Market Overview

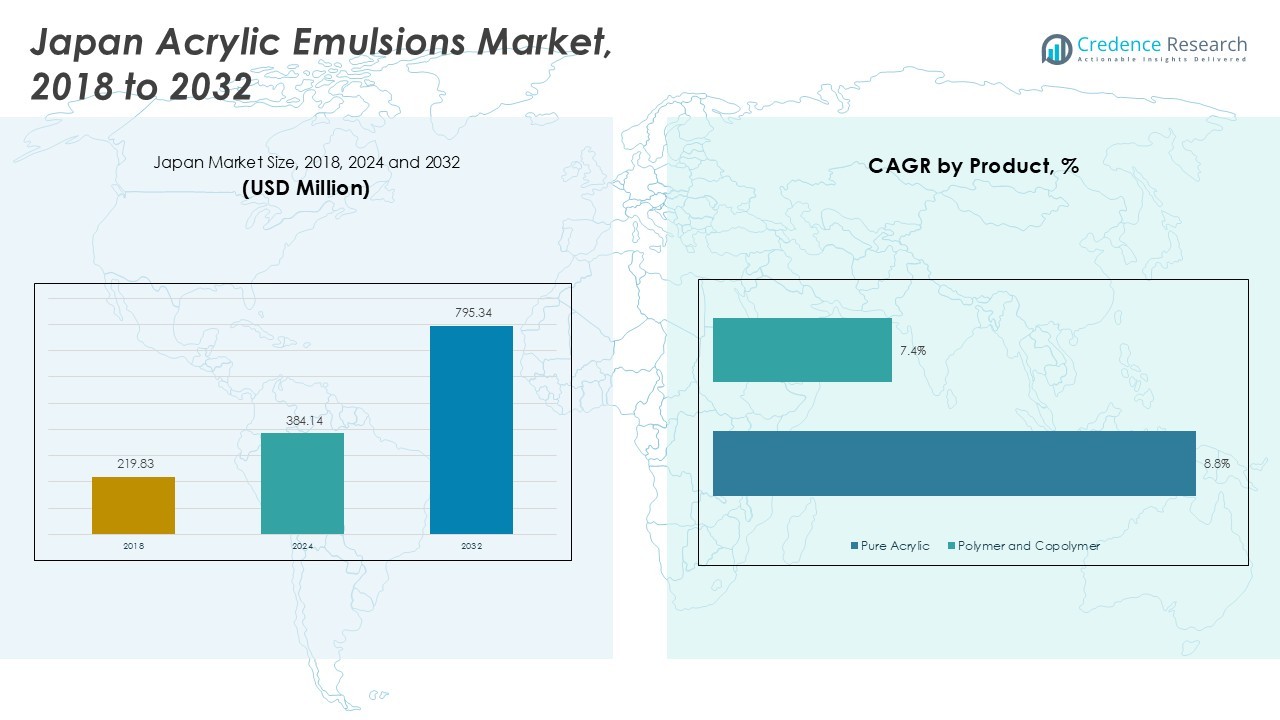

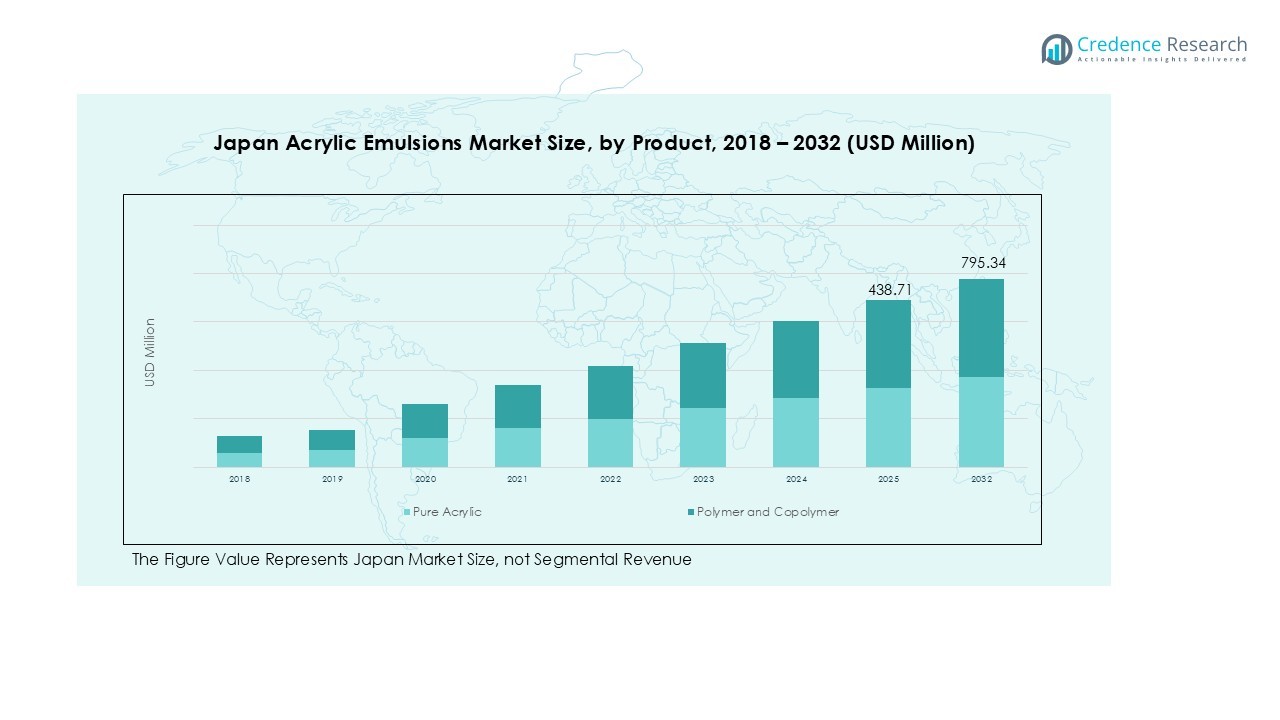

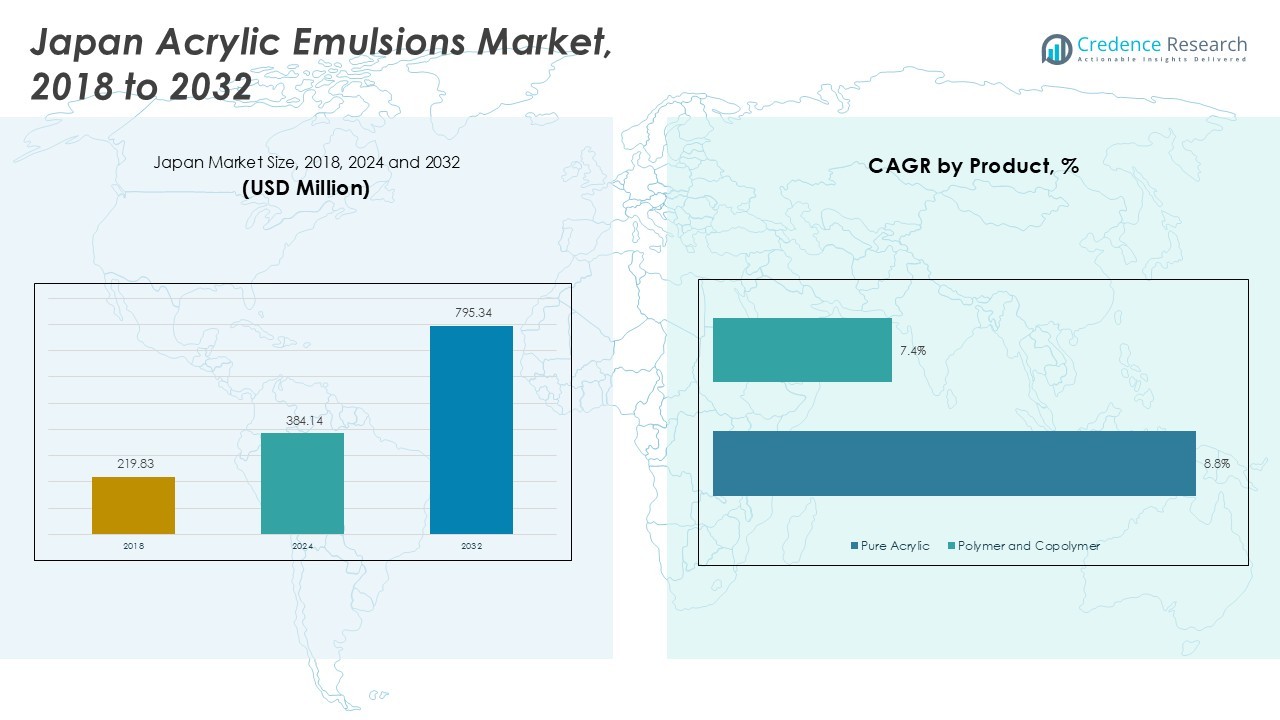

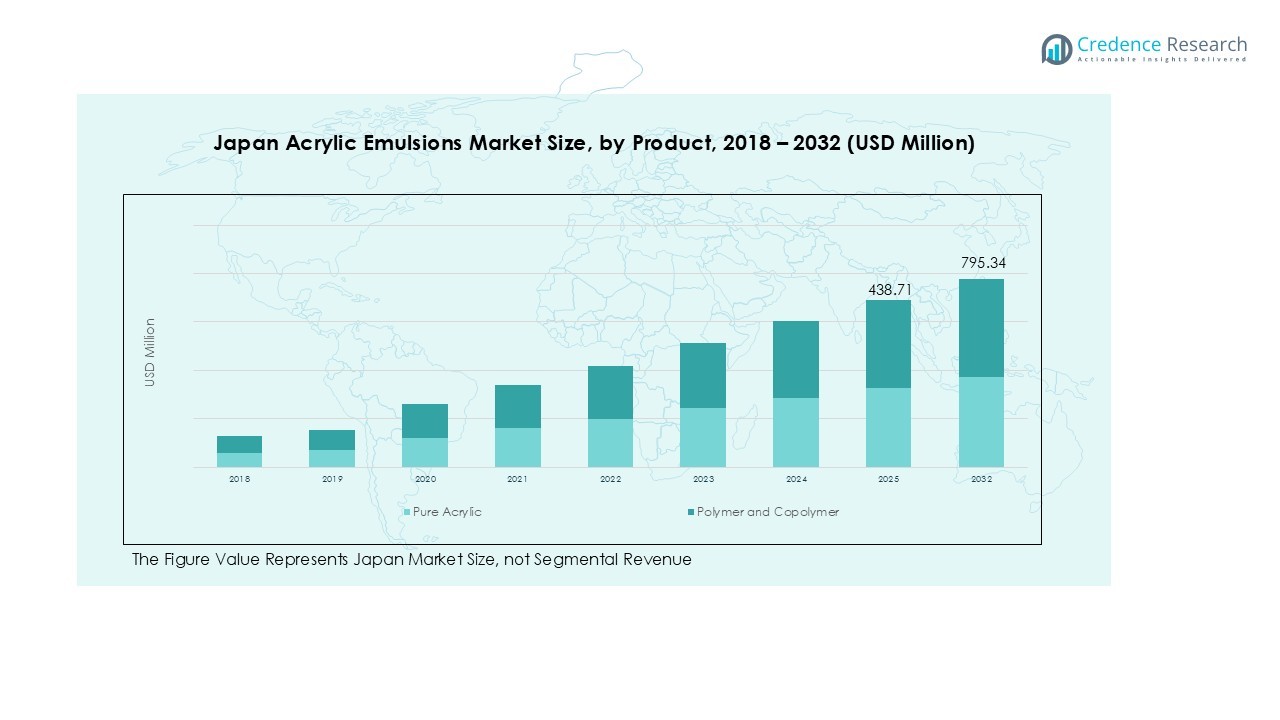

Japan Acrylic Emulsions Market size was valued at USD 219.83 million in 2018, reaching USD 384.14 million in 2024, and is anticipated to attain USD 795.34 million by 2032, registering a CAGR of 8.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Acrylic Emulsions Market Size 2024 |

USD 384.14 Million |

| Japan Acrylic Emulsions Market , CAGR |

8.87% |

| Japan Acrylic Emulsions Market Size 2032 |

USD 795.34 Million |

The Japan Acrylic Emulsions Market is led by major players such as DIC Group, Nippon Shokubai Co., Ltd., Mitsubishi Chemical Corporation, Tosoh Corporation, Sumitomo Chemical Co., Ltd., Mitsui Chemicals, Inc., Asahi Kasei Corporation, and UBE Industries, Ltd. These companies collectively hold a significant share of the domestic market, driven by strong manufacturing capabilities, innovation in eco-friendly formulations, and strategic expansion across industrial and architectural applications. Regionally, the Kanto region dominates with 37% of the total market share, supported by its extensive industrial infrastructure and construction activity. Kansai and Chubu follow as key regional hubs, benefiting from advanced manufacturing bases and increasing demand for sustainable coatings and adhesives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Acrylic Emulsions Market was valued at USD 384.14 million in 2024 and is projected to reach USD 795.34 million by 2032, registering a CAGR of 8.87% during the forecast period.

- Market growth is driven by the rising demand for water-based and low-VOC coatings, supported by Japan’s stringent environmental regulations and increasing infrastructure modernization projects.

- Emerging trends include the shift toward bio-based and sustainable formulations, along with advancements in polymer chemistry that enhance durability, weather resistance, and application versatility.

- The market is moderately consolidated, with leading players such as DIC Group, Nippon Shokubai, Mitsubishi Chemical, and Sumitomo Chemical investing heavily in R&D, product innovation, and eco-friendly solutions.

- Regionally, the Kanto region leads with 37% market share, followed by Kansai with 24% and Chubu with 18%; by segment, Polymer and Copolymer products account for 58%, and Paints and Coatings applications hold 62% of total market revenue.

Market Segmentation Analysis:

By Product:

The Polymer and Copolymer segment dominates the Japan Acrylic Emulsions Market, accounting for over 58% of the total market share in 2024. This dominance is driven by its exceptional versatility, durability, and cost efficiency in producing paints, coatings, and adhesives. Polymer and copolymer emulsions offer superior adhesion and weather resistance, making them ideal for both indoor and outdoor applications. Meanwhile, pure acrylic emulsions are witnessing steady growth due to their enhanced UV stability and eco-friendly characteristics, appealing to industries transitioning toward sustainable and low-VOC formulations.

- For instance, Dow’s PRIMAL™ AC-2337 pure acrylic emulsion polymer offers superior gloss, dirt resistance, and long-lasting performance in exterior house paints, making it popular in sustainable and low-VOC paint formulations.

By Application:

The Paints and Coatings segment leads the application category, capturing approximately 62% market share in 2024. The growth is primarily driven by Japan’s expanding construction and automotive industries, which demand high-performance coatings with improved gloss retention and environmental compliance. Acrylic emulsions are preferred in this segment due to their excellent film-forming properties and resistance to weathering. Additionally, rising consumer inclination toward water-based coatings and eco-safe materials continues to propel the use of acrylic emulsions across architectural and industrial coatings, reinforcing their dominant position in the Japanese market.

- For instance, Nissan is trialing a metamaterial-based “cool paint” that lowers vehicle surface temperatures by up to 21.6°F, improving energy efficiency for electric vehicles.

By End User:

The Architectural segment holds the largest share, representing about 54% of the Japan Acrylic Emulsions Market in 2024. This dominance is attributed to the strong use of acrylic emulsions in architectural paints and surface coatings for residential and commercial infrastructure. Growing urban redevelopment projects and the increasing demand for aesthetic, durable, and low-VOC coatings fuel this segment’s growth. The industrial segment follows closely, benefiting from Japan’s robust manufacturing base and the growing adoption of eco-friendly emulsions in industrial coatings and maintenance applications.

Key Growth Drivers

Rising Demand for Water-Based Coatings

The growing preference for water-based coatings in Japan significantly drives the acrylic emulsions market. Environmental regulations promoting low-VOC and solvent-free formulations have accelerated the shift from solvent-based to water-based systems. Acrylic emulsions offer superior adhesion, flexibility, and weather resistance, making them ideal for eco-friendly paints and coatings. With increasing awareness of sustainability among consumers and manufacturers, demand for water-based products continues to rise, strengthening the adoption of acrylic emulsions in architectural, industrial, and automotive coating applications.

- For instance, Nippon Paint Holdings Group introduced a water-based base paint that enables continuous coating for automotive repair, improving repair processes while supporting environmental regulations with low VOC emissions.

Expanding Construction and Infrastructure Development

Japan’s ongoing investments in infrastructure renewal and urban redevelopment are fueling demand for acrylic emulsions. The material’s superior bonding, water resistance, and flexibility make it a key component in construction coatings and additives. The government’s focus on energy-efficient and sustainable buildings further boosts the market, as acrylic emulsions support formulations for heat-reflective paints and waterproofing solutions. This construction boom, coupled with rising residential renovation activities, continues to reinforce market growth across architectural and commercial applications nationwide.

- For instance, BASF introduced a water-based acrylic emulsion for architectural coatings that enhances durability and weather resistance in Japanese buildings.

Technological Advancements in Polymer Chemistry

Continuous innovation in polymer and copolymer chemistry enhances the performance and application range of acrylic emulsions. Japanese manufacturers are investing in advanced emulsion polymerization techniques to develop products with improved UV resistance, gloss retention, and weatherability. These innovations enable customized solutions for diverse end users, from paints and coatings to adhesives and paper coatings. Enhanced production efficiency and bio-based raw material integration also strengthen the market’s sustainability profile, offering competitive advantages to manufacturers in both domestic and export markets.

Key Trends & Opportunities

Shift Toward Bio-Based and Sustainable Formulations

The Japan acrylic emulsions market is witnessing a strong trend toward bio-based formulations. Companies are increasingly adopting renewable feedstocks and green manufacturing processes to meet sustainability targets. These eco-friendly emulsions help reduce carbon footprints while maintaining performance standards comparable to synthetic products. As both consumers and industries emphasize sustainable choices, this shift presents significant opportunities for innovation and differentiation in product portfolios, particularly in paints, coatings, and construction materials.

- For instance, Dow’s PRIMAL™ RN-1000V is a high-performance acrylic emulsion for interior paints containing 30% biocarbon content, offering low odor and VOC emissions while maintaining excellent quality.

Rising Adoption in High-Performance Industrial Applications

Acrylic emulsions are gaining traction in high-performance industrial applications, including automotive coatings, protective films, and industrial adhesives. This trend is driven by Japan’s advanced manufacturing base and the growing need for durable, corrosion-resistant, and weather-stable materials. Continuous R&D in hybrid acrylic technologies enables manufacturers to enhance performance properties such as heat resistance and chemical durability. As industries seek multifunctional coatings, this segment offers a lucrative opportunity for market expansion and product diversification.

- For instance, 3M offers the Scotch-Weld™ Acrylic Adhesive DP805, a two-part acrylic adhesive widely used for bonding plastics and metals in industrial applications, known for its fast curing and strong adhesion without requiring special surface treatments.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material prices poses a major challenge for the Japan acrylic emulsions market. The dependence on petroleum-based feedstocks for acrylic monomers often leads to cost fluctuations influenced by global oil prices. This instability affects production costs and profit margins for manufacturers. Additionally, supply chain disruptions and import dependency can exacerbate pricing pressures. To counter these challenges, companies are investing in alternative bio-based materials and local sourcing strategies to stabilize operations and ensure consistent supply.

Stringent Environmental and Regulatory Compliance

Strict environmental regulations governing chemical usage and emissions create compliance challenges for acrylic emulsion manufacturers in Japan. Adhering to evolving safety and environmental standards, such as VOC limits and waste management laws, requires continuous process optimization and investment in cleaner technologies. Smaller manufacturers may face difficulty meeting these requirements due to limited financial resources. While the regulations promote sustainability, they also increase operational costs and complexity, compelling companies to adopt innovative and energy-efficient production methods to remain competitive.

Regional Analysis

Kanto

The Kanto region holds the largest share of the Japan Acrylic Emulsions Market, accounting for 37% of the total market in 2024. This dominance stems from the region’s strong industrial base, extensive construction projects, and the presence of key manufacturing hubs in Tokyo and Kanagawa. The growing adoption of eco-friendly paints and coatings in commercial and residential projects further fuels demand. Additionally, robust investments in infrastructure renovation and technological innovation drive the use of acrylic emulsions across various applications, particularly in paints, adhesives, and waterproof coatings.

Kansai

The Kansai region represents 24% of the Japan Acrylic Emulsions Market share in 2024, supported by its thriving automotive, electronics, and construction sectors. Osaka, Kyoto, and Hyogo serve as major production and consumption centers, driving demand for high-performance coatings and adhesives. Increasing industrial output and urban development contribute to consistent market expansion. Moreover, growing awareness of sustainable materials encourages local manufacturers to shift toward water-based and low-VOC acrylic emulsions, reinforcing Kansai’s position as a significant growth driver in Japan’s chemical and construction industries.

Chubu

The Chubu region accounts for 18% of the Japan Acrylic Emulsions Market share in 2024, driven by strong industrial manufacturing activities, particularly in Nagoya and Shizuoka. The region’s robust automotive and machinery sectors utilize acrylic emulsions in coatings, adhesives, and sealants to enhance durability and weather resistance. Rising investments in residential infrastructure and government-backed initiatives promoting sustainable building materials further accelerate growth. Chubu’s strategic industrial location and established supply chain networks continue to make it a key contributor to the overall market performance.

Kyushu and Okinawa

Kyushu and Okinawa collectively hold 12% of the Japan Acrylic Emulsions Market share in 2024. The region’s expanding construction sector, driven by residential development and tourism infrastructure projects, underpins steady market growth. Increasing demand for durable and weather-resistant coatings suitable for humid climates supports the use of acrylic emulsions in architectural and marine applications. Furthermore, rising investments in renewable energy and industrial manufacturing are boosting demand for eco-friendly and performance-enhanced polymer products, contributing to the region’s growing role in the national acrylic emulsions market.

Tohoku and Hokkaido

The Tohoku and Hokkaido region represents 9% of the Japan Acrylic Emulsions Market share in 2024. Growth in this region is supported by expanding residential and public infrastructure projects, particularly in reconstruction and energy-efficient building initiatives. The region’s cold climate has increased the use of acrylic emulsions in protective and insulating coatings, offering superior durability and weather resistance. Additionally, government-led regional revitalization programs are encouraging industrial activities, which indirectly stimulate demand for coatings and adhesives, ensuring steady growth for acrylic emulsions across northern Japan.

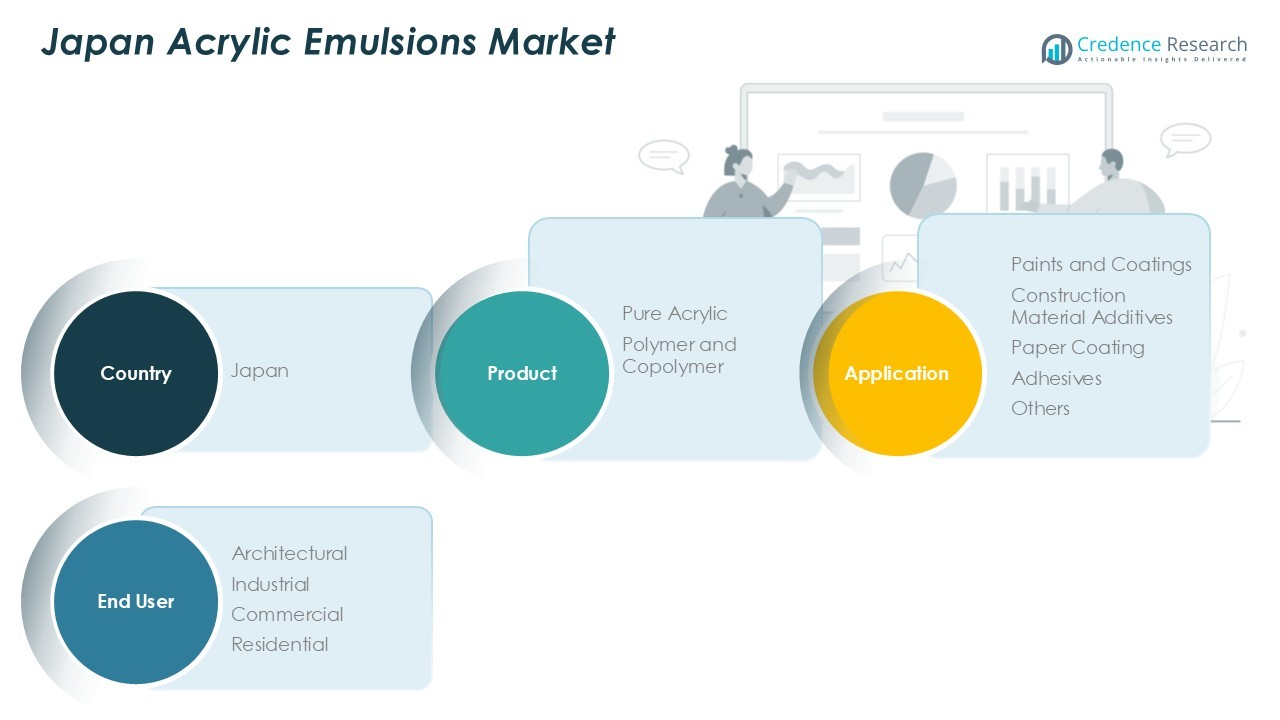

Market Segmentations:

By Product

- Pure Acrylic

- Polymer and Copolymer

By Application

- Paints and Coatings

- Construction Material Additives

- Paper Coating

- Adhesives

- Others

By End User

- Architectural

- Industrial

- Commercial

- Residential

By Region

- Kanto

- Kansai

- Chubu

- Kyushu and Okinawa

- Tohoku and Hokkaido

Competitive Landscape

The competitive landscape of the Japan Acrylic Emulsions Market features prominent players such as DIC Group, Nippon Shokubai Co., Ltd., Mitsubishi Chemical Corporation, Tosoh Corporation, Sumitomo Chemical Co., Ltd., Mitsui Chemicals, Inc., Asahi Kasei Corporation, and UBE Industries, Ltd. These companies dominate the market through strong production capabilities, extensive R&D investments, and diversified product portfolios. Most players focus on developing eco-friendly, low-VOC, and high-performance acrylic emulsions to meet Japan’s stringent environmental standards and growing demand for sustainable materials. Strategic collaborations, capacity expansions, and technological advancements in polymer chemistry remain central to maintaining competitiveness. Furthermore, companies are emphasizing local manufacturing and supply chain optimization to mitigate import dependencies and enhance cost efficiency. Continuous innovation, coupled with an increasing focus on bio-based emulsions and specialty formulations, is expected to shape the next phase of market growth and intensify competition among domestic and international participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DIC Group

- Nippon Shokubai Co., Ltd.

- Anhui Sinograce Chemical Co., Ltd.

- Tosoh Corporation

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- Asahi Kasei Corporation

- UBE Industries, Ltd.

Recent Developments

- In November 2024, Nippon Shokubai Ltd. acquired Emulsion Technology Co. (E-TEC) from JSR Corp., strengthening its capabilities in emulsion-based products, particularly for industrial applications.

- In July 2024, Trinseo launched LIGOS™ A 9200, a waterborne acrylic emulsion for flexible packaging, offering enhanced performance and environmental benefits aligned with the industry’s shift toward sustainable solutions.

- In 2024, DIC Group introduced a new line of low-VOC acrylic emulsions, catering to the growing demand for eco-friendly coatings in Japan while meeting stringent environmental regulations without compromising performance.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Acrylic Emulsions Market will continue to expand due to strong demand from construction, automotive, and industrial coating applications.

- Increasing adoption of water-based and low-VOC formulations will drive sustainable growth across end-use industries.

- Technological advancements in polymer chemistry will enhance product performance and widen application scope.

- Rising government support for green building initiatives will boost the use of eco-friendly acrylic emulsions.

- The paints and coatings segment will maintain its dominance, supported by architectural and infrastructure developments.

- Domestic manufacturers will focus on developing bio-based and high-performance emulsions to meet sustainability goals.

- Strategic partnerships and capacity expansions will strengthen the competitive position of leading companies.

- Growth in industrial and commercial renovation projects will sustain long-term market demand.

- Regional markets like Kanto and Kansai will remain primary hubs for production and consumption.

- Continuous R&D investments will drive innovation, efficiency, and product differentiation in the coming years.