Market Overview:

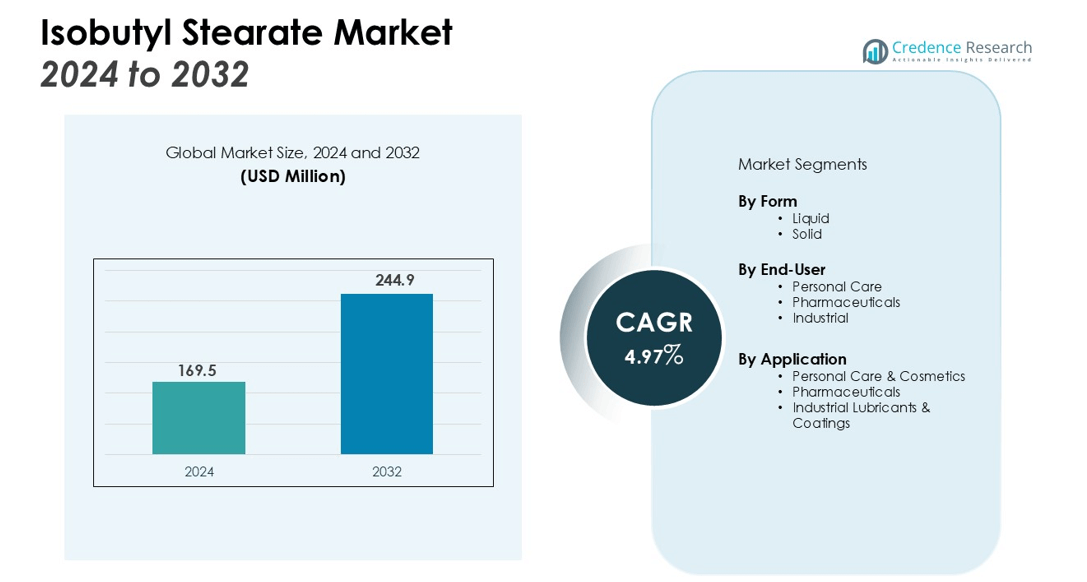

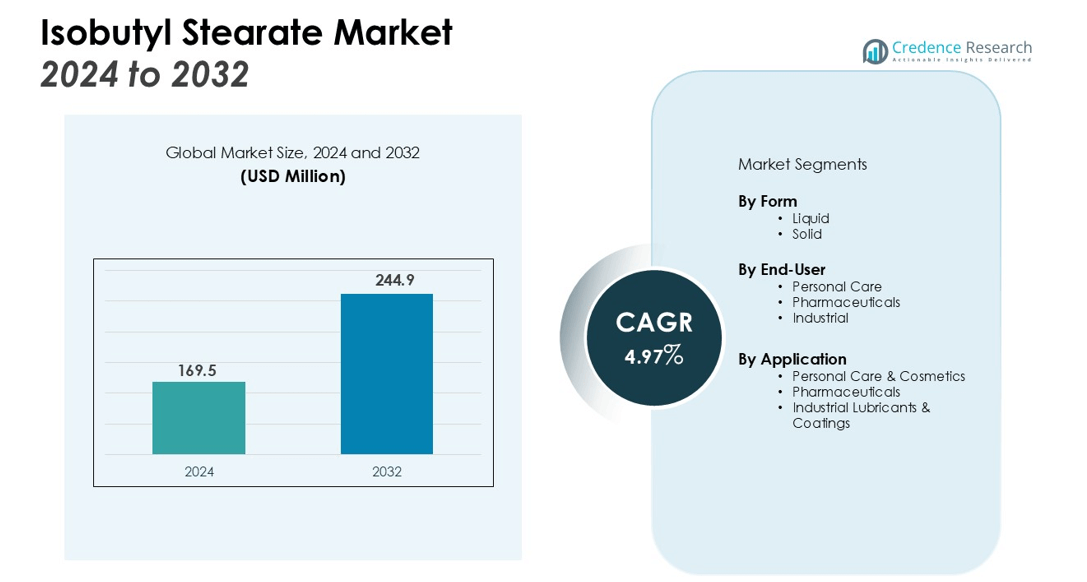

The Isobutyl Stearate Market size was valued at USD 169.5 million in 2024 and is anticipated to reach USD 244.9 million by 2032, at a CAGR of 4.97% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isobutyl Stearate Market Size 2024 |

USD 169.5 million |

| Isobutyl Stearate Market, CAGR |

4.97% |

| Isobutyl Stearate Market Size 2032 |

USD 244.9 million |

Key drivers of market growth include the expanding demand for personal care and cosmetic products, particularly in skincare formulations, where isobutyl stearate is valued for its ability to enhance texture and moisturization. The increasing trend toward bio-based and sustainable ingredients in formulations further boosts demand for isobutyl stearate, as it is often derived from renewable sources. Additionally, the growth of the pharmaceutical sector, especially in drug formulations, contributes significantly to the market’s expansion. The rising consumer preference for eco-friendly and clean-label products further accelerates the adoption of isobutyl stearate in various industries.

Regionally, North America holds the largest market share due to the high demand for isobutyl stearate in the personal care and pharmaceutical industries. Europe follows closely, driven by its well-established chemical industry and regulatory support for sustainable ingredients. The Asia Pacific region is expected to witness the highest growth rate, fueled by expanding manufacturing capabilities and increasing consumer demand for personal care products in countries like China and India. The rapid industrialization and growth of the cosmetics sector in emerging markets also support regional growth.

Market Insights:

- The Isobutyl Stearate Market size was valued at USD 169.5 million in 2024 and is projected to reach USD 244.9 million by 2032, growing at a CAGR of 4.97% during the forecast period.

- The growing demand for personal care and cosmetic products, particularly in skincare formulations, is a key driver. Isobutyl stearate is valued for enhancing texture and providing moisturization, fueling its use in these industries.

- The trend toward bio-based and sustainable ingredients further boosts the market. As a renewable source, isobutyl stearate meets the increasing consumer preference for eco-friendly formulations in personal care products.

- The pharmaceutical sector’s expansion also contributes significantly to the market. Isobutyl stearate’s role as a solvent and emulsifying agent in drug formulations supports the growth of the market as the demand for drug delivery systems increases.

- Technological advancements in product development create new opportunities for the Isobutyl Stearate Market. Improved production techniques and growing R&D efforts allow manufacturers to scale production and introduce innovative applications across industries.

- Raw material supply fluctuations pose challenges to market stability. Price volatility, driven by disruptions in the natural raw material supply chain, impacts production costs and market growth, especially in price-sensitive regions.

- North America holds the largest market share of 40%, driven by strong demand in personal care, cosmetics, and pharmaceuticals. The United States leads in consumption, with regulatory support further enhancing isobutyl stearate’s adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Personal Care and Cosmetics

The increasing demand for personal care and cosmetic products is one of the primary drivers of the Isobutyl Stearate Market. It is highly valued in skincare formulations for its ability to enhance texture, improve spreadability, and provide moisturization. The rise of skincare routines among consumers, particularly in developed markets, has increased the demand for high-quality emollients and solvents, where isobutyl stearate is a preferred ingredient. This trend aligns with the growing focus on self-care and wellness, which further fuels market growth.

- For instance, The Hallstar Company produces HallStar® IBST, which becomes a viscous liquid at 24°C, a key property that allows it to function as a non-greasy emollient in skin care formulations.

Shift Toward Bio-Based and Sustainable Ingredients

Consumers are increasingly prioritizing bio-based and sustainable ingredients in their personal care and cosmetic products. Isobutyl stearate, being derived from renewable sources, benefits from this shift toward eco-friendly formulations. Manufacturers are adapting to this trend by incorporating sustainable materials to meet consumer demand for cleaner, greener products. This change enhances the appeal of isobutyl stearate, contributing to its growing adoption in the market.

- For instance, BASF has championed this shift with its biomass balance approach, a certified method that replaces fossil inputs with renewable raw materials and has been applied to more than 200 of its products.

Expansion of the Pharmaceutical Sector

The Isobutyl Stearate Market also experiences growth due to the pharmaceutical sector’s expansion. It is used in various drug formulations, where its role as a solvent and emulsifying agent is crucial. The increase in chronic diseases, the aging population, and the demand for innovative drug delivery systems further stimulate the need for ingredients like isobutyl stearate. Its compatibility with different active pharmaceutical ingredients makes it an essential compound in drug formulation processes.

Technological Advancements in Product Development

Technological innovations in product development are also driving the growth of the Isobutyl Stearate Market. Advances in production techniques enable manufacturers to produce high-quality isobutyl stearate at scale, improving availability and reducing production costs. The growth of research and development efforts also results in new applications for isobutyl stearate across industries. These developments create new opportunities for its use, thereby expanding its market presence.

Market Trends:

Increasing Adoption of Eco-Friendly and Clean Label Products

The Isobutyl Stearate Market is experiencing a significant trend toward the adoption of eco-friendly and clean label products. Consumers are increasingly seeking products that are natural, non-toxic, and derived from sustainable sources. This demand is driving manufacturers to formulate products with ingredients like isobutyl stearate, which is bio-based and meets the rising consumer preference for sustainability. Brands that focus on transparency and product safety are gaining consumer trust, leading to higher demand for ingredients that support these clean label trends. As regulatory frameworks continue to tighten around product labeling, companies are likely to incorporate more bio-based ingredients, further supporting the growth of isobutyl stearate in various applications.

- For instance, in January 2018, Clariant and Global Bioenergies developed a new bio-based cosmetic polymer from renewable sources, creating a direct 1:1 replacement for petroleum-based equivalents that conforms to the ISO 16128:2016 standard for natural ingredients.

Technological Advancements in Cosmetic and Pharmaceutical Formulations

Technological advancements in cosmetic and pharmaceutical formulations are transforming the Isobutyl Stearate Market. New developments in delivery systems, such as enhanced emulsification and more efficient solubility, have expanded the use of isobutyl stearate in these sectors. In cosmetics, it is increasingly used in high-performance skincare, offering superior texture, long-lasting moisturization, and improved product stability. In pharmaceuticals, the compound’s use as a solvent in drug formulations is becoming more prominent, driven by innovations in drug delivery methods. These technological improvements allow manufacturers to better meet the growing demand for more effective and versatile products, contributing to the increasing market potential of isobutyl stearate.

- For instance, specialty chemical company Hallstar offers HallStar® IBST, a grade of isobutyl stearate used to enhance high-performance skincare products, this ingredient demonstrates high stability with a flash point of over 93°C, a key technical specification that ensures the safety and integrity of the final cosmetic formulation.

Market Challenges Analysis:

Raw Material Supply and Price Fluctuations

One of the key challenges facing the Isobutyl Stearate Market is the fluctuation in raw material prices. The compound is derived from natural sources, and any disruptions in the supply chain for these raw materials can lead to price volatility. As global demand for bio-based ingredients rises, there is increasing pressure on suppliers to maintain consistent production at competitive prices. These fluctuations in raw material costs can directly impact the overall cost structure for manufacturers, which may hinder market growth, particularly in price-sensitive regions or applications. Ensuring a stable and cost-effective supply of raw materials remains a critical concern for the industry.

Regulatory Constraints and Compliance Requirements

The Isobutyl Stearate Market faces stringent regulatory requirements, particularly in the personal care and pharmaceutical industries. Compliance with international standards for ingredient safety, environmental impact, and manufacturing processes can be challenging. Regulations around labeling, sourcing, and the use of bio-based ingredients require companies to invest in certification processes and adapt their production methods to meet evolving standards. These regulatory hurdles can slow down the market adoption of isobutyl stearate, especially in regions with complex or frequently changing regulations, creating barriers for both new entrants and established players.

Market Opportunities:

Expansion in Emerging Markets Driven by Consumer Demand

The Isobutyl Stearate Market holds significant opportunities in emerging markets, where increasing disposable incomes and a growing middle class are driving demand for personal care and pharmaceutical products. As consumers in regions such as Asia-Pacific and Latin America become more aware of skincare and health product benefits, the demand for high-quality ingredients like isobutyl stearate rises. Companies can capitalize on this opportunity by expanding their market presence and tailoring products to meet the needs of these rapidly developing markets. The rising demand for sustainable and bio-based products in these regions further enhances the potential for isobutyl stearate’s adoption.

Rising Popularity of Sustainable and Clean Label Products

There is a growing trend towards sustainable and clean label products across various industries, including personal care, cosmetics, and pharmaceuticals. Consumers increasingly demand products that are transparent, eco-friendly, and free from harmful chemicals. This shift presents a key opportunity for the Isobutyl Stearate Market, as it is a renewable, bio-based ingredient that aligns with these consumer preferences. Manufacturers who emphasize sustainability and clean labeling can leverage this trend to enhance brand appeal and differentiate themselves in a competitive market, driving growth opportunities for isobutyl stearate.

Market Segmentation Analysis:

By Form

The Isobutyl Stearate Market is segmented by form into liquid and solid forms. Liquid forms dominate the market due to their versatility and ease of application in various industries, particularly in personal care and pharmaceuticals. It is widely used in liquid formulations for cosmetics, skincare, and drug solutions. The solid form is preferred in specific applications such as industrial lubricants and coatings, where consistency and stability are required.

- For instance, Hallstar manufactures its HallStar® IBST, which exists as a viscous liquid at temperatures above 24°C, enabling its versatile application as a skin-conditioning agent in various cosmetic products.

By End-User

The Isobutyl Stearate Market serves a diverse range of end-users, including personal care, pharmaceuticals, and industrial applications. The personal care sector leads demand, driven by increasing consumer interest in skincare products, cosmetics, and hair care formulations. The pharmaceutical industry also contributes significantly, utilizing isobutyl stearate in drug formulations and delivery systems. Industrial applications account for a smaller share but are essential, particularly in lubricants and coatings for machinery and other equipment.

- For instance, Henkel has launched LOCTITE ABLESTIK NCA 01UV, a specialized adhesive for bonding automotive camera modules that fully cures in just 3 seconds using UV LED light.

By Application

In terms of application, the Isobutyl Stearate Market is utilized across multiple sectors, with personal care and cosmetics leading. It is a key ingredient in skincare products, moisturizers, and emulsions due to its ability to improve texture and provide moisturization. The pharmaceutical sector uses it primarily in drug formulations, especially as a solvent and emulsifier. Industrial applications, including lubricants and coatings, are also important but account for a smaller portion of the market.

Segmentations:

- By Form

- By End-User

- Personal Care

- Pharmaceuticals

- Industrial

- By Application

- Personal Care & Cosmetics

- Pharmaceuticals

- Industrial Lubricants & Coatings

- By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading Market Driven by Personal Care and Pharmaceutical Demand

North America holds the largest market share of 40% in the Isobutyl Stearate Market, driven by high demand in personal care, cosmetics, and pharmaceutical industries. The region’s advanced healthcare infrastructure and well-established chemical industry support the consistent growth of bio-based ingredients like isobutyl stearate. The United States leads consumption, with personal care brands incorporating eco-friendly and sustainable ingredients. Regulatory support for clean label ingredients further enhances the adoption of isobutyl stearate, contributing to its widespread use. The growing trend toward sustainable consumer products strengthens the regional market presence.

Europe: Strong Focus on Sustainable Ingredients and Regulatory Support

Europe holds a significant market share of 30% of the Isobutyl Stearate Market, driven by its strong emphasis on sustainability and eco-friendly ingredients in personal care and cosmetics. Strict regulations around ingredient transparency and environmental impact drive the demand for bio-based alternatives like isobutyl stearate. Key markets such as Germany, France, and the United Kingdom lead this trend, with increasing consumer demand for natural ingredients. The pharmaceutical sector further contributes to growth, using isobutyl stearate in various drug formulations. The region’s regulatory environment and focus on product safety continue to shape the market’s dynamics.

Asia Pacific: Rapid Growth in Personal Care and Pharmaceutical Sectors

The Asia Pacific region holds a market share of 25% in the Isobutyl Stearate Market, driven by strong demand in personal care and pharmaceuticals. The region is witnessing rising disposable incomes and rapid urbanization in countries like China, India, and Japan, which increase demand for personal care products. This growth is further supported by the increasing preference for sustainable and bio-based ingredients. The pharmaceutical industry in Asia Pacific is expanding rapidly, providing significant opportunities for isobutyl stearate in drug formulations. As manufacturing capabilities increase, the region is expected to see continued market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Isobutyl Stearate Market is highly competitive, with key players like BASF, Stepan Company, and Kraton Polymers leading by offering high-quality, bio-based products. These companies invest in research and development to meet the rising demand for eco-friendly solutions across personal care, pharmaceuticals, and industrial applications. Smaller players also contribute by targeting niche markets and offering specialized formulations. Strategic partnerships and acquisitions are common for expanding production capacity and entering emerging markets, particularly in Asia Pacific. The competitive landscape is shaped by a focus on innovation, sustainability, regulatory compliance, and clean-label ingredients, which are increasingly sought by consumers and manufacturers alike.

Recent Developments:

- In August 2025, Merck KGaA entered into a strategic collaboration with Skyhawk Therapeutics to discover and develop novel RNA-targeting small molecules for neurological disorders.

- In May 2025, Emery Oleochemicals announced it would deliver a technical presentation at the STLE 2025 Annual Meeting in Atlanta, GA, and showcase its portfolio of ester base stocks and additives.

Report Coverage:

The research report offers an in-depth analysis based on Form, End-User, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Isobutyl Stearate Market will continue to see strong growth driven by increasing consumer demand for sustainable and bio-based ingredients.

- Personal care and cosmetics will remain the largest application segment, with a rising focus on skincare products that enhance texture and moisturization.

- The pharmaceutical sector will expand its use of isobutyl stearate, particularly in drug formulations and delivery systems, as demand for more efficient and sustainable solutions grows.

- Bio-based and clean-label ingredients will see higher adoption across all industries, fueling demand for isobutyl stearate in eco-friendly formulations.

- The Asia Pacific region will experience the fastest growth, with increasing disposable incomes and a shift towards premium personal care products in countries like China and India.

- Manufacturers will invest in advanced production technologies to improve the efficiency and scalability of isobutyl stearate production.

- Regulatory frameworks will continue to evolve, pushing companies to adopt more transparent and sustainable practices in the sourcing and production of ingredients.

- North America will remain a dominant market, driven by high demand in personal care, pharmaceuticals, and regulatory support for clean-label products.

- New applications will emerge as companies explore innovative uses for isobutyl stearate in industrial sectors such as lubricants and coatings.

- Competitive pressure will lead to more strategic partnerships and collaborations among key players to expand market reach and improve product offerings.