Market Overview

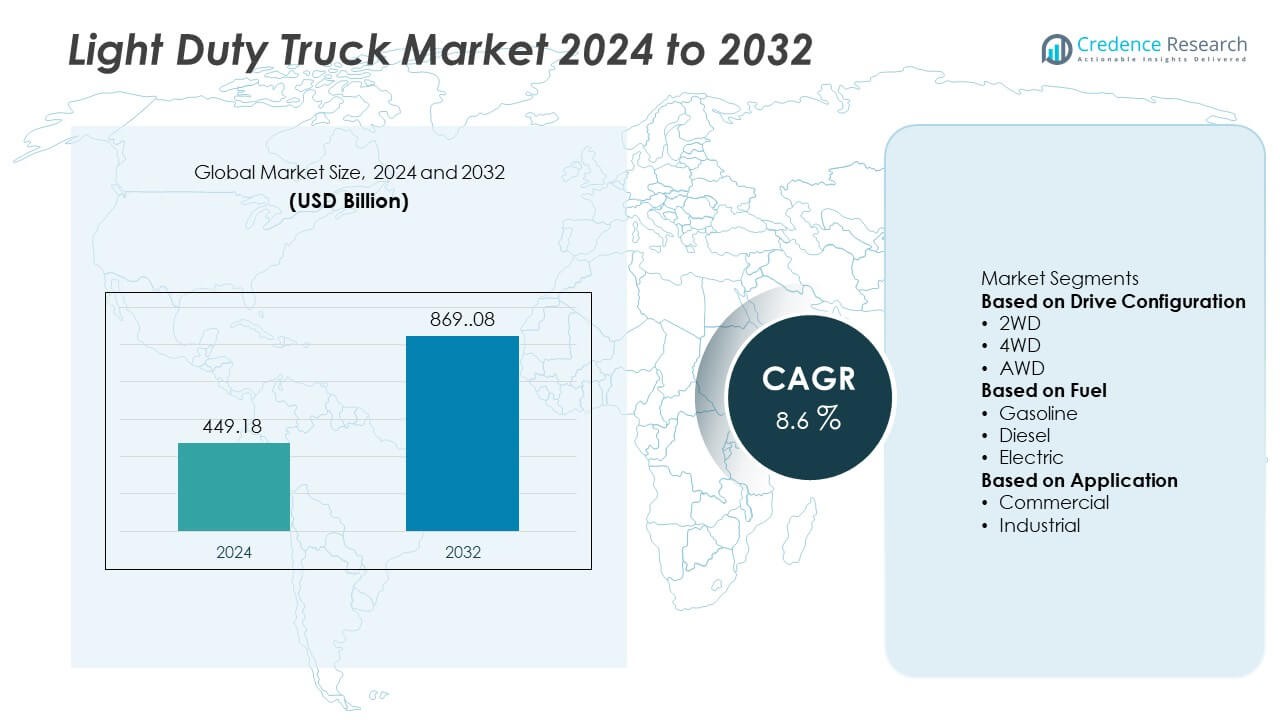

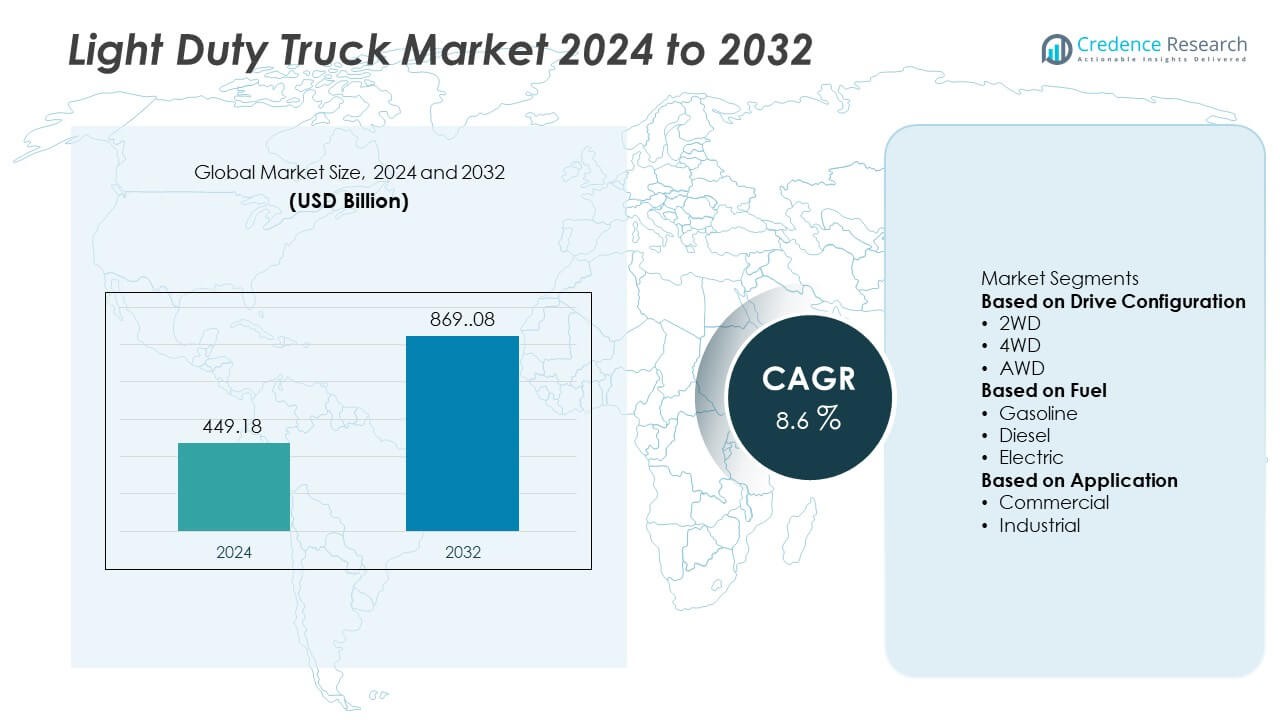

The Light Duty Truck market was valued at USD 449.18 billion in 2024 and is projected to reach USD 869.08 billion by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Light Duty Truck Market Size 2024 |

USD 449.18 Billion |

| Light Duty Truck Market, CAGR |

8.6% |

| Light Duty Truck Market Size 2032 |

USD 869.08 Billion |

The Light Duty Truck market is led by major players including Hyundai, Tata, Volkswagen, Daimler, Isuzu, Toyota, GM, Renault, Ford, and Flat, all of which compete through innovation, electrification, and strong distribution networks. These companies focus on expanding production capacities and enhancing fleet solutions to address rising demand across commercial and industrial applications. Regionally, North America dominated the market with 36% share in 2024, supported by high vehicle ownership, robust logistics networks, and growing e-commerce. Europe followed with 27% share, driven by strict emission regulations and adoption of electric trucks, while Asia-Pacific held 24% share, emerging as the fastest-growing region fueled by rapid urbanization and large-scale infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Light Duty Truck market was valued at USD 449.18 billion in 2024 and is expected to reach USD 869.08 billion by 2032, growing at a CAGR of 8.6%.

- Rising e-commerce expansion and demand for last-mile delivery are driving adoption, with the commercial segment leading at 58% share in 2024.

- Key trends include the rapid shift toward electric and hybrid trucks, supported by stricter emission norms and government incentives for fleet electrification.

- The market is highly competitive with players such as Hyundai, Tata, Volkswagen, Daimler, Isuzu, Toyota, GM, Renault, Ford, and Flat focusing on innovation, sustainability, and telematics integration.

- Regionally, North America led with 36% share in 2024, followed by Europe at 27% and Asia-Pacific at 24%, while Latin America and the Middle East & Africa together accounted for 13%, showing steady growth through infrastructure development and expanding logistics networks.

Market Segmentation Analysis:

By Drive Configuration

The 2WD segment dominated the Light Duty Truck market with 46% share in 2024, largely due to its cost-effectiveness and fuel efficiency. These trucks are widely used in urban and semi-urban areas where road conditions are favorable, making them the preferred choice for personal and small-scale commercial use. Although 4WD and AWD are gaining traction in off-road, construction, and utility applications, their higher costs limit broader adoption. Increasing demand for affordable mobility and expanding logistics networks in emerging economies continue to support the strong growth of the 2WD segment.

- For instance, the Ford F-150 has for years incorporated a 10-speed automatic transmission to improve fuel performance for a wide range of logistics and transport operations.

By Fuel

Gasoline-powered light duty trucks accounted for 52% share in 2024, maintaining dominance due to lower upfront costs, widespread fueling infrastructure, and consistent demand from personal and small-business users. Diesel trucks hold a significant portion of the market, favored in commercial and industrial applications for their higher torque and better fuel efficiency. Electric trucks, though holding a smaller share, are rapidly expanding due to government incentives, stricter emission regulations, and fleet electrification strategies, which will reshape the segment in the coming years.

- For instance, General Motors offers a Chevrolet Silverado electric Max Range Work Truck (8WT) equipped with an available 205 kWh battery pack, offering an EPA-estimated driving range of up to 793 km (493 miles), targeting commercial fleet electrification programs in the U.S.

By Application

The commercial segment led the Light Duty Truck market with 58% share in 2024, driven by rising demand in logistics, retail distribution, and last-mile delivery. E-commerce expansion, urban freight growth, and small business adoption fuel this dominance. The industrial segment, though smaller in share, is gaining importance with increasing use in construction sites, mining operations, and utility services requiring robust transportation solutions. Advancements in telematics and fleet management systems further support adoption, reinforcing the commercial segment’s leadership while enabling the industrial segment to expand steadily during the forecast period.

Key Growth Drivers

Expansion of E-commerce and Last-Mile Delivery

The rise of e-commerce has significantly increased the need for efficient last-mile delivery, making light duty trucks the backbone of urban logistics. Their compact size, fuel efficiency, and ability to navigate congested city roads make them ideal for parcel distribution and retail deliveries. Growing investments in e-commerce infrastructure and consumer demand for quick, same-day delivery strengthen the segment’s reliance on these vehicles. As online shopping penetration continues to expand globally, the demand for light duty trucks is expected to accelerate steadily over the forecast period.

- For instance, FedEx is systematically expanding its electric vehicle (EV) fleet for last-mile deliveries as part of a phased approach to achieve carbon-neutral operations globally by 2040. The company is incorporating electric vans and other vehicles from various manufacturers, including BrightDrop, for use in urban centers in the U.S., Europe, Asia Pacific, and other key markets.

Electrification and Sustainability Push

Stricter emission standards and sustainability goals are accelerating the shift toward electric light duty trucks. Governments worldwide are offering incentives, subsidies, and tax benefits to promote fleet electrification. These trucks offer lower operating costs, reduced emissions, and compliance with environmental regulations, making them attractive for businesses. Automakers are investing heavily in expanding electric truck portfolios with improved battery ranges and charging infrastructure. This transition not only reduces carbon footprints but also positions electric light duty trucks as a major growth driver in the evolving transportation sector.

- For instance, Rivian has delivered thousands of Electric Commercial Vans (EDVs) to logistics companies like Amazon in North America, with a current model featuring a battery designed to achieve a target range of approximately 240 kilometers. The ongoing fleet electrification supports operations in line with strict environmental regulations.

Infrastructure Development and Urbanization

Rapid urbanization and infrastructure development projects are fueling demand for light duty trucks in both developed and emerging economies. Expanding construction activities, growing utility services, and rising demand for material transport require efficient, durable, and flexible vehicles. Light duty trucks are preferred due to their versatility across short-haul and medium-haul operations. Emerging markets, especially in Asia-Pacific and Latin America, are witnessing increasing adoption driven by urban housing projects and government-backed infrastructure initiatives. This trend reinforces the critical role of light duty trucks in supporting economic growth and urban expansion.

Key Trends & Opportunities

Integration of Telematics and Fleet Management Solutions

The adoption of telematics and digital fleet management tools is reshaping operations in the light duty truck market. Businesses increasingly rely on connected solutions for real-time tracking, predictive maintenance, and optimized route planning. These innovations improve fuel efficiency, reduce downtime, and enhance overall operational productivity. Rising adoption of AI-driven analytics and IoT-enabled monitoring is creating opportunities for automakers and fleet operators to differentiate services. As logistics companies prioritize efficiency and sustainability, the integration of smart technologies into light duty trucks emerges as a key market trend.

- For instance, Verizon Connect uses telematics solutions to help fleet operators improve vehicle maintenance and reduce downtime through predictive maintenance and real-time diagnostics

Rising Demand for Electric and Hybrid Models

Electric and hybrid light duty trucks are gaining momentum as businesses shift toward greener transportation options. Expanding charging infrastructure, advancements in battery technology, and supportive regulatory frameworks are enabling broader adoption. Fleet operators in logistics, retail, and municipal services are increasingly investing in electric trucks to reduce operating costs and align with emission mandates. While adoption is currently concentrated in urban areas, declining battery costs and government incentives are expected to expand their reach globally, creating significant growth opportunities in the coming decade.

- For instance, Daimler Truck’s FUSO subsidiary has delivered several hundred eCanter electric light-duty trucks, initially equipped with 81 kWh batteries providing a range of approximately 100 kilometers. The next generation offers a modular battery concept, with an L battery pack (124 kWh) providing a range of up to 200 km, or up to 324 km on a Japanese test cycle, targeting last-mile delivery fleets across Europe and Japan.

Key Challenges

High Initial Costs of Advanced Models

Despite growing demand, high upfront costs of electric and advanced technology-enabled light duty trucks remain a key barrier. Electric trucks, while cost-effective in the long term, require significant initial investment in vehicle purchase and charging infrastructure. Many small businesses and logistics operators in emerging economies find affordability a challenge. This limits the pace of fleet electrification and adoption of connected features. Overcoming this challenge will require cost reductions through economies of scale, technological innovations, and expanded government support for buyers.

Supply Chain Disruptions and Raw Material Volatility

The light duty truck market faces challenges from global supply chain disruptions and fluctuations in raw material prices. Semiconductor shortages, rising costs of steel and batteries, and logistic bottlenecks have constrained production in recent years. Such disruptions directly impact automakers’ ability to meet rising demand, delaying deliveries and driving up costs. Uncertainty in the supply chain particularly affects the availability of electric models, as battery materials remain in high demand. Addressing these issues requires diversifying supply chains and investing in localized production facilities.

Regional Analysis

North America

North America held the largest share of 36% in the Light Duty Truck market in 2024, driven by strong demand from the U.S. and Canada. The region’s dominance stems from robust e-commerce activity, last-mile delivery expansion, and consumer preference for pickup trucks. Government incentives for electric vehicle adoption and investments in charging infrastructure are boosting the shift toward electric light duty trucks. The commercial sector continues to drive growth, supported by advanced telematics integration and fleet modernization. With high vehicle ownership rates and strong replacement demand, North America remains the leading market for light duty trucks.

Europe

Europe accounted for 27% share of the Light Duty Truck market in 2024, supported by stringent emission regulations and growing adoption of electric vehicles. Countries like Germany, France, and the UK lead with strong logistics and retail distribution networks. The region’s focus on sustainability and low-emission zones in urban areas has accelerated the uptake of electric and hybrid light duty trucks. Infrastructure modernization, coupled with government-backed green mobility initiatives, further drives market expansion. Growing adoption in Eastern Europe is also contributing, with logistics and construction sectors increasingly integrating light duty trucks for regional distribution.

Asia-Pacific

Asia-Pacific captured 24% share of the Light Duty Truck market in 2024, with China, India, and Japan being the leading contributors. Rapid urbanization, infrastructure development, and the expansion of e-commerce platforms are fueling strong demand. China dominates production and consumption, supported by large-scale manufacturing and government incentives for electric trucks. India’s growing logistics and construction sectors also contribute significantly, while Japan focuses on technological innovations in hybrid and electric models. The region’s cost-competitive manufacturing base and increasing consumer adoption make Asia-Pacific the fastest-growing market for light duty trucks during the forecast period.

Latin America

Latin America represented 7% share of the Light Duty Truck market in 2024, led by Brazil and Mexico. Growth is supported by rising construction projects, expanding retail networks, and improving road infrastructure. The region is seeing greater adoption of light duty trucks in last-mile delivery and small business logistics, particularly as e-commerce gains traction. However, economic instability and limited charging infrastructure slow the adoption of electric models. Despite these challenges, foreign direct investments in automotive manufacturing and logistics modernization continue to create opportunities, supporting steady growth in the region’s light duty truck market.

Middle East & Africa

The Middle East & Africa accounted for 6% share of the Light Duty Truck market in 2024, with demand concentrated in Gulf countries and South Africa. Expanding construction and utility projects, coupled with rising commercial activity, are key drivers in the region. Governments are investing in infrastructure development and fleet modernization, creating opportunities for both conventional and electric trucks. However, slower adoption of electrification due to limited charging infrastructure remains a challenge. Ongoing urban development projects and the expansion of logistics services ensure steady demand, positioning the region as an emerging growth area in the global market.

Market Segmentations:

By Drive Configuration

By Fuel

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Light Duty Truck market is defined by key players such as Hyundai, Tata, Volkswagen, Daimler, Isuzu, Toyota, GM, Renault, Ford, and Flat. These companies compete through a mix of product innovation, advanced drivetrain technologies, and expanded production capabilities to capture market share. Many focus on developing electric and hybrid trucks to align with global sustainability targets and meet stringent emission norms. Partnerships with fleet operators, logistics providers, and government agencies are common strategies to strengthen market presence. Leading players also invest in telematics, safety features, and connected technologies to enhance vehicle performance and operational efficiency. Regional expansions, especially in Asia-Pacific and Latin America, further support their growth. Intense competition drives continuous improvements in design, fuel efficiency, and pricing strategies, ensuring that established automakers maintain their stronghold while new entrants attempt to capture niche opportunities in the rapidly evolving Light Duty Truck market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hyundai

- Tata

- Volkswagen

- Daimler

- Isuzu

- Toyota

- GM

- Renault

- Ford

- Flat

Recent Developments

- In September 2025, Tata Motors launched the all-new Tata LPT 812, a 5-ton payload, 4-tyre truck for urban haulage.

- In September 2025, Hyundai announced plans to launch a body-on-frame mid-size pickup in the U.S. before 2030.

- In July 2025, Tata Motors struck a deal to acquire Iveco’s commercial vehicles business (excluding defense), to deepen its global truck footprint.

- In January 2025, Tata Motors unveiled six electric commercial vehicles (including mini trucks and pickups) at Auto Expo 2025.

Report Coverage

The research report offers an in-depth analysis based on Drive Configuration, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand from e-commerce and last-mile delivery.

- Electric and hybrid trucks will gain traction as emission regulations tighten globally.

- Commercial applications will continue to dominate overall demand in the coming years.

- Industrial use will increase with infrastructure development and construction growth.

- Telematics and fleet management adoption will enhance efficiency and reduce downtime.

- Asia-Pacific will emerge as the fastest-growing regional market.

- North America will maintain leadership supported by logistics and consumer demand.

- Europe will strengthen its position through sustainability and green mobility policies.

- Product innovations will focus on battery range, lightweight materials, and safety features.

- Competitive intensity will rise as global players expand fleets and local production.