Market Overview

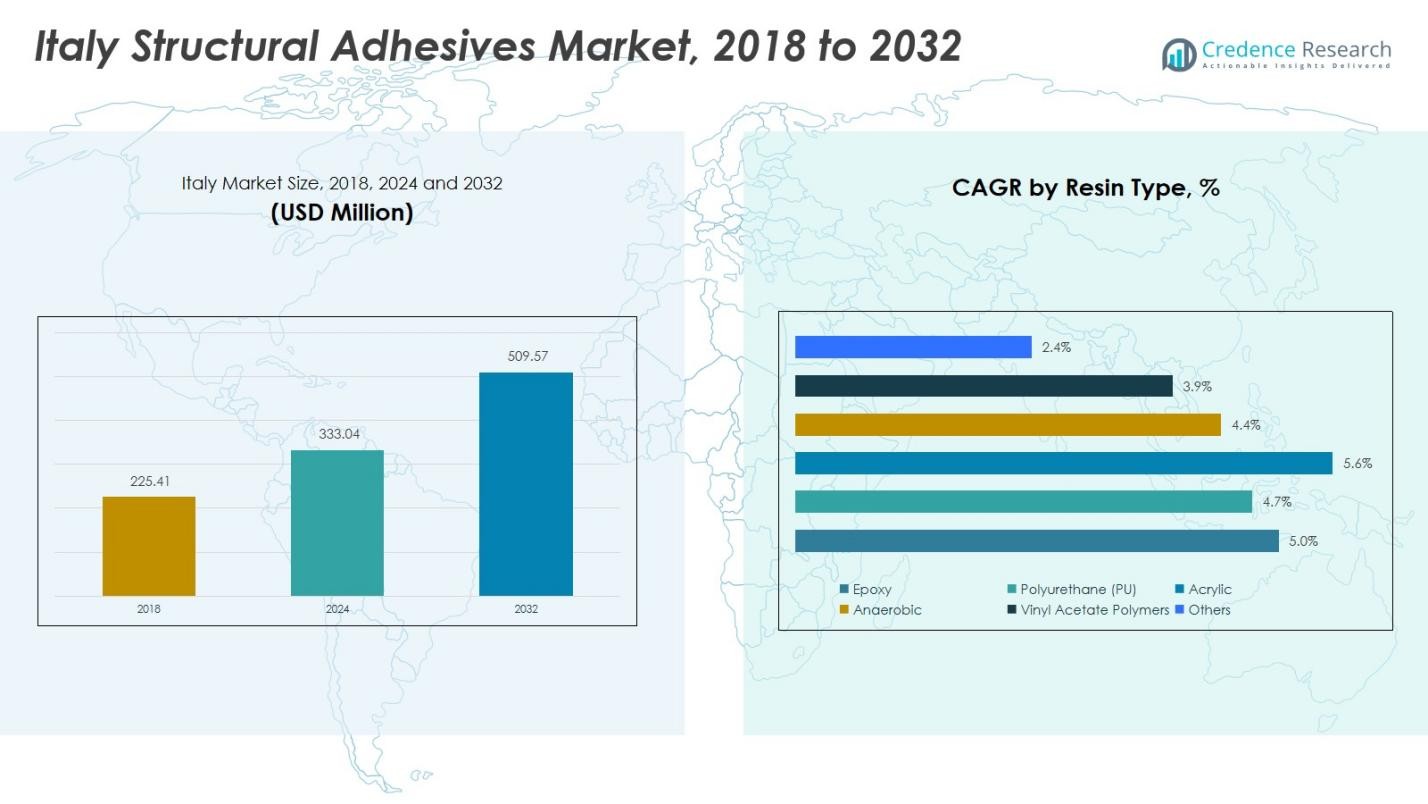

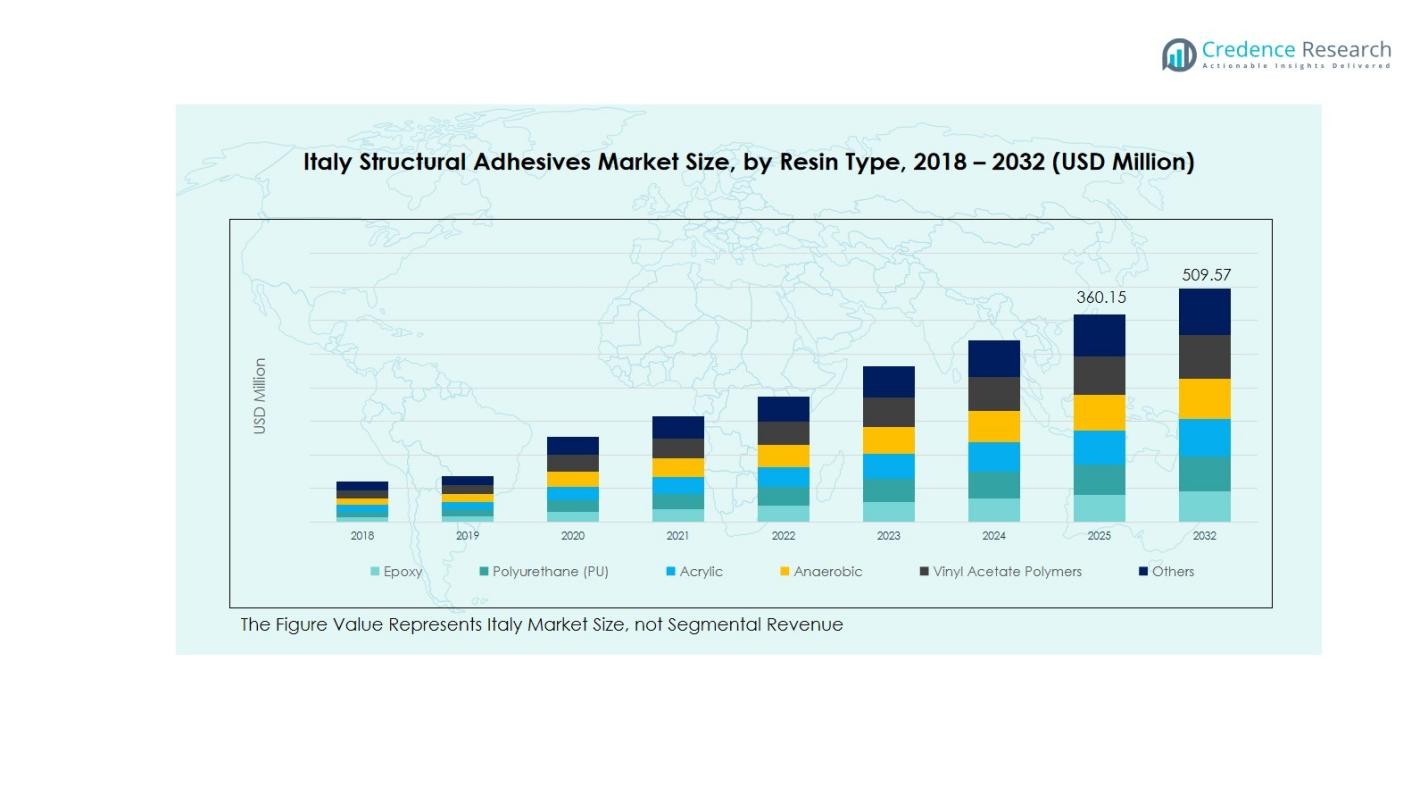

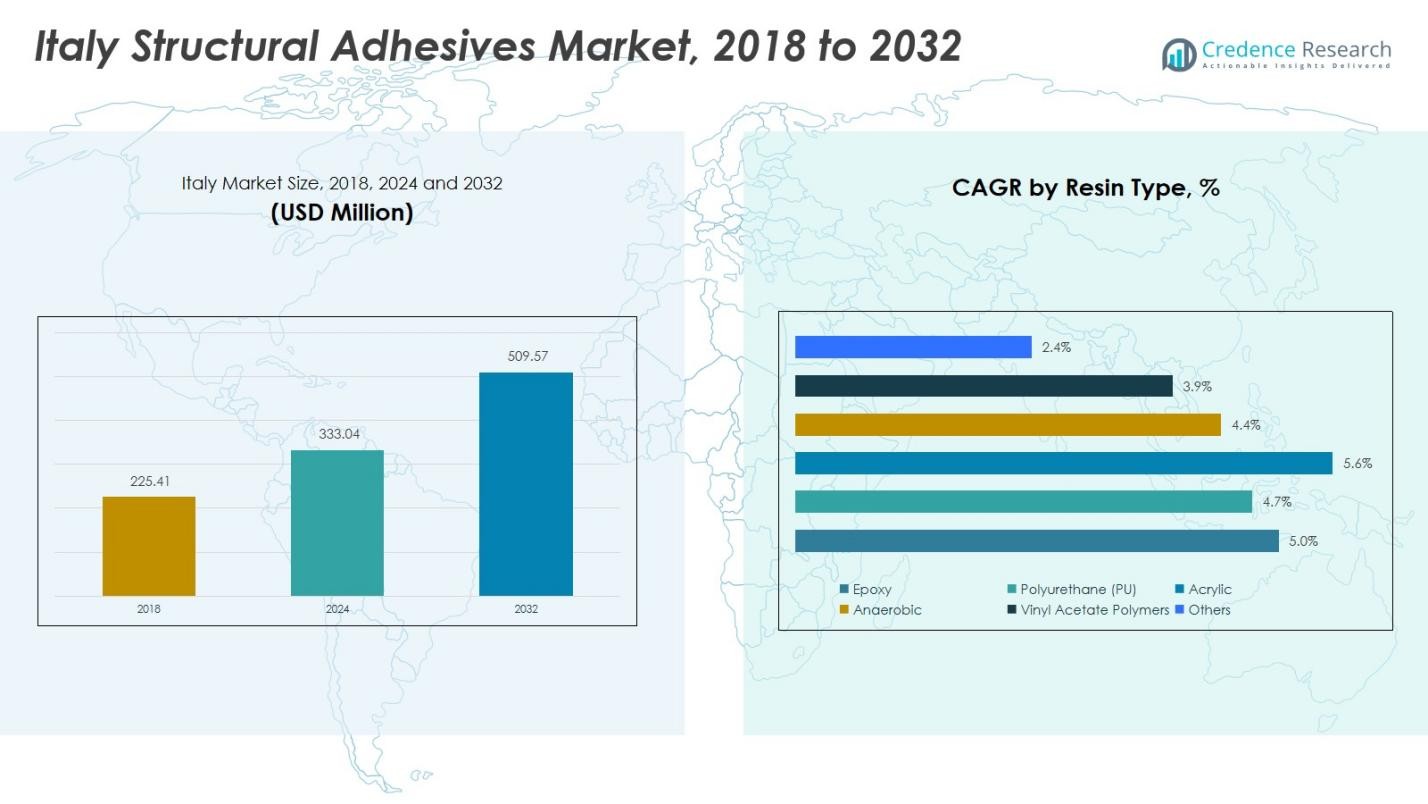

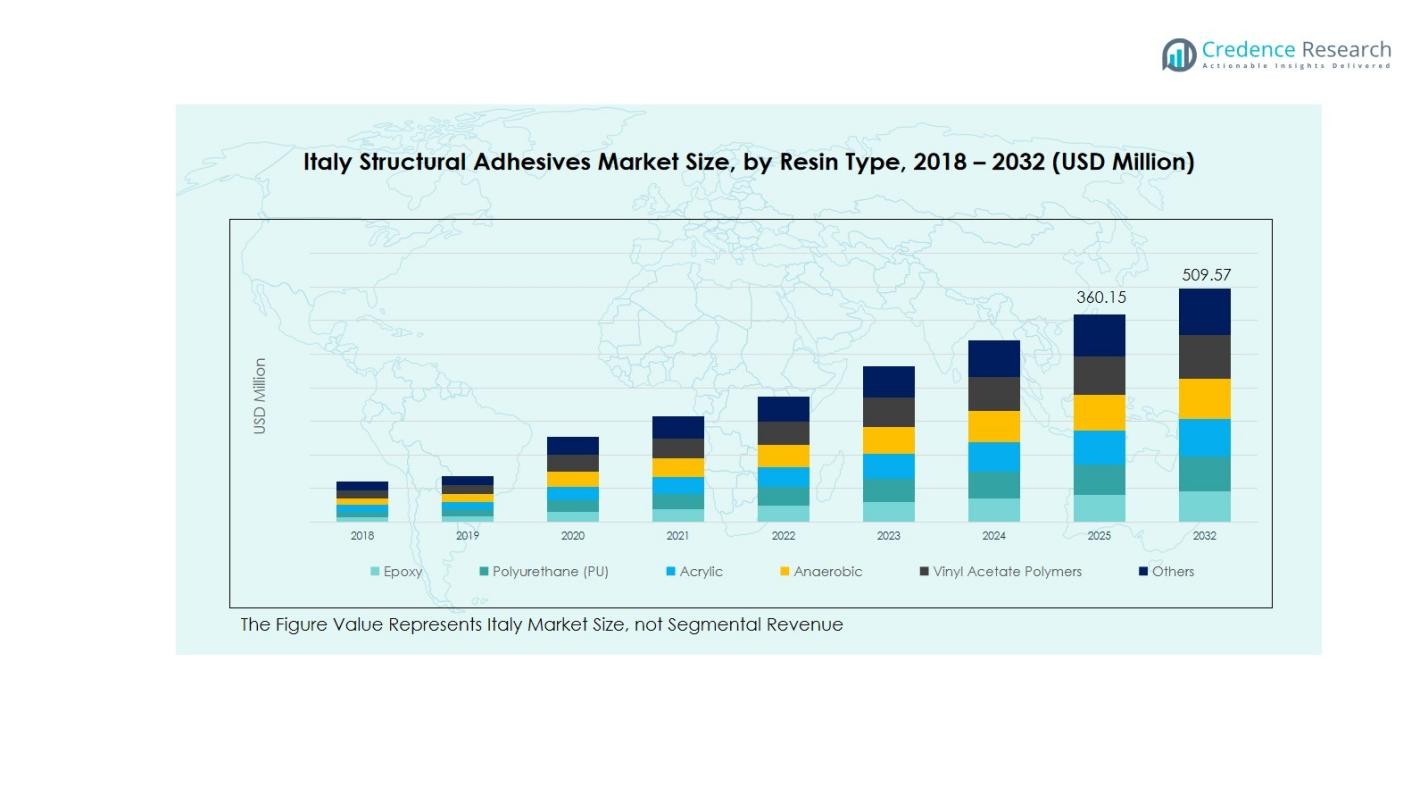

Italy Structural Adhesives Market size was valued at USD 225.41 Million in 2018, growing to USD 333.04 Million in 2024, and is anticipated to reach USD 509.57 Million by 2032, at a CAGR of 5.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Structural Adhesives Market Size 2024 |

USD 333.04 Million |

| Italy Structural Adhesives Market, CAGR |

5.08% |

| Italy Structural Adhesives Market Size 2032 |

USD 509.57 Million |

The Italy Structural Adhesives Market is highly competitive, with leading players including Henkel AG & Co. KGaA, Sika AG, Arkema S.A., H.B. Fuller Company, RPM International Inc., BASF SE, Huntsman Corporation, Dow Inc., Jowat SE, and 3M Company. These companies drive market growth through strong product portfolios, technological innovation, and strategic partnerships, focusing on high-performance adhesives for automotive, aerospace, construction, and industrial applications. Epoxy and polyurethane resins dominate their offerings, catering to the increasing demand for lightweight and durable bonding solutions. Northern Italy emerges as the leading region, accounting for 38% of the market, supported by its robust industrial infrastructure, concentration of automotive and aerospace manufacturing hubs, and growing adoption of advanced adhesive technologies. The combined strategies of key players and regional industrial strength position Northern Italy as the primary contributor to the country’s structural adhesives market growth.

Market Insights

- The Italy Structural Adhesives Market was valued at USD 333.04 Million in 2024 and is projected to reach USD 509.57 Million by 2032, growing at a CAGR of 5.08%. Epoxy resin dominates the market, and Northern Italy holds the largest regional share at 38%.

- Growth is driven by rising demand from automotive, aerospace, and construction sectors, where lightweight, high-strength, and durable bonding solutions are increasingly required.

- The market trend is shifting toward eco-friendly and low-VOC adhesives, with growing adoption of water-based technologies and advanced multi-functional formulations across industrial applications.

- The market is competitive, led by major players such as Henkel AG & Co. KGaA, Sika AG, Arkema S.A., H.B. Fuller, RPM International, BASF SE, Huntsman, Dow Inc., Jowat SE, and 3M Company, focusing on innovation, product differentiation, and regional expansion.

- Market restraints include high costs of advanced adhesives and complex application requirements, while regional growth is supported by Northern Italy’s industrial hubs, Central Italy’s construction demand, and emerging adoption in Southern and Insular Italy.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin Type:

Epoxy resins dominate the Italy Structural Adhesives Market, accounting for approximately 38% of the segment share. Their superior mechanical strength, chemical resistance, and excellent adhesion to multiple substrates drive widespread adoption across automotive, aerospace, and industrial manufacturing applications. Polyurethane (PU) and acrylic follow as significant contributors, supported by demand in flexible bonding and high-performance applications. Growth in construction and automotive sectors further propels epoxy usage, as manufacturers seek durable and long-lasting bonding solutions. The increasing focus on lightweight materials in transportation and aerospace continues to reinforce the preference for epoxy-based adhesives.

For instance, Permabond’s epoxy-based adhesives ET5428 and ET5429 are widely employed in aerospace for bonding carbon fiber and lightweight honeycomb composites, which helps reduce aircraft weight while maintaining strength.

By Substrate:

Metal is the dominant substrate segment, holding a 42% share of the Italy Structural Adhesives Market. The high demand stems from extensive use in automotive, aerospace, and industrial manufacturing, where structural adhesives provide enhanced strength, vibration resistance, and weight reduction compared to mechanical fasteners. Composites and plastics are also gaining traction, particularly in lightweight applications across transportation and electronics. Rising adoption of hybrid materials in automotive and industrial sectors, coupled with stricter regulations for safety and emissions, drives growth in metal bonding adhesives, reinforcing their position as the leading substrate segment.

For instance, 3M’s Scotch-Weld™ Epoxy Adhesive 2216 is used in cryogenic bonding applications, such as in aerospace and transportation systems, where it maintains structural integrity at temperatures as low as -423°F (-252°C) and delivers a bonded shear strength of up to 3,200 psi at room temperature.

By Technology:

Solvent-based adhesives lead the technology segment with a 45% market share, driven by their superior bonding strength and versatility across various substrates, including metals and composites. They are widely preferred in automotive, aerospace, and construction sectors due to fast curing times and high structural performance. Water-based adhesives are growing steadily, favored for environmentally friendly and low-VOC applications, particularly in building and industrial sectors. The demand for high-performance, easy-to-apply solutions continues to fuel the adoption of solvent-based technology, maintaining its dominance while emerging technologies offer niche growth opportunities.

Key Growth Drivers

Rapid Automotive & Aerospace Expansion

The growing automotive and aerospace industries in Italy significantly drive structural adhesives market growth. Manufacturers increasingly use lightweight materials and hybrid assemblies to meet fuel efficiency, safety, and emission standards. Structural adhesives offer superior bonding strength, vibration resistance, and weight reduction, making them essential for these sectors. Rising demand for electric vehicles and advanced aerospace components further amplifies adoption. As companies prioritize durable and reliable bonding solutions, the automotive and aerospace expansions continue to act as a primary catalyst for the market’s sustained growth.

For instance, Fiat’s electric 500 production at the Mirafiori plant in Turin integrates structural adhesives alongside robotic welding to assemble battery-powered vehicles, with Comau’s advanced vision systems ensuring precise adhesive dispensing for body components, enhancing structural integrity and manufacturing efficiency.

Preference for Lightweight & High-Performance Materials

The shift toward lightweight and high-performance materials fuels structural adhesives adoption. Industries are increasingly replacing mechanical fasteners with adhesives to reduce assembly weight and enhance structural integrity. Epoxy and polyurethane adhesives are particularly favored for their durability and chemical resistance. The focus on energy efficiency, especially in transportation and construction, drives demand for adhesives compatible with metals, composites, and plastics. This growing emphasis on lightweight material integration not only supports sustainable manufacturing practices but also reinforces the market’s steady growth trajectory across multiple sectors.

For instance, 3M’s Scotch-Weld™ Toughened Epoxy Adhesive is used in bonding carbon fiber and stainless steel components for lightweight drilling platforms, demonstrating high resistance to dynamic loads and harsh environments.

Stringent Regulatory & Safety Standards

Regulatory mandates on emissions, safety, and building codes in Italy accelerate structural adhesives adoption. Stringent safety standards require strong and reliable bonding solutions in automotive, aerospace, and construction sectors. Structural adhesives enhance structural durability, reduce the need for mechanical fasteners, and support compliance with environmental regulations. As industries strive to meet these rigorous standards while maintaining performance, the demand for high-quality adhesives rises. This regulatory-driven adoption remains a key growth driver, ensuring consistent market expansion and encouraging innovation in environmentally compliant, high-strength adhesive technologies.

Key Trends & Opportunities

Trend Toward Eco-Friendly Adhesives

The Italy structural adhesives market is witnessing a notable trend toward eco-friendly, low-VOC, and water-based adhesives. Growing environmental awareness and stringent European Union regulations push manufacturers to adopt sustainable formulations. Companies are developing adhesives that reduce environmental impact without compromising performance, particularly for construction, automotive, and industrial applications. This trend creates opportunities for innovation in bio-based and recyclable adhesive solutions. As demand for sustainable manufacturing practices grows, eco-friendly adhesives are set to become a prominent feature of the Italian market.

For instance, DuPont developed the MEGUM™ W 9500, a water-based adhesive that reduces VOC emissions from over 11 kg per kg of dried bonding agent to zero, without sacrificing performance, enhancing safety with its non-flammable composition in automotive and industrial uses.

Integration of Advanced Technologies

Adoption of advanced technologies, such as high-performance epoxy and multi-functional adhesives, is creating new opportunities in Italy’s structural adhesives market. Smart adhesives that offer faster curing times, enhanced strength, and compatibility with diverse substrates are gaining traction in aerospace, automotive, and electronics applications. Integration with automated assembly lines and precision manufacturing processes further supports efficiency and quality. This trend not only drives market growth but also encourages innovation in next-generation adhesive solutions, positioning the market for long-term expansion and enhanced industrial applicability.

For instance, Henkel’s aerospace-grade epoxy adhesives offer fast curing times, high thermal and chemical resistance, and reliable multi-substrate bonding, supporting efficient assembly in aerospace manufacturing.

Key Challenges

High Cost of Advanced Adhesives

One of the primary challenges in the Italy structural adhesives market is the high cost of advanced formulations. Premium epoxy, polyurethane, and multi-functional adhesives often require specialized production and application processes, which can deter small and medium-scale manufacturers. High pricing can slow adoption in cost-sensitive segments such as mass-market automotive and industrial manufacturing. Companies must balance performance benefits with cost considerations to remain competitive. This challenge underscores the need for cost-efficient solutions without compromising adhesive strength and reliability.

Complex Application & Curing Processes

Structural adhesives often require precise surface preparation and controlled curing conditions, which can complicate manufacturing processes. Improper application can lead to weak bonds, product failures, and safety risks. This complexity limits adoption in small-scale operations and necessitates skilled labor or automated solutions. Manufacturers must invest in training and process optimization to mitigate risks. Consequently, application complexity remains a notable challenge, particularly in industries with high production volumes or stringent quality standards, influencing market growth and operational efficiency.

Regional Analysis

Northern Italy

Northern Italy leads the structural adhesives market, holding a 38% share due to its strong industrial and automotive presence. The region hosts major manufacturing hubs, including automotive, aerospace, and machinery sectors, which demand high-performance adhesives for lightweight and durable bonding solutions. The presence of key manufacturers and robust infrastructure supports efficient production and distribution. Growth in electric vehicles and industrial automation further drives demand. Northern Italy’s focus on innovation, compliance with strict safety standards, and adoption of advanced resin types like epoxy and polyurethane reinforce its position as the largest contributor to the country’s structural adhesives market.

Central Italy

Central Italy accounts for a 27% share of the structural adhesives market, driven by its growing construction, aerospace, and industrial manufacturing activities. The region’s urban development and expansion of commercial infrastructure increase demand for adhesives compatible with metal, composite, and wood substrates. Key applications in automotive and aerospace manufacturing support high-performance resin adoption, including epoxy and acrylic adhesives. The concentration of small and medium-sized enterprises encourages customized adhesive solutions, while regional investments in sustainable and eco-friendly materials further fuel market growth. Central Italy remains a significant contributor due to its balanced industrial and construction demand.

Southern Italy

Southern Italy represents 20% of the structural adhesives market, benefiting from emerging industrial zones and infrastructure development. Automotive component manufacturing, light machinery, and building projects are primary drivers of adhesive consumption in this region. Growth is supported by increasing adoption of solvent-based and water-based technologies, especially for cost-effective and eco-friendly applications. Although the market is smaller compared to Northern and Central regions, incentives for regional industrial growth, rising demand for high-performance adhesives, and integration of modern manufacturing practices are enhancing market penetration. Southern Italy continues to witness steady growth as industrialization and construction activities expand.

Insular Italy (Sicily & Sardinia)

Insular Italy holds a 15% share of the structural adhesives market, driven by growing infrastructure projects, industrial activities, and niche manufacturing. Adhesives are increasingly used in construction, electronics, and transportation applications, with epoxy and polyurethane leading adoption. Limited industrial base and logistical challenges restrict market size, but government initiatives and investment in sustainable building projects support growth. Water-based and environmentally friendly adhesive technologies are gaining traction in the region. Insular Italy shows potential for expansion as infrastructure modernization and industrial development continue, contributing steadily to the overall structural adhesives market in Italy.

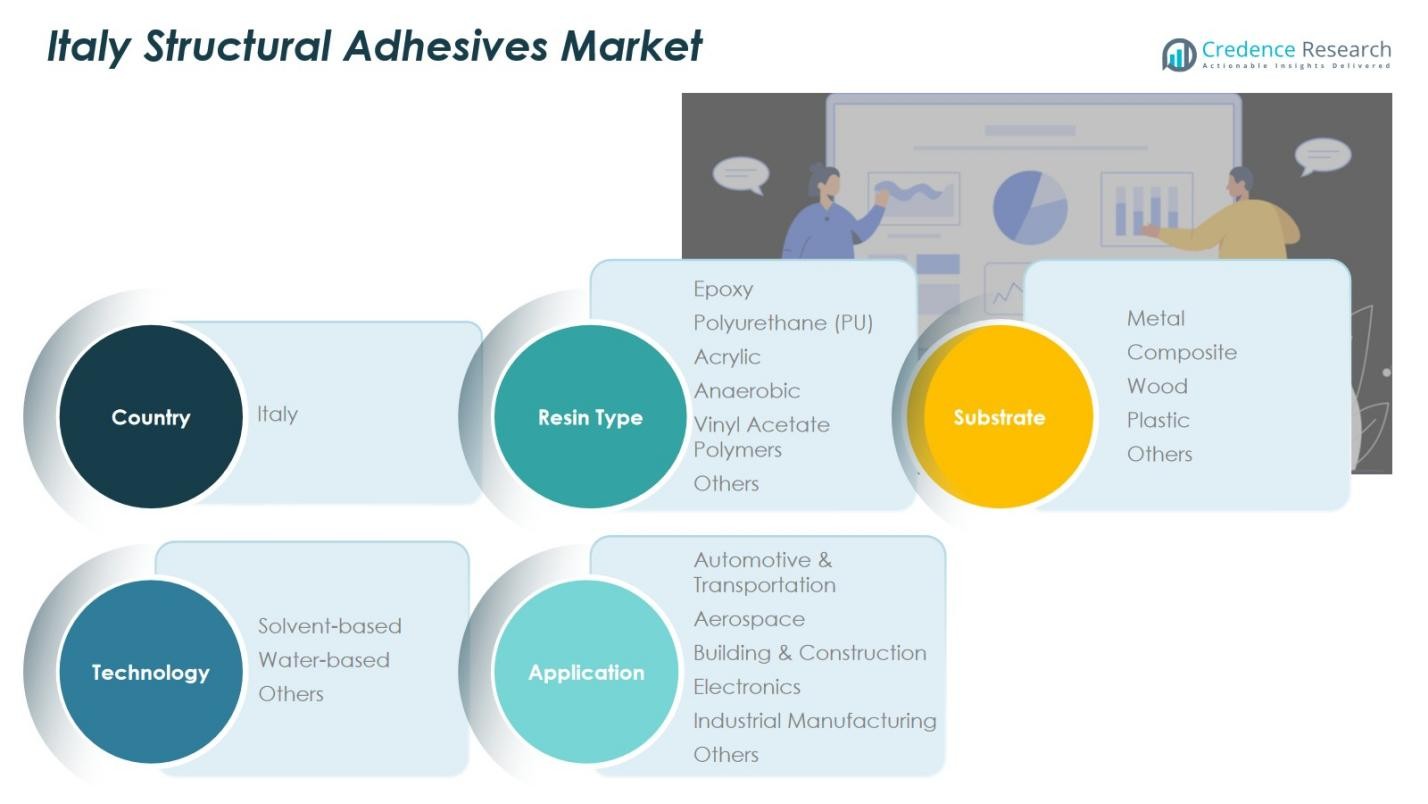

Market Segmentations:

By Resin Type:

- Epoxy

- Polyurethane (PU)

- Acrylic

- Anaerobic

- Vinyl Acetate Polymers

- Others

By Substrate:

- Metal

- Composite

- Wood

- Plastic

- Others

By Technology:

- Solvent-based

- Water-based

- Others

By Application:

- Automotive & Transportation

- Aerospace

- Building & Construction

- Electronics

- Industrial Manufacturing

- Others

By Region:

- Northern Italy

- Central Italy

- Southern Italy

- Insular Italy

Competitive Landscape

The competitive landscape of the Italy Structural Adhesives Market features key players such as Henkel AG & Co. KGaA, Sika AG, Arkema S.A., H.B. Fuller Company, RPM International Inc., BASF SE, Huntsman Corporation, Dow Inc., Jowat SE, and 3M Company. These companies dominate the market through strong product portfolios, strategic partnerships, and continuous innovation in high-performance adhesive solutions. Market competition is intensified by the growing demand for lightweight, durable, and eco-friendly adhesives across automotive, aerospace, and construction sectors. Players focus on developing advanced resin types, including epoxy and polyurethane, and expanding water-based and solvent-based adhesive technologies. Strategic mergers, acquisitions, and regional expansions further strengthen their market position. The competitive landscape is characterized by product differentiation, technological advancements, and a focus on meeting stringent regulatory standards, enabling key players to maintain leadership while fostering innovation and capturing emerging opportunities in Italy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Henkel AG & Co. KGaA

- Sika AG

- Arkema S.A.

- B. Fuller Company

- RPM International Inc.

- BASF SE

- Huntsman Corporation

- Dow Inc.

- Jowat SE

- 3M Company

Recent Developments

- In February 2025, Gehring-Montgomery entered a distribution agreement with ddchem of Italy to supply epoxy resins and hardeners across the Mid-Atlantic and Northeast United States, strengthening product availability and market reach.

- In May 2022, Henkel launched new products Loctite Liofol LA 7818 RE / 6231 RE and Loctite Liofol LA 7102 RE / 6902 RE designed to enhance recyclability in packaging applications, addressing the growing demand for eco-friendly adhesives.

- In 2025, Huntsman Corporation launched a new line of epoxy-based structural adhesives , offering superior bonding strength and durability to meet evolving sector demands.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand from automotive and aerospace sectors.

- Increasing adoption of lightweight and high-performance materials will boost structural adhesive usage.

- Expansion in construction and industrial manufacturing will drive consistent market growth.

- Eco-friendly and low-VOC adhesive formulations will gain higher acceptance.

- Advancements in solvent-based and water-based technologies will create new opportunities.

- Integration of structural adhesives in electric vehicles will support market expansion.

- Growth in metal and composite substrate applications will strengthen demand.

- Rising focus on regulatory compliance and safety standards will encourage high-quality adhesive adoption.

- Technological innovation and R&D investment by key players will enhance product performance.

- Regional industrialization and infrastructure development will continue to support market penetration.