Market Overview

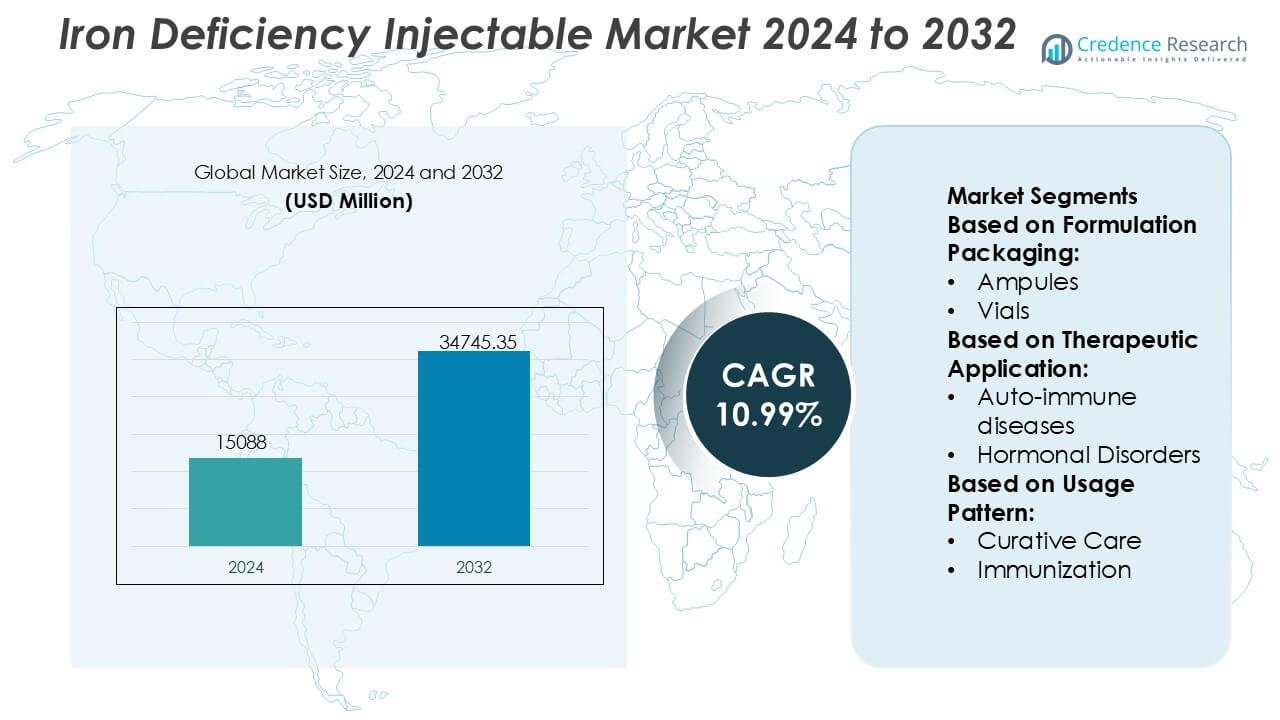

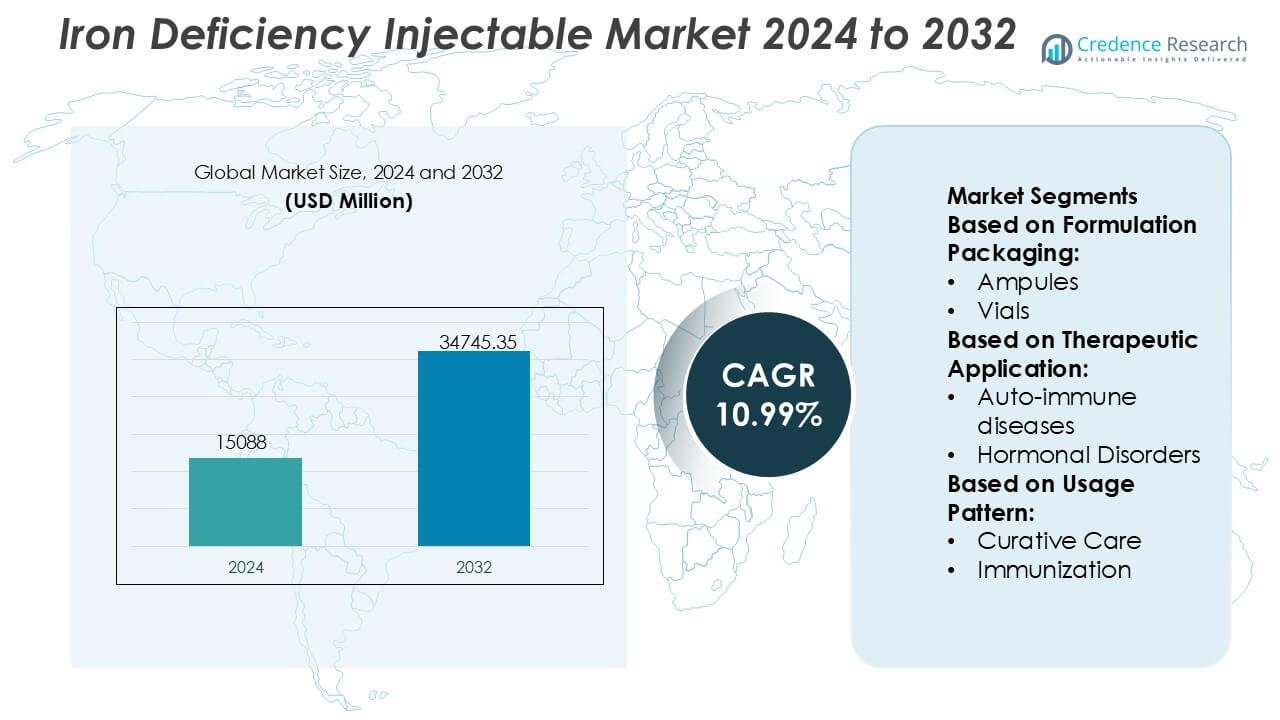

Iron Deficiency Injectable Market size was valued USD 15088 million in 2024 and is anticipated to reach USD 34745.35 million by 2032, at a CAGR of 10.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Iron Deficiency Injectable Market Size 2024 |

USD 15088 Million |

| Iron Deficiency Injectable Market , CAGR |

10.99% |

| Iron Deficiency Injectable Market Size 2032 |

USD 34745.35 Million |

The iron deficiency injectable market is led by a mix of global pharmaceutical companies and specialized therapy providers that compete through strong clinical portfolios, regulatory expertise, and established hospital presence. Market participants focus on high-efficacy formulations, safety optimization, and expanded indications across nephrology, oncology, gastroenterology, and women’s health. Strategic priorities include lifecycle management, geographic expansion, and alignment with evidence-based anemia treatment protocols to strengthen physician adoption. Regionally, North America dominates the market with an exact 38% share, supported by advanced healthcare infrastructure, widespread use of parenteral therapies, favorable reimbursement frameworks, and high diagnosis rates of chronic and iron deficiency–related conditions. This combination of strong players and regional leadership sustains competitive intensity and long-term market stability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Iron Deficiency Injectable Market was valued at USD 15,088 million in 2024 and is projected to reach USD 34,745.35 million by 2032, expanding at a CAGR of 10.99%, driven by rising clinical preference for rapid and reliable iron repletion therapies.

- Growing prevalence of iron deficiency anemia across chronic kidney disease, oncology, gastrointestinal disorders, and women’s health continues to drive demand, with injectable formulations preferred for moderate to severe cases due to faster efficacy and better tolerability.

- High-dose, low-frequency injectable formulations represent the dominant segment, accounting for the largest share as they reduce infusion visits, improve patient compliance, and optimize hospital resource utilization.

- The competitive landscape remains moderately consolidated, with leading players focusing on safety optimization, expanded indications, lifecycle management, and geographic expansion to strengthen hospital and infusion-center penetration.

- Regionally, North America leads with an exact 38% market share, supported by advanced healthcare infrastructure, strong reimbursement coverage, and high diagnosis rates, while Asia-Pacific shows accelerating adoption driven by large patient populations and expanding healthcare access.

Market Segmentation Analysis:

By Formulation Packaging

Within formulation packaging, vials represent the dominant sub-segment, accounting for the largest market share due to their widespread adoption in hospital pharmacies, infusion centers, and outpatient clinics. Vials support multi-dose and single-dose administration, enabling flexible dosing regimens for iron deficiency injectable therapies across diverse patient populations. Their compatibility with standard intravenous infusion systems, longer shelf stability, and reduced risk of contamination during controlled handling strengthen demand. Ampules and cartridges serve niche settings, while bottles see limited use, primarily in specialized institutional environments.

- For instance, Zydus Group operates injectable manufacturing facilities approved by the US FDA and EMA, where high-speed aseptic vial filling lines achieve output capacities exceeding 18,000 vials per hour, supported by automated visual inspection systems capable of detecting particulate defects as small as 50 microns.

By Therapeutic Application

Among therapeutic applications, oncology holds the dominant market share, driven by the high prevalence of iron deficiency anemia in cancer patients undergoing chemotherapy, radiotherapy, and targeted therapies. Injectable iron enables rapid hemoglobin correction when oral iron proves ineffective or poorly tolerated. Strong clinical emphasis on maintaining treatment intensity and reducing transfusion dependency further supports uptake. Auto-immune diseases and hormonal disorders follow, reflecting chronic inflammation-related iron dysregulation, while orphan diseases and other indications contribute smaller but clinically important volumes.

- For instance, CSL Vifor’s ferric carboxymaltose (Injectafer®) has been supported by oncology-inclusive clinical programs in which single infusions delivered doses up to 1,000 mg of iron within 15 minutes, and multicenter trials such as FAIR-HF and CONFIRM-HF collectively enrolled more than 750 patients, generating over 18,000 individual hemoglobin measurements with documented increases exceeding 1.0 g/dL within 4 weeks of administration.

By Usage Pattern

By usage pattern, curative care leads the market with the highest share, supported by its central role in correcting moderate to severe iron deficiency and anemia in acute and chronic conditions. Injectable iron delivers faster hematologic response compared to oral alternatives, making it essential in hospital-based and specialist-led treatment pathways. Curative use dominates across oncology, nephrology, and gastroenterology settings. Immunization-related use remains limited, while other usage patterns include supportive therapy in perioperative and chronic disease management contexts.

Key Growth Drivers

Rising Prevalence of Iron Deficiency and Anemia

The growing global burden of iron deficiency anemia significantly drives demand for injectable iron therapies. High incidence rates among pregnant women, infants, the elderly, and patients with chronic conditions such as chronic kidney disease, inflammatory bowel disease, and cancer increase the need for rapid and effective iron replenishment. Injectable formulations offer faster hemoglobin restoration and improved iron stores compared with oral alternatives, particularly in cases of malabsorption or intolerance. Expanding diagnostic screening and greater clinical awareness further accelerate adoption across hospital and specialty care settings.

- For instance, over the past decade Teoxane has delivered more than 12 million RHA® syringes injected worldwide, with clinical data from 18-month follow-ups demonstrating persistent volume correction in dynamic wrinkles and folds and up to *1 year of retention in lip augmentation cases†, supported by multiple peer-reviewed studies and regulatory clearances.

Clinical Preference for Rapid and Reliable Iron Repletion

Healthcare providers increasingly favor injectable iron products due to their predictable pharmacokinetics, controlled dosing, and faster therapeutic outcomes. These therapies reduce treatment duration and minimize gastrointestinal side effects commonly associated with oral iron supplements. In acute care, perioperative management, and oncology settings, injectables support quicker patient stabilization and improved treatment adherence. Growing emphasis on evidence-based protocols and standardized anemia management pathways reinforces the role of injectable iron as a preferred intervention for moderate to severe iron deficiency.

- For instance, Akebia’s lead therapy Vafseo® (vadadustat), approved for adults with dialysis-dependent CKD anemia, is supported by broad commercial supply agreements covering nearly 100% of U.S. dialysis patients, and collaborative clinical enrollment that has surpassed 650 patients in VOICE studies, with a planned Phase 3 trial aiming for approximately 1,500 late-stage non-dialysis CKD subjects, as outlined in regulatory filings and company press releases.

Expansion of Healthcare Infrastructure and Access to Parenteral Therapies

Improving healthcare infrastructure, particularly in emerging economies, supports broader access to injectable iron therapies. Investments in hospitals, infusion centers, and specialty clinics enhance the availability of parenteral treatments. Government-led maternal health programs, renal care initiatives, and oncology services increasingly integrate injectable iron into standard care protocols. In parallel, favorable reimbursement frameworks and inclusion of iron injectables in essential medicines lists strengthen market penetration and support sustained growth across both public and private healthcare systems.

Key Trends & Opportunities

Shift Toward High-Dose, Low-Frequency Injectable Formulations

A notable trend in the market involves the adoption of high-dose injectable iron formulations that enable complete iron repletion in fewer administrations. These products improve patient convenience, reduce clinic visits, and lower overall treatment costs for healthcare providers. Reduced infusion frequency also enhances compliance and optimizes resource utilization in high-volume care settings. This trend creates opportunities for manufacturers to differentiate products through improved safety profiles, shorter infusion times, and simplified dosing regimens.

- For instance, AbbVie Inc., through its Allergan Aesthetics and specialty injectables manufacturing network, operates FDA-approved sterile fill-finish facilities equipped with high-precision peristaltic pumping and isolator-based aseptic systems capable of filling more than 15,000 injectable units per hour, with in-line weight checks conducted on 100% of filled units and batch release supported by over 25 validated critical quality tests, including particulate matter, endotoxin limits, and container-closure integrity.

Integration into Comprehensive Anemia Management Programs

Injectable iron therapies increasingly form part of integrated anemia management strategies across nephrology, oncology, and women’s health. Multidisciplinary care models emphasize early diagnosis, targeted treatment, and outcome monitoring, positioning injectables as a core therapeutic option. Digital health tools and clinical decision-support systems further support appropriate patient selection and dosing optimization. This integration expands utilization beyond acute care into long-term disease management, creating opportunities for sustained demand growth.

- For instance, Sanofi has advanced its manufacturing infrastructure by deploying its global digital health and manufacturing network, which includes more than 70 manufacturing sites worldwide.

Growth Opportunities in Emerging and Underserved Markets

Emerging economies present significant opportunities due to high anemia prevalence and improving access to advanced therapies. Rising healthcare spending, expanding insurance coverage, and increased focus on maternal and child health drive uptake of injectable iron products. Local manufacturing partnerships and regulatory harmonization also facilitate market entry. Companies that tailor pricing strategies and distribution models to resource-constrained settings can capture untapped demand and strengthen regional market presence.

Key Challenges

Safety Concerns and Monitoring Requirements

Despite clinical benefits, injectable iron therapies face challenges related to safety perceptions and administration requirements. Risks of hypersensitivity reactions and infusion-related adverse events necessitate medical supervision and post-administration monitoring. These requirements limit use in primary care settings and increase dependence on hospital-based infrastructure. Concerns around patient safety can slow adoption, particularly in regions with limited trained personnel or inadequate emergency support, constraining broader market expansion.

Cost Constraints and Reimbursement Variability

Higher acquisition and administration costs compared with oral iron therapies pose a challenge, especially in cost-sensitive healthcare systems. Reimbursement policies vary widely across regions and payers, influencing prescribing behavior and patient access. In markets with limited insurance coverage, out-of-pocket expenses can restrict utilization. Manufacturers must address these barriers through value-based pricing, real-world evidence generation, and engagement with policymakers to support favorable reimbursement and long-term adoption.

Regional Analysis

North America

North America leads the iron deficiency injectable market, accounting for an estimated 38% market share, supported by advanced healthcare infrastructure and strong clinical adoption of parenteral therapies. High prevalence of chronic kidney disease, cancer-related anemia, and iron deficiency among aging populations drives consistent demand. Physicians widely prefer injectable iron due to faster correction of iron stores and predictable outcomes. Favorable reimbursement policies, established infusion centers, and strong presence of branded products further reinforce market dominance. Ongoing clinical guideline updates and proactive anemia screening programs continue to sustain utilization across hospital and outpatient care settings.

Europe

Europe holds approximately 29% of the global market share, driven by structured anemia management protocols and strong public healthcare systems. Countries such as Germany, France, and the UK emphasize evidence-based use of injectable iron in nephrology, oncology, and women’s health. National health services support access through standardized reimbursement, while rising awareness of iron deficiency beyond anemia broadens treatment adoption. Increasing use of high-dose formulations that reduce infusion frequency improves cost efficiency. Regulatory harmonization across the region and growing focus on patient safety and outcomes further strengthen market stability.

Asia-Pacific

Asia-Pacific represents nearly 22% of the market share and demonstrates the fastest expansion due to high anemia prevalence and improving healthcare access. Large patient populations in China, India, and Southeast Asia drive substantial demand, particularly in maternal health and chronic disease management. Governments increasingly prioritize anemia control through public health initiatives and hospital capacity expansion. Growing penetration of injectable therapies in urban hospitals, coupled with rising private healthcare investment, supports adoption. Improved diagnostic reach and gradual inclusion of injectables in treatment protocols accelerate regional market growth.

Latin America

Latin America accounts for about 7% of the global market share, supported by gradual improvements in healthcare infrastructure and rising awareness of iron deficiency treatment. Brazil and Mexico lead regional demand due to expanding hospital networks and increased management of chronic conditions. Injectable iron adoption grows steadily in tertiary care centers, particularly for renal and oncology patients. However, uneven reimbursement coverage and budget constraints limit widespread penetration. Ongoing healthcare reforms and expanding insurance coverage are expected to improve access and support moderate long-term market growth.

Middle East & Africa

The Middle East & Africa region holds roughly 4% market share, reflecting limited but steadily improving adoption of injectable iron therapies. Demand concentrates in Gulf Cooperation Council countries, where investments in advanced hospitals and specialty care drive usage. High prevalence of nutritional anemia and chronic diseases creates unmet clinical need across the region. However, access challenges persist in parts of Africa due to infrastructure gaps and cost barriers. International health initiatives, government funding, and gradual expansion of infusion services are supporting incremental market development.

Market Segmentations:

By Formulation Packaging:

By Therapeutic Application:

- Auto-immune diseases

- Hormonal Disorders

By Usage Pattern:

- Curative Care

- Immunization

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The iron deficiency injectable market players such as Novartis AG, Zydus Group, CSL Vifor, Johnson & Johnson Services, Inc., Teoxane, Bayer AG, Akebia Therapeutics, Inc., GSK plc, AbbVie Inc. (Allergan), Sanofiorcing sustained competitive pr. The iron deficiency injectable market demonstrates a moderately consolidated competitive environment driven by product differentiation, clinical performance, and market access strategies. Companies compete by advancing formulation technologies that enable higher iron dosing with reduced infusion frequency, improving safety and patient compliance. Strong emphasis on regulatory approvals, real-world evidence generation, and adherence to clinical guidelines supports broader physician adoption. Market participants invest in expanding manufacturing capacity, strengthening supply chains, and optimizing hospital and infusion-center distribution networks. Strategic focus on therapeutic areas such as nephrology, oncology, gastroenterology, and women’s health further intensifies competition. In parallel, players pursue geographic expansion, pricing optimization, and partnerships to enhance reach in emerging markets, reinf essure and continuous innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Selkirk Pharma, Inc. launched ClinFAST a specialized fill-finish service for clinical trial injectables (under 10k vials), addressing long waits at large CMOs by parallelizing processes, using pre-stocked materials, and offering a template approach to speed up early-stage drug supply for biotech/pharma clients.

- In July 2024, Schott AG introduced new 10ml ready-to-use cartridges designed for storing medications for various diseases such as cancer, genetic disorders, metabolic disorders, cardiovascular conditions, and immunological diseases.

- In April 2024, Baxter announced that it is expanding its product offerings in the US. The company recently launched five new injectable medications, including pre-filled syringes and ready-to-use intravenous solutions.

- In April 2024, Eli Lilly and Company acquireda manufacturing facility from Nexus Pharmaceuticals to boost its production of injectable medications. This FDA-approved facility is located in Wisconsin and will help Lilly meet the growing demand for its drugs. This move strengthens Lilly’s position in the injectable drug market.

Report Coverage

The research report offers an in-depth analysis based on Formulation Packaging, Therapeutic Application, Usage Pattern and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Injectable iron therapies will continue gaining preference due to faster correction of iron stores and improved treatment adherence.

- Clinical guidelines will increasingly recommend injectable formulations for moderate to severe iron deficiency across multiple indications.

- High-dose, low-frequency products will see wider adoption to reduce infusion burden and optimize healthcare resources.

- Integration of injectable iron into comprehensive anemia management programs will expand across hospital and outpatient settings.

- Growing awareness of iron deficiency beyond anemia will support earlier diagnosis and timely intervention.

- Expansion of infusion centers and specialty clinics will improve access to parenteral iron therapies.

- Emerging markets will experience rising uptake driven by maternal health initiatives and chronic disease management programs.

- Manufacturers will focus on enhancing safety profiles and reducing infusion-related risks to strengthen physician confidence.

- Digital health tools will support better patient selection, dosing optimization, and treatment monitoring.

- Competitive intensity will increase as companies pursue portfolio expansion, geographic reach, and lifecycle management strategies.