Market Overview:

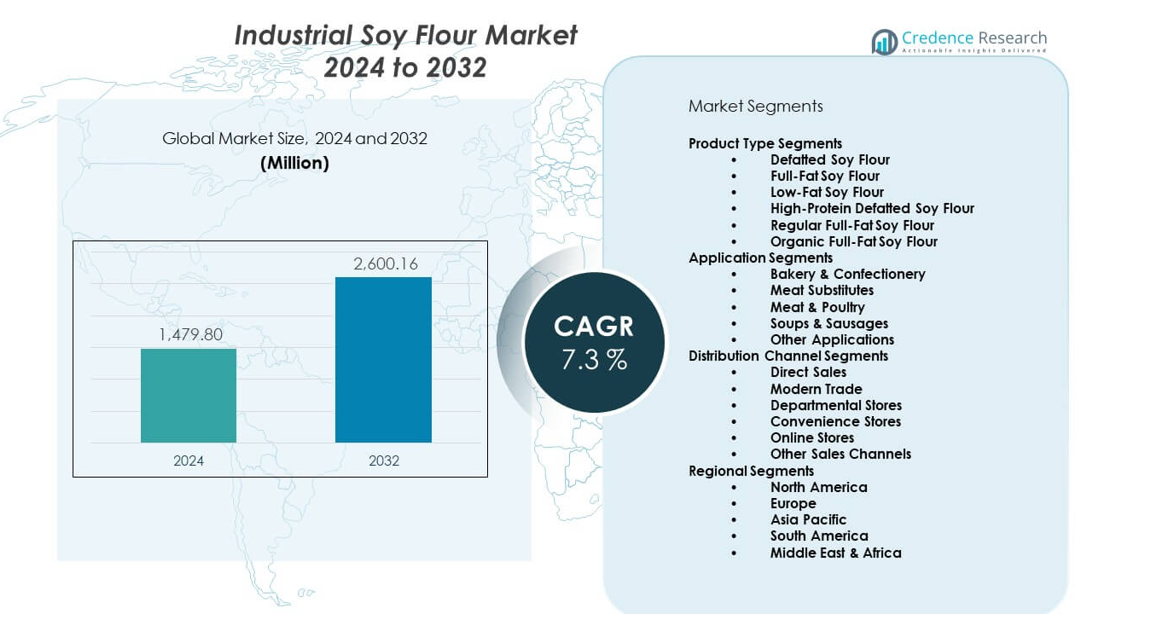

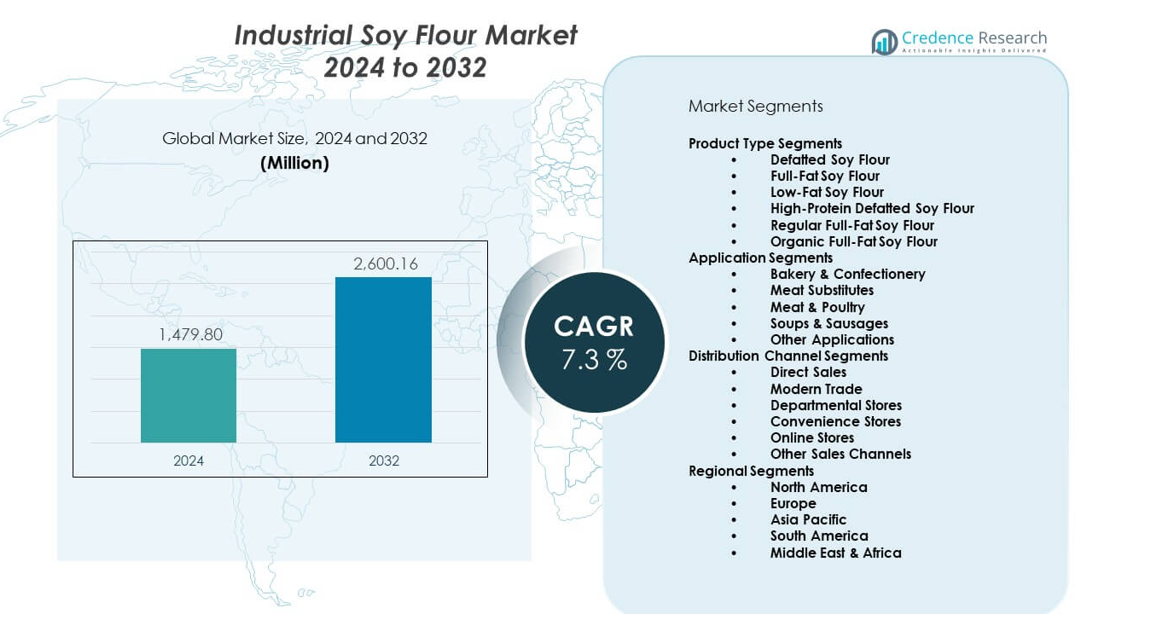

The Industrial soy flour market is projected to grow from USD 1,479.8 million in 2024 to an estimated USD 2,600.16 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Soy Flour Market Size 2024 |

USD 1,479.8 million |

| Industrial Soy Flour Market, CAGR |

7.3% |

| Industrial Soy Flour Market Size 2032 |

USD 2,600.16 million |

Demand grows as producers incorporate soy flour to improve binding strength, texture uniformity, and moisture stability in diverse product lines. Food processors use it in bakery mixes, soups, sausages, and meat substitutes due to predictable behavior under varied production conditions. Industrial sectors evaluate soy-based binders to enhance coating performance and reduce dependence on synthetic inputs. Clean-label expectations support broader use across established and emerging product categories. This shift toward functional plant-based ingredients strengthens the overall market outlook.

Regional trends show North America leading due to advanced soybean supply systems and strong adoption across food processing and industrial applications. Europe records steady gains supported by sustainability policies and rising use of plant-derived materials in food and specialty coatings. Asia Pacific emerges as a fast-growing region driven by expanding food processing capacity and rising demand for affordable protein sources. South America benefits from strong soybean availability, while the Middle East & Africa progress gradually with increasing use of functional ingredients in developing markets.

Market Insights:

- The Industrial soy flour market reached USD 1,479.8 million in 2024 and is projected to hit USD 2,600.16 million by 2032, advancing at a CAGR of 7.3% driven by rising use in food processing, plant-based products, and industrial applications.

- North America (35), Europe (30%), and Asia Pacific (27%) hold the largest shares due to strong processing capacity, sustainability-focused regulations, and expanding food manufacturing systems.

- Asia Pacific, holding 27%, is the fastest-growing region supported by expanding food processing infrastructure, rising demand for cost-effective protein inputs, and increasing use of plant-based formulations.

- Bakery and confectionery account for the largest application share at over 35%, driven by consistent use of soy flour for structure, moisture control, and binding strength.

- Defatted soy flour leads product-type demand with over 40% share, supported by its functional stability, cost efficiency, and broad use across food and industrial formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Use Of Soy-Based Ingredients Across Diverse Industrial Applications

Demand rises as manufacturers shift toward plant-derived binders and stabilizers. Firms rely on soy flour to support texture control in food mixes. Paper and wood processors use soy inputs to strengthen coating quality. Adhesive producers explore soy blends to reduce petrochemical dependence. The Industrial soy flour market benefits from steady moves toward cleaner inputs. It helps companies improve performance in high-volume operations. Buyers adopt improved grades to maintain uniform quality. Product consistency strengthens trust across global supply chains.

- For instance, Cargill Incorporated markets its Prolía® soy flour for plywood and wood adhesives; testing shows it reduces drying time, consumes less water, and generates less waste compared with conventional glues.

Rising Preference For Cost-Effective Protein Sources In Bulk Processing Environments

Producers look for ingredients that deliver stable performance at scale. Many operations use soy flour to support predictable viscosity control. It offers a cost edge over several synthetic materials. Textile and paper processors integrate soy fractions to improve workflow stability. The Industrial soy flour market gains momentum from wider procurement programs. It supports high-capacity equipment that depends on reliable ingredients. Quality improvements help producers manage tighter production cycles. Strong output stability strengthens long-term adoption across major facilities.

- For instance, CHS Inc. offers defatted soy flour with around 50% protein that boosts water-binding capacity, increasing yield and shelf-life in baked products.

Stronger Industry Push Toward Sustainable Raw Material Adoption Across Key Sectors

Manufacturers pursue materials that support lower environmental load. Firms evaluate soy flour due to its renewable origin. Many processors upgrade blending systems to handle specialty soy grades. It supports sustainability targets set by global industrial groups. The Industrial soy flour market benefits from this transition across sectors. Cleaner input strategies help companies improve regulatory alignment. Buyers choose soy derivatives to reduce emissions in certain workflows. Expanding eco-focused standards strengthen long-term usage patterns.

Growing Need For Functional Ingredients That Deliver Better Binding And Structural Support

Producers search for materials that offer reliable adhesion. Soy flour helps maintain bond quality across varied temperature zones. Food processors use functional soy grades to support product stability. Wood composite makers rely on soy fractions to improve panel durability. The Industrial soy flour market advances due to this performance focus. It supports consistent curing in adhesive segments. Improved milling technology raises ingredient precision. Strong functional output helps companies meet stricter quality benchmarks.

Market Trends:

Rising Interest In High-Purity Soy Flour Grades For Specialized Industrial Formulations

Producers request tighter control over protein distribution. Higher-purity grades support advanced coating requirements. Firms test new milling approaches to reach narrow particle limits. It helps improve texture uniformity in demanding applications. The Industrial soy flour market sees stronger demand for premium inputs. Buyers expect stable batch behavior in complex mixes. Quality screening improves confidence in high-output facilities. Enhanced grade segmentation shapes procurement strategies across global operations.

- For instance, some food-ingredient suppliers have developed milling methods that deliver high-protein soy flour, which supports stable emulsions and dough uniformity in gluten-free baked goods.

Growing Adoption Of Bio-Based Blending Techniques Across Packaging And Coating Lines

Packaging teams explore soy flour to support flexible coating designs. Firms invest in systems that handle bio-based blends reliably. It improves layer uniformity across moving substrates. The Industrial soy flour market gains from interest in renewable solutions. Many processors refine mix ratios to optimize coating performance. Buyers search for blends that hold shape under thermal load. Improved wetting behavior supports cleaner film application. These patterns influence long-term technology upgrades.

- For instance, a soy-based adhesive produced under the trade name Soyad helped manufacture more than 150 million hardwood plywood panels globally using soy-based adhesive instead of formaldehyde-based resins.

Increasing Integration Of Soy Derivatives In Emerging Material Science Projects

Research groups test soy flour in new composite structures. It supports better surface bonding in light-duty materials. Developers examine soy fractions for experimental bio-resins. The Industrial soy flour market aligns with these scientific efforts. Many institutions test hybrid compounds for industrial-scale use. Controlled experiments help refine mechanical properties. Strong interest in alternative binders fuels new product trials. Data-driven development guides future material choices.

Growing Role Of Automation In Scaling Soy-Based Ingredient Processing Systems

Producers enhance milling and blending lines with automated controls. It improves consistency during high-speed output. The Industrial soy flour market experiences gains from this shift. Automated inspection reduces batch errors. Digital trackers support better inventory accuracy. Faster line adjustments improve operational efficiency. Companies use advanced systems to handle diverse grade profiles. Automation strengthens reliability across industrial ingredient supply chains.

Market Challenges Analysis:

Supply Variability And Exposure To Crop-Driven Price Movement Across Procurement Cycles

Producers face uncertainty when supply depends on seasonal crop output. Weather disruptions influence bean availability. It creates difficulties for firms that plan long production cycles. The Industrial soy flour market deals with fluctuating input quality. Global competition for soy raises volatility risk. Firms struggle to maintain consistent grade specifications. Inventory planning becomes more complex under shifting conditions. Long-term contracts require careful risk balancing.

Technical Compatibility Concerns Within High-Performance Industrial Formulation Workflows

Some segments require precise functional thresholds. Firms face limits when soy flour reacts differently under extreme heat. The Industrial soy flour market manages adoption barriers in advanced applications. Adhesive producers often need tighter curing behavior. Paper processors need uniform behavior under fast coating speeds. It challenges suppliers to refine processing steps. Compatibility tests extend development timelines. Performance gaps slow integration into specialized product lines.

Market Opportunities:

Expansion Of Bio-Based Manufacturing Lines Across Food, Adhesive, And Coating Industries

Companies invest in systems that favor renewable materials. It raises interest in soy flour for bulk industrial use. The Industrial soy flour market gains room to grow with new sustainability targets. Producers explore blends that support reduced emissions. High-functionality grades open doors to newer applications. Firms evaluate soy-based binders for wider integration. Better process control helps unlock more product categories. Strong regulatory momentum supports faster market entry.

Rising Demand For Alternative Protein Inputs Across Global Industrial Supply Chains

Buyers search for dependable plant-based materials that enhance performance. The Industrial soy flour market benefits from rising evaluations by emerging processors. It supports scalable production across multiple sectors. Food technologists test functional grades for new formats. Coating and composite makers explore soy inputs to diversify raw materials. Strong interest in renewable proteins shapes long-term planning. Wider acceptance across developing regions raises future opportunities.

Market Segmentation Analysis:

Product Type Analysis

Defatted soy flour holds strong demand due to its stable performance in high-volume processing. Full-fat and low-fat variants support diverse formulation needs across food and industrial blends. High-protein defatted grades attract buyers that require tighter nutrition control. Regular full-fat soy flour secures demand in bakery and coating lines that rely on richer texture support. Organic full-fat options gain traction in clean-label programs. The Industrial soy flour market benefits from this broad product range that supports different functional outcomes.

- For instance, CHS produces food-grade defatted soy flour with a protein level of up to 50%, which enhances water-holding capacity and improves dough yield in commercial baking operations, according to the U.S. Soybean Export Council (USSEC). Full-fat and low-fat variants support diverse formulation needs across food and industrial blends.

Application Analysis

Bakery and confectionery remain the dominant users due to consistent demand for structure and moisture control. Meat substitutes adopt soy flour to support firmness in plant-based formats. Meat and poultry processors use it to enhance binding performance in processed items. Soups and sausages rely on soy fractions to improve thickness and stability. Other applications draw interest from coating, adhesive, and filler producers. The wide application base supports ongoing product innovation.

- For instance, ADM reports that its high-gel soy flour increases batter viscosity, improving volume and crumb structure in large-scale baking, as noted in ADM’s functional ingredients documentation. Meat substitutes adopt soy flour to support firmness in plant-based formats.

Distribution Channel Analysis

Direct sales lead due to large industrial procurement needs. Modern trade supports bulk purchase behavior across established processing hubs. Departmental and convenience stores supply small-scale buyers that require flexible purchase options. Online stores gain traction with mid-size processors that seek wider product variety. Other channels support regional supply chains with diverse access points. This channel mix strengthens market reach and customer engagement.

Segmentation:

Product Type Segments

- Defatted Soy Flour

- Full-Fat Soy Flour

- Low-Fat Soy Flour

- High-Protein Defatted Soy Flour

- Regular Full-Fat Soy Flour

- Organic Full-Fat Soy Flour

Application Segments

- Bakery & Confectionery

- Meat Substitutes

- Meat & Poultry

- Soups & Sausages

- Other Applications

Distribution Channel Segments

- Direct Sales

- Modern Trade

- Departmental Stores

- Convenience Stores

- Online Stores

- Other Sales Channels

Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the leading position with an estimated 38% share of the Industrial soy flour market. Strong processing capacity supports steady integration of soy-based ingredients across food and industrial sectors. The region benefits from established soybean supply chains that improve sourcing efficiency. It sees rising use of defatted and full-fat grades in bakery, meat processing, and coating lines. Manufacturers focus on higher-purity inputs to meet strict quality standards. Growth in clean-label adoption strengthens long-term regional demand. The Industrial soy flour market maintains a solid foothold due to consistent industrial uptake.

Europe

Europe accounts for nearly 30% share, supported by strict sustainability targets and strong preference for plant-derived materials. The region invests in advanced milling technologies that improve functional soy ingredient development. It adopts soy flour in processed foods, sausages, meat alternatives, and industrial binders. Regulatory focus on renewable inputs improves usage across adhesives and paper coatings. Buyers emphasize traceability, pushing demand for organic and high-protein grades. Strong innovation in plant-based foods drives wider incorporation across major markets. It positions Europe as a stable growth contributor.

Asia Pacific, South America, and Middle East & Africa

Asia Pacific holds 27% share, driven by large-scale food processing growth and rising demand for cost-effective protein inputs. The region expands soy flour use across bakery, snacks, and blended industrial materials. Strong soybean availability in key markets supports competitive pricing. South America secures 6% share, supported by rising domestic processing and strong raw material presence. Middle East & Africa hold 4% share, with growing interest from emerging food manufacturers and industrial mixers. It gains steady traction in regions that seek affordable functional ingredients. This scaled regional distribution shapes future expansion patterns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cargill Incorporated

- Archer Daniels Midland (ADM) Company

- Bunge Limited

- DuPont de Nemours Inc.

- CHS Inc.

- The Scoular Company

- Wilmar International

- Bob’s Red Mill Natural Foods

- SunOpta Inc.

- Kerry Group

Competitive Analysis:

Competition remains intense as global producers focus on quality improvements, processing upgrades, and broader product portfolios. Leading companies strengthen supply chains to serve large food and industrial buyers with consistent grade profiles. The Industrial soy flour market features firms that expand capacity to meet rising demand for high-protein and specialty variants. It sees investment in advanced milling systems that support finer control of particle size. Key players raise their presence across high-growth regions to secure long-term contracts. Product innovation shapes differentiation strategies across full-fat, defatted, and organic lines. Strong distribution networks help major brands retain competitive strength.

Recent Developments:

- In November 2025, Bob’s Red Mill unveiled three new specialty baking flours designed to elevate the homemade baking experience. The product lineup includes Super-Fine Cake Flour, Self-Rising Flour, and High Fiber Flour, all packaged in 3-pound resealable stand-up bags for convenience and freshness. The Super-Fine Cake Flour is formulated to produce tender crumb texture suitable for delicate cakes, cupcakes, and cookies. The Self-Rising Flour contains flour, salt, and leavening agents, simplifying baking by eliminating the need to measure raising agents separately. The High Fiber Flour offers a nutritious alternative with five times the fiber of traditional all-purpose flour and serves as a direct cup-for-cup replacement for standard all-purpose flour, providing about 6 grams of fiber per serving. These products are available on Amazon and retail channels at prices ranging from USD 14.59 to USD 19.59.

- In September 2025, Archer Daniels Midland (ADM) announced plans to shutter its soy protein production facility in Bushnell, Illinois, as part of a strategic consolidation effort to enhance operational efficiency across its global network. This restructuring decision was made on August 29, 2025, aligning with ADM’s strategy to leverage recent investments, including the recommissioning of its Decatur, Illinois plant, which had been sidelined following a major explosion in September 2023.

- In August 2025, Bunge Limited entered into a purchase agreement with Solae to acquire substantially all lecithin, soy protein concentrate, and crush operations from International Flavours and Fragrances (IFF). The acquired business generated approximately USD 240 million in revenue for IFF in 2024 and employs about 250 people worldwide. The transaction was expected to close by the end of 2025, subject to customary regulatory conditions and adjustments. According to J Erik Fyrwald, CEO of IFF, the divestment would allow IFF to focus on its more specialized isolated soy protein business while enabling Bunge Limited to manage these commodity products more efficiently. This acquisition significantly enhances Bunge’s global soy portfolio and complements its earlier USD 8.2 billion merger with Viterra, completed in July 2025, which consolidated operations across major soybean-producing regions including Brazil, the United States, and Argentina.

- In June 2025, Cargill announced the acquisition of a soybean crushing unit, refinery, and oil bottling facility located in Barreiras, Bahia, Brazil. This strategic acquisition concluded a lease contract that had been active since 1998, ending 27 years of leasing operations. The facility employs 250 people and produces high-quality soybean meal, pelleted husk, degummed oil, and refined oil marketed under the Liza brand. According to Paulo Sousa, Cargill’s President in Brazil and Agricultural Business in Latin America, this initiative strengthens the company’s regional operations and supports growth objectives for both domestic market clients and the global soybean meal sector. This acquisition comes during Cargill’s 60th-year anniversary of operations in Brazil, where the company has invested R$ 8.1 billion over the last five years, maintaining 29 factories, 75 warehouses, and seven port facilities across the country.

Report Coverage:

The research report offers an in-depth analysis based on Product Type Segments, Application Segments, Distribution Channel Segments, and Regional Segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for cleaner and renewable ingredients will support wider product adoption.

- High-protein grades will gain more traction in processed food and industrial mixes.

- Rising interest in sustainable inputs will expand opportunities in advanced coatings.

- Digital milling systems will improve ingredient consistency and processing efficiency.

- Growth in plant-based foods will strengthen the role of soy flour in new product lines.

- Companies will expand regional supply chains to reduce procurement risks.

- Organic soy flour will see higher adoption under strict clean-label standards.

- Blends with enhanced functionality will enter more industrial applications.

- Market players will invest in non-GMO supply networks to meet regulatory shifts.

- Stronger emphasis on bio-based materials will support innovation across sectors.