Market Overview

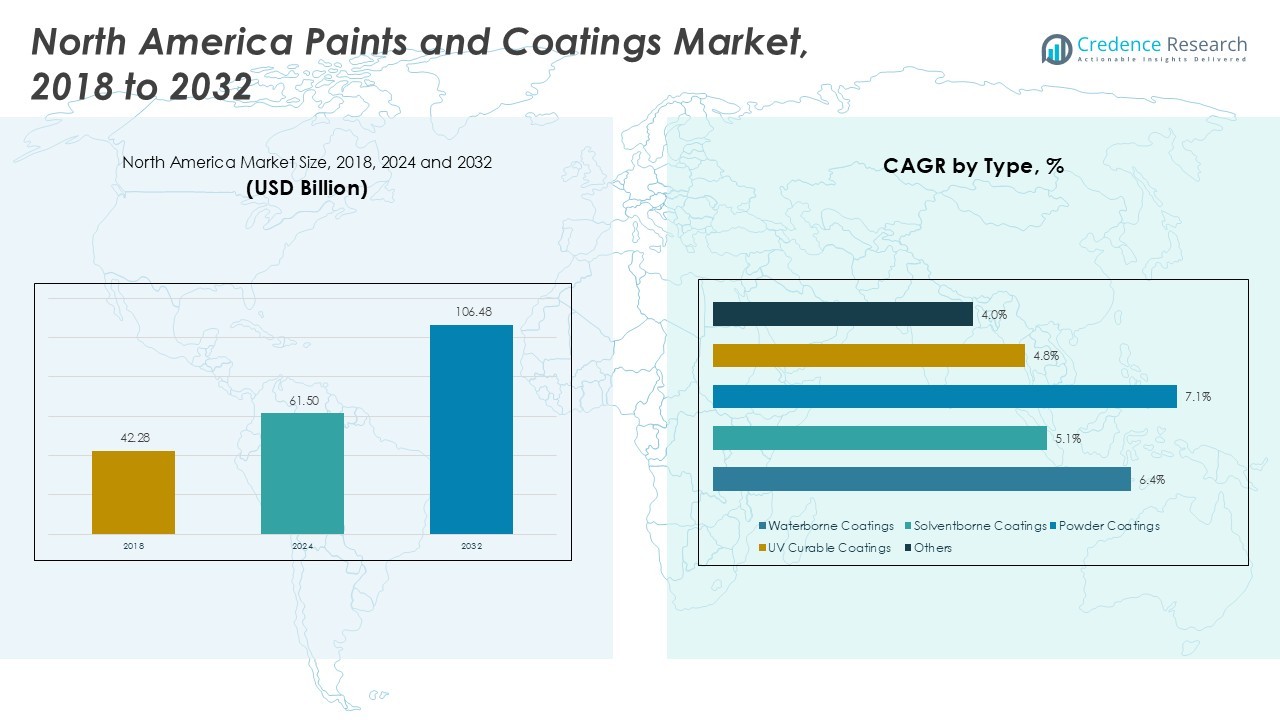

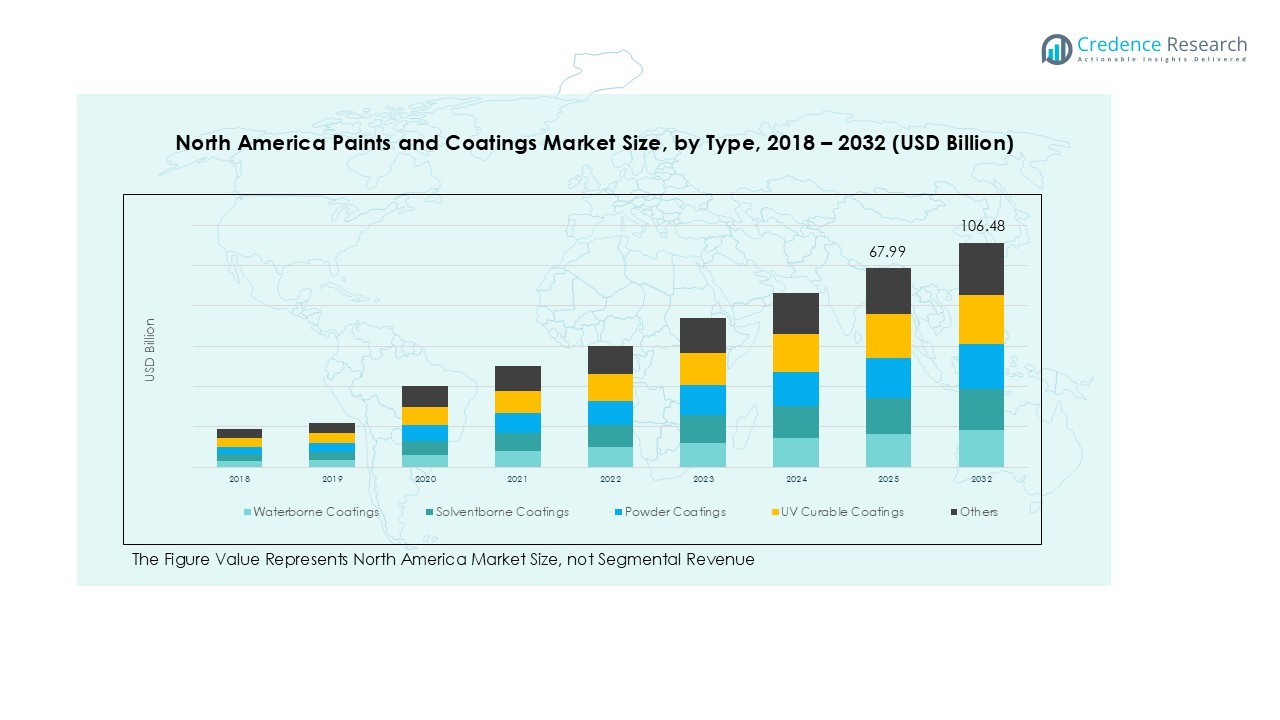

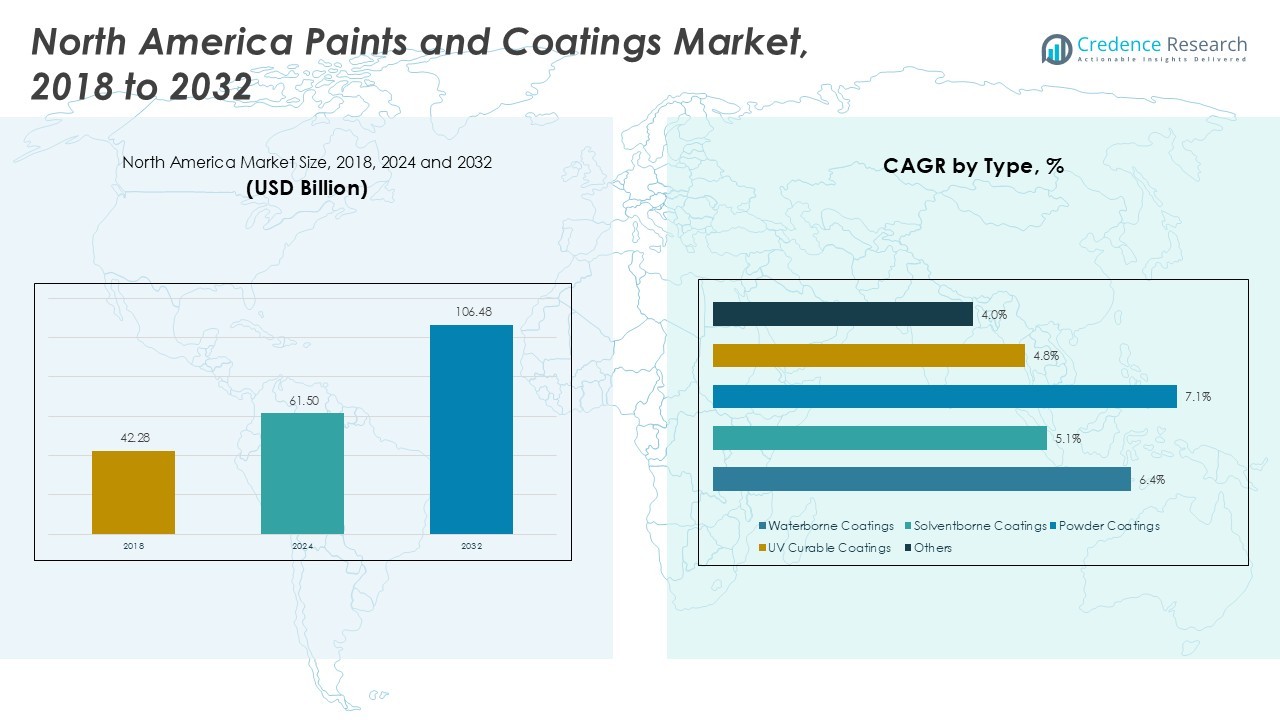

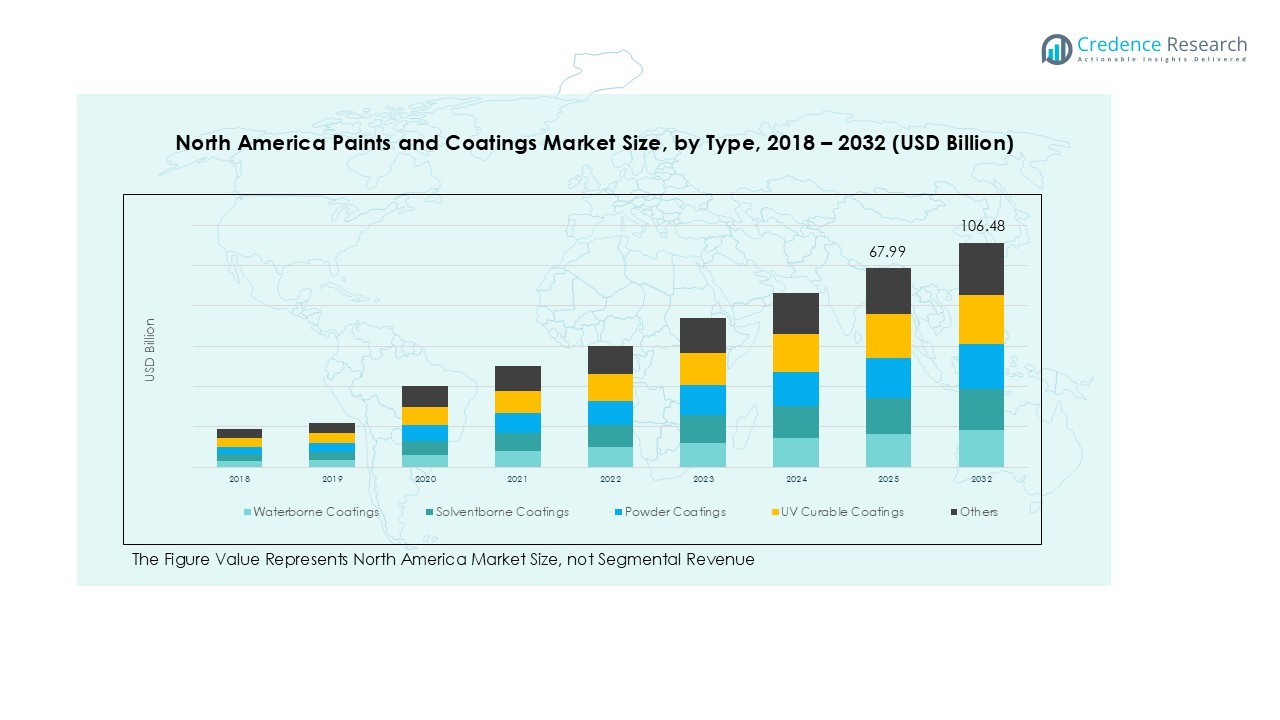

North America Paints and Coatings market size was valued at USD 42.28 Bn in 2018 and grew to USD 61.50 Billion in 2024. The market is anticipated to reach USD 106.48 Billion by 2032, registering a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Paints and Coatings market Size 2024 |

USD 61.50 Billion |

| North America Paints and Coatings market , CAGR |

6.6% |

| North America Paints and Coatings market Size 2032 |

USD 106.48 Billion |

The North America paints and coatings market is dominated by key players including Sherwin-Williams Company, Akzo Nobel N.V., PPG Industries, Inc., BASF SE, RPM International Inc., Asian Paints Limited, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Axalta Coating Systems, and Jotun A/S. These companies lead through innovation, sustainable product offerings, and strategic expansions, catering to residential, commercial, automotive, and industrial sectors. The United States is the largest regional contributor, holding a 68% market share, driven by robust construction activity, automotive production, and regulatory support for eco-friendly coatings. Canada follows with a 20% share, benefiting from infrastructure projects and industrial demand, while Mexico accounts for 12%, supported by growing industrialization and construction initiatives. Together, these regions shape the North American market, providing significant opportunities for growth in high-performance and environmentally compliant coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- North America paints and coatings market was valued at USD 61.50 Bn in 2024 and is projected to reach USD 106.48 Bn by 2032, growing at a CAGR of 6.6%. Waterborne coatings dominate the type segment with a 38% share, while acrylic coatings lead the technology segment with 32% share. Residential construction holds the largest end-user segment with 35% share.

- Market growth is driven by increasing demand for eco-friendly, low-VOC coatings and rising construction and renovation activities across the United States, Canada, and Mexico.

- Key trends include adoption of advanced coating technologies such as UV-curable and powder coatings, along with digital and automated application systems, enhancing efficiency and product performance.

- Competitive landscape is dominated by Sherwin-Williams, PPG Industries, Akzo Nobel, BASF, and RPM International, focusing on product innovation, sustainability, and strategic expansions.

- Market restraints include fluctuating raw material costs and strict environmental regulations, impacting pricing and operational efficiency, while regional growth is highest in the United States (68% share), followed by Canada (20%) and Mexico (12%).

Market Segmentation Analysis:

By Type:

The North America paints and coatings market is led by waterborne coatings, accounting for approximately 38% of the type segment. Their increasing adoption is driven by stringent environmental regulations and growing demand for low-VOC solutions across residential and commercial construction. Solventborne coatings follow with a 28% share, valued for their superior durability in industrial applications. Powder coatings (16% share) and UV curable coatings (10% share) are gaining traction due to energy efficiency and faster curing times, while other types contribute the remaining 8%, supporting niche industrial and decorative applications.

- For instance, Axalta Coating Systems LLC and PPG Industries Inc. have intensified competition in North America’s waterborne coatings segment, largely due to their high demand in automotive and architectural applications where low-VOC solutions are prioritized.

By Technology:

In terms of technology, acrylic coatings dominate the North American market, representing nearly 32% of the technology segment, attributed to their versatility, weather resistance, and strong aesthetic appeal. Epoxy coatings hold a 25% share, benefiting from robust performance in industrial and automotive applications. Polyurethane (PU) coatings account for 18%, favored for high-performance protective layers, while alkyd (12%) and polyester coatings (8%) continue to serve decorative and industrial segments. Other technologies, with a 5% share, are gradually emerging, focusing on eco-friendly and UV-curable solutions.

- For instance, PPG Industries offers advanced acrylic coatings in architectural applications known for strong aesthetic appeal and durability.

By End User Industry:

The residential construction sector leads the market with a 35% share, driven by rising housing demand and increased renovation activities. Commercial construction follows at 25%, supported by infrastructure development and sustainable building initiatives. The automotive segment accounts for 20%, benefiting from rising production and the need for corrosion-resistant coatings. Industrial manufacturing (12% share) and other end users (8%) continue to adopt specialized coatings for machinery, equipment, and protective applications, reflecting steady growth driven by performance and regulatory compliance requirements.

Key Growth Drivers

Rising Demand for Eco-Friendly Coatings

The North America paints and coatings market is propelled by increasing demand for environmentally friendly and low-VOC coatings. Regulatory frameworks and stricter emission standards encourage manufacturers and end users to adopt waterborne and powder coatings. Consumers and commercial builders increasingly prefer sustainable products that reduce indoor pollution and environmental impact. This shift not only boosts sales of compliant products but also incentivizes innovation in green technologies, creating long-term growth potential across residential, commercial, and industrial sectors.

- For instance, AkzoNobel has introduced sustainable coating solutions that contribute to healthier living spaces by significantly reducing emissions during application.

Expansion of Construction and Infrastructure Activities

The rapid growth of residential and commercial construction projects in North America drives significant demand for paints and coatings. Renovation and urban infrastructure initiatives stimulate demand for decorative, protective, and durable coatings. Rising urbanization, coupled with government investments in smart buildings and sustainable infrastructure, enhances the market’s scale. This demand spans both private and public projects, increasing the adoption of high-performance coatings, particularly waterborne and acrylic-based products, which offer longevity, aesthetic appeal, and compliance with evolving building standards.

- For instance, Sherwin-Williams provided premium architectural coatings for projects like The Stavros Niarchos Foundation Library and The Epic, emphasizing long-lasting durability and vibrant aesthetics to meet high indoor-air quality standards.

Growth in Automotive and Industrial Manufacturing

The automotive and industrial manufacturing sectors remain critical drivers for paints and coatings growth. Rising vehicle production, coupled with stringent safety and corrosion-resistance requirements, supports epoxy, polyurethane, and powder coatings. Similarly, industrial manufacturers increasingly rely on protective coatings to enhance equipment lifespan and reduce maintenance costs. Technological advancements in coating formulations, including UV-curable and high-durability products, further accelerate adoption, positioning these end-user industries as consistent revenue contributors while supporting innovation-led market expansion.

Key Trends & Opportunities

Technological Advancements in Coating Solutions

Advancements in coating technologies, including UV-curable, powder, and hybrid formulations, are creating new market opportunities. These technologies offer faster curing, higher durability, and lower environmental impact, appealing to both industrial and commercial users. Additionally, smart coatings with anti-corrosion, self-cleaning, and antimicrobial properties are gaining traction. Companies investing in R&D to develop innovative products can capture high-value segments, differentiate their portfolios, and strengthen market positioning, particularly in sectors requiring performance-driven solutions like automotive, aerospace, and industrial manufacturing.

- For instance, AkzoNobel has developed UV-curable powder coatings that cure within seconds under UV light, reducing production cycles and energy use while enabling coating of heat-sensitive substrates in electronics and luxury furniture sectors.

Increasing Adoption of Digital and Automated Coating Systems

The integration of digital and automated coating systems in industrial and commercial applications presents a significant growth opportunity. Automation improves efficiency, consistency, and waste reduction, while reducing labor costs. Advanced spray, robotic, and powder coating systems enhance productivity in high-volume manufacturing and construction projects. Additionally, digital color matching and smart coating technologies allow for precise customization, meeting evolving customer demands. Early adoption of such solutions provides a competitive edge for manufacturers, creating sustainable market expansion and operational efficiency gains.

- For instance, Sprimag’s Robot Shuttle System precisely coats complex automotive and electronic parts with flexible programming, minimizing setup time and maximizing productivity.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material prices, particularly for solvents, resins, and pigments, poses a major challenge to the North America paints and coatings market. Price fluctuations can impact profit margins, especially for small and mid-sized manufacturers. Supply chain disruptions, global trade uncertainties, and dependence on petrochemical derivatives further exacerbate cost pressures. Manufacturers must adopt strategic sourcing, alternative materials, and efficient production processes to maintain competitiveness, while balancing quality and compliance with environmental regulations.

Strict Environmental and Regulatory Compliance

Compliance with stringent environmental regulations, including VOC limits and hazardous chemical restrictions, presents a persistent challenge for manufacturers. Regulatory requirements demand significant investment in research, reformulation, and production process modifications. Non-compliance can result in fines, restricted market access, and reputational damage. Companies must proactively implement sustainable practices, adopt eco-friendly coatings, and continuously monitor evolving regulations to mitigate risks, ensuring both legal adherence and long-term market sustainability.

Regional Analysis

United States

The United States dominates the North America paints and coatings market, holding a market share of 68%. Strong growth is driven by extensive residential and commercial construction activities, rising automotive production, and increasing adoption of eco-friendly coatings. High demand for decorative and protective coatings supports the waterborne, acrylic, and epoxy segments. Government regulations promoting low-VOC and sustainable products further stimulate market expansion. Major players in the U.S., including Sherwin-Williams and PPG Industries, focus on innovative product launches and strategic acquisitions to strengthen their position, making the country the largest contributor to the regional market’s revenue.

Canada

Canada accounts for a market share of 20% in the North America paints and coatings market. Growth is primarily fueled by urban infrastructure projects, residential renovation activities, and industrial manufacturing requirements. Waterborne and acrylic coatings lead the market due to environmental regulations and performance advantages in cold climates. Automotive and industrial sectors also contribute to demand for high-performance coatings, including epoxy and polyurethane formulations. Leading companies actively invest in sustainable product development and localized manufacturing to meet regulatory standards and customer preferences, positioning Canada as a stable and growing market within the North American region.

Mexico

Mexico holds a market share of 12% in the North America paints and coatings market, driven by industrial growth, automotive production, and expanding residential and commercial construction. Demand for cost-effective, high-performance coatings, including solventborne and waterborne solutions, is increasing. Rapid industrialization and government support for infrastructure development encourage adoption of protective and decorative coatings. Companies operating in Mexico focus on partnerships, distribution network expansion, and localized manufacturing to capitalize on market growth. The rising preference for environmentally compliant coatings also drives innovation and product diversification, strengthening Mexico’s position as a key contributor to the North American paints and coatings landscape.

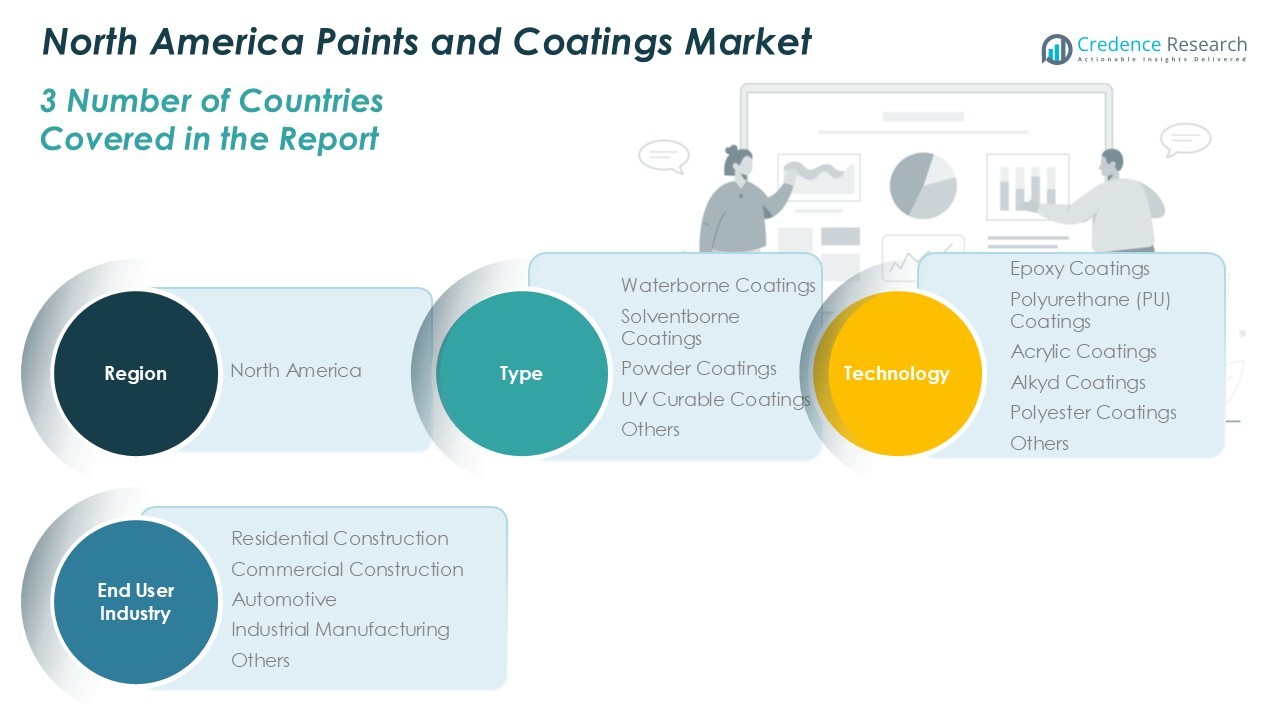

Market Segmentations:

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- North America overall

- U.S.

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America paints and coatings market is led by Sherwin-Williams Company, Akzo Nobel N.V., PPG Industries, Inc., BASF SE, RPM International Inc., Asian Paints Limited, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Axalta Coating Systems, and Jotun A/S. The market is highly fragmented, with companies focusing on product innovation, sustainable solutions, and expansion of distribution networks to strengthen their market presence. Key players are investing in low-VOC, waterborne, and high-performance coatings to comply with environmental regulations while meeting growing construction, automotive, and industrial demand. Strategic partnerships, mergers, and acquisitions further enhance competitiveness, allowing companies to capture high-value segments. Innovation in digital coating technologies, customized solutions, and eco-friendly formulations continues to drive differentiation, supporting long-term growth and establishing strong brand loyalty in the North American paints and coatings market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, BASF launched biomass-balanced refinish coatings in North America, focusing on sustainability and reducing the carbon footprint in the automotive sector.

- In October 2025, Axalta introduced Alesta® e-PRO FG Black and Alesta® e-PRO Dielectric Gray coatings to enhance heat protection and electrical insulation for electric vehicle batteries.

- In March 2025, BASF formed a strategic partnership with NIO to develop advanced coating technologies with a focus on sustainability and carbon neutrality.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User Industry, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily, driven by increasing construction and infrastructure activities.

- Adoption of eco-friendly and low-VOC coatings will accelerate across residential and commercial sectors.

- Waterborne and acrylic coatings are likely to maintain dominance in their respective segments.

- Automotive and industrial manufacturing will continue to demand high-performance and protective coatings.

- Technological innovations such as UV-curable, powder, and hybrid coatings will create new growth opportunities.

- Digital and automated coating systems will improve application efficiency and reduce waste.

- Companies will focus on R&D and sustainable product development to comply with environmental regulations.

- Strategic partnerships, mergers, and acquisitions will strengthen market positions and expand distribution networks.

- Rising awareness of energy-efficient and long-lasting coatings will drive adoption in industrial and commercial projects.

- North America will remain the leading region, with the United States retaining the largest market share.