Market Overview

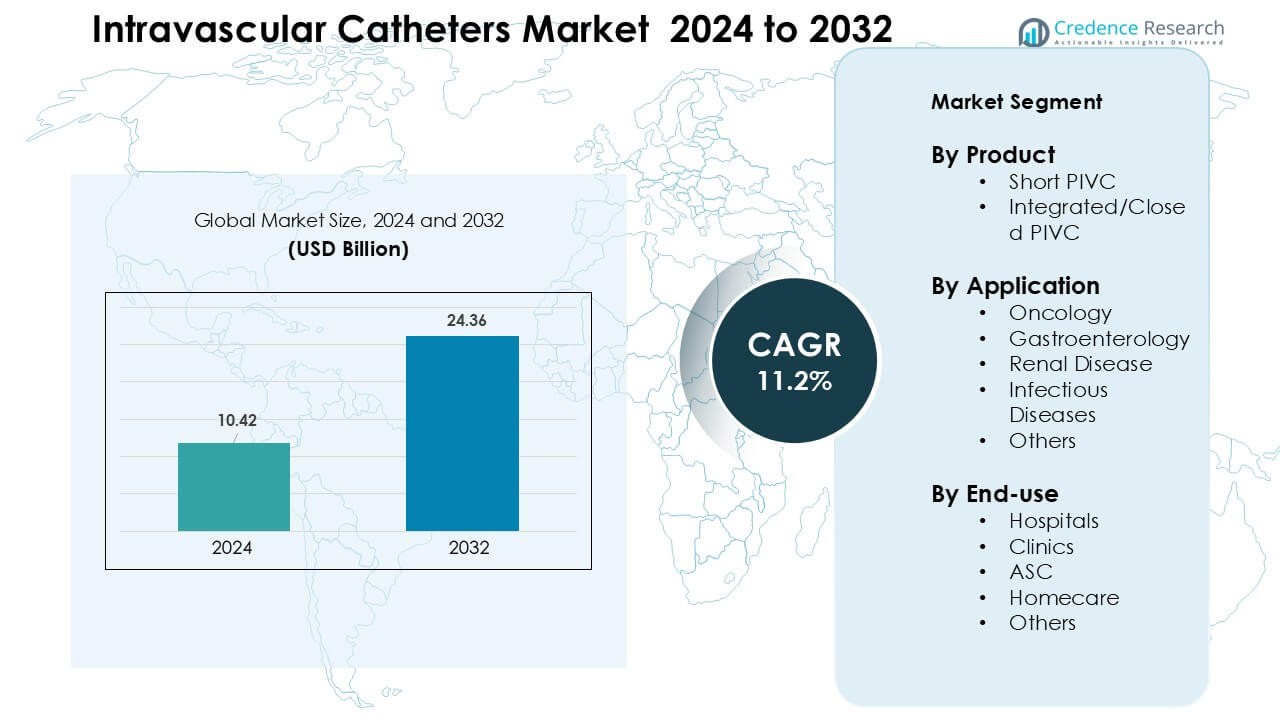

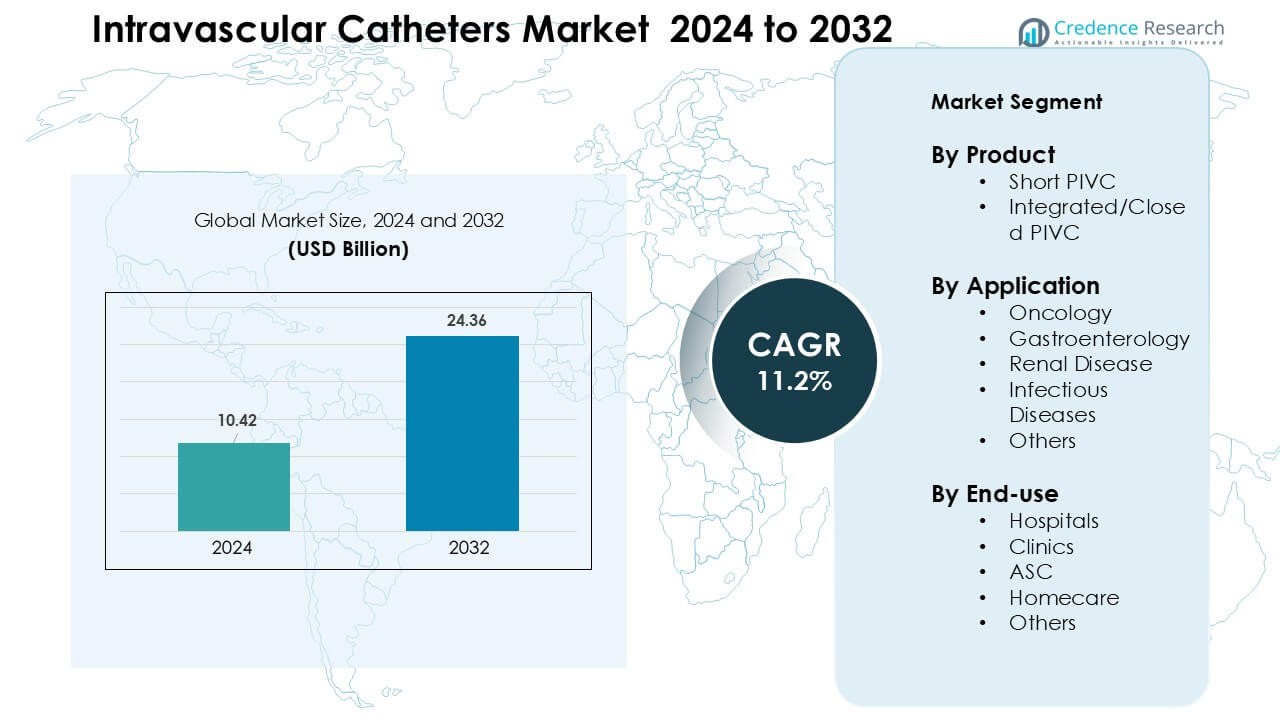

Intravascular Catheters Market was valued at USD 10.42 billion in 2024 and is anticipated to reach USD 24.36 billion by 2032, growing at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravascular Catheters Market Size 2024 |

USD 10.42 Billion |

| Intravascular Catheters Market, CAGR |

11.2% |

| Intravascular Catheters Market Size 2032 |

USD 24.36 Billion |

The intravascular catheters market includes major players such as Abbott, Boston Scientific Corporation, Medtronic, Coloplast, Braun Melsungen AG, Vitality Medical, Koninklijke Philips N.V., B. Braun, Medtronic Plc, and Melsungen. These companies compete through advanced safety-engineered PIVCs, antimicrobial technologies, and closed catheter systems that reduce infection risk and improve clinical efficiency. Strong product portfolios and broad hospital partnerships help these firms maintain steady global reach. North America led the market in 2024 with about 38% share, supported by high procedure volumes, rapid technology adoption, and strong investment in vascular-access safety standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The intravascular catheters market reached USD 10.42 billion in 2024 and is projected to reach USD 24.36 billion by 2032, growing at a CAGR of 11.2% during the forecast period.

- Demand rises as chronic diseases, oncology cases, and emergency procedures expand, with short PIVCs leading the product segment with about 68% share due to broad hospital use and faster insertion.

- Closed and safety-engineered catheters gain traction as facilities focus on infection-prevention, longer dwell times, and improved patient outcomes, supported by advancements in antimicrobial coatings and integrated catheter designs.

- The market remains competitive with key players expanding portfolios of safety catheters, strengthening distribution networks, and investing in training programs; cost sensitivity in some regions continues to restrain full adoption of advanced systems.

- North America held the largest regional share at about 38% in 2024, while oncology dominated applications with nearly 37% share; Asia-Pacific is the fastest-growing region thanks to rising procedure volumes and improving healthcare infrastructure.

Market Segmentation Analysis:

By Product

Short PIVC led the product segment in 2024 with about 68% share due to broad use in routine IV therapy, emergency care, and rapid drug delivery. Hospitals preferred short PIVCs because nurses can insert them quickly, and the devices support a wide range of infusion needs. Demand grew as care teams adopted safety-engineered catheters that reduce needlestick injuries and improve dwell time. Integrated/closed PIVCs expanded at a faster pace as providers shifted toward closed systems to lower bloodstream infection risks and enhance patient comfort.

- For instance, in a 2014 randomized study comparing open vs closed safety peripheral IV catheters a leading device maker deployed closed safety PIVCs the probability that a standard (MOS) PIVC would remain functional for 96 hours was 79.9%.

By Application

Oncology dominated the application segment in 2024 with nearly 37% share, driven by rising cancer cases and frequent infusion requirements for chemotherapy and supportive care. Catheters remained essential for repeated dosing cycles, high-viscosity drugs, and hydration therapy. Usage increased as cancer centers standardized infusion protocols and invested in safer vascular access tools. Gastroenterology, renal disease, and infectious disease therapies also showed steady growth, but oncology maintained the lead due to higher treatment intensity and longer care duration.

- For instance, the BD Nexiva™ Closed IV Catheter System demonstrated a median dwell time of up to 144 hours compared with 96 hours for the open system in the randomized study cited by the manufacturer, supporting longer continuous use in infusion-intensive settings such as oncology infusion suites.

By End-use

Hospitals held the largest end-use share in 2024 at about 61% because most acute patients require IV access for medications, fluids, and diagnostics. Hospital adoption stayed strong as facilities expanded vascular access programs and trained teams to reduce catheter-related complications. Demand also rose with higher surgical volumes and emergency admissions. Clinics and ASCs showed rising interest in integrated PIVCs for outpatient infusions, while homecare adoption grew in chronic therapy settings, but hospitals remained the dominant user group.

Key Growth Drivers

Growing Burden of Chronic and Acute Diseases

Rising cases of cancer, cardiovascular disorders, kidney failure, and infectious diseases continue to expand the need for reliable vascular access. Hospitals use intravascular catheters for chemotherapy, dialysis support, antibiotic delivery, and fluid resuscitation. Growth also comes from higher surgical volumes and emergency admissions, where quick vascular access is essential for stabilizing patients. Ageing populations add further pressure as older adults need more infusion-based therapies and monitoring. Health systems invest in structured vascular-access programs to reduce complications, which increases the use of advanced catheters. As treatment intensity rises across care settings, demand for short peripheral catheters, closed systems, and specialty access devices remains on a firm upward path.

- For instance, the global number of patients requiring hemodialysis has risen sharply: worldwide, about four million people now require hemodialysis reflecting the growing burden of end-stage renal disease and kidney failure that need reliable vascular access for dialysis.

Shift Toward Safer and Closed Catheter Systems

Healthcare facilities continue moving from traditional open catheters to closed or integrated designs to improve safety and reduce bloodstream infections. Closed systems lower exposure to contaminants and minimize handling steps, which helps care teams reduce catheter-related complications. Regulation also supports this shift as hospitals adopt safety-engineered devices to meet infection-prevention goals. Manufacturers respond with products that improve dwell time and lower insertion failure. Rising awareness of patient safety, combined with stronger clinical guidelines, drives rapid adoption of advanced PIVCs. Growth remains strong in oncology, emergency care, and chronic infusion programs, where reliable access and reduced infection risk are top priorities. This shift encourages innovation in antimicrobial coatings and securement technologies.

- For instance, in a randomized controlled trial comparing integrated (closed) PIVC systems with traditional non-integrated ones, the integrated PIVCs achieved a median dwell time of 144.5 hours (≈ 6 days) versus 99 hours (≈ 4 days) for non-integrated systems.

Expansion of Outpatient and Home-Based Infusion Care

Outpatient centers, ASCs, and homecare programs increasingly use intravascular catheters as care shifts away from inpatient settings. Patients with cancer, chronic infections, and gastrointestinal conditions receive more therapies outside hospitals because these settings lower cost and improve comfort. The rise of home-infusion services also increases demand for catheters with better stability, simplified insertion, and extended dwell time. Providers prefer closed PIVCs for these environments because they reduce maintenance complexity and enhance safety. As health systems scale remote-care models, catheter makers develop solutions tailored for decentralized care. Growth continues as payers support home therapy to reduce hospital burden and improve patient outcomes.

Key Trends & Opportunities

Technological Advancements in Catheter Design

Innovation strengthens catheter performance through better materials, kink-resistant tubing, and advanced coatings that reduce irritation and thrombosis. Pressure-resistant designs help clinicians deliver complex infusion drugs with higher accuracy and comfort. Integrated stabilization wings and needle-safety features improve insertion success and reduce complications. These upgrades support hospitals aiming to standardize vascular-access quality and lower infection rates. Technology plays a large role in expanding the use of closed systems, antimicrobial-lined catheters, and ultrasound-guided insertion tools. As research improves biocompatibility and durability, performance gains open new uses in oncology, intensive care, and long-term infusion therapy.

- For instance, Researchers have developed a novel antimicrobial catheter coating that integrates selenium nanoparticles (Se-NPs) via a one-step crosslinking process. This coating drastically reduces bacterial adhesion and protein adsorption on catheter surfaces, inhibiting colonization by common pathogens such as Staphylococcus aureus and Enterococcus faecalis.

Rising Investments in Infection-Control Solutions

Hospitals prioritize devices that reduce catheter-associated bloodstream infections, creating strong demand for solutions with antimicrobial properties, securement devices, and improved flushing technology. Providers adopt catheters built with safer hubs, closed ports, and better flow stability. Manufacturers add disinfecting caps and barrier systems to support compliance with clinical protocols. Regulatory pressure pushes facilities to reduce infection rates, which encourages procurement of advanced catheters across departments. As infection-control budgets rise, demand expands in both developed and emerging markets. These improvements support consistent quality in high-risk units, including oncology, intensive care, and emergency medicine.

- For instance, a 2022 clinical evaluation of PIVCs with closed‐hub systems and disinfecting port caps reported a reduction of catheter-associated bloodstream infection incidence from 3.2 per 1,000 catheter-days (with open-hub standard devices) to 0.4 per 1,000 catheter-days showing a more than 8-fold drop after instituting sealed-hub, antimicrobial-compatible catheters with proper maintenance protocols.

Opportunities in Emerging Markets and Ambulatory Care

Growth accelerates in Asia-Pacific, Latin America, and the Middle East as hospitals expand infusion capacity, improve emergency services, and build modern specialty centers. Rising insurance coverage increases treatment access, boosting catheter use for chronic and acute diseases. Ambulatory surgical centers and clinics in these regions grow fast, creating strong demand for short PIVCs and closed safety systems. Global manufacturers partner with local distributors to improve supply reliability and training programs. These markets offer room for expanded product portfolios, including antimicrobial-coated catheters and integrated designs tailored for high-volume care environments.

Key Challenges

Risk of Catheter-Related Infections and Complications

Catheter-associated infections, phlebitis, and infiltration remain key challenges that limit outcomes and raise care costs. Facilities must maintain strict insertion and maintenance protocols to avoid bloodstream infections, which demand skilled nursing, advanced hygiene, and stable supply of safety devices. Variations in training increase complication rates, especially in low-resource settings. Although closed and antimicrobial catheters reduce risk, cost pressures limit wide adoption for some facilities. Managing complications requires consistent monitoring and structured vascular-access teams, which not every provider can support. These issues slow adoption in segments with limited budgets or workforce.

High Cost of Advanced and Safety-Engineered Catheters

Closed PIVCs, antimicrobial-coated catheters, and advanced insertion systems offer strong clinical benefits but come at a higher price than standard devices. Budget-constrained hospitals, especially in emerging markets, face challenges adopting premium solutions across all departments. Training and device standardization add to total cost, making procurement decisions harder for smaller clinics and public hospitals. Price sensitivity limits rapid expansion of advanced technologies even where demand exists. Manufacturers must balance cost and performance to increase adoption. Economic constraints continue to delay upgrades from traditional catheters in several regions.

Regional Analysis

North America

North America led the intravascular catheters market in 2024 with about 38% share, supported by high procedure volumes, strong hospital infrastructure, and rapid adoption of closed and safety-engineered PIVCs. Cancer, cardiac disease, and renal failure cases remained high, driving sustained infusion therapy demand. Hospitals invested in vascular-access teams, infection-prevention programs, and advanced catheter technologies to improve outcomes. Outpatient infusion centers and home-based therapy also expanded, strengthening product use across care settings. Continuous innovation from regional manufacturers further supported market leadership and accelerated upgrades toward integrated catheter systems.

Europe

Europe held roughly 29% share in 2024, driven by strong chronic-disease management programs, standardized infusion protocols, and high adoption of safety-enhanced catheter systems. Countries such as Germany, France, and the U.K. expanded day-care oncology services, increasing the need for durable vascular access. Hospitals followed strict clinical guidelines for catheter maintenance, boosting demand for closed PIVCs and antimicrobial solutions. Aging populations required more long-term infusion care, supporting steady market expansion. Government-led infection-control initiatives also encouraged broader use of advanced devices, sustaining consistent growth across the region.

Asia-Pacific

Asia-Pacific accounted for about 23% share in 2024 and showed the fastest growth as healthcare infrastructure expanded across China, India, and Southeast Asia. Rising hospitalization rates, higher surgical volumes, and increasing cancer and renal-disease cases boosted catheter demand. Hospitals upgraded infusion units and adopted safety-engineered catheters to reduce infection risks. Growing investment in ambulatory care and home-infusion programs supported wider use of short PIVCs and integrated systems. Improved insurance coverage and urban healthcare modernization helped accelerate adoption of advanced vascular-access technologies across developing markets.

Latin America

Latin America captured nearly 6% share in 2024, driven by increased hospital admissions, rising chronic-disease burden, and government investments in public healthcare. Brazil and Mexico led demand as hospitals expanded emergency and oncology services, which rely heavily on peripheral catheters for infusion therapy. Adoption of closed PIVCs grew gradually as facilities focused on lowering infection rates, though cost sensitivity slowed rapid upgrades. The expansion of private clinics and day-care surgery centers also boosted product use. Training programs from global manufacturers helped improve vascular-access standards across major markets.

Middle East & Africa

The Middle East & Africa region held about 4% share in 2024, with growth driven by expanding hospital networks, rising non-communicable diseases, and increasing investments in specialty care. Gulf countries led adoption of advanced PIVCs due to stronger budgets and modern clinical infrastructure. Demand increased in oncology, emergency care, and renal disease management. In several African nations, catheter use grew as access to basic infusion therapy expanded, though adoption of closed systems remained limited by budget constraints. Gradual improvements in infection-control practices continued to support market development across the region.

Market Segmentations:

By Product

- Short PIVC

- Integrated/Closed PIVC

By Application

- Oncology

- Gastroenterology

- Renal Disease

- Infectious Diseases

- Others

By End-use

- Hospitals

- Clinics

- ASC

- Homecare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The intravascular catheters market includes leading companies such as Abbott, Boston Scientific Corporation, Medtronic, Coloplast, Braun Melsungen AG, Vitality Medical, Koninklijke Philips N.V., B. Braun, Medtronic Plc, and Melsungen. These players compete through advanced PIVC designs, antimicrobial coatings, and closed-system technologies that reduce infection risks and improve insertion success. Many firms strengthen portfolios with safety-engineered products and ultrasound-guided access tools to meet rising hospital standards. Strategic moves such as product launches, regulatory approvals, and supply-chain expansion support stronger global reach. Companies also invest in clinician training and digital support platforms to improve vascular-access outcomes. North America remained the largest regional market in 2024, supported by strong technology adoption and well-established healthcare systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott

- Boston Scientific Corporation

- Medtronic

- Coloplast

- Braun Melsungen AG

- Vitality Medical

- Koninklijke Philips N.V.

- B. Braun

- Medtronic Plc

- Melsungen

Recent Developments

- In March 2025, Abbott received FDA Investigational Device Exemption (IDE) clearance to run the TECTONIC clinical trial of its Coronary Intravascular Lithotripsy (IVL) System (to evaluate IVL for treating severe coronary calcification prior to stenting).

- In February 2025, Medtronic enrolled the first patient in a global pivotal study for its Prevail™ drug-coated balloon (DCB) intended for coronary percutaneous interventions a catheter-based therapy development that advances its interventional cardiology portfolio.

- In December 2024, Boston Scientific Corporation: The U.S. FDA classified a recall involving Boston Scientific s POLARx Cryoablation Balloon Catheters as most serious after reports of esophageal injuries and associated adverse events; the company issued use-advice and updated instructions rather than a product removal. (relevant to catheter safety/market sentiment).

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as chronic and acute disease cases continue to increase worldwide.

- Closed and safety-engineered PIVCs will gain wider adoption to reduce infection risks.

- Hospitals will invest more in vascular-access teams to improve insertion success and catheter longevity.

- Home-infusion and outpatient care growth will expand the use of long-dwell and integrated catheters.

- Antimicrobial coatings and advanced biomaterials will become standard across premium product lines.

- Ultrasound-guided insertion tools will see higher use, improving accuracy in difficult vascular access cases.

- Emerging markets will accelerate adoption as healthcare infrastructure and insurance coverage expand.

- Manufacturers will compete through training programs, supply-chain expansion, and clinical-support platforms.

- Regulatory focus on infection reduction will push facilities to upgrade older catheter models.

- Digital monitoring and catheter-tracking technologies will create new opportunities for performance improvement.