Market Overview:

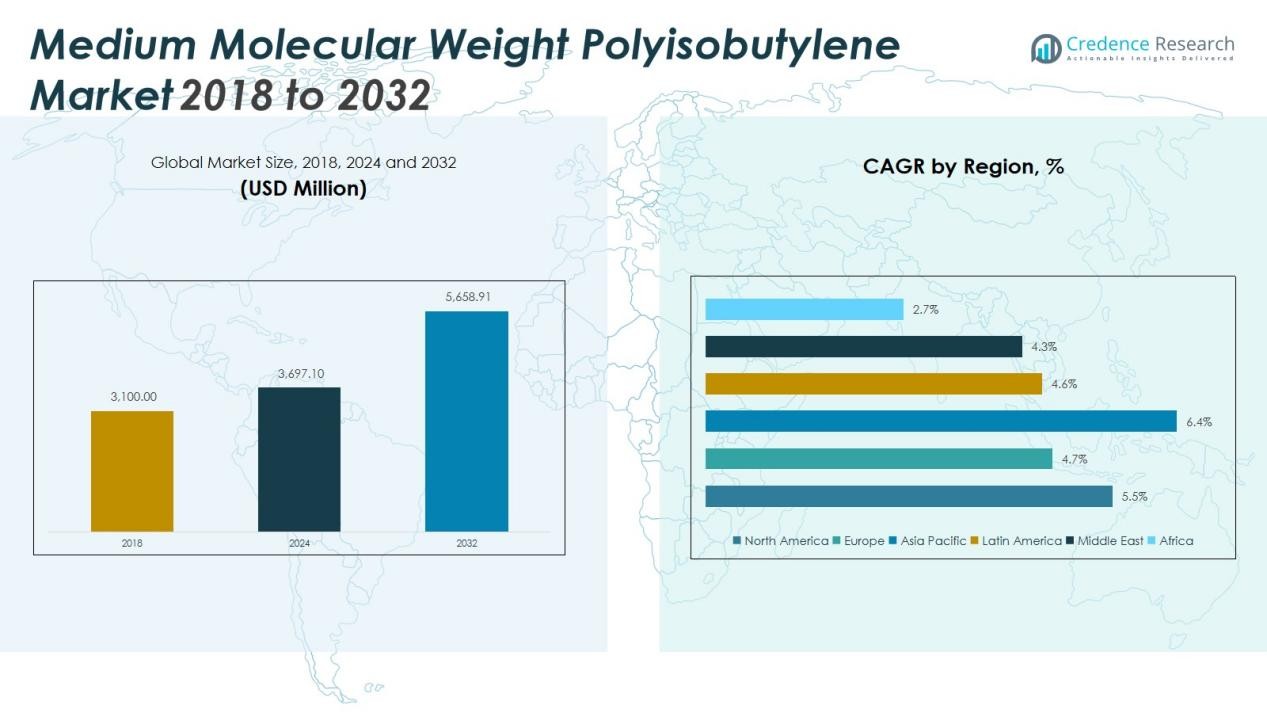

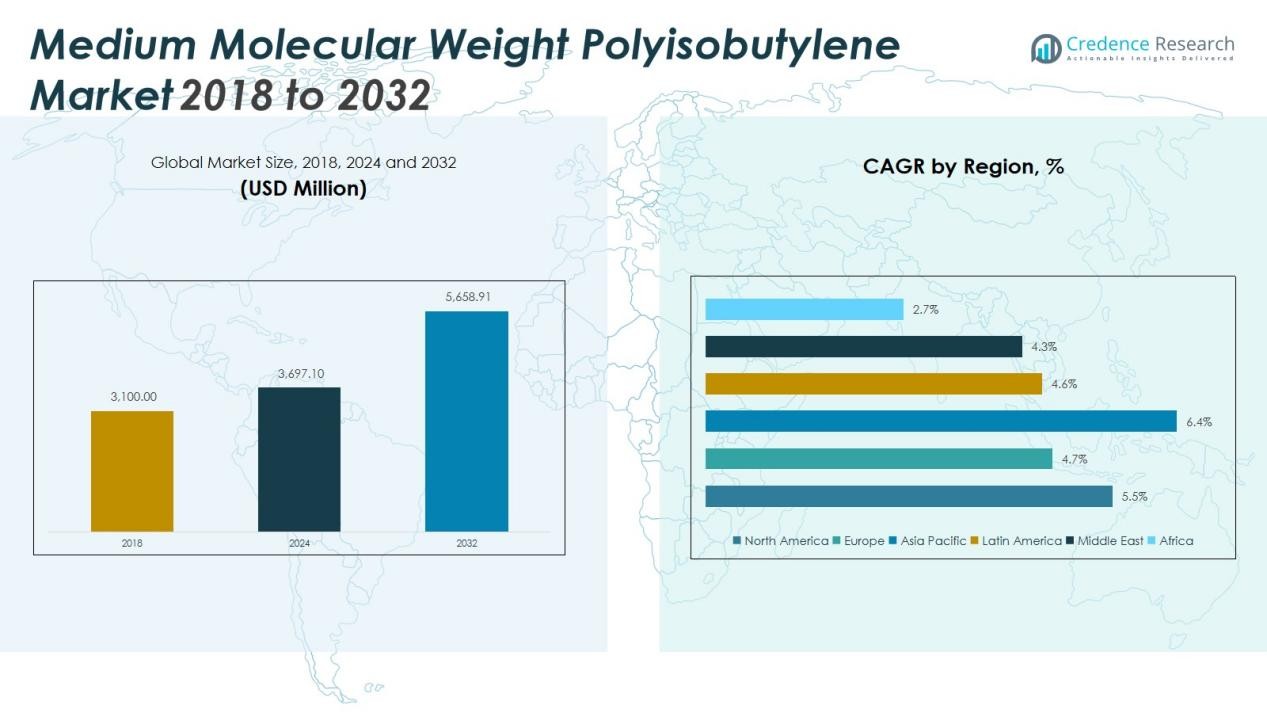

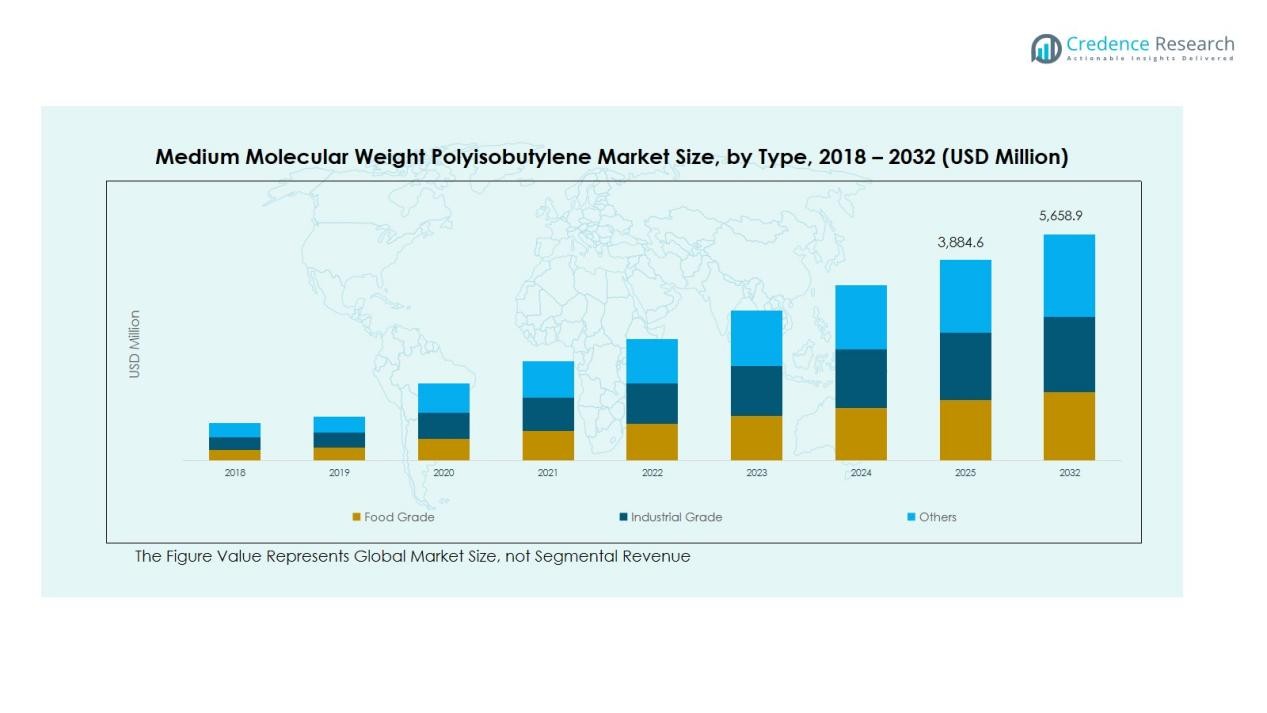

The Global Medium Molecular Weight Polyisobutylene Market size was valued at USD 3,100 million in 2018 to USD 3,697.10 million in 2024 and is anticipated to reach USD 5,658.91 million by 2032, at a CAGR of 5.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Molecular Weight Polyisobutylene Market Size 2024 |

USD 3,697.10 Million |

| Medium Molecular Weight Polyisobutylene Market, CAGR |

5.52% |

| Medium Molecular Weight Polyisobutylene Market Size 2032 |

USD 5,658.91 Million |

Key growth drivers include rising use of MMW PIB in adhesives and sealants, driven by infrastructure development and industrial modernization. The polymer’s flexibility, impermeability, and thermal stability make it ideal for durable bonding solutions. It is also widely used as a viscosity modifier in lubricants, enhancing fuel efficiency and reducing engine wear. Increasing preference for low-VOC and environmentally compliant materials further strengthens its market adoption.

Regionally, North America dominates the market due to strong automotive and chemical industries. Europe follows with steady demand from industrial manufacturing and infrastructure renovation. The Asia-Pacific region is expected to register the fastest growth, led by rapid industrialization, expanding automotive production, and increasing construction activities in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Medium Molecular Weight Polyisobutylene Market was valued at USD 3,697.10 million in 2024 and is projected to reach USD 5,658.91 million by 2032, growing at a CAGR of 5.52%.

- Rising demand in adhesives and sealants production drives growth, supported by infrastructure expansion and industrial modernization.

- North America leads with a 34% share in 2024, supported by established automotive, lubricant, and chemical industries.

- Europe holds 30% of the market, driven by sustainable product innovation and demand for low-emission materials.

- Asia-Pacific dominates with a 37% share and is the fastest-growing region due to industrialization in China, India, and Southeast Asia.

Market Drivers:

Rising Demand from Adhesives and Sealants Industry

The Global Medium Molecular Weight Polyisobutylene Market benefits from strong adoption in adhesives and sealants production. It offers high flexibility, resistance to moisture, and strong adhesion on varied surfaces. These properties make it ideal for automotive, construction, and packaging applications where durability is essential. Manufacturers favor MMW PIB for its stability and non-reactivity in harsh environments. This expanding use across industrial and consumer adhesives continues to strengthen market growth.

- For Instance, BASF continues to innovate with its broad portfolio of polyisobutylene (PIB)-based materials, marketed under the OPPANOL® and GLISSOPAL® brands, which are used in various automotive and industrial sealant applications due to their durability, flexibility, and barrier properties

Expanding Use in Lubricants and Fuel Additives

Increasing applications in lubricants and fuel additives drive steady demand for medium molecular weight polyisobutylene. It functions as a viscosity modifier and enhances the performance of engine oils by reducing wear and improving efficiency. The growing automotive sector, supported by global mobility needs, encourages lubricant innovation. Demand for cleaner and longer-lasting fuels further supports its use. This trend positions MMW PIB as a preferred material in the automotive and industrial lubrication markets.

- For instance, in 2024, the automotive lubricant market utilized 280,000 tons of polyisobutylene, with high-performance engine oils accounting for 65% of this consumption.

Growth in Automotive and Construction Industries

Rapid expansion of automotive and construction sectors strengthens the Global Medium Molecular Weight Polyisobutylene Market. It supports production of sealants, gaskets, and protective coatings used in vehicle assembly and infrastructure projects. Lightweight and high-performance materials gain preference for improving efficiency and structural reliability. Urbanization and industrial development in emerging economies increase consumption volumes. The integration of PIB-based solutions helps manufacturers meet quality and regulatory standards.

Technological Advancements and Sustainable Product Development

Ongoing innovation in polymer processing and product formulation enhances PIB’s performance and environmental profile. Companies invest in cleaner production methods to meet sustainability goals and reduce emissions. The focus on recyclable and low-VOC materials expands its appeal in multiple sectors. It aligns with industry efforts to improve energy efficiency and environmental safety. These advancements reinforce the long-term adoption of MMW PIB in diverse industrial applications.

Market Trends:

Shift Toward High-Performance and Specialty Applications

The Global Medium Molecular Weight Polyisobutylene Market is witnessing a steady transition toward high-performance and specialty-grade applications. It is increasingly used in high-durability adhesives, industrial sealants, and synthetic lubricants due to its superior elasticity and oxidation resistance. The demand for advanced materials that maintain performance under extreme temperature and pressure conditions supports this trend. Manufacturers are developing tailored PIB formulations for use in electrical insulation, rubber modification, and protective coatings. The growing focus on performance optimization in automotive and aerospace industries further enhances adoption. Investments in R&D aimed at improving molecular uniformity and purity expand the scope of specialized PIB products. This trend underscores the market’s move toward value-added applications that provide better functionality and longevity.

- For Instance, Daelim Industrial expanded its annual Highly Reactive Polybutene (HRPB) capacity at its Yeosu Industrial Complex from 65,000 tons to 100,000 tons.

Rising Focus on Sustainable Manufacturing and Circular Economy Practices

Sustainability has become a central trend shaping the production and use of medium molecular weight polyisobutylene. It drives efforts to develop low-carbon manufacturing processes and recyclable PIB-based products. Companies are investing in cleaner catalytic technologies and energy-efficient polymerization systems to minimize environmental impact. The push for environmentally compliant materials in construction, packaging, and automotive sectors encourages adoption of greener PIB formulations. It aligns with regulatory initiatives promoting low-VOC adhesives and sustainable polymers across global industries. Collaboration among producers and research institutions supports innovation in renewable feedstock utilization. This growing commitment to eco-efficient production methods strengthens the long-term competitiveness of the market.

- For instance, BASF increased its production capacity for medium-molecular weight polyisobutenes by 25% at its Ludwigshafen site by the first half of 2025.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Constraints

The Global Medium Molecular Weight Polyisobutylene Market faces challenges due to fluctuating prices of isobutylene and other petrochemical feedstocks. It depends heavily on crude oil derivatives, making production costs sensitive to global energy market instability. Supply chain disruptions and transportation delays further affect raw material availability. Manufacturers struggle to maintain consistent margins under these conditions. The imbalance between regional production capacities and demand growth also contributes to periodic shortages. Companies are focusing on developing alternative sourcing and long-term supplier partnerships to mitigate risks. Maintaining cost stability remains a key concern for market participants.

Stringent Environmental Regulations and Disposal Concerns

Strict environmental regulations concerning polymer production and waste management present ongoing challenges for industry players. It requires compliance with emission control standards and sustainable manufacturing practices. Non-biodegradable nature of PIB products raises concerns about post-use disposal and environmental persistence. Manufacturers must invest in cleaner technologies to reduce environmental impact and meet regional compliance norms. These regulatory pressures often increase production costs and slow product approvals. Transitioning toward eco-friendly formulations demands significant R&D investment and technological adaptation. The focus on sustainability continues to redefine competitive strategies across the market.

Market Opportunities:

Expansion in Emerging Economies and Industrial Growth Potential

The Global Medium Molecular Weight Polyisobutylene Market is positioned to benefit from rapid industrialization in emerging economies. Rising infrastructure development, growing automotive production, and expanding construction activities in Asia-Pacific and Latin America create new demand avenues. It supports applications in adhesives, sealants, and lubricants required for industrial and commercial projects. Increasing investments in manufacturing hubs like India, China, and Indonesia enhance local PIB consumption. Government initiatives promoting industrial modernization further stimulate market expansion. Companies are exploring regional production facilities to reduce import dependence and improve supply efficiency. This regional diversification strengthens global market reach and long-term growth prospects.

Development of Sustainable and High-Performance PIB Formulations

Growing interest in sustainable materials creates strong opportunities for innovation in PIB production. It encourages manufacturers to develop bio-based and recyclable variants that align with global sustainability goals. Advancements in catalytic polymerization and process optimization improve product efficiency and reduce emissions. Demand for low-VOC adhesives and environmentally safe lubricants supports this transition. Strategic R&D collaborations help producers design customized solutions for niche sectors such as aerospace and renewable energy. The emphasis on circular economy principles drives adoption of cleaner, high-performance PIB grades. This technological evolution enhances the competitiveness of leading market participants.

Market Segmentation Analysis:

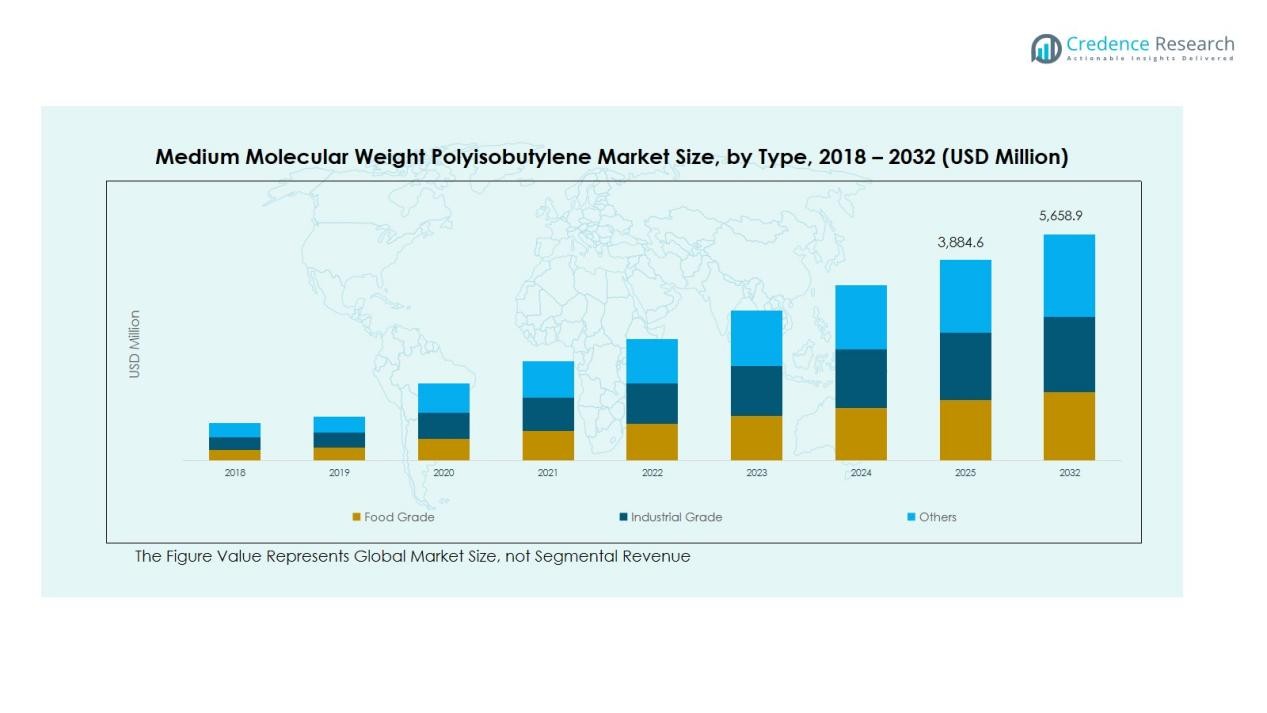

By Type

The Global Medium Molecular Weight Polyisobutylene Market is segmented into food grade, industrial grade, and others. The industrial grade segment dominates the market, driven by its use in adhesives, sealants, and lubricants. It provides strong chemical resistance and flexibility required in demanding industrial applications. The food grade segment holds a steady share, supported by its safe use in chewing gum and food packaging. Growing awareness of product purity and quality standards further drives demand across both categories.

- For instance, Daelim’s food-grade polyisobutylene (PB1300F, PB1400F, PB1500F) meets Korea Food Additives Board standards and is used as a base material for chewing gum and bubble gum formulations with viscosity ranging from 645 to 4700 cSt at 100°C.

By Application

Key applications include gum base, adhesives and sealants, lubricants, and others. The adhesives and sealants segment leads the market, supported by expanding construction and automotive industries. It benefits from PIB’s high adhesion strength and moisture resistance. The lubricant segment also contributes significantly due to increasing use in engine oils and fuel additives. Demand for gum base applications remains stable, backed by consumer preference for long-lasting chewable products.

- For instance, Sika developed SikaLastomer IG-105, a polyisobutylene-based thermoplastic primary sealant for insulating glass units that achieves a water vapor transmission rate of 0.1 g/(m²·d).

By End-User

The market serves automotive, construction, transportation, chemical, and other end-use sectors. The automotive segment holds the largest share due to PIB’s vital role in lubricant additives and sealing materials. The construction industry continues to adopt PIB-based sealants for durable, weather-resistant structures. The chemical sector shows growth potential in specialty formulations and coatings. Expanding industrial and transportation activities worldwide further sustain overall segment growth.

Segmentations:

By Type

- Food Grade

- Industrial Grade

- Others

By Application

- Gum Base

- Adhesives & Sealants

- Lubricants

- Others

By End-User

- Automotive

- Construction

- Transportation

- Chemical

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Medium Molecular Weight Polyisobutylene Market size was valued at USD 830.80 million in 2018, reached USD 974.53 million in 2024, and is projected to reach USD 1,488.87 million by 2032, at a CAGR of 5.5% during the forecast period. The Global Medium Molecular Weight Polyisobutylene Market in this region holds a 34% share in 2024, driven by strong demand from automotive and lubricant industries. It benefits from established manufacturing facilities, advanced R&D infrastructure, and a robust supply chain network. Growth in electric and hybrid vehicles also supports lubricant innovation, increasing PIB consumption. Construction and packaging industries continue to integrate PIB-based sealants due to their superior resistance properties. Stringent performance standards in industrial applications further promote high-quality PIB adoption across the region.

Europe

The Europe Medium Molecular Weight Polyisobutylene Market size was valued at USD 747.10 million in 2018, reached USD 853.19 million in 2024, and is anticipated to reach USD 1,226.58 million by 2032, at a CAGR of 4.7% during the forecast period. The region accounts for about 30% of the Global Medium Molecular Weight Polyisobutylene Market in 2024. It is driven by demand from the automotive, construction, and industrial manufacturing sectors. European manufacturers focus on developing eco-friendly and recyclable PIB formulations that comply with environmental standards. Growth in electric vehicle lubricants and low-emission sealants boosts product utilization. Research investments in polymer science enhance local production efficiency. The region’s emphasis on sustainability supports steady market expansion.

Asia Pacific

The Asia Pacific Medium Molecular Weight Polyisobutylene Market size was valued at USD 1,142.97 million in 2018, grew to USD 1,403.22 million in 2024, and is expected to reach USD 2,297.52 million by 2032, at a CAGR of 6.4% during the forecast period. The region dominates the Global Medium Molecular Weight Polyisobutylene Market with a 37% share in 2024. It benefits from rapid industrialization and large-scale infrastructure projects in China, India, and Southeast Asia. Expanding automotive manufacturing drives strong demand for PIB in lubricants and sealants. Urbanization and economic growth stimulate construction activities, enhancing PIB usage in adhesives. Favorable government policies and rising R&D investment encourage regional production. Local manufacturers continue to expand capacities to meet export and domestic demand.

Latin America

The Latin America Medium Molecular Weight Polyisobutylene Market size was valued at USD 198.40 million in 2018, increased to USD 234.36 million in 2024, and is projected to reach USD 333.14 million by 2032, at a CAGR of 4.6% during the forecast period. The region holds about 8% of the Global Medium Molecular Weight Polyisobutylene Market share in 2024. Demand is supported by growing construction, automotive maintenance, and industrial repair sectors. Brazil and Mexico remain key markets with increasing investment in automotive and lubricant production. Local manufacturers adopt PIB-based solutions to improve adhesive durability and weather resistance. Trade agreements and import liberalization promote material availability. Continued infrastructure expansion sustains moderate growth across the region.

Middle East

The Middle East Medium Molecular Weight Polyisobutylene Market size was valued at USD 127.10 million in 2018, grew to USD 142.68 million in 2024, and is expected to reach USD 198.66 million by 2032, at a CAGR of 4.3% during the forecast period. The region contributes around 6% to the Global Medium Molecular Weight Polyisobutylene Market in 2024. It benefits from expanding petrochemical industries and rising demand for advanced lubricants in energy and transportation sectors. Investment in infrastructure development supports PIB use in construction materials and sealants. The growing focus on diversifying economies away from oil dependency promotes industrial manufacturing. Local refineries enhance PIB feedstock production, improving supply stability. Strong downstream industry growth continues to drive regional market potential.

Africa

The Africa Medium Molecular Weight Polyisobutylene Market size was valued at USD 53.63 million in 2018, reached USD 89.12 million in 2024, and is anticipated to reach USD 114.14 million by 2032, at a CAGR of 2.7% during the forecast period. The region holds about 3% of the Global Medium Molecular Weight Polyisobutylene Market in 2024. It experiences gradual growth supported by urban development and emerging industrial activities. Rising automotive maintenance and construction applications drive limited yet steady PIB demand. Market expansion remains constrained by high import costs and limited local production capabilities. Growing partnerships between international suppliers and African distributors improve access to quality materials. Ongoing economic reforms and infrastructure projects are expected to create future market opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Medium Molecular Weight Polyisobutylene Market is characterized by strong competition among global and regional producers focusing on product innovation and capacity expansion. Key companies include BASF SE, JX Nippon Oil & Energy Corporation, Shandong Hongrui Petrochemical Co. Ltd., Zhejiang Shunda New Material Co., Ltd., TPC Group, INEOS Group Holdings S.A., ExxonMobil Corporation, and Lubrizol Corporation. It is driven by continuous investments in advanced polymerization technologies to improve product performance and sustainability. Companies emphasize long-term supply agreements and R&D collaborations to strengthen their market position. Expansion into high-growth regions such as Asia-Pacific and strategic partnerships with end-use industries enhance global reach. The competitive landscape remains dynamic, with leading players focusing on quality differentiation and cost optimization to maintain profitability amid volatile raw material prices.

Recent Developments:

- In August 2025, Zhejiang advanced materials cluster saw a major milestone when Global New Material International Holdings Ltd., a Zhejiang-based peer, held the acquisition closing ceremony for Merck KGaA Surface Solutions (SUSONITY) business and simultaneously launched its Asia-Pacific Headquarters in Hangzhou.

- In February 2025, TPC Group announced a leadership succession plan following the retirement of Senior Vice President Charles Graham, with Adrian Jacobsen promoted to Senior Vice President, Commercial, and Dan Valenzuela to Senior Vice President and Chief Financial Officer.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Medium Molecular Weight Polyisobutylene Market will witness steady growth driven by rising demand in adhesives, sealants, and lubricants applications.

- It will benefit from technological advancements that enhance polymer performance, stability, and environmental compatibility.

- Expansion of the automotive industry will continue to fuel consumption in lubricant additives and sealing materials.

- Construction and infrastructure development will strengthen demand for PIB-based adhesives and weather-resistant sealants.

- Manufacturers will focus on developing bio-based and recyclable formulations to align with sustainability goals.

- R&D investments will increase to support high-performance and specialty-grade product innovations.

- Strategic mergers and capacity expansions will enhance global production capabilities and market presence.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization and manufacturing growth.

- Collaborations between producers and end-user industries will improve product customization and application efficiency.

- Global trade liberalization and digital supply chain integration will further support long-term market expansion.