Market Overview:

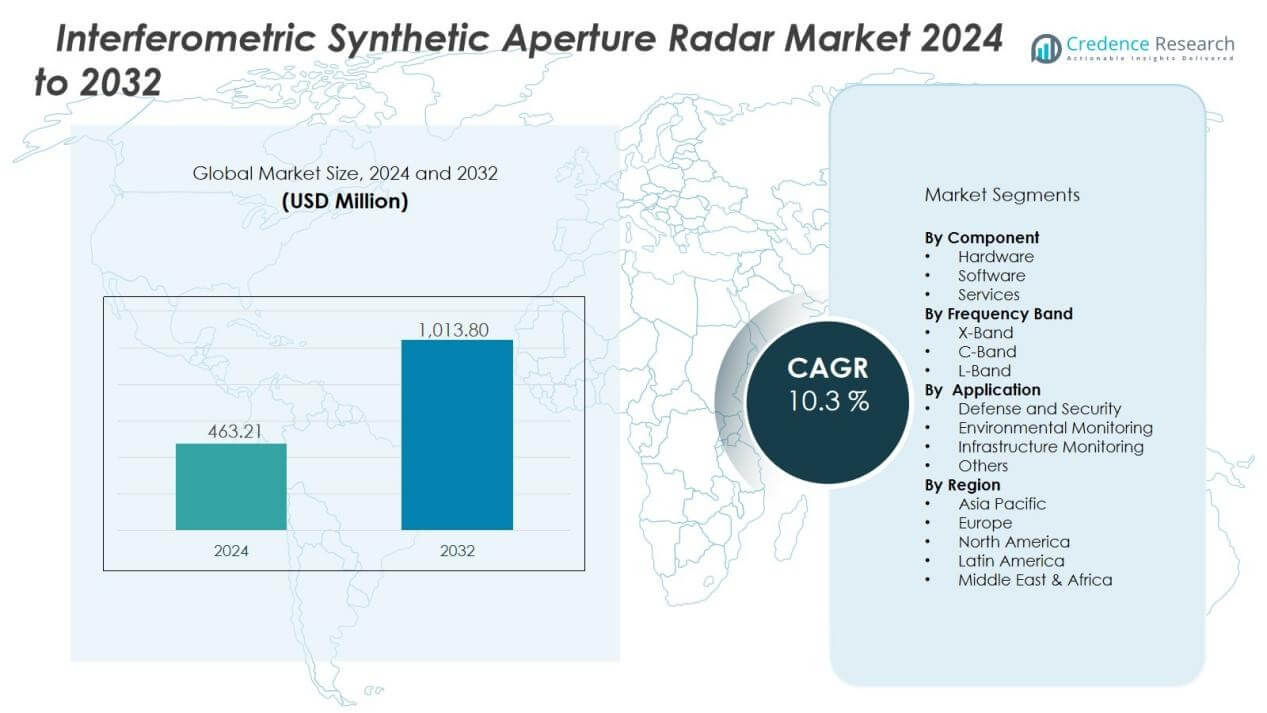

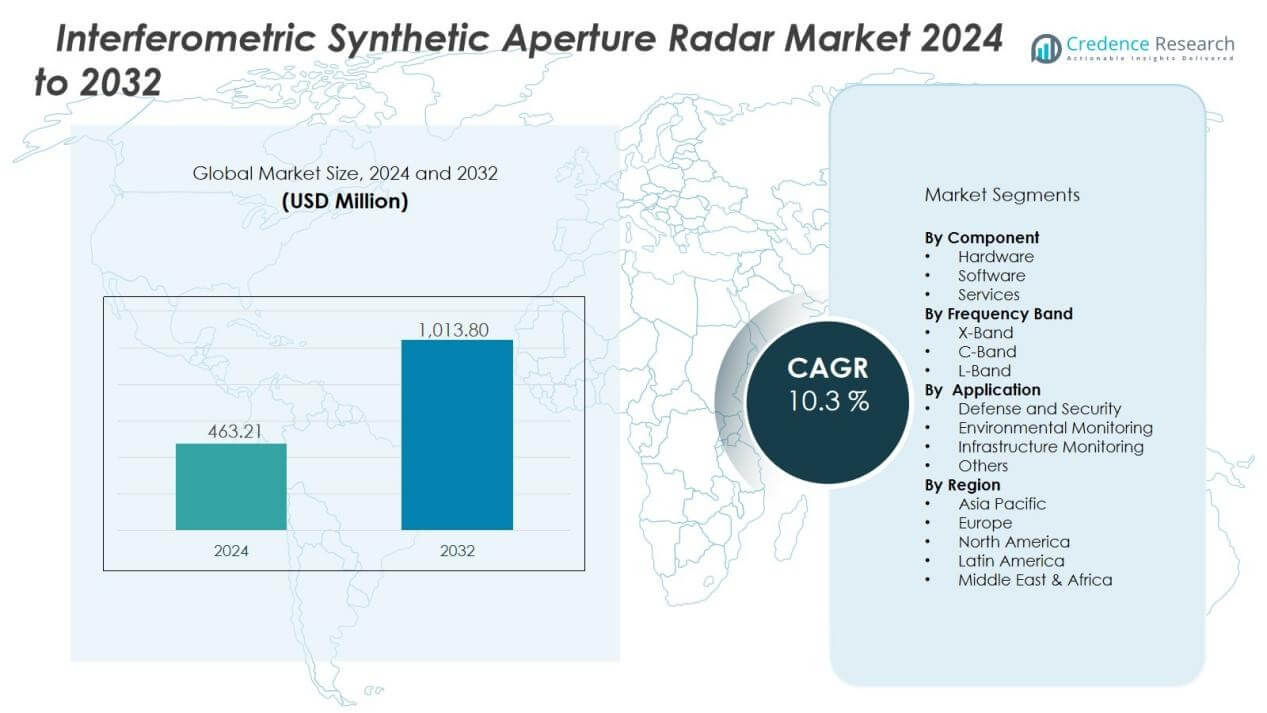

The interferometric synthetic aperture radar market size was valued at USD 463.21 million in 2024 and is anticipated to reach USD 1,013.80 million by 2032, at a CAGR of 10.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interferometric Synthetic Aperture Radar Market Size 2024 |

USD 463.21 Million |

| Interferometric Synthetic Aperture Radar Market, CAGR |

10.3% |

| Interferometric Synthetic Aperture Radar Market Size 2032 |

USD 1,013.80 Million |

Key drivers fueling market expansion include growing demand for precise topographic mapping, disaster management, and environmental monitoring. Governments and defense agencies increasingly rely on InSAR for surveillance and border security, while commercial sectors adopt it for urban planning, mining, and oil exploration. Advancements in satellite constellations, cloud-based analytics, and cost-effective data processing further strengthen adoption. Rising concerns over climate change and natural hazards also push demand for accurate terrain deformation monitoring.

Regionally, North America leads the market due to strong defense budgets, advanced space infrastructure, and active participation of leading technology providers. Europe follows closely, supported by the European Space Agency’s initiatives and widespread environmental monitoring projects. Asia-Pacific is projected to register the fastest growth, driven by rapid urbanization, infrastructure development, and expanding satellite programs in China, India, and Japan. Meanwhile, Latin America and the Middle East & Africa present emerging opportunities through energy exploration and regional security applications.

Market Insights:

- The interferometric synthetic aperture radar market was valued at USD 463.21 million in 2024 and is expected to reach USD 1,013.80 million by 2032, growing at a CAGR of 10.3% from 2024 to 2032.

- Rising demand for accurate topographic mapping and land monitoring supports strong adoption across government, defense, and commercial sectors.

- InSAR plays a critical role in disaster management and environmental monitoring by detecting earthquakes, landslides, floods, and volcanic activity with precision.

- Defense, security, and infrastructure development drive significant growth as the technology improves surveillance, reconnaissance, and structural safety.

- Technological progress, including satellite constellations, AI integration, and cloud-based analytics, strengthens efficiency and reduces operational challenges.

- High costs, technical complexity, and limited availability of skilled professionals remain barriers to wider adoption in developing regions.

- North America held 38% market share in 2024, led by strong defense investments, advanced space programs, and commercial adoption in energy and infrastructure.

- Europe accounted for 29% market share in 2024, supported by European Space Agency initiatives, environmental projects, and robust regulatory frameworks.

- Asia-Pacific captured 22% market share in 2024, emerging as the fastest-growing region due to space investments, urbanization, and climate monitoring needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Accurate Topographic Mapping and Land Monitoring:

The interferometric synthetic aperture radar market benefits from the growing need for precise mapping solutions. Governments, defense agencies, and commercial enterprises rely on InSAR to generate high-resolution digital elevation models. It provides consistent data regardless of weather conditions, enabling year-round monitoring. Expanding applications in land use planning, resource management, and geological studies drive steady adoption.

- For instance, ICEYE’s InSAR processing has demonstrated the capability to update a 5.6 km × 5.6 km DEM with a statistical height estimation error of approximately 0.15 m.

Expanding Role in Disaster Management and Environmental Monitoring:

InSAR technology plays a crucial role in assessing natural hazards and environmental changes. It helps authorities monitor earthquakes, landslides, volcanic activity, and flooding events with high precision. The interferometric synthetic aperture radar market gains momentum through its ability to detect surface deformation and predict risks. It supports faster response times, improving disaster preparedness and reducing long-term damage.

- For instance, following the 6.0 magnitude earthquake in Crete on September 27, 2021, InSAR data revealed a vertical ground displacement of nearly 20 centimeters, enabling accurate hazard assessment and targeted disaster response.

Increasing Adoption in Defense, Security, and Infrastructure Development:

Defense and security sectors are major contributors to the growth of InSAR adoption. The interferometric synthetic aperture radar market benefits from its utility in border surveillance, intelligence gathering, and strategic reconnaissance. Infrastructure developers also use the technology to monitor structural stability in bridges, tunnels, and railways. It ensures safer construction practices while reducing project risks and costs.

Technological Advancements and Integration with Satellite Constellations:

Rapid advancements in satellite constellations and data analytics enhance the effectiveness of InSAR solutions. The interferometric synthetic aperture radar market grows with the integration of cloud-based processing, artificial intelligence, and automation tools. These innovations improve image quality, shorten processing times, and expand accessibility to multiple industries. It ensures broader adoption in both government-led projects and commercial ventures worldwide.

Market Trends:

Growing Integration of Cloud Platforms, AI, and Big Data Analytics:

The interferometric synthetic aperture radar market is witnessing strong momentum from integration with cloud platforms and advanced analytics. Organizations increasingly adopt artificial intelligence and machine learning to enhance image interpretation and automate change detection. It enables real-time analysis of large datasets, making insights more accessible across industries such as defense, oil exploration, and agriculture. Cloud-based platforms reduce infrastructure costs while improving scalability and accessibility for end users. The trend aligns with the demand for faster processing and actionable intelligence in monitoring applications. It also strengthens collaboration between commercial and government agencies by allowing data sharing and cross-domain research initiatives.

Rising Use of Multi-Satellite Constellations and Commercial Participation:

The interferometric synthetic aperture radar market is experiencing expansion through multi-satellite constellations designed for frequent revisit times. Governments and private firms invest heavily in deploying small satellites that lower operational costs while improving spatial coverage. It supports near-continuous monitoring of critical areas, offering better insights into urban growth, climate impact, and resource management. Commercial participation is increasing, with start-ups and established aerospace players driving innovation in satellite design and service models. The trend encourages broader adoption across industries previously limited by high costs and technical barriers. It also positions InSAR technology as a critical tool for both global security and sustainable development initiatives.

Market Challenges Analysis:

High Costs, Technical Complexity, and Limited Accessibility

The interferometric synthetic aperture radar market faces constraints from high operational costs and technical challenges. Developing, launching, and maintaining advanced satellite systems requires significant investments that limit participation to a few major players. It also demands specialized expertise in radar imaging and data interpretation, restricting accessibility for smaller organizations. Limited availability of skilled professionals further slows adoption across developing regions. Data processing complexity and the need for advanced infrastructure add barriers for widespread use. The combination of financial and technical constraints continues to challenge market penetration.

Data Accuracy, Interference, and Policy Restrictions

The interferometric synthetic aperture radar market is affected by concerns related to data reliability and external interference. InSAR measurements can be disrupted by atmospheric conditions or vegetation cover, which affects accuracy. It raises the need for advanced correction techniques and validation processes. Policy restrictions on satellite imaging and defense-related data sharing also limit commercial deployment in sensitive regions. International regulations often slow project approvals and delay implementation timelines. The presence of these barriers creates uncertainty for stakeholders aiming to expand InSAR-based solutions globally.

Market Opportunities:

Expanding Applications Across Infrastructure, Energy, and Environmental Management:

The interferometric synthetic aperture radar market offers significant opportunities through broader applications in infrastructure and energy sectors. Governments and private developers increasingly use InSAR to monitor bridges, tunnels, dams, and rail networks for structural stability. It helps reduce maintenance costs and prevent failures through early detection of ground movement. In the energy industry, applications in oil, gas, and renewable projects enhance site selection and safety monitoring. Environmental agencies also benefit from accurate data on deforestation, glacier retreat, and coastal erosion. These diverse applications create long-term growth potential across multiple industries.

Rising Demand in Emerging Economies and Commercial Space Initiatives:

The interferometric synthetic aperture radar market is positioned to benefit from rising demand in emerging economies. Countries in Asia-Pacific, Latin America, and Africa invest in space programs and geospatial technologies to support development goals. It creates strong opportunities for technology providers offering cost-efficient solutions and collaborative projects. Commercial space initiatives further expand the market through small satellite constellations and private-sector investments. Partnerships between government agencies, research institutions, and commercial operators open new avenues for innovation. Growing interest in sustainable development and climate monitoring strengthens adoption across both public and private domains.

Market Segmentation Analysis:

By Component:

The interferometric synthetic aperture radar market is segmented by component into hardware, software, and services. Hardware holds a major share, driven by demand for advanced radar sensors, antennas, and satellite payloads. It ensures reliable image acquisition under diverse weather conditions. Software adoption is increasing with the integration of AI, cloud platforms, and automated data processing tools. Services play a growing role in data interpretation, consulting, and technical support, enhancing accessibility for commercial and government users.

- For Instance,the Shuttle Radar Topography Mission (SRTM) in February 2000, a second receiving antenna was deployed on a 60-meter-long, extendable mast, not a slidable lattice grate.

By Frequency Band:

The interferometric synthetic aperture radar market by frequency band includes X-band, C-band, and L-band systems. X-band dominates due to its high-resolution imaging capabilities, supporting defense surveillance and urban mapping. C-band finds strong use in environmental monitoring and climate studies, offering a balance between resolution and coverage. L-band is gaining traction for its ability to penetrate vegetation and soil, enabling applications in agriculture, forestry, and geological studies. It provides reliable long-term deformation monitoring for infrastructure and natural terrain.

- For instance, ICEYE, an industry leader in X-band SAR technology, launched multiple satellites with a 1200 MHz radar bandwidth and achieved imaging resolutions up to 25 cm, supporting timely and precise urban surveillance and disaster monitoring missions.

By Application:

The interferometric synthetic aperture radar market is categorized by application into defense and security, environmental monitoring, infrastructure monitoring, and others. Defense and security lead adoption with extensive use in surveillance, reconnaissance, and border management. Environmental monitoring is expanding as governments track climate change, deforestation, and natural hazards. Infrastructure monitoring grows rapidly, with developers using InSAR to ensure safety in railways, bridges, and dams. It also finds niche applications in mining, oil exploration, and urban planning.

Segmentations:

By Component

- Hardware

- Software

- Services

By Frequency Band

By Application:

- Defense and Security

- Environmental Monitoring

- Infrastructure Monitoring

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America held 38% market share in 2024, making it the leading region. The interferometric synthetic aperture radar market in this region is supported by advanced defense programs and established space infrastructure. It benefits from government funding, satellite launches, and integration into national security projects. Commercial adoption is also strong, with industries using InSAR for energy exploration, agriculture, and infrastructure monitoring. Leading technology providers in the United States continue to drive innovation and expand service offerings. Increasing collaborations between defense agencies and private companies reinforce the region’s dominance.

Europe:

Europe accounted for 29% market share in 2024, reflecting its strong presence in global adoption. The interferometric synthetic aperture radar market in this region is shaped by the European Space Agency’s initiatives and national space programs. It plays a central role in environmental monitoring, climate studies, and sustainable urban development. European countries actively invest in research projects to improve InSAR accuracy and expand civil applications. Private companies partner with government agencies to enhance satellite constellations and data accessibility. Strong regulatory support and funding mechanisms continue to strengthen Europe’s market position.

Asia-Pacific:

Asia-Pacific captured 22% market share in 2024 and is projected to expand rapidly. The interferometric synthetic aperture radar market in this region benefits from rising investments in space programs by China, India, and Japan. It supports large-scale infrastructure development, urban planning, and disaster management initiatives. Governments actively fund satellite launches and expand national geospatial capabilities. Private companies are also entering the sector, offering innovative, cost-efficient services. Growing awareness of climate challenges and demand for accurate monitoring drive further adoption across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Lockheed Martin Corporation

- SDT Space & Defence Technologies Inc.

- BAE Systems

- AIRBUS

- L3Harris Technologies, Inc.

- IMSAR LLC

- IAI

- General Atomics

- Maxar Technologies

- Northrop Grumman

- Saab

- Metasensing

- SRC Inc.

Competitive Analysis:

The interferometric synthetic aperture radar market is highly competitive with global defense and aerospace companies leading innovation. Key players include Lockheed Martin Corporation, SDT Space & Defence Technologies Inc., BAE Systems, AIRBUS, L3Harris Technologies, IMSAR LLC, IAI, and General Atomics, with Maxar Technologies strengthening its presence through advanced satellite imaging solutions. It is defined by continuous investment in satellite constellations, radar payloads, and integrated analytics platforms. Companies focus on expanding their defense and security offerings while targeting commercial applications in infrastructure, energy, and environmental monitoring. Strategic partnerships with governments, space agencies, and private operators remain central to capturing long-term contracts. It benefits from rapid technological advances, where competition emphasizes high-resolution imaging, real-time data delivery, and global coverage. The landscape reflects a mix of established defense contractors and specialized radar firms, each working to expand market reach and technological capabilities.

Recent Developments:

- In March 2025, Airbus advanced key technologies for next-generation single-aisle aircraft, including hydrogen-powered flight and improved fuel efficiency, targeting entry into service in the 2030s.

- In July 2025, L3Harris introduced new launched effects vehicles named “Red Wolf” and “Green Wolf” designed for long-range precision strikes and electronic warfare, with low-rate initial production expected by the end of 2025.

Report Coverage:

The research report offers an in-depth analysis based on Component, Frequency Band, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The interferometric synthetic aperture radar market will expand with increasing reliance on geospatial intelligence for defense and civilian use.

- It will see higher adoption in infrastructure monitoring, particularly for bridges, dams, and transportation networks.

- Climate change initiatives will drive demand for advanced InSAR solutions in glacier, forest, and coastal monitoring.

- The market will benefit from private space companies deploying small satellite constellations for frequent data collection.

- Integration of artificial intelligence and machine learning will improve data interpretation and predictive modeling.

- Commercial adoption will rise in energy exploration, mining, and agriculture through cost-effective monitoring solutions.

- Government investments in national security and border surveillance will continue to strengthen market opportunities.

- Cross-border collaborations and international projects will expand accessibility to InSAR-based services worldwide.

- Growing focus on sustainable urban planning will create new applications for smart cities and infrastructure.

- The market will evolve toward cloud-based platforms, enabling faster processing, scalability, and broader user adoption.