Market Overview

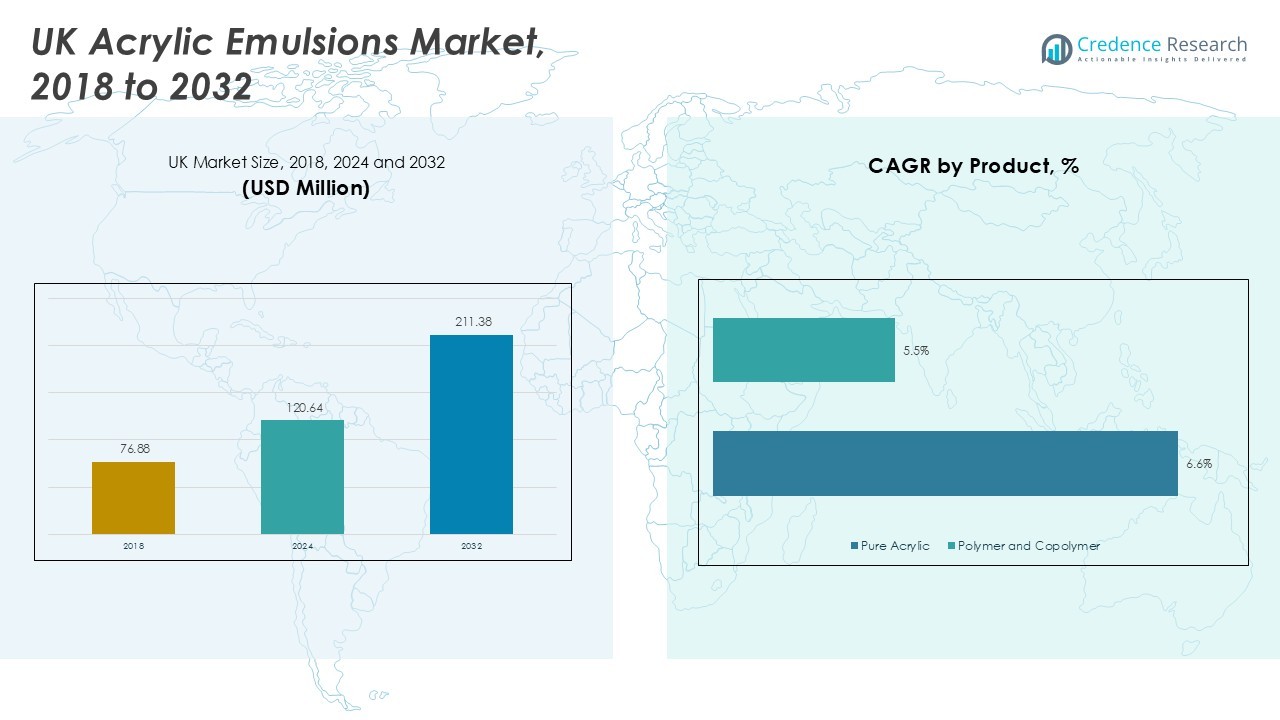

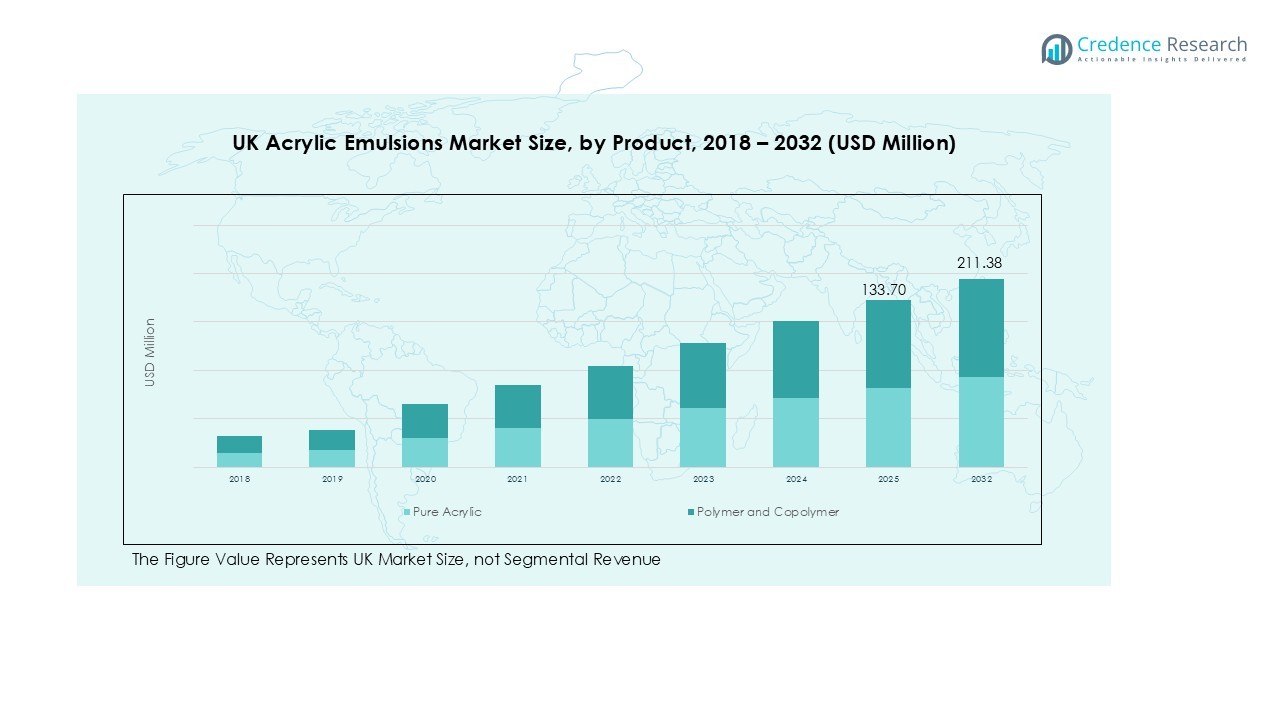

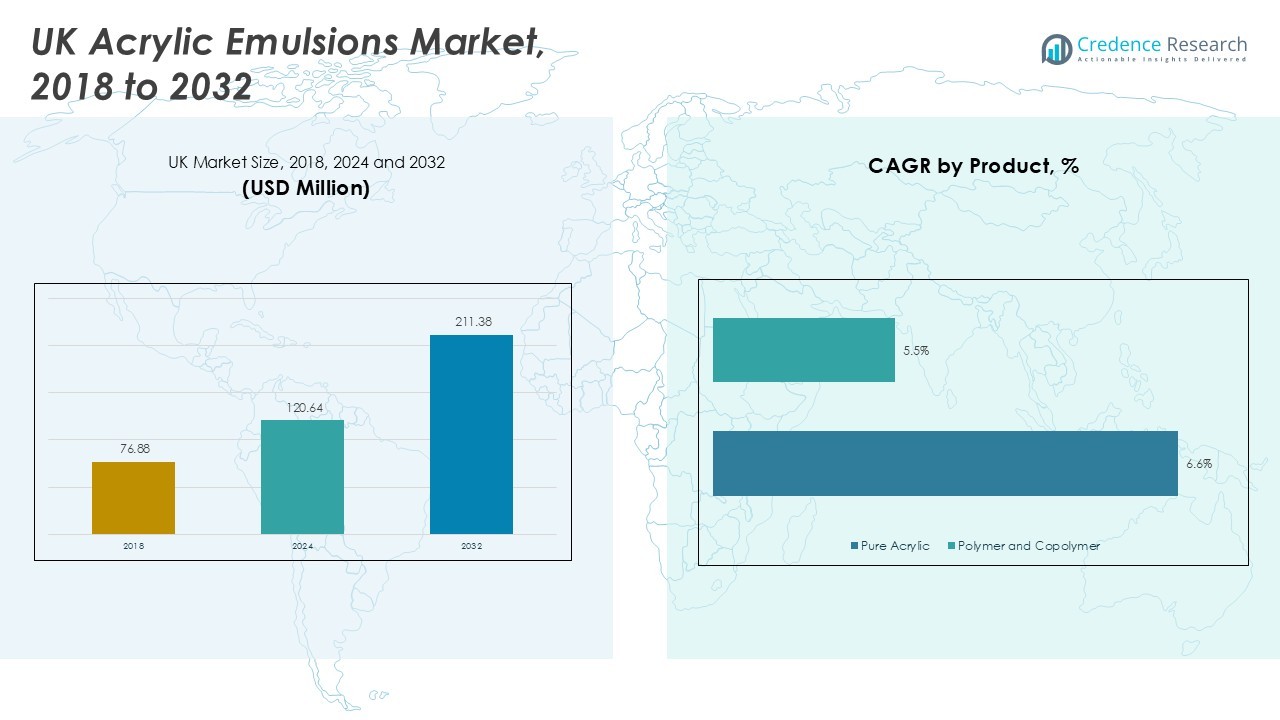

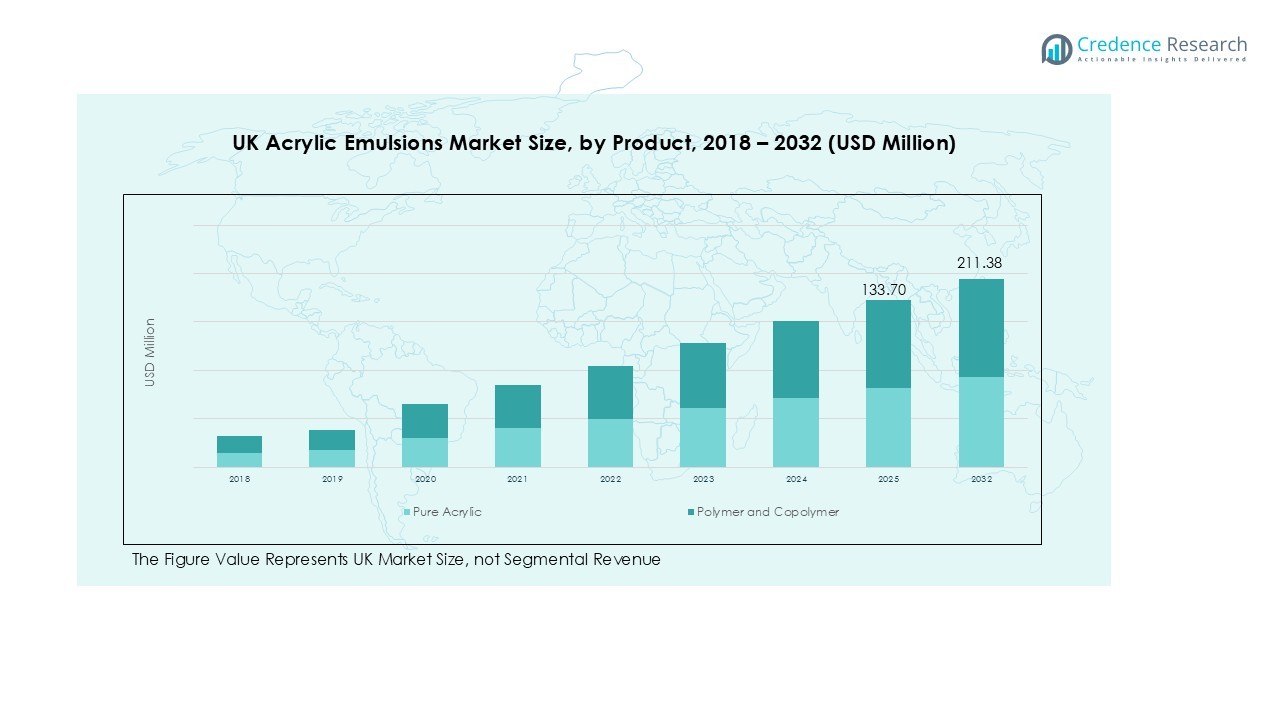

UK Acrylic Emulsions market size was valued at USD 76.88 Million in 2018, increasing to USD 120.64 Million in 2024, and is anticipated to reach USD 211.38 Million by 2032, growing at a CAGR of 6.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Acrylic Emulsions market Size 2024 |

USD 120.64 Million |

| UK Acrylic Emulsions market, CAGR |

6.76% |

| UK Acrylic Emulsions market Size 2032 |

USD 211.38 Million |

The UK Acrylic Emulsions market is highly competitive, led by key players including Synthomer plc, Akzo Nobel N.V., BASF SE, Trinseo PLC, DIC Group, Covestro AG, Arkema, The Lubrizol Corporation, Avery Dennison, and Clariant AG. These companies focus on innovation, expanding product portfolios, and strengthening distribution networks to maintain market leadership. England emerges as the dominant region, commanding a 65% market share, driven by extensive residential, commercial, and infrastructure projects in cities such as London, Manchester, and Birmingham. Scotland, Wales, Northern Ireland, and other regions collectively contribute the remaining share, with increasing adoption of eco-friendly and high-performance emulsions. Strong R&D capabilities, technological advancements, and strategic initiatives by top players reinforce their leadership while meeting the growing demand across architectural, industrial, and specialty applications in the UK Acrylic Emulsions market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Acrylic Emulsions market was valued at USD 120.64 Million in 2024 and is projected to reach USD 211.38 Million by 2032, growing at a CAGR of 6.76% during the forecast period.

- Rising construction activities, demand for eco-friendly low-VOC coatings, and technological advancements in emulsion formulations are driving the growth of the UK Acrylic Emulsions market.

- Paints and Coatings dominate the application segment with a 54% share, while Pure Acrylic holds the largest share of 58% in the product segment, reflecting strong demand for high-performance, durable coatings.

- The market is highly competitive, led by Synthomer plc, Akzo Nobel N.V., BASF SE, Trinseo PLC, DIC Group, Covestro AG, and other major players, who focus on innovation, strategic partnerships, and product diversification.

- England leads regional demand with a 65% market share, followed by Scotland at 12%, Wales 9%, Northern Ireland 6%, and other regions contributing 8%, reflecting concentrated industrial and construction activity.

Market Segmentation Analysis:

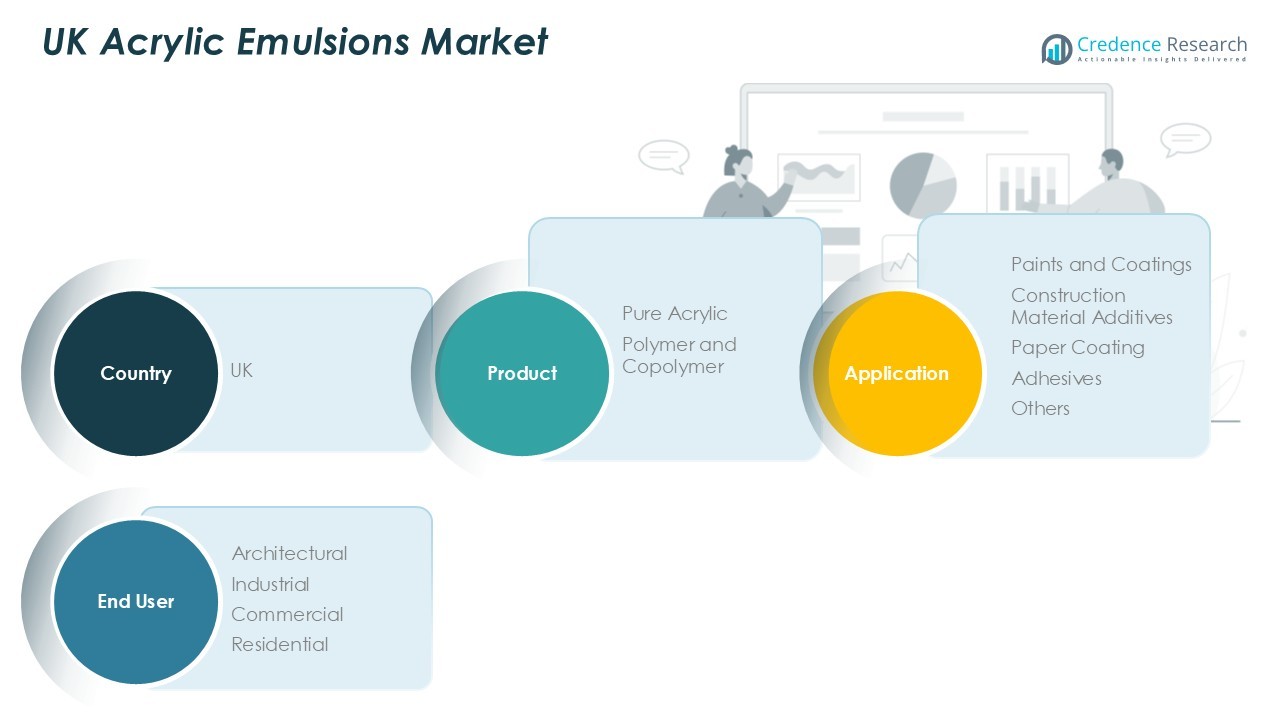

By Product Segment:

In the UK Acrylic Emulsions market, the product segment is primarily divided into Pure Acrylic and Polymer & Copolymer. Pure Acrylic dominates the market with a share of approximately 58%, driven by its superior durability, chemical resistance, and versatility across multiple applications. Manufacturers increasingly favor Pure Acrylic for high-performance coatings and adhesives due to its long-lasting finish and compatibility with water-based formulations. Polymer and Copolymer emulsions hold a significant share of around 42%, supported by their cost-effectiveness and adaptability in specialized industrial applications, yet the robust performance of Pure Acrylic maintains its leadership in the market.

- For instance, BASF produces pure acrylic emulsions widely used in high-performance architectural and industrial coatings, valued for their excellent adhesion and weather resistance, making them suitable for both exterior and interior applications.

By Application Segment:

The application segment is led by Paints and Coatings, capturing roughly 54% of the UK market. Strong demand in architectural and decorative coatings, coupled with growing construction activity, fuels this dominance. Construction Material Additives follow with a 20% share, leveraging acrylic emulsions to enhance cement and mortar properties. Paper Coating, Adhesives, and Other applications collectively account for 26%, supported by rising packaging requirements and industrial bonding needs. Innovation in eco-friendly formulations and improved adhesion properties continues to drive growth across these segments, with Paints and Coatings remaining the most influential sub-segment.

- For instance, AkzoNobel’s introduction of low-VOC, water-based architectural coatings has supported strong demand in London and Southeast England, driven by sustainable building trends and urban refurbishment projects.

By End User Segment:

Architectural end users dominate the UK Acrylic Emulsions market with a 50% share, reflecting sustained demand from residential and commercial construction projects. Industrial users follow at 25%, utilizing emulsions in manufacturing and specialty coatings. Commercial and Residential sub-segments together account for 25%, supported by ongoing renovations and infrastructure development. Drivers include increasing emphasis on eco-friendly, low-VOC coatings, and the need for high-performance finishes that ensure durability and aesthetic appeal. The architectural segment’s preference for high-quality emulsions reinforces its leading market position.

Key Growth Drivers

Increasing Construction Activities

The expansion of residential, commercial, and infrastructure projects in the UK is a primary growth driver for the acrylic emulsions market. Rising urbanization and government initiatives for modern housing developments are boosting demand for paints, coatings, and construction material additives. Acrylic emulsions are favored for their durability, water resistance, and aesthetic appeal, making them essential in both new constructions and renovation projects. This sustained construction growth directly translates to increased consumption of high-performance acrylic-based solutions across architectural and industrial applications.

- For instance, Dow’s PRIMAL™ SF-016 ER acrylic emulsion is widely used in interior and exterior coatings across the UK for its excellent pigment binding capacity and exterior durability, enabling high-performance, low-odor paints suitable for modern construction needs.

Demand for Eco-Friendly Coatings

Environmental regulations and consumer awareness are driving demand for low-VOC and water-based coatings in the UK. Acrylic emulsions offer a sustainable alternative to solvent-based products, reducing harmful emissions while maintaining high performance. Manufacturers are increasingly developing eco-friendly formulations that meet stringent environmental standards, stimulating market growth. This shift is particularly evident in paints, adhesives, and paper coatings, where eco-compliance has become a decisive factor for end users, further reinforcing acrylic emulsions as a preferred choice in environmentally conscious applications.

- For instance, Celanese has developed 100% acrylic emulsions designed for low- to zero-VOC formulations, enabling manufacturers to produce durable coatings that meet environmental standards without sacrificing performance.

Technological Advancements in Emulsion Formulations

Continuous innovations in acrylic emulsion chemistry, such as enhanced adhesion, durability, and weather resistance, are driving market expansion. New copolymer blends and specialty emulsions improve performance across diverse applications, including coatings, adhesives, and construction additives. These advancements enable manufacturers to cater to niche requirements, such as anti-corrosion or high-gloss finishes, which increases market adoption. As a result, the demand for technologically advanced emulsions is rising, positioning the UK market for sustained growth through improved product offerings and differentiated applications.

Key Trends and Opportunities

Rising Demand in Architectural Coatings

Architectural coatings represent a growing opportunity within the UK acrylic emulsions market, driven by renovation projects, aesthetic trends, and demand for durable finishes. The increasing preference for vibrant, long-lasting, and low-maintenance paints is fueling market growth. Manufacturers are exploring innovative color palettes, textured finishes, and performance-enhancing emulsions to capture this segment. This trend creates opportunities for premium product launches and partnerships with construction and real estate firms, strengthening market penetration and boosting overall demand for high-quality acrylic-based coatings.

- For instance, Dulux launched a quick-drying acrylic exterior paint designed for the UK’s variable climate, providing enhanced weather resistance and durability while catering to aesthetic demands.

Expansion in Industrial and Specialty Applications

Industrial applications, including adhesives, paper coatings, and specialty construction additives, are emerging as lucrative opportunities. Increasing automation, packaging demands, and protective coatings in industries are boosting consumption of acrylic emulsions. Manufacturers are capitalizing on this trend by developing customized solutions to meet industry-specific requirements, such as high adhesion, chemical resistance, or flexibility. This diversification beyond traditional architectural applications offers a strategic avenue for growth, allowing companies to expand revenue streams while addressing evolving market needs in both industrial and commercial sectors.

- For instance, BASF offers a strong portfolio of additives for industrial coatings that enhance sustainability and performance, catering specifically to industrial needs like protection and durability.

Key Challenges

Fluctuating Raw Material Prices

The UK acrylic emulsions market faces challenges due to volatile prices of key raw materials, such as acrylic monomers and polymers. Price fluctuations impact production costs, supply chain stability, and profit margins for manufacturers. Sudden increases in raw material costs may lead to higher product prices, affecting demand among price-sensitive end users. Companies must adopt efficient procurement strategies, cost optimization, and supply chain diversification to mitigate this challenge, ensuring competitiveness while maintaining product quality and consistent supply in a market sensitive to pricing dynamics.

Regulatory Compliance and Environmental Restrictions

Strict environmental regulations regarding VOC emissions, chemical safety, and waste management pose challenges for acrylic emulsion manufacturers. Compliance requires investment in R&D, reformulation, and testing, which can increase production costs and limit flexibility. Non-compliance may result in penalties or restricted market access. Additionally, evolving standards create uncertainty, requiring companies to adapt rapidly. This challenge underscores the need for continuous innovation in eco-friendly formulations while maintaining performance standards to meet regulatory requirements without compromising market competitiveness.

Regional Analysis

England

England leads the UK Acrylic Emulsions market with a dominant share of 65%, driven by extensive residential, commercial, and infrastructure projects. High urbanization, government-backed housing initiatives, and renovation activities have fueled demand for paints, coatings, and construction material additives. Architectural and industrial applications in major cities such as London, Manchester, and Birmingham significantly contribute to market growth. Manufacturers focus on premium and eco-friendly emulsions to meet consumer demand for low-VOC, high-performance coatings. The strong industrial base and continuous technological advancements in formulation further strengthen England’s position as the primary growth hub in the UK Acrylic Emulsions market.

Scotland

Scotland holds a 12% share of the UK Acrylic Emulsions market, supported by growing urban development and construction activities in Glasgow, Edinburgh, and Aberdeen. Increasing demand for architectural coatings, residential renovations, and commercial construction projects drives the adoption of acrylic emulsions. Industrial sectors are also exploring specialty coatings and adhesives to improve performance and sustainability. Manufacturers are introducing low-VOC, water-based formulations to comply with environmental regulations while catering to eco-conscious consumers. The Scottish market demonstrates steady growth, with rising investments in infrastructure and public housing creating consistent demand for high-quality acrylic emulsion products.

Wales

Wales contributes 9% to the UK Acrylic Emulsions market, with growth fueled by the residential and commercial construction sector. Regional government initiatives aimed at sustainable housing and renovation projects increase demand for water-based paints and coatings. The adoption of acrylic emulsions in construction material additives and adhesives is rising due to durability, weather resistance, and cost-effectiveness. Industrial applications in smaller urban centers are gradually expanding, providing new avenues for market growth. Manufacturers focus on localized production and distribution strategies, ensuring timely delivery of environmentally compliant, high-performance emulsions to meet Wales’ evolving architectural and industrial requirements.

Northern Ireland

Northern Ireland accounts for 6% of the UK Acrylic Emulsions market, with growth supported by urban development and infrastructure projects in Belfast and surrounding areas. Increasing construction of residential and commercial buildings drives demand for acrylic-based paints, coatings, and adhesives. Government initiatives promoting sustainable, low-VOC products further encourage adoption of eco-friendly emulsions. The industrial sector is gradually incorporating specialty emulsions for enhanced performance in protective coatings and bonding applications. Market expansion is facilitated by regional manufacturers and distributors offering tailored solutions to meet local construction and industrial needs, making Northern Ireland an emerging yet significant contributor to the UK Acrylic Emulsions market.

Other Regions

Other regions, including smaller urban and rural areas across the UK, collectively hold a 8% share of the acrylic emulsions market. Demand in these regions is primarily driven by residential renovations, small-scale construction projects, and industrial applications such as adhesives and paper coatings. Manufacturers are increasingly targeting these markets with cost-effective, eco-friendly emulsions to meet local consumer requirements. While growth is moderate compared to major regions, consistent government initiatives for housing and infrastructure, combined with rising awareness of sustainable products, are gradually enhancing the market presence of acrylic emulsions across these areas.

Market Segmentations:

By Product

- Pure Acrylic

- Polymer and Copolymer

By Application

- Paints and Coatings

- Construction Material Additives

- Paper Coating

- Adhesives

- Others

By End User

- Architectural

- Industrial

- Commercial

- Residential

By Region

- England

- Scotland

- Wales

- Northern Ireland

- Others

Competitive Landscape

The competitive landscape of the UK Acrylic Emulsions market is dominated by key players including Synthomer plc, Akzo Nobel N.V., BASF SE, Trinseo PLC, DIC Group, Covestro AG, Arkema, The Lubrizol Corporation, Avery Dennison, and Clariant AG. These companies focus on innovation, strategic partnerships, and expanding product portfolios to strengthen their market presence. Intense competition drives continuous improvements in formulation, eco-friendly solutions, and high-performance emulsions to meet diverse end-user requirements. Companies are investing in research and development to enhance durability, adhesion, and low-VOC characteristics of emulsions, catering to both architectural and industrial applications. Strategic initiatives, including mergers, acquisitions, and regional expansions, enable players to capture market share and address evolving customer demands, ensuring sustained growth and resilience in a competitive and highly dynamic market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Synthomer plc

- Trinseo PLC

- Akzo Nobel N.V.

- BASF SE

- DIC Group

- Covestro AG

- Arkema

- The Lubrizol Corporation

- Avery Dennison

- Clariant AG

Recent Developments

- In January 2023, Univar Solutions was appointed as the distributor for Dow’s acrylic emulsion polymer products, specifically from the PRIMAL™ and UCAR™ LATEX portfolios, in the UK and Ireland.

- In January 2023, Univar Solutions partnered with Dow as the distributor for Dow’s PRIMAL™ and UCAR™ LATEX acrylic emulsion products in the UK and Ireland, strengthening distribution in construction applications like cementitious products and architectural coatings.

- In May 2025, EPS launched a new fluorosurfactant-free acrylic emulsion, EPS 2731, for architectural coatings. The product provides enhanced exterior durability, resistance to dirt pickup, color fade, and efflorescence, along with low coalescent demand.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising construction and renovation activities across the UK.

- Demand for eco-friendly, low-VOC coatings will drive adoption of water-based acrylic emulsions.

- Architectural coatings will continue to dominate, supported by urban development and residential projects.

- Industrial applications, including adhesives and paper coatings, will expand with increasing automation and packaging needs.

- Technological advancements in emulsion formulations will enhance durability, adhesion, and weather resistance.

- Manufacturers will focus on product differentiation to capture niche applications and specialty markets.

- Strategic partnerships, mergers, and acquisitions will strengthen market presence and distribution networks.

- Regional demand in England, Scotland, and Wales will remain the primary growth driver.

- Sustainability initiatives and regulatory compliance will shape product innovation and market strategies.

- Market competition will intensify, encouraging continuous improvements in quality, performance, and eco-friendly offerings.