Market Overview:

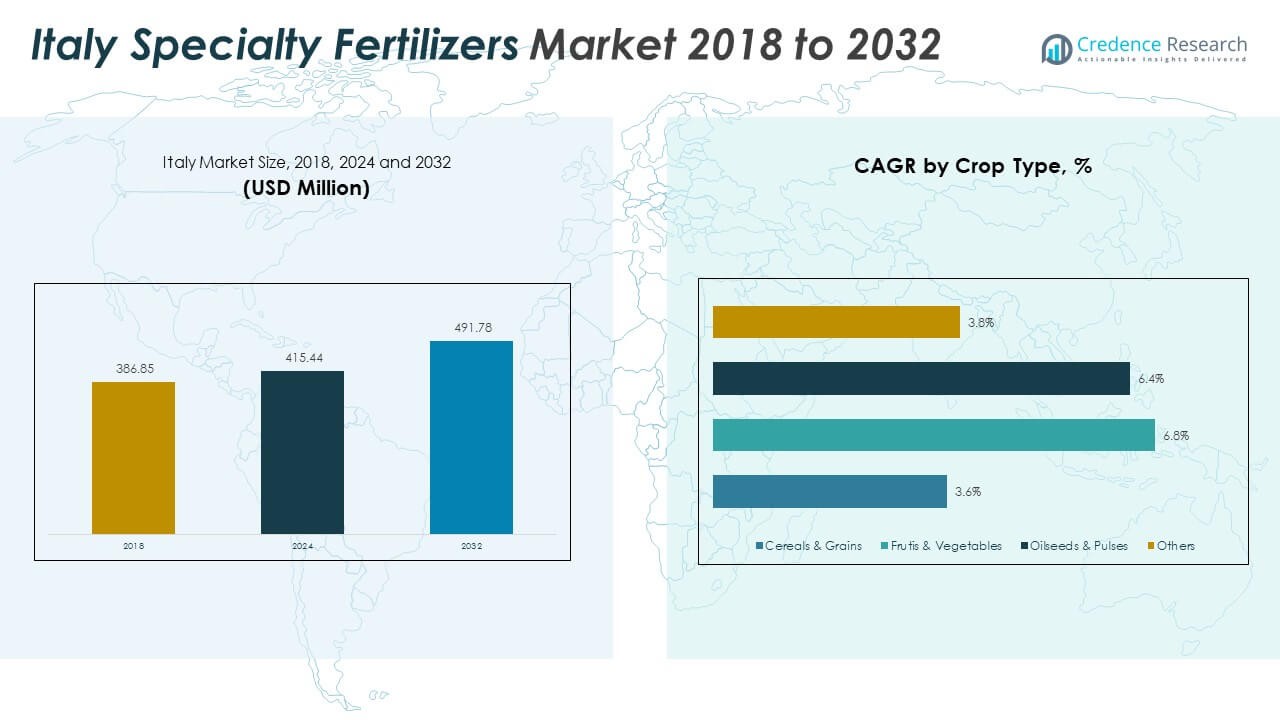

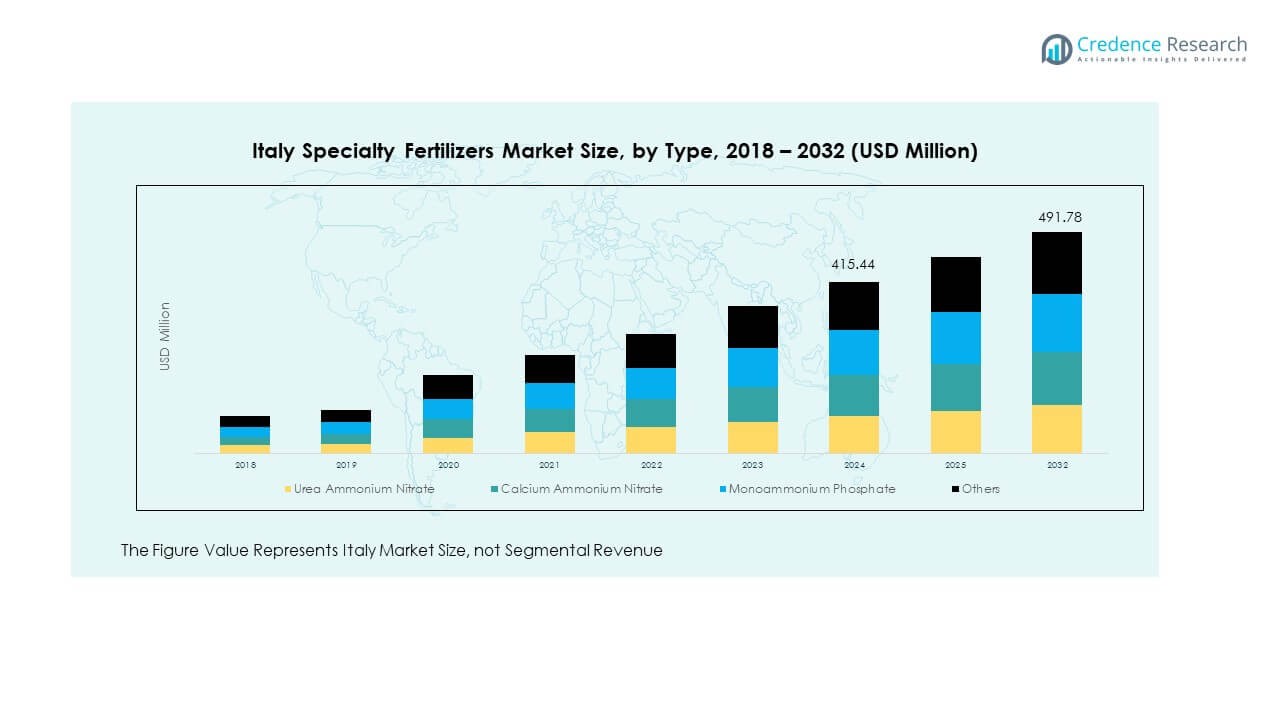

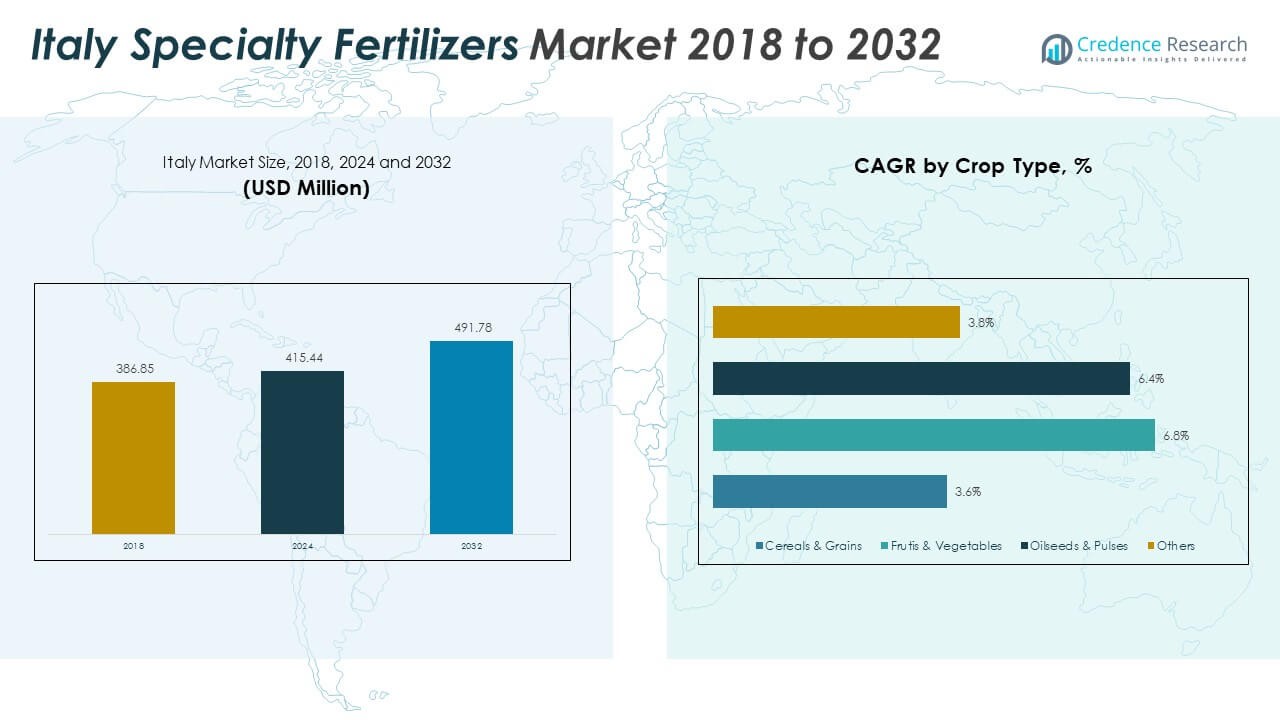

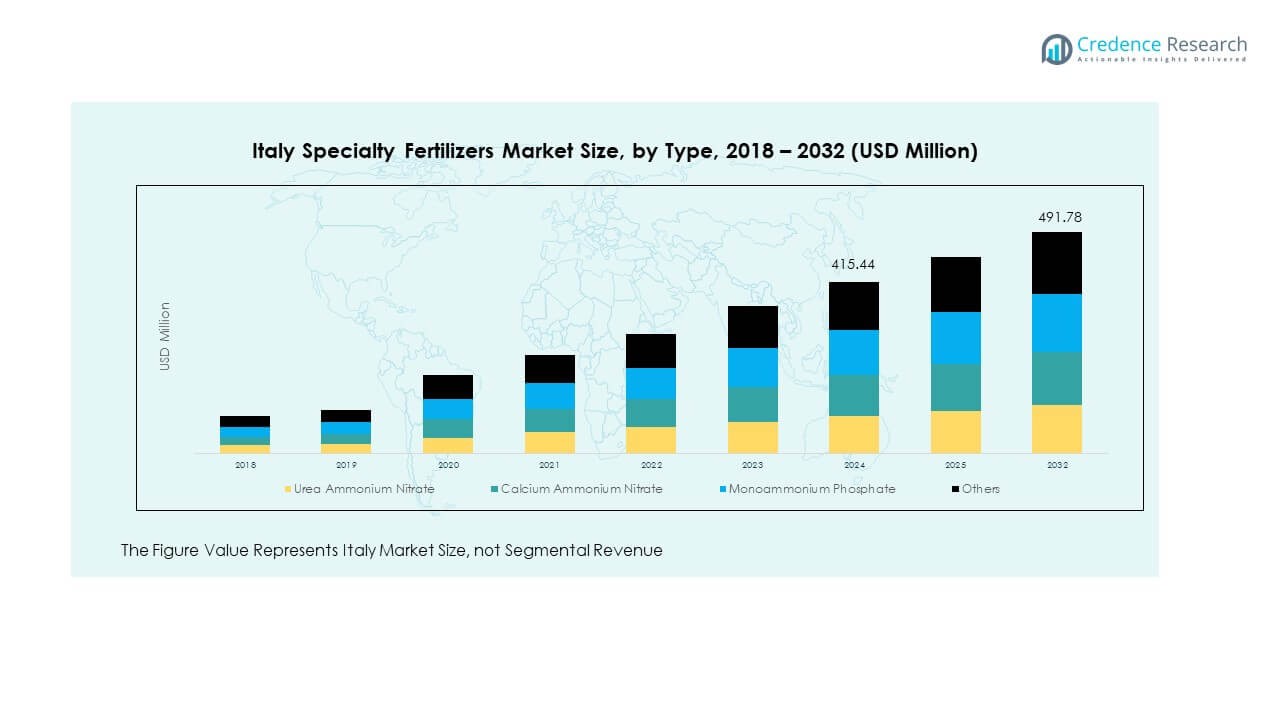

The Italy Specialty Fertilizers Market size was valued at USD 386.85 million in 2018 to USD 415.44 million in 2024 and is anticipated to reach USD 491.78 million by 2032, at a CAGR of 2.13% during the forecast period

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Specialty Fertilizers Market Size 2024 |

USD 415.44 Million |

| Italy Specialty Fertilizers Market, CAGR |

2.13% |

| Italy Specialty Fertilizers Market Size 2032 |

USD 491.78 Million |

Market growth is primarily driven by the rising adoption of precision agriculture and the expansion of greenhouse farming. Farmers are increasingly investing in controlled-release and water-soluble fertilizers to maximize nutrient efficiency and reduce losses. Regulatory pressures on traditional fertilizers encourage the shift toward sustainable options, creating demand for specialty formulations. Technological advancements, including digital nutrient monitoring and integration of biostimulants, enhance the performance of specialty fertilizers. Expanding fruit, vegetable, and horticulture production further supports long-term demand, making innovation a core competitive strategy for leading companies.

Regionally, Northern Italy leads the market due to its advanced farming practices, greenhouse adoption, and diversified high-value crops. Central Italy shows steady progress, supported by cereals, fruits, and mixed farming activities. Southern Italy, while still emerging, is seeing rising demand for specialty fertilizers, particularly in horticulture and small-scale farming. Regional differences in soil quality, crop diversity, and infrastructure shape adoption patterns, with Northern Italy serving as the most competitive and innovation-driven hub, while Central and Southern regions steadily expand their market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Specialty Fertilizers Market size was USD 386.85 million in 2018, reached USD 415.44 million in 2024, and is projected to hit USD 491.78 million by 2032, registering a CAGR of 2.13%.

- Northern Italy leads with 42% share due to advanced farming infrastructure, greenhouse adoption, and diverse high-value crops. Central Italy follows with 31%, supported by cereals and mixed cultivation, while Southern Italy holds 27%, driven by expanding small-scale and horticultural farming.

- Southern Italy, with a 27% share, is the fastest-growing region, supported by government incentives, rising demand for horticulture, and adoption of eco-friendly fertilizers.

- By type, urea ammonium nitrate and NPK blends stand out for their strong role in supplying balanced nutrients across multiple crop varieties, making them the most preferred options among farmers.

- By application, fertigation leads the market, supported by extensive greenhouse farming practices and the availability of efficient irrigation systems, especially across Northern and Central Italy.

Market Drivers

Rising Adoption Of Precision Agriculture And Technologically Advanced Nutrient Management

The Italy Specialty Fertilizers Market benefits from growing adoption of precision agriculture techniques. It allows farmers to apply nutrients accurately based on soil and crop requirements. Manufacturers provide controlled-release and water-soluble fertilizers that improve nutrient efficiency. Fertilizers designed for specific crops enhance yields and quality. It supports sustainable agricultural practices by reducing resource wastage. Digital nutrient monitoring tools offer real-time insights for improved farm management. Government initiatives encourage efficient fertilizer use to meet environmental standards. It strengthens competitive positioning for companies offering innovative specialty fertilizers.

- For instance, Haifa Group offers the NutriNet™ expert system, a free web-based platform that helps growers worldwide plan fertigation and fertilization programs by integrating crop, soil, and water data, improving nutrient use efficiency through tailored solutions.

Increased Focus On Sustainable Agriculture And Environmental Regulations

Environmental regulations in Italy push farmers to reduce chemical overuse. Specialty fertilizers help maintain soil health while meeting crop nutritional needs. It reduces nutrient runoff into water bodies, supporting ecological balance. Farmers show preference for eco-friendly, low-impact solutions. Certification programs highlight the benefits of sustainable fertilizer application. Research institutes collaborate with manufacturers to develop nutrient-efficient products. It drives investment in next-generation formulations for long-term soil fertility. Government incentives for sustainable practices encourage wider adoption across regions.

- For instance, Valagro is a recognized leader in biostimulant and specialty nutrients production, using the GeaPower technology platform to provide advanced solutions supporting nutrient efficiency and sustainable practices Valagro regularly collaborates with European research institutes to develop and validate products for soil health and ecological balance.

Expansion Of Horticulture And Greenhouse Farming Driving Demand

Horticulture and greenhouse farming expand rapidly in Northern and Central Italy. Specialty fertilizers enhance crop quality and consistency under controlled environments. It supports year-round production of vegetables, fruits, and flowers. Manufacturers supply nutrient blends tailored for greenhouse conditions. Soil-specific solutions help optimize growth and minimize crop loss. It increases profitability for high-value crop producers. Farmers adopt fertilizers that improve plant resilience against pests and diseases. It contributes to steady market growth through targeted product innovations.

Technological Advancements In Fertilizer Formulations Enhancing Efficiency

Fertilizer technology improves solubility, nutrient release patterns, and crop-specific blends. The Italy Specialty Fertilizers Market sees innovation in micronutrient-enriched formulations. It enhances nutrient uptake efficiency and reduces wastage. Manufacturers integrate data-driven insights to design advanced solutions. Controlled-release fertilizers extend nutrient availability throughout growth cycles. It reduces the need for frequent application and labor costs. Research in smart fertilizers strengthens competitive advantage. Farmers increasingly rely on products that deliver predictable results under varying conditions.

Market Trends

Shift Toward Digitally Integrated Fertilizer Solutions For Enhanced Farm Management

The Italy Specialty Fertilizers Market incorporates digital tools for soil and nutrient monitoring. It helps farmers adjust fertilizer application in real time. IoT-enabled devices provide data on soil moisture and nutrient levels. It enables predictive fertilization schedules for optimal crop output. Technology integration reduces over-application and nutrient losses. It fosters partnerships between tech providers and fertilizer manufacturers. Precision insights improve resource efficiency across farming operations. It creates opportunities for subscription-based digital fertilizer solutions.

- For instance, Yara partnered with PepsiCo Europe in May 2025 to deploy digital crop and soil monitoring across 1,000 farms covering 128,000 hectares in Italy and the EU, integrating the Atfarm platform and CropTrak analytics to optimize fertilizer use and help achieve a 24 percentage point reduction in fertilizer production emissions while maintaining crop yields.

Growing Demand For Crop-Specific And Customized Fertilizers Across Italy

Farmers prioritize fertilizers tailored to individual crop requirements. Specialty fertilizers in Italy include blends for cereals, vegetables, and fruits. It enhances yield, taste, and quality consistency. Formulations address local soil nutrient deficiencies and climatic conditions. It encourages R&D investments in nutrient-rich, targeted solutions. Companies collaborate with agricultural consultants to optimize crop nutrition. It reduces reliance on generic fertilizers with limited efficacy. Farmers adopt solutions that provide measurable improvements in productivity.

- For instance, field trials in Central Italy using Sentinel-2 NDVI imagery demonstrated the effectiveness of variable-rate nitrogen fertilization in wheat, where satellite data guided zone-specific recommendations and improved nitrogen use efficiency compared to uniform applications.

Rising Popularity Of Organic And Biodegradable Fertilizer Alternatives

Organic and biodegradable fertilizers gain attention for environmental and health reasons. The Italy Specialty Fertilizers Market responds with nutrient-rich, eco-friendly products. It helps maintain soil fertility without chemical buildup. Farmers seek organic solutions for premium crops and sustainable certifications. Innovative blends combine natural compounds with mineral nutrients. It supports integrated farming systems with reduced environmental impact. Consumer demand for clean-label produce drives adoption. Companies expand offerings to meet organic farming standards across regions.

Integration Of Advanced Micronutrients And Nano-Fertilizer Solutions

Micronutrient-enriched and nano-formulated fertilizers improve efficiency and crop performance. It provides precise nutrient delivery at cellular levels. The Italy Specialty Fertilizers Market benefits from research in nutrient absorption and retention. Manufacturers introduce products tailored for specific deficiencies and stress conditions. It supports high-yield and quality-focused cultivation practices. Trials indicate better growth, resilience, and nutrient uptake. Companies leverage advanced technology for differentiation in competitive markets. It attracts farmers seeking measurable productivity gains under diverse farming conditions.

Market Challenges Analysis

Complex Regulatory Environment And Compliance Requirements Limiting Market Growth

The Italy Specialty Fertilizers Market faces strict regulations for nutrient composition and environmental safety. Compliance increases operational costs for manufacturers. It requires rigorous testing and certification before market launch. Companies must adapt formulations to meet region-specific standards. Limited flexibility in raw material sourcing affects production schedules. It challenges smaller manufacturers with limited compliance infrastructure. Policy shifts and evolving standards demand continuous monitoring. It slows entry of innovative products into local markets. Firms must allocate resources for regulatory adherence and risk mitigation.

High Production Costs And Price Sensitivity Affecting Market Penetration

Specialty fertilizers involve advanced technology, increasing production and R&D costs. It affects affordability for small and mid-scale farmers. Market growth slows in regions with cost-sensitive agricultural segments. Transport and storage of nutrient-rich formulations add additional expenses. It creates reliance on premium product segments with slower adoption rates. Price fluctuations in raw materials impact profitability. It challenges manufacturers to balance innovation with cost-effectiveness. Strategic pricing and value-based solutions are essential to maintain competitiveness.

Market Opportunities

Expansion Of High-Value Crop Segments And Greenhouse Cultivation Creating Growth Potential

The Italy Specialty Fertilizers Market can target high-value vegetables, fruits, and floriculture. It supports year-round greenhouse production through precise nutrient formulations. Companies can develop crop-specific fertilizers to maximize yield and quality. It encourages collaborations with greenhouse operators for tailored solutions. Controlled-release and micronutrient-enriched fertilizers enhance productivity under intensive farming conditions. It opens opportunities in regions expanding protected agriculture infrastructure. Strategic partnerships with research institutions strengthen product efficacy. Farmers benefit from predictable results and optimized resource use.

Emergence Of Technologically Advanced Fertilizer Products Driving Market Expansion

Advanced formulations, including nano-fertilizers and digital nutrient monitoring, offer new growth avenues. It enables precise, efficient, and sustainable fertilization practices. Companies can introduce subscription-based smart fertilizer programs for commercial farms. It encourages data-driven decisions that optimize nutrient application and reduce losses. Innovation in biodegradable and organic blends attracts environmentally conscious farmers. It strengthens competitive positioning of early adopters in Italy. Manufacturers can expand market share by demonstrating measurable productivity gains. Farmers gain from enhanced efficiency, quality, and profitability through advanced solutions.

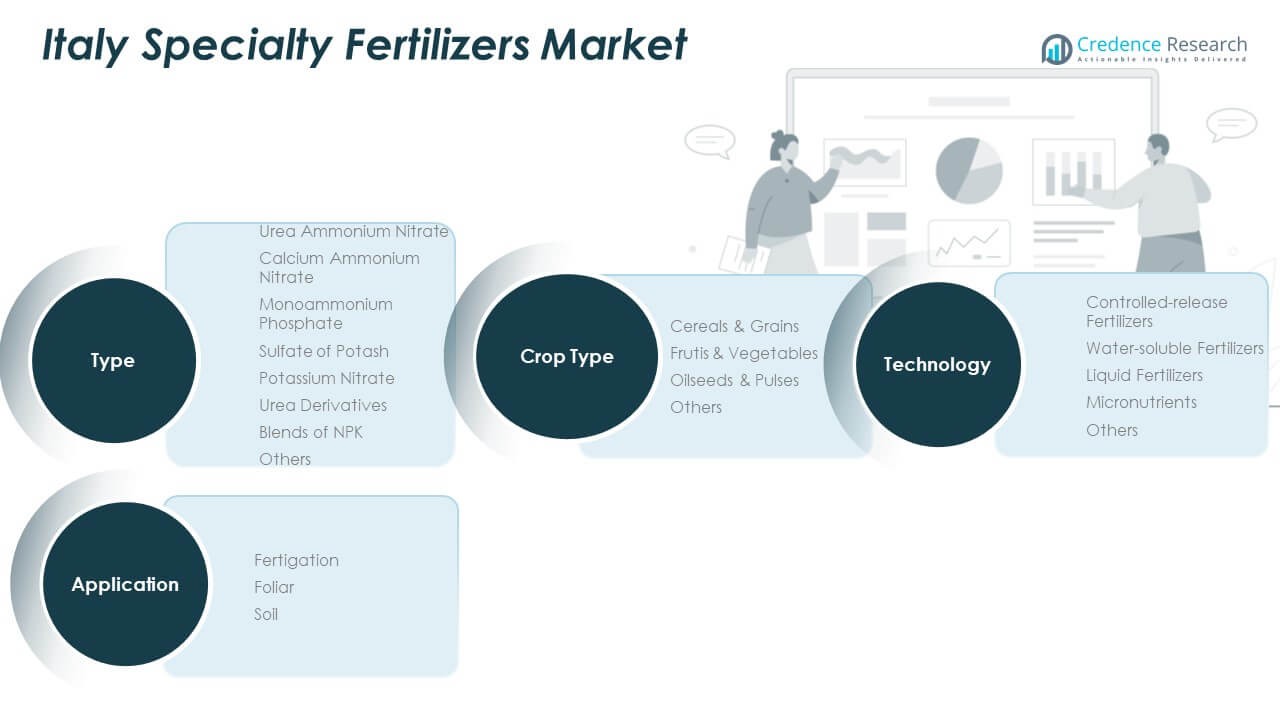

Market Segmentation Analysis

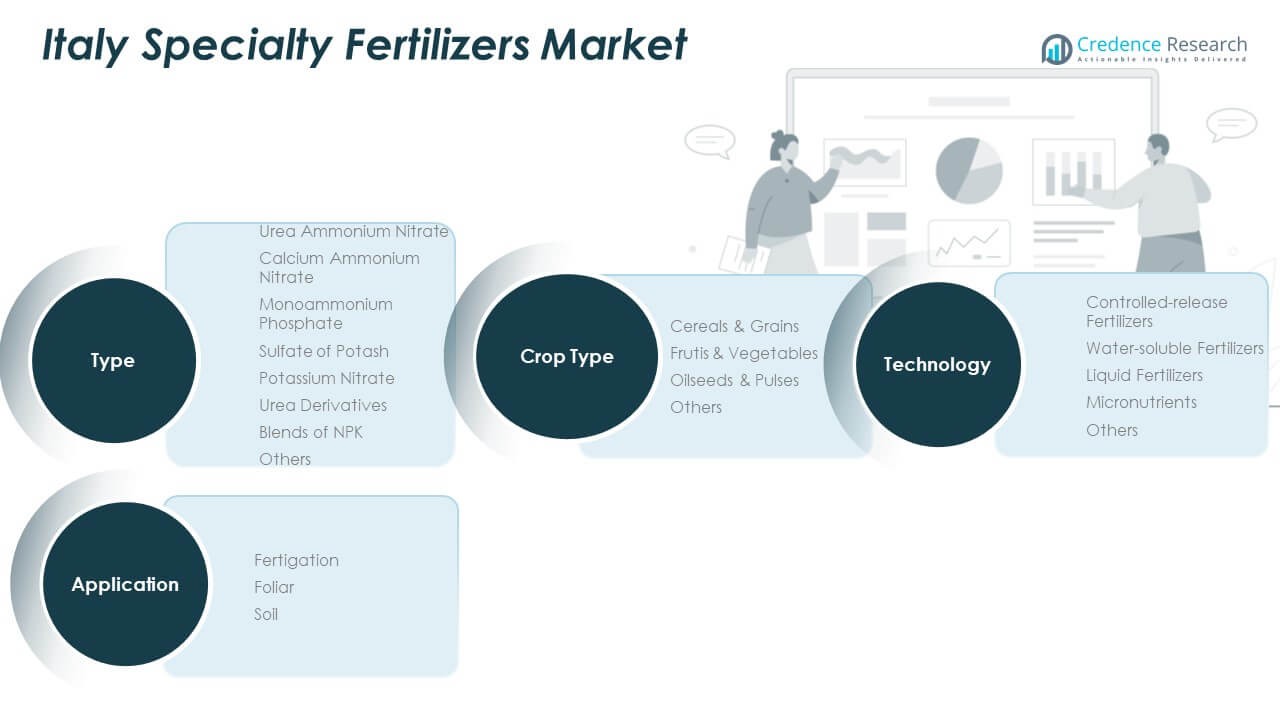

By Type Segment

The Italy Specialty Fertilizers Market is led by urea ammonium nitrate and blends of NPK due to their balanced nutrient delivery and compatibility with diverse crops. Calcium ammonium nitrate and potassium nitrate are also widely used for high-value horticultural production. Monoammonium phosphate supports intensive farming where phosphorus enrichment is required. Sulfate of potash and urea derivatives hold demand in specialized fruit and vegetable cultivation. It reflects strong adoption of nitrogen-rich and multi-nutrient products tailored for yield optimization.

By Application Segment

Fertigation remains the dominant application segment, supported by extensive greenhouse farming and advanced irrigation infrastructure. Foliar fertilizers gain traction for quick nutrient absorption and enhanced crop resilience. Soil-based applications maintain relevance across cereals and grains, where farmers seek long-lasting nutrient availability. It underlines a balanced demand pattern influenced by crop type, irrigation practices, and regional farming methods.

- For instance, Haifa Multi-K GG Potassium Nitrate (13.5-0-46.2 crystalline) is certified by the manufacturer for use in Italian greenhouse fertigation and hydroponic systems, highlighting fully water-soluble delivery and suitability for Nutrigation and foliar feeding across diverse crops, as detailed in official product documentation updated in 2024–2025.

By Technology Segment

Controlled-release fertilizers hold strong presence due to efficiency in nutrient management and reduced application frequency. Water-soluble fertilizers show high adoption in greenhouse and horticulture systems. Liquid fertilizers gain importance in precision farming where uniform application is essential. Micronutrients address specific soil deficiencies, ensuring balanced nutrition. It highlights continuous innovation in formulations to improve nutrient uptake and minimize losses.

- For instance, COMPO EXPERT’s NovaTec stabilized fertilizers use a nitrification inhibitor (DMPP) to reduce nitrogen leaching and increase nitrogen efficiency, with product sheets verifying that NovaTec Classic 12-8-16(+3+TE) delivers controlled release for optimal nutrient delivery in European crops, documented with official company resources as of August 2025.

By Crop Type Segment

Cereals and grains account for the largest share of the Italy Specialty Fertilizers Market, reflecting their dominance in Italian agriculture. Fruits and vegetables follow, supported by expanding greenhouse farming and export-driven demand. Pulses and oilseeds adopt targeted nutrient solutions to improve yield stability. Others include niche crops where specialty blends address unique nutritional needs. It ensures product diversity aligned with Italy’s agricultural landscape.

Segmentation

By Type Segment

- Urea Ammonium Nitrate

- Calcium Ammonium Nitrate

- Monoammonium Phosphate

- Sulfate of Potash

- Potassium Nitrate

- Urea Derivatives

- Blends of NPK

- Others

By Application Segment

By Technology Segment

- Controlled-Release Fertilizers

- Water-Soluble Fertilizers

- Liquid Fertilizers

- Micronutrients

- Others

By Crop Type Segment

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Regional Analysis

Northern Italy Leading With Advanced Agricultural Practices

Northern Italy dominates the Italy Specialty Fertilizers Market with a 42% market share. It benefits from high adoption of precision agriculture and greenhouse farming techniques. Fertilizer manufacturers focus on crop-specific formulations for vegetables, fruits, and high-value horticulture. It supports consistent yields and improved crop quality. Strong distribution networks and research collaborations strengthen market penetration. The presence of large-scale farms accelerates demand for technologically advanced fertilizers. It remains the most competitive and innovation-driven subregion in Italy.

Central Italy Exhibiting Steady Growth Through Diversified Farming

Central Italy holds a 31% share of the Italy Specialty Fertilizers Market. It has mixed cultivation of cereals, fruits, and vegetables, requiring versatile nutrient solutions. It supports gradual adoption of controlled-release and water-soluble fertilizers. Manufacturers tailor products to local soil conditions and climatic variations. It benefits from moderate infrastructure and increasing awareness of sustainable practices. Regional agricultural cooperatives play a key role in distribution and advisory services. It shows potential for continued growth with targeted product launches.

Southern Italy Emerging Through Expansion Of Horticulture And Small-Scale Farming

Southern Italy accounts for 27% of the Italy Specialty Fertilizers Market. It relies on small-scale and family-run farms, with rising interest in specialty fertilizers. It encourages adoption of foliar and fertigation techniques to improve yields. Manufacturers introduce affordable, crop-specific products suitable for local farming conditions. It faces challenges in infrastructure and technology penetration but shows growth potential. Regional government initiatives support adoption of eco-friendly fertilizers. It represents an emerging subregion with opportunities for strategic market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Valagro S.p.A.

- Fertiberia

- ICL Specialty Fertilizers Italia

- SQM S.A.

- EuroChem Group AG

- OCP Group

- Haifa Chemicals Ltd.

- CF Industries Holdings, Inc.

- Yara International ASA

- The Mosaic Company

Competitive Analysis

The Italy Specialty Fertilizers Market is highly competitive, driven by leading multinational and regional players. It includes companies such as Valagro S.p.A., Fertiberia, ICL Specialty Fertilizers Italia, SQM S.A., EuroChem Group AG, OCP Group, Haifa Chemicals Ltd., CF Industries Holdings, Inc., Yara International ASA, and The Mosaic Company. These players strengthen their position through product innovation, strategic partnerships, and extensive distribution networks. It relies heavily on R&D investments to develop advanced nutrient formulations, including controlled-release, water-soluble, and micronutrient-enriched fertilizers. Companies focus on crop-specific solutions tailored for Italian soil types and climatic conditions. It encourages manufacturers to pursue mergers, acquisitions, and regional expansions to increase market reach and consolidate their presence. Competitive differentiation comes from technological advancements, sustainability-driven products, and digital nutrient monitoring tools. It also depends on customer service, technical advisory, and training programs to support farm adoption. Companies continuously monitor regulatory changes and market trends to maintain relevance and profitability. It remains a dynamic market where innovation, operational efficiency, and strategic growth initiatives determine long-term competitiveness.

Recent Developments

- In September 2025, Dorf Ketal, an India-based specialty chemicals manufacturer, entered advanced talks to acquire Italmatch Chemicals SpA for approximately $1.6 billion. Italmatch, with operations in Italy, is a prominent name in specialty chemicals and fertilizers. This potential acquisition demonstrates the increasing strategic value and consolidation in the specialty fertilizer industry in Italy and across Europe.

- In June 2025, Hello Nature announced the expansion of its biostimulant production facility located in Biandrate, Novara, Italy. The company will double its production capacity to meet the growing demand for specialty fertilizers and biostimulants in the region, underscoring its commitment to supporting advanced agriculture and sustainability.

- In April 2025, ICL Specialty Fertilizers expanded its biological technologies by acquiring Lavie Bio, a leader in microbiome-based agricultural solutions. This acquisition aims to integrate Lavie Bio’s biostimulant innovations into ICL’s specialty fertilizer offerings for the Italian and wider European markets, positioning ICL as a leader in sustainable fertilizer technologies.

- In December 2023, Yara finalized the acquisition of the organic-based fertilizer business of Agribios Italiana. The deal enables Yara to enrich its crop nutrition portfolio in Italy, tapping into Agribios’s expertise in high-quality organic-based fertilizers. This acquisition also supports Yara’s organic strategy in Europe, helping farmers enhance soil health and nutrient efficiency. Agribios produced around 60,000 metric tons of fertilizer in 2022, with a notable impact on Italy’s organic market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Crop Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Precision agriculture tools will expand specialty fertilizer adoption through improved efficiency and tailored application.

- Controlled-release and water-soluble fertilizers will dominate demand due to higher nutrient utilization rates.

- Farmers will seek customized nutrient blends designed for specific soil conditions and crop requirements.

- Greenhouse farming and horticulture will create stronger demand for crop-quality focused fertilizer solutions.

- Organic and biodegradable fertilizers will see rising uptake supported by sustainability regulations.

- Digital nutrient monitoring will integrate with fertilizer application, driving smart agriculture adoption.

- Research into micronutrient and nano-fertilizers will accelerate product innovation and differentiation.

- Regional cooperatives will play a greater role in distribution and advisory services.

- Partnerships between fertilizer manufacturers and technology providers will strengthen competitive positioning.

- Government support for sustainable farming will further shape product development and adoption.