Market Overview:

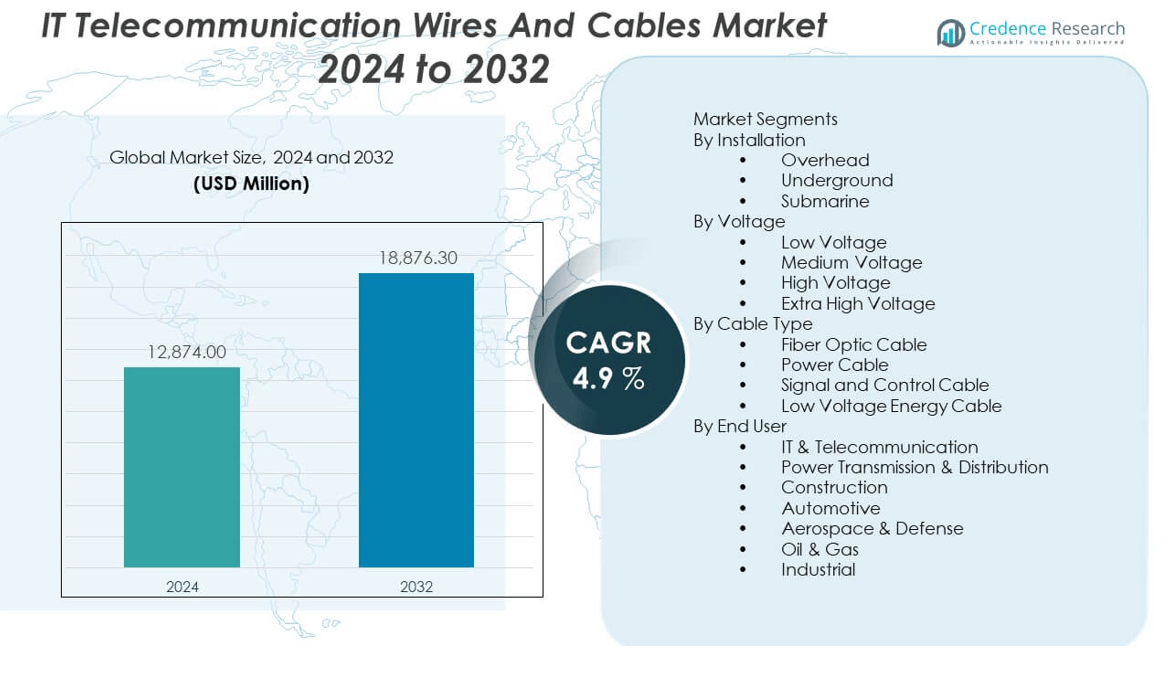

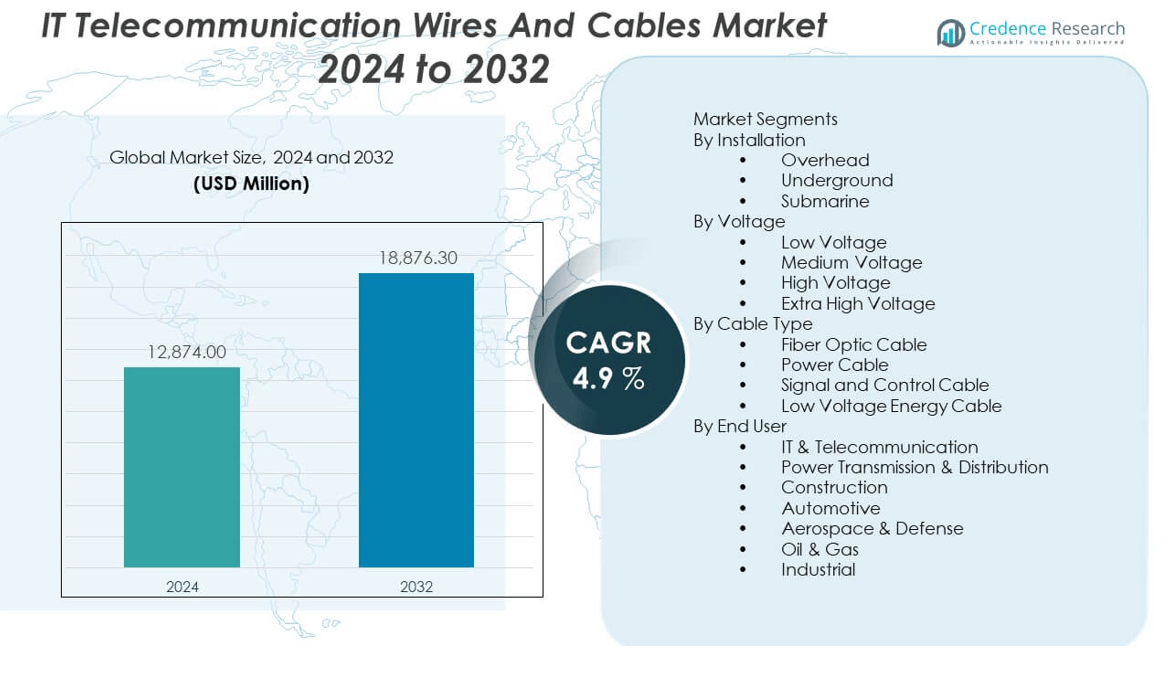

The IT telecommunication wires and cables market is projected to grow from USD 74,216.5 million in 2024 to an estimated USD 129,875.6 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IT Telecommunication Wires and Cables Market Size 2024 |

USD 74,216.5 million |

| IT Telecommunication Wires and Cables Market, CAGR |

7.3% |

| IT Telecommunication Wires and Cables Market Size 2032 |

USD 129,875.6 million |

The market grows steadily as global demand for high-speed data transmission and advanced telecommunication infrastructure accelerates. With the rollout of 5G networks, the need for robust, low-latency communication systems drives large-scale deployment of fiber optic and coaxial cables. Data center expansion, cloud computing proliferation, and increasing internet penetration further fuel the demand for reliable cabling systems. Enterprises and service providers invest heavily in upgrading legacy infrastructure to meet modern digital requirements, propelling market growth across both developed and developing economies.

Regionally, North America leads the IT telecommunication wires and cables market due to early 5G adoption, strong broadband infrastructure, and high investments in fiber optic networks. Europe follows closely with advanced telecom regulations and widespread digitization. Meanwhile, Asia-Pacific emerges as the fastest-growing region, fueled by rapid urbanization, expanding mobile subscriber bases, and government initiatives in India, China, and Southeast Asia to enhance digital connectivity. These dynamics create significant growth opportunities in emerging markets.

Market Insights:

- The IT telecommunication wires and cables market is projected to grow from USD 74,216.5 million in 2024 to USD 129,875.6 million by 2032, registering a CAGR of 7.3% during the forecast period.

- Rising 5G deployment and demand for high-speed internet access are driving large-scale investments in fiber optic and coaxial cable infrastructure.

- Increasing data center expansion and cloud adoption create strong demand for high-performance cabling systems supporting data-intensive applications.

- Volatile raw material prices and supply chain disruptions limit manufacturing efficiency and impact project costs across the market.

- Regulatory hurdles and logistical barriers, especially in densely populated urban areas, challenge the timely rollout of new cable infrastructure.

- North America leads due to early adoption of advanced telecom technologies, followed by Europe with strong broadband coverage and policy support.

- Asia-Pacific emerges as the fastest-growing region due to rapid digitization, rising mobile user base, and government-driven broadband expansion in countries like India and China.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Accelerating Global Deployment of 5G Infrastructure Across Telecommunications Networks

Telecommunication operators worldwide prioritize upgrading their networks to support 5G capabilities. The IT telecommunication wires and cables market benefits from strong demand for high-bandwidth, low-latency infrastructure that supports real-time communication. Governments and private companies allocate significant investments to fiber optic and coaxial cable installations. These cables form the backbone of next-generation networks capable of supporting increased data traffic and device connectivity. It supports the need for faster and more efficient data transmission across mobile and fixed-line networks. High-speed networks also enable new technologies such as autonomous vehicles, smart cities, and IoT deployments. Countries like the U.S., China, and South Korea lead 5G rollouts, pushing large-scale cabling projects. The need to cover urban, suburban, and rural areas creates massive infrastructure demand. It positions cable providers as essential enablers of future connectivity.

- For instance, Prysmian Group has launched its EcoSpan™ cables equipped with FlexRibbon™ technology that can support fiber counts up to 6,912 fibers within a single cable, enhancing rural broadband deployment with efficient fiber density and installation flexibility.

Expansion of Data Centers Driving High-Volume Cable Infrastructure Demand

The increasing reliance on cloud computing and digital services drives the rapid expansion of hyperscale and edge data centers. The IT telecommunication wires and cables market sees consistent demand due to the volume of interconnectivity required within and between facilities. Operators invest in high-density fiber cabling systems to support data-heavy operations, low-latency requirements, and continuous uptime. It supports the performance needs of AI-driven workloads, content streaming, and real-time analytics. Enterprises and cloud providers such as AWS, Microsoft Azure, and Google Cloud expand their facilities to address growing regional demand. These expansions include internal cable networks, external fiber routes, and power-related wiring infrastructure. The market strengthens further as latency-sensitive industries such as banking and healthcare seek localized computing power. It reinforces the need for scalable, high-performance cable solutions within the data ecosystem.

- For instance, Fujikura Ltd. recently introduced the world’s first 13,824-core fiber optic cable, doubling previous fiber density, which greatly optimizes space and bandwidth for hyperscale data centers.

Rapid Digitization and Internet Penetration in Emerging Economies

Emerging markets experience a surge in digital transformation, triggering massive investments in telecommunications infrastructure. The IT telecommunication wires and cables market benefits from initiatives that aim to expand internet access to underserved regions. National broadband missions and public-private partnerships deploy both fiber and copper networks to enhance connectivity. It enables rural populations to access digital services in education, healthcare, and finance. Governments in India, Brazil, and Southeast Asia provide funding and regulatory support for telecom expansion projects. Domestic cable manufacturers scale production capacity to meet growing national demand. The rise in mobile phone usage and low-cost smartphones also fuels backend cabling needs. It supports broader digital inclusion efforts while creating long-term infrastructure growth opportunities for cable providers.

Upgrades to Legacy Network Infrastructure in Developed Economies

Aging copper-based networks in developed markets undergo extensive modernization to meet today’s digital performance standards. The IT telecommunication wires and cables market captures opportunities from ongoing replacements with fiber optics and hybrid systems. It supports faster broadband speeds, enhanced reliability, and future-proof scalability for residential and commercial users. Regulatory pressure to improve service quality and reduce downtime prompts telecom providers to accelerate upgrades. Operators in North America, Western Europe, and Japan commit to replacing outdated DSL and coaxial lines with fiber-to-the-home (FTTH) and fiber-to-the-building (FTTB) solutions. These projects drive sustained demand for high-performance cabling systems. It allows telecom companies to remain competitive while aligning with smart city and IoT initiatives. The shift to greener, more energy-efficient cabling also aligns with environmental regulations and corporate sustainability goals.

Market Trends:

Integration of Artificial Intelligence for Network Performance Optimization

The integration of artificial intelligence (AI) into telecommunications infrastructure reshapes demand patterns. The IT telecommunication wires and cables market reflects a shift toward cables that support intelligent, high-speed data transfer for AI-enabled systems. It includes applications such as network monitoring, predictive maintenance, and traffic management. Service providers require cabling systems capable of transmitting and processing vast data volumes without latency. AI also enables self-optimizing networks, which rely on real-time data movement and adaptive algorithms. Cable manufacturers now design systems optimized for AI-based monitoring tools and diagnostics. These cables support reduced downtimes, faster troubleshooting, and better efficiency. It aligns with operator goals to lower operational costs while improving user experience. AI-enabled cabling also plays a role in autonomous network deployment and real-time configuration adjustments.

- For instance, Sumitomo Electric Industries has partnered with 3M to implement Expanded Beam Optical Interconnect technology, optimized for AI-based network traffic monitoring and capable of transmitting up to 10 Gbps with minimal signal loss.

Growing Adoption of Sustainable and Low-Carbon Cable Materials

Sustainability trends drive a transformation in cable production standards and material usage. The IT telecommunication wires and cables market experiences a shift toward low-carbon manufacturing practices. It includes demand for halogen-free, recyclable, and energy-efficient cable designs. Telecom operators face growing pressure to reduce the environmental footprint of infrastructure projects. Cable producers introduce eco-friendly insulation and sheathing materials to comply with green building codes and corporate sustainability mandates. Recyclability and end-of-life considerations become critical in long-term cable planning. It supports circular economy goals while enhancing brand value and ESG performance. Governments and regulatory bodies across Europe and North America incentivize low-emission cable production. Sustainable product certifications and green procurement policies shape purchasing decisions in both public and private sectors. It fosters a growing market for environmentally responsible cable systems.

- For instance, Nexans S.A. acquired Cables RCT, a company specializing in halogen-free and recyclable cables, enabling Nexans to broaden its portfolio of eco-friendly products compliant with stringent European green standards.

Rise in Hybrid Fiber-Coaxial (HFC) Solutions for Cost-Effective Network Expansion

Hybrid fiber-coaxial technologies gain prominence for their cost efficiency and scalability in access networks. The IT telecommunication wires and cables market incorporates growing demand for HFC deployments in residential and small-business broadband services. It supports rapid network upgrades without the high cost of full-fiber rollouts. Cable operators use HFC to extend coverage in urban and suburban regions while balancing performance and cost. These systems combine the high capacity of fiber with the reach of existing coaxial networks. Vendors develop integrated HFC cabling systems optimized for high-speed DOCSIS protocols and video transmission. It provides cable providers a transitional pathway toward fiber without service disruption. The approach becomes particularly attractive in competitive markets with rising bandwidth demands. It enables operators to achieve faster deployment timelines with manageable capital investment.

Emphasis on Low-Latency Connectivity for Next-Generation Applications

Low-latency connectivity emerges as a critical performance metric in modern telecommunications systems. The IT telecommunication wires and cables market responds to this demand by offering advanced fiber solutions designed for ultra-fast data transmission. It supports latency-sensitive use cases such as remote surgery, online gaming, industrial automation, and autonomous mobility. Telecom operators require cabling systems with minimal signal distortion and high reliability. Manufacturers innovate with enhanced fiber geometries, bend-insensitive fibers, and advanced shielding techniques. These improvements reduce signal degradation over distance and environmental interference. It strengthens the performance of metro, long-haul, and last-mile networks. Low-latency cable networks also support edge computing and AI workloads requiring immediate data access. The trend reshapes cabling requirements in both public and private infrastructure projects.

Market Challenges Analysis:

Supply Chain Volatility and Raw Material Price Fluctuations Limit Manufacturing Stability

The IT telecommunication wires and cables market faces persistent challenges in sourcing raw materials at stable prices. It depends heavily on copper, aluminum, and polymers, which experience frequent cost fluctuations due to geopolitical tensions, trade restrictions, and global demand cycles. Unpredictable price shifts disrupt production schedules and increase project costs for manufacturers and telecom operators. Logistics bottlenecks and port delays further strain cable supply timelines. Smaller cable producers often struggle to maintain profitability under such volatility. It reduces their ability to compete or invest in R&D for high-performance cabling. Contract renegotiations and delayed infrastructure rollouts create uncertainty for clients and stakeholders. While some manufacturers hedge risks with long-term contracts, many remain exposed to sudden price swings that hinder scalability and investment confidence.

Regulatory Complexity and Installation Challenges in Densely Populated Areas

Deploying telecommunication cabling in urban environments presents logistical and regulatory hurdles. The IT telecommunication wires and cables market encounters difficulties in navigating local zoning laws, permitting procedures, and public resistance. It complicates fiber installations in cities where underground space is limited or heavily occupied. Telecom companies face delays due to coordination with utilities, municipalities, and property owners. In many regions, aging infrastructure requires replacement before new cables can be laid. It increases installation time and costs, particularly in central business districts or heritage zones. Bureaucratic delays discourage aggressive expansion, especially for small and mid-tier telecom providers. Compliance with safety, environmental, and labor codes adds to operational burden. These factors hinder the pace of broadband rollouts and infrastructure modernization efforts in urban markets.

Market Opportunities:

Expansion of Smart City Projects and IoT Networks Unlocks Infrastructure Demand

Global smart city initiatives generate sustained infrastructure investments across multiple sectors. The IT telecommunication wires and cables market finds opportunity in supporting connectivity frameworks for traffic management, surveillance, utilities, and urban mobility systems. It supplies high-speed fiber and hybrid cables for smart grids, public Wi-Fi, and sensor-based applications. City governments and private developers prioritize network resilience and bandwidth capacity. These developments drive consistent demand for advanced cabling infrastructure in metropolitan regions.

Private Network Deployment and Industrial Digitalization Create Niche Growth Avenues

Industries such as manufacturing, mining, and logistics adopt private 5G and wired networks to improve operational control and data security. The IT telecommunication wires and cables market benefits from cabling needs in industrial parks, oil fields, and offshore platforms. It enables mission-critical systems with low-latency performance and electromagnetic protection. Custom cable solutions for hazardous or high-temperature environments drive innovation and contract-based growth. This industrial shift supports long-term market expansion.

Market Segmentation Analysis:

By Installation

The IT telecommunication wires and cables market supports a range of installation methods based on environmental and technical needs. Overhead installations remain widely used for long-distance and rural transmission due to lower infrastructure costs. Underground installations are preferred in urban settings for their safety, durability, and reduced exposure to weather-related disruptions. Submarine cables are critical for global data exchange, enabling intercontinental communication networks that handle massive bandwidth.

- For instance, Furukawa Electric unified its global optical fiber cable operations into its Lightera brand, which includes high-capacity submarine cables capable of transmitting over 18 Tbps per fiber pair, facilitating high-speed intercontinental communications.

By Voltage

Different voltage levels meet specific network demands. Low and medium voltage cables support local distribution and internal telecom facility wiring. High voltage and extra high voltage cables are essential for long-haul transmission, connecting network nodes across cities and countries. It ensures stable power and signal delivery to support continuous high-speed communication.

- For instance, LS Cable & System Ltd. launched 400 kV Extra High Voltage cables and advanced High-Temperature Low-Sag (HTLS) overhead conductors designed to support the increased power demands of modern telecommunications and 5G infrastructure with enhanced thermal performance and reduced sagging over long distances.

By Cable Type

Fiber optic cables dominate the IT telecommunication wires and cables market, offering high-speed transmission, greater bandwidth, and long-distance performance. Power cables remain integral in hybrid network setups, while signal and control cables provide precise data flow management. Low voltage energy cables enable efficient electrical supply to telecom infrastructure, including base stations and routers.

By End User

The IT & telecommunication sector drives the highest demand, fueled by 5G deployment and data traffic growth. Power transmission and distribution companies integrate advanced cabling for smart grids. The construction, automotive, and industrial sectors use specialized cables for automation and connectivity. Aerospace & defense and oil & gas industries require durable, high-performance cabling for secure, mission-critical operations.

Segmentation:

By Installation

- Overhead

- Underground

- Submarine

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Cable Type

- Fiber Optic Cable

- Power Cable

- Signal and Control Cable

- Low Voltage Energy Cable

By End User

- IT & Telecommunication

- Power Transmission & Distribution

- Construction

- Automotive

- Aerospace & Defense

- Oil & Gas

- Industrial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Demonstrate Mature Market Dynamics

North America holds a 23.1% share of the IT telecommunication wires and cables market, supported by early 5G adoption, dense fiber optic networks, and a high concentration of data centers. The United States leads regional growth due to ongoing investments in broadband expansion, cloud infrastructure, and private telecom networks. Canada contributes with rural broadband initiatives and smart city deployments. Europe accounts for 21.6% of the market, driven by strong telecom regulations, EU-wide digital infrastructure policies, and advanced cabling standards. Germany, France, and the UK remain key countries with robust investments in fiber-to-the-home (FTTH) and network modernization. It benefits from consistent demand in both public and enterprise applications across urban centers.

Asia Pacific Leads Global Market with Rapid Infrastructure Development

Asia Pacific dominates the IT telecommunication wires and cables market with a 35.4% share, propelled by rapid digitization, large-scale 5G rollouts, and strong government support. China drives most of the regional volume with extensive fiber deployments and industrial automation. India emerges as a high-growth market due to rural broadband initiatives, data center expansions, and telecom reforms. Japan, South Korea, and Southeast Asia also show high demand, driven by rising mobile user bases and expanding smart city projects. It experiences significant investment in submarine cabling to support global data routing through the region. Telecom operators and infrastructure developers push capacity and coverage upgrades at record pace.

Latin America and Middle East & Africa Show Steady Expansion Potential

Latin America contributes 10.1% to the global market, led by Brazil and Mexico, where telecom modernization and internet penetration efforts gain momentum. National broadband plans and fiber expansion projects enhance regional demand. The Middle East & Africa region holds a 9.8% market share, driven by growing connectivity needs, urbanization, and investment in data infrastructure. Gulf countries focus on smart city integration and enterprise-grade telecom networks. Sub-Saharan Africa sees gradual progress, supported by public-private partnerships and undersea cable projects. It gains from global digital inclusion efforts and increasing smartphone adoption, supporting long-term infrastructure development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Prysmian Group (Italy)

- Nexans S.A. (France)

- Sumitomo Electric Industries, Ltd. (Japan)

- LS Cable & System Ltd. (South Korea)

- Southwire Company LLC (US)

- Fujikura Ltd. (Japan)

- Furukawa Electric Co., Ltd. (Japan)

- Belden Inc. (US)

- Leoni AG (Germany)

- NKT A/S (Denmark)

Competitive Analysis:

The IT telecommunication wires and cables market features a mix of global giants and regional players competing on technology, product performance, and infrastructure partnerships. Key companies include Prysmian Group, Nexans, Sumitomo Electric, LS Cable & System, and Southwire, all of which maintain strong R&D capabilities and large-scale manufacturing operations. It favors companies that offer comprehensive cabling solutions with high data transmission speeds, energy efficiency, and durability. Players compete by securing long-term contracts with telecom operators, governments, and industrial clients. Vertical integration, global distribution networks, and innovation in fiber optic technologies define competitive strength. Leading firms continue to expand their geographic reach and product portfolios to strengthen market share and respond to diverse regional demands.

Recent Developments:

- In 2025, Prysmian Groupof Italy announced a 7-year framework agreement with N-Sea, a Dutch subsea solutions provider, to enhance the security and maintenance of submarine cables for the IT and telecommunications sector. This partnership, disclosed on March 26, 2025, introduces a dedicated vessel and specialized engineering services for rapid response, inspection, maintenance, and repair of submarine cables, reinforcing critical infrastructure security and resilience for telecom networks.

- In France, Nexans S.A. completed the acquisition of Cables RCT in Spain on June 2, 2025. This move significantly boosts Nexans’ presence in Southern Europe and expands its low-voltage cable offerings, particularly for fire safety in buildings. The acquisition enhances Nexans’ manufacturing footprint and capacity to deliver advanced telecommunication and electrification solutions, accelerating growth in core European markets.

- Sumitomo Electric Industries, Ltd. of Japan entered into a new assembler agreement with 3M on March 21, 2025. This collaboration enables Sumitomo Electric to offer a range of optical fiber connectivity products incorporating 3M Expanded Beam Optical Interconnect technology, specifically targeting high-density data centers and advanced telecom networks. The partnership also includes plans for comprehensive EBO-based solutions, boosting their global product suite for next-generation communication infrastructures.

Market Concentration & Characteristics:

The IT telecommunication wires and cables market shows moderate to high concentration, led by a few multinational corporations with strong brand equity and integrated supply chains. It is characterized by high capital intensity, long sales cycles, and strong dependence on infrastructure investments. Product differentiation lies in performance, durability, and bandwidth capacity. Barriers to entry include regulatory compliance, technology patents, and customer relationships. The market evolves through innovation in fiber technology and the growing need for sustainable and energy-efficient cabling systems.

Report Coverage:

The research report offers an in-depth analysis based on installation type, voltage level, cable type, and end-user segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Fiber optic cable demand will increase rapidly, driven by the global shift to high-speed internet and 5G deployment.

- Integration of AI and automation in telecom networks will require advanced, low-latency cabling systems.

- Emerging markets in Asia-Pacific and Africa will attract major infrastructure investments for broadband expansion.

- Upgrades of aging infrastructure in North America and Europe will sustain long-term cable replacement demand.

- Submarine cable projects will expand to meet rising intercontinental data traffic and global connectivity needs.

- Smart city and IoT initiatives will create consistent demand for reliable, high-capacity cable networks.

- Energy-efficient and sustainable cabling solutions will gain traction under environmental compliance mandates.

- Industrial sectors will increasingly adopt private 5G networks, boosting demand for customized cable solutions.

- Mergers and acquisitions among global cable manufacturers will reshape competitive dynamics.

- Government-led digital inclusion programs will support large-scale telecom infrastructure rollouts worldwide.