Market Overview

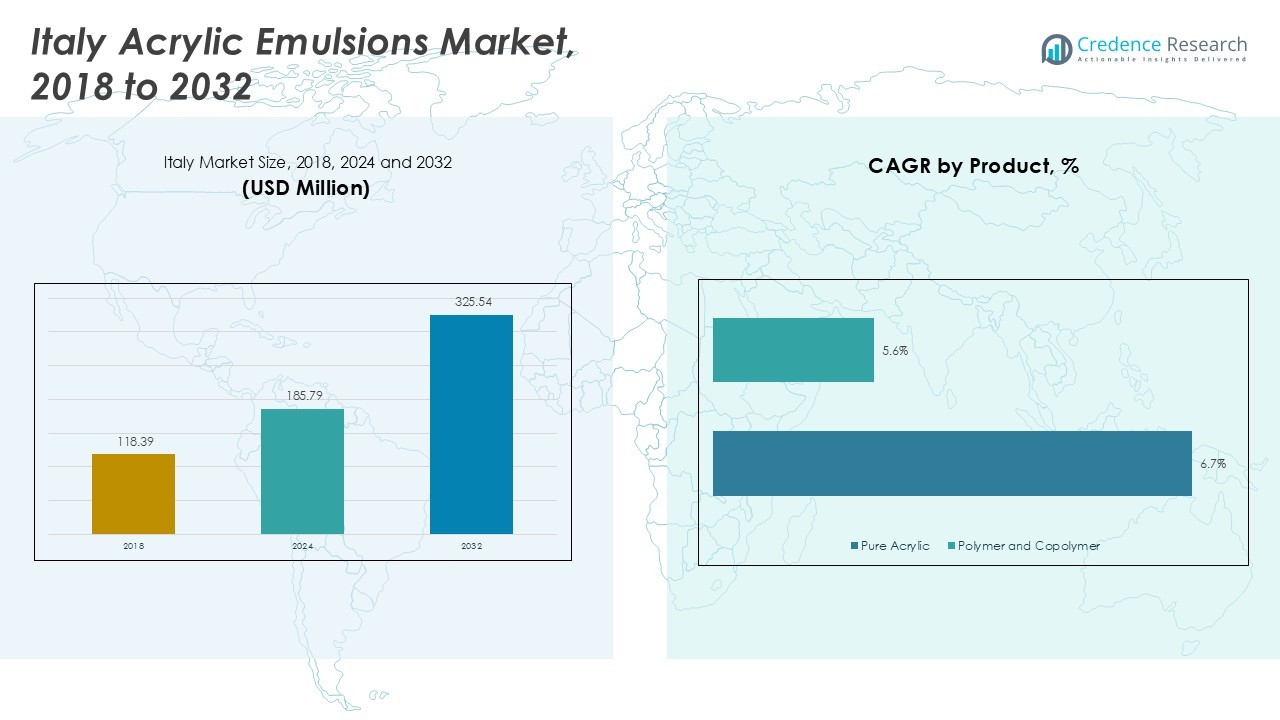

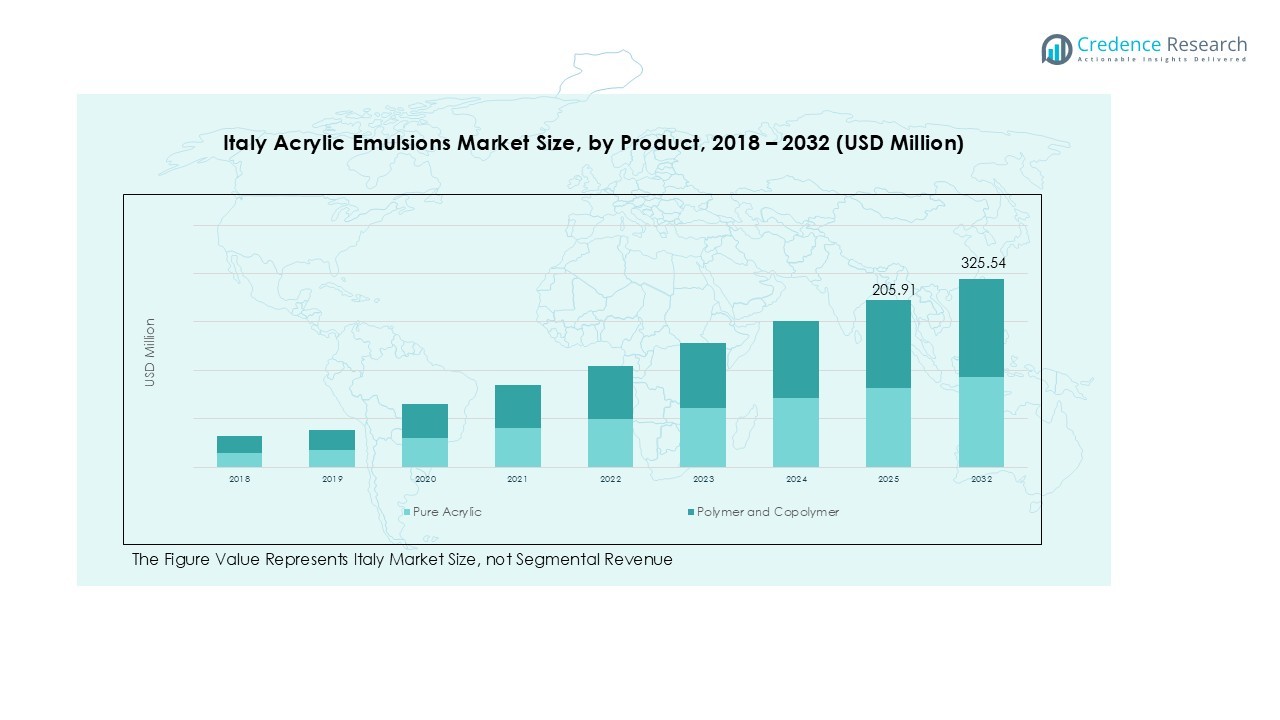

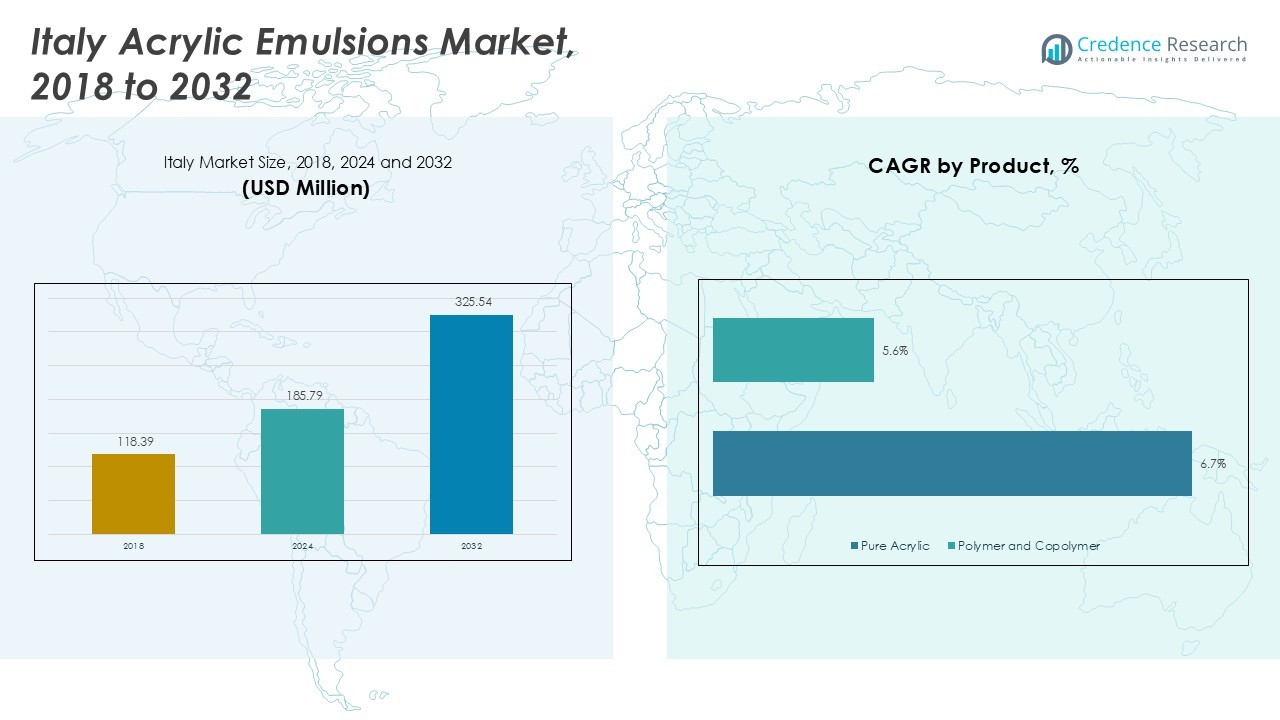

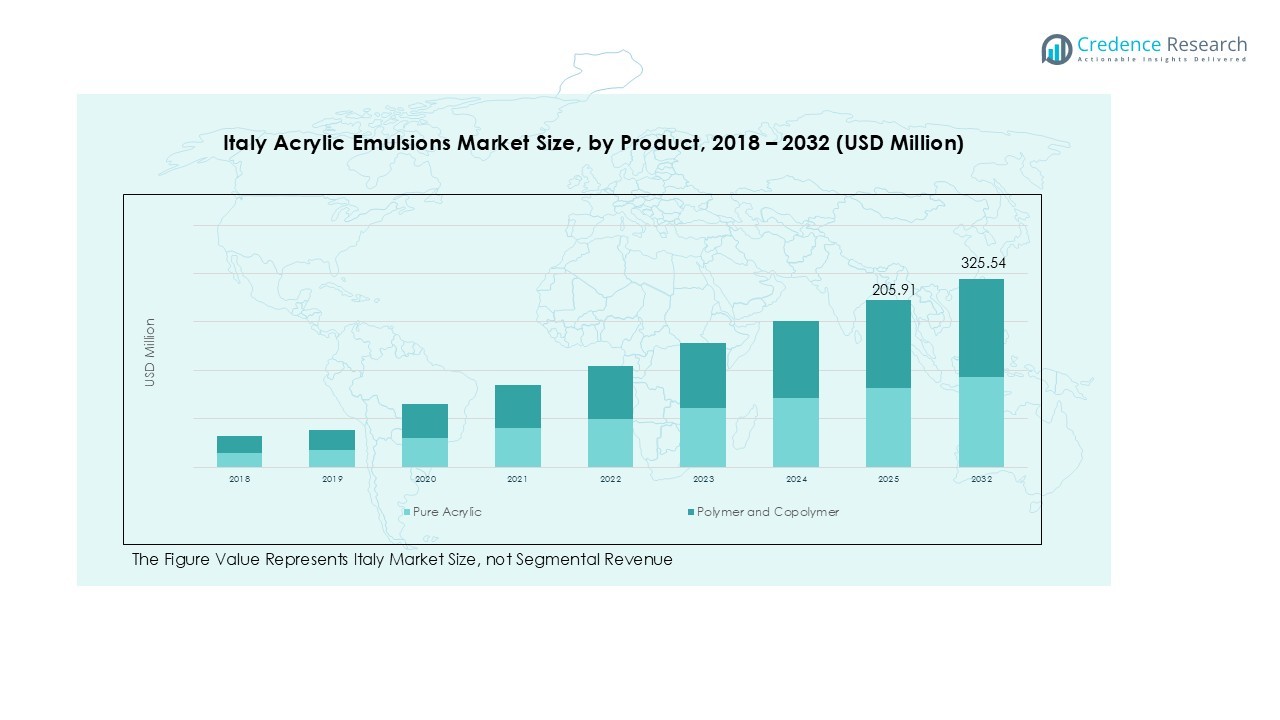

Italy Acrylic Emulsions market size was valued at USD 118.39 Million in 2018, increasing to USD 185.79 Million in 2024, and is anticipated to reach USD 325.54 Million by 2032, at a CAGR of 6.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Acrylic Emulsions market Size 2024 |

USD 185.79 Million |

| Italy Acrylic Emulsions market , CAGR |

6.76% |

| Italy Acrylic Emulsions market Size 2032 |

USD 325.54 Million |

The Italy Acrylic Emulsions market is led by key players including Akzo Nobel N.V., BASF SE, Arkema, Covestro AG, Synthomer plc, DIC Group, Trinseo PLC, Clariant AG, The Lubrizol Corporation, and Avery Dennison. These companies maintain a strong presence through extensive product portfolios, R&D investments, and strategic distribution networks. Northern Italy emerges as the leading region, capturing 42% of the market, driven by industrial activity, urban infrastructure, and high demand for paints and coatings. Central Italy holds 28% of the market, supported by residential and commercial construction, while Southern Italy and the islands contribute 18% and 12%, respectively. The dominance of pure acrylic emulsions across all regions, coupled with the adoption of eco-friendly, water-based products, underpins sustained growth and competitive differentiation in Italy’s evolving acrylic emulsions landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Acrylic Emulsions market was valued at USD 185.79 Million in 2024 and is projected to reach USD 325.54 Million by 2032, growing at a CAGR of 6.76%.

- Growth is driven by rising construction and renovation activities, increasing demand for durable paints and coatings, and adoption of eco-friendly, water-based emulsions across industrial, residential, and commercial applications.

- Key trends include innovation in specialty emulsions such as UV-resistant and high-gloss coatings, along with the growing demand for retro-fit and renovation solutions in aging infrastructure.

- The competitive landscape is led by Akzo Nobel N.V., BASF SE, Arkema, Covestro AG, Synthomer plc, DIC Group, Trinseo PLC, Clariant AG, The Lubrizol Corporation, and Avery Dennison, focusing on product innovation, sustainability, and regional distribution strategies.

- Northern Italy holds 42% of the market, Central Italy 28%, Southern Italy 18%, and the islands 12%, with pure acrylic emulsions dominating product segments and paints and coatings leading application segments.

Market Segmentation Analysis:

By Product Segment:

The Italy Acrylic Emulsions market by product is primarily divided into Pure Acrylic and Polymer & Copolymer emulsions. Pure Acrylic dominates the segment, accounting for approximately 58% of the total product revenue. Its strong position is driven by its superior durability, chemical resistance, and adaptability across multiple applications, particularly in paints and coatings. Meanwhile, Polymer & Copolymer emulsions hold a smaller share but are gaining traction due to their cost-effectiveness and performance in specialized industrial applications. The demand for high-performance coatings in architectural and industrial sectors further supports the growth of Pure Acrylic in the Italian market.

- For instance, Dow’s PRIMAL™ AC-2337, a pure acrylic emulsion polymer, is widely recognized for its excellent exterior durability and high gloss retention, making it ideal for outdoor coatings.

By Application Segment:

In terms of application, paints and coatings lead the Italy Acrylic Emulsions market with a share of around 52%. This dominance is fueled by increasing construction activities, renovation projects, and the demand for environmentally friendly water-based coatings. Construction material additives follow closely, capturing roughly 20% of the segment, driven by the need for improved adhesion, flexibility, and durability in building materials. Paper coatings and adhesives together account for about 18%, benefiting from growth in packaging and paper-based industries. The others category represents niche applications, contributing the remaining 10% of the market.

- For instance, Acronal® water-based acrylic emulsions by BASF are widely used in high-performance, sustainable paints that offer excellent durability and environmental benefits in Italian construction projects.

By End User Segment:

The end-user analysis reveals that the architectural segment commands the largest share of 55% in the Italy Acrylic Emulsions market. This is attributed to the rising construction and renovation projects in residential and commercial spaces, where high-quality coatings and finishes are preferred. The industrial segment holds approximately 25% share, supported by applications in machinery, automotive, and equipment coatings. Commercial and residential end users account for 12% and 8% respectively, reflecting the gradual adoption of premium emulsions for specialty coatings and adhesives. Overall, growth is driven by sustainability trends and demand for durable, high-performance products.

Key Growth Drivers

Rising Construction and Renovation Activities

The Italy Acrylic Emulsions market is significantly propelled by the surge in construction and renovation projects. Growing residential and commercial developments, coupled with urban infrastructure expansion, have increased the demand for high-performance coatings and construction material additives. Architects and contractors prefer acrylic emulsions for their durability, flexibility, and weather resistance. This trend directly boosts the consumption of pure acrylic and polymer emulsions in paints, coatings, and construction applications, positioning the market for sustained growth throughout the forecast period.

- For instance, Acronal®, a product line by BASF, provides high-performance acrylic and styrene-acrylic emulsions widely used in the construction sector for paints and coatings. These emulsions deliver sustainability, excellent adhesion, and weather resistance, making them popular among Italian builders and contractors.

Preference for Environmentally Friendly Solutions

Increasing environmental awareness among consumers and stricter regulatory standards in Italy are driving demand for water-based, low-VOC acrylic emulsions. These eco-friendly products offer the dual advantage of reduced environmental impact and superior performance compared to solvent-based alternatives. Manufacturers are focusing on sustainable formulations to meet green building requirements, which has enhanced adoption across architectural, industrial, and residential applications. This shift toward sustainable solutions serves as a major growth catalyst, particularly in paints, coatings, and adhesive applications.

- For instance, Dow’s PRIMAL™ series includes water-based acrylic emulsions known for durability and low VOC emissions, catering to green building requirements in architectural coatings.

Expansion in Industrial and Packaging Applications

The industrial and packaging sectors are emerging as strong growth engines for acrylic emulsions in Italy. Industrial coatings, adhesives, and paper coating applications require high-performance emulsions with enhanced adhesion, chemical resistance, and flexibility. Growing demand from packaging and paper industries further stimulates market expansion, as emulsions improve product durability and appearance. The rising industrial output and modernization of manufacturing processes are encouraging manufacturers to adopt advanced acrylic emulsions, boosting overall market revenues and providing long-term growth opportunities.

Key Trends & Opportunities

Innovation in Specialty Emulsions

Manufacturers are increasingly developing specialty emulsions tailored for high-performance applications, such as anti-fungal coatings, UV-resistant paints, and high-gloss finishes. These innovations open new avenues for the Italy Acrylic Emulsions market, addressing specific industrial and architectural requirements. Customization and technological advancements not only enhance product efficiency but also allow brands to differentiate themselves in a competitive landscape. This trend presents opportunities for premium product offerings, catering to niche markets with higher margins and fostering overall market growth.

- For instance, for UV-resistant applications, NANOMYTE UVP coatings block ultraviolet radiation, preserving material integrity by preventing UV light penetration.

Growing Adoption in the Renovation and Retro-Fit Market

Italy’s aging building infrastructure has created substantial demand for renovation and retro-fit solutions. Acrylic emulsions, particularly pure acrylic products, are preferred due to their superior adhesion, durability, and aesthetic appeal. This trend is further amplified by government incentives promoting energy-efficient and environmentally friendly renovations. As a result, companies can capitalize on this opportunity by providing specialized emulsions tailored for refurbishment projects, increasing market penetration in both residential and commercial sectors.

- For instance, Viero Paints offers a range of decorative acrylic finishes that enhance interior and exterior wall renovation while providing moisture resistance and aesthetic elegance.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in raw material costs, particularly acrylic monomers and chemical intermediates, pose a significant challenge for market participants. Price volatility can impact profit margins, forcing manufacturers to adjust pricing strategies frequently. This unpredictability may slow adoption, particularly among cost-sensitive segments such as small-scale industrial users or budget-conscious construction projects. Companies must invest in supply chain optimization and strategic sourcing to mitigate these risks, ensuring consistent production and market stability despite fluctuating raw material costs.

Stringent Regulatory Compliance

Compliance with stringent environmental and safety regulations in Italy and the European Union remains a key challenge for acrylic emulsion manufacturers. Products must meet low-VOC standards, chemical safety norms, and sustainability benchmarks. Adhering to these regulations often requires significant investment in R&D, production upgrades, and quality control measures. Non-compliance risks fines, recalls, and reputational damage, which can restrict market entry or growth. Manufacturers must balance regulatory adherence with cost-effectiveness to maintain competitiveness in the market.

Regional Analysis

Northern Italy

Northern Italy holds the largest share of the Italy Acrylic Emulsions market, accounting for 42% of total revenue. The region’s robust industrial base, including automotive, construction, and packaging sectors, drives strong demand for high-performance acrylic emulsions. Additionally, urban infrastructure development and renovation projects contribute to the increasing consumption of pure acrylic and polymer emulsions in paints, coatings, and construction material additives. Leading manufacturers maintain a significant presence in the region, leveraging established distribution networks and local partnerships to meet rising demand. Sustainability trends further support the adoption of eco-friendly, water-based emulsions in Northern Italy.

Central Italy

Central Italy contributes 28% to the overall acrylic emulsions market, driven by growing residential and commercial construction activities. The demand for paints and coatings in architectural applications is particularly strong, with pure acrylic emulsions leading the segment. Industrial applications such as adhesives and construction material additives are also gaining traction, further supporting market growth. The region’s increasing focus on eco-friendly and low-VOC products aligns with national environmental regulations, promoting the adoption of sustainable emulsions. Manufacturers are investing in localized production and distribution strategies to cater to the rising demand from central urban centers and renovation projects across the region.

Southern Italy

Southern Italy accounts for 18% of the Italy Acrylic Emulsions market, with growth fueled by expanding residential projects and the rising popularity of water-based paints and coatings. Limited industrial activity compared to the north is balanced by increasing investments in infrastructure, public construction, and renovation programs. Pure acrylic emulsions dominate, supported by their durability, chemical resistance, and aesthetic appeal. The market is also witnessing steady adoption of polymer and copolymer emulsions in adhesives and paper coating applications. Growing awareness of environmentally sustainable solutions and government initiatives for energy-efficient buildings are further driving regional market growth in Southern Italy.

Islands (Sicily & Sardinia)

The islands of Sicily and Sardinia contribute 12% to the overall Italy Acrylic Emulsions market. Market growth is largely influenced by residential construction, renovation, and specialized industrial coatings for marine and coastal infrastructure. Paints and coatings applications dominate due to the demand for weather-resistant and UV-protective emulsions. Pure acrylic products remain the leading sub-segment, supported by their durability and performance in harsh coastal climates. Limited industrial manufacturing is supplemented by local construction and packaging projects. The trend toward sustainable, water-based emulsions is gradually gaining momentum, presenting opportunities for manufacturers to expand their presence across these island regions.

Market Segmentations:

By Product:

- Pure Acrylic

- Polymer and Copolymer

By Application:

- Paints and Coatings

- Construction Material Additives

- Paper Coating

- Adhesives

- Others

By End User:

- Architectural

- Industrial

- Commercial

- Residential

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Islands

Competitive Landscape

The competitive landscape of the Italy Acrylic Emulsions market features key players such as Akzo Nobel N.V., BASF SE, Arkema, Covestro AG, Synthomer plc, DIC Group, Trinseo PLC, Clariant AG, The Lubrizol Corporation, and Avery Dennison. Market competition is driven by product innovation, sustainability initiatives, and regional distribution strength. Leading players focus on developing eco-friendly, water-based emulsions, enhancing product performance in paints, coatings, adhesives, and construction material additives. Strategic investments in R&D, partnerships, and acquisitions strengthen market positioning and enable entry into niche applications. Companies also emphasize tailored solutions for industrial, architectural, and residential end users, addressing evolving consumer preferences. The competitive intensity encourages continuous technological advancements, pricing strategies, and quality improvements, ensuring resilience against volatility in raw material costs while maintaining growth momentum across Italy’s key regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2023, Akzo Nobel N.V. introduced a high-performance polyurethane dispersion for adhesives, enhancing both performance and sustainability in adhesive applications across the region.

- In May 2025, EPS launched EPS 2731, a fluorosurfactant-free acrylic emulsion for architectural coatings. The product enhances exterior durability, resists dirt pickup, color fading, and efflorescence on alkali substrates, supporting the trend toward sustainable and low-VOC solutions.

- In August 2025, IMCD acquired 100% of Italian coatings distributor Tillmanns, strengthening its presence in Italy and enhancing distribution capabilities for acrylic emulsions across the region.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance acrylic emulsions is expected to grow across paints, coatings, and construction material applications.

- Pure acrylic emulsions will continue to dominate due to their durability, chemical resistance, and versatility.

- Water-based and low-VOC emulsions will gain increased adoption driven by environmental regulations and sustainability trends.

- Expansion in residential and commercial construction projects will support steady market growth.

- Industrial applications, including adhesives and paper coatings, will provide new growth opportunities.

- Innovation in specialty emulsions, such as UV-resistant and anti-fungal products, will attract niche segments.

- Regional growth will remain concentrated in Northern and Central Italy, with Southern regions showing moderate expansion.

- Manufacturers will focus on strengthening local production and distribution networks to enhance market reach.

- Strategic partnerships, mergers, and acquisitions will shape competitive dynamics in the market.

- Rising consumer preference for eco-friendly and high-quality coatings will continue to drive product demand.