Market Overview

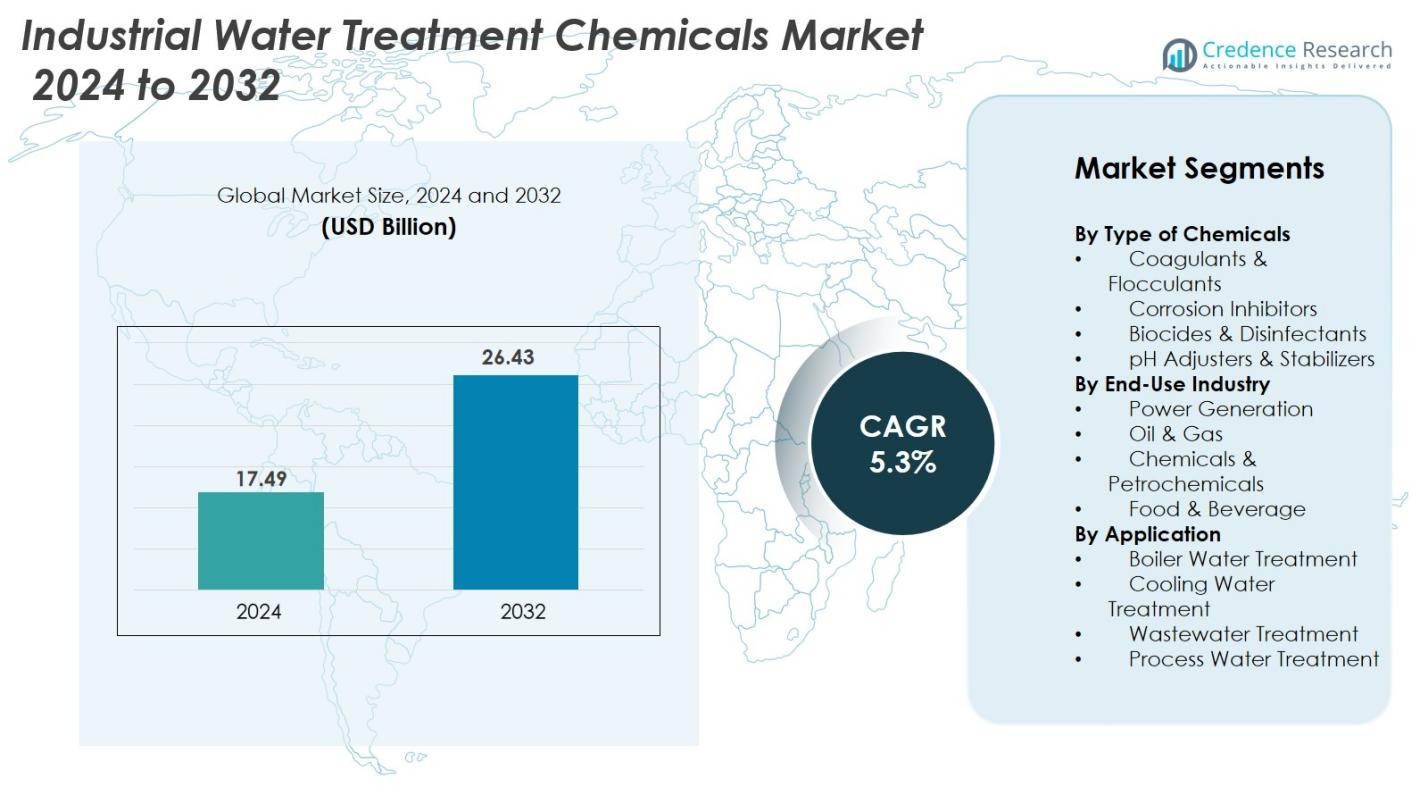

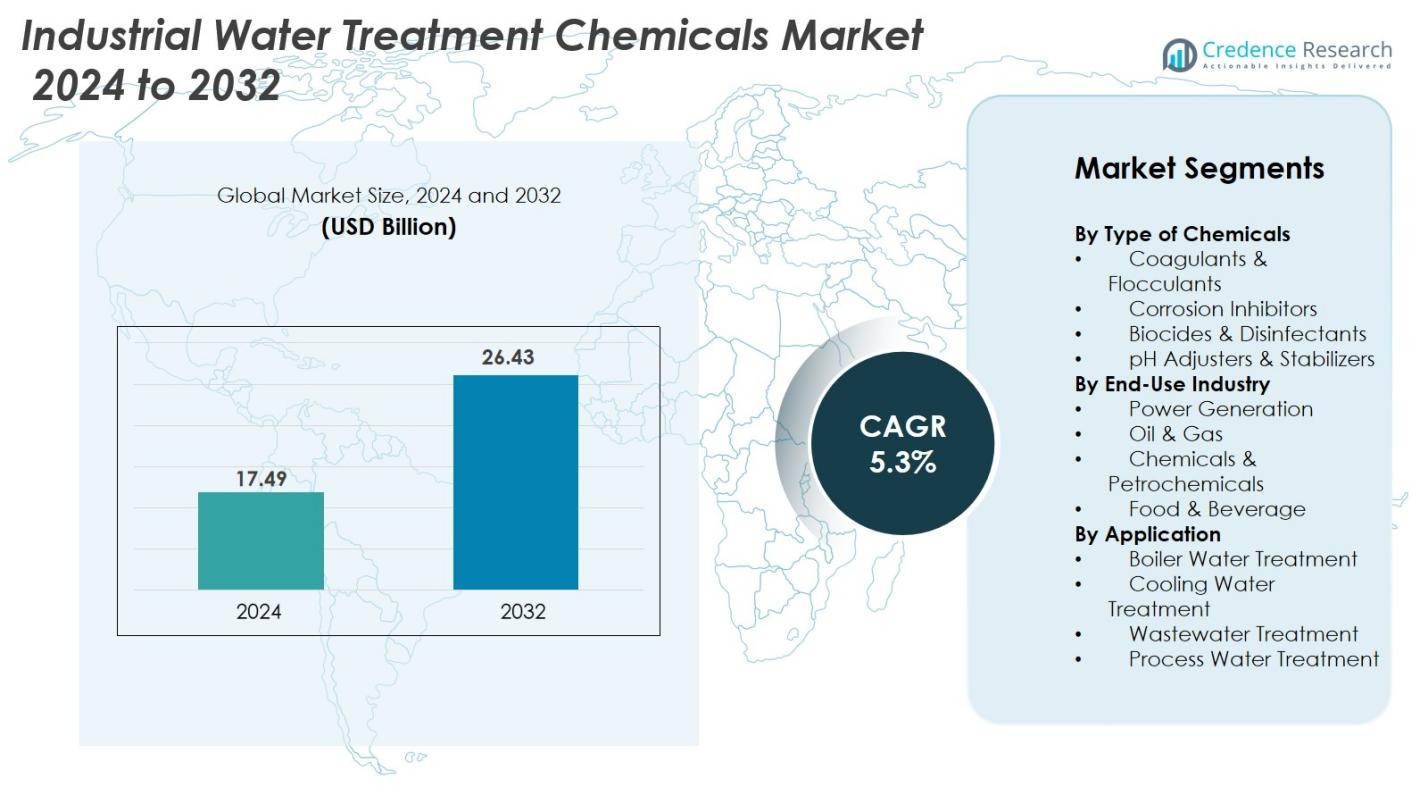

The Industrial Water Treatment Chemicals Market size was valued at USD 17.49 billion in 2024 and is anticipated to reach USD 26.43 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Water Treatment Chemicals Market Size 2024 |

USD 17.49 Billion |

| Industrial Water Treatment Chemicals Market, CAGR |

5.3% |

| Industrial Water Treatment Chemicals Market Size 2032 |

USD 26.43 Billion |

The Industrial Water Treatment Chemicals Market is anchored by industry leaders including Ecolab Inc., Kemira Oyj, Kurita Water Industries Ltd., BASF SE, Dow Inc., SNF Floerger, Solenis LLC and IXOM, each driving innovation in specialty chemistries and global distribution. Regionally, the Asia Pacific leads with a market share of 38.7% in 2024, followed by Europe at 30.1% and North America at 21.0%. These companies are leveraging the strong regional growth particularly in Asia Pacific with tailored product portfolios aimed at boiler and cooling treatment, wastewater reuse and zero‑liquid discharge applications, aligning their capabilities with the dominant geographic demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Industrial Water Treatment Chemicals Market size stood at USD 17.49 billion in 2024 and is projected to reach USD 26.43 billion by 2032, reflecting a CAGR of 5.3 %.

- Demand is driven by growing industrial water usage, tighter environmental regulations, and the rise of water recycling practices, with the Coagulants & Flocculants segment holding a 38.7 % share in 2024.

- The market is witnessing a shift towards green and sustainable chemical solutions, digital dosing systems and IoT‑enabled monitoring, creating opportunities for eco‑friendly product development and smart chemical delivery.

- High operational costs and a shortage of technical expertise in emerging markets are restraining faster adoption of advanced water treatment chemicals across some industrial sectors.

- Regionally, Asia Pacific leads with a 38.7 % share in 2024, followed by Europe at 30.1 % and North America at 21.0 %, underscoring the global variation in demand and regulatory pressure across the industrial water treatment chemicals market.

Market Segmentation Analysis

By Type of Chemicals

In the Industrial Water Treatment Chemicals Market, the Coagulants & Flocculants segment holds the dominant market share, accounting for 38.7% in 2024. This sub-segment is driven by the increasing demand for effective water purification processes in industrial applications, particularly in wastewater treatment. Coagulants and flocculants are essential in removing suspended solids, oils, and other impurities from water, making them crucial for industries like power generation and chemicals. The growing focus on environmental regulations and sustainable water management solutions is expected to fuel further growth in this segment.

- For instance, Kemira Oyj states it “produces in excess of 350 000 tons of water treatment chemicals annually at its four UK manufacturing sites” (Goole, Ellesmere Port, Teesport and Bradford).

By End-Use Industry

The Power Generation industry leads the end-use market for industrial water treatment chemicals, commanding a 28.5% share in 2024. The need for effective cooling and boiler water treatment in power plants, where water quality is critical for operational efficiency and equipment longevity, drives this dominance. With an increasing demand for energy and a push toward more efficient energy generation, power plants require advanced water treatment solutions to reduce corrosion, scale formation, and environmental impact, which contributes to the growth of the industrial water treatment chemicals market within this sector.

- For instance, NTPC’s Vindhyachal Super Thermal Power Station in India operates with an installed capacity of 4,760 MW and treats more than 280,000 cubic meters of water per day through dedicated chemical dosing, demineralization, and cooling-water conditioning systems.

By Application

The Boiler Water Treatment application dominates the industrial water treatment chemicals market with a share of 40.2% in 2024. Boiler systems in industries such as power generation and chemicals require water treatment chemicals to prevent scaling, corrosion, and fouling, which can hinder performance and increase maintenance costs. The consistent demand for steam generation and the need to maintain operational efficiency in boiler systems contribute to the growth of this segment. Additionally, rising energy demands and industrialization are significant drivers for continued market expansion in this application.

Key Growth Drivers

Rising Demand for Industrial Water Recycling

The increasing global focus on sustainability and water conservation has driven the demand for industrial water recycling. Industries are seeking cost-effective and environmentally friendly solutions to treat and reuse water. Water treatment chemicals are crucial for enhancing water quality in recycling processes, helping industries comply with regulations while reducing freshwater consumption. As industrial sectors such as power generation, chemicals, and food processing adopt water recycling practices, the demand for water treatment chemicals is expected to grow significantly, driving market expansion.

- For instance, Nestlé’s dairy processing plant in Lagos de Moreno, Jalisco, Mexico became a ‘zero-water’ facility by implementing a sophisticated water recycling system that treats condensate from milk processing for reuse. This initiative enables the plant to save approximately 1.6 million liters of groundwater per day, utilizing advanced technologies such as membrane bioreactors and reverse osmosis which require disinfectants, coagulants, and membrane-cleaning chemicals.

Strict Environmental Regulations

Environmental regulations related to wastewater management and water quality standards are key growth drivers in the Industrial Water Treatment Chemicals Market. Governments are enforcing stringent policies to prevent water pollution and ensure the safe disposal of industrial effluents. These regulations push industries to adopt advanced water treatment solutions, thereby increasing the demand for water treatment chemicals. Companies must invest in chemical solutions to meet legal requirements, ensuring operational compliance while mitigating environmental impacts, further propelling market growth.

- For instance, Samsung Electronics operates a large manufacturing complex (Smart City campus) in Gumi, South Korea, which employs advanced, multi-step chemical dosing and membrane filtration in its on-site wastewater treatment facilities to purify effluent and ensure compliance with stringent national limits on substances like fluorides, nitrates, and organic residues before discharging the treated water to a public sewage treatment plant.

Expansion of Industrial Sectors

The ongoing expansion of industries such as power generation, oil and gas, and chemicals is a significant growth driver for the Industrial Water Treatment Chemicals Market. As industrial production intensifies, there is a corresponding increase in water consumption, leading to greater demand for water treatment chemicals to ensure optimal water quality. Additionally, the expansion of emerging markets with growing industrialization, particularly in Asia-Pacific and Africa, will continue to drive the market as these regions seek reliable and efficient water treatment solutions.

Key Trends & Opportunities

Adoption of Green Water Treatment Solutions

One of the key trends shaping the Industrial Water Treatment Chemicals Market is the growing adoption of environmentally friendly or green chemicals. As industries seek to reduce their environmental footprint, the demand for biodegradable, non-toxic, and sustainable water treatment chemicals is increasing. Companies are investing in research and development to create eco-friendly alternatives to traditional chemicals, opening new opportunities in the market. This trend aligns with global sustainability goals and offers a competitive edge to companies that prioritize eco-conscious solutions.

- For instance, Kemira’s R&D center in Espoo, Finland, operates dedicated pilot lines for developing bio-based coagulants and exploring innovative, low-carbon aluminum and iron salts to support the future of greener wastewater treatment solutions

Integration of Automation and IoT in Water Treatment

The integration of automation and the Internet of Things (IoT) in water treatment processes presents a significant opportunity for the market. Smart water treatment systems equipped with sensors and real-time monitoring capabilities enable industries to optimize chemical usage, reduce costs, and improve operational efficiency. This technology allows for better management of water quality and more accurate dosing of chemicals, ensuring optimal performance. The increasing adoption of IoT-enabled water treatment solutions provides a lucrative growth opportunity for companies in the industrial water treatment chemicals market.

- For instance, Ecolab’s 3D TRASAR technology is installed in more than 40,000 industrial systems worldwide and uses sensors to take over 20 million water-quality readings daily, enabling automated chemical dosing and real-time performance optimization.

Key Challenges

High Operational Costs

A major challenge faced by industries in adopting industrial water treatment chemicals is the high operational costs associated with chemical procurement, water treatment equipment, and maintenance. For small and medium-sized enterprises (SMEs), the cost burden of investing in advanced water treatment solutions can be prohibitive. Although water treatment chemicals help improve efficiency and meet environmental standards, the ongoing expenses related to their use, alongside the need for skilled operators, can limit market growth for certain businesses.

Lack of Awareness and Technical Expertise

A significant challenge in the Industrial Water Treatment Chemicals Market is the lack of awareness and technical expertise in certain regions. Many industries, especially in developing markets, may not fully understand the importance of using the right chemicals for water treatment or the long-term benefits of investing in advanced water treatment solutions. Additionally, the lack of skilled professionals to manage and optimize these systems can hinder the widespread adoption of effective water treatment practices, slowing market growth in these regions.

Regional Analysis

Asia Pacific

The Asia Pacific region held a market share of 38.7% in 2024 in the industrial water treatment chemicals market. Rapid industrialization, increasing water scarcity, and escalating environmental regulations are key drivers for this dominance. Governments in countries such as China and India have enacted aggressive policies including zero liquid discharge mandates and enhanced wastewater reuse initiatives that are spurring chemical adoption in water treatment systems. The region’s growth is further strengthened by the expanding power generation, textiles, and chemicals sectors, all of which demand efficient treatment solutions to meet both operational and regulatory requirements.

Europe

In Europe, the industrial water treatment chemicals market accounted for 30.1% share in 2024. Stringent regulatory frameworks such as the EU Water Framework Directive and the REACH Regulation have compelled industries to adopt higher-performance chemical solutions for wastewater management and process water treatment. Mature industrial economies, strong emphasis on sustainability, and growing demand for effluent quality control in sectors like pulp & paper, food & beverage, and petrochemicals bolster the regional market. Investment in advanced treatment formulations and monitoring technologies also contributes to Europe’s robust share.

North America

North America captured a market share of 21.0% in 2024 within the industrial water treatment chemicals segment. The region’s growth is supported by aging industrial water infrastructure, strict enforcement of discharge standards under the Clean Water Act, and increasing corporate commitments to water reuse and sustainability. Industries such as power generation, oil & gas, and food & beverage in the U.S. and Canada drive demand for treatment chemicals that protect equipment and ensure regulatory compliance. The move toward smart dosing and digital monitoring systems further enhances market opportunities.

Middle East & Africa (MEA)

The Middle East and Africa region is identified as a high-growth area in the industrial water treatment chemicals market, holding a market share of 8.2% in 2024. This growth is driven by severe water scarcity, high desalination activity, and rapid industrial expansion. The region is noted for its above-average growth rate in the forecast period. Key drivers include rising oil & gas operations, heavy reliance on desalination, and ZLD (zero liquid discharge) mandates in Gulf countries, as well as increased regulatory focus on industrial effluent treatment in Africa’s emerging markets. The combination of these factors is expected to further accelerate the demand for water treatment chemicals in the region.

Latin America

In Latin America, steady growth underpins the industrial water treatment chemicals market, accounting for 9.5% of the global share in 2024. The demand is driven by the expansion of industries such as mining, oil & gas, and pulp & paper. Regional challenges, such as water scarcity and stricter environmental regulations, are prompting industries to invest in advanced treatment solutions. Countries like Brazil and Mexico are tightening wastewater standards, creating new opportunities for water treatment chemical providers as industries work to enhance their water management processes.

Market Segmentations

By Type of Chemicals

- Coagulants & Flocculants

- Corrosion Inhibitors

- Biocides & Disinfectants

- pH Adjusters & Stabilizers

By End-Use Industry

- Power Generation

- Oil & Gas

- Chemicals & Petrochemicals

- Food & Beverage

By Application

- Boiler Water Treatment

- Cooling Water Treatment

- Wastewater Treatment

- Process Water Treatment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The industrial water treatment chemicals market is highly competitive, with key players such as Veolia Water Technologies, Suez Water Technologies, Ecolab Inc., Kemira Oyj, Kurita Water Industries Ltd., BASF SE, Dow Inc., SNF Floerger, Solenis LLC, and IXOM leading the industry. These companies dominate the market through extensive product portfolios, strategic partnerships, technological advancements, and a strong global presence. Major players are focusing on expanding their product offerings, particularly in sustainable and eco-friendly chemicals, to meet the rising demand for environmental compliance. In addition to traditional water treatment chemicals, several companies are leveraging innovations such as smart water monitoring systems and automation technologies to enhance operational efficiency and reduce costs. Strategic acquisitions, collaborations, and partnerships with key industry players further strengthen their position in the market. The increasing emphasis on water reuse, recycling, and energy efficiency is driving competition among companies, with a focus on developing solutions that address both environmental concerns and the growing industrial demand for high-quality water treatment chemicals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kurita Water Industries Ltd.

- Dow Inc.

- SNF Floerger

- BASF SE

- Solenis LLC

- Ecolab Inc.

- IXOM

- Suez Water Technologies

- Veolia Water Technologies

- Kemira Oyj

Recent Developments

- In 2025, Global Water Technology, Inc. (“GWT”) acquired Essential Water Technologies, LLC (“EWT”) to strengthen its Chicago market position and expand its national footprint in industrial water-treatment solutions.

- In 2025, Kemira Oyj signed a purchase agreement to acquire Water Engineering, Inc. (Nebraska, USA) for approximately USD 150 million in cash, expanding its industrial water-treatment services offering.

- In August 2025, Grundfos A/S completed the acquisition of Newterra Group Inc. to further enhance its industrial water-treatment portfolio.

Report Coverage

The research report offers an in-depth analysis based on Type of Chemicals, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising industrial water usage and stricter environmental regulations worldwide.

- Increasing adoption of water recycling and reuse technologies will drive demand for industrial water treatment chemicals.

- There will be a growing shift toward sustainable and eco-friendly chemicals to comply with environmental standards.

- The power generation and oil & gas sectors will remain significant consumers of water treatment chemicals.

- Technological advancements, including IoT and smart monitoring systems, will enhance chemical dosing accuracy and water quality management.

- Rising water scarcity and the need for desalination will accelerate the demand for water treatment chemicals in regions like the Middle East and Africa.

- Stringent zero liquid discharge (ZLD) regulations will drive the adoption of advanced water treatment solutions across industries.

- Increasing industrialization in emerging markets, particularly in Asia-Pacific and Africa, will provide significant growth opportunities.

- Investment in research and development of innovative water treatment chemicals will lead to more efficient and cost-effective solutions.

- The rise in corporate sustainability commitments will push industries to adopt green and biodegradable water treatment chemicals.