| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Medical Device Contract Manufacturing Market Size 2024 |

USD 5,507.31 Million |

| Japan Medical Device Contract Manufacturing Market, CAGR |

11.59% |

| Japan Medical Device Contract Manufacturing Market Size 2032 |

USD 13,244.23 Million |

Market Overview

Japan Medical Device Contract Manufacturing Market size was valued at USD 5,507.31 million in 2024 and is anticipated to reach USD 13,244.23 million by 2032, at a CAGR of 11.59% during the forecast period (2024-2032).

The Japan medical device contract manufacturing market is driven by rising demand for advanced medical technologies, an aging population, and increasing healthcare expenditure. Stringent regulatory standards in Japan encourage medical device companies to outsource production to specialized contract manufacturers with the technical expertise and compliance capabilities to meet quality requirements. Additionally, the push for cost efficiency and accelerated time-to-market fuels the preference for contract manufacturing solutions. Technological advancements such as automation, precision engineering, and additive manufacturing are enhancing production capabilities and reducing lead times. The growing trend of personalized medicine and minimally invasive procedures further amplifies the need for specialized components and tailored manufacturing services. Moreover, international medical device companies are increasingly partnering with Japanese contract manufacturers to leverage local market knowledge and regulatory proficiency. This combination of market dynamics and innovation positions contract manufacturing as a strategic solution in Japan’s evolving medical device landscape.

Japan’s medical device contract manufacturing industry is a significant segment of the global medical device market, driven by the country’s advanced technological capabilities, strong regulatory framework, and high-quality production standards. Japan’s medical device manufacturers are renowned for their precision engineering, innovation, and commitment to high-quality production processes. Major players in this sector include prominent companies such as Terumo Corporation, Olympus Corporation, and Hitachi Medical Corporation, which have established robust partnerships with both domestic and international clients. These companies benefit from Japan’s highly skilled workforce, excellent infrastructure, and efficient supply chains, which support the production of a wide range of medical devices, from diagnostic equipment to surgical instruments. The geographical advantage of being situated in East Asia also allows for easier access to other key markets across Asia and beyond, making Japan a critical hub for medical device manufacturing. Furthermore, Japan’s focus on research and development continually drives innovation within this space.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Medical Device Contract Manufacturing market was valued at USD 5,507.31 million in 2024 and is projected to reach USD 13,244.23 million by 2032, growing at a CAGR of 11.59% during the forecast period (2024-2032).

- The global medical device contract manufacturing market was valued at USD 79,181.52 million in 2024 and is expected to reach USD 1,90,413.88 million by 2032, growing at a CAGR of 11.59% during the forecast period (2024-2032).

- Market growth is primarily driven by the increasing demand for high-quality medical devices, coupled with technological advancements in manufacturing processes.

- The rise in chronic diseases and the aging population in Japan are fueling the demand for specialized medical equipment.

- Key trends include increased adoption of automation, 3D printing, and AI in medical device production.

- Competitive landscape is dominated by major players like Terumo Corporation, Olympus Corporation, and Hitachi Medical Corporation.

- Market restraints include stringent regulatory standards and the high cost of compliance.

- Japan’s strong infrastructure and proximity to key Asian markets make it a leading hub for medical device manufacturing in the region.

Report Scope

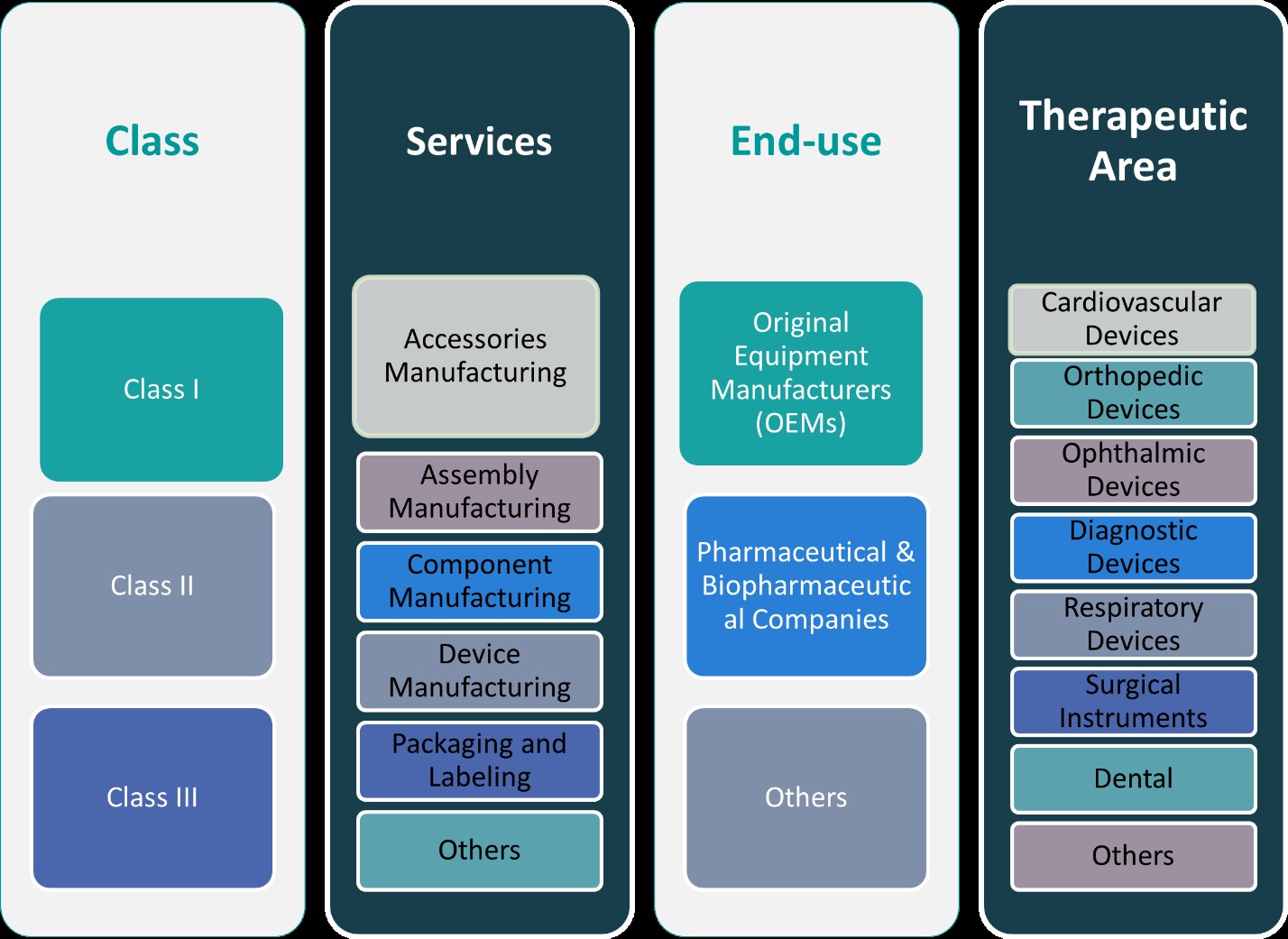

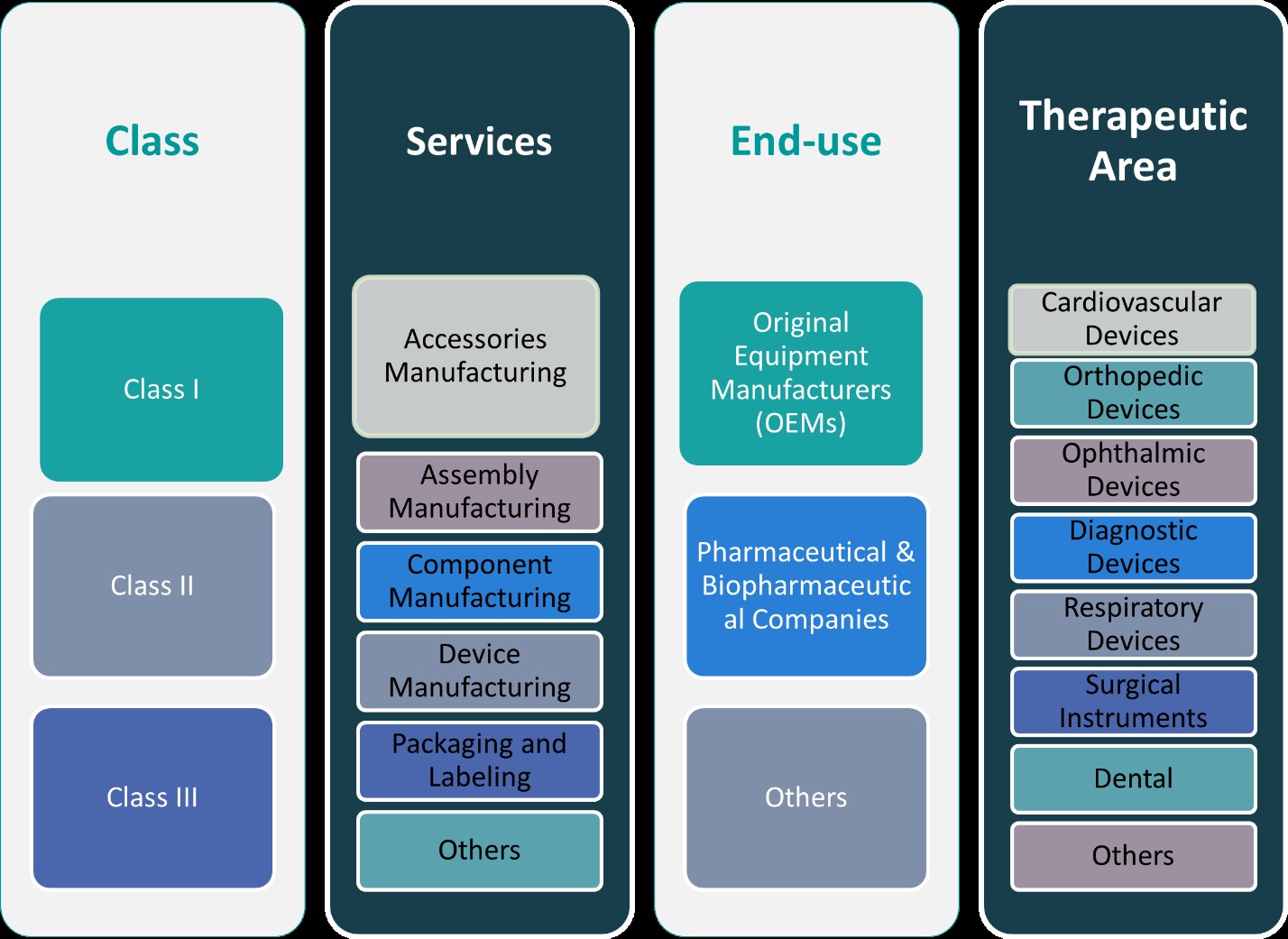

This report segments the Japan Medical Device Contract Manufacturing market as follows:

Market Drivers

Aging Population and Rising Healthcare Demand

Japan’s rapidly aging population is a primary driver of growth in the medical device contract manufacturing sector. With nearly 30% of the population aged 65 and above, there is an escalating demand for advanced medical devices that cater to age-related conditions such as cardiovascular diseases, orthopedic issues, and diabetes. This demographic shift significantly increases the burden on Japan’s healthcare system, prompting hospitals and clinics to adopt more efficient and innovative medical solutions. For instance, Japan’s long-term care insurance system supports the rental of essential medical equipment, such as AI-integrated wheelchairs and patient monitoring devices, to improve elderly care. Consequently, medical device companies are under pressure to deliver high-quality products swiftly, leading to a greater reliance on contract manufacturing firms that can meet stringent production and regulatory standards while reducing time-to-market.

Cost Optimization and Operational Efficiency

Rising development costs and global competition are compelling medical device companies in Japan to explore cost-effective manufacturing alternatives. Contract manufacturing offers a strategic solution by enabling OEMs (original equipment manufacturers) to focus on core competencies such as R&D, marketing, and product innovation while outsourcing labor-intensive and capital-heavy manufacturing processes. For instance, Japan’s National Medical Cost Optimization Basic Policies encourage hospitals to differentiate bed functions, ensuring that acute care beds are used efficiently while recovery beds accommodate long-term patients. Japanese contract manufacturers provide high-precision, scalable production capabilities at a lower cost compared to in-house operations. This model not only improves operational efficiency but also enhances flexibility, allowing companies to respond quickly to market changes, scale production according to demand, and minimize capital investment.

Regulatory Compliance and Quality Assurance

Japan’s regulatory environment for medical devices is highly stringent, with the Pharmaceuticals and Medical Devices Agency (PMDA) enforcing rigorous standards for product safety and performance. Contract manufacturers in Japan are well-equipped to navigate this complex regulatory framework, offering specialized expertise in compliance, documentation, and quality assurance. Their familiarity with ISO certifications, Good Manufacturing Practices (GMP), and PMDA requirements makes them attractive partners for both domestic and international medical device companies. The assurance of consistent quality and regulatory adherence helps manufacturers mitigate risk and avoid costly delays, positioning contract manufacturing as a vital element in the supply chain.

Technological Advancements and Innovation in Manufacturing

The integration of advanced technologies such as automation, robotics, additive manufacturing (3D printing), and AI-driven quality control is transforming Japan’s contract manufacturing landscape. These innovations enable high-precision, customized production at scale, meeting the growing demand for minimally invasive and patient-specific medical devices. Additionally, digital technologies are streamlining production workflows, enhancing traceability, and reducing lead times. Japanese contract manufacturers are increasingly investing in R&D and technology upgrades to remain competitive and meet evolving customer needs. This focus on innovation not only enhances manufacturing capabilities but also strengthens Japan’s position as a global leader in medical device production.

Market Trends

Adoption of Advanced Manufacturing Technologies

Japan’s medical device contract manufacturing industry is increasingly embracing advanced technologies such as automation, 3D printing, and robotics. These innovations enhance production efficiency, reduce costs, and enable the creation of complex, customized medical devices. For instance, 3D printing facilitates rapid prototyping and the production of intricate components, while automation ensures consistent quality and scalability. The integration of these technologies allows manufacturers to meet the growing demand for sophisticated medical devices, particularly those tailored to individual patient needs. This trend positions Japan as a leader in high-precision medical device manufacturing, catering to both domestic and international markets.

Emphasis on Regulatory Compliance and Quality Assurance

Japan’s stringent regulatory environment necessitates a strong focus on compliance and quality assurance within the medical device manufacturing sector. Contract manufacturers are investing in robust quality management systems and obtaining certifications such as ISO 13485 to meet these rigorous standards. For instance, high-risk devices such as pacemakers must undergo extensive safety evaluations before receiving market approval. The adoption of the JIS T 62366-1:2022 standard, aligning with international human factors engineering guidelines, underscores the industry’s commitment to safety and usability. By prioritizing regulatory compliance, Japanese contract manufacturers enhance their credibility and appeal to global medical device companies seeking reliable partners for product development and manufacturing.

Rising Demand for Personalized and Minimally Invasive Devices

The shift towards personalized medicine and minimally invasive procedures is driving demand for specialized medical devices in Japan. This trend necessitates the production of customized, high-precision components, prompting manufacturers to collaborate with contract manufacturing organizations (CMOs) that possess the necessary expertise and technological capabilities. Outsourcing enables medical device companies to efficiently develop and produce tailored solutions, such as patient-specific implants and advanced diagnostic tools. This collaboration accelerates innovation and ensures timely delivery of cutting-edge medical devices to the market.

Strategic Partnerships and Global Collaboration

Japanese medical device companies are increasingly forming strategic partnerships with international organizations to enhance their product offerings and expand their global reach. Collaborations with contract research organizations (CROs) and other industry players facilitate knowledge exchange, streamline regulatory approval processes, and foster innovation. For example, partnerships between Japanese firms and global entities have led to the development of advanced diagnostic solutions and efficient manufacturing processes. These alliances enable Japanese manufacturers to leverage external expertise, access new markets, and maintain competitiveness in the rapidly evolving medical device industry.

Market Challenges Analysis

Complex Regulatory Landscape and Approval Delays

One of the most significant challenges facing the medical device contract manufacturing sector in Japan is navigating the country’s complex and evolving regulatory environment. The Pharmaceuticals and Medical Devices Agency (PMDA) enforces strict standards for product safety, quality, and efficacy, which often result in lengthy approval processes and extended time-to-market. For instance, the PMDA’s review period for priority medical devices averages 7.3 to 8.4 months, while regular new devices take approximately 10.8 to 12 months for approval. While these regulations ensure high product standards, they can create barriers for contract manufacturers, especially smaller firms lacking the resources to keep pace with frequent regulatory updates and rigorous documentation requirements. Moreover, differences between Japanese regulations and international standards may complicate cross-border collaborations, delaying product launches and increasing compliance costs for both domestic and global manufacturers.

Labor Shortages and Rising Operational Costs

Japan’s contract manufacturing industry is also grappling with labor shortages, primarily due to the country’s aging workforce and declining birth rate. The shortage of skilled technicians and engineers hampers production capacity and places added strain on existing personnel, potentially impacting output quality and efficiency. To address this issue, many manufacturers are investing in automation and smart manufacturing systems, but the high upfront costs of these technologies can be prohibitive for smaller players. In addition to labor constraints, rising material costs and fluctuating exchange rates have put pressure on operating margins. These economic factors challenge the ability of contract manufacturers to offer competitive pricing while maintaining quality, further intensifying market competition and necessitating continuous investment in cost management and operational efficiency.

Market Opportunities

Japan’s medical device contract manufacturing sector presents significant growth opportunities driven by demographic trends, healthcare reforms, and technological innovation. The country’s aging population continues to generate strong demand for advanced and specialized medical devices, such as implantable devices, diagnostic imaging equipment, and minimally invasive surgical tools. This demand opens avenues for contract manufacturers to expand their service offerings and production capacities, particularly in high-precision and customized manufacturing. Moreover, the Japanese government’s ongoing efforts to improve healthcare infrastructure and incentivize the adoption of new medical technologies create a supportive environment for the expansion of outsourced manufacturing services. As original equipment manufacturers (OEMs) increasingly seek to streamline operations and reduce costs, contract manufacturing becomes a vital strategic partner in delivering quality products with speed and compliance.

Additionally, international medical device companies view Japan as an attractive market due to its technological sophistication and high standards for product safety and efficacy. As these companies look to localize their operations and navigate Japan’s complex regulatory system, they are turning to domestic contract manufacturers with established regulatory expertise and production capabilities. This trend supports the formation of cross-border partnerships, joint ventures, and technology transfer agreements, creating long-term growth prospects for Japanese CMOs. Furthermore, advancements in additive manufacturing, digital health, and smart medical devices offer new revenue streams for contract manufacturers that can adapt quickly and invest in innovation. As healthcare systems globally shift toward value-based care, the emphasis on efficient, high-quality production further enhances the role of contract manufacturers in shaping the future of Japan’s medical device industry.

Market Segmentation Analysis:

By Class:

The Japan medical device contract manufacturing market is segmented into Class I, Class II, and Class III devices, with each class representing varying levels of complexity and regulatory scrutiny. Class I devices, which include low-risk products such as surgical instruments and handheld diagnostic tools, constitute a steady share of the market due to their high volume and relatively simple manufacturing processes. Class II devices, such as infusion pumps and powered wheelchairs, have seen increased outsourcing activity as companies seek specialized contract manufacturers to ensure regulatory compliance and cost-effective production. However, the most significant growth is observed in the Class III segment, which includes high-risk and highly regulated devices like implantable pacemakers, stents, and life-supporting systems. The growing demand for these advanced devices, particularly for aging patients requiring long-term care and intervention, is driving contract manufacturers to invest in sophisticated manufacturing capabilities, cleanroom environments, and advanced quality control processes. This trend positions Class III manufacturing as a high-value opportunity in Japan’s contract manufacturing landscape.

By Services:

In terms of services, the market is diversified into accessories manufacturing, assembly, component manufacturing, device manufacturing, packaging and labelling, and other auxiliary services. Device manufacturing represents the largest segment, reflecting the demand for full-scale, end-to-end production solutions from OEMs aiming to streamline their operations. Component and assembly manufacturing are also vital, especially for Class II and Class III devices that require precision engineering and multi-stage assembly. Packaging and labelling, although often overlooked, are gaining importance due to strict regulatory and safety requirements in Japan. Accurate labelling in line with PMDA standards is crucial for market approval and product traceability. Additionally, contract manufacturers offering flexible, customized accessory and component solutions are well-positioned to cater to the evolving needs of OEMs developing innovative, patient-centric devices. The breadth of services offered enables manufacturers to act as strategic partners throughout the product lifecycle, from prototyping and pilot production to final packaging and post-market support.

Segments:

Based on Class:

- Class I

- Class II

- Class III

Based on Services:

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Based on End- Use:

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others

Based on Therapeutic Area:

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Surgical Instruments

- Dental

- Others

Based on the Geography:

- Kanto Region

- Kansai Region

- Chubu Region

- Kyushu Region

- Other Regions

Regional Analysis

Kanto Region

The Kanto Region dominates the Japan medical device contract manufacturing market, accounting for approximately 35% of the total market share. As Japan’s most industrialized and densely populated region, Kanto—anchored by Tokyo and surrounding prefectures—hosts a high concentration of medical device OEMs, research institutions, and advanced manufacturing facilities. The region benefits from strong infrastructure, robust healthcare networks, and proximity to government regulatory bodies such as the Pharmaceuticals and Medical Devices Agency (PMDA). Kanto’s dynamic ecosystem supports rapid innovation and encourages partnerships between contract manufacturers and global medical technology companies. This favorable environment drives consistent investment in automation, precision engineering, and regulatory compliance capabilities, solidifying the region’s leadership in contract manufacturing for both domestic and export markets.

Kansai Region

The Kansai Region, including major cities like Osaka and Kyoto, holds a market share of around 25%, making it the second-largest contributor to Japan’s medical device contract manufacturing industry. Kansai is recognized for its historical strength in precision machinery, biotechnology, and academic research. The region is home to numerous universities and medical device R&D centers, facilitating the development of advanced technologies. Contract manufacturers in Kansai often focus on producing high-complexity components and devices, particularly those used in diagnostics and minimally invasive procedures. In recent years, the region has witnessed growing collaboration between OEMs and mid-sized CMOs, aiming to enhance production efficiency and integrate digital technologies into manufacturing workflows. This has created a fertile environment for innovation and high-value manufacturing services.

Chubu Region

The Chubu Region, accounting for approximately 18% of the market, is known for its strong manufacturing heritage, particularly in the fields of precision instruments and industrial automation. Centered around Nagoya, Chubu’s contract manufacturers benefit from access to a skilled workforce and proximity to major OEMs in the automotive and electronics industries, which has translated well into medical device production. The region’s capabilities are particularly relevant in component and assembly manufacturing, where precision and consistency are critical. Chubu is increasingly attracting investment in cleanroom facilities and process automation, aiming to strengthen its role in producing Class II and Class III medical devices.

Kyushu Region

The Kyushu Region holds about 12% of the market share and is emerging as a competitive hub due to its growing medical technology base and government-backed industrial development initiatives. The region’s relatively lower operating costs and investment in innovation parks have attracted new contract manufacturers and startups seeking to expand production capacity. Kyushu is especially active in packaging, labelling, and the final assembly of export-oriented medical devices. With expanding transportation infrastructure and trade connections to other parts of Asia, Kyushu is well-positioned for future growth in global medical device manufacturing.

Key Player Analysis

- Terumo Corporation

- Fujifilm Medical Systems

- Seiko Instruments Inc.

- Olympus Corporation

- Hitachi Medical Corporation

Competitive Analysis

The competitive landscape of Japan’s medical device contract manufacturing market is characterized by the presence of several key players with a strong focus on innovation, quality, and technological advancements. Leading companies such as Terumo Corporation, Olympus Corporation, Hitachi Medical Corporation, Fujifilm Medical Systems, and Seiko Instruments Inc. dominate the market, each contributing to its growth with unique strengths. Companies in this market compete primarily through their ability to deliver high-quality, precision-engineered devices that meet the stringent regulatory requirements of the healthcare industry. Players focus on integrating advanced technologies such as automation, AI, and 3D printing into their manufacturing processes to improve efficiency and reduce production costs. In addition, manufacturers are increasingly leveraging strategic partnerships with global medical device companies to expand their product portfolios and gain access to new markets. The competitive environment is also shaped by the growing emphasis on research and development (R&D), with companies investing heavily in innovation to develop next-generation devices that address evolving healthcare needs. The presence of strong infrastructure, a highly skilled workforce, and favorable regulatory frameworks in Japan gives local manufacturers a significant advantage in the global market. However, challenges such as rising production costs, regulatory complexities, and the need to stay ahead of technological advancements require companies to continuously adapt to remain competitive. As the market grows, new players are entering, intensifying competition and driving the need for sustained innovation and efficiency.

Recent Developments

- In February 2025, Jabil completed the acquisition of Pii, a contract development and manufacturing organization (CDMO) specializing in aseptic filling, lyophilization, and oral solid dose manufacturing.

- In November 2024, Integer completed the sale of its non-medical Electrochem business for $50 million, making it a pure-play medical technology company and allowing it to redeploy capital into high-growth medtech markets.

- In October 2024, At CPHI Milan 2024, Thermo Fisher launched its Accelerator Drug Development platform, a 360° CDMO and CRO offering. This service provides customizable manufacturing, clinical research, and supply chain solutions for small molecules, biologics, and cell and gene therapies, covering the full drug development lifecycle.

Market Concentration & Characteristics

The Japan medical device contract manufacturing market exhibits a moderate to high concentration, with a few key players dominating the industry. These leading companies maintain significant market share due to their established reputation, technological expertise, and ability to comply with stringent regulatory standards. The market is characterized by a blend of large, multinational corporations and smaller, specialized firms that focus on niche areas of medical device manufacturing. Companies in this sector often leverage advanced technologies such as automation, robotics, and 3D printing to enhance production efficiency and precision. High product quality, reliability, and compliance with international regulatory requirements are essential characteristics that define the competitive landscape. Additionally, the market is marked by strategic partnerships and collaborations between contract manufacturers and global medical device companies to expand product portfolios and market reach. Despite the presence of a few dominant players, the market remains dynamic, with ongoing innovations and the entry of new players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Class, Services, End-Use, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan medical device contract manufacturing market is expected to witness steady growth driven by technological advancements and increasing demand for high-quality medical devices.

- Automation and AI integration will play a critical role in enhancing manufacturing efficiency and reducing operational costs.

- The adoption of 3D printing technology will continue to grow, allowing for more customized and complex medical device production.

- The aging population in Japan will drive demand for medical devices related to chronic disease management and elderly care.

- Increased investments in research and development will result in the introduction of next-generation medical devices with advanced features.

- Stringent regulatory standards will remain a key factor in ensuring the consistent quality of products, requiring companies to invest in compliance processes.

- Strategic collaborations with global medical device companies will increase, broadening market reach and facilitating knowledge sharing.

- As competition intensifies, manufacturers will focus on enhancing product innovation and efficiency to maintain a competitive edge.

- Japan’s strong infrastructure and skilled workforce will continue to make it an attractive location for global medical device manufacturing.

- The market will increasingly focus on sustainability, with companies incorporating eco-friendly practices and materials into their manufacturing processes.