Market Overview:

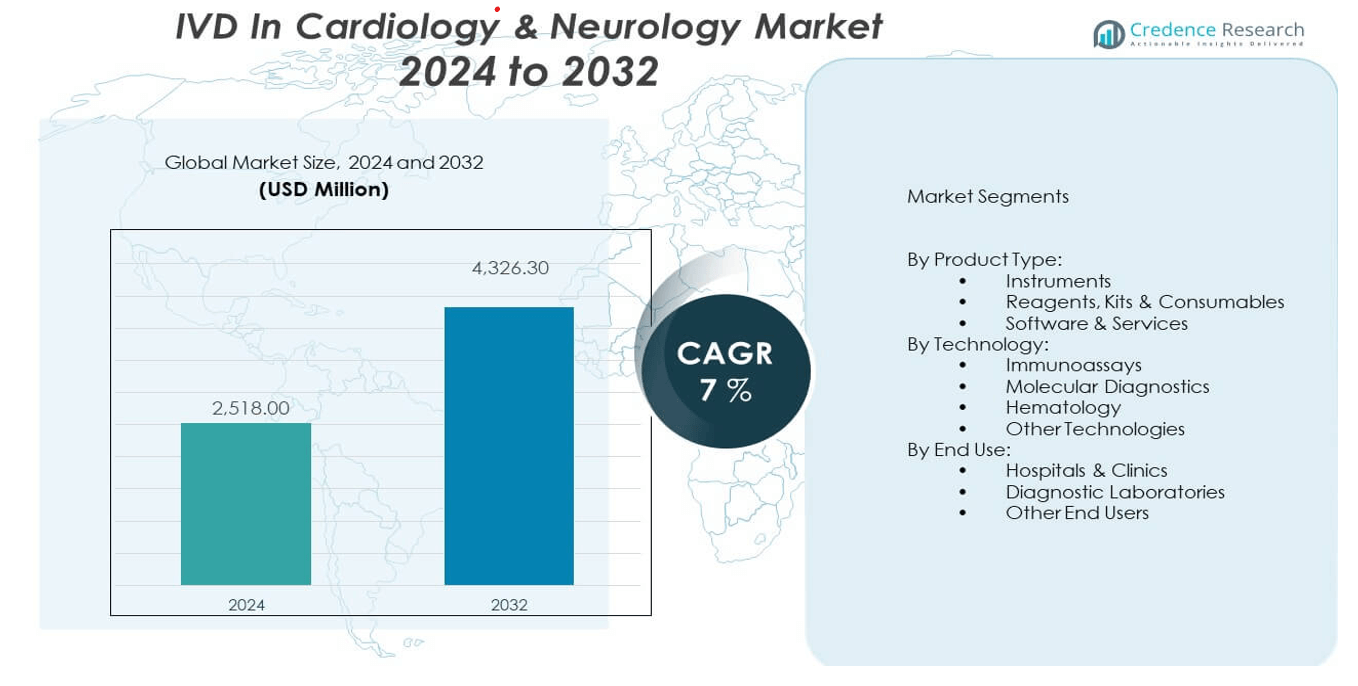

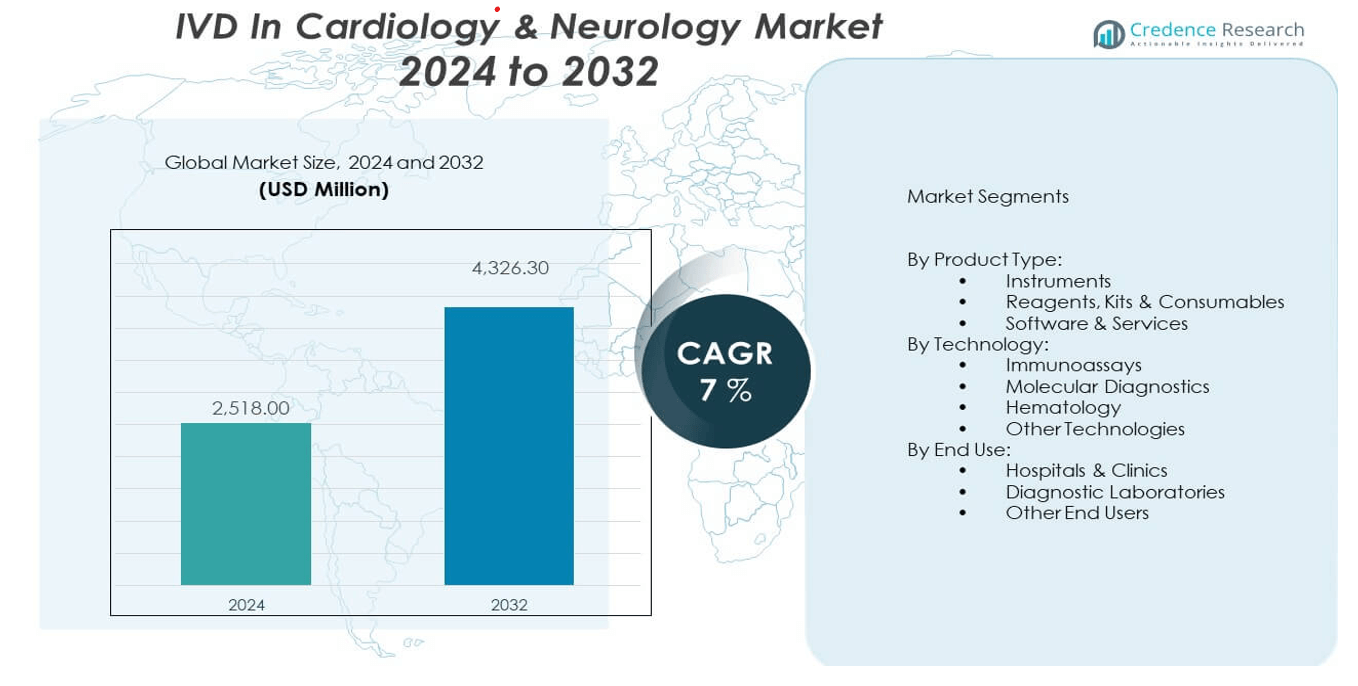

The IVD in cardiology & neurology market is projected to grow from USD 2,518 million in 2024 to an estimated USD 4,326.3 million by 2032, with a compound annual growth rate (CAGR) of 7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| IVD in cardiology & neurology market Size 2024 |

USD 2,518 million |

| IVD in cardiology & neurology market, CAGR |

7% |

| IVD in cardiology & neurology market Size 2032 |

USD 4,326.3 million |

This market experiences steady growth due to the rising global prevalence of cardiovascular and neurological disorders, which demand early and accurate diagnostics. Increasing awareness about the benefits of early disease detection, coupled with ongoing technological advancements in in-vitro diagnostics (IVD), is driving adoption. Hospitals, specialty clinics, and diagnostic laboratories are integrating advanced IVD tools to enable faster diagnosis and personalized treatment. Furthermore, the aging population and growing burden of chronic diseases enhance the need for continuous monitoring and diagnostic efficiency in both cardiology and neurology applications.

North America currently leads the IVD in cardiology & neurology market, primarily due to advanced healthcare infrastructure, higher healthcare expenditure, and strong presence of key diagnostic companies. Europe follows closely, benefiting from robust reimbursement policies and growing elderly demographics. Meanwhile, Asia-Pacific is emerging as a high-growth region, driven by expanding healthcare access, rising investments in diagnostics, and increased disease burden in countries such as India and China. These factors collectively shape a dynamic and evolving global landscape for IVD solutions in cardiology and neurology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The IVD in cardiology & neurology market is projected to grow from USD 2,518 million in 2024 to USD 4,326.3 million by 2032, at a CAGR of 7%, driven by increasing demand for early and accurate diagnostics.

- Rising cases of heart disease, stroke, Alzheimer’s, and epilepsy are accelerating the need for timely IVD tools to improve patient outcomes and disease management.

- Technological advancements in immunoassays and molecular diagnostics such as PCR and NGS enable faster, more precise detection, supporting broader clinical adoption.

- Personalized medicine is expanding the role of IVD by enabling targeted therapies, with pharmaceutical and diagnostic firms investing in biomarker-based platforms.

- Public awareness and government-led initiatives are improving diagnostic access, especially in emerging economies, through screening programs and infrastructure support.

- Regulatory complexity and varied compliance requirements across regions delay market entry and increase development costs, particularly for startups and smaller firms.

- High costs of advanced diagnostic systems restrict widespread adoption in resource-limited regions, highlighting the need for affordable and scalable testing solutions.

Market Drivers:

Growing Burden of Cardiovascular and Neurological Diseases Increases Diagnostic Demand:

The rising global incidence of heart disease, stroke, Alzheimer’s, and epilepsy significantly drives the IVD in cardiology & neurology market. These conditions require timely and precise diagnosis to improve patient outcomes and guide treatment strategies. Lifestyle factors, including poor diet, lack of exercise, and increasing stress, contribute to earlier onset and higher prevalence of these diseases. Aging populations in both developed and emerging nations create consistent demand for long-term diagnostic monitoring. Physicians rely on IVD tools for real-time insights into biomarkers, enzyme levels, and neurological markers. It empowers providers to make early interventions and manage chronic conditions effectively. Governments and NGOs push for better screening programs, further supporting market penetration. Early detection through non-invasive diagnostics is now considered essential in both preventive and acute care settings.

- For instance, Abbott Laboratories has developed the Architect STAT high-sensitivity troponin assay, which provides rapid cardiac injury detection with improved precision at low biomarker concentrations, enabling earlier diagnosis of acute myocardial infarction.

Technological Advancements in Molecular and Immunoassay Diagnostics Fuel Adoption:

The rapid pace of innovation in molecular diagnostics and immunoassays plays a crucial role in expanding the IVD in cardiology & neurology market. These technologies offer higher sensitivity and specificity, enabling accurate diagnosis even in early or asymptomatic stages. Real-time PCR, next-generation sequencing (NGS), and point-of-care (POC) platforms are transforming traditional lab workflows. They reduce turnaround time and improve access to care in outpatient and remote settings. It supports better disease tracking, outcome prediction, and tailored therapies. The integration of automation and digital interfaces in diagnostic equipment boosts clinical efficiency. Healthcare providers are adopting these solutions to reduce diagnostic errors and enhance decision-making. Innovation in biomarker discovery also continues to expand the range of conditions addressable by IVD platforms.

- For instance, Roche Diagnostics’ cobas Liat PCR system delivers molecular testing with turnaround times as short as 20 minutes, enabling rapid pathogen and biomarker detection in cardiology and neurology diagnostics.

Increased Investment and Focus on Personalized Medicine Strengthens Market Relevance:

Pharmaceutical and diagnostic companies are increasingly investing in personalized medicine, reinforcing the role of IVD in the cardiology & neurology market. Tailored treatment regimens require a precise understanding of individual biomarkers and disease progression. IVD tools enable this customization, particularly in complex cases such as stroke risk or neurodegenerative conditions. Health systems value data-driven, patient-specific care models to reduce hospitalization and improve long-term outcomes. It contributes to the expanding use of companion diagnostics and therapeutic monitoring. Strategic partnerships between device manufacturers and biopharma companies are aligning diagnostics with novel therapies. Public and private investments continue to support R&D initiatives for next-generation IVD applications. These efforts collectively ensure sustained relevance of diagnostics across clinical pathways.

Rising Awareness and Government Initiatives Accelerate Diagnostic Accessibility:

Public health campaigns and national screening programs increase diagnostic awareness across both urban and rural areas. Governments recognize the importance of early intervention in managing non-communicable diseases, leading to stronger healthcare policies. National and regional agencies are funding diagnostic infrastructure, particularly in low- and middle-income countries. The IVD in cardiology & neurology market benefits from expanded reimbursement policies and favorable regulatory frameworks. It improves patient willingness to undergo early screening and regular monitoring. Community-level health workers are also being trained to operate basic IVD tools, expanding reach. Educational programs targeted at physicians and patients promote the clinical importance of biomarkers. These efforts directly support broader and earlier adoption of diagnostic tools across demographics.

Market Trends:

Integration of Artificial Intelligence and Data Analytics Enhances Diagnostic Accuracy:

The adoption of artificial intelligence (AI) and data analytics tools is reshaping the IVD in cardiology & neurology market. AI algorithms assist in identifying subtle patterns in diagnostic data, improving accuracy and consistency. Machine learning models are being applied to ECG, EEG, and imaging data to predict risks and support clinical decisions. It helps reduce misdiagnosis and ensures faster interpretation of complex data sets. AI-powered platforms are also being integrated into cloud-based diagnostics, making remote analysis feasible. Healthcare systems now explore AI to link diagnostics with electronic health records and personalize patient management. Startups and major players are launching AI-assisted test interpretation systems for both hospitals and labs. These systems shorten time to diagnosis while ensuring quality control in high-throughput environments. Adoption of such tools reflects the industry’s shift toward automation and intelligent diagnostics.

- For instance, Siemens Healthineers has incorporated AI algorithms into its Atellica Solution analyzer, which processes diagnostic data with machine learning to enhance workflow efficiency and provide predictive analytics in cardiology testing.

Miniaturization and Portability of Diagnostic Devices Improves Point-of-Care Reach:

The trend toward portable and miniaturized diagnostic devices is gaining strong momentum in the IVD in cardiology & neurology market. Compact analyzers, handheld ECG devices, and mobile-based testing kits are being widely adopted in outpatient and homecare settings. These devices increase access to diagnostic services outside traditional hospital environments. It enables continuous or on-demand monitoring for high-risk patients, especially in rural or resource-limited areas. Wearables equipped with neurological or cardiovascular sensors now generate real-time biomarker data. Such tools support early symptom recognition and faster emergency response. Manufacturers are investing in durable, user-friendly, and battery-powered diagnostic solutions. These innovations help decentralize diagnostics and reduce the burden on centralized labs. Point-of-care IVD platforms are becoming a standard feature in chronic disease management protocols.

- For instance, Bio-Rad Laboratories developed a portable Cardiochek analyzer capable of delivering rapid cholesterol and lipid panel results at the point of care, enabling immediate risk assessment and management in diverse clinical settings.

Growing Use of Multiplex Testing Enhances Diagnostic Efficiency and Speed:

Multiplex testing is gaining importance in the IVD in cardiology & neurology market due to its ability to detect multiple biomarkers simultaneously. Hospitals and labs prefer multiplex assays to reduce cost, increase throughput, and conserve patient samples. These tests support the rapid evaluation of conditions with overlapping symptoms, such as neuroinflammatory or cardiac syndromes. It improves clinical decision-making by presenting a broader diagnostic picture in a single test cycle. Emerging platforms integrate nucleic acid and protein detection for more comprehensive analysis. Laboratories benefit from shorter workflows and reduced reagent usage. Diagnostic companies now offer multiplex panels tailored to cardiovascular risk and neurological disorders. Adoption of these solutions reflects the growing demand for efficient, high-output diagnostics in busy clinical environments.

Focus on Consumer-Centric and At-Home Testing Solutions Gains Traction:

The IVD in cardiology & neurology market is witnessing a shift toward patient-centric models that prioritize at-home diagnostics. Consumers seek convenience, privacy, and real-time insights into their health, driving demand for direct-to-consumer (DTC) solutions. At-home blood test kits, digital ECG monitors, and saliva-based neurological assays are entering mainstream use. It empowers patients to track their health proactively and share results with physicians remotely. Online platforms and telehealth integration support seamless ordering, testing, and consultation. Companies are designing tests with simple sample collection, easy instructions, and app-based result delivery. Regulatory bodies are evolving to accommodate the rise of over-the-counter diagnostic options. This trend aligns with the broader movement toward personalized and participatory healthcare delivery.

Market Challenges Analysis:

Regulatory Complexity and Diagnostic Accuracy Concerns Limit Rapid Commercialization:

The IVD in cardiology & neurology market faces significant regulatory complexity that delays product launches and scalability. Diagnostics intended for critical health conditions must meet stringent approval standards, which vary across regions. Meeting these requirements increases development time and compliance costs. Differences between FDA, CE, and other regulatory frameworks create hurdles for global market entry. It limits access to promising diagnostic innovations in lower-income markets. Ensuring consistent diagnostic accuracy across population segments also poses a major challenge. Clinical validation in diverse patient groups is essential but resource-intensive. Small companies often struggle to secure funding to meet rigorous validation demands. Market growth can stall if newly introduced diagnostics fail to meet clinical or regulatory benchmarks.

High Cost of Advanced Diagnostics Limits Widespread Adoption in Resource-Constrained Regions:

Advanced IVD solutions—especially molecular and AI-integrated platforms—carry high costs, restricting access in underfunded health systems. Healthcare providers in emerging markets often rely on basic diagnostic kits with limited sensitivity and scope. The IVD in cardiology & neurology market cannot realize its full potential without affordable solutions. Procurement budgets in public hospitals remain tight, prioritizing essential medications over diagnostics. High instrument and maintenance costs further limit deployment in remote or decentralized settings. Lack of insurance coverage for diagnostics in many regions discourages regular testing. Without economies of scale, manufacturers cannot reduce pricing for broad market reach. Addressing cost-related barriers is essential to increase diagnostic equity across populations.

Market Opportunities:

Untapped Potential in Emerging Economies Opens New Revenue Streams:

Emerging countries present major growth opportunities for the IVD in cardiology & neurology market. Rising healthcare investment, growing disease awareness, and expanding middle-class populations improve market readiness. Governments are prioritizing early diagnosis programs and modernizing healthcare infrastructure. It creates strong demand for reliable diagnostic technologies, especially in cardiology and neurology. Companies offering cost-effective and scalable solutions can rapidly capture market share. Local partnerships and public-private collaborations may help overcome access challenges. Investments in manufacturing and distribution networks within these regions are also expanding. Long-term growth will come from adapting products to local needs and reimbursement dynamics.

Innovation in Biomarker Discovery and Digital Health Platforms Creates Future Pathways:

Ongoing research in novel biomarkers and digital diagnostics expands the functional reach of IVD tools. The IVD in cardiology & neurology market benefits from discoveries that link specific protein or gene markers to early-stage disease. It enables the development of more targeted, predictive, and non-invasive tests. Integration with digital health platforms allows real-time data transfer and patient monitoring. Clinical decision support systems will increasingly rely on IVD results for treatment optimization. Startups are driving innovation in portable diagnostic apps and AI-based test interpretation. Future market growth will depend on how well these technologies integrate into standard care models.

Market Segmentation Analysis:

By Product Type

The IVD in cardiology & neurology market is primarily driven by the demand for reagents, kits, and consumables, which see consistent usage in routine and specialized diagnostics. Instruments contribute significantly, supported by hospital and laboratory investments in advanced diagnostic platforms. Software and services are emerging as important components, particularly with the shift toward digital health integration and remote diagnostic capabilities.

- For instance, Beckman Coulter’s reagents for cardiac marker assays have been widely adopted globally for reliable and reproducible test results in automated immunoassay analyzers.

By Technology

Immunoassays dominate this segment due to their widespread application in detecting cardiac markers and monitoring neurological disorders. Molecular diagnostics holds a substantial share, propelled by precision medicine trends and the growing focus on early disease detection. Hematology supports diagnosis in both cardiovascular and neurological cases, especially where blood abnormalities intersect with disease progression. Other technologies, including sequencing and specialized biochemical methods, cater to complex and research-oriented diagnostics.

- For instance, Sysmex Corporation’s hematology analyzers integrate advanced parameters that aid in detailed blood profiling used to support diagnosis in stroke and other neurological conditions.

By End Use

Hospitals and clinics represent the largest end-user segment, attributed to higher patient throughput, access to advanced diagnostic infrastructure, and the adoption of point-of-care testing. Diagnostic laboratories continue to play a vital role by offering accurate, large-scale testing services across multiple disease states. Other end users, including academic and research institutions, contribute through innovation, pilot testing, and validation of new diagnostic solutions. Each end-use segment influences how technologies and products are adopted across the broader healthcare landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product Type:

- Instruments

- Reagents, Kits & Consumables

- Software & Services

By Technology:

- Immunoassays

- Molecular Diagnostics

- Hematology

- Other Technologies

By End Use:

- Hospitals & Clinics

- Diagnostic Laboratories

- Other End Users

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America leads the IVD in cardiology & neurology market with a market share of approximately 38%. The region benefits from advanced healthcare infrastructure, strong diagnostic awareness, and rapid adoption of innovative IVD technologies. The United States drives regional growth through high healthcare spending and favorable reimbursement frameworks. Key players such as Abbott Laboratories, Thermo Fisher Scientific, and Quest Diagnostics hold strong operational bases across this market. Regulatory clarity and fast-track approvals from the FDA contribute to quicker adoption of novel diagnostic solutions. Demand remains high for cardiac biomarker testing and genetic screening tools in neurological conditions, reinforcing North America’s leadership in this sector.

Europe

Europe ranks second, capturing around 29% of the global market share. It maintains a robust diagnostic ecosystem supported by government-funded healthcare systems and increasing investment in precision medicine. Countries like Germany, the UK, and France exhibit strong uptake of immunoassays and molecular diagnostics, particularly for cardiovascular risk assessment and neurodegenerative disease detection. The presence of global IVD firms such as Roche and Siemens Healthineers enhances regional competitiveness and product availability. Europe’s aging population and rising burden of lifestyle-related disorders support continuous growth in diagnostic testing. It also emphasizes quality standards and cross-border healthcare initiatives, accelerating the integration of advanced IVD platforms.

Asia Pacific and Rest of the World

Asia Pacific holds a growing share of 24%, while the Rest of the World accounts for 9% of the IVD in cardiology & neurology market. Asia Pacific’s growth is fueled by rising healthcare access, urbanization, and increased government focus on diagnostic infrastructure in countries like China, India, and Japan. Local manufacturers are expanding offerings while international players increase strategic collaborations across the region. The Rest of the World, including Latin America and the Middle East & Africa, is witnessing gradual market expansion, driven by improving diagnostic capabilities and donor-backed health programs. Both regions face challenges related to affordability and infrastructure, but the rising incidence of cardiovascular and neurological disorders keeps demand steadily increasing.

Key Player Analysis:

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd. (Roche Diagnostics)

- Sysmex Corporation

- Siemens Healthineers AG

- Quest Diagnostics Incorporated

- Abbott Laboratories

- BD (Becton, Dickinson and Company)

- Bio-Rad Laboratories, Inc.

- Beckman Coulter, Inc.

- Randox Laboratories

Competitive Analysis:

The IVD in cardiology & neurology market is highly competitive, with leading players investing heavily in R&D and diagnostics innovation. Companies such as Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, and Thermo Fisher Scientific dominate due to their strong product portfolios and global reach. Mid-sized firms and new entrants focus on specialized assays, digital diagnostics, and automation. Strategic collaborations with hospitals and research institutions help expand market penetration. Players differentiate through accuracy, speed, cost-efficiency, and regulatory compliance. The market rewards firms that can balance scale with customization and clinical value. It remains innovation-driven, with molecular diagnostics and point-of-care testing creating opportunities for product diversification.

Recent Developments:

- In July 2024, Quest Diagnostics Incorporated announced a strategic global collaboration with BD (Becton, Dickinson and Company) to develop and commercialize flow cytometry-based companion diagnostics for cancer and other diseases. This partnership aims to provide end-to-end solutions from exploratory panel development to FDA-approved diagnostic kit distribution.

- In June 2024, F. Hoffmann-La Roche Ltd. (Roche Diagnostics) received U.S. FDA Emergency Use Authorization for its cobas Liat SARS-CoV-2, Influenza A/B & RSV multiplex RT-PCR assay on the cobas Liat system. Additionally, in July 2024, Roche unveiled its next-generation cobas Mass Spec solution and modular core lab systems at the Association for Diagnostics & Laboratory Medicine meeting, further advancing routine laboratory integration and throughput for diagnostics, including Alzheimer’s disease and infectious disease testing.

- In June 2024, Sysmex Corporation began sales of the HISCL VEGF and PEDF Assay Kits for Research Use in regenerative cellular medicine, aimed at enhancing quality control in cell therapy production within the Japanese market. In September 2024, Sysmex launched the HISCL HIT IgG Assay Kit for detecting adverse drug reactions and, by April 2025, started manufacturing the XQ-Series Hematology Analyzer at its new Indian plant, expanding capacity for hematology diagnostics in emerging markets.

Market Concentration & Characteristics:

The IVD in cardiology & neurology market shows moderate-to-high concentration, with a few multinational corporations holding significant market share. It features high barriers to entry due to stringent regulatory standards and the need for clinically validated technologies. The market thrives on continuous innovation, rapid diagnostics, and automation. It responds quickly to healthcare demands for faster, more accurate, and disease-specific testing. Product lifecycles are shaped by technological advancement and clinical relevance, and customer loyalty is driven by reliability, scalability, and service support. Emerging companies find niche opportunities in biomarkers and AI-based diagnostic platforms.

Report Coverage:

The research report offers an in-depth analysis based on type, technology, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of AI-powered diagnostics will increase for faster result interpretation.

- Point-of-care testing will gain more relevance in emergency and rural settings.

- Blood-based biomarkers will drive innovation in neurology diagnostics.

- Integration with electronic health records will streamline diagnostic workflows.

- Demand for early-stage detection tools for Alzheimer’s and stroke will grow.

- Immunoassay and molecular platforms will expand in mid-tier hospitals.

- Strategic mergers and acquisitions will reshape competitive dynamics.

- Regulatory bodies will push for faster approvals of high-accuracy IVD tools.

- Remote diagnostics and home testing kits will see increased market entry.

- Focus on personalized diagnostics will expand across cardiology and neurology.