Market Overview:

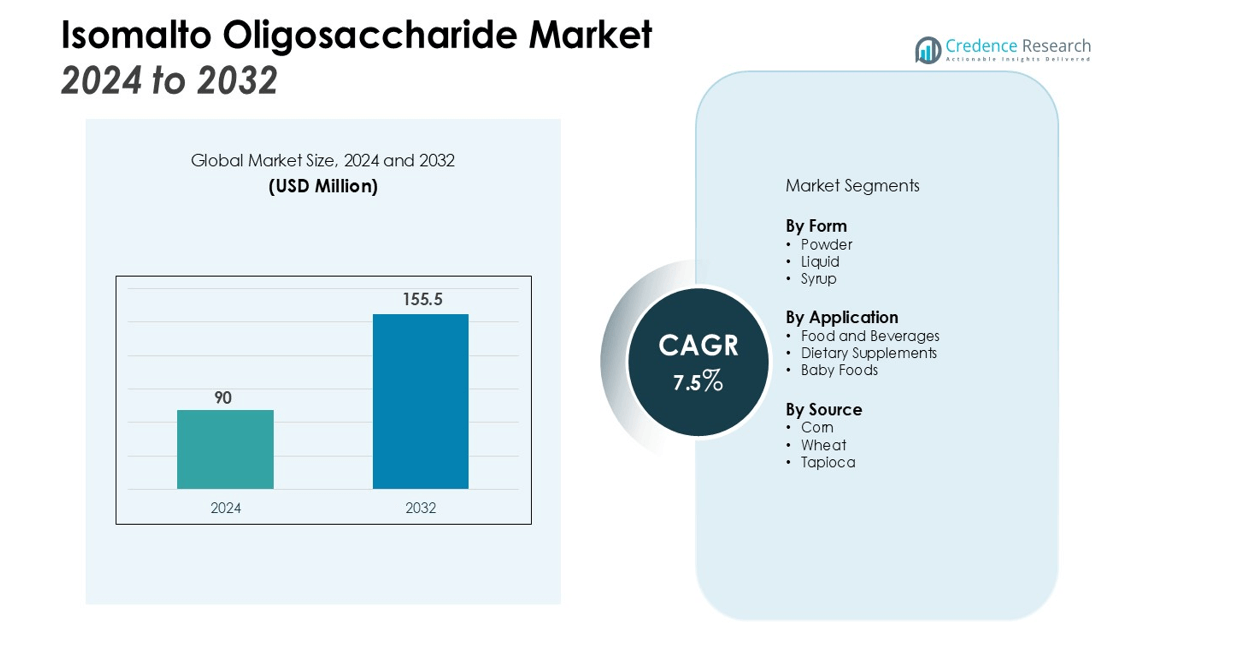

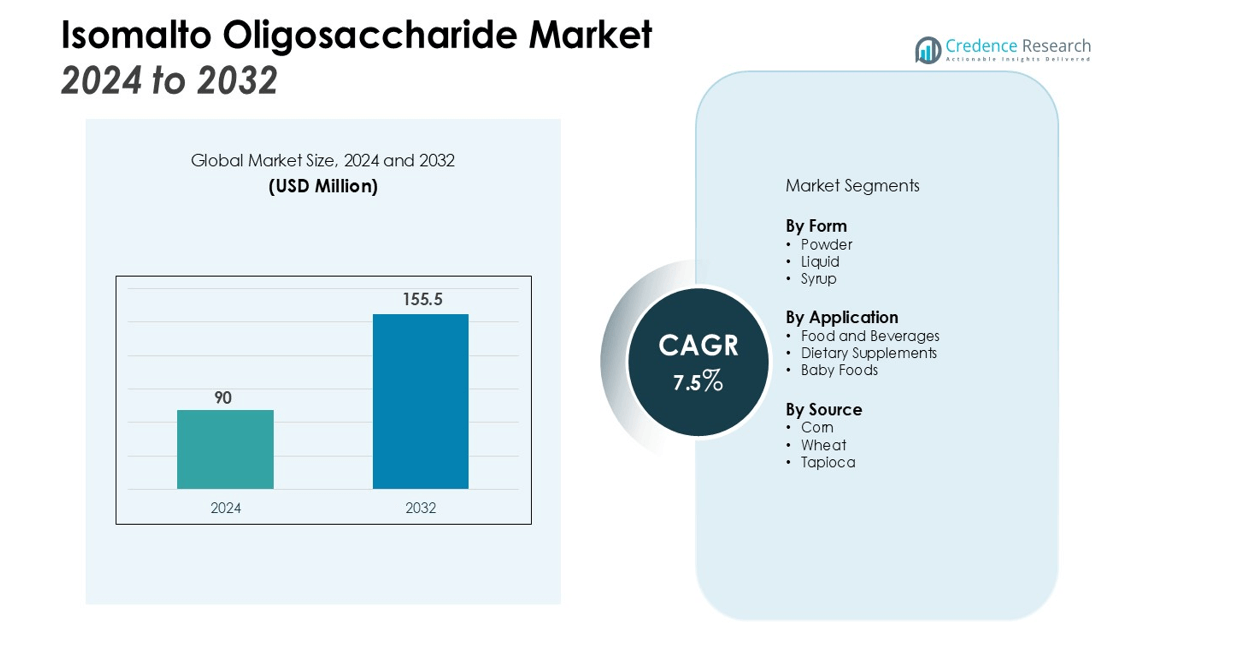

The Isomalto Oligosaccharide Market size was valued at USD 90 million in 2024 and is anticipated to reach USD 155.5 million by 2032, at a CAGR of 7.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isomalto Oligosaccharide Market Size 2024 |

USD 90 million |

| Isomalto Oligosaccharide Market, CAGR |

7.5% |

| Isomalto Oligosaccharide Market Size 2032 |

USD 155.5 million |

The Isomalto Oligosaccharide (IMO) market is primarily driven by the rising health-conscious consumer base, growing awareness of gut health, and increasing demand for natural sweeteners as a sugar substitute. IMO is widely used in the food and beverage industry due to its prebiotic properties, which aid in digestion and support overall gut health. Additionally, the expanding trend of clean-label products, coupled with the preference for non-caloric sweeteners, further accelerates market growth. The growing use of IMO in functional foods, dietary supplements, and baby foods contributes to the market’s positive trajectory. The market is also benefiting from advancements in production technologies, improving the cost-effectiveness and scalability of IMO manufacturing.

Geographically, the Isomalto Oligosaccharide market is dominated by North America, which accounts for a significant share due to the high consumption of functional foods and health supplements. Europe follows closely, driven by increasing consumer demand for health-conscious food products and natural sweeteners. The Asia-Pacific region is projected to witness the fastest growth, driven by rising health awareness, urbanization, and expanding food and beverage industries in countries like China and India. As a result, the Asia-Pacific region is expected to become a key growth hub for the IMO market in the coming years.

Market Insights:

- The Isomalto Oligosaccharide market is valued at USD 90 million and is expected to reach USD 155.5 million by 2032, growing at a CAGR of 7.5%.

- The growing health-conscious consumer base is driving demand for IMO, as it offers a low-calorie, non-glycemic alternative to sugar.

- IMO’s prebiotic properties, promoting beneficial gut bacteria, make it increasingly popular in functional foods and dietary supplements.

- The increasing preference for natural sweeteners over artificial options supports IMO’s adoption in food and beverages, especially for diabetic and weight management products.

- Technological advancements in IMO production are enhancing cost-effectiveness, making it more accessible for various applications.

- The Asia-Pacific region, with a 25% market share, is seeing rapid growth due to rising health awareness and expanding food sectors in countries like China and India.

- North America dominates the market with a 40% share, driven by high consumer demand for health-focused and functional food products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Health-Conscious Consumer Base

The growing health-conscious consumer base plays a significant role in driving the Isomalto Oligosaccharide market. With increasing awareness about the harmful effects of excessive sugar consumption, many consumers are seeking healthier alternatives. IMO, being a low-calorie and non-glycemic sweetener, aligns well with the rising preference for sugar substitutes. Its use in health-focused products, such as low-sugar and sugar-free foods, is expanding rapidly, contributing to the market’s growth.

- For instance, BioNeutra Global Corporation’s VitaFiber IMO product is formulated to have a caloric value of just 2.4 calories per gram, offering a lower-calorie alternative to sugar for health-focused food manufacturers.

Increasing Focus on Gut Health

Gut health is a primary driver behind the demand for Isomalto Oligosaccharide. Known for its prebiotic properties, IMO promotes the growth of beneficial gut bacteria, which supports digestive health. As consumers become more aware of the link between gut health and overall well-being, products containing IMO are gaining popularity. This trend is particularly evident in functional foods, dietary supplements, and health-focused beverages, where IMO is incorporated to enhance digestive benefits.

Growing Demand for Natural Sweeteners

The increasing preference for natural sweeteners further boosts the Isomalto Oligosaccharide market. As consumers look for clean-label products, IMO offers a natural alternative to artificial sweeteners. It is derived from starch and has a minimal impact on blood sugar levels, making it a suitable choice for people with diabetes or those managing their weight. The demand for natural ingredients in food and beverages continues to grow, positioning IMO as an ideal sweetener for manufacturers aiming to meet consumer expectations.

- For instance, a study demonstrated that IMO derived from cassava remained largely intact after a full 2 hours in simulated human gastric juice, confirming its suitability as a slow-release, functional sweetener.

Technological Advancements in Production

Technological advancements in the production of Isomalto Oligosaccharide are making it more cost-effective and scalable. Enhanced manufacturing processes have improved the yield and efficiency of IMO production, enabling companies to meet the rising demand. These innovations also allow for better customization of IMO formulations, catering to specific applications in food, beverages, and supplements. As production becomes more efficient, the availability of IMO increases, supporting its widespread adoption in the market.

Market Trends:

Increasing Demand for Clean-Label and Functional Foods

The growing demand for clean-label products and functional foods is a prominent trend in the Isomalto Oligosaccharide market. Consumers are increasingly seeking transparency in food labeling, driving the popularity of natural, minimally processed ingredients. IMO fits into this trend as a natural, non-GMO sweetener that aligns with consumer preferences for healthier, cleaner options. The shift toward functional foods, which offer additional health benefits beyond basic nutrition, has also contributed to the rising adoption of IMO. It is commonly found in products that target digestive health, weight management, and diabetic-friendly diets. This shift reflects a broader consumer interest in foods that not only taste good but also support overall well-being, fueling IMO’s integration into a wide range of food and beverage categories.

- For instance, ingredient manufacturer BENEO has demonstrated through over 50 human intervention studies that consuming just 3 grams of its chicory root fiber per day significantly increases beneficial Bifidobacteria in the gut.

Growth of Plant-Based and Sugar-Free Product Segments

Another significant trend driving the Isomalto Oligosaccharide market is the expansion of plant-based and sugar-free product categories. As consumers become more aware of the benefits of plant-based diets, manufacturers are increasingly using IMO to create plant-based alternatives to traditional sugary products. The sugar-free segment is also gaining traction, with IMO acting as an effective substitute in confectionery, beverages, and baked goods. These products cater to individuals with dietary restrictions, such as those with diabetes or those following ketogenic or low-carb diets. The versatility of IMO in different formulations, combined with its health benefits, supports its growing role in the development of plant-based and sugar-free foods.

- For instance, Ingredion developed a plant-based milk alternative using its VITESSENCE® 1853 pea protein isolate, successfully creating a clean-tasting pea milk that contains 8 grams of protein per serving.

Market Challenges Analysis:

High Production Costs and Limited Availability

One of the key challenges facing the Isomalto Oligosaccharide market is the relatively high production cost. The extraction process of IMO from starch requires advanced technology, which increases manufacturing expenses. This makes it less cost-effective compared to other sweeteners, especially for price-sensitive markets. The limited availability of raw materials also contributes to supply chain constraints. As a result, some manufacturers may struggle to source sufficient quantities of high-quality IMO, limiting its broader application across industries. These factors could restrict market growth, particularly in regions where cost-conscious consumers dominate.

Consumer Awareness and Adoption Barriers

Despite the growing health-conscious trend, consumer awareness about Isomalto Oligosaccharide remains limited. While it is gaining traction among niche groups, mainstream acceptance is still slow due to a lack of widespread education about its benefits. Many consumers may not fully understand its advantages over traditional sugar or other artificial sweeteners, which could hinder market penetration. The slow adoption of IMO in certain regions or product categories presents a barrier, particularly when competing with more established sweeteners. Building consumer trust and expanding awareness will be crucial for overcoming this challenge and ensuring long-term market growth.

Market Opportunities:

Expansion in Emerging Markets and Health-Conscious Segments

The Isomalto Oligosaccharide market holds significant growth potential in emerging markets, where health awareness and disposable incomes are rising. As consumers in countries like China and India become more health-conscious, the demand for sugar substitutes and functional foods is increasing. IMO’s appeal as a low-calorie, prebiotic sweetener makes it an attractive option for these markets, where there is a growing shift towards healthier food alternatives. The expanding middle class in these regions is also fueling demand for products that promote digestive health and weight management, creating new opportunities for IMO adoption in both traditional and modern food products.

Innovation in Product Applications and Functional Foods

There are considerable opportunities for the Isomalto Oligosaccharide market in the expanding sector of functional foods and beverages. As consumers look for products that offer health benefits beyond basic nutrition, IMO’s role in digestive health, blood sugar regulation, and weight management is increasingly being recognized. Its versatility as a sweetener in various food and beverage applications, from dairy and confectionery to nutritional supplements, opens avenues for product innovation. Manufacturers can explore new formulations and functional food categories, particularly those targeting specific health concerns like diabetes, gut health, and immunity, further driving IMO’s market growth.

Market Segmentation Analysis:

By Form

The market is divided into powder, liquid, and syrup forms. The powder form holds the largest share due to its versatility and ease of use in food and beverage manufacturing. It is widely incorporated into functional foods, dietary supplements, and beverages. The liquid form is gaining traction due to its convenience in ready-to-consume products, while syrup-based IMO is popular in confectionery and bakery applications.

- For instance, the company Sgnutri offers a specific grade of powdered Isomalto-Oligosaccharide known as IMO 500, derived from organic corn and designed for easy use in dry food and supplement formulations.

By Application

The primary applications of Isomalto Oligosaccharide are in food and beverages, dietary supplements, and baby foods. In food and beverages, IMO is used as a sugar substitute in low-calorie, sugar-free, and functional products. Its prebiotic properties drive its use in dietary supplements aimed at promoting digestive health. The growing demand for baby foods enriched with prebiotic fibers also contributes significantly to the IMO market.

- For instance, Beech-Nut’s Carrot, Apple & Sweet Potato pouch for babies contains exactly 2g of prebiotic fiber per serving.

By Source

The Isomalto Oligosaccharide market is predominantly sourced from starch, mainly derived from corn, wheat, and tapioca. Starch-based IMO offers cost-effectiveness and scalability, making it a popular choice for large-scale production. The use of non-GMO starch sources further drives its adoption in clean-label and natural product formulations.

Segmentations:

By Form:

By Application:

- Food and Beverages

- Dietary Supplements

- Baby Foods

By Source:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest market share in the Isomalto Oligosaccharide market, accounting for 40% of the global share. This dominance is driven by a strong demand for health-conscious food products and supplements. The increasing preference for low-calorie, low-sugar alternatives is propelling the growth of IMO in the region, particularly in functional foods and beverages. The presence of established players in the food and beverage industry, along with a high level of awareness about gut health and wellness, supports its widespread adoption. North America’s well-developed healthcare infrastructure and regulatory environment further facilitate the market’s expansion. The growing consumer base seeking natural sweeteners and prebiotic ingredients ensures sustained growth in this region.

Europe

Europe accounts for 30% of the Isomalto Oligosaccharide market share, driven by stringent food regulations and increasing demand for clean-label, functional foods. Consumers in Europe are becoming more health-conscious, favoring products that support digestive health, weight management, and overall well-being. IMO’s popularity is particularly high in countries like Germany and the UK, where there is a strong emphasis on natural ingredients and low-sugar alternatives. The European market is expected to continue growing, driven by rising consumer awareness and the region’s robust food safety standards, which promote the use of safe and natural ingredients in food products.

Asia-Pacific

The Asia-Pacific region holds 25% of the Isomalto Oligosaccharide market share, with rapid expansion in emerging economies such as China and India. Rising health awareness and a growing middle class are driving the demand for functional foods and natural sweeteners. The expanding food and beverage sector in these countries presents significant opportunities for IMO adoption. Urbanization, coupled with changing dietary preferences towards healthier alternatives, supports this market growth. The region’s increasing focus on wellness products and the adoption of healthier eating habits are expected to fuel IMO’s market expansion in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Isomalto Oligosaccharide market is highly competitive, with key players focusing on product innovation, cost reduction, and expanding distribution networks. Leading companies are investing in advanced production technologies to enhance scalability and reduce costs, making IMO more accessible to a wider range of industries. These players are also focusing on product diversification, catering to growing demands for health-conscious food products, especially those targeting digestive health, weight management, and diabetes. Companies such as Ingredion Incorporated, Cargill, and Tate & Lyle are at the forefront, offering a variety of IMO-based products across different food and beverage segments. Competitive strategies include expanding global presence, forming strategic partnerships, and ensuring a reliable supply of high-quality raw materials. The market is expected to witness continued consolidation as larger firms seek to strengthen their position by acquiring smaller competitors or entering new regional markets with rising demand for natural sweeteners.

Recent Developments:

- In May 2024, BioNeutra Global Corporation’s subsidiary, BioNeutra North America Inc., entered into a Master Partnership Agreement with Protein Industries Canada.

- In September 2025, Nikon Shikuhin Kako Co., announced that it would increase its dividend.

Report Coverage:

The research report offers an in-depth analysis based on Form, Application, Source and Region It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Isomalto Oligosaccharide is expected to grow as consumers continue shifting towards health-conscious and low-calorie food options.

- Increasing awareness of gut health will drive the adoption of IMO in functional foods, dietary supplements, and beverages.

- IMO will see wider application in plant-based products, responding to the growing trend of plant-based diets.

- The expansion of sugar-free and low-sugar products in the food and beverage industry will further fuel IMO’s market growth.

- Advances in production technologies will enhance IMO’s cost-effectiveness, supporting its integration into a broader range of food products.

- North America will continue to lead the market, driven by high consumer demand for health-focused food solutions.

- The Asia-Pacific region will become a key growth hub, with increasing health awareness and expanding food industries in countries like China and India.

- Rising consumer preference for clean-label and natural ingredients will strengthen IMO’s market position as a sugar substitute.

- Growth in functional foods and personalized nutrition will create new opportunities for IMO in emerging food segments.

- The market will experience increased competition, with leading companies focusing on strategic partnerships, acquisitions, and regional expansions.