Market Overview

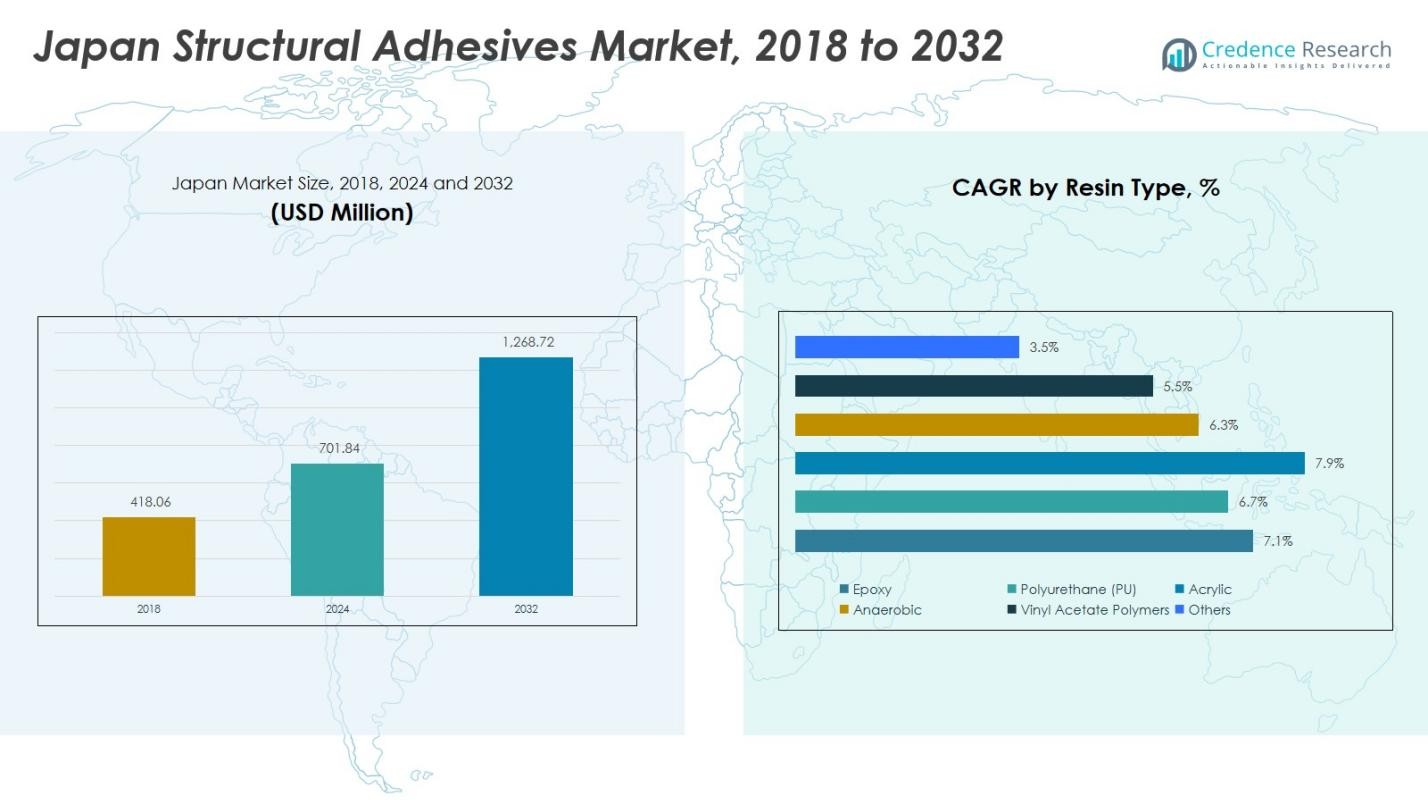

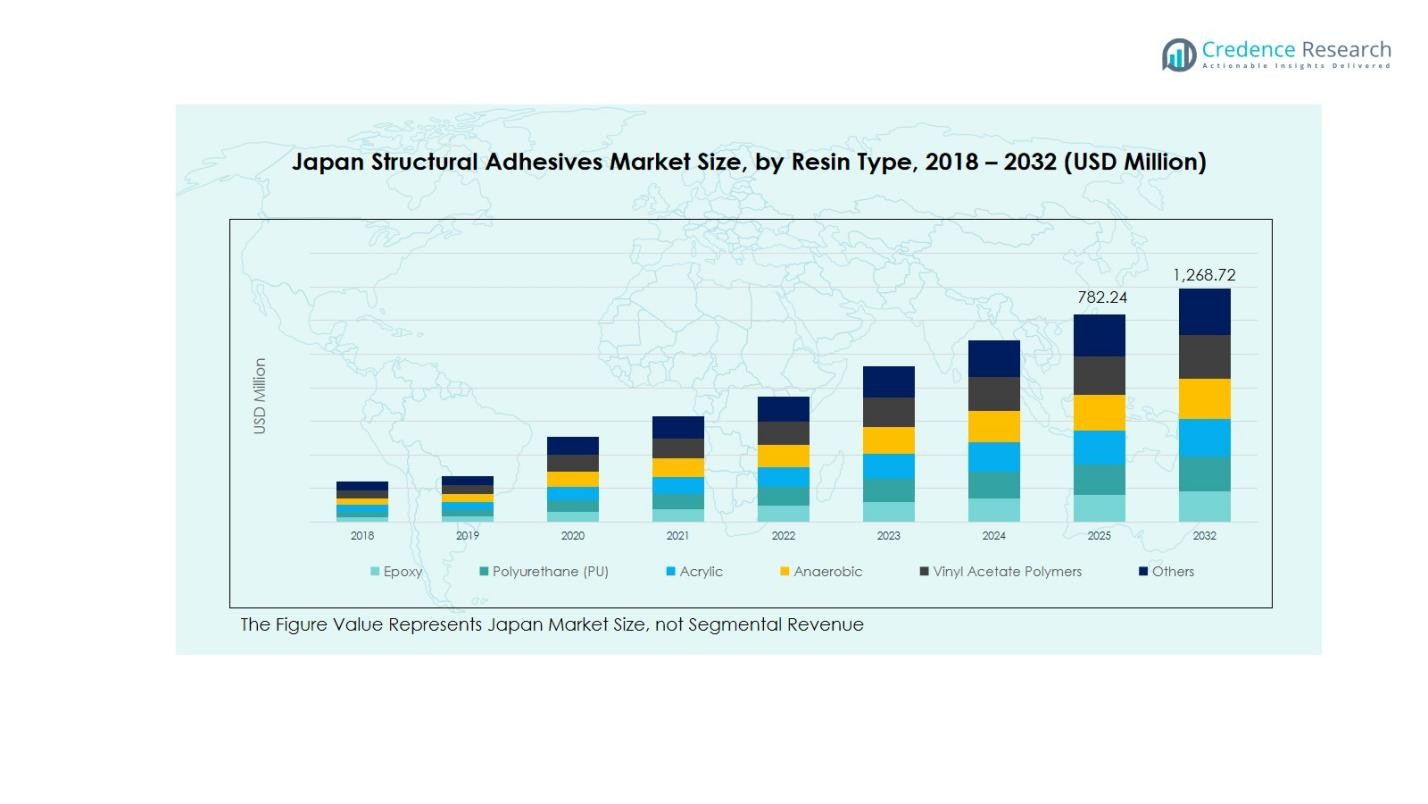

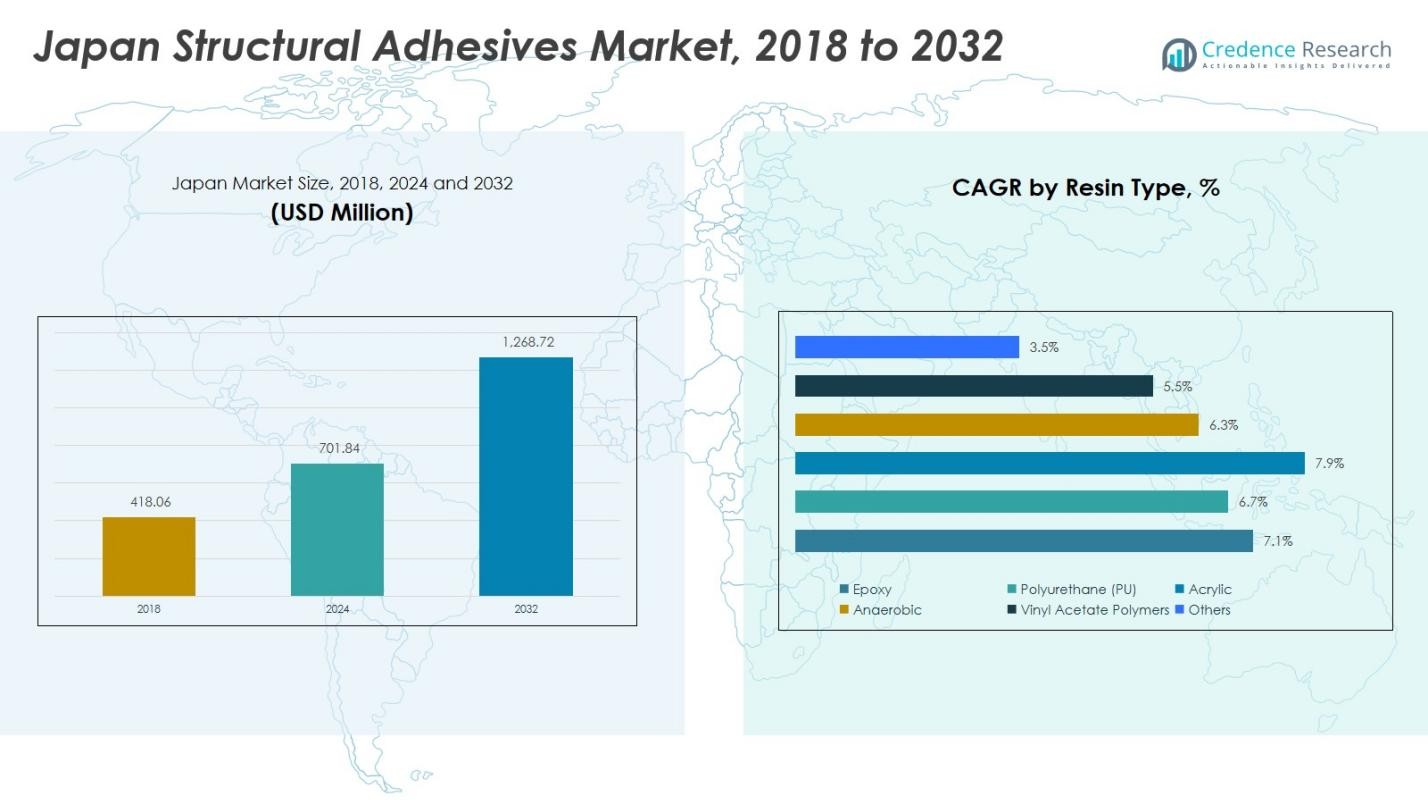

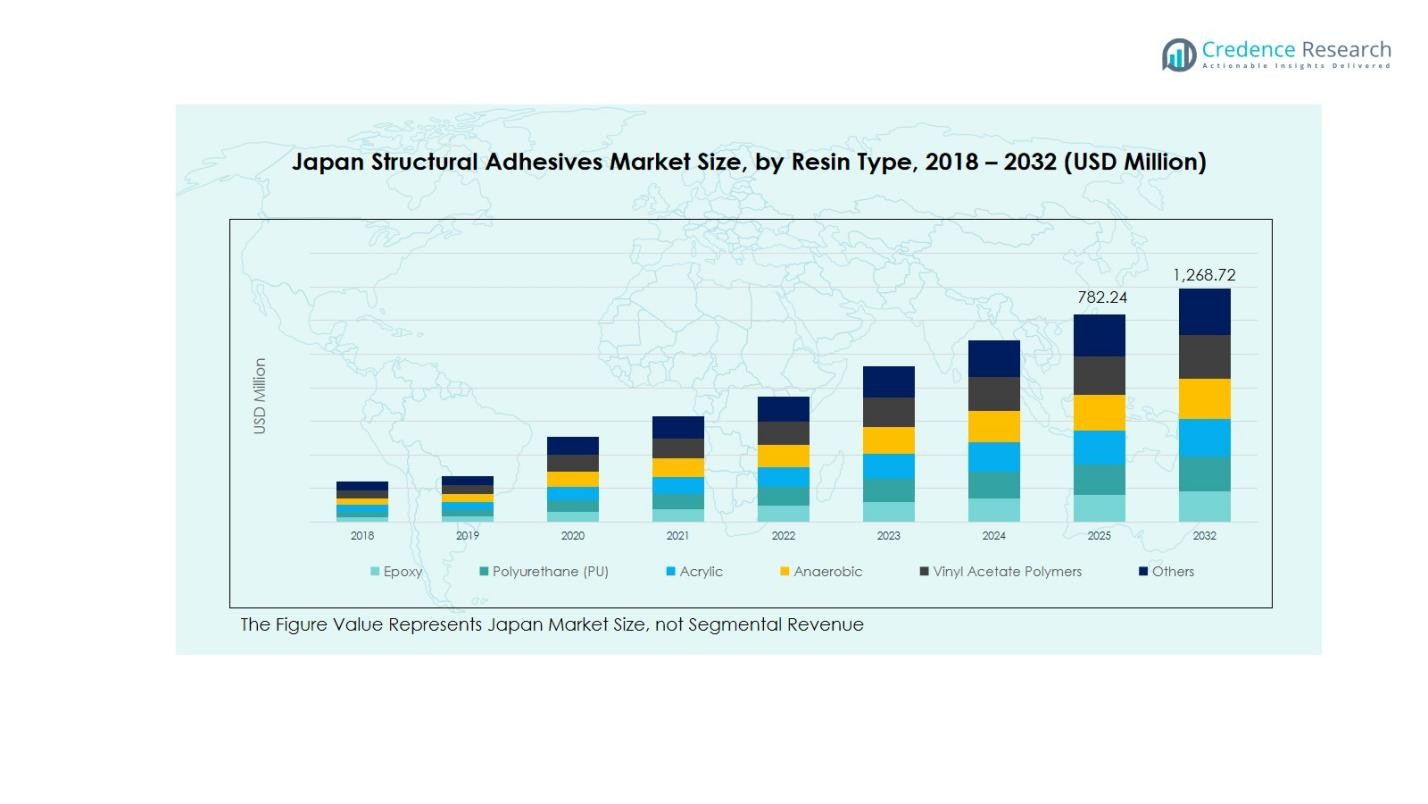

Japan Structural Adhesives Market size was valued at USD 418.06 Million in 2018, grew to USD 701.84 Million in 2024, and is anticipated to reach USD 1,268.72 Million by 2032, at a CAGR of 7.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Structural Adhesives Market Size 2024 |

USD 701.84 Million |

| Japan Structural Adhesives Market, CAGR |

7.15% |

| Japan Structural Adhesives Market Size 2032 |

USD 1,268.72 Million |

The Japan Structural Adhesives Market is highly competitive, with key players such as Henkel AG & Co. KGaA, Sika AG, Arkema S.A., 3M Company, Dow Inc., Huntsman Corporation, Illinois Tool Works Inc., RPM International Inc., Lord Corporation, and H.B. Fuller Company driving market growth through innovation, strategic partnerships, and strong distribution networks. These companies focus on high-performance adhesive solutions, including epoxy, polyurethane, and acrylic formulations, catering to automotive, aerospace, electronics, and industrial applications. Technological advancements, eco-friendly formulations, and regional production facilities further enhance their market positioning. The Kanto region emerges as the leading market in Japan, commanding a 35% share, supported by dense industrial clusters, robust infrastructure, and high demand from automotive and aerospace manufacturing hubs. This combination of strong regional demand and active participation by global players ensures sustained growth and competitive intensity in the Japan Structural Adhesives Market.

Market Insights

- The Japan Structural Adhesives Market was valued at USD 701.84 Million in 2024 and is projected to reach USD 1,268.72 Million by 2032, growing at a CAGR of 7.15%. Epoxy dominates the resin type segment with a 42% share, while the metal substrate segment leads with 48%. Solvent-based adhesives account for 55% of the technology segment, and the Kanto region holds the largest regional share at 35%.

- Market growth is driven by rising demand from automotive and aerospace sectors, where lightweighting and high-strength bonding solutions are critical. Industrial manufacturing expansion and increased electronics assembly further support adoption.

- Trends indicate a shift toward eco-friendly and water-based adhesives, with opportunities emerging in renewable energy, electronics, and green construction applications.

- The market is competitive, with key players including Henkel, Sika, Arkema, 3M, Dow, and Huntsman leveraging innovation, strategic partnerships, and regional production facilities.

- Challenges include high costs of advanced adhesives and complex application processes, which may limit adoption in smaller-scale operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin Type:

In the Japan Structural Adhesives Market, epoxy dominates the resin type segment, capturing approximately 42% of the market share in 2024. Its superior bonding strength, chemical resistance, and versatility across automotive, aerospace, and industrial applications drive its adoption. Polyurethane (PU) and acrylic follow, benefiting from flexibility and quick curing properties. Increasing demand from automotive lightweighting and electronics assembly supports epoxy growth. Emerging applications in renewable energy and infrastructure further strengthen the segment, making epoxy the preferred choice for high-performance and durable adhesive solutions.

For instance, Toyota employs epoxy-based adhesives in lightweight vehicle parts, supporting the automotive industry’s shift towards fuel efficiency and emission reduction.

By Substrate:

The metal substrate segment holds the largest share at 48% in the Japan Structural Adhesives Market. Metals’ extensive use in automotive, aerospace, and industrial manufacturing makes it the dominant substrate for structural adhesives. The segment’s growth is fueled by rising demand for lightweight vehicles, corrosion-resistant bonding solutions, and strong joint integrity requirements. Composites and plastics are growing steadily due to expansion in aerospace and electronics, but metal remains the primary substrate, supported by its compatibility with high-performance resins like epoxy and polyurethane.

For instance, ThreeBond developed the 2249K adhesive, which bonds multiple materials like steel, aluminum, and CFRP, enhancing lightweight electric vehicle designs by maintaining structural integrity under heat and chemical exposure. This innovation supports the shift toward lighter, safer vehicles.

By Technology:

Within technology, solvent-based adhesives lead the Japan Structural Adhesives Market, accounting for 55% of the market share. Solvent-based systems offer excellent bonding strength, temperature resistance, and versatility across multiple substrates, driving adoption in automotive, construction, and industrial applications. Water-based adhesives are gaining traction due to environmental regulations and reduced VOC emissions, but solvent-based adhesives continue to dominate due to performance advantages. Rising industrial production, automotive assembly, and infrastructure projects further propel demand for solvent-based structural adhesives in Japan.

Key Growth Drivers

Rising Automotive & Aerospace Demand

The Japan Structural Adhesives Market is primarily driven by the expanding automotive and aerospace sectors. Lightweight vehicles and fuel-efficient designs increasingly rely on high-strength adhesives to replace mechanical fasteners, reducing weight while enhancing structural integrity. Aerospace applications demand reliable bonding for composites and metals, further boosting adoption. Manufacturers are adopting epoxy and polyurethane adhesives to meet performance standards. This growing emphasis on lightweighting, safety, and durability in both sectors is expected to sustain strong demand for structural adhesives across Japan over the forecast period.

For instance, Nagoya University and Aisin Chemical developed a next-generation structural epoxy adhesive for automotive use, which significantly contributes to vehicle weight reduction, driving stability improvement, fuel efficiency, and emissions reduction.

Industrial Manufacturing Expansion

Industrial manufacturing in Japan fuels the adoption of structural adhesives, particularly in machinery, electronics, and construction equipment production. Adhesives provide efficient joining solutions, reducing assembly time and maintenance costs while ensuring high strength and durability. The shift toward automation and precision assembly further increases reliance on solvent-based and water-based adhesives. Rising industrial output, modernization of factories, and adoption of advanced materials drive growth across multiple substrate applications, positioning structural adhesives as a preferred solution in industrial manufacturing operations across the country.

For instance, SciGrip’s SG5000 acrylic adhesive, employed by GRP HighTech in automotive manufacturing, bonding ABS parts to metal substructures with high tensile strength and fast curing suitable for precision assembly.

Advancements in Adhesive Technology

Continuous innovations in adhesive chemistry and formulation are supporting market growth. Enhanced properties, such as faster curing, higher temperature resistance, and improved environmental compliance, make adhesives suitable for diverse applications. Development of water-based and eco-friendly adhesives aligns with Japan’s sustainability regulations, attracting adoption across multiple industries. Additionally, improved compatibility with metals, composites, plastics, and wood expands the range of applications. These technological advancements provide manufacturers with flexible, high-performance bonding solutions, driving demand for structural adhesives and fostering long-term market growth.

Key Trends & Opportunities

Expansion in Electronics & Renewable Energy

Structural adhesives are increasingly used in electronics and renewable energy sectors, presenting significant growth opportunities. Adhesives ensure secure bonding in compact electronic components and lightweight solar panels, where mechanical fasteners are unsuitable. The trend toward miniaturization, high-precision assembly, and renewable energy infrastructure adoption stimulates demand for high-performance adhesives. Companies investing in research for thermally resistant and durable adhesives can capitalize on these emerging applications, broadening their product portfolios and strengthening market presence in Japan’s evolving industrial and green technology sectors.

For instance, Henkel’s Loctite® Bergquist® thermal solutions dissipate heat efficiently in electronic devices, enhancing performance and extending lifespan

Shift Toward Eco-Friendly Adhesives

Environmental sustainability and stringent regulations are driving the shift toward water-based and low-VOC adhesives. Japan’s focus on reducing emissions and promoting green manufacturing has created opportunities for eco-friendly structural adhesives. Manufacturers are developing formulations that maintain performance while meeting regulatory requirements. This trend allows companies to differentiate their products, cater to environmentally conscious customers, and enter new application areas, such as green construction and sustainable automotive assembly. Adoption of eco-friendly adhesives is expected to accelerate, providing a competitive advantage for innovative players in the market.

For instance, Mitsui Chemicals has developed a water-based acrylic adhesive used in surface protective tape during laser cutting, promoting eco-friendly production processes with reduced emissions.

Key Challenges

High Cost of Advanced Adhesives

High-performance structural adhesives, particularly epoxy and polyurethane types, involve significant production and raw material costs. These costs can impact adoption among small and medium-sized enterprises, especially for large-scale industrial applications. Price sensitivity in automotive, electronics, and construction sectors may slow market penetration. Companies must balance performance benefits with affordability to remain competitive. Additionally, frequent formulation upgrades to meet evolving performance and environmental standards can increase operational expenses, posing a challenge to sustainable market growth and limiting accessibility for price-conscious end-users.

Complex Application and Curing Processes

Certain structural adhesives require precise surface preparation, specialized equipment, and controlled curing conditions, which complicates their application. Improper handling can lead to bond failure, reducing product reliability and performance. Industries such as aerospace and automotive require skilled labor and quality control measures, increasing operational costs. Furthermore, curing times and environmental sensitivity limit processing efficiency in fast-paced production lines. These complexities restrict adoption in small-scale operations and industries seeking faster assembly processes, posing a challenge for widespread market expansion despite growing demand in Japan.

Regional Analysis

Kanto

The Kanto region leads the Japan Structural Adhesives Market with a market share of 35% in 2024, driven by the concentration of automotive, aerospace, and electronics manufacturing hubs. Strong industrial infrastructure, coupled with high demand for lightweight and durable bonding solutions, supports the adoption of epoxy and polyurethane adhesives. Major manufacturers are investing in local production facilities to meet regional demand efficiently. The presence of key industrial clusters in Tokyo, Kanagawa, and Saitama enhances accessibility and distribution, while technological advancements and sustainability initiatives further propel market growth in this region.

Kansai

Kansai holds a market share of 25% in the Japan Structural Adhesives Market, backed by thriving manufacturing sectors including electronics, machinery, and chemical industries. Osaka, Kyoto, and Hyogo are primary industrial centers driving the need for high-performance adhesives. Epoxy and solvent-based adhesives dominate due to their durability and strong bonding properties on metals and composites. Regional growth is further supported by ongoing industrial automation, precision assembly demands, and rising infrastructure projects. The concentration of R&D facilities and innovation hubs in Kansai strengthens product development and adoption, positioning the region as a significant contributor to overall market expansion.

Chubu

The Chubu region captures a 20% market share in 2024, fueled by strong automotive manufacturing activity in Aichi and Gifu prefectures. Structural adhesives are widely used for vehicle lightweighting, assembly, and component bonding. Epoxy and acrylic adhesives are particularly preferred for metal and composite substrates. Industrial growth, coupled with advanced manufacturing technologies, supports high adoption rates. Investment in research for high-performance adhesives and regional government incentives further boost market penetration. The presence of Tier-1 automotive suppliers and large-scale industrial operations ensures a stable demand for structural adhesives, driving consistent regional market growth.

Kyushu

Kyushu accounts for 12% of the Japan Structural Adhesives Market, with growth supported by industrial and electronics manufacturing in Fukuoka, Kumamoto, and Nagasaki. The region emphasizes renewable energy, automotive components, and industrial machinery, increasing the need for strong adhesive bonding solutions. Polyurethane and solvent-based adhesives are widely adopted due to versatility across metals, plastics, and composites. Local manufacturers are expanding production capacities to meet growing demand, while innovations in eco-friendly adhesives align with regional sustainability initiatives. The combination of industrial expansion and increasing adoption in electronics and automotive sectors drives Kyushu’s market contribution.

Hokkaido

Hokkaido contributes 8% to the Japan Structural Adhesives Market, primarily driven by automotive assembly, machinery production, and construction projects. Solvent-based and epoxy adhesives are preferred for metal and composite substrates in harsh climatic conditions. Industrial growth, infrastructure development, and demand for high-strength, durable bonding solutions support adoption. Limited population density is offset by large-scale industrial operations and manufacturing hubs in Sapporo and surrounding areas. Ongoing technological improvements and regional focus on environmentally compliant adhesives further enhance market potential. Hokkaido’s contribution, though smaller than major industrial regions, remains significant due to strategic industrial activities and specialized applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

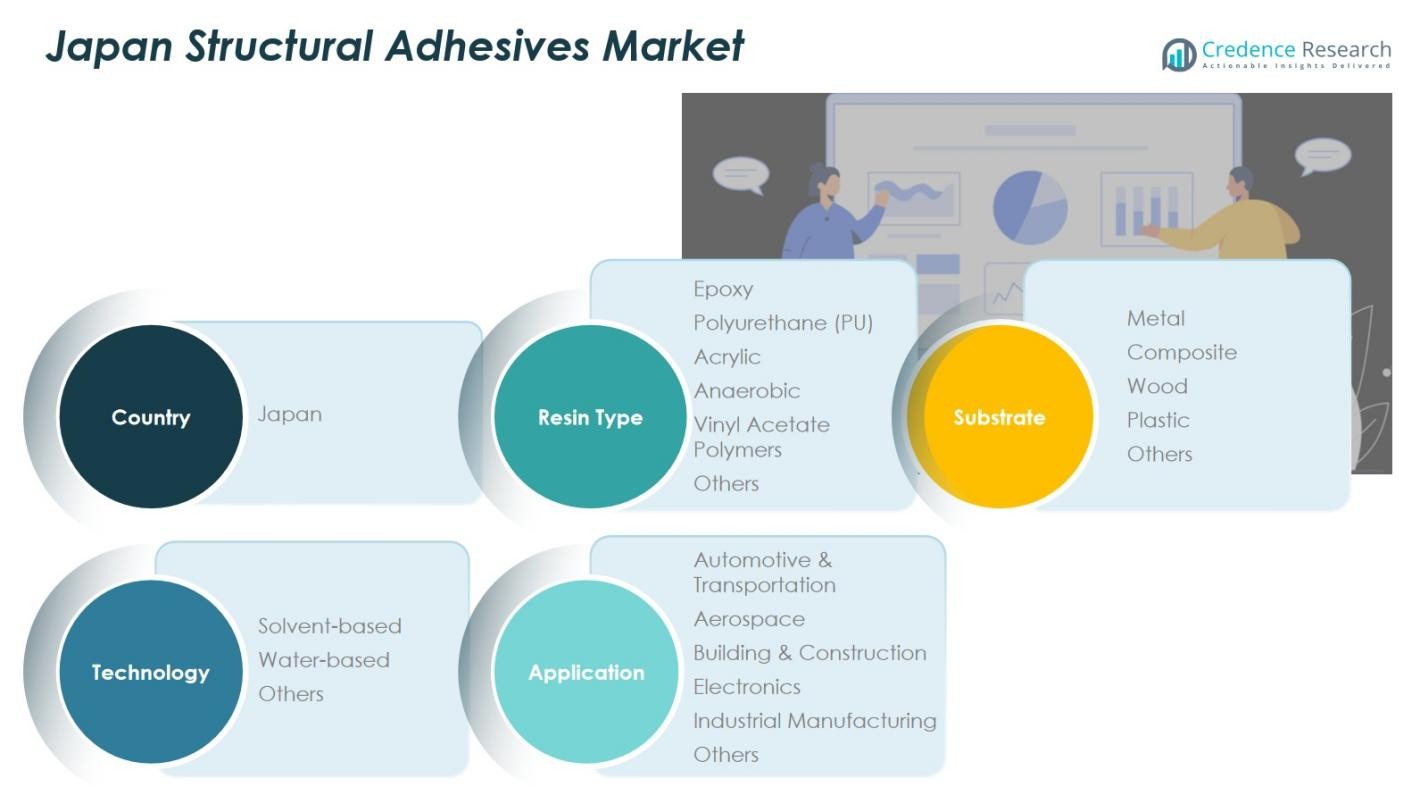

Market Segmentations:

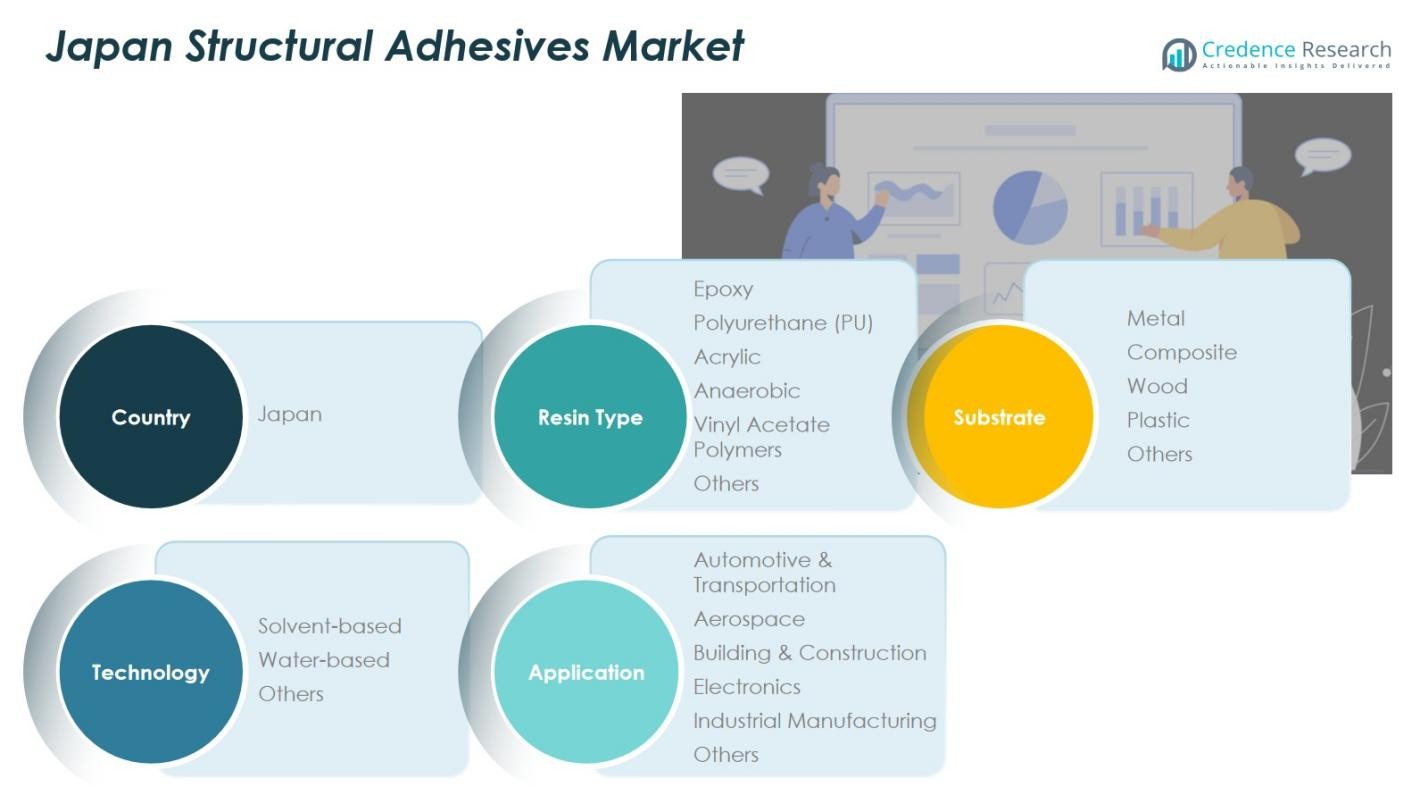

By Resin Type:

- Epoxy

- Polyurethane (PU)

- Acrylic

- Anaerobic

- Vinyl Acetate Polymers

- Others

By Substrate:

- Metal

- Composite

- Wood

- Plastic

- Others

By Technology:

- Solvent-based

- Water-based

- Others

By Application:

- Automotive & Transportation

- Aerospace

- Building & Construction

- Electronics

- Industrial Manufacturing

- Others

By Region:

- Kanto

- Kansai

- Chubu

- Kyushu

- Hokkaido

Competitive Landscape

The competitive landscape of the Japan Structural Adhesives Market features key players such as Henkel AG & Co. KGaA, Sika AG, Arkema S.A., 3M Company, Dow Inc., Huntsman Corporation, Illinois Tool Works Inc., RPM International Inc., Lord Corporation, and H.B. Fuller Company. These companies leverage advanced product portfolios, strategic partnerships, and strong distribution networks to maintain leadership in the market. Innovation in high-performance adhesives, including epoxy, polyurethane, and acrylic formulations, drives differentiation. Regional production facilities and local R&D centers enable rapid response to evolving customer requirements in automotive, aerospace, electronics, and industrial sectors. Competitive strategies include acquisitions, joint ventures, and sustainable product development to meet Japan’s regulatory standards. The focus on eco-friendly, solvent- and water-based adhesives, combined with technological advancements, ensures continuous growth while strengthening market share and maintaining dominance against emerging domestic and international competitors.

Key Player Analysis

- Henkel AG & Co. KGaA

- Sika AG

- Arkema S.A.

- 3M Company

- Dow Inc.

- Huntsman Corporation

- Illinois Tool Works Inc.

- RPM International Inc.

- Lord Corporation

- B. Fuller Company

Recent Developments

- In April 2024, Shin-Etsu Chemical Co., Ltd. acquired Setex Technologies’ biomimicry-based dry adhesive technology, ShineGrip™, introducing a gecko-inspired adhesive that provides strong friction and adhesion without chemical adhesives, aimed at expanding into new markets.

- In September 2025, Albert Invent launched its Japanese subsidiary, Albert Invent Japan K.K., headquartered in Tokyo, to support innovation in Japan’s chemical and materials industry and provide digital transformation solutions for material science.

- In October 2024, Bodo Moller Chemie GmbH entered the Japanese structural adhesives market by establishing Bodo Moller Chemie Japan K.K., setting up a sales office in Tokyo and a warehouse in Nagoya to cater to key industries including aerospace and automotive.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand from automotive and aerospace sectors.

- Increasing industrial manufacturing activities will continue to drive adhesive adoption.

- Lightweighting trends in vehicles and infrastructure projects will boost structural adhesive usage.

- Technological advancements in epoxy, polyurethane, and acrylic adhesives will enhance performance and application scope.

- Adoption of eco-friendly and low-VOC adhesives will accelerate in compliance with sustainability regulations.

- Expansion in electronics, renewable energy, and construction sectors will create new growth opportunities.

- Regional manufacturing hubs will strengthen market presence and distribution efficiency.

- Investment in research and development will lead to innovative adhesive formulations.

- Collaborations, mergers, and acquisitions among key players will consolidate market competition.

- Demand for high-performance bonding solutions across diverse substrates will sustain long-term market growth.