovation and value-added services.

Key Challenges

High Upfront Installation Costs and Operational Downtime During Application

Despite long-term performance benefits, industrial floor coatings often require significant initial investment, especially in large-scale facilities or environments demanding specialized formulations. Installation typically involves surface preparation, curing schedules, and temporary shutdowns, which can disrupt production and increase operational costs. For facilities operating around the clock, prolonged downtime becomes a major deterrent to adopting new coatings or undertaking flooring refurbishment. Additionally, high-performance systems—such as chemical-resistant or rapid-cure technologies—carry premium material and labor costs. These financial and operational barriers slow upgrade cycles and make some industries reluctant to transition from traditional concrete floors, particularly in cost-sensitive sectors or small to mid-size manufacturing units.

Performance Limitations Under Extreme Conditions and Improper Surface Preparation

Industrial floor coatings are highly dependent on correct application procedures, environmental conditions, and substrate readiness. Poor surface preparation, moisture issues, or incorrect mixing ratios can lead to premature failures such as blistering, peeling, or delamination. Extreme operational conditions—such as temperature fluctuations, heavy thermal shock, continuous chemical exposure, or intense mechanical abrasion—challenge even advanced coating systems. Food processing plants, cold storage units, and metal fabrication shops often operate in conditions that test coating integrity, requiring specialized solutions that not all facilities adopt due to cost or complexity. These performance uncertainties create hesitance among users and highlight the need for skilled applicators, controlled installation environments, and rigorous adherence to preparation protocols.

Regional Analysis

North America

North America holds a substantial share of the industrial floor coating market, accounting for around 32–34% driven by strong manufacturing activity, stringent regulatory standards, and widespread facility modernization initiatives. High adoption of epoxy and polyaspartic systems across automotive plants, food processing units, and logistics hubs supports consistent growth. The U.S. leads the region due to extensive industrial infrastructure and strong investments in refurbishment projects that prioritize safety compliance and surface durability. Canada contributes through demand from aerospace, mining, and cold-storage environments, where rapid-cure and high-performance coatings are essential for minimizing downtime.

Europe

Europe represents approximately 26–28% of the market, led by well-established industrial sectors, strict workplace safety norms, and strong adoption of environmentally compliant coating technologies. Germany, France, and the U.K. drive demand through advanced manufacturing, pharmaceuticals, and food processing operations requiring seamless, chemical-resistant flooring. The EU’s focus on VOC reduction and sustainable construction further accelerates the transition toward low-emission epoxy and polyaspartic systems. Eastern Europe shows increasing uptake due to growth in automotive component production and logistics hubs. The region’s emphasis on high-quality infrastructure and lifecycle efficiency strengthens long-term coating adoption.

Asia-Pacific

Asia-Pacific dominates the global market with around 36–38% share, supported by rapid industrialization, expanding manufacturing clusters, and extensive development of industrial parks. China, India, Japan, and Southeast Asian nations contribute strong demand from electronics, automotive, chemicals, and food processing sectors. Investments in new factories, warehousing networks, and export-driven production create sustained requirements for heavy-duty coatings capable of handling continuous loads and chemical exposure. Government-led infrastructure programs, coupled with rising safety compliance awareness, accelerate adoption. Asia-Pacific’s cost competitiveness and expanding industrial footprint position it as the fastestgrowing regional market.

Latin America

Latin America captures about 6–7% of the market, influenced by rising investments in food processing, mining, and automotive component manufacturing. Brazil and Mexico lead regional demand, supported by industrial corridor developments and modernization initiatives across medium-sized factories. Adoption of epoxy coatings grows steadily due to their affordability, durability, and suitability for high-humidity environments. However, overall penetration remains moderate, as budget-sensitive industries often delay refurbishment activities. Increasing regulatory alignment with international safety standards and the expansion of logistics hubs present opportunities for higher-quality coating systems, particularly rapid-cure and antibacterial flooring solutions.

Middle East & Africa

The Middle East & Africa region accounts for around 4–5% of the market, with demand concentrated in the Gulf states where industrial diversification and large-scale construction projects drive uptake. Manufacturing, petrochemical processing, and aviation maintenance facilities require high-performance coatings resistant to heat, chemical spills, and heavy machinery. The UAE and Saudi Arabia lead adoption due to major industrial zone expansions and stringent facility compliance requirements. In Africa, South Africa generates notable demand from mining and food packaging sectors, though adoption remains limited by budget constraints and slower industrial upgrades. Growing investment in industrial logistics supports gradual market expansion.

Market Segmentations:

By Binder Type

By End Use

- Manufacturing

- Aviation & Transportation

- Food Processing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the industrial floor coating market is characterized by the strong presence of global manufacturers that continually expand their portfolios through advanced resin technologies, rapid-cure formulations, and environmentally compliant solutions. Leading companies such as PPG Industries, The Sherwin-Williams Company, Sika AG, RPM International, and BASF SE leverage extensive R&D capabilities and wide distribution networks to address diverse industrial requirements across manufacturing, logistics, food processing, and transportation sectors. These players focus on enhancing coating durability, chemical resistance, and installation efficiency to support demanding operational environments. Strategic initiatives—including mergers, facility expansions, and product line upgrades—strengthen their market positioning, while collaborations with applicators and industrial contractors improve service delivery and project execution. Regional competitors in Asia-Pacific and Europe increasingly challenge global brands by offering cost-effective solutions tailored to localized industrial conditions. As sustainability and performance reliability become priority criteria, innovation-centered competition intensifies across binder types, application methods, and service offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Sherwin-Williams launched the “Pro Industrial Fast-Cure Epoxy Flooring System” in North America, offering a diffusion-hardening schedule of 4 hours at 25 °C to support high-traffic industrial and warehouse facilities.

- In October 2024, RPM announced the acquisition of TMP Convert SAS, a French manufacturer of outdoor design and landscape products, as part of its Performance Coatings segment.

- In 2024, ArmorPoxy published blog content highlighting its “ArmorUltra Industrial Epoxy Flooring” system for factory-floor applications, emphasising high durability, chemical resistance and long-term performance

Report Coverage

The research report offers an in-depth analysis based on Binder type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of rapid-cure and high-performance polyaspartic systems will accelerate as industries prioritize reduced downtime.

- Demand for eco-friendly, low-VOC, and sustainable coating formulations will rise due to tightening environmental regulations.

- Smart flooring technologies with embedded sensors and condition-monitoring capabilities will gain traction in high-value facilities.

- Increasing automation and expansion of industrial parks will drive steady upgrades to durable epoxy flooring systems.

- Growth in food processing and pharmaceutical sectors will boost demand for hygienic, seamless, and antimicrobial floors.

- Advanced decorative and functional flooring finishes will expand in logistics hubs and modern manufacturing units.

- Rising refurbishment activities in aging factories will strengthen the market for resurfacing and heavy-duty coating solutions.

- Innovations in abrasion-resistant and chemical-resistant resins will support adoption in harsh industrial environments.

- Regional manufacturing shifts toward Asia-Pacific will create strong opportunities for coating suppliers.

- Collaboration between coating manufacturers and flooring contractors will improve application efficiency and project execution.